The customer data platform (CDP) is specialized software used to collect, combine, organize, and manage customer data from many sources. The main aim of CDP is to create a collective and detailed view of each customer, commonly known as a single customer view. This provides functionalities like data ingestion, data cleansing, data deduplication, identity resolution, segmentation, analytics, Customer Journey Analytics, and activation. These platforms help to improve customer engagement by centralizing customer data and providing a detailed view of each customer.

As per Brandon Gaille, the global Customer Data Platform (CDP) market is poised for significant growth, expanding from $2.4 billion in 2020 to $10.3 billion by 2025. Data-driven businesses are 23 times more likely to acquire new clients, with 62% of retailers citing data analytics as a competitive advantage. Enhancing customer experience remains a priority, with 46% focusing on loyalty, 43% on conversion, and 42% on experience improvement. Notably, 96% of customers say service impacts brand loyalty, while 65% convert into long-term clients with superior experiences. Brands prioritizing CX see an 80% revenue surge, as 70% of customer experience hinges on perceived treatment.

There is a growing trend to identify consumer behavior by using social media, blogs, e-commerce platforms, and websites by consumers, as these insights help to identify how customers' preferences are evolving to adapt to competitive conditions, boosting the growth of this Customer Data Platform Market. Manual collection of customer data and its classification is time-consuming and expensive thus, companies are willing to spend money on a data platform that provides unified consumer profiles, which expands the growth of The

Digital Banking Platform.

However, many customer data service providers face legal issues about sharing customer insights within the organization, which hinders the growth of this market.

Research Scope and Analysis

By Component

The platform segment is expected to obtain the majority of revenue share based on components in 2024. The requirement for software is increasing due to the growing need for customer satisfaction. Also, many sectors are investing in marketing to provide specific solutions to customers.

The service segment is expected to grow due to investment by vendors in platform maintenance, AI, and

machine learning integration services. CDP service providers may offer expertise and assistance in various aspects of deployment, such as data strategy development, data governance, solution architecture design, and campaign management.

By Type

Based on type, the CDP market is segmented into analytic, campaign, and access. The analytic segment is expected to dominate this market with the largest revenue share in 2024. This segment focuses on analytical capabilities provided by these platforms which involve the ability to collect, process, and analyze large volumes of customer data from many sources in real-time.

Demand for the analytic segment is increasing due to facilities like automation of consumer profiles depending on the customer life cycle journey. Also, it helps to automatically generate profiles based on segmentation criteria, providing personalized marketing efforts, and driving the growth of this segment.

The campaigns segment accounted for the highest revenue share in 2024 due to its ability to compare customer data from many sources and ensure the compilation of customers based on different parameters.

By Deployment mode

Cloud deployment is expected to lead the global customer data platform market with a revenue share of 93.1% in 2024. It involves hosting the CDP software on third-party servers managed by cloud service providers like AWS, and Microsoft Azure. It provides data security, helps to protect sensitive client information, more storage space, and allows for cost-effective expansion.

The on-premise segment is expected to grow with a high CAGR as it is frequently used by advertisers and markets to manage the data system, also it gives complete control over the data provided by the organization.

By Organization

Small and medium enterprises are expected to dominate the CDP market in 2024 due to rising demand for PaaS, SaaS, and IaaS solutions which increased the adoption of customer data platforms, driving the growth of this segment. SMEs require CDP solutions that offer essential features for managing customer data, analyzing customer behavior, and executing targeted marketing campaigns, while also being cost-effective and easy to implement.

Large Enterprises are also expected to grow in coming years due to the increasing adoption of collaborative strategies like forming partnerships with CDP providers that incorporate customer data platforms into their digital transformation efforts, driving the growth of this market.

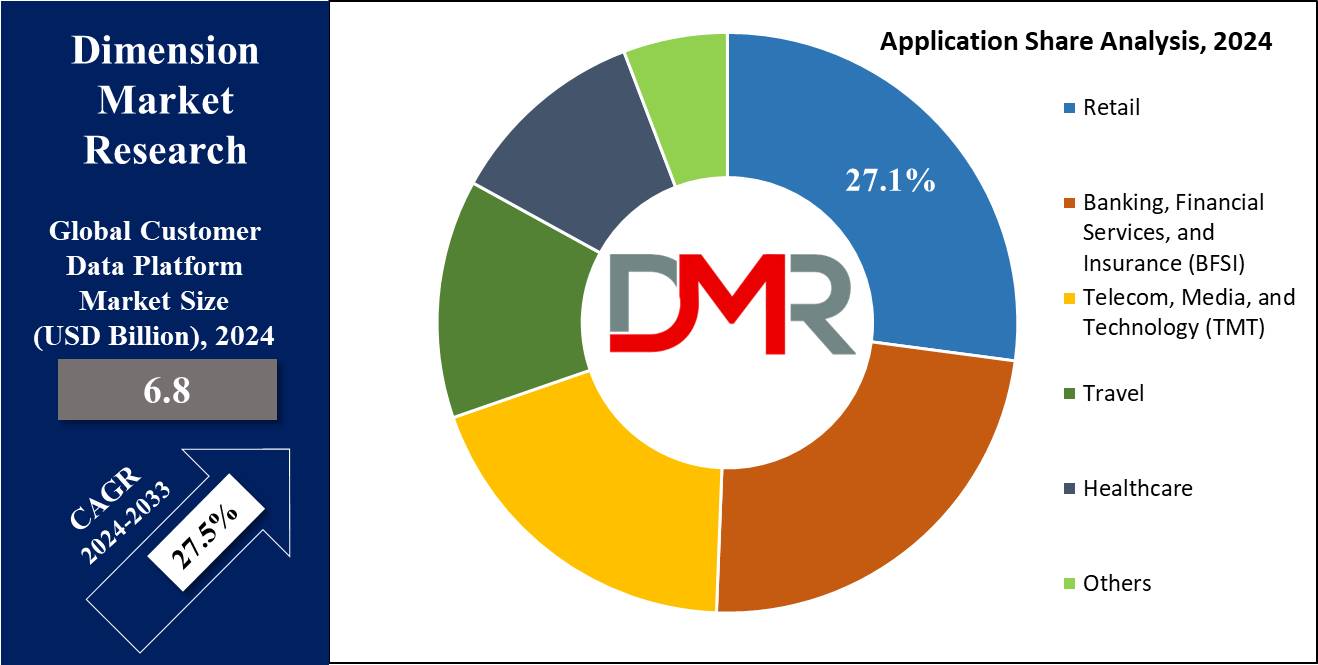

By Application

The retail segment as an application is expected to generate the highest revenue of 27.1% in 2024 for the global customer data platform market, as attractive marketing strategies, rising customer loyalty, and improving shoppers' experience are boosting the growth of the segment. The demand for CDP in this segment is rising among B2B companies due to advantages like time-based analysis of consumer engagement and online & offline collection of data from different sources.

According to a study by the CDP Institute,

34% of the B2B companies planned to deploy CDP. BFSIs are increasingly opting for these platforms due to the increase in dependency on technology for marketing products and services catered to a specific group of consumers.

The Global Customer Data Platform Market Report is segmented based on the following:

By Component

By Type

- Analytics

- Campaign

- Access

By Deployment Mode

By Organization

- Small & Medium Enterprises

- Large Enterprises

By Application

- Retail

- Banking, Financial Services, and Insurance (BFSI)

- Telecom, Media, and Technology (TMT)

