Market Overview

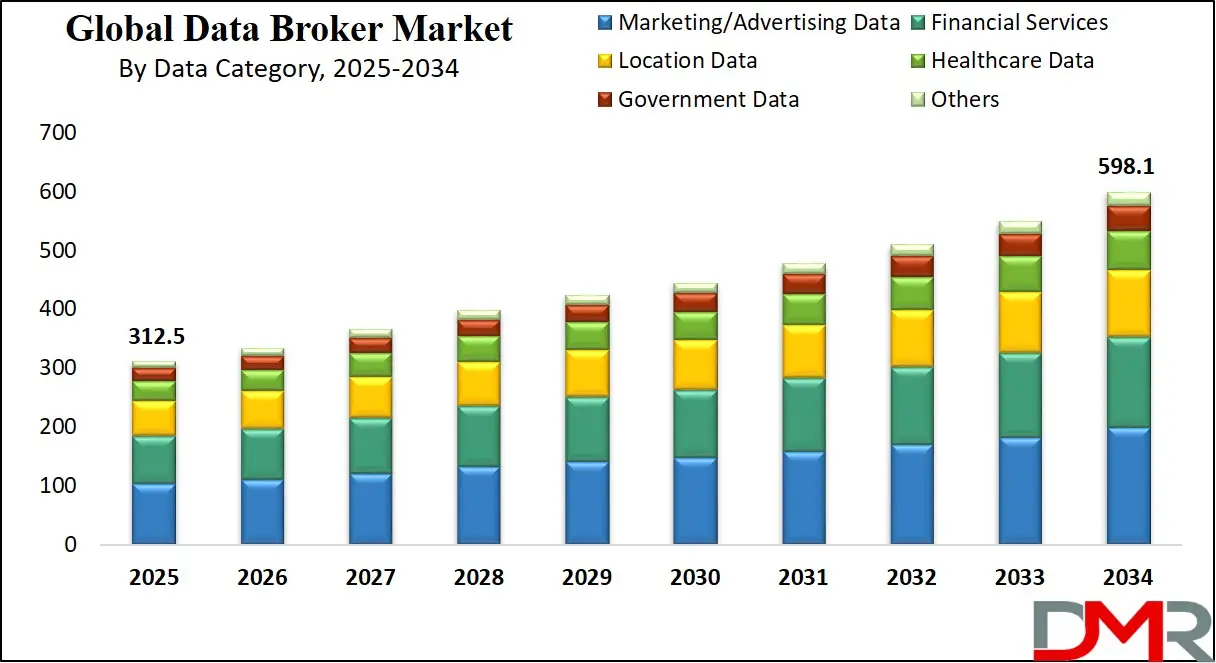

The Global Data Broker Market is expected to be valued at USD 312.5 billion in 2025, and which is further anticipated to reach USD 598.1 billion by 2034 at a CAGR of 7.5%.

The global data broker market refers to an industry involved with collecting, aggregating, analyzing, and selling of data derived from public and private channels. Data brokers collect information from online transactions, social media platforms, government records, surveys, and other digital interactions to form comprehensive datasets which they use to offer insights to businesses, marketers, financial institutions, or any organization that needs them for analytical or decision making purposes.

The data broker market plays a critical role in enabling businesses to access high-quality data that enhances their operational efficiency and strategic planning. With the proliferation of digital platforms, the demand for detailed customer insights has surged, making data brokerage services essential.

Companies utilize brokered data to segment audiences, personalize marketing campaigns, and optimize customer engagement strategies. Additionally, data brokers help businesses gain competitive intelligence by offering information on market trends, competitor behavior, and consumer purchasing patterns.

One of the defining aspects of the data broker market is its ability to provide highly customized, and detailed datasets. Data brokers offer demographic, behavioral, and psychographic data that helps businesses better understand their target audiences more accurately, which is especially useful in industries like retail, finance, and healthcare where personalized services and precise marketing are critical elements. Being able to deliver customized data solutions further strengthens this market in today's modern business landscape.

Market participants also leverage advanced technologies, including artificial intelligence, machine learning, and big data analytics, to enhance accuracy, speed, scalability, and refine insights for brokers offering data brokerage services to businesses. Automated algorithms can identify patterns, predict consumer behavior and offer predictive insights, further increasing value to business clients while driving market expansion across various industries.

This technological evolution is propelling market expansion as its applications broaden significantly. Despite its growth, the data broker market faces challenges related to data privacy regulations and ethical considerations. Stringent data protection laws such as General Data Protection Regulation (GDPR), and California Consumer Privacy Act (CCPA) impose strict compliance requirements on data collection, storage, and distribution practices.

Additionally, growing public awareness about data privacy is prompting consumers to demand greater transparency and control over their personal information. These factors are reshaping the market landscape, encouraging data brokers to adopt more ethical and transparent data sourcing methods to maintain trust and regulatory compliance.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Data Broker Market

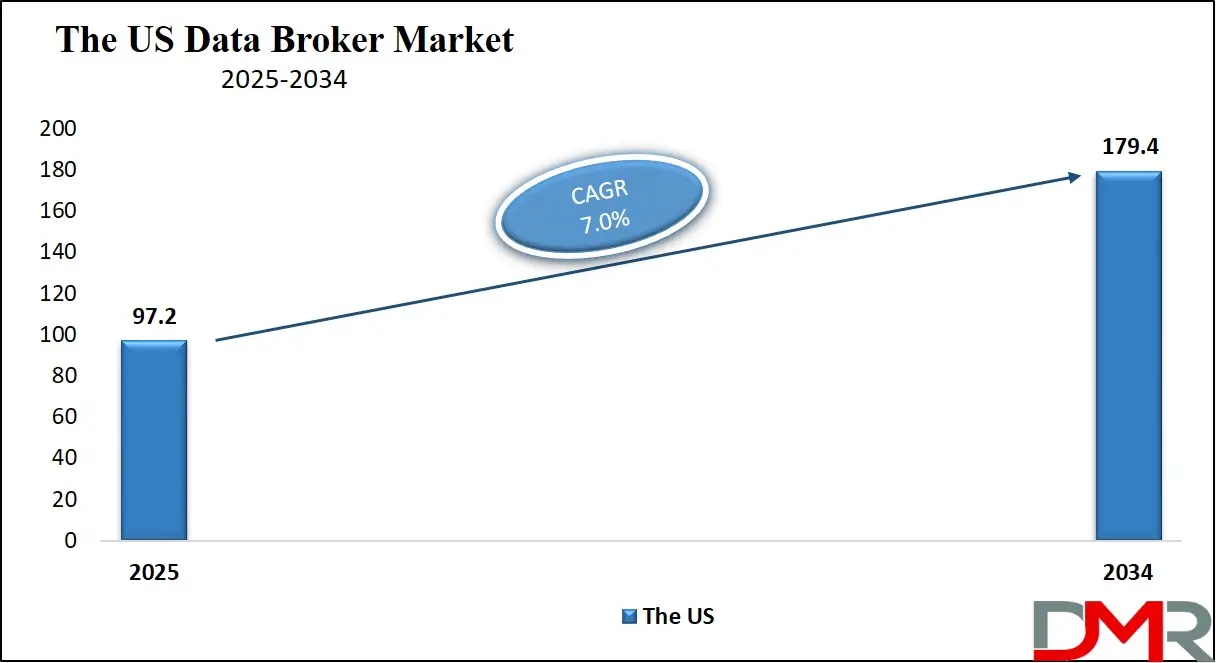

The US Data Broker Market is projected to be valued at

USD 97.2 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding

USD 179.4 billion in 2034 at a

CAGR of 7.0%.

The US data broker market is impacted by rising consumer insights and

business intelligence requirements across industries, particularly retail, finance, and healthcare. Rapid digital transformation across these sectors has created an urgent demand for comprehensive data solutions.

Businesses in the US utilize brokered data to improve customer targeting efforts, streamline supply chains, and optimize risk management processes, making data brokers an integral part of strategic decision making processes. US regulatory environment is changing quickly with the passage of data privacy with laws like CCPA that seek to safeguard consumer data. While such regulations impose stringent compliance standards on data brokers, they also encourage transparent data practices among companies.

More and more organizations are adopting privacy-centric approaches in their business operations while meeting consumer rights obligations. The US market is witnessing an increasing interest in alternative data sources such as location-based information, social media activity, and transaction records. Investment firms, marketers, and logistics providers rely heavily on such unconventional types of information for deeper customer insights and market trends analysis.

Their increasing adoption is broadening market scope while improving value proposition for data brokerage services. Technological advancements are revolutionizing the US data broker market, with AI and machine learning playing an essential role in data collection and analysis. Automated algorithms provide faster processing times with more accurate insights for businesses of all sizes, driving innovation while creating growth opportunities in this competitive industry.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Global Data Broker Market: Key Takeaways

- Market Value: The global data broker market size is expected to reach a value of USD 598.1 billion by 2034 from a base value of USD 312.5 billion in 2025 at a CAGR of 7.5%.

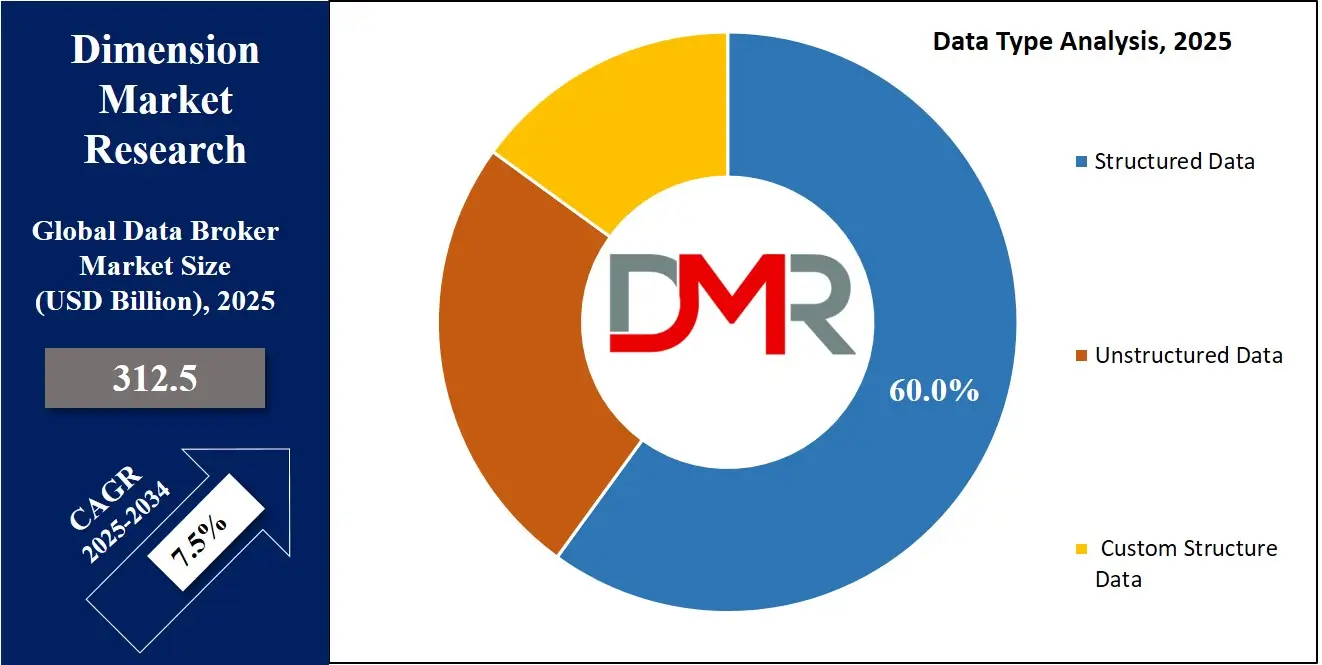

- By Data Type Segment Analysis: Structured Data is anticipated to lead in the data type segment, capturing 60.0% of the market share in 2025.

- By Data Category Segment Analysis: Marketing/Advertising Data is poised to consolidate its market position in the data category segment capturing 33.0% of the total market share in 2025.

- By Data Source Type Segment Analysis: Public Sources are expected to maintain their dominance in the data source type segment capturing 40.0% of the total market share in 2025.

- By End User Segment Analysis: Banking end users are anticipated to dominate the end user segment, capturing 25.0% of the total market share in 2025.

- Regional Analysis: North America is anticipated to lead the global data broker market landscape with 37.0% of total global market revenue in 2025.

- Key Players: Some key players in the global data broker market are Bright Data, Datarade, Coresignal, Trifacta, Cloudera, Stability AI, Spire Global, Kpler, Common Crawl, OpenAI, and Other Key Players.

Global Data Broker Market: Use Cases

- Market Research and Competitive Intelligence: Businesses leverage data sources such as consumer surveys, web scraping, and purchase history to analyze market trends and competitor activities. This helps companies identify customer demands, forecast market growth, and develop strategies to launch new products or expand into emerging markets. Additionally, data sources provide insights into competitor pricing strategies, product launches, and customer reviews. Businesses use this information to fine-tune their marketing campaigns and improve product differentiation.

- Customer Sentiment Analysis in Social Media Monitoring: Organizations utilize social media data from platforms like Twitter, Instagram, and Facebook to assess customer opinions and brand perception. Real-time data helps companies improve marketing campaigns, respond to customer feedback, and enhance brand loyalty by understanding audience preferences. By analyzing text-based posts, comments, and hashtags, businesses can identify customer pain points and trending topics.

- Risk Assessment and Fraud Detection: Financial institutions and insurance companies rely on transactional data, identity verification databases, and credit scores to detect fraudulent activities. This helps in identifying unusual patterns, ensuring compliance with regulations, and minimizing financial losses through automated fraud detection systems. Advanced machine learning algorithms analyze large volumes of financial data to flag suspicious transactions in real time. Data providers supply blacklisted account information and identity theft databases to enhance fraud detection accuracy.

- Supply Chain Optimization: Data providers offer logistics data, inventory records, and location-based information to improve supply chain efficiency. Companies use this data to forecast demand, optimize delivery routes, and reduce operational costs, leading to better resource management and faster delivery times. IoT-based sensors and GPS tracking systems provide real-time shipment data, enabling businesses to monitor delivery status and predict delays. Historical sales data helps companies plan inventory levels and avoid stock outs or overstock situations.

Global Data Broker Market: Stats & Facts

- The US Federal Trade Commission (FTC) was one of the first government organizations to shed light on the hidden operations of data brokers. In its 2014 report titled "Data Brokers: A Call for Transparency and Accountability," the FTC revealed how data brokers collect, analyze, and sell massive volumes of consumer information without direct interaction or consent from individuals.

- In addition, the report highlighted that these companies source data from public records, social media platforms, online purchases, and various other channels, often leaving consumers unaware of how their personal information is being used.

- The European Data Protection Supervisor (EDPS) released a report in 2015, emphasizing the ethical risks posed by data brokers. The report warned about the extensive profiling practices used by these companies and called for greater transparency to protect user privacy.

- In addition, the report laid the foundation for the General Data Protection Regulation (GDPR), which was enforced in 2018 across the European Union. GDPR established strict rules requiring companies, including data brokers, to seek user consent before processing personal data, disclose the purpose of data collection, and allow consumers to request data deletion.

- The California Consumer Privacy Act (CCPA) came into effect in 2020, making California one of the first regions in the US to regulate data brokers. Under this act, data brokers are required to register with the California Attorney General and provide consumers with the right to opt out of data sales.

- Regulatory bodies such as the Information Commissioner's Office (ICO) in the UK have taken action against data brokers. The ICO fined two major data broker companies, Experian and Equifax, for non-compliance with data protection laws. The ICO's investigation highlighted how data brokers were repurposing personal data for marketing purposes without proper consent, reinforcing the need for ethical data practices.

- According to Gartner, an estimated 5,000 data brokers work globally.

- According to NATO Strategic Communications Centre of Excellence, there are 4.8 billion internet users globally and 175 zettabytes of data produced worldwide by 2025.

- According to NATO Strategic Communications Centre of Excellence, the global data economy is projected to reach USD 400.0 billion by 2025.

- According to NATO Strategic Communications Centre of Excellence, The US-based data broker Acxiom (recently rebranded to LiveRamp) is considered one of the world’s leading data brokers and serves as a point of reference for the scale of the industry. Acxiom reportedly has over 20,000 servers for collecting and analysing data on over 700.0 million individuals worldwide.

- The United Nations Conference on Trade and Development (UNCTAD) published a report in 2021 advocating for the creation of global data protection standards to prevent cross-border misuse of consumer data. The report highlighted the vulnerability of consumers in developing countries, where regulatory frameworks are often weak or nonexistent, making them more susceptible to data exploitation by global data brokers.

Global Data Broker Market: Market Dynamic

Global Data Broker Market: Driving Factors

Growing Adoption of Data-Driven Decision Making Across Industries

Organizations are shifting their focus from traditional business models towards more analytical ones in which data plays an essential part in shaping strategies and operational processes. Rising competition across industries such as retail, healthcare, finance, and manufacturing is pushing businesses to use data for improving performance, improving customer experiences, and creating sustainable competitive advantages.

Companies are turning to different data sources, such as transactional data, customer behavior data, and market intelligence to make more accurate and informed decisions. Big data analytics and artificial intelligence technologies have greatly propelled the demand for high-quality data sources, as these require extensive amounts of information for accurate predictive modeling and automation processes.

Rising Demand for Real-Time Data Insights

Rising demand for real-time data insights has been one of the primary catalysts driving growth in the global data source market. Businesses prioritize instant access to data so they can make quick and informed decisions in fast-changing market environments. Real-time data provides organizations with an invaluable way to monitor customer behaviors, evaluate operational performance, and adapt quickly to market changes.

Industry sectors including e-commerce, logistics, and financial services rely heavily on real-time data for inventory control, fraud detection, and customized customer experiences. As Internet of Things (IoT) devices, connected sensors, and digital platforms create streams of real-time information, the demand for reliable data suppliers has further increased.

Global Data Broker Market: Restraints

Data Privacy and Security Concerns

Data privacy and security concerns pose major hurdles to the market growth potential of global data source markets. With a large amount of data being generated and shared between industries, data breaches, unauthorized access, and misuse have become a concerning matter. Data protection regulations such as Europe's General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA) place stringent compliance obligations on data providers.

Businesses must ensure that the data they source is ethically collected, properly anonymized, and stored securely to avoid legal penalties and reputational damage. Moreover, the lack of transparency regarding data sourcing methods among some providers creates trust issues among buyers. These privacy and security challenges are prompting organizations to adopt more stringent vendor selection criteria, which can slow down market growth.

High Cost of Data Acquisition and Management

Sourcing large volumes of high-quality data through multiple channels requires considerable financial investments, especially for niche or proprietary datasets. Cleaning, structuring, and validating raw data to ensure accuracy and consistency involves advanced technologies and skilled professionals, further adding to operational expenses. Small and medium enterprises frequently struggle with budget constraints that limit access to premium data sources.

Furthermore, ongoing expenses associated with data storage, security, and integration with existing systems create long-term financial burdens on organizations. Particularly businesses in developing regions are unable to access premium sources in this manner, and are limited in their participation in the data source market. The financial burden is further intensified by the need for regular data updates, licensing fees, and compliance with evolving data protection regulations, making it difficult for businesses to maintain continuous access to high-quality datasets.

Global Data Broker Market: Opportunities

Expansion of Data Monetization Services

Companies are capitalizing on their internal data to generate new sources of income by offering it to third-party organizations through subscription-based models or one-time purchases. This trend is particularly evident in industries like telecom, retail, and financial services where companies produce vast amounts of customer and operational data. Cloud-based platforms and data markets have made data monetization more accessible by offering seamless sharing and licensing across industries.

Encryption and anonymization technologies enable businesses to sell data without jeopardizing sensitive information or breaking privacy regulations. The increasing interest among hedge funds, marketers, and researchers for alternative data sources has significantly expanded market potential. Monetizing data also encourages partnerships between data providers and enterprises for a more collaborative ecosystem.

Rising Demand for Industry-Specific Data Solutions

Businesses are increasingly seeking customized data sets tailored to their unique operational needs and market requirements. Industries such as healthcare, automotive, energy, and agriculture require highly specialized data, such as patient records, vehicle performance statistics, energy consumption patterns, and climate data. This shift towards niche data solutions is driving data providers to develop vertical-specific offerings that deliver more relevant insights. Additionally, companies prefer curated data sets that align with regulatory standards and industry best practices, enhancing their decision-making capabilities. The growing adoption of AI and machine learning applications further increases the need for sector-specific data to train algorithms effectively.

Global Data Broker Market: Trends

Growing Integration of Blockchain for Data Transparency

Blockchain's decentralized ledger system enables secure, tamper-proof data transactions, ensuring that data remains authentic and traceable throughout its lifecycle. This technology helps businesses verify the origin and quality of data, addressing concerns about data manipulation and unauthorized alterations.

Data providers are increasingly adopting blockchain to create transparent data marketplaces where buyers can access verified datasets with full trust. The immutability and encryption features of blockchain also strengthen data security, making it highly suitable for sensitive industries like healthcare and finance. As the demand for trusted, high-quality data rises, blockchain-based solutions are expected to gain wider adoption, reshaping how data is exchanged and validated in the global market.

Rising Adoption of Alternative Data Sources

Alternative data, such as satellite imagery, geolocation data, web scraping data, and IoT sensor data, is increasingly being utilized to gain new perspectives on market trends, consumer behaviors, and operational performance. Alternative data provides more granular, and real-time insights that traditional data sets lack.

Investment firms, e-commerce platforms, and logistics companies are increasingly turning to this form of data to enhance decision-making capabilities and boost predictive analytics capabilities. Digital tools and AI algorithms make it easier to extract, process, and analyze alternative data sources, fuelling its rapid adoption into markets across industries. This trend is revolutionizing business practices by expanding data sources available and giving businesses a competitive edge.

Global Data Broker Market: Research Scope and Analysis

By Data Type

Structured data is projected to dominate the data type segment, accounting for 60.0% of the total market share in 2025 due to its standardized format and simple processing requirements. Data organized into tables, rows, and columns makes it highly compatible with relational databases and analytics tools.

Companies depend on structured data for many critical business functions, including customer relationship management, financial transactions, and supply chain operations. As digital transformation initiatives gain steam across industries, companies are increasingly investing in structured data management systems to streamline workflows, increase accuracy, and automate processes. Structured data has become even more prevalent with the increased adoption of cloud-based analytics platforms and enterprise resource planning (ERP) systems.

In contrast, unstructured data is emerging as a valuable but complex component of the data landscape, offering vast potential for organizations seeking deeper insights beyond traditional datasets. Unlike structured data, unstructured data lacks a predefined format and includes various forms such as emails, social media posts, multimedia files, and sensor data. This type of data is generated at an unprecedented rate, driven by the increasing use of digital communication, IoT devices, and user-generated content.

While unstructured data presents challenges in terms of storage, processing, and interpretation, advancements in artificial intelligence, natural language processing, and big data analytics are enabling organizations to unlock its hidden value. Businesses are increasingly investing in technologies that can analyze and extract meaningful patterns from unstructured data, allowing them to enhance customer engagement, monitor brand sentiment, and develop personalized marketing strategies.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Data Category

Marketing/Advertising data is expected to strengthen its market position in the data category segment, securing 33.0% of the total market share in 2025, propelled by the increasing demand for precision-based customer targeting and personalized promotional strategies. Data about consumer behavior includes patterns such as buying preferences, demographic information, and online activity that helps businesses optimize their marketing campaigns.

The digital advertising landscape is evolving quickly and companies are increasingly turning to marketing data as they leverage it to target specific audiences, predict buying trends, and refine customer acquisition strategies. Data-driven platforms and programmatic advertising solutions fuel this need for high-quality marketing data across various industries. The proliferation of social media platforms, e-commerce websites, and digital applications has significantly contributed to the surge in marketing data generation.

Businesses rely on this data to create personalized content, execute performance-based advertising campaigns, and measure the effectiveness of their promotional efforts. Financial services data also plays an integral part in this market by providing insights into customer creditworthiness, transaction patterns, and investment preferences. Financial institutions use this information to assess risk profiles, streamline loan approvals, and customize financial products.

The growing emphasis on digital banking and fintech solutions has increased the need for accurate financial data, allowing companies to enhance fraud detection, improve credit scoring models, and optimize wealth management services. Furthermore, financial services data enables businesses to develop predictive models that anticipate customer needs and offer tailored solutions, strengthening customer loyalty and satisfaction.

By Data Source Type

Public sources are projected to retain their leading position in the data source type segment, accounting for 40.0% of the total market share in 2025, driven by their accessibility and consistency in delivering vast quantities of valuable information.

These sources include government publications, business registries, social media platforms, and publicly available databases, which offer invaluable insight into demographics, economic indicators, and industry trends. Public data can be an economical resource for businesses seeking to enhance market research, competitor analysis, and strategic planning.

The rising emphasis on transparency and open data initiatives by various governments and institutions is further driving the availability of public data, making it a valuable asset across industries. Public sources provide invaluable data sources in industries like finance, healthcare, and retail. Businesses use it to gain insights into regulatory changes, economic forecasts, and consumer behavior patterns.

Search history data plays an integral part in this field, providing businesses with invaluable insight into consumer intent and preferences. It comes directly from user search activities across search engines and digital platforms, reflecting interests, product inquiries, and emerging consumer trends in real time.

Businesses utilize this type of data for optimizing digital advertising strategies, improving search engine rankings, creating customized marketing campaigns. The growing reliance on search engine marketing (SEM) and search engine optimization (SEO) strategies further elevates the importance of search history data for brands looking to enhance online visibility and engagement.

In addition to marketing applications, search history data is increasingly being used in predictive analytics and customer behavior modeling. Companies analyze aggregated search patterns to anticipate market demand, adjust pricing strategies, and identify new business opportunities.

By End User

Banking users are projected to lead the end-user segment, accounting for 25.0% of the total market share in 2025. This dominance is attributed to the sector's growing dependence on data-driven decision-making processes aimed at improving operational efficiency and enhancing customer experience. Banks leverage data to optimize credit risk assessment, detect fraudulent activities, and develop personalized financial products.

The growing adoption of digital banking platforms and mobile payment applications has further amplified the need for accurate and real-time data. Additionally, banking institutions are investing in predictive analytics to anticipate customer needs, improve loan disbursement processes, and deliver customized services that enhance customer satisfaction and retention. The integration of advanced technologies such as artificial intelligence and blockchain is also reshaping how banks utilize data, enabling secure data sharing and improving transparency in transactions. By analyzing large datasets, banks can gain deeper insights into customer spending patterns and financial behaviors.

Financial services also play a pivotal role in this segment by using data for wealth management, investment strategies, and insurance underwriting. Companies in this industry rely heavily on data to assess investment risks, predict market trends, and optimize portfolio management. Financial service providers use data to create customized investment plans and assess clients' risk tolerance, helping them deliver more personalized financial advisory services.

Additionally, the rise of robo-advisors and algorithmic trading platforms has significantly increased the demand for data to drive automated decision-making processes. Insurance companies play a crucial role in financial services by using data for risk evaluation, claim handling, and policy pricing. By examining historical claims data and customer behavior patterns, insurers can increase underwriting accuracy while simultaneously improving fraud detection capabilities more quickly.

The Data Broker Market Report is segmented on the basis of the following:

By Data Type

- Structured Data

- Unstructured Data

- Custom Structure Data

By Data Category

- Marketing/Advertising Data

- Financial Services Data

- Healthcare Data

- Government Data

- Location Data

- Others

By Data Source Type

- Public Sources

- Search History

- Online Agreements

- Purchase History

By End User

- Banking

- Financial Services

- Insurance

- Retail and ecommerce

- Media & Entertainment

- Education

- Telecommunications

- Construction & Real Estate

- Others

Global Data Broker Market: Regional Analysis

The region with the largest Revenue Share

North America is projected to dominate the global data broker market, accounting for

32.0% of the total global market revenue in 2025, driven by the region's advanced technological infrastructure and widespread adoption of data-driven business models.

Major data brokerage companies residing within a strong digital economy have made North America a key hub for data collection, processing, and distribution, which is further enhanced by customer insights across sectors like banking, healthcare, retail, and telecommunications, driving demand for customer insights across these industries. Furthermore, rapid digital transformation in industries like healthcare and financial services is driving up demand for high-quality data.

Healthcare providers rely heavily on data for patient management, predictive diagnostics, personalized treatment plans, as well as patient retention. Financial institutions leverage data for streamlining credit risk assessment processes, detecting fraudulent activities and creating investment solutions that contribute to market expansion.

The region with the highest CAGR

Asia Pacific is projected to experience the highest compound annual growth rate (CAGR) for data broker services market, driven by rapid digital transformation, rising internet penetration rates, and adoption of data-centric business strategies across industries. The region's dynamic economic landscape, coupled with the rising number of tech startups and small-to-medium enterprises (SMEs), is fueling the demand for data brokerage services to enhance business operations and gain a competitive edge. Countries like

China, India, Japan, and South Korea are at the forefront of this growth, leveraging data-driven insights to optimize marketing strategies, streamline supply chains, and improve customer experiences. The proliferation of e-commerce platforms and digital payment systems across the region is generating vast amounts of consumer data, creating opportunities for data brokers to offer customized data solutions. With the rising preference for personalized shopping experiences and targeted advertisements, businesses are increasingly relying on data brokerage services to segment audiences and predict purchasing behaviors.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Data Broker Market: Competitive Landscape

The global data source market exhibits a highly competitive environment, driven by rising demand for data-driven decision making across industries. Market players are taking strategic steps such as mergers, acquisitions, partnerships, and collaborations to expand their data collection capabilities and enhance service offerings.

Leading companies focus on offering high-quality datasets customized for various applications like market research, customer analytics, and predictive modeling. The competition is further fueled by the increasing reliance on big data, AI, and machine learning technologies, which require diverse and accurate data sources for optimal performance. Established data providers are taking advantage of global networks and technological infrastructure to provide enterprises with customized data solutions.

Established data providers are taking advantage of global networks and technological infrastructure to provide enterprises with customized data solutions tailored specifically for them. Companies focus on using advanced tools such as data enrichment platforms, API-based data delivery solutions, and cloud storage services to increase data accessibility and accuracy.

Market leaders invest heavily in security measures designed to meet strict privacy regulations, this helps build trust among clients while keeping competitive edges intact. The global market is witnessing the rise of niche data providers who specialize in specific data types such as location-based information, web scraping data, and alternative financial data.

Some of the prominent players in the global data broker market are:

- Oracle

- Bright Data

- Datarade

- Coresignal

- Trifacta

- Cloudera

- Stability AI

- Spire Global

- Kpler

- Common Crawl

- OpenAI

- Other Key Players

Global Data Broker Market: Recent Developments

- December 2024: Colovore, a data center company specializing in high-density liquid-cooled facilities, underwent a major ownership change to support its expansion in AI and machine learning infrastructure. This strategic shift aligns with the rising demand for high-performance computing services driven by increased data volumes and AI workloads. The new ownership is expected to boost the company’s operational capacity across North America.

- December 2024: Global Switch, a prominent data center operator, sought a co-investor partnership for its London campus as part of its expansion plan. The deal is intended to improve data center capacity and operational efficiency, catering to the growing demand for colocation services and cloud infrastructure. This move is aligned with the region’s increasing cloudadoption and digital transformation initiatives.

- November 2024: Kpler, a French data and maritime analytics platform, acquired Spire Maritime for USD 241.0 million to strengthen its position in the maritime data intelligence market. This acquisition enhances Kpler’s capabilities in vessel tracking, port intelligence, and cargo monitoring, addressing the rising demand for real-time maritime data across global trade networks.

- October 2024: Synopsys completed the USD 35.0 billion acquisition of Ansys, a leading provider of engineering simulation software. This merger combined Synopsys' expertise in chip design with Ansys' simulation technologies, enabling more comprehensive data-driven product development in sectors like semiconductors, automotive, and aerospace.

- September 2024: HPE acquired Juniper Networks for USD 14.0 billion to boost its expertise in AI- driven networking and cybersecurity solutions. The merger aimed to accelerate digital transformation for enterprises by offering advanced cloud-based network management solutions and AI-powered analytics, contributing to the growth of the data broker market.

- August 2024: TP ICAP, a UK-based interdealer broker, considered an IPO for Parameta, its data division, on the U.S. stock exchange. This strategic move aimed to unlock greater market value and bolster Parameta’s position in the financial data services market, especially with the rising demand for market intelligence and risk assessment data.

- August 2024: Diamondback Energy acquired Endeavor Energy Resources for USD 25.8 billion t achieve economies of scale and improve operational efficiency. While primarily in the energy sector, this acquisition boosted Diamondback’s access to geological and environmental data, a key segment in the data broker market for resource exploration and management.

Report Details

|

Report Characteristics

|

| Market Size (2025) |

USD 312.5 Bn |

| Forecast Value (2034) |

USD 598.1 Bn |

| CAGR (2025-2034) |

7.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 97.2 Bn |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Data Type (Structured Data, Unstructured Data, Custom Structure Data), By Data Category (Marketing/Advertising Data, Financial Services Data, Healthcare Data, Government Data, Location Data, and Others), By Data Source Type (Public Sources, Search History, Online Agreements, and Purchase History), By End User (Banking, Financial Services, Insurance, Retail and Ecommerce, Media & Entertainment, Education, Telecommunications, Construction & Real Estate, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Bright Data, Datarade, Coresignal, Trifacta, Cloudera, Stability AI, Spire Global, Kpler, Common Crawl, OpenAI, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global data broker market?

▾ The global data broker market size is estimated to have a value of USD 312.5 billion in 2025 and is expected to reach USD 598.1 billion by the end of 2034.

What is the size of the US data broker market?

▾ The US data broker market is projected to be valued at USD 97.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 179.4 billion in 2034 at a CAGR of 7.0%.

Which region accounted for the largest global data broker market?

▾ North America is expected to have the largest market share in the global data broker market with a share of about 37.0% in 2025.

Who are the key players in the global data broker market?

▾ Some of the major key players in the global data broker market are Bright Data, Datarade, Coresignal, Trifacta, Cloudera, Stability AI, Spire Global, Kpler, Common Crawl, OpenAI, and many others.