The market has seen major growth in the recent past and is predicted to grow significantly during the forecasted period as well.

CBD or Cannabidiol is a widely used compound with proven health benefits and is the second most abundant active element in marijuana. It's commonly used as a key ingredient in a wide range of personal care & cosmetic products, as well as healthcare & pharma's.

As per to CFAH, 64% of CBD users use it for pain relief. In the U.S., 21% of men and 16% of women have tried CBD. Among pet owners, 50% use CBD for their pets, while 35.12% of veterinarians recommend it. Additionally, 16.7%, or approximately 1 in 6 marijuana users, consume delta 8 THC.

However, 25% of CBD brands do not conduct purity testing. These figures highlight the growing adoption of CBD products for both humans and pets, although there remain concerns regarding product quality and safety standards in the market.

The demand for cannabidiol (CBD) products continues to surge globally, driven by their perceived wellness benefits and expanding legal acceptance. Industry events and conferences, especially those hosted in attractive venues with amenities like pools, offer networking and collaboration opportunities for professionals across CBD, wellness, and health sectors.

As per the Techreport, North America is currently the largest CBD market, with the U.S. as the top contributor. The U.S. market is valued at $2.58 billion in 2024 but is projected to decline to $2.5 billion by 2029 at a CAGR of -0.23%. In 2024, there are approximately 140.8 million CBD users in the U.S., reflecting an increase of 21.8 million from 2023.

Japan’s CBD user base is around 17.24 million in 2024, expected to rise to 21.66 million by 2029. Mexico’s CBD revenue is projected to grow from $190.7 million in 2024 to $223.2 million by 2029, with a CAGR of 3.2%. Canada’s CBD market is set to peak at $472.6 million in 2024, declining to $452.4 million by 2026.

These gatherings showcase the latest advancements in CBD research, product innovation, and regulatory updates, offering insights into new market trends and consumer demand patterns. Notable recent news includes increased investments in CBD, a growing focus on sustainable cultivation, and regulatory changes in various regions, which could reshape the market landscape.

Market Dynamic

The global CBD oil market is expanding due to the growing recognition of CBD's potential

health benefits, mainly in managing anxiety & pain, as consumers highly turn to natural remedies. Changing legal frameworks & regulations play a major role in this expansion, with more regions legalizing & regulating CBD products, creating new investment opportunities.

However, the market's growth is challenged by concerns over product quality & accurate labeling, as poorly labeled or low-quality products can ruin consumer trust, which underscores the importance of strict quality control & labeling standards. In addition, as the market expands, competition among CBD manufacturers & retailers intensifies, providing challenges for newcomers to build themselves & gain market share, emphasizing the need for differentiation & strategic positioning.

Research Scope and Analysis

By Source

By source, the market has been categorized into hemp and marijuana. In 2023, the hemp segment emerges as the major dominant force in driving the global market by contributing the largest share of total revenue, which is anticipated to experience rapid growth during the forecast period, mainly driven by growing demand from the pharmaceutical industry & increase in consumer awareness of its health benefits. The legalization of medicinal cannabis & rising disposable incomes further fuel the CBD demand in the pharmaceutical sector.

Further, a range of CBD products, from oils & capsules to topical solutions & edibles, is in high demand, providing market growth. Also, Hemp-derived CBD, known for its anti-inflammatory & antioxidant properties, finds applications in pharmaceuticals, personal care, nutraceuticals, & food & beverage industries, indicating significant future growth.

