Market Overview

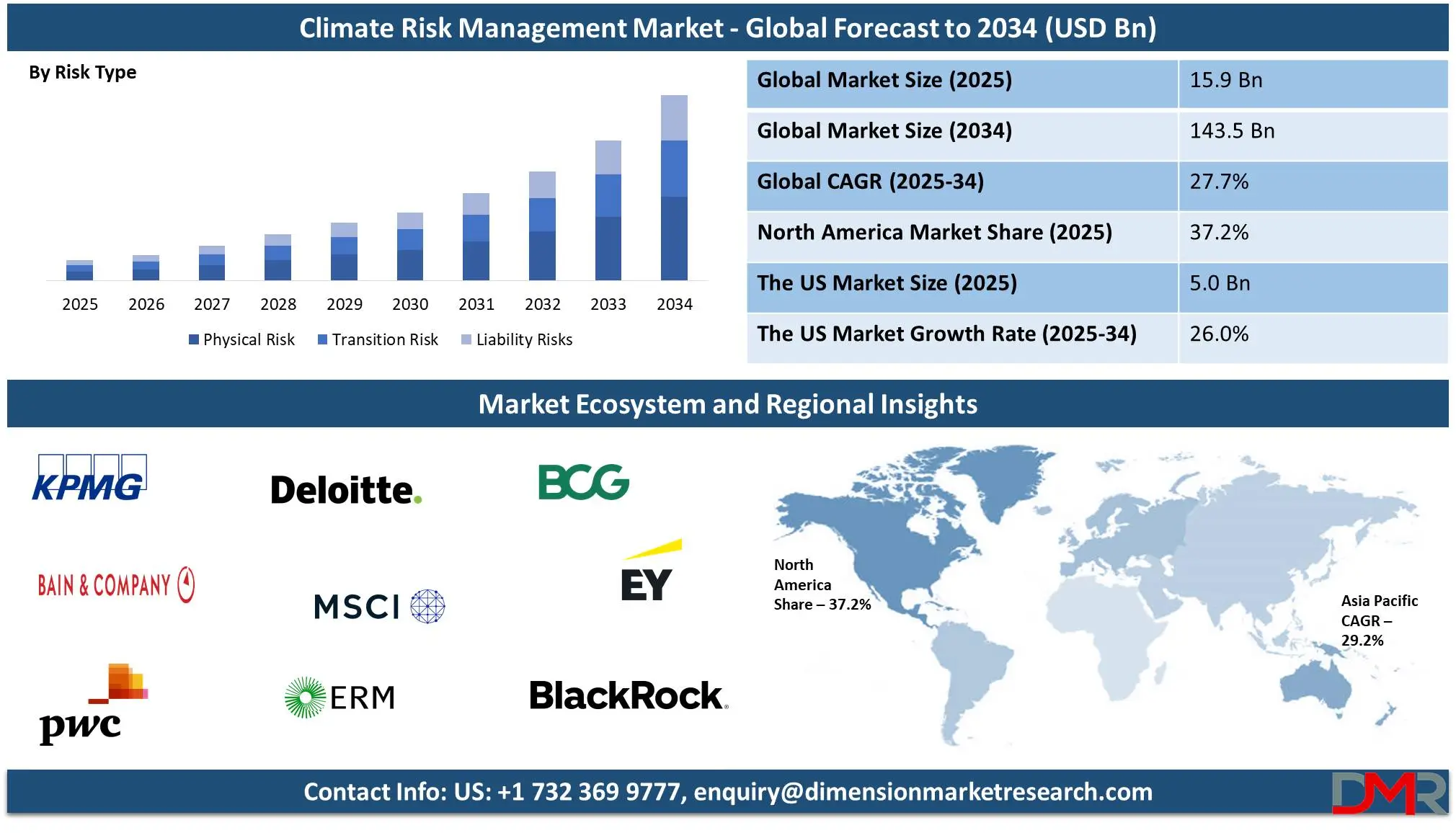

The Global Climate Risk Management Market is projected to reach

USD 15.9 billion in 2025 and grow at a compound annual growth

rate of 27.7% from there until 2034 to reach a value of

USD 143.5 billion.

Climate risk management refers to the strategies, tools, and processes organizations utilize to identify, assess, and mitigate climate-change-related risks. These threats include physical threats like extreme weather events, rising sea levels, and temperature shifts, along with financial and regulatory threats related to changing policies, investor expectations, and market demands. Businesses, governments, and financial institutions use climate risk management practices to ensure resilience and long-term sustainability when faced with new environmental challenges.

Climate risk management has become more of a priority as industries adapt their operations for sustainability, facing intense industry-specific pressure to incorporate climate-related considerations. Businesses must protect assets, supply chains, and financial stability from climate-related disruptions while governments across the globe impose strict climate disclosure regulations, forcing businesses to develop comprehensive risk mitigation strategies. Investors and consumers also value sustainability considerations in decision-making processes, as evidenced by increasing investor pressure for companies to incorporate climate considerations.

Climate risk management is becoming ever more relevant as industries adapt to increased environmental regulations and consumer demands for sustainability in their operations. Businesses must protect assets, supply chains, and finances against climate-related disruptions to remain financially sustainable and prevent disruptions that threaten operations or operations at an earlier date than planned. Governments around the world have implemented stricter climate risk disclosure requirements, forcing organizations to adopt comprehensive risk management strategies, while investors and consumers increasingly place importance on sustainability considerations as key decision-making criteria in the decision-making processes of organizations.

Recent years have experienced several climate-related events that underscored the significance of effective risk management. Weather events like wildfires, hurricanes, and floods caused extensive economic and environmental damages; rising global temperatures led to droughts and water shortages across many regions; these events prompted policymakers to strengthen climate policies while encouraging businesses to develop comprehensive climate risk mitigation plans.

Climate risk management for businesses is essential to their operational stability and financial well-being. Organizations that neglect to identify and reduce climate risks risk disruption, regulatory penalties, and irreparable damage. Businesses that proactively incorporate climate strategies can gain a competitive edge, build investor trust, increase resilience over time, and align themselves with global efforts toward creating a more sustainable economy.

As climate risks continue to escalate, organizations must strengthen their risk management strategies accordingly. Governments and regulatory bodies will likely introduce stringent climate regulations that make compliance essential. Technology like AI-powered analytics and real-time climate monitoring will become even more integral to risk assessment and mitigation strategies - prioritizing climate risk management is vital in protecting future sustainability goals while contributing to global sustainability efforts.

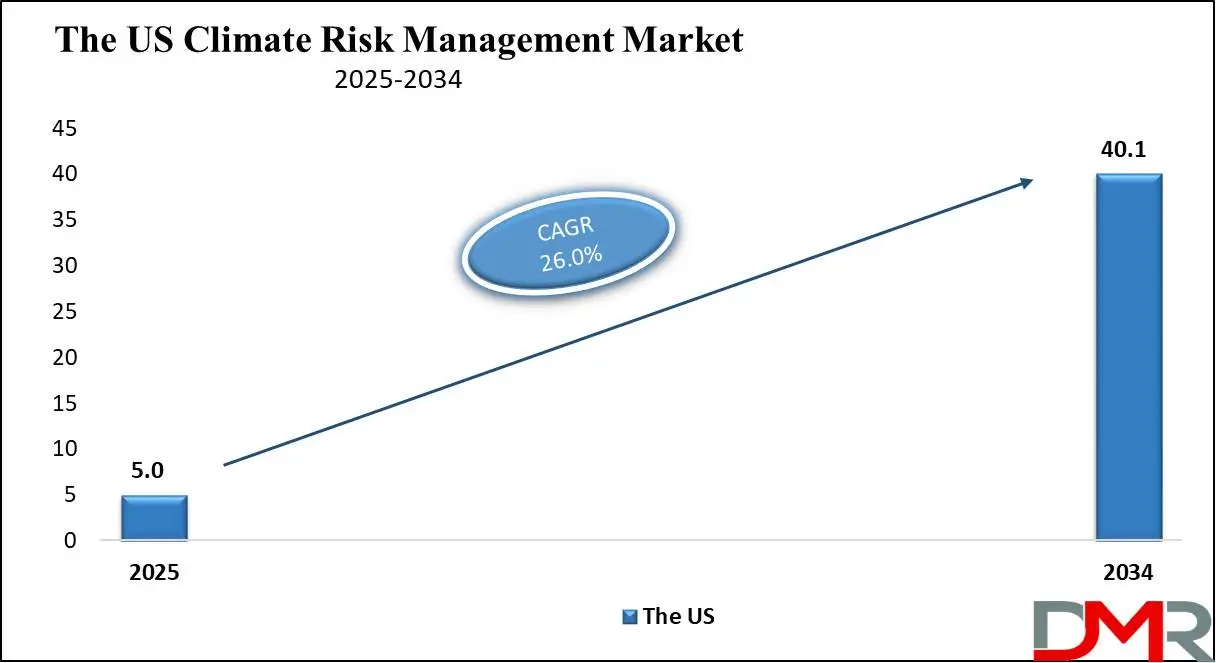

The US Climate Risk Management Market

The US Climate Risk Management Market is projected to reach USD 5.0 billion in 2025 at a compound annual growth rate of 26.0% over its forecast period.

The U.S. has strong growth opportunities in the climate risk management market due to growth in regulatory requirements, rising climate-related financial risks, and corporate sustainability goals. Development in AI-driven risk assessment, climate modeling, and carbon tracking solutions are driving demand. Growing investments in green finance, resilient infrastructure, and ESG compliance further boost market expansion across industries. These advancements also intersect with innovations in the

AI TRiSM (Trust, Risk, and Security Management) , as organizations seek to ensure data integrity, manage AI-driven insights securely, and build stakeholder trust in climate-related decision-making tools.

The U.S. climate risk management market is driven by strict environmental regulations, increasing climate-related disasters, and rising corporate focus on sustainability. Financial institutions and businesses are adopting advanced risk assessment tools to comply with ESG standards. However, the market experiences restraints like high implementation costs, complex data integration challenges, and uncertainty in climate policies, which can slow down widespread adoption across industries.

Climate Risk Management Market: Key Takeaways

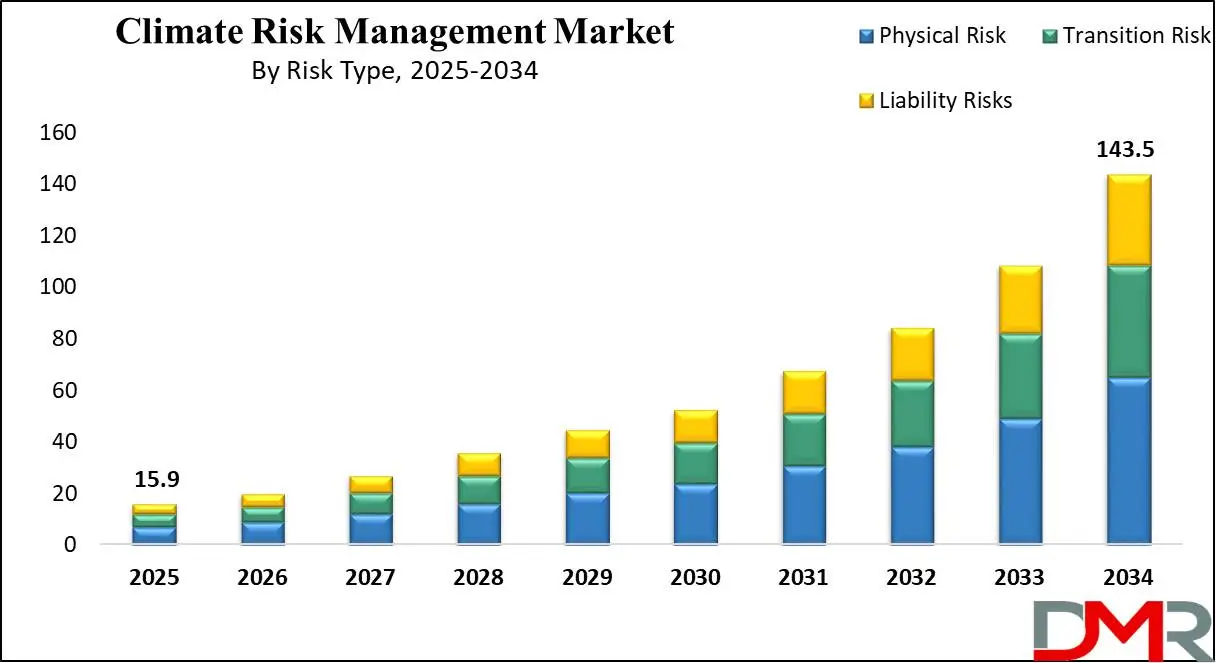

- Market Growth: The Climate Risk Management Market size is expected to grow by 123.6 billion, at a CAGR of 27.7%, during the forecasted period of 2026 to 2034.

- By Risk Type: The physical risks segment is anticipated to get the majority share of the Climate Risk Management Market in 2025.

- By Deployment Mode: The cloud-based deployment is expected to get the largest revenue share in 2025 in the Climate Risk Management Market.

- Regional Insight: North America is expected to hold a 37.2% share of revenue in the Global Climate Risk Management Market in 2025.

- Use Cases: Some of the use cases of Climate Risk Management include financial services & insurance, supply chain & manufacturing, and more.

Climate Risk Management Market: Use Cases

- Financial Services & Insurance: Banks and insurers assess climate risks to protect investments, adjust premiums, and develop climate-resilient financial products.

- Real Estate & Infrastructure: Developers and city planners use climate data to design resilient buildings, prevent flood damage, and comply with environmental regulations.

- Supply Chain & Manufacturing: Companies analyze climate risks to secure supply chains, prevent production disruptions, and ensure sustainable sourcing of raw materials.

- Agriculture & Food Security: Farmers and agribusinesses use climate forecasting and risk management to protect crops, manage water resources, and secure losses due to extreme weather.

Stats & Facts

- According to UNEP FI, in 2023, global temperatures shattered records with a 116-day streak of peak temperatures, highlighting the urgent need for financial institutions to integrate climate risk management into their strategic frameworks.

- The 2024 Climate Risk Landscape Report by UNEP FI provides financial institutions with tools to assess physical and transition climate risks, offering best practices, case studies, and regulatory insights to enhance resilience and sustainability.

- As per Germanwatch.org, between 1993 and 2022, over 765,000 people lost their lives due to extreme weather events, with direct economic losses totaling nearly USD 4.2 trillion (inflation-adjusted) from more than 9,400 disasters.

- Germanwatch.org states that in the long-term Climate Risk Index (1993-2022), Dominica, Honduras, and Myanmar were among the most affected countries due to highly unusual and extreme weather events, while China, India, and the Philippines faced recurring climate threats.

- UNEP FI highlights that the financial sector plays a key role in addressing climate risks as insurers, banks, and investors increasingly integrate climate-related risks into their decision-making to protect assets and ensure long-term stability.

- According to Germanwatch.org, in 2022, Pakistan, Belize, and Italy ranked as the most affected countries by extreme weather impacts, demonstrating that climate risks are not limited to low-income nations but also impact high-income economies.

- UNEP FI reports that financial institutions are leveraging AI-driven risk assessment tools and climate disclosure frameworks to enhance their climate risk management strategies and align with global sustainability goals.

- The Germanwatch.org Climate Risk Index states that from 1993 to 2022, storms caused the highest economic losses (56% or USD 2.33 trillion inflation-adjusted), followed by floods, which contributed to 32% (USD 1.33 trillion) of total losses.

- UNEP FI’s Climate Risk and TCFD Programme aims to support banks, insurers, and investors in enhancing their climate risk management capabilities, ensuring they contribute to global sustainability efforts.

- As per Germanwatch.org, floods affected the highest number of people among all extreme weather events from 1993 to 2022, accounting for over half of those impacted worldwide.

- The Germanwatch.org Climate Risk Index indicates that seven of the ten most affected countries in 2022 belonged to the high-income group, showing that even developed nations must strengthen climate risk management strategies.

- UNEP FI emphasizes that evolving climate risk regulations require financial institutions to implement robust monitoring, assessment, and disclosure tools to meet compliance standards and enhance resilience.

- Germanwatch.org warns that human-induced climate change is transforming extreme weather events from rare occurrences into continual threats, creating a "new normal" of climate-related risks worldwide.

- COP29 failed to deliver an ambitious New Collective Quantified Goal (NCQG) on Climate Finance, and Germanwatch.org highlights that the USD 300 billion annually by 2035 is only a bare minimum to address escalating climate crises in developing nations.

- According to Germanwatch.org, the lack of strong mitigation efforts has left even high-income countries vulnerable to extreme weather, underscoring the need for increased climate action, ambitious emission reduction targets, and effective implementation of national climate commitments.

Market Dynamic

Driving Factors in the Climate Risk Management Market

Rising Frequency of Extreme Weather EventsThe increasing occurrence of extreme weather events such as hurricanes, floods, wildfires, and heat waves is a major driver for the climate risk management market. As per Germanwatch.org, between 1993 and 2022, over

9,400 extreme weather events led to losses exceeding

USD 4.2 trillion and claimed more than

765,000 lives.

These disasters disrupt economies, destroy infrastructure, and impact global supply chains, prompting governments and businesses to prioritize climate risk management. Financial institutions, real estate developers, and industries are investing in advanced risk assessment tools to mitigate potential damages.

The growing need for climate-resilience planning, predictive analytics, and real-time monitoring solutions is pushing organizations to adopt climate risk management strategies. As climate change intensifies, the demand for data-driven risk mitigation tools and frameworks will constantly rise, further accelerating market growth.

Stringent Climate Regulations and Disclosure Requirements

Governments and regulatory bodies around the world are tightening climate-related regulations, driving the need for robust risk management solutions. Frameworks like the Task Force on Climate-related Financial Disclosures (TCFD) and the European Union’s Corporate Sustainability Reporting Directive (CSRD) need businesses to disclose climate-related risks, increasing the adoption of climate risk management tools.

UNEP FI reports that financial institutions are integrating climate risk assessment frameworks to comply with these evolving regulations while ensuring long-term resilience. Companies now experience pressure from investors, stakeholders, and policymakers to measure and mitigate climate risks effectively. Non-compliance can result in reputational damage, legal penalties, and financial losses. With more governments implementing carbon pricing mechanisms and mandatory climate risk reporting, businesses are investing in climate analytics, stress testing, and scenario modeling solutions, driving significant market growth.

Restraints in the Climate Risk Management Market

High Implementation Costs and Limited Financial Resources

The adoption of climate risk management solutions demands significant financial investment, making it a major challenge for many organizations. Developing and integrating advanced risk assessment tools, predictive analytics, and climate modeling software demands higher capital expenditure. Small and medium-sized enterprises (SMEs), in particular, struggle to allocate budgets for these solutions due to limited financial resources.

In addition, hiring skilled professionals to analyze climate data and implement risk mitigation strategies further increases costs. Many businesses, primarily in developing economies, prioritize short-term financial stability over long-term climate resilience. As a result, cost concerns impact broad adoption, slowing the market’s growth. Without government incentives or funding support, many organizations hesitate to invest in comprehensive climate risk management solutions.

Lack of Standardization in Climate Risk Assessment

The lack of universally accepted methodologies for climate risk assessment creates confusion among businesses and financial institutions, restricting market growth. Different organizations use varying models, frameworks, and metrics to evaluate climate risks, leading to inconsistencies in reporting and decision-making. UNEP FI highlights that the climate risk tool landscape is highly fragmented, making it difficult for companies to choose the right solutions.

In addition, evolving regulatory requirements and changing climate risk disclosure frameworks add to the complexity. The lack of standardized approaches makes it challenging for businesses to compare risk assessments across industries and geographies. This inconsistency discourages companies from fully investing in climate risk management solutions as they struggle to align with multiple guidelines and frameworks. Without globally recognized standards, businesses face difficulties in integrating climate risk strategies effectively.

Opportunities in the Climate Risk Management Market

Growing Demand for Climate Risk Disclosure and Regulatory Compliance

As governments and regulatory bodies around the world tighten climate-related disclosure requirements, businesses are highly compelled to integrate climate risk management into their operations. Frameworks like the Task Force on Climate-related Financial Disclosures (TCFD) and upcoming global sustainability standards push companies to assess, report, and mitigate climate risks. Financial institutions, investors, and insurers are mainly focused on aligning with these regulations to ensure resilience and transparency.

This regulatory transformation creates a significant opportunity for climate risk management solution providers to provide advanced risk assessment, monitoring, and reporting tools. Companies that proactively adopt these solutions gain a competitive edge by ensuring compliance and enhancing investor confidence. As climate-related disclosures become mandatory in more regions, the need for effective climate risk management strategies is expected to surge.

Advancements in Technology and Data AnalyticsThe rapid evolution of

artificial intelligence (AI), big data analytics, and predictive modeling presents a major opportunity for the climate risk management market. These technologies improve the accuracy of climate risk assessment, allowing businesses to predict extreme weather events and long-term climate impacts more effectively. AI-powered risk modeling helps financial institutions and insurers assess potential losses and adjust their strategies accordingly.

Satellite imagery, IoT

sensors, and geospatial data further enhance real-time climate risk monitoring, enabling proactive decision-making. As technology constantly evolves, climate risk management solutions will become more efficient, affordable, and accessible to a broader range of industries. The integration of AI-driven climate analytics into financial and business planning provides a strong market opportunity for technology providers and climate-focused enterprises.

Trends in the Climate Risk Management Market

Integration of Artificial Intelligence (AI) in Climate Risk ManagementOrganizations are majorly adopting AI technologies to enhance their climate risk management strategies. AI facilitates the automation of data-intensive tasks, like processing greenhouse gas emissions data, thereby enhancing the efficiency and accuracy of environmental reporting. In addition, AI-powered tools are being used to generate reports and forecast the impacts of decarbonization efforts, allowing companies to make informed decisions regarding their climate strategies.

However, organizations need to maintain human oversight to ensure the reliability and credibility of AI-generated data, as they remain accountable for their ESG disclosures.

Emphasis on Supply Chain Emissions Management

Companies are placing greater focus on managing Scope 3 emissions, which originate from their supply chains and often constitute the majority of their total emissions footprint. About 70% of organizations are actively collaborating with their suppliers to implement decarbonization initiatives, which highlights the recognition that addressing supply chain emissions is crucial for achieving comprehensive climate risk management and meeting sustainability targets. By engaging with suppliers and promoting sustainable practices throughout the value chain, companies aim to significantly reduce their overall environmental impact.

Research Scope and Analysis

By Risk Type Analysis

Physical risks will lead the climate risk management market in 2025 with a 45.3% share, driven by the growing impact of extreme weather events like hurricanes, floods, wildfires, and heat waves. These risks threaten businesses, infrastructure, and communities, forcing companies and governments to invest in climate adaptation and risk management strategies. Industries like agriculture, real estate, and insurance are at high risk, leading to an increase in demand for advanced forecasting, disaster recovery solutions, and resilient infrastructure.

The growing costs of climate-related damages push organizations to integrate physical risk assessments into their business planning. With climate change intensifying natural disasters, businesses and policymakers are prioritizing proactive measures to minimize financial losses and ensure long-term sustainability, driving the growth of the climate risk management market.

Moreover, liability risks are experiencing significant growth over the forecast period as businesses and governments experience growth in legal and financial challenges related to climate change. Companies are being held accountable for environmental damage, carbon emissions, and failure to adapt to climate risks, leading to an increase in lawsuits and regulatory penalties. Industries like energy, manufacturing, and finance are under pressure to meet strict environmental standards, driving demand for climate risk management solutions.

Investors and stakeholders expect companies to disclose climate-related risks, making liability management vital for corporate sustainability. With growing environmental awareness and stronger regulations, businesses are prioritizing legal risk mitigation strategies, insurance coverage, and compliance measures, which is accelerating the adoption of climate risk management solutions, ensuring organizations can navigate legal challenges while maintaining financial stability.

By Solution Analysis

In terms of solution type, risk assessment and analysis will lead the climate risk management market with a 31.7% share in 2025, driven by the growing demand for businesses and governments to understand and prepare for climate-related threats. Companies across industries are utilizing advanced data analytics, AI, and predictive modeling to assess potential risks from extreme weather, increasing temperatures, and environmental changes.

Financial institutions, insurers, and corporations depend on these assessments to make informed decisions, protect assets, and comply with stricter regulations. With climate risks becoming more unpredictable, organizations are investing in complete risk analysis to identify vulnerabilities and develop long-term resilience strategies. This growth in demand for accurate climate risk evaluation is fueling market growth, ensuring that businesses can adapt to changing environmental conditions while minimizing financial and operational disruptions.

Further, monitoring and reporting solutions are experiencing significant growth over the forecast period as businesses and governments aim to track climate risks and regulatory compliance. Companies are utilizing data collection, satellite imaging, and AI-driven reporting tools to monitor environmental changes and measure sustainability efforts. Stricter regulations demand that organizations disclose climate risks, carbon emissions, and adaptation strategies, increasing the demand for automated reporting solutions.

Financial institutions and investors also depend on transparent climate data to assess risks and make responsible investment decisions. As climate-related regulations tighten and stakeholders demand greater accountability, businesses are prioritizing monitoring and reporting solutions to ensure compliance, enhance decision-making, and reduce financial exposure. This rising need for accurate climate data is driving growth in the climate risk management market.

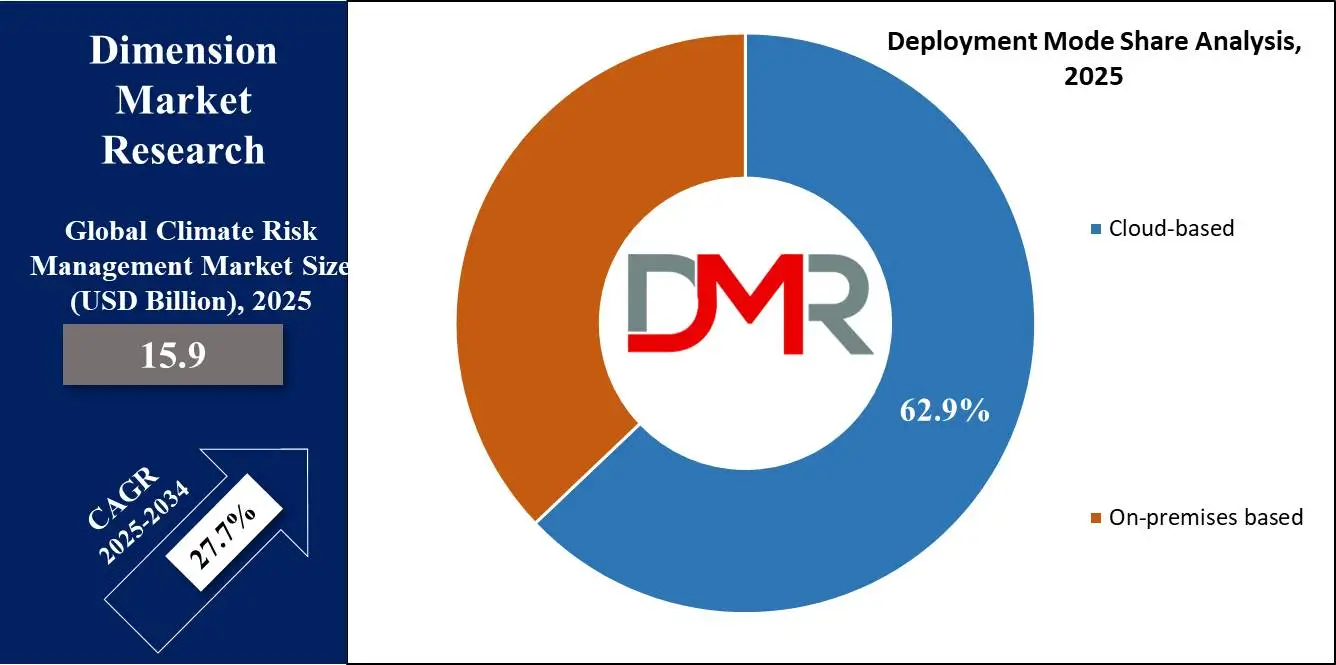

By Deployment Mode Analysis

In 2025, cloud-based deployment will lead the climate risk management market with a 62.9% share, driven by its flexibility, scalability, and affordability. Businesses and governments are transforming to cloud solutions to access live climate data, advanced analytics, and AI-driven risk assessments from anywhere. Cloud platforms allow easy integration with other systems, ensuring better decision-making and regulatory compliance.

Companies benefit from automatic updates, enhanced security, and minimal infrastructure costs compared to traditional systems. With climate risks evolving rapidly, cloud-based solutions allow organizations to respond quickly and efficiently. As the need for remote access and data-driven insights grows, more industries are adopting cloud-based climate risk management, fueling market expansion and making it the preferred choice for businesses looking to improve resilience and sustainability.

Further, on-premises deployment is experiencing major growth over the forecast period as companies with strict data security and compliance requirements invest in in-house climate risk management solutions. Industries like banking, government agencies, and large enterprises prefer on-premises systems for greater control over sensitive climate data and risk assessments. These solutions provide customized security measures, ensuring critical information remains protected from cyber threats.

Businesses with complex IT infrastructures depend on on-premises deployment to integrate climate risk management with existing systems while maintaining full ownership of data. While cloud adoption is rising, organizations needing high security, customization, and regulatory compliance constantly drive demand for on-premises solutions, contributing to steady market growth in this segment.

By Enterprise Size Analysis

Based on the size of enterprises, large enterprises will lead the climate risk management market with a 71.3% share, driven by their demand to protect global operations, assets, and supply chains from climate-related threats. Multinational corporations, financial institutions, and major industries are investing highly in advanced risk assessment, monitoring, and adaptation strategies to comply with strict environmental regulations and minimize financial losses.

These companies are utilizing AI-driven analytics, cloud-based platforms, and real-time data tracking to improve decision-making and ensure long-term sustainability. With growing pressure from investors, stakeholders, and governments to disclose climate risks, large enterprises are prioritizing comprehensive risk management solutions.

Their major financial resources and global reach make them key players in adopting and advancing climate resilience strategies, further driving the expansion of the climate-risk management market.

In addition, Small and medium-sized enterprises (SMEs) are experiencing significant growth over the forecast period as they recognize the importance of climate risk management to protect their businesses.

Rising climate-related disruptions, regulatory requirements, and supply chain vulnerabilities are pushing SMEs to adopt affordable and scalable risk management solutions. Many are turning to cloud-based platforms, AI-driven analytics, and insurance products to assess and mitigate risks effectively. Governments and financial institutions are also providing support through funding, incentives, and guidelines to help SMEs build resilience. As awareness increases and technology becomes more accessible, SMEs are expected to play a growing role in the climate risk management market, driving adoption across various industries.

By Industry Vertical Analysis

Financial services and insurance as an industry vertical will lead the climate risk management market with a 29.8% share, driven by the growth in the need to assess and mitigate climate-related financial risks. Banks, investment firms, and insurance companies are integrating climate risk analysis into their decision-making to protect assets, ensure regulatory compliance, and maintain financial stability.

Insurers are developing new policies to cover climate-related damages, while financial institutions are utilizing risk assessment tools to evaluate investments and loans. Governments are enforcing stricter climate disclosure rules, pushing companies to adopt better risk management strategies. As climate risks constantly impact economies, the financial sector is playing a vital role in shaping sustainable investment and insurance solutions, driving strong market growth.

Further, real estate and infrastructure are experiencing significant growth over the forecast period as climate risks create major threats to properties and public assets. Rising sea levels, extreme weather, and shifting environmental conditions are pushing developers, city planners, and investors to adopt climate risk management strategies. Companies are investing in resilient construction, flood protection, and smart infrastructure to reduce damage and financial losses.

Governments are implementing strict building regulations and requiring climate risk assessments for new projects. With urbanization expanding and climate risks escalating, the demand for solutions that protect real estate investments and infrastructure is growing, driving strong market expansion in this sector.

The Climate Risk Management Market Report is segmented on the basis of the following

By Risk Type

- Physical Risks

- Transition Risks

- Liability Risks

By Solution

- Risk Assessment & Analysis

- Risk Mitigation & Adaptation

- Monitoring & Reporting Solutions

- Consulting & Advisory Services

By Deployment Mode

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Industry Vertical

- Financial Services & Insurance

- Energy & Utilities

- Agriculture & Forestry

- Manufacturing & Industrial

- Real Estate & Infrastructure

- Government & Public Sector

Regional Analysis

Leading Region in the Climate Risk Management Market

In 2025, North America will lead the climate risk management market with a

37.2% share, owing to strong government policies, growth in climate-related disasters, and a rise in awareness among businesses. The US and Canada are at the forefront, investing in advanced risk assessment technologies, insurance solutions, and sustainable infrastructure. Large corporations & financial institutions are actively integrating climate risk strategies to protect assets and comply with stricter regulations. The region's well-developed financial sector plays a major role in driving growth, with insurers and banks offering innovative products to manage climate risks.

In addition, technological developments, like AI and

big data analytics, help enhance risk predictions and response strategies. Government initiatives, like carbon reduction targets and green energy investments, further boost market expansion. With extreme weather events becoming more frequent, businesses and communities are prioritizing climate risk management, leading to growth in the demand for solutions that minimize financial and environmental damage. This strong momentum makes North America a key player in shaping the global climate risk management landscape in the coming years.

Fastest Growing Region in the Climate Risk Management Market

Asia Pacific will see significant growth in the climate risk management market over the forecast period, driven by growth in climate threats, rapid urbanization, and strong government actions. Countries like China, India, and Japan are investing majorly in disaster preparedness, resilient infrastructure, and sustainable energy solutions.

