Third-party suppliers to whom daily IT management tasks are outsourced, and management services include security, network, infrastructure, and mobility services, which are referred to as cloud-managed services.

Key factors contributing toward the growth in the market include increased demand for security services which will help the organization protect sensitive data on cloud environments. IAM and encryption are some of the managed security services that are gaining traction as organizations work to achieve compliance with regulatory standards and avoid cyberattacks. Growing demands for managed network services to enhance and optimize the performance and connectivity of cloud infrastructure drive the demand in the market.

Service types are further segmented into managed infrastructure services, managed security services, managed mobility services, managed network services, and managed communication and collaboration services.

The segment of deployment type is dominated by a public cloud owing to its benefits related to scalability and cost. Large enterprises continue to dominate the segment of organization size as their loading and complexity require large IT support.

Key vendors in the cloud-managed services market are making enviable investments in innovative technologies like Artificial Intelligence (AI) and

Machine Learning (ML) to offer better service delivery. North America dominated the region due to the strong presence of major cloud service providers and high adoption across industries. The market will continue to exhibit growth as businesses progressively outsource more IT resources to focus on core competencies.

As per cloudzero A significant shift towards cloud adoption is underway, with two-thirds of respondents operating in a public cloud and 45% using a private cloud. However, 55% still rely on traditional on-premises systems. Nearly half plan to migrate at least half of their applications to the cloud within the next year, while 47% are pursuing a cloud-first strategy.

As cloud adoption grows, 39% of respondents are already running at least half of their workloads in the cloud, with 58% planning to do so within 12-18 months. More than 94% of organizations with over 1,000 employees have substantial workloads in the cloud. Multi-cloud and hybrid cloud strategies are gaining popularity, with 54% planning to move workloads to the public cloud in the next year.

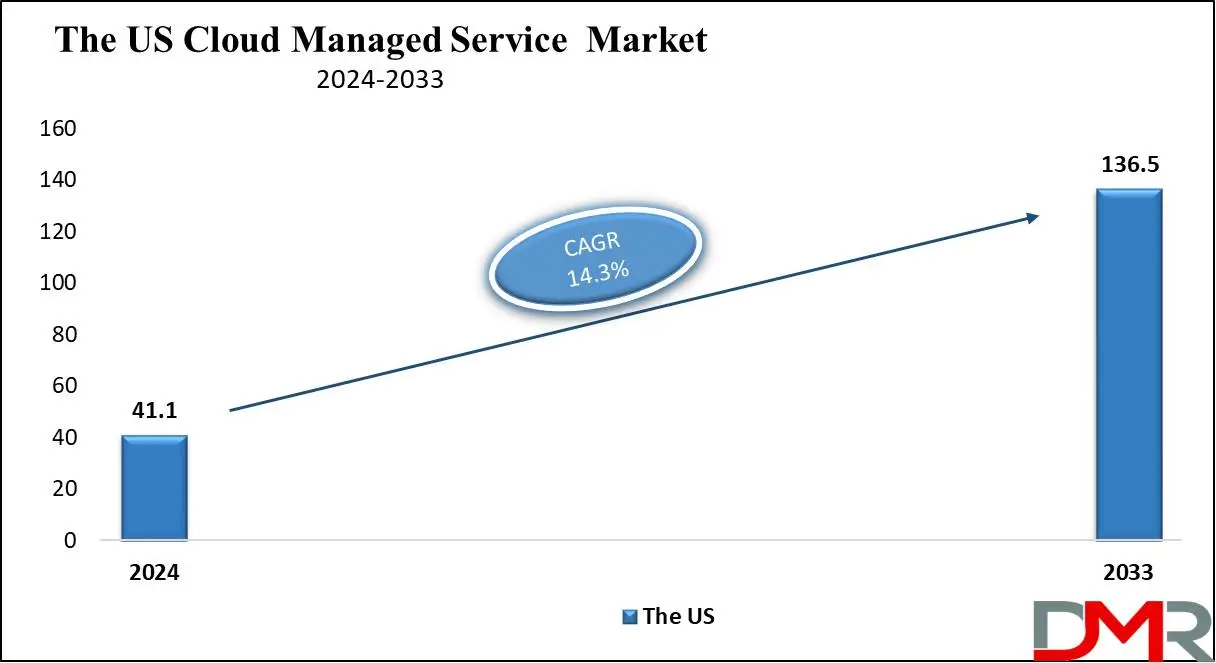

The US Cloud Managed Service Market

The US Cloud Managed Service Market is projected to be valued at USD 41.1 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 136.5 billion in 2033 at a CAGR of 14.3%.

The cloud-managed services market in the United States represents a leading position owing to the strong presence of key players such as Amazon Web Services and Google Cloud. Businesses across the United States are looking to cloud-managed services to build stronger, cost-efficient IT infrastructure with higher operational efficiencies.

Enterprises is this region deploy cloud-managed services primarily on public clouds due to the scalability and cost-efficient nature of these services. The trend of moving towards the adoption of hybrid cloud environments, especially for highly regulated industries like healthcare and finance that demand privacy and security, is on the rise.

Recent developments mark an increasing demand for managed security services to combat the rising cyber threats and threats against companies. The segment of managed network services also sees demand due to an organization's need to enhance the performance and reliability of the network. Furthermore, the increasing adoption of cloud solutions among large enterprises and SMEs is one of the major reasons the U.S. is considered one of the most important markets for cloud-managed services.

Key Takeaways

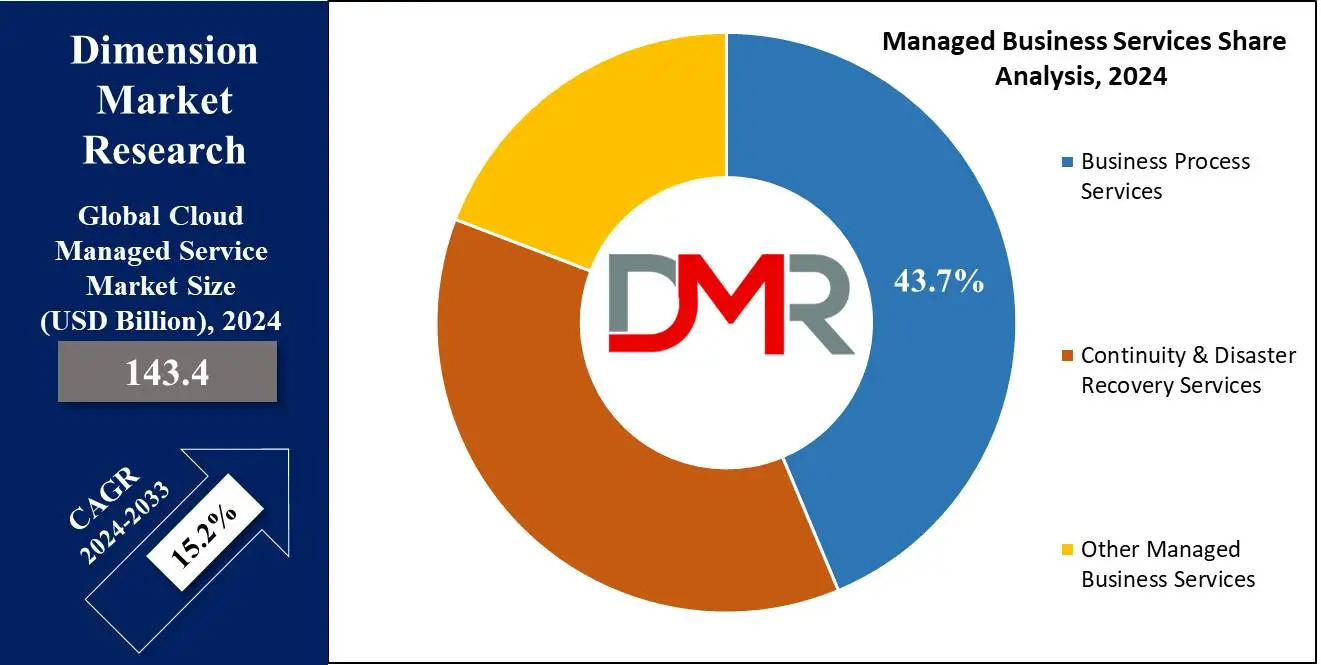

- Global Value: The global cloud-managed service market size is estimated to have a value of USD 143.4 billion in 2024 and is expected to reach USD 514.3 billion by the end of 2033.

- The US Market Value: The US Cloud Managed Service Market is projected to be valued at USD 136.5 billion from the base value of USD 41.1 billion in 2024 at a CAGR of 14.3%.

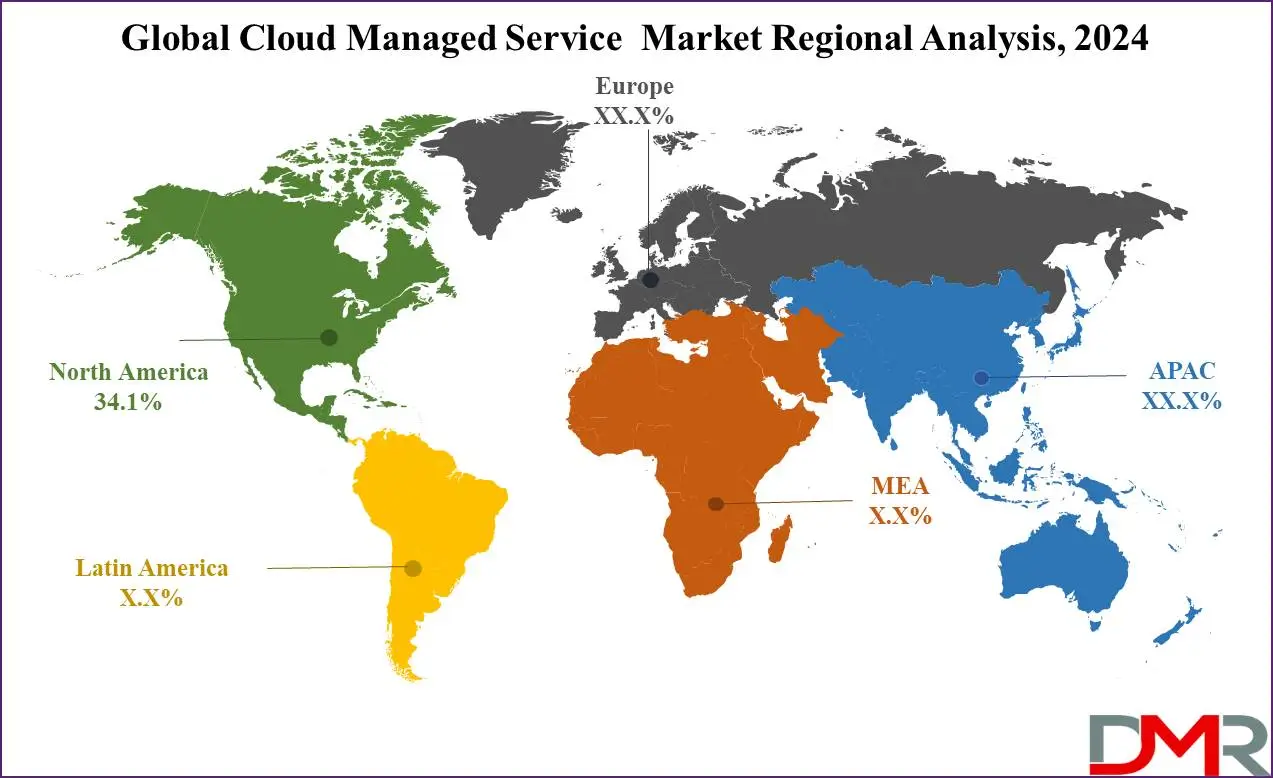

- Regional Insights: North America is expected to have the largest market share in the global cloud managed service market with a share of about 34.1% in 2024.

- By Managed Mobility Service Segment Analysis: Device management services are anticipated to hold the highest market share in the managed mobility service segment in 2024.

- By Managed Business Service Segment Analysis: Business process service process services are projected to dominate this market with 43.7% of the market share in 2024.

- By Organization Size Segment Analysis: Large organizations are projected to dominate this segment as they will hold 63.1% of the market share by the end of 2024.

- By Industry Vertical Segment Analysis: BFSI is anticipated to dominate this market in terms of industry verticals as it holds the highest market share in 2024.

- Key Players: Some of the major key players in the Global Cloud Managed Service Market are Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM, Cisco Systems, and many others.

- Global Growth Rate: The market is growing at a CAGR of 15.2 percent over the forecasted period.

Use Cases

- Managed Security Services: Businesses outsource the management of security services in the cloud to ensure proper data protection and compliance, safeguarding against cyber threats.

- Managed Network Services: Businesses rely on third-party providers to manage their cloud network infrastructure, optimizing performance and uptime.

- Managed Infrastructure Services: Enterprises utilize cloud-managed infrastructure to streamline their IT operations, ensuring cost-efficient scalability.

- Managed Communication and Collaboration Services: Organizations deploy cloud solutions for unified communication, enhancing collaboration through tools like VoIP and video conferencing.

Cloud Managed Service Market Dynamics

Trends

Increased Adoption of Hybrid Cloud ModelsOrganizations are rapidly embracing hybrid cloud architectures, integrating both public and private clouds for workload optimization. This model allows sensitive data to reside in a private cloud with increased security while using scalable and cost-effective resources of the public cloud for less sensitive operations.

This is becoming a complex environment to manage, with businesses expanding their digital footprint and regulatory compliance becoming stronger. Such an upward trend is raising demand for cloud-managed services as companies seek expertise to keep tabs on these elaborate systems for management, monitoring, and security. This HYBRID CLOUD adoption can be paramount in industries such as healthcare, financial services, or government sectors, each having strict requirements concerning privacy linked with data.

Growing Use of Artificial Intelligence and Automation

AI and automation are altering the cloud-managed services' mode of delivery. Today, AI-driven tools are highly in use in routine work of IT by service providers, helping to automate routine IT tasks, optimize resource allocation, and enhance infrastructure monitoring of IT.

Large-scale environments governed by automation reduce a lot of manual intervention and related errors. AI enhances security by providing predictive analytics, identifying potential risks, and mitigating those in real time. For example, AI-powered managed security services can identify unusual behavior or malware, reducing data breaches. This is one of the big trends: integrating AI into the processes and making cloud-managed services more efficient, responsive, and scalable.

Growth Drivers

Rising Demand for Managed Security Services

Growing Demand Due to Increased Cyberattacks, Data Breaches, and Stringent Compliance Requirements. In addition, increasing utilization is driving organizations towards rendering more managed security services for cloud security. IAM, encryption, intrusion detection, and incident response, amongst others, have become so crucial for an organization dealing with or storing sensitive information in the cloud environment.

With managed security services, organizations not only remain compliant with regulatory frameworks like GDPR, HIPAA, and PCI DSS but also stay proactive in patching up these vulnerabilities. The rise in security incidents across industries, especially in banking and healthcare, has forced organizations to take up managed security services to protect critical information. Today, organizations depend on managed service providers to protect the continuity of digital assets.

Growing Adoption of Cloud Services by SMEs

Small and medium-sized enterprises are one of the major contributors to growth in the cloud-managed services market. While SMEs aim to digitalize their operations and become competitive in the cloud-driven world, they are looking towards managed service providers to offer scalable and affordable solutions. The cloud-managed services model lets SMEs adopt enterprise-level technologies, services, and expertise without having to invest heavily in infrastructure or an IT team.

In general, the services offer flexibility to SMEs in scaling IT operations up or down depending on demand. From this perspective, the cost-effectiveness of cloud solutions is further complemented by the possibility of outsourcing key functions like network management and security, making cloud-managed services one more valuable contributor for SMEs. This, in turn, will be one of the major contributors to the growth of the market filled by more SMEs adopting cloud services.

Growth Opportunities

Expansion of Industry-Specific Cloud Solutions

Industry-specific cloud solutions are highly in demand, which presents a very good opportunity for cloud-managed service providers. Each industry will always need to manage and establish data security, keeping within the regulatory compliance to ensure operational efficiency within the healthcare, BFSI, manufacturing, and retail sectors.

For example, healthcare requires cloud solutions that are HIPAA-compliant, while financial institutions have to abide by high bars of cybersecurity. These MSPs will be able to carve a niche in the market and expand their share by offering tailored services for those industries. The demand for customized cloud solutions will, therefore, continue opening more avenues for growth as different industry segments proceed with the adoption of various cloud technologies that are mission-critical.

Demand for Multi-Cloud Management Solutions

With more organizations adopting multi-cloud strategies to avoid vendor lock-in, enhance their resilience posture, and optimize cost structures, demand is surging for multi-cloud management solutions. Since most of these multi-cloud environments necessary span multiple models, such as public, private, and hybrid, managing them will necessarily drive up IT operational complexity. Businesses seek cloud-managed service providers that make the orchestration between these different environments easier, improve visibility, and ensure security across all platforms.

Indeed, growing interest in multi-cloud strategies presents a significant opportunity for service providers that could offer seamless integration, real-time performance monitoring, and unified security across diverse cloud infrastructures. This is quite strong within retail and e-commerce industries where uptime is key and the pace of service delivery is very important.

Restraints

Data Privacy and Security Concerns

Despite the growing benefits of cloud-managed services, data privacy, and security concerns act as a significant barrier to growth in cloud-managed services adoption. Organizations are largely skeptical, particularly those whose businesses rely heavily on regulated vertical industries like healthcare, finance, and government outnumber the ones that readily outsource their crucial IT functions with third-party service providers.

The potential risk of data breaches and unauthorized access to sensitive information holds many businesses from fully embracing cloud-managed services. Compliance with strict regulations such as the GDPR, HIPAA, and other data protection laws makes organizations valued for control over their data.

With way more regulations set and an increasing demand for the highest security standards, ensuring that managed service providers work within these regulations is key. However, questions of trust and control remain the biggest barriers to adoption.

Lack of Skilled Workforce

The unavailability or scarcity of a talented workforce with proficiencies in cloud technologies is hence said to be another major restraining factor affecting growth in the cloud-managed services market. Most organizations suffer from a lack of talent that can manage, secure, and optimize cloud environments.

Certainly, this skill gap is much more pronounced in the more advanced functions of the cloud: multi-cloud management, security orchestration, and AI-driven automation. In the absence of skilled people, companies either delay the adoption of the cloud or rely too much on managed service providers, which sometimes creates problems related to vendor dependency. Competition among employers for cloud-savvy professionals further raised salary expectations, in turn increasing the cost of delivering cloud-managed services and slowing growth in some regions.

Cloud Managed Service Market Research Scope and Analysis

By Managed Security Services

In the context of managed security services, managed identity and access management services are projected to dominate this market as they hold the highest market share by the end of 2024. The increasing cloud usage is the driving force that pushes the demand for security access to cloud environments, thereby the highest market share of the managed security segment is going to manage identity and access management.

The organizations need to secure only the authorized personnel that have access to sensitive data and applications. IAM provides a single point of control for user authentication and authorization.

Moreover, data protection regulations such as GDPR and CCPA have further imposed demands on strong identity management frameworks. Accordingly, managed service providers offer IAM solutions that provide multi-factor authentication and automatic user provisioning, thereby reducing the risk associated with unauthorized access.

Given that managing a path to hybrid cloud environments is becoming a universal activity, businesses are increasingly confronting challenges presented by the complexity of managing identities across different platforms, and IAM should be regarded as an integral element of cloud security.

The increasing frequency of cybersecurity attacks, coupled with data breaches, is a catalyzing factor toward the increasing demand for managed IAM services in organizations that work towards ensuring sensitive information and personal data are secure and compliant for regulatory purposes.

By Managed Network Services

Managed network provision is anticipated to dominate the managed network service as it holds the highest market share in 2024. The factor that pushes the demand of this segment in the managed network services is managed network provisioning, thus becoming highly relevant in managing networks effectively in these cloud environments. Organizations are moving to cloud spaces, and they must have seamless connectivity and network performance across the board.

Managed network provisioning services allow businesses to automate network configuration and optimization, thus ensuring reliable connectivity across distributed environments. These services allow for real-time monitoring, automatic provisioning of network resources, and dynamic scaling to adapt to changing demands in traffic.

With the rise of SDN and NFV, the use of managed network provisioning further increases, since both technologies accommodate flexible and programmable network architectures. Besides, the deployment of managed services ensures consistency in network security protocols, reduces the chances of cyber-attacks, and ensures that industry standards and best practices are catered to. Instead, in the evolution of cloud computing, the demand for managed network provisioning services will increase, thus, this segment is very likely to retain the leading position in the network services market.

By Managed Infrastructure Services

In terms of managed infrastructure services, is dominated by storage management due in large part to the exponential growth of data across industries. Since enterprises generate and store massive amounts of data, efficient storage management is a key differentiator in maintaining seamless operations.

Managed service providers scale and secure cloud storage to store, retrieve, and manage organizational data. It includes identity and access management, automated backup, disaster recovery, data archiving, data restoration, and data replication to ensure data availability for business continuity. The increasing demand for cloud storage, particularly in hybrid and multi-cloud environments, has been fueling the demand for managed storage services.

Organizations are waiting to see a storage model that will provide flexibility in scalability as per their data requirement, yet at economical costs. Furthermore, with regulations related to the protection of data, every organization is obliged to implement a robust storage management solution that ensures integrity and security.

Advanced encryption and access control mechanisms in managed storage services secure sensitive information. With data growing at unseen rates, the dominance of storage management in the managed infrastructure services market is expected to gain momentum.

By Managed Communication & Collaboration Services

In terms of managed communication and collaboration service, managed voice-over-internet protocol is projected to dominate this segment with a significant market share in 2024. In the context of managed communication and collaboration services managed Voice over Internet Protocol is projected to drive the growth of this market due to growing demand for effective communication solutions at low cost.

VoIP enables the business to make voice calls via the Internet, reducing the cost of maintaining traditional phone lines, hence bringing down highly the cost of communications. Advanced VoIP managed services include call routing, conferencing, and unified communication that will eventually help an enterprise make better collaboration in their geographically dispersed teams.

The last few years have accelerated the trend toward work-from-home and, more recently, hybrid models, increasing demand for managed VoIP as it is reliable to provide virtually foolproof communication.

Moreover, with the inclusion of VoIP in other cloud-based collaboration tools such as video conferencing and instant messaging, managed service providers ensure it is integrated to ensure seamlessness in the communication experience. The scalability and flexibility of VoIP make it an ideal solution for businesses of all sizes, hence taking over the top in the managed communication and collaboration services market.

By Managed Mobility Services

Device management services are anticipated to hold the highest market share in the managed mobility service segment in 2024. The device management services segment leads the managed mobility services, considering the increased application of mobile devices in organizations. With more and more organizations embracing mobile solutions to help them bring efficiency, management of the mobile devices is becoming very crucial.

Overall device management solutions provided by the managed service providers include device provisioning, security, and monitoring. The services ensure that the mobile device is appropriately configured, secure, and corporation policy compliant. However, businesses have to deal with the plethora of devices and operating systems that come with BYOD.

Managed mobility services take that challenge by providing businesses with one-stop control over the configuration of devices, application management, and security protocols, among many more. More so, providers of managed services provide mobile threat detection and response to keep the devices protected from cyber-attacks and information secure.

The increasing use of mobile devices for various business operations, coupled with the need for security and management associated with it, drives the dominance of device management services in the managed mobility services market.

By Managed Business Services

In the context of managed business services, business process service process services are projected to dominate this market with

43.7% of the market share in 2024. Business process services dominate the managed business service segment due to the rising demand for outsourcing non-core business functions. Every industry is trying to smoothen its operations and focus on its strategic initiatives by outsourcing routine business processes like HR, payroll, and customer services among others.

A managed service provider extends an end-to-end solution in automating and optimizing those processes for efficiency and cost savings. The advantages of cloud technologies have only made the demands for managed business services grow further because businesses can manage their processes using cloud-based platforms even remotely.

Managed business services also provide scalability in a way that companies can increase or decrease their service levels according to the fluctuating needs of the enterprise.

Artificial intelligence and automation integrated into the management of business processes further enhance the efficiency and accuracy of the services. It follows, therefore, that with an increasing demand for operational efficiency and agility on the part of business organizations, business process services will keep on dominating the managed business services market.

By Deployment Type

Public cloud deployment holds the maximum share in cloud-managed services due to scalability, cost-effectiveness, and ease of adoption. It allows organizations to share the infrastructure and resources rather than spending huge upfront capital on IT infrastructure. It finds great appeal among small and medium-sized enterprise circles that require flexibility and affordable cloud solutions.

Public cloud service providers, like Amazon Web Services, Google Cloud, and Microsoft Azure, offer an array of completely managed services from security to network and storage management. Every important IT function can be outsourced to the cloud. Besides, with complete power to scale resources up or down depending on demand or workload, the public cloud is ideal for companies whose workloads frequently fluctuate.

The increasing organization adoption of cloud technologies and growing demand for cost-effective and scalable solutions drive dominance in the public cloud deployment model of the cloud-managed services market. Private cloud and hybrid cloud models continue further to gain more traction, but the market still sees the highest adoption rate from the public cloud.

By Organization Size

Large organizations are projected to dominate the organization size segment as they will hold 63.1% of the market share by the end of 2024. Large organizations have a leading share in the cloud-managed services market based on organization size, due to their significant IT infrastructure and multi-control operational needs. Thus, large organizations are increasingly adopting cloud-managed services to simplify their IT operations and reduce costs while enhancing scalability.

Since large enterprises include a huge number of employees, several departments, and global operations, they need strong and scalable cloud solutions to support their varied needs. Large organizations hire managed service providers according to their needs, which may be managed security services, network, infrastructure, and communication services. Large enterprises also outsource IT management to experienced cloud-managed service providers due to the necessity of enhanced security and adherence to industrial regulations.

Moreover, large enterprises can invest finances in advanced solutions on the cloud, hence large enterprises are considered key contributors to the growth in the cloud-managed services market. The dominance in the cloud-managed services market by large enterprises is expected to continue in this period of accelerated digital transformation.

By Industry verticals

BFSI is anticipated to dominate the global cloud-managed service market in the context of industry verticals as it holds the highest market share by the end of 2024. Also, owing to the high demand for secure, scalable, and compliant IT solutions, the Banking, Financial Services, and Insurance vertical is projected to dominate the cloud-managed services market.

The BFSI industry is one of the most highly regulated industries, it mandates strong security measures while maintaining compliance with the set industry standards to protect sensitive financial data. IAM, data encryption, and other managed security services are critical to enabling BFSI enterprises to prevent their information from being infiltrated or breached.

Besides these, several managed network services are also deployed heavily by the BFSI sector to maintain seamless connectivity and uptime concerning financial transactions. Fintech, digital banking, and mobile payment have become increasingly popular and, thus, are adding to the demand for managed services within the BFSI sector.

Managed service providers offer bespoke solutions catering to the needs of the BFSI vertical, including compliance with regulations such as GDPR, PCI DSS, and SOX. The dominance of this vertical is foreseen to rise in the cloud-managed services market, as the BFSI sector has been more or less digitizing its operations.

The Cloud Managed Service Market Report is segmented based on the following

By Managed Security Services

- Managed Identity & Access Management

- Managed Antivirus/Anti-Malware

- Managed Firewall

- Managed Risk & Compliance Management

- Managed Vulnerability Management

- Managed Security Information & Event Management

- Managed Intrusion Detection System/Intrusion Prevention System

- Managed Data Loss Prevention

- Other Managed Security Services

By Managed Network Services

- Managed Network Provisioning

- Managed Network Monitoring & Management

By Managed Infrastructure Services

- Storage Management

- Server Management

- Managed Print Services

By Managed Communication & Collaboration Services

- Managed Voice Over Internet Protocol

- Managed Unified Communication as a Service

By Managed Mobility Services

- Device Management Services

- Application Management Services

By Managed Business Services

- Business Process Services

- Continuity & Disaster Recovery Services

- Other Managed Business Services

By Deployment Type

By Organization Size

By Industry Verticals

- BFSI

- Telecom

- Government & Public Sector

- Healthcare & Life Sciences

- Retail & Consumer Goods

- Manufacturing

- Energy & Utilities

- Other Vertical

Cloud Managed Service Market Regional Analysis

North America is projected to dominate the global cloud-managed services market as it will hold

34.1% of the market share by the end of 2024. North America's dominance in the global cloud-managed services market is a testament to key players like Amazon Web Services, Google Cloud, and Microsoft Azure, among others.

Further, highly developed IT infrastructure and the wide adoption of cloud technologies in different sectors have been a booster for the region to position as leading in the global cloud-managed services market. Organizations across North America are rapidly outsourcing their IT operations to managed service providers so that they can pay more attention to their core competencies in operational efficiency.

The United States market holds the most potential for lucrative returns, thereby contributing towards major market growth as organizations are taking on the workload of the cloud about scalability, security, and cost-effectiveness. The demand for IAM and encryption, among other managed security services, is also ignited by the region's regulatory environment, influenced largely by data privacy and security.

Besides, the trend of the hybrid cloud across enterprises contributes to the growth of the market in the North American region. The leading position of the region is contributed by the increased demand for services of managed network services, as organizations try to optimize their cloud infrastructure to achieve better performance and reliability.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Cloud Managed Service Market Competitive Landscape

The nature of the global cloud-managed services market is highly competitive, as there are a large number of key players present in the market offering different cloud solutions. Some major companies contributing to the significant share of the market include Amazon Web Services, Inc. (AWS), Google Cloud, Microsoft Azure, IBM, and Cisco due to their comprehensive service offerings and strong presence in the market.

These companies provide managed security, network, infrastructure, and mobility services to businesses across various industries. The competitive landscape has been pioneered through continuous innovation, where the market players invest in advanced technologies related to the cloud like AI, ML, and automation to enhance their capabilities of service offering.

Partnership and acquisition are one of the most common strategies that players in the industry of cloud-managed services consider as this helps them reach a more considerable proportion of customers and consolidate their positions in the market. The managed services providers are now focused on providing customized solutions for different industry verticals, which further increases competition in the market.

Some of the prominent players in the Global Cloud Managed Service Market are

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud

- IBM

- Cisco Systems

- Hewlett Packard Enterprise (HPE)

- Rackspace Technology

- Accenture

- Fujitsu

- Wipro

- Tata Consultancy Services (TCS)

- Atos

- NTT Data

- Other Key Players

Cloud Managed Service Market Recent Developments

- September 2024: Microsoft Azure launched a new suite of AI-powered managed services, designed to enhance cloud security and automate IT operations for enterprise customers. These services integrate advanced artificial intelligence (AI) and machine learning (ML) capabilities, enabling businesses to proactively detect and mitigate security threats in real-time.

- August 2024: Google Cloud announced a strategic partnership with leading cybersecurity firms to bolster its managed security services offerings. This collaboration aims to provide enhanced security for the Banking, Financial Services, and Insurance (BFSI) sector, addressing critical concerns around data privacy and regulatory compliance.

- July 2024: Amazon Web Services (AWS) introduced a new managed network service specifically designed for hybrid cloud environments. This service helps large enterprises optimize their network performance by providing automated network provisioning, real-time monitoring, and advanced network security features.

- June 2024: IBM completed the acquisition of a leading cloud consulting firm, strengthening its managed cloud services offerings, particularly in the healthcare sector. This acquisition enables IBM to provide more specialized cloud solutions for healthcare providers, focusing on secure data management, compliance with healthcare regulations, and scalable infrastructure.

- May 2024: Cisco launched an updated version of its managed communication and collaboration services, designed to support the evolving needs of remote and hybrid work environments. The new service includes integrated solutions for Voice over Internet Protocol (VoIP), video conferencing, and team collaboration tools, all hosted on Cisco’s cloud platform.

- April 2024: AWS expanded its managed infrastructure services by launching new storage management solutions aimed at optimizing data storage in public cloud environments. The new service provides advanced data compression, automated backups, and real-time analytics on storage utilization, helping businesses reduce costs while ensuring data availability and security.

- March 2024: Microsoft Azure introduced a new managed mobility service tailored for the automotive industry, focusing on secure device management and IoT connectivity. Azure new service is expected to address the specific needs of the automotive industry, further strengthening its foothold in the managed mobility services market.

- February 2024: Google Cloud expanded its managed network services by launching a new SD-WAN solution designed for global enterprises. The software-defined wide area network (SD- WAN) service enables businesses to optimize their network performance across multiple cloud environments, providing greater control and visibility over traffic management.

- January 2024: IBM rolled out new managed security services focused on AI-driven threat detection and response for the retail sector. The service is designed to help retailers protect customer data and prevent security breaches during high-traffic periods, such as holiday sales and major promotional events.

Cloud Managed Service Market Report Details

| Report Characteristics |

| Market Size (2024) |

USD 143.4 Bn |

| Forecast Value (2033) |

USD 514.3 Bn |

| CAGR (2024-2033) |

15.2% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 41.2 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Managed Security Services (Managed Identity & Access Management, Managed Antivirus/Anti-Malware, Managed Firewall, Managed Risk & Compliance Management, Managed Vulnerability Management, Managed Security Information & Event Management, Managed Intrusion Detection System/Intrusion Prevention System, Managed Data Loss Prevention, and Other Managed Security Services), By Managed Network Services (Managed Network Provisioning, Managed Network Monitoring & Management), By Managed Infrastructure Services (Storage Management, Server Management, and Managed Print Services), By Managed Communication & Collaboration Services (Managed Voice Over Internet Protocol, and Managed Unified Communication as a Service), By Managed Mobility Services (Device Management Services, and Application Management Services), By Managed Business Services (Business Process Services, Continuity & Disaster Recovery Services, and Other Managed Business Services), By Deployment Type (Public, and Private), By Organization Size (SMEs, and Large Enterprises), By Industry Verticals (BFSI, Telecom, Government & Public Sector, Healthcare & Life Sciences, Retail & Consumer Goods, Manufacturing, Energy & Utilities, and Other Vertical) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Amazon Web Services, Microsoft Azure, Google Cloud, IBM, Cisco Systems, Hewlett Packard Enterprise (HPE), Rackspace Technology, Accenture, Fujitsu, Wipro, Tata Consultancy Services (TCS), Atos, NTT Data, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |