Market Overview

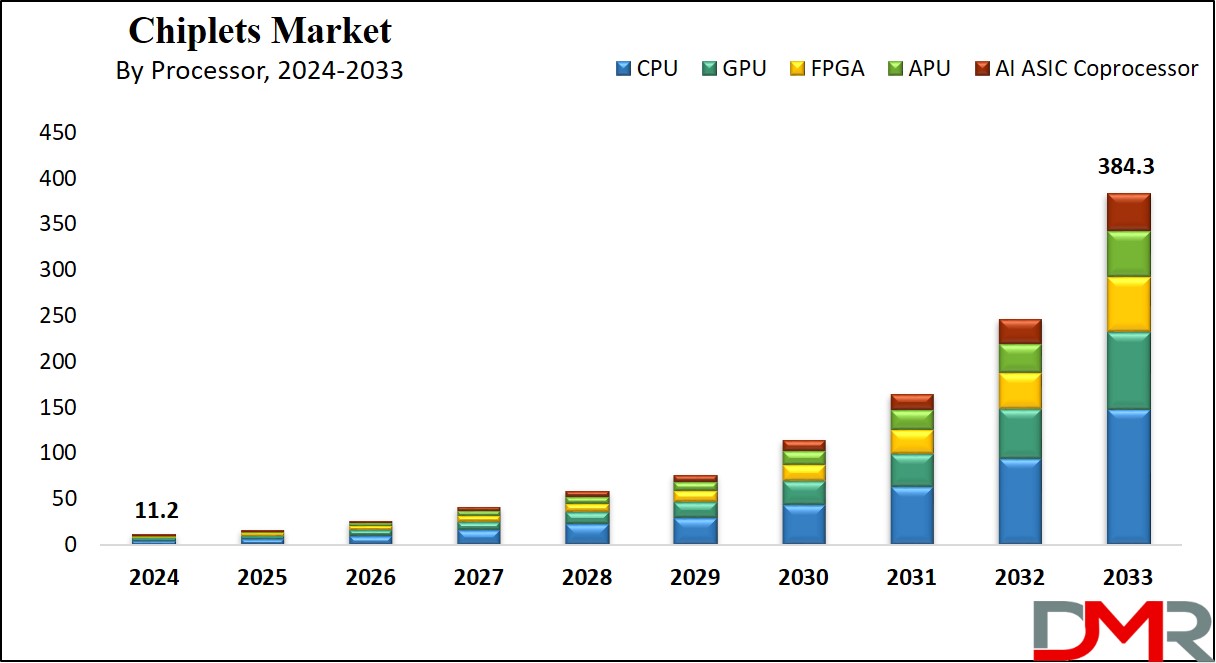

The Global Chiplets Market is projected to reach

USD 11.2 billion in 2024 and grow at a compound annual growth rate of

48.1% from there until 2033 to reach a value of

USD 384.3 billion.

Chiplets are small, modular integrated circuits (ICs) designed to work together as building blocks to create a larger, more complex processor. Instead of manufacturing a single, large monolithic chip, chiplets are made individually and connected on a substrate or through advanced packaging technologies, which simplifies production, minimizes costs, and allows companies to mix and match chiplets for specific needs, like integrating different processing cores, memory units, or accelerators into one system. Chiplets have become a game-changer in the semiconductor industry because they enable improved scalability and flexibility.

Further, the demand for chiplets is growing, driven by the growing complexity of computing needs in areas like artificial intelligence (AI), 5G networks, cloud computing, and advanced gaming. Chiplets provide an affordable way to enhance performance without the challenges of developing ultra-large chips using advanced lithography.

As transistors shrink in size with smaller process nodes, manufacturing defects and costs rise. Chiplets solve this issue by transforming defective units without scrapping the entire processor. In addition, they improve yields and accelerate innovation, making them highly attractive for the semiconductor industry.

Further, a major trend is the shift toward standardized interconnect technologies, like Universal Chiplet Interconnect Express (UCIe), which allows chipsets from different manufacturers to work easily together, which supports a broader ecosystem, promoting collaboration between companies and reducing barriers to chiplet adoption.

Another trend is the growth of heterogeneous computing, where diverse chiplets—optimized for tasks like AI, graphics, or data processing—are integrated into a single package. Companies also invest in advanced packaging techniques, like 3D stacking, to enhance power efficiency and reduce latency in chiplet-based systems.

Moreover, many semiconductor giants, like Intel, AMD, and TSMC, made many developments in chiplet technology. Intel announced plans to utilize chiplets for its future processors, while AMD continued its leadership with its Zen-based chiplet architectures.

Also, TSMC introduced new packaging solutions, like 3D Fabric, to assist in chiplet integration. Partnerships between companies, like the UCIe consortium, also gained momentum, laying the groundwork for open, interoperable chiplet ecosystems. In 2024, this trend is expected to continue, with more startups and tech giants embracing chiplets to meet growing market demands.

Furthermore, chiplets provide many benefits, like lesser development costs, faster time-to-market, and better scalability. They allow manufacturers to reuse proven designs, reducing risks linked with new chip development. However, challenges remain, like ensuring reliable interconnections between chiplets, managing heat dissipation in densely packed designs, and overcoming software compatibility issues. These challenges are constantly being addressed through industry collaboration and research, but they remain vital to the broad adoption of chiplets.

The chiplet market is poised for exponential growth, as industries like AI, autonomous vehicles, and the Internet of Things (IoT) demand high-performance, customizable computing solutions. The adoption of standards like UCIe will drive innovation, enabling wide collaboration across the semiconductor value chain. Companies investing in chiplet technology now are likely to gain a competitive edge in the years ahead.

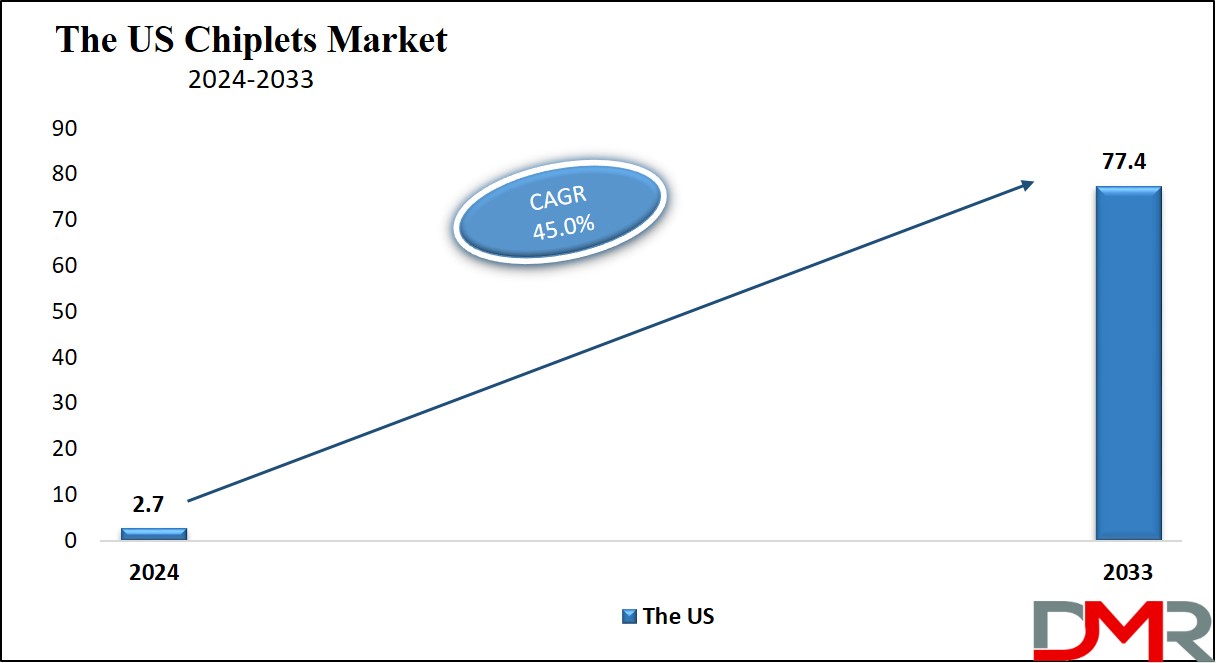

The US Chiplets Market

The US Chiplets Market is projected to reach

USD 2.7 billion in 2024 at a compound annual growth rate of 45.0% over its forecast period.

The U.S. has many growth opportunities in the chiplet market, driven by its leadership in advanced semiconductor technologies and strong R&D capabilities. Government initiatives heling domestic chip manufacturing and collaborations with industry leaders further boost growth. Expanding applications in AI, cloud computing, and 5G create high demand for chiplets, positioning the U.S. as a key player in innovation and adoption.

Further, the market is driven by strong investments in semiconductor research, government support for domestic manufacturing, and increasing demand for AI, 5G, and data center solutions. However, a key challenge is the high complexity and cost of chiplet production, requiring advanced packaging technologies and industry-standardization efforts, which could slow adoption.

Key Takeaways

- Market Growth: The Chiplets Market size is expected to grow by USD 368.2 billion, at a CAGR of 48.1% during the forecasted period of 2025 to 2033.

- By Processor: The CPU segment is anticipated to get the majority share of the Chiplets Market in 2024.

- By Packaging Technology: The 2.5D/3D are expected to be leading the market in 2024

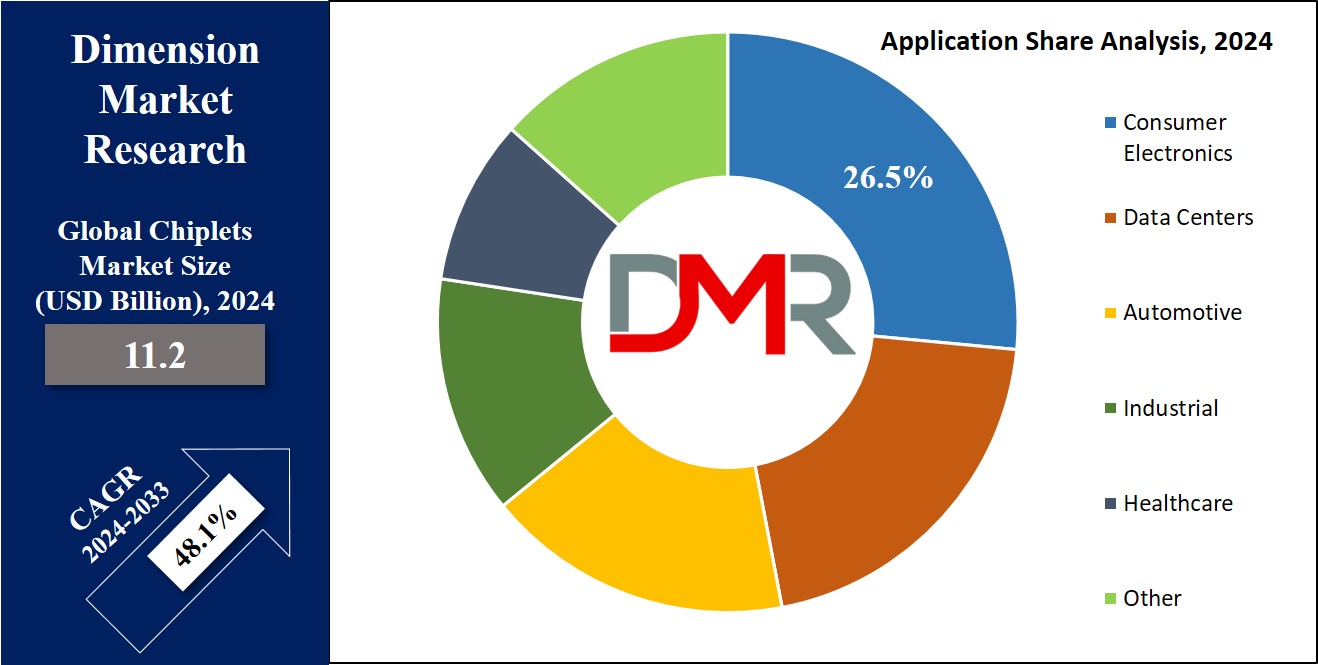

- By Application: The consumer electronic segments is expected to get the largest revenue share in 2024 in the Chiplets Market.