Businesses are also adopting risk management strategies to protect supply chains and assets from extreme weather events. Governments are enforcing stricter environmental policies, pushing industries to adopt climate-resilience measures. With the rise in awareness and advanced technology like AI-driven risk assessment, the region is becoming a major player in climate risk solutions, ensuring long-term economic and environmental stability.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The climate risk management market is becoming highly competitive as businesses, financial institutions, and governments focus on tackling climate-related challenges. Many companies are developing advanced risk assessment tools, data analytics solutions, and AI-driven platforms to help organizations predict and mitigate climate risks. Service providers are providing customized solutions for industries like banking, insurance, real estate, and energy, addressing specific risks such as extreme weather events, regulatory changes, and carbon footprint management.

With rising demand, firms are expanding their offerings by integrating real-time climate monitoring and predictive modeling. Competition is also growing due to stricter environmental regulations, pushing companies to improve their risk management capabilities. Innovation, regulatory compliance, and technological advancements are the key factors shaping the competitive landscape in this evolving market.

Some of the prominent players in the Global Climate Risk Management are

- KPMG

- Deloitte

- RMS

- Bains & Company

- BCG

- Finalyse

- Anthesis Group

- Maplecroft

- Aon

- RepRisk

- PwC

- EY

- MSCI

- BlackRock

- Jupiter Intelligence

- XDI

- ERM

- The Climate Service

- EcoAct

- Carbon Delta

- Other Key Players

Recent Developments

- In February 2025, Bloomberg announced that its risk management solutions suite has been expanded by the launch of a new module, MARS Climate, to support portfolio and risk managers in assessing their exposure to the financial impacts of climate change. The new solution adds to Bloomberg’s physical and transition risk offering. Regulators and central banks across the world increasingly demand that financial firms assess their exposure to climate risks, driven by growing evidence of the economic impacts of climate change.

- In October 2024, The Reserve Bank of India, or RBI, proposed to create a data repository, namely, the Reserve Bank Climate Risk Information System (RB-CRIS), comprising of two parts. The first part will be a web-based directory listing various data sources that will be publicly accessible on the RBI website. The second part will be a data portal comprising datasets. Access to this data portal will be made available only to the regulated entities in a phased manner.

- In October 2024, Duck Creek Technologies unveiled the acquisition of Risk Control Technologies, Inc. (“RCT”), a Toronto-based provider of risk management and loss control solutions, which is set to transform how insurance carriers prevent loss and manage risk, enabling deployment of advanced AI and machine learning capabilities at the forefront.

- In September 2024, The U.S. Environmental Protection Agency launched a new website, the Climate Resilience and Adaptation Funding Toolbox. CRAFT is a user-friendly resource for technical assistance providers working with federal funding applicants and recipients to develop, apply for, and implement climate-resilient investments. The website provides simple, easy-to-understand resources that can support users consider climate adaptation and resilience before, during, and after applying for EPA funding opportunities.

- In June 2024, FIS launched its Climate Risk Financial Modeler, which aims to help businesses across all industries better assess, reduce, and report their exposure to the physical risks of climate change. By unlocking FIS’s powerful risk modeling and market-leading insurance analytics, FIS Climate Risk Financial Modeler harmonizes client data with third-party climate data and is hosted on a new interface that is directly tailored to the risk management needs of corporates and financial institutions—ultimately looking to drive more proactive foresight into potential climate-related risks.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 15.9 Bn |

| Forecast Value (2034) |

USD 143.5 Bn |

| CAGR (2025-2034) |

27.7% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 5.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Risk Type (Physical Risks, Transition Risks, and Liability Risks), By Solution (Risk Assessment & Analysis, Risk Mitigation & Adaptation, Monitoring & Reporting Solutions, and Consulting & Advisory Services), By Deployment Mode (Cloud-based and On-premises), By Enterprise Size (Large Enterprises, and Small & Medium Enterprises (SMEs)), By Industry Vertical (Financial Services & Insurance, Energy & Utilities, Agriculture & Forestry, Manufacturing & Industrial, Real Estate & Infrastructure, and Government & Public Sector) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

KPMG, Deloitte, RMS, Bains & Company, BCG, Finalyse, Anthesis Group, Maplecroft, Aon, RepRisk, PwC, EY, MSCI, BlackRock, Jupiter Intelligence, XDI, ERM, The Climate Service, EcoAct, Carbon Delta, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Climate Risk Management Market size is expected to reach a value of USD 15.9 billion in 2025 and is expected to reach USD 143.5 billion by the end of 2034.

North America is expected to have the largest market share in the Global Climate Risk Management Market, with a share of about 37.2% in 2025.

The Global Climate Risk Management Market in the US is expected to reach USD 5.0 billion in 2025.

Some of the major key players in the Global Climate Risk Management Market are KPMG, Deloitte, RMS, and others

The market is growing at a CAGR of 27.7 percent over the forecasted period.