Market Overview

The

Global Data Integration Software Market size is expected to reach a

value of USD 7.3 billion in 2024, and it is further anticipated to reach a market

value of USD 20.1 billion by 2033 at a

CAGR of 11.9%.

The global data integration software market is witnessing significant growth, driven by rapidly increasing demand from various industries for real-time data integration. The demand for seamless data integration solutions keeps growing in businesses where informed decisions are to be taken with the help of multiple data sources.

The market also drives growth with the adoption of cloud technologies that offer scalable and cost-effective solutions for managing disparate data systems. The integration software market is crucial in allowing organizations to integrate various data sources and analyze them for consistency, accuracy, and better decision-making. The increasing reliance on data-driven decisions, AI, and ML further adds to the trend upwards.

One important market trend is increasing cloud-based services, which offer flexibility to businesses and real-time access to data. Companies are also seeking customized options that can cater to the specific demands of each firm. The market is foreseeing a higher level of growth due to a rise in demand for personalized solutions.

New integration technologies will continue to emerge to meet the growing demand for comprehensive and efficient data management systems. Indeed, leading companies in the market launch innovative offerings with a strong focus on data accuracy, governance, and privacy. Competition between various companies drives development, investment, and strategic initiatives will become highly important in this growing market.

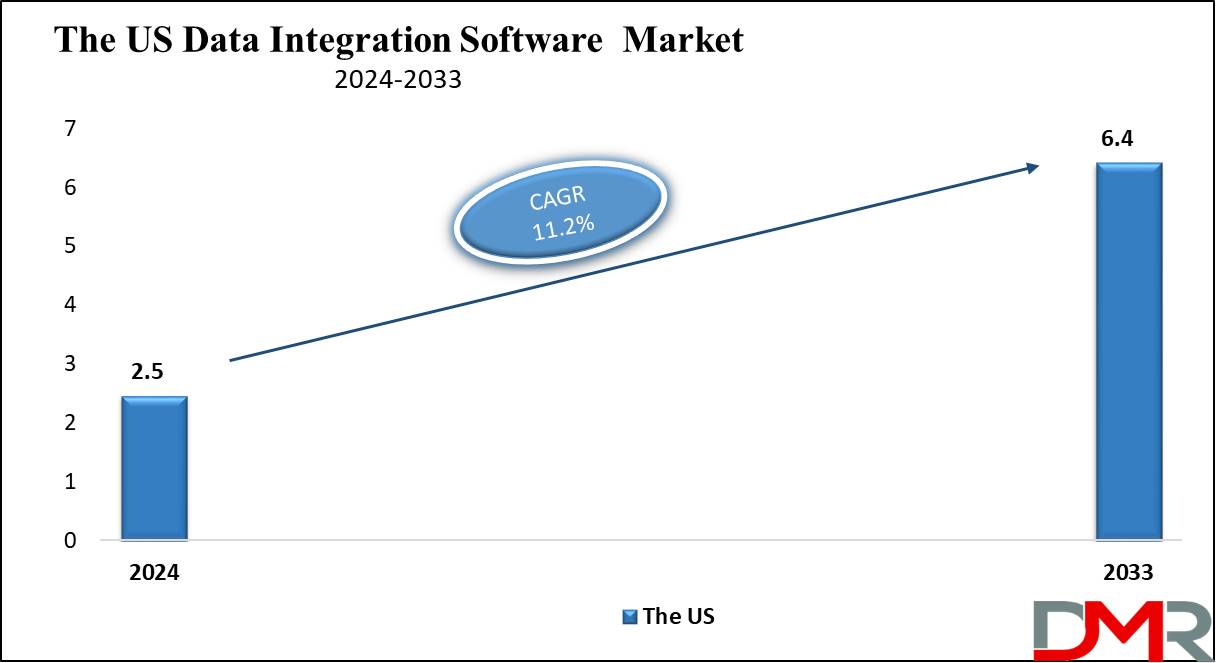

The US Data Integration Software Market

The US Data Integration Software Market is projected to be valued at USD 2.5 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 6.4 billion in 2033 at a CAGR of 11.2%. The U.S. data integration software market is proliferating as businesses recognize the importance of leveraging data from diverse sources.

Key trends playing a vital role in the development of the U.S. market include the enablement of cloud-based solutions for cost efficiency and higher-order data management. For cost efficiency and higher-order data management, its adoption has picked up significantly, moving organizations to integrate massive volumes of data in real-time with minimized infrastructure costs.

Another major development within the U.S. market is the increasing focus on data-driven decision-making. Data integration software helps companies draw valuable insights from their data, thus enhancing efficiency and competitive positioning. Technologies of artificial intelligence and machine learning came into the limelight, which changed the way business operations handle data. These factors are further driving demand for integration solutions.

In addition, U.S. organizations, especially those in verticals such as healthcare, finance, and retail, are looking to integrate data from disparate sources with the aim of better understanding their customers, optimizing business processes, and baseline regulatory requirements. This is driving demand for customized data-integration solutions based on business-specific needs.

This ensures that US business remains at the pace of global trends that relate to data integration. As the market continues to remodel itself, the US data integration software market is sure to continue growing in the forthcoming years.

Key Takeaways

- Global Market Value: The Global Data Integration Software Market size is estimated to have a value of USD 7.3 billion in 2024 and is expected to reach USD 20.1 billion by the end of 2033.

- The US Market Value: The US Data Integration Software Market is projected to be valued at USD 6.4 billion in 2033 from a base value of USD 2.5 billion in 2024 at a CAGR of 11.2%.

- By Deployment Segment Analysis: Cloud-based deployment is projected to dominate the deployment segment in this market as it commands over 53.1% of market share in 2024.

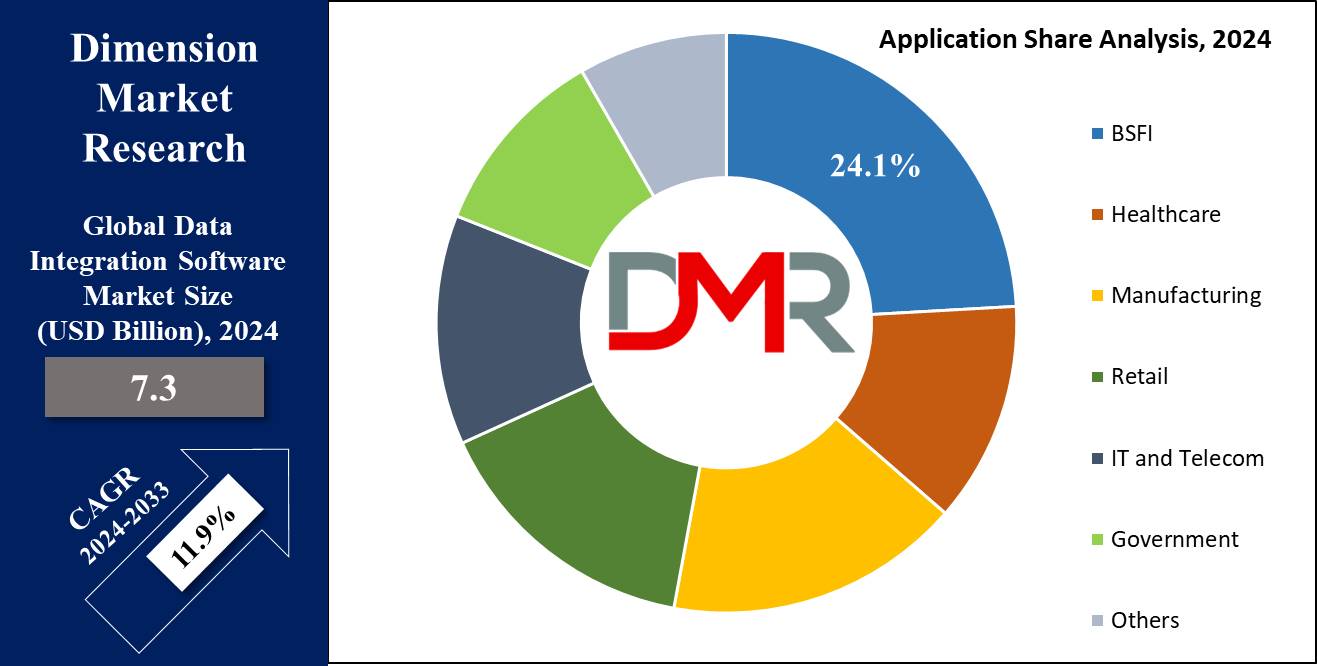

- By Application Segment Analysis: The BFSI (Banking, Financial Services, and Insurance) sector is anticipated to dominate the application segment in this market as it will hold 24.1% of market share in 2024.

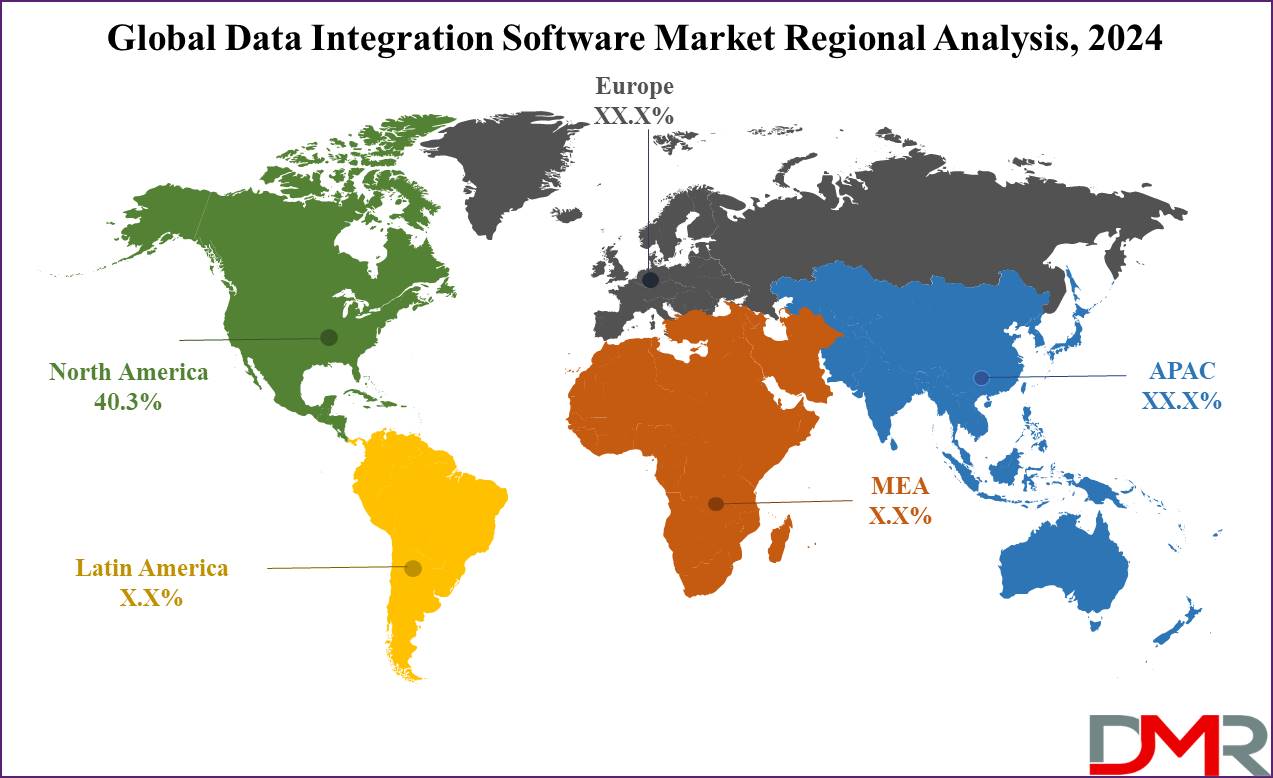

- Regional Analysis: North America is expected to have the largest market share in the Global Data Integration Software Market with a share of about 40.3% in 2024.

- Key Players: Some of the major key players in the Global Data Integration Software Market are IBM, Oracle Corporation, Liaison Technologies Inc., Microsoft Corporation, and many others.

- Global Growth Rate: The market is growing at a CAGR of 11.9 percent over the forecasted period.

Use Cases

- Healthcare: Healthcare professionals through the use of data integration software integrate patient data from EHRs, medical equipment, and other sources into a single database. This therefore will promote better health care since it improves the level of critical analysis and timely decision making.

- Finance: The financial institutions utilize data integration solutions to aggregate data from different systems, like transaction records, databases, and risk management systems. This therefore presents an organization with one single view of customer behavior and financial trends, hence in a position to support financial forecasting with fraud detection.

- Retail: This is an industry where data integration technologies have to be implemented for integrating the various data from online and offline sales channels, inventory systems, and customer feedback platforms. Such integration enhances supply chain management, enabling better customer experience through personalized marketing strategies.

- Manufacturing: Utilizing data integration software, manufacturing companies combine information across IoT devices, production systems, and supply chain databases to smoothen their flows. In return, this integration provides real-time insight into production processes and enables predictive maintenance, hence improving efficiency in operations.

Market Dynamic

Trends

Cloud Integration Driving the MarketThe growing adoption of cloud-based data integration solutions is a major trend in the data integration software market. As businesses increasingly move to on-cloud platforms, demand has been observed to increase for effective and scalable data integration tools that facilitate proper data flow through any number of applications and environments. Real-time access to data, scalability with cost-efficiency, amongst other factors is one of the most attractive features of cloud-based data integration solutions among enterprises of all sizes.

Moreover, the integration of various data sources from on-premise to cloud environments becomes necessary as companies are heading toward digital transformation-is increasing and further giving a boost to the demand for the technology of cloud-based data integration.

AI and Machine Learning Enhancing Data Integration

In all, AI and machine learning are the future of data integration software. AI-based technologies let companies automate complex data integration processes; that is, mapping, transformation, and cleaning, because AI identifies the route and automates it. More importantly, they learn from patterns of the past and optimize data flows for better accuracy and efficiency.

AI and ML also power predictive analytics to let companies make better decisions. Indeed, this trend is going to continue since companies are embracing AI-enabled technologies to improve their data integration processes day by day.

Growth Drivers

Increasing Data-Driven Decision Making

Driving factors for the data integration software market include the ever-growing dependence on data-driven decision-making across industries. While businesses continue to gather huge levels of information from diverse sources, the ability to integrate and analyze this information in near real-time has become paramount.

Data integration solutions are increasingly being incorporated by organizations to eliminate complexes, enhance customer experiences, and create competitive advantages. Market growth compels companies to invest increasingly in data integration software that can handle diverse data sets and provide actionable insights due to the great demand for accurate and timely data insights.

Digital Transformation Across Industries

Another widely influential factor that fuels the demand for global data integration software includes the growing digital transformation initiatives taken by organizations of various sectors, such as finance, healthcare, retail, and manufacturing. While organizations are moving ahead with digitizing their operations, they find an increasing need to integrate data from legacy systems and modern platforms via advanced integration tools.

This, in turn, is attributed to extracting benefits of operational efficiencies, enhancing customer interaction, and for businesses to be agile. This is also driven by the fact that data integration technologies are critical in allowing organizations to realize these objectives by having a unified view of the data across many systems.

Growth Opportunities

SME Adoption and Cloud Solutions

One of the factors that has altered the growth opportunities is the increasing use of data integration software by small and medium enterprises. SMEs could not conventionally engage in implementing data integration technologies as they are listed with high costs and complexities. The availability of cloud-based data integration solutions has allowed this business an option at viable costs.

Cloud platforms provide SMEs with flexibility and scalability, allowing them to implement data integration technologies without large investments in infrastructure. Thus, with increasing digital transformation by SMEs, the demand for cloud-based data integration software will rise in the forecast period and drive market growth.

Industry-Specific Data Integration Solutions

The rising demand for industry-specific data integration solutions offers a significant opportunity for vendors in the data integration software market. Every industry like healthcare, finance, or automotive-requires data integration driven by various industry-specific regulations, standards, and types of data.

Hence, those vendors developing customizable and tailored solutions for these demands will capture larger market shares. For instance, healthcare institutions require data integration platforms that support, among other things, the requirements of HIPAA, while financial businesses require those that guarantee proper data governance and risk management.

Restraints

Data Privacy and Security Concerns

Concerns over data-related privacy and security concerns are major dampeners on market growth. Financial institutions, healthcare providers, and other institutions possessing sensitive information are extremely circumspect about data integration across multiple platforms, where leakage or breach of data may be considered a serious infringement of privacy laws like GDPR or HIPAA.

When these are added to integrating data from the cloud, along with on-premise integrations, the process of securely transmitting and storing the data becomes more complicated. This can make companies, especially those involved in heavily regulated industries, wary of comprising sensitive data and slowing the rate of adoption of data integration technologies.

Integration Complexity and High Costs

Another major restraint in the data integration software market may be viewed as the complexity involved in the integration of disparate data sources across legacy systems and modern applications. Most organizations, especially those operating on pretty outdated systems, have difficulties in harmonizing data across different formats, structures, and platforms.

Such integration often involves strikingly huge investments in terms of time, resources, and skilled personnel. Besides, a few of these data integration solutions have high initial setup costs that might be unaffordable for smaller-scale organizations. This could be complicated and costly enough to prevent the widespread use of such technologies, mainly among the enterprise classes with limited IT infrastructures.

Research Scope and Analysis

By Deployment

Cloud-based deployment is projected to dominate the deployment segment in the data integration software market as it will hold 53.1% of market share in 2024. Cloud-based deployment dominates the data integration software market because of flexibility, scalability, and cost-effectiveness. The adoption of cloud-based solutions has become highly necessary in digitally transformed business operations, as this helps to easily integrate data from various systems that are potentially located at different sites.

These platforms make it possible for organizations to access and integrate data in real-time, all without requiring hefty upfront infrastructure investments, thus making them attractive for businesses of all sizes. One of the distinguishing factors that will drive dominance in cloud-based deployment is its ability to integrate data and analytics for real-time performance.

This feature is highly beneficial for organizations that require timely decisions with pinpoint accurate and updated information. Hence, organizations will be able to integrate data from various sources by including the use of cloud technologies, on-premise systems, and other cloud manifestations by assuring integrated continuity without any glitches.

Besides, data security is better in the cloud, and regulatory compliance is more impeccable because some standards have been implemented in the financial and healthcare sectors. Advanced encryption, data governance, and privacy controls are available from cloud providers, this minimizes the danger of data breach cases, as sensitive information is handled in security.

Company-wide cloud-based data integration solutions are also highly scalable, which empowers organizations to scale their resources up or down depending on demand. Such flexibility means a lot for SMEs, seeing that they cannot afford to invest as many resources in extensive IT infrastructure but badly need strong data integration. That is how increasing demand for decision-making, based on a complete form of data insights, was justifying the trend across industries, thereby ensuring the dominance of cloud-based solutions in the data integration software market.

By Application

The BFSI (Banking, Financial Services, and Insurance) sector is projected to dominate the application segment in the data integration software market as it holds 24.1% of market share in 2024. BFSI is a high-growth industry in the application segment, as it requires data integration software to handle, analyze, and utilize large data across various platforms. Financial institutions deal with highly sensitive data in large volumes.

Strong solutions in data integration thus assure data accuracy and data security, from customer information to transaction records. That is one of the major reasons BFSI dominates, as the whole industry thrives on real-time data for risk management, fraud detection, and various regulatory compliances. Such integration software can consolidate data churned out from different sources into one coherent view, enabling financial institutions to track every transaction with real-time feeds, recognize abnormalities, and take necessary action instantaneously.

For maintaining trust as well as avoiding loss in the case of fraud, this is very important. Furthermore, increased digital banking adoption and rising online transactions put additional demands on advanced data integration solutions. While customers are in contact with banks through every other channel, such as mobile applications, websites, and ATMs, there is an emerging need to deliver a consistent customer experience.

Data integration software allows financial institutions to combine data from multiple touchpoints, thus providing a 360-degree view of customer behavior and preferences. The sector also faces difficult regulatory requirements, hence making governance and compliance of data very important. Through data integration technologies, financial institutions maintain their competent data while meeting regulations such as the General Data Protection Regulation, among others, together with Know Your Customer policies.

The BFSI, considering the critical handling of data, would still dominate in the data integration software market based on the proposed digital transformation and the growing complexity of financial data.

The Data Integration Software Market Report is segmented on the basis of the following

By Deployment

By Application

- BSFI

- Healthcare

- Manufacturing

- Retail

- IT and Telecom

- Government

- Others

Regional Analysis

North America is projected to dominate the data integration software market as it commands over

40.3% of the market share in 2024. North America dominates the data integration software market due to its pre-eminent position in several key factors that determine the adoption and innovation of such technologies. Among the major reasons, the presence of advanced technology infrastructure in countries like the U.S. and Canada is predominant.

The region has a substantial number of industries whose operations are based on data, such as financial services, healthcare, retail, and manufacturing. It accelerates the adoption of data integration solutions to ease operations and enhance the process of decision-making. Adding to the eminence of North America is the growing focus on cloud computing and digital transformation across industries. Companies in the region are moving to cloud-based platforms that enable real-time data integration across diverse systems.

This development of cloud technologies allows for easy integration of fragmented sources of data, hence making North America act as a major spot for ongoing innovations in the solutions for cloud-based data integration. Moreover, North America has also seen significant investments in the field of emerging technologies such as Artificial Intelligence and Machine Learning.

These technologies have started to integrate into data integration software, thereby helping businesses automate and enrich data workflows. The stringent regulatory landscape of this region, especially in industries like BFSI and healthcare, acts as a catalyst for demanding secure and compliant platforms for data integration.

In addition, the presence of major data integration software Vendors such as Microsoft, IBM, and Oracle further reinforces the strategic leadership of the North American region in the global market. With their continued innovations, these companies are offering businesses rich data integration solutions that cater to their evolving needs, and thus strengthen North America's leading position in the global data integration software market.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The data integration software market is fiercely competitive, which means key players are continuously striving to develop and enhance their offerings with innovation and advanced technologies. Some key players operating in this market are Microsoft, IBM, Oracle, Informatica, and SAP. These companies hold larger shares in the market because of their more comprehensive product portfolios and stronger global presence.

Meanwhile, Microsoft is an acknowledged leader and key provider of Azure Data Integration which offers strong cloud-based integration with support for real-time analytics and machine learning applications. IBM has also now been recognized as one of the leading vendors given that it introduces the IBM InfoSphere that allows data governance and integration solutions, precisely targeted at the BFSI and healthcare sectors.

Informatica is also well established with the Informatica Cloud Data Integration platform, providing scalable and high-performance data integration across industries. For its part, Oracle continues to innovate with Oracle Data Integrator, a flexible, cloud-ready solution that a company can turn to for the transformation and integration of data.

The competitive landscape also includes a growing number of startups and niche players that offer various industry-specific solutions. Smaller vendors are targeting this by offering customized and affordable data integration software for various industries. In the global marketplace, fierce competition is also reflected by heavy investments in R&D to attain an edge over the market.

Some of the prominent players in the Global Data Integration Software Market are

- Hitachi Vantara Corporation

- IBM

- Oracle Corporation

- Liaison Technologies, Inc.

- Microsoft Corporation

- SAS Institute, Inc.

- Attunity Inc.

- Dell

- Informatica LLC

- Talend Inc.

- Jitterbit Inc.

- Cisco Systems, Inc.

- Actian Corporation

- SAP SE

- Other Key Players

Recent Developments

- September 2024: Microsoft announced the launch of a new AI-powered data integration tool within its Azure Synapse Analytics platform. This tool leverages machine learning algorithms to automate data mapping and transformation processes, enabling businesses to integrate large datasets more efficiently.

- August 2024: Informatica introduced an enhanced version of its Informatica Cloud Data Integration platform, featuring improved real-time data synchronization across hybrid and multi-cloud environments. The update also includes enhanced security features and compliance with global data privacy regulations, addressing growing concerns in sectors such as BFSI and healthcare.

- July 2024: IBM unveiled a partnership with AWS to integrate its IBM InfoSphere DataStage platform with Amazon's cloud services. This collaboration aims to simplify the process of integrating on-premise and cloud data systems for large enterprises. The joint solution provides businesses with greater flexibility in managing cloud-based and legacy data environments.

- June 2024: Oracle announced the release of Oracle Cloud Data Integration, an upgraded solution focused on automating data workflows across enterprise applications. The platform is designed to improve real-time data processing for businesses adopting cloud-first strategies. Oracle’s solution also includes new features for data lineage and governance, enabling better compliance with data privacy regulations.

- May 2024: Talend launched a self-service data integration platform aimed at empowering non-technical users to manage data pipelines. This development is in line with the growing demand for solutions that support citizen data integrators within organizations, reducing reliance on IT departments and enhancing data democratization.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 7.3 Bn |

| Forecast Value (2033) |

USD 20.1 Bn |

| CAGR (2024-2033) |

11.9% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 2.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Deployment (Cloud-based, and On-premise), By Application (BSFI, Healthcare, Manufacturing, Retail, IT and Telecom, Government, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Hitachi Vantara Corporation, IBM, Oracle Corporation, Liaison Technologies, Inc., Microsoft Corporation, SAS Institute Inc., Attunity Inc., Dell, Informatica LLC, Talend Inc., Cisco Systems, Inc., Actian Corporation, SAP SE, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Data Integration Software Market size is estimated to have a value of USD 7.3 billion in 2024 and is expected to reach USD 20.1 billion by the end of 2033.

The US Data Integration Software Market is projected to be valued at USD 2.5 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 6.4 billion in 2033 at a CAGR of 11.2%.

North America is expected to have the largest market share in the Global Data Integration Software Market with a share of about 40.3% in 2024.

Some of the major key players in the Global Data Integration Software Market are IBM, Oracle Corporation, Liaison Technologies Inc., Microsoft Corporation, and many others.

The market is growing at a CAGR of 11.9 percent over the forecasted period.