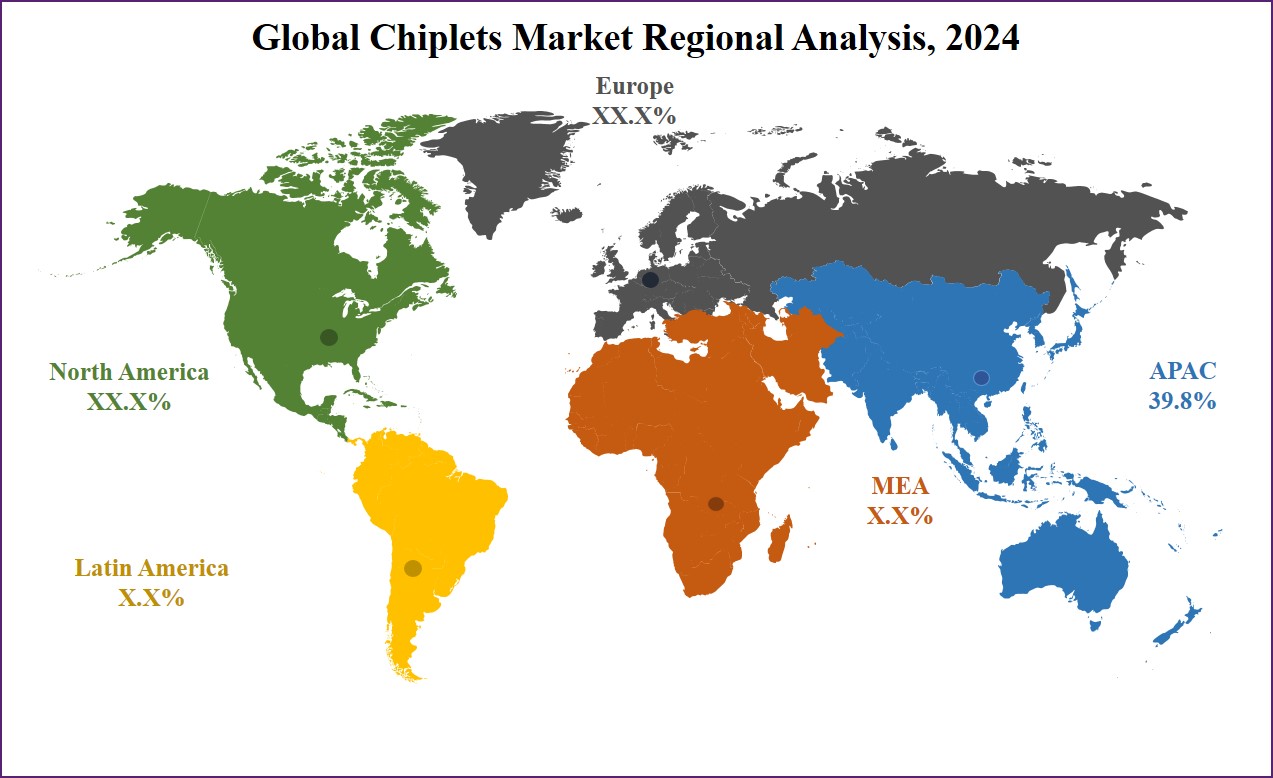

- Regional Insight: Asia Pacific is expected to hold a 39.8% share of revenue in the Global Chiplets Market in 2024.

- Use Cases: Some of the use cases of Chiplets include consumer electronics, 5G & IoT Devices, and more.

Use Cases

- High-Performance Computing (HPC): Chiplets allows the creation of powerful processors for AI, machine learning, and data analytics by intergrating specialized components like cores and accelerators.

- Consumer Electronics: Chiplets optimize performance & efficiency in smartphones, gaming consoles, and wearables by integrating custom components for specific device functions.

- Data Centers and Cloud Computing: Chiplets improve scalability and power efficiency in servers by integrating high-speed, energy-efficient modules for processing massive data loads.

- 5G and IoT Devices: Chiplets helps in compact, energy-efficient designs for 5G infrastructure and IoT devices, allowing better connectivity and smarter technologies.

Statistics

- According to SEMI, China, Taiwan, and Korea are projected to remain the top three destinations for semiconductor equipment spending in 2023 and 2024, with Taiwan regaining the lead in 2023 and China reclaiming it in 2024.

- Further, global equipment spending is expected to decline across most regions in 2023 but rebound in 2024.

- As per the Information Technology & Innovation Foundation (ITIF), China aims for self-sufficiency across the semiconductor supply chain, minimizing foreign dependency while building competitive enterprises.

- Also, Chinese firms are 1-2 years behind global leaders in logic chip design for AI and mobile devices.

- In subsectors like memory chips, semiconductor manufacturing equipment, and assembly, testing, and packing (ATP), Chinese companies are further behind but showing innovation.

- As per ITIF from 2021–2022, 55% of global semiconductor patent applications originated from China, doubling the number from the U.S.

- In 2022, China surpassed the U.S. and Japan in semiconductor patents granted, leading globally.

- ITIF also reported that China's semiconductor R&D intensity is 7.6%, only 40% of the U.S. rate (18.8%) and below the EU's 15%.

- China has made advancements in legacy semiconductor production (>28 nm), competing more on cost than innovation.

- Huawei's, Mate 60 Pro smartphone features are within 18–24 months of global competitors’ designs.

- Moreover, export controls placed by the U.S. in October 2022 restrict China's access to equipment for manufacturing chips below 20 nm, affecting DUV and EUV technologies.

- ITIF announced that in June 2023, the U.S. and Netherlands agreed to restrict exports of ASML's leading-edge EUV lithography equipment to China.

- In addition, China faces challenges in developing a closed-loop semiconductor ecosystem due to the complexity of the industry and export controls.

- Moreover, as per ITIF, lithography, mainly EUV technology pioneered by ASML with a EUR 6 billion (USD 6.3 billion approx.) investment over 17 years, remains a critical chipmaking process.

- In addition, Chinese firms are accelerating their IP and innovation capabilities but continue to lag in most facets of design and fabrication.

Market Dynamic

Driving Factors

Rising Demand for High-Performance and Energy-Efficient Computing

The demand for advanced computing solutions in areas like AI, machine learning, and data analytics is driving the adoption of chiplets, which allow manufacturers to combine specialized components, enhancing performance and energy efficiency, which is mainly critical for data centers, cloud computing, and HPC systems, where scalability and less power consumption are key. Chiplets also address the challenges of traditional monolithic chips, making them an attractive choice for next-gen technologies.

Expansion of Consumer Electronics and IoT Devices

The growth in the market for compact, high-performance devices like smartphones, wearables, and smart home systems is accelerating chiplet adoption. These devices need smaller chips with powerful capabilities, which chiplets achieve through innovative integration techniques. In addition, the growth of IoT and interconnected devices has created a need for energy-efficient, versatile processors. By allowing customized solutions, chiplets meet the transforming needs of consumer electronics and IoT markets, driving their growth globally.

Restraints

Complex Manufacturing Processes and High Costs

While chiplets provide numerous benefits, their production involves complex integration and advanced packaging technologies, like 2.5D and 3D packaging. This complexity increases manufacturing costs and requires significant investment in specialized equipment and expertise. Smaller companies may find it challenging to adopt chiplet technology due to these barriers. In addition, ensuring easy communication between chiplets within a package can add to design and testing challenges, potentially slowing market growth.

Limited Standardization Across the Industry

The lack of universal standards for chiplet designs and interconnect technologies develops compatibility issues between products from different manufacturers, which can affect widespread adoption, as companies may need to develop proprietary solutions, increasing development time and costs. Furthermore, collaboration among industry players is important for creating a robust ecosystem, but achieving consensus on standards remains a challenge, acting as a restraint for market expansion.

Opportunities

Advancements in Packaging Technologies

The development of innovative packaging methods, such as 2.5D and 3D integration, provides new opportunities for chiplet adoption. These technologies allow higher performance, better energy efficiency, and miniaturization, meeting the demands of modern applications like AI, IoT, and autonomous vehicles. As these packaging techniques become more affordable and scalable, they can drive wide adoption across industries, creating significant growth potential in the chiplet market.

Growing Demand in Emerging Technologies

The quick expansion of emerging technologies, like 5G, edge computing, and AI-powered devices, provides a massive growth opportunity for chiplets. These applications demands specialized, modular designs for optimal performance and energy efficiency, which chiplets are well-suited to deliver. As industries highly depends on advanced computing solutions, chiplets can play a major role in supporting innovation and addressing the unique challenges of these next-generation technologies.

Trends

Adoption of Heterogeneous Integration

A key trend in the chiplet market is the growth of heterogeneous integration, where chiplets with different functions and technologies are combined into a single package, which allows customized solutions for applications like AI, high-performance computing, and telecommunications. It allows manufacturers to mix older, proven chip designs with advanced components, minimizing costs and accelerating development timelines, which has made chiplets a preferred choice for industries requiring adaptable and efficient processors.

Focus on Standardization and Ecosystem Collaboration

In recent times, there has been a major focus on developing industry standards for chiplet design and interconnect technologies. Initiatives like the Universal Chiplet Interconnect Express (UCIe) focus on ensuring compatibility across manufacturers, fostering a more robust ecosystem, which encourages collaboration among key players in the semiconductor industry, simplifying adoption and driving innovation. Standardization is expected to accelerate the widespread use of chiplets in diverse applications.

Research Scope and Analysis

By Processor

The CPU segment is set to grow significantly in the chipset market throughout the forecast period, as it plays a major role in powering many types of computing devices. With the growing demand for faster processing, better energy efficiency, and scalability, chipset-based CPU designs are becoming highly popular.

These designs enable manufacturers to build CPUs in a modular way, integrating specialized chiplets for tasks like processing cores, cache, and memory management. This modular approach enhances CPU performance and efficacy while making them more adaptable to disturbed needs, from personal gadgets to large-scale data centers, which is driven by new workloads like AI and data analytics, are also boosting this trend.

Further, GPUs play a big role in driving the growth of the chipset market because they are vital for handling heavy tasks like gaming, AI, and data processing. Their ability to process multiple operations at once makes them perfect for modern computing needs. With the rise of AI, machine learning, and high-resolution graphics, GPUs are in high demand. Chiplet technology further boosts their potential by allowing manufacturers to build more powerful, modular GPUs that are efficient and scalable, fueling the overall growth of the chipset market.

By Packaging Technology

2.5D and 3D packaging have become breakthrough technologies transforming how chipsets are integrated. These methods allow multiple chips to be combined into one package, providing better performance, higher bandwidth, and compact designs. In 2.5D packaging, chips are placed side-by-side on a silicon interposer, creating very dense connections between them.

In 3D packaging, chips are stacked vertically, minimizing the distance for interconnects and reducing the package size. These approaches make it possible to get greater energy efficiency and packing density. Over the years, 2.5D and 3D packaging have gained popularity as ideal platforms for chiplet integration, meeting the increasing demands of advanced, efficient, and space-saving semiconductor designs.

Further, System-in-Package (SiP) also plays a major role in boosting the chipset market by integrating various components, like processors, memory, and sensors, into a single compact package, which allows devices to perform better while saving space, making SiP perfect for modern gadgets like smartphones, wearables, and IoT devices. SiP technology enhances energy efficiency, reduces manufacturing complexity, and supports diverse functions within one unit. Its ability to meet the growing demand for smaller, more efficient systems is driving the chipset market's expansion.

By Application

In 2024, the consumer electronics segment is expected to dominate the global chiplet market, holding the largest share due to the critical role chiplets play in improving the performance and efficiency of devices like smartphones, tablets, laptops, and gaming consoles. Chiplets use a modular design that allows high-performance components to be integrated without the challenges and high costs of traditional monolithic chips.

This modular approach helps manufacturers optimize chips for specific functions, improving device performance while lowering production complexity and costs. Consumer electronics demand constant innovation, smaller designs, and better energy efficiency, all of which chiplets address by offering tailored solutions for various device needs. This capability allows companies to enhance functionality and maintain competitive pricing in a market that thrives on efficiency and performance.

Further, the rise in adoption of smart home devices and wearable technologies drives the demand for chiplets in consumer electronics. These products need compact yet powerful computing systems, making chiplets an ideal solution. With the rapid development of the Internet of Things (IoT), where interconnected devices are becoming the norm, chiplets provide the flexibility and efficiency demanded to help this trend. By allowing powerful, energy-efficient, and adaptable chips, chiplets solidify their vitality in consumer electronics, ensuring that this segment continues to lead the global chiplet market in the coming years.

By End User

The IT and telecommunication services sector will be holding a strong position in the chiplet market in 2024, accounting for a major global share, which is driven by its vital role in supporting the modern digital economy, where businesses and services increasingly depend on advanced technology. As digitization accelerates, the demand for efficient, high-performance computing infrastructure grows, making chiplets an ideal solution.

Chiplets allow for the creation of custom processors to meet the distinctive needs of IT and telecommunication services, providing better flexibility, performance, and cost efficiency. These features are vital for maintaining the reliability and scalability of digital infrastructure in a fast-paced, data-driven world.

Further, the rapid growth of cloud computing, data centers, and 5G networks has driven the demand for chiplets in this sector. These technologies demand energy-efficient, high-speed computing solutions capable of processing massive data. By integrating numerous technologies into a single compact package, chiplets provide better performance while minimizing power consumption is vital for telecom providers upgrading their systems to handle growing traffic and support next-gen networks.

In addition, the growing use of AI and machine learning in IT applications has created a need for more specialized, powerful processors. With their modular design and ability to adapt to evolving requirements, chiplets are perfectly suited to meet these demands, reinforcing the IT and telecom sector's leadership in the chiplet market.

The Chiplets Market Report is segmented on the basis of the following

By Processor

- Field-Programmable Gate Array (FPGA)

- Graphics Processing Unit (GPU)

- Central Processing Unit (CPU)

- Application Processing Unit (APU)

- Artificial Intelligence Application-specific Integrated Circuit (AI ASIC) Coprocessor

By Packaging Technology

- System-in-Package (SiP)

- Flip Chip Chip Scale Package (FCCSP)

- Flip Chip Ball Grid Array (FCBGA)

- 2.5D/3D

- Wafer-Level Chip Scale Package (WLCSP)

- Fan-Out (FO)

By Application

- Consumer Electronics

- Data Centers

- Automotive

- Industrial

- Healthcare

- Other Applications

By End User

- IT and Telecommunication Services

- Automotive

- Healthcare and Life Sciences

- Consumer Electronics

- Other End-Users

Regional Analysis

In 2024, the Asia-Pacific region is set to establish a significant foothold in the global chiplets market, securing a dominant position with over a

39.8% share. This substantial market share underscores the pivotal role APAC plays in the semiconductor and microelectronics industries, driven by advanced manufacturing capabilities and extensive investments in research and development.

The region’s strategic focus on enhancing semiconductor technologies, coupled with strong government support and collaborations between tech giants, continues to fuel growth and innovation within the chiplets market. This dominance not only highlights APAC’s integral contribution to the global market but also its potential to lead future advancements in chiplet technology.

North America is also expected to hold a significant share, which benefits from the presence of major semiconductor companies and a strong ecosystem helping technological innovation. The adoption of chiplets in North America is mainly driven by the demand for high-performance computing solutions in sectors like cloud computing and advanced electronics.

Also Europe, the market share is slightly lower compared to the other. However, the region’s focus on automotive and industrial applications significantly contributes to the growth of the chiplets market. Europe’s commitment to minimizing electronic waste and enhancing energy efficiency also drives the development in chiplet technologies, making it a key region in sustainable electronic design.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The chiplet market is moderately fragmented, with numerous players focusing on innovation to capture growing demand across industries. Companies are investing heavily in advanced packaging technologies like 2.5D and 3D integration to improve performance, scalability, and energy efficiency. Collaboration among semiconductor manufacturers, research institutions, and standardization bodies is becoming common to drive interoperability and accelerate adoption. Competition is also intensifying as firms develop customized solutions for emerging applications, like AI, 5G, and IoT, which promote rapid technological advancements and benefit the overall chiplet ecosystem.

Some of the prominent players in the global Chiplets are:

- IBM Corp

- Intel Corp

- NVIDIA Corp

- Micron Technology

- Samsung Electronics

- TSMC

- Broadcom Inc

- Qualcomm Inc

- ON Semiconductor

- AMD

- Other Key Players

Recent Developments

- In November 2024, Cadence unveiled the development and successful tape-out of its first Arm-based system chiplet, which is a major advancement in chiplet technology, showcasing Cadence's commitment to driving industry-leading solutions through its chiplet architecture and framework.

- In November 2024, SEMIFIVE introduced its collaboration with Synopsys to develop an advance high-performance computing (HPC) platform combining SEMIFIVE's CPU chiplet with a third-party I/O chiplet into a unified package. Further, its HPC chiplet platform will provide notable advantages over traditional chiplet platforms to reduce cost, optimize performance, and enable development flexibility.

- In October 2024, Faraday Technology Corporation and Kiwimoore announced that their jointly developed 2.5D packaging platform has successfully entered the mass production stage. The one-stop advanced packaging platform & service developed via collaboration between Faraday and Kiwimoore, which incorporates Kiwimoore’s Chiplet interconnect and NDSA solutions, highlights the significant achievements both companies have made in the Chiplet market.

- In June 2024, Rapidus Corporation and IBM introduced a partnership focused on establishing mass-production technologies for chiplet packages, which will allow Rapidus to receive packaging technology from IBM for high-performance semiconductors, and the two companies will collaborate, aiming to further innovate in this space. Further, the agreement is part of an international collaboration within the framework of the “Development of Chiplet and Package Design and Manufacturing Technology for 2nm-Generation Semiconductors” project being taken by Japan’s New Energy and Industrial Technology Development Organization (NEDO) and builds on an existing agreement with IBM for the joint development of 2nm node technology.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 11.2 Bn |

| Forecast Value (2033) |

USD 384.3 Bn |

| CAGR (2024-2033) |

48.1% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 2.7 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Processor (Field-Programmable Gate Array (FPGA), Graphics Processing Unit (GPU), Central Processing Unit (CPU), Application Processing Unit (APU), and Artificial Intelligence Application-specific Integrated Circuit (AI ASIC) Coprocessor), By Packaging Technology (System-in-Package (SiP), Flip Chip Chip Scale Package (FCCSP), Flip Chip Ball Grid Array (FCBGA), 2.5D/3D, Wafer-Level Chip Scale Package (WLCSP), Fan-Out (FO)), By Application (Consumer Electronics, Data Centers, Automotive, Industrial, Healthcare, and Other Applications), By End User (IT and Telecommunication Services, Automotive, Healthcare and Life Sciences, Consumer Electronics, and Other End-Users) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

IBM Corp, Intel Corp, NVIDIA Corp, Micron Technology, Samsung Electronics, TSMC, Broadcom Inc, Qualcomm Inc, ON Semiconductor, AMD, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Chiplets Market size is expected to reach a value of USD 11.2 billion in 2024 and is expected to reach USD 384.3 billion by the end of 2033.

Asia Pacific is expected to have the largest market share in the Global Chiplets Market with a share of about 39.8% in 2024.

The Chiplets Market in the US is expected to reach USD 2.7 billion in 2024.

Some of the major key players in the Global Chiplets Market are IBM Corp, Intel Corp, NVIDIA Corp, and others

The market is growing at a CAGR of 48.1 percent over the forecasted period.