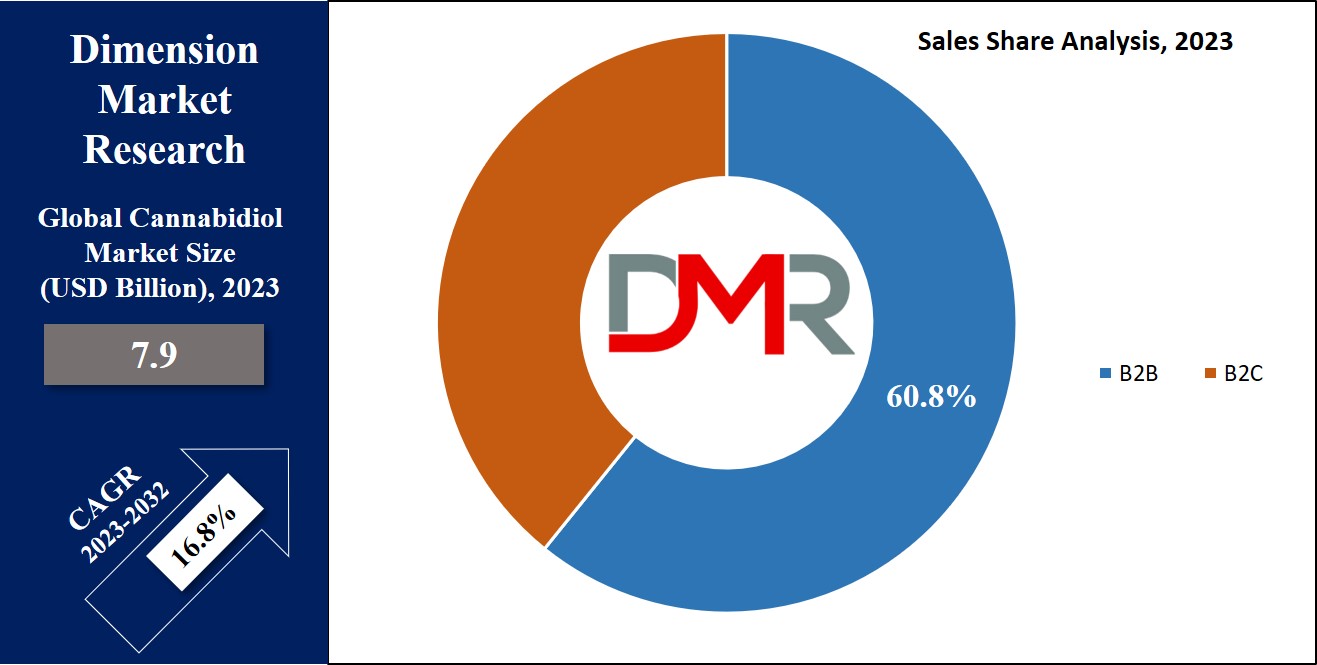

By Sales

The B2B segment holds a dominant position in the market, contributing significantly to the total revenue in 2023, which is expected to experience significant growth during the forecast period. The growth is attributed to the growth in the number of wholesalers entering the CBD oil market & the rise in demand for CBD oil as a raw material. Further, the legalization of CBD products in numerous countries has increased the consumer base & created new opportunities for product distribution.

Moreover, within the B2C segment, the hospital pharmacies are forecasted to witness significant growth, which can be said owing to businesses forming partnerships with retail pharmacies to enhance their visibility & build dedicated spaces for customers to purchase CBD products. The market is expected to offer a number of opportunities owing to the growth in the stocking of CBD products in pharmacies, the formation of exclusive partnerships, & the rising number of patients opting for CBD as a treatment option.

By End Use

In the CBD market, the

pharmaceuticals sector drives the growth of the market in 2023, accounting for a significant share of revenue, & it's anticipated to continue growing substantially, which is primarily driven by the growth in the number of

clinical trials investigating CBD's effects on different health conditions, which is expected to fuel the demand for these products in the coming years.

In addition, many companies are buying bulk CBD oil to develop CBD-infused products that consumers use as an alternative for managing pain & stress, contributing to this sector's expansion. Further, the pharmaceutical sector is expected to have the fastest growth, as CBD evolves from herbal remedies to prescription drugs, driven by its recognized medical benefits and therapeutic properties.

The Cannabidiol Market Report is segmented on the basis of the following

By Source

By Sales

By End Use

- Medical

- Pharmaceuticals

- Personal Use

- Wellness

Regional Analysis

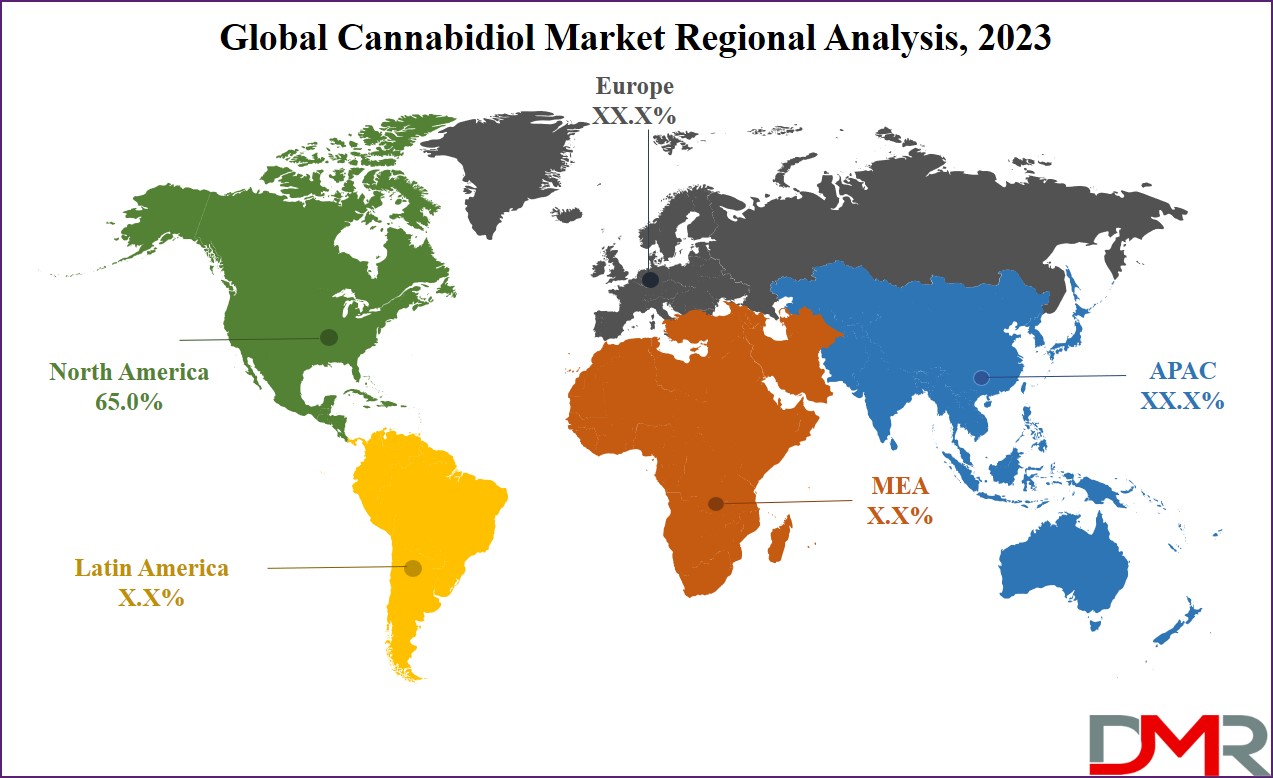

North America leads in the global CBD market in 2023,

capturing 65.0% of the revenue share, & it's expected to maintain its dominant position in the coming future., which can be attributed to many key factors, including a growth in population of health-conscious individuals, a rise in acceptance of CBD products, the presence of major manufacturers, & the recent approval of the U.S. Farm Bill. The region stands out for its advanced cannabis industry, featuring a high number of CBD companies & relatively lenient CBD regulations.

Further Asia Pacific & Europe also anticipated significant growth, driven by the foundation of hemp production facilities, mainly in China, the leading hemp producer in Asia. China exports a large portion of its hemp products, and it has initiated hemp cultivation for CBD extraction in many provinces. Government assistance, low production costs, & large-scale manufacturing capabilities are anticipated to intensify competition for CBD suppliers in the U.S., Canada, & the European Union.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombi

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Cannabidiol (CBD) market is characterized by its decentralization & intense competition, with various prominent companies operating within it. These companies, each with their unique strengths & strategies, compete for their place in this rapidly evolving market, offering a wide range of CBD products to meet diverse consumer preferences and needs.

Like, in January 2023, Medical Marijuana, Inc. unveiled that its subsidiary, HempMeds Brasil, introduced two fresh full-spectrum CBD products in Brazil. These products come in two different strengths, offering 3,000 mg & 6,000 mg concentrations, and are available in two sizes, which are 30 mL & 60 mL jars, delivering consumers with a variety of options to choose from to meet their CBD needs in the Brazilian market.

Some of the prominent players in the global Cannabidiol Market are:

- Medical Marijuana

- Cannoid LLC

- Elixinol

- Tilray

- ENDOCA

- Pharmahemp D.o.o.

- Nuleaf Naturals

- Folium Biosciences

- Isodiol International Inc

- Aurora Cannabis

- Other Key Players

COVID-19 Pandemic & Recession: Impact on the Global Cannabidiol Market

The COVID-19 pandemic & recession had a mixed impact on the global CBD market. As people looked for natural remedies for stress & wellness, the need for CBD products grew. Online sales increased owing to lockdowns, but supply chain disruptions & economic uncertainty-imposed challenges. Regulatory changes also influenced the market landscape, with some regions easing restrictions to assist economic growth.

Smaller businesses experienced difficulties, leading to market consolidation. Despite economic concerns, CBD's affordability & perceived health benefits the growth in its demand. The long-term market impact hinges on evolving consumer preferences, regulatory decisions, & economic recovery trajectories.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 7.9 Bn |

| Forecast Value (2032) |

USD 31.8 Bn |

| CAGR (2023-2032) |

16.8% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Source (Hemp and Marijuana), By Sales (B2B and

B2C), By End Use (Medical, Pharmaceuticals, Personal

Use, and Wellness) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

JMedical Marijuana, Cannoid LLC, Elixinol, Tilray,

ENDOCA, Pharmahemp D.o.o., Nuleaf Naturals,

Folium Biosciences, Isodiol International Inc, Aurora

Cannabis, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |