Cell Culture Market Overview

The

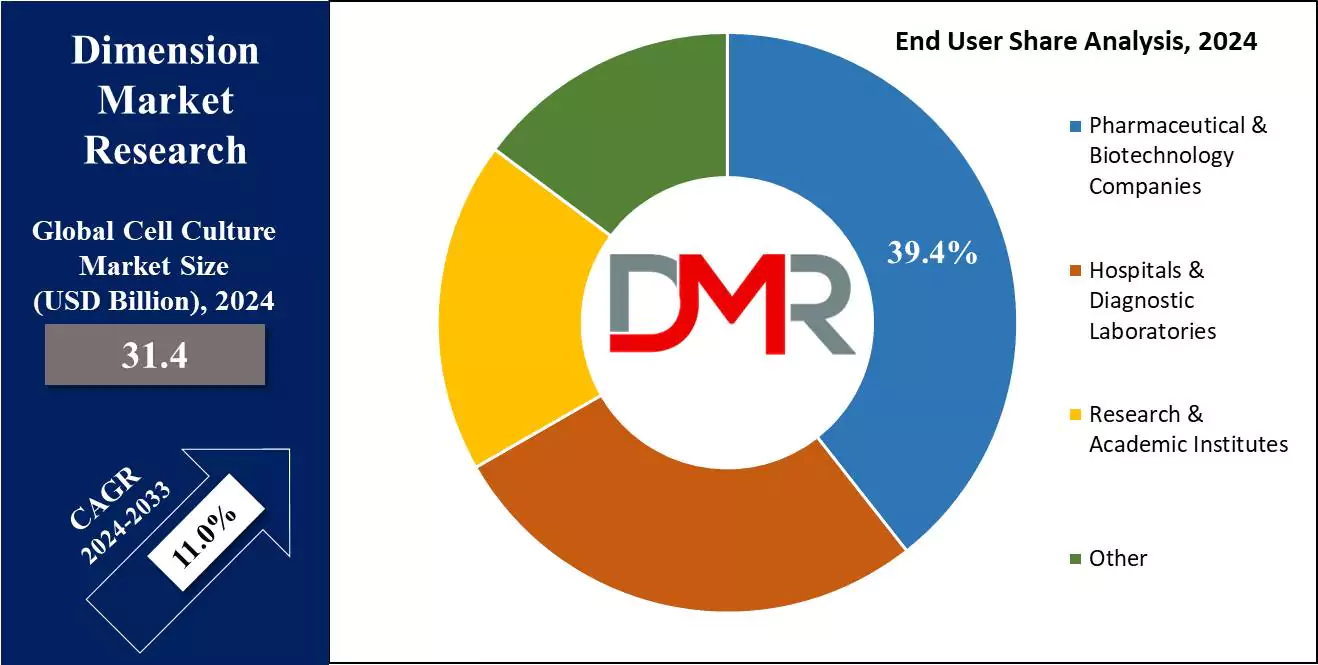

Global Cell Culture Market size is expected to reach a value of

USD 31.4 billion in 2024, and it is further anticipated to reach a market value of

USD 80.3 billion by 2033 at a

CAGR of 11.0%.

Cell culture includes cultivating cells in a controlled environment, typically outside their natural surroundings. Cells of interest are isolated from living tissue & can thrive under these controlled conditions, which allows for the sustained growth & study of cells outside their native environment, providing researchers with a valuable tool for different applications in biomedical research & biotechnology.

The global demand for vaccines has increased due to the threat of virus outbreaks, prompting the

pharmaceutical industry to look for highly efficient vaccine variants, as the cell culture has become a cornerstone in vaccine development, finding application in creating vaccines for various diseases. Further, developed nations exhibit a growing preference for cell-based vaccines, streamlining regulatory approval processes, as the awareness of the numerous benefits offered by cell culture vaccines is also on the rise.

However, market growth faces challenges, like the high costs associated with R&D, limited infrastructure in certain regions, expensive medicines, & inadequate awareness in less economically advanced economies. Also, challenges arise from unfavorable reimbursement scenarios, limited technology penetration in developing nations, high customs duties on medical devices, & inadequate infrastructure in low- and middle-income countries, creating hurdles for the market in the forecast period.

Cell Culture Market Key Takeaways

- Market Size: The global cell culture market is projected to reach a market value of USD 80.3 billion in 2033 from a base value of USD 31.4 billion in 2024

- Market Definition: The cell culture market encompasses the products, technologies, and services used for the growth, maintenance, and study of cells in controlled environments for research, biopharmaceutical manufacturing, and therapeutic applications.

- By Product Segment Analysis: By Product, Consumables leads in 2024 & is anticipated to dominate this segment with 73.8% of market share throughout the forecasted period.

- By Application Segment Analysis: Drug Discovery is projected to take the lead and dominate this market as it holds the highest market share in 2024.

- By End User Segment Analysis: Pharmaceutical and Biotechnology companies are projected to dominate the end-user segment as they hold 39.4% of the market share in 2024.

- Growth Driver: The rising need for biopharmaceuticals, advancements in cell culture media, and the growth of research and development activities are key growth drivers in the global cell culture market.

- Regional Analysis: North America is projected to have a 37.0% share of revenue in 2024 and exert its dominance on the global cell culture market.

Cell Culture Market Use Cases

- Drug Development: Cell culture techniques are used to check the efficacy and safety of new drugs, presenting a controlled environment for preclinical screening and toxicity research.

- Vaccine Production: Cell cultures are employed to produce vaccines, consisting of those for influenza and COVID-19, ensuring high yield and consistency in vaccine manufacturing processes.

- Cancer Research: Researchers use cell culture to study most cancers' cell behavior, test treatment plans, and understand mechanisms of cancer progression and metastasis.

- Regenerative Medicine: Stem cell cultures are vital for growing regenerative therapies, which include tissue engineering and organ regeneration, aiming to restore or replace damaged tissues and organs.

Cell Culture Market Dynamic

Trends

Rapid Adoption of 3D Cell Culture TechniquesThe cell culture market around the world is slowly moving to another level that involves 3D cell culture techniques. These have proven to offer more advanced cell biology models than conventional techniques thereby improving the substance discovery processes in the pharmaceutical industry as well as the tissue engineering industry. The ongoing and increasing knowledge of

3D cell culture is proving beneficial to the cell culture market and potential uses contributing to market growth for cell culture processes.

Expansion of Stem Cell ResearchCell culture is incredibly dependent on stem cell research as the latter is seen as one of the key market-driving forces in this particular field. Due to the rising issues of people getting diseases such as diabetes and other chronic illnesses,

stem cell culture finds its demand through the rise of regenerative medicine and personalized therapies. Such trends aimed at continued research will consequently boost the growth of the cell culture market size on increased investment in stem cell solutions and correlated cell culture products.

Integration of Automation and AI in Cell Culture

The global cell culture market is under the positive influence of automatism and artificial intelligence. Automated cell culture helps in providing better and standard cell culturing techniques, and thus, it supports better efficiency and reproducibility. The analytics conducted with the help of AI increase the efficiency and effectiveness of the market analysis and the models used for the same. This trend continues to grow and enhances the market by optimizing the methods of cell culturing and driving more understanding of cell biology.

Growth Drivers

Rising Demand for BiopharmaceuticalsThe growing need for cell culture due to the global increased demand for biopharmaceuticals can be considered as one of the main factors. Cell culture techniques are widely used in the biopharmaceutical production of cells for growth and cultivation as used in the preparation of drugs. This necessity is driving the growth of the cell culture market size, particularly concerning monoclonal

antibodies, vaccines, and other therapeutic proteins.

Advancements in Cell Culture Media

Advancements in cell culture media improvement are improving cell differentiation and Proliferation hence contributing to the growth of the market. Technological advancements in media compositions that can be targeted to the particular cell type and use are more helpful in enhancing the successful cell culture processes. These are features that will help the progress of the cell culture industry hence boosting the cell culture market.

Growth Opportunities

Emerging MarketsThe cell culture market constitutes developing nations as new growth prospects for the global market. The Asia-Pacific and Latin American countries are escalating their investment in

biotechnology and healthcare structures. This expansion is increasing the scope for the growth of the size of the cell culture market as more players are identifying opportunities in these regions by entering the market to satisfy the increasing demand for cell culture products.

Innovative Cell Culture Products

Some opportunities for growth can be attributed to the emergence of new developments in cell culture products and technologies. New technologies in cell culture/media include developed cell culture media, which improve the efficiency of cells in large-scale culture and automation in cell culture systems. These innovations play a crucial role in fulfilling the continuously emerging needs of the cell culture industry and thus influencing the cell culture market size.

Restraints

High Cost of Cell Culture Products

One of the major factors that have limited the cell culture market growth is the early expenses that are incurred on items including the cell culture media, reagents, and even the cell culture equipment. Such costs are high for small-scale laboratory and research organizations that, in turn, restrict the use of advanced cell culture methods and impede the growth of the cell culture market.

Technical Challenges in Cell Culture

Some of the technical factors that are likely to affect the market growth include; contamination risks, fluctuating cell growth rates, and cell viability challenges accompanying the cell culture. These challenges entail specialized work and quality control measures which could be costly and time-consuming, thereby possibly limiting the growth of the cell culture market size.

Ethical Concerns and Regulatory Hurdles

Some of the restraints that can be seen in the stem cell research include ethical issues involved in stem cell research and stringent regulatory standards especially regarding cell culture based products. These problems may lead to the delays in approval of products and the possible restrictions in the number and range of the conducted research and development, thus, putting pressure on the rate of the growth of the global cell culture market. Inconsistent global regulations are also an issue for the cell culture market’s participants since they need to adhere to different laws in various countries.

Cell Culture Market Research Scope and Analysis

By Product

In terms of product, the consumables segment is to hold the largest market share 61.3% in 2024 and is anticipated to experience significant growth in the forecast period, driven by the constant demand for consumables and increased R&D spending by biotechnology & biopharmaceutical companies, with increased investment, aims to develop advanced biologics, like monoclonal antibodies & vaccines, further boosting the consumption of consumables. The consumables segment includes reagents, media, and sera, all of which are expected to maintain high demand.

Moreover, within the consumables segment, the cell culture media category claimed the largest share in 2023, due to the surge in R&D investments, the expansion of life sciences industries, mainly in biopharmaceutical products, & the overall growth of the biotechnology sector. In addition, the growing interest in stem cells & their expanding applications in biotechnological research are significant contributors to the expanding market for cell culture media.

By Application

The global cell culture market is dominating the biopharmaceuticals segment by 35.6% in 2024, driven by the vast use of mammalian cell cultures in developing pharmaceuticals & the higher demand for genetically & proteomically improved medicines.

Further, the effectiveness of biopharmaceuticals in treating various diseases has contributed to their popularity among patients, driving segment growth. Also, the surge in R&D activities in biopharmaceuticals has increased the demand for cell culture techniques, mainly among contract researchers & manufacturers who highly adopt third-party services.

Furthermore, the most promising segment in the forecast period is

drug discovery, responding to the growth in the need for innovative drugs owing to the prevalence of chronic & genetic diseases. As cell-based research studies, integral to drug discovery, have experienced an evolution from 2D to 3D culture techniques, developing accuracy in high-throughput screening. Increased investments by biopharmaceutical companies in drug discovery processes to develop novel therapies & vaccines are anticipated to propel the growth of the drug discovery segment in the cell culture market.

By End User

Pharmaceutical & biotechnology companies is projected to stand as crucial end-users in the cell culture market by driving the growth of the overall market in 2024. These industries highly utilize cell culture technologies for different applications, like drug development, vaccine production, & biopharmaceutical manufacturing.

Further, the need for cell culture techniques are highly used in pharmaceutical and biotech companies due to their dependency on precise & controlled environments for cultivating cells, tissues, and microorganisms. The market to the specific needs of these companies facilitates the growth of cells for research and large-scale production of therapeutic products.

In addition, in the pharmaceutical & biotechnology sectors, the adoption of advanced cell culture technologies is vital for improving research capabilities & optimizing the production of biologics. The industry's constant desire for new drugs, vaccines, & biopharmaceuticals requires sophisticated cell culture methodologies, making these companies key contributors to the market's growth.

The Cell Culture Market Report is segmented on the basis of the following

By Product

- Consumables

- Media

- Serum Containing Media

- Serum Free Media

- Protein Expression Media

- Stem Cell Media

- Hybridoma Media

- Primary Cell Media

- Insect Cell Media

- Immunology Media

- CHO Cell Culture Media

- HEK Media

- BHK Media

- Protein Free Media

- Chemically Defined Media

- Sera

- Fetal Bovine Sera (FBS)

- Adult Bovine Sera (ABS)

- Other Animal Sera

- Reagents

- Growth Factors

- Supplements

- Buffers & Chemicals

- Cell Dissociation Reagents

- Cryoprotective Agents

- Other Reagents

- Cultureware

- Vessels

- Roller/Roux Bottles

- Cell Stacks

- Multiwell Plates

- Flasks

- Petri Dishes

- Accessories

- Instruments

- Supporting Equipment

- Filtration Systems

- Cell Counters

- Carbon Dioxide Incubators

- Centrifuges

- Autoclaves

- Microscopes

- Biosafety Cabinets

- Other Supporting Equipment

- Bioreactors

- Static Culture system

- Hollow Fiber Bioreactor System

- Stirred Bioreactor Systems

- Perfusion Bioreactor Systems

- Microcarrier Based Systems

- Suspension Culture Systems

- Storage Equipment

- Refrigerators & freezers

- Cryostorage Systems

- Other Equipment

- Cell Isolation System

- Automated Cell Processing Systems

- Cryopreservation Systems

- Cell Characterization & analysis systems

- Automated Filling & Packaging Systems

- Automated Liquid Handing Systems

By Application

- Drug Discovery

- Biopharmaceuticals

- Monoclonal Antibody Production

- Vaccine Production

- Other Therapeutic Protein Production

- Tissue Culture and Engineering

- Cell and Gene Therapy

- Other Tissue Engineering and Regenerative Medicine Applications

- Vaccine Production

- Gene Therapy

- Others

By End User

- Pharmaceutical & Biotechnology Companies

- Hospitals & Diagnostic Laboratories

- Research & Academic Institutes

- Other

How Does Artificial Intelligence Contribute To Improve Cell Culture Market ?

- Automated Monitoring: AI-powered imaging and sensors enable real-time monitoring of cell growth and health.

- Optimized Media Formulation: AI algorithms design the best culture media compositions for enhanced cell viability.

- Predictive Modeling: AI predicts cell behavior in different environments, reducing trial-and-error experiments.

- Bioprocess Optimization: AI optimizes bioreactor conditions, improving large-scale cell production.

- Quality Control: AI detects contamination and ensures batch-to-batch consistency.

- Drug Development: AI-driven models accelerate drug screening and toxicity testing.

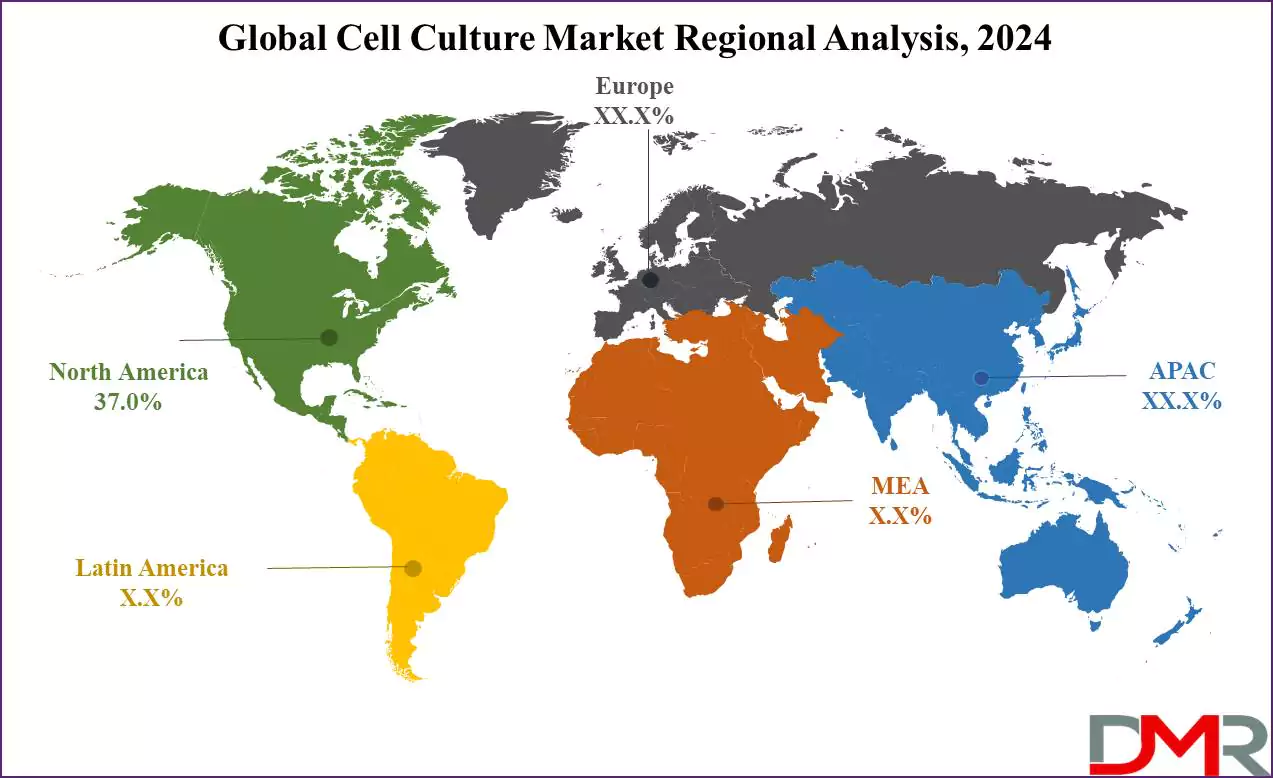

Cell Culture Market Regional Analysis

North America is expected to dominate the market

with a significant 37.0% share in 2024, mainly due to the well-established pharmaceutical & biotech sectors, along with the broad usage of technologically developed in the US. Further, the region also benefits from a strong market for cell culture technologies, driven by vast

cell therapy research undertaken by different universities as the need for such technologies in both research & clinical applications is further driven by the increasing number of chronic & infectious diseases in the region.

Moreover, the Asia Pacific region is expected to have rapid expansion, projected to be the fastest-growing market over the forecast period, which is fueled by increased healthcare expenditure, growing awareness of cell & gene therapies, and a high potential for clinical research applications. The adoption of scientific technologies & emerging therapeutics, like regenerative medicines and cancer immunotherapies, is anticipated to further boost the region's growth in the coming years.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Cell Culture Market Competitive Landscape

The cell culture market experiences moderate competition with a focus on several key players. A few major companies currently hold significant market share. Further, the ongoing competition is intensified by constant advancements & enhancement in cell culture platforms introduced by these major players, emphasizing the dynamic and evolving nature of the market.

In July 2023, Merck made a major investment of about USD 25.85 million in Kansas, USA, to expand the production capacity for cell culture media, which highlights Merck's commitment to meeting the growing demand for cell culture media & reflects the company's dedication to improving its capabilities in the development &manufacturing of essential biopharmaceutical components.

Some of the prominent players in the Global Cell Culture Market are

- Merck KGaA

- Corning Incorporated

- Lonza

- FUJIFILM Irvine

- VWR International

- BioSpherix Ltd

- BD

- Avantor

- PromoCell

- Thermo Fisher Scientific

- Other Key Players

Cell Culture Market Recent Development

January 2024

- Merck: Introduced its first digital hub outside of the United States and Europe, the Merck Digital Hub in Singapore.

October 2023

- Thermo Fisher and Lonza: Announced a collaboration to create a scalable cell culture manufacturing platform for biopharmaceutical production, combining Lonza’s cell line development and manufacturing expertise with Thermo Fisher’s automation and bioprocessing experience.

- Cytiva: Acquired Cevec Pharmaceuticals to enhance its biomanufacturing solutions portfolio, improving its capacity to meet the increasing demand for effective biopharmaceutical research and manufacturing.

- Sartorius: Unveiled BIOFLOAT™ 96-well plates, designed for spheroid culture without surface-attached cells, benefiting tissue engineering and cancer research by streamlining spheroid culture and enhancing its viability and function.

May 2023

- Pfizer and Thermo Fisher Scientific Inc.: Entered into a collaboration agreement to increase local access to next-generation sequencing (NGS)-based testing for lung and breast cancer patients in over 30 countries.

April 2023

- Agilent Technologies Inc.: Introduced the Agilent SureSelect Cancer CGP Assay, designed for somatic variant profiling across a broad range of solid tumor types.

February 2022

- Nucleus Biologics: Introduced Krakatoa, a media maker that allows researchers to produce customized cell culture media directly at the point of use, enhancing efficiency and convenience in laboratory practices.

- KromaTiD: Announced an extensive suite of services covering cell and blood culture growth, isolation, processing, and control, enriching the company's portfolio and contributing to the growing demand for cell culture products and consumables.

- Cellular Evolution: Raised USD 1.75 million to accelerate the launch of its continuous cell culture technology.

June 2022

- Evonik: Launched the cQrex portfolio, a range of cell culture ingredients designed to enhance efficiency and productivity in bioprocesses, optimizing the production of monoclonal antibodies, vaccines, viral vectors, and therapeutic cells.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 31.4 Bn |

| Forecast Value (2033) |

USD 80.3 Bn |

| CAGR (2024-2033) |

11% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Consumables, Instruments,) By Application (Drug Discovery, Biopharmaceuticals, Tissue Culture and Engineering, Vaccine Production, Gene Therapy, Others, By End User (Pharmaceutical & Biotechnology Companies, Hospitals & Diagnostic Laboratories, Research & Academic Institutes, Other) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Merck KGaA, Corning Incorporated, Lonza, FUJIFILM Irvine, VWR International, BioSpherix Ltd, BD, Avantor, PromoCell, Thermo Fisher Scientific, Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Cell Culture Market size is expected to have a value of USD 31.4 billion in 2024 and is expected to reach USD 80.3 billion by the end of 2033.

North America has the largest market share for the Global Hospital Asset Management Market with a share of about 37.0% in 2024.

Some of the major key players in the Global Cell Culture Market are Merck KGaA, Corning Incorporated, Lonza, and many others.

The market is growing at a CAGR of 11.0 percent over the forecasted period.