- Travel

- Healthcare

- Others

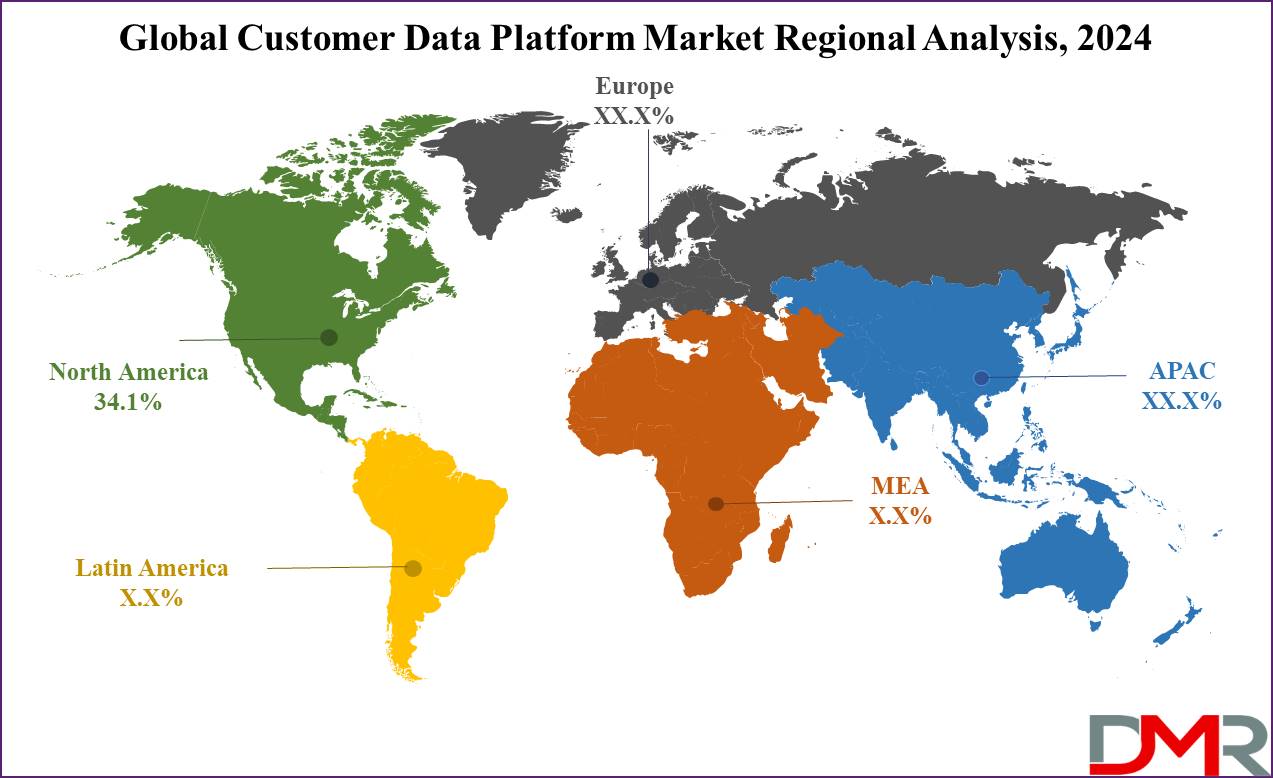

Regional Analysis

North America is expected to dominate the CDP market with the largest

revenue share of 34.1% in 2024 due to the presence of specific vendors focused particularly on providing CDP solutions and subsidiary products. This region has dominated the market due to the presence of prominent market players and increased investment in these technologies. Moreover, organizations in this region are willing to adopt these technologies as early as possible.

Europe region is expected to grow at a high CAGR due to the presence of a large number of providers offering analytics and campaign-based CDP solutions. The number of vendors present in the European market is half of the total CDP market vendors which contributes to the overall growth of this market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The CDP market is scattered a lot because of the abundance of players who are adapting advanced solutions to get an edge in the competition. Businesses are partnering with both technology companies and service providers to create better platforms. For example, AgileOne collaborated with Snowflake Inc. to develop a solution that improves access to processed customer data. Major players in this market are Tealium, Segment.io, NGDATA, ENSIGHTEN, Salesforce.com, and Adobe.

Companies are actively engaging in strategic partnerships, acquisitions, and the integration of additional capabilities to reinforce their market position. Moreover, the market is showing significant growth due to the introduction of automation platforms like Oracle and SAP SE, alongside other CDP-focused vendors.

Some of the prominent players in the global customer data platform market are

- Oracle

- Salesforce.com, Inc.

- SAP SE

- Adobe

- Tealium

- Segment.io, Inc.

- AgileOne

- mParticle, Inc.

- Dun & Bradstreet, Inc.

- Leadspace, Inc

- Others

Recent Development

- In August 2023, Simon Data Inc., a startup specializing in an AI-driven customer data platform that merges analytics and marketing automation, secured a significant investment of USD 54.0 million.

- In December 2023, Zeotap CDP introduced a feature called "Non-Customer Entity Data" to its Customer Data Platform which ensures seamless integration and utilization of both customer and non-customer entity data in ways previously unprecedented.

- In March 2023, Adobe launched an innovation in Adobe Real-time CDP to help brands with business insight as it delivers more than 600 billion predictive insights per year based on real-time customer data.

- In August 2022, Oracle extended an important agreement with AT&T to enhance the capabilities and capacity of the company's applications and databases operating in the Oracle Cloud.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 6.8 Bn |

| Forecast Value (2033) |

USD 60.4 Bn |

| CAGR (2023-2032) |

27.5% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Analytics, Campaign, and Access), By Deployment Mode (Cloud and On-premises), By Organization (Small &Medium-sized Enterprises and Large Enterprises), By Component (Platform and Services), By Application (Retail, Banking, Financial Services, Insurance, Telecom, Media and Technology, Travel, Healthcare, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Oracle, Salesforce.com Inc., SAP SE, Adobe, Tealium, Segment.io, Inc., AgileOne, mParticle, Inc., Dun & Bradstreet, Inc., Lead space Inc, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |