Dialysis Products and Services market are set for rapid expansion due to demographic shifts, rising disease prevalence rates and technological development. Chronic Kidney Disease (CKD) and End-Stage Renal Disease (ESRD), brought on by diabetes and hypertension cases worldwide is rapidly expanding the dialysis patient base globally; while increasing demand from both developed and emerging markets' aging populations plays a prominent role as age remains one of the primary risk factors of kidney disease.

Technological developments are having a transformative effect on market dynamics, from innovations in hemodialysis machines and wearable/portable dialysis devices, to enhancements of peritoneal dialysis techniques that improve patient experiences and outcomes. Meanwhile, home-based dialysis services have seen an exponential surge in recent years, driven by patient preferences for convenience as well as healthcare system objectives to reduce hospital-based care costs - opening new avenues for companies offering home dialysis products/services.

However, this market does not come without its challenges: high treatment costs, complex reimbursement structures and stringent regulatory requirements could impede growth. Yet despite such obstacles to market expansion, dialysis service provider consolidation and adoption of advanced technologies should increase operational efficiencies while simultaneously driving better patient outcomes. Overall, Dialysis Products and Services market is on an optimistic growth path due to an escalating global burden of kidney diseases coupled with technological progress as well as shift towards patient-centric care models that make care accessible and available.

Key Takeaways

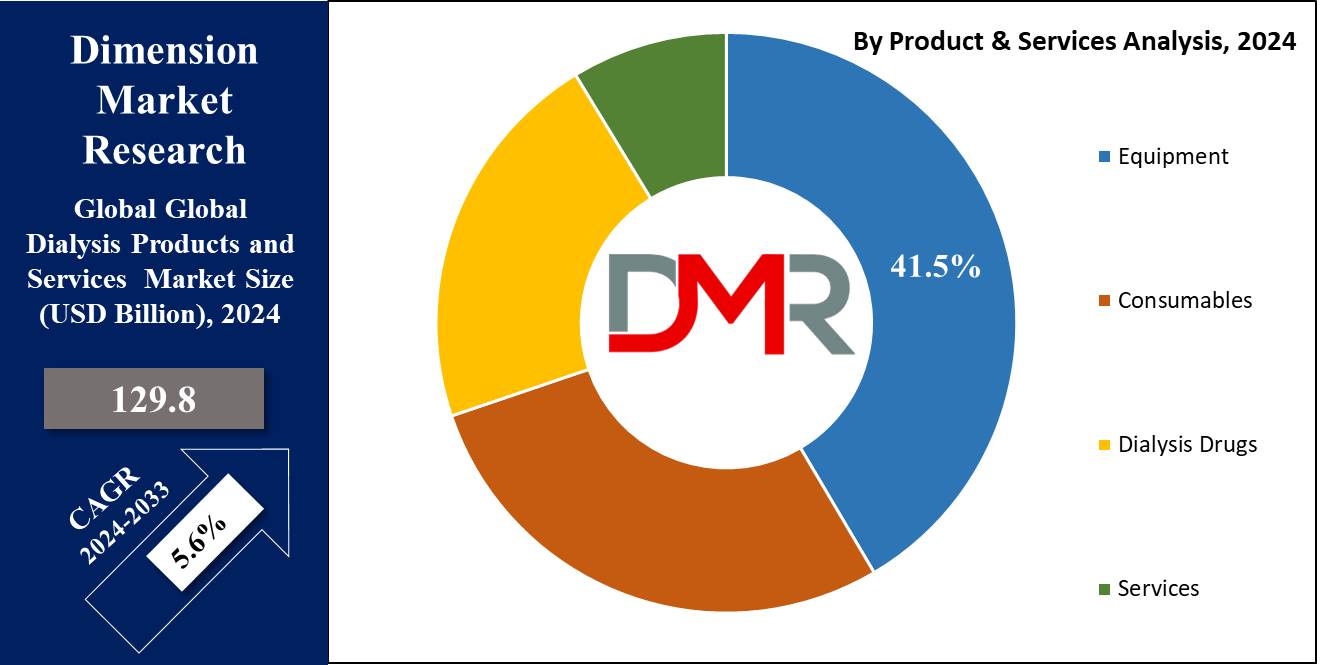

- Dialysis Products and Services Market Size Is Projected to Reach USD 216.0 Bn by 2033 From USD 129.5 Bn In 2024, with CAGR of 5.6%.

- Hemodialysis holds over 67.8% market share.

- Services held the largest market share at 41.5% in 2024 due to increased efforts on behalf of service providers to deliver top-quality care to patients.

- Dialysis centers & hospitals will command a 57.9% market share by 2024 due to favorable reimbursement offered by renal facilities for treatments offered within their facilities.

- North America is projected to account for 31.8 % of market shares.

Use Cases

- Home-Based Dialysis Adoption: Home-based dialysis adoption has increased patient autonomy and convenience. This has spurred demand for portable machines and related services in developed markets where patient-centric care models have root.

- Expanding into Emerging Markets: The Asia-Pacific and Latin American emerging markets have emerged as key growth areas due to this increasing prevalence of chronic kidney disease. Coupled with the improvement of healthcare infrastructure, this offers substantial potential for market expansion.

- Technological Improvements in Dialysis Equipment: Changes from their predecessors to more modern and efficient hemodialysis machines and automated peritoneal dialysis systems have further increased the improvement of treatment outcomes and patient contentment, hence enlarging the market.

- Value-based care initiatives: Healthcare industries' shift toward value-based care models is driving adoption of dialysis solutions which emphasize improved patient outcomes while being cost efficient, reaping dividends for companies providing effective products that address this market shift.

- Telemedicine Integration in Dialysis Treatments: Telemedicine's integration into dialysis treatments has allowed for enhanced patient management and support, especially among home dialysis users, thus expanding market reach and accessibility.

Driving Factors

Demand Increases Rapidly Worldwide Amid Rising Prevalence of ESRD and CKD

Rising rates of end-stage renal disease (ESRD) and chronic kidney disease (CKD) are one of the key contributors to market expansion for dialysis products and services. Chronic kidney disease afflicts approximately 10-12% of population each year with millions succumbing each year due to diabetes or hypertension being primary contributors; more individuals require dialysis services due to increasing patient numbers necessitating both in-center and home dialysis options leading to sustained market expansion.

Shortage of Donor Kidneys Raise Demand for Dialysis Services

Dialysis Products and Services Market The lack of donor kidneys significantly hinders market by driving more ESRD patients onto dialysis as life-sustaining treatment; even with advances in transplant medicine only a portion of those needing transplants are actually getting them; currently 100,000 Americans alone are on kidney transplant waiting lists and average wait time ranges from three to five years; due to this shortage, an increasing number of individuals must rely on dialysis treatment for extended periods leading to sustained demand for dialysis products, consumables, and services globally

Increased Awareness and Education Initiatives Fuel Market Growth

Raising awareness and education initiatives have played an invaluable role in early detection and management of kidney disease, thus contributing to its treatment, leading to expansion in the Dialysis Products and Services Market. Government health agencies, non-profit organizations and healthcare providers are increasingly focused on raising awareness of CKD risk factors and early symptoms. Initiatives of this sort promote early diagnosis and intervention, leading to greater need for dialysis treatments as the disease advances. These efforts are also helping to normalize dialysis treatment and educate patients on its benefits, leading to higher demand for both products and services, ultimately benefitting market. Furthermore, informed patient populations and healthcare systems contribute towards increased acceptance of dialysis as an integral component of renal care management resulting in more widespread adoption of this form of therapy as an essential tool in patient management.

Growth Opportunities

Home and Portable Dialysis Machine Adoption Has Increased Drastically

As home dialysis and portable machines become more widely adopted, their rising use will present the global Dialysis Products and Services market with significant opportunities in 2024. Home dialysis allows patients greater freedom, convenience, and autonomy over their dialysis treatments schedules - helping to ensure more successful management. This trend is most prominent in developed markets where healthcare systems are shifting towards patient-centric care models that emphasize quality of life. Portable dialysis machines that facilitate treatment at home or while on the move further support this shift and may benefit from patients and healthcare providers increasingly seeking alternatives to in-center dialysis treatments. The market could enjoy benefits associated with this growing preference for home dialysis machines as a result.

Expanding into Emerging Markets with High Kidney Disease Prevalence

Emerging markets, particularly those located in Asia-Pacific and Latin America, present significant growth potential for the global Dialysis Products and Services market. These regions boast large populations with increased rates of chronic kidney disease (CKD) and end-stage renal disease (ESRD), driven by rising rates of diabetes and hypertension; yet access to dialysis services was historically restricted here; by 2024 market players will have an opportunity to expand into underserved regions by providing cost-effective solutions and partnerships aimed at filling these underserved spots; doing this should drive significant revenue growth as demand for dialysis products and services rises exponentially!

Innovation Enhances Market Competitiveness for Dialysis Products

Development of innovative dialysis products that offer improved efficiency, comfort and usability will be one of the keys to market expansion in 2024. Advancements in technology, such as more user-friendly machines with improved biocompatibility materials or enhanced treatment modalities that improve patient outcomes and satisfaction are driving market expansion; such innovations not only attract new patients but also motivate existing ones to continue treatment indefinitely and drive expansion further down the pipeline. Companies focused on innovation may gain an edge as healthcare providers and patients increasingly look for products that deliver both superior performance and ease-of use solutions.

Key Trends

Shift toward Value-based Care via Advanced Dialysis Solutions

The healthcare industry will see a significant shift toward value-based care in 2024, which will significantly impact the global Dialysis Products and Services Market. This model places patient outcomes and cost efficiency first, incentivizing healthcare providers to adopt advanced dialysis solutions that offer greater effectiveness while simultaneously decreasing long-term costs. Dialysis providers are increasingly emphasizing innovations that improve patient outcomes while streamlining operations and lessening healthcare systems' financial strain. This trend is driving the adoption of next-generation dialysis machines, more cost-efficient consumables and integrated care models that adhere to value-based care principles. Companies that can demonstrate the efficacy and cost-effectiveness of their products are best positioned to secure market share.

Implementation of Telemedicine and Remote Monitoring into Dialysis Care Delivery System.

Telemedicine and remote monitoring technology is quickly emerging as a key trend in dialysis treatments in 2024, especially home dialysis treatments. Remote patient monitoring and virtual consultations offer many advantages to both patient comfort and outcomes such as reduced travel requirements and more consistent monitoring of treatment adherence and outcomes. Telehealth technologies continue to advance and become more accepted both among healthcare providers as well as patients alike - driving this trend further by the shift toward home-based dialysis care that makes dialysis accessible and personalized. Integrating telemedicine into dialysis care not only facilitates improved management but also contributes towards more home-based dialysis care overall - driving dialysis care towards home-based treatments which makes dialysis more accessible and personalized treatments overall.

Personalizing Dialysis Therapy and Formulating Effective Approaches to Therapy

Personalized medicine is becoming an ever-increasing force within the global Dialysis Products and Services market. By 2024, personalized dialysis treatment plans tailored to individual patient needs will become an increasing focus, taking into account factors like genetic profiles, comorbidities and lifestyle preferences as a basis of optimizing treatment protocols that could potentially enhance results while decreasing complications for each person on dialysis. Companies offering solutions supporting personalized therapy could stand to benefit as healthcare providers strive to offer more targeted and effective care solutions to their patients.

Restraining Factors

Workforce Limitations Due to Shortage of Skilled Healthcare Professionals

Skilled healthcare professionals are one of the main limiting factors preventing growth of the Dialysis Products and Services Market. Dialysis treatments require professionals with specific knowledge and skill-set to operate dialysis machines, manage patient care and address complications during procedures. Unfortunately, however, rural and underserved areas across the world face severe shortages in dialysis professionals. Dialysis centers lack sufficient capacity to meet increased patient demand for dialysis treatment, leading to longer waiting and reduced access to healthcare services. Poor staff training could pose challenges that compromise care delivered; discouraging people from opting for dialysis altogether or prompting them to pursue alternative forms of care altogether. As a result, overall market growth may be limited as services scale to match patient demands.

Health Risks Associated with Dialysis Treatment

Dialysis's potential complications and side effects present another key barrier to market expansion. Though lifesaving, dialysis carries risks. Patients undergoing hemodialysis, for instance, can face various complications related to access site infections, blood clots and variations in blood pressure that could require hospitalizations, increased healthcare costs and, potentially, life-threatening situations. Fear of these risks could dissuade patients from commencing or continuing dialysis treatment, thus restricting its market growth. Additionally, ongoing management of complications puts additional pressure on healthcare resources, exacerbating issues created by shortage of trained personnel. Together these health risks and complications contribute to an increasingly cautious attitude among both patients and providers towards dialysis, potentially slowing its adoption rate and hampering market expansion.

By Dialysis Type

Hemodialysis was the clear market leader in 2024 in terms of Dialysis Type in the Dialysis Products and Services Market, accounting for more than 67.8%. Hemodialysis remains an ideal treatment modality for end-stage renal disease patients due to its wide availability, well-established protocols, efficient waste removal from blood, as well as significant investments into advanced machines and consumables that enhance treatment efficacy while protecting patient safety.

Peritoneal dialysis has recently seen significant advancements, particularly within home dialysis settings. Peritoneal treatments held a notable market share due to their advantages in terms of patient convenience, reduced healthcare costs, and rising popularity as home treatments for dialysis treatments. Peritoneal dialysis (PD) treatment will likely experience steady expansion as advancements in its equipment such as automated peritoneal dialysis systems make access more user-friendly and cost-effective for treatment. Peritoneal dialysis's potential advantages - like helping preserve residual kidney function while offering greater treatment schedule flexibility - have become widely acknowledged, encouraging both patients and healthcare providers alike to consider it as a possible replacement for hemodialysis.

By Product & Services

Services held the dominant market position within the Dialysis Products and Services market in 2024, taking up over 41.5%. Services comprise in-center dialysis services, home dialysis support services, and associated care management that play an essential part in driving demand for professional dialysis services due to the increasing prevalence of chronic kidney disease (CKD) and end-stage renal disease (ESRD), increasing care management needs, value-based care models that focus on improved outcomes while comprehensive patient management.

Equipment plays an integral part in the Product & Services market. Equipment such as dialysis machines, water treatment systems, and portable dialysis devices make up this segment; essential to providing dialysis treatments both clinically and at home. As more advanced hemodialysis and peritoneal dialysis machines become popularized across developed markets, their adoption drives growth within this segment; more efficient user-friendly equipment should add further fuel.

Consumable products like dialyzers, bloodlines and catheters comprise another crucial aspect of the market. Recurring demand due to the disposable nature of these items makes this segment particularly vibrant - supporting its steady expansion thanks to the increasing number of dialysis procedures worldwide.

Dialysis drugs represent another critical part of dialysis treatment regimens, playing a vital part in managing complications associated with kidney disease and dialysis treatment. They include phosphate binder drugs, iron supplements and erythropoiesis-stimulating agents that must be managed appropriately to manage complications associated with both. Their growth can be driven by needing to treat anemia, mineral/bone disorders as well as any additional comorbid conditions present among dialysis patients.

By End-User

Dialysis centers and hospitals were the dominant market players in 2024 for an end-User segment of the Dialysis Products and Services market in terms of End User revenue share, with over 57.9% of market share in terms of market revenue share. This success can primarily be attributed to their extensive infrastructure, specialized equipment, and skilled personnel available there to provide complex dialysis treatments like hemodialysis. Preference for in-center dialysis at dedicated centers remains strong due to the guarantee of professional oversight, prompt access to emergency care as well as ability to monitor patients who require intensive monitoring due to being more reliable overall performance of treatment outcomes.

However, home care has recently gained momentum in line with an evolving trend towards patient-centric and flexible treatments options. Home dialysis therapies accounted for an increasingly larger share of the market. Portable machines and telemedicine enable patients to receive treatment while remaining connected to healthcare providers for monitoring and guidance purposes. This shift toward home care was further reinforced by portable machines making home treatment convenient while remaining within healthcare provider reach for monitoring purposes and guidance purposes.

The Dialysis Products and Services Market Report is segmented based on the following:

By Dialysis Type

- Hemodialysis

- Peritoneal Dialysis

By Product & Services

- Equipment

- Consumables

- Dialysis Drugs

- Services

By End-User

- Dialysis Centers & Hospitals

- Home Care

- Other End-Users

Regional Analysis

North America emerged as the dominant region in 2024's Dialysis Products and Services Market with 31.8% market share, led by high prevalence rates of chronic kidney disease (CKD) and end-stage renal disease (ESRD), plus advanced healthcare infrastructure and robust reimbursement frameworks that support access to dialysis treatment options. Fresenius Medical Care, Baxter International Inc. and DaVita Inc bolster this dominance further as major players like them established extensive networks of dialysis centers offering advanced products; further consolidating North America's leading position within this global market.

Europe follows closely behind, driven by rising incidence of kidney diseases across Western Europe and significant investments made into dialysis technology resulting in steady market expansion. Germany, France and Britain play key roles in driving regional market activity as key manufacturers and service providers provide key support.

Asia Pacific stands out as an impressively fast-growing segment of the market, propelled by large population bases, increasing rates of diabetes and hypertension prevalence, improving healthcare infrastructure improvements, as well as an escalation in investments into dialysis facilities and home based dialysis solutions. China, India and Japan serve as driving markets due to an ever increasing burden of chronic kidney disease (CKD) and end stage renal disease (ESRD).

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

In 2024, the global Dialysis Products and Services market is marked by fierce competition between several key players that each contribute to its expansion and innovation. At the head of this race are Fresenius Medical Care AG & Co KGaA and Baxter International Inc.; each renowned for offering extensive dialysis machines, consumables and services portfolios; Fresenius stands out with its integrated care model which connects product offerings to a global network of dialysis centers while Baxter leads with innovative home dialysis solutions in response to patients' growing demands for patient-centric care solutions.

B. Braun and Becton Dickinson and Company are two prominent players, offering an expansive selection of dialysis products and medical devices designed for both in-center and home care settings. Furthermore, their dedication to developing advanced technology while expanding into emerging markets reinforces their market positions further.

Medtronic plc and Nipro Corporation have made outstanding technological contributions to dialysis equipment, improving treatment efficacy and patient comfort. Meanwhile, NIKKISO CO. LTD and Asahi Kasei Corporation are recognized for developing groundbreaking dialysis products such as high performance dialyzers and bloodline systems.

Some of the prominent players in the Global Dialysis Products and Services Market are:

- B. Braun

- Baxter International Inc.

- Fresenius Medical Care AG & Co. KGaA

- Asahi Kasei Corporation

- Becton, Dickinson, and Company

- DaVita Inc.

- Medtronic plc

- Nipro Corporation

- NIKKISO CO., LTD.

- Satellite Healthcare Inc.

- Toray Industries, Inc.

- Other Key Players

Recent developments

- DaVita Inc. secured an investment to expand their home dialysis program across the United States in April 2024. The funding aims to improve accessibility while simultaneously improving patient outcomes by offering advanced home dialysis equipment and support services.

- Fresenius Medical Care announced in January 2024 its acquisition of a regional dialysis provider in Latin America to increase their presence and expand into emerging markets. This move should broaden their service capabilities as well as reach within Latin American regions.

- Medtronic announced the introduction of their improved filtration hemodialysis system in June 2023, intended to increase treatment efficacy and safety as well as to cement Medtronic's presence within the dialysis market.

- Rockwell Medical acquired Evoqua Water Technologies' hemodialysis concentrates business in July 2023 to strengthen their presence in the market for home dialysis treatment; similarly Nextkidney acquired Dialyss Pte Ltd of Singapore to increase technology capabilities within home hemodialysis treatment systems in January 2022.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 129.8 Bn |

| Forecast Value (2032) |

USD 216.0 Bn |

| CAGR (2024-2033) |

5.6% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Dialysis Type(Hemodialysis, Peritoneal Dialysis), By Product & Services(Equipment, Consumables, Dialysis Drugs, Services), By End-User(Dialysis Centers & Hospitals, Home Care, Other End-Users) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

B. Braun, Baxter International Inc., Fresenius Medical Care AG & Co. KGaA, Asahi Kasei Corporation, Becton, Dickinson, and Company, DaVita Inc., Medtronic plc, Nipro Corporation, NIKKISO CO., LTD., Satellite Healthcare Inc., Toray Industries, Inc., Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |