The Diamond Wire Saw (OD below 0.5mm) Market encompasses cutting solutions employing ultrathin diamond-coated wires with an outer diameter of less than 0.5mm. These precision tools play a crucial role in high-tech industries like electronics and semiconductors where meeting exacting material slicing standards is critical to operations, such as electronics or semiconductor production. Diamond wire saws are designed for precision and efficiency allowing meticulous cutting of delicate materials without wasteful production processes or decreased yield; their wide array of applications span everything from microelectronic production to processing advanced materials processing - driven by rising demand for cutting solutions suitable to these innovative sectors.

The Diamond Wire Saw (OD below 0.5mm) Market is experiencing rapid expansion, driven by technological advancements in precision cutting technology and rising demands from high-tech sectors like electronics and semiconductors. Ultrathin diamond wire saws, distinguished by minimal outer diameters, are becoming essential in applications requiring high precision and minimal material waste; their demand reflects industry trends toward increased precision and efficiency, in which optimizing yield while minimizing waste is paramount.

Technological innovation lies at the core of this market's expansion, with advances in diamond wire saw design driving improvements in accuracy, longevity, and efficiency. These advancements fit with an overall shift towards automation and precision engineering driven by production needs for complex miniaturized components.

Even as this market grows, challenges remain. High costs of diamond wire saws as well as their special maintenance requirements may hamper adoption among smaller enterprises and emerging markets, yet the market outlook remains optimistic due to substantial investments in high-tech infrastructure and an increase in focus on advanced technologies across various industrial applications.

Key Takeaways

- Market Growth: The market is forecasted to expand from USD 727.9 million in 2024 to USD 916.9 million by 2033, with a CAGR of 2.6%, driven by increasing demand for precision cutting in advanced sectors.

- Regional Leadership: Asia Pacific is ready to dominate with a 40.2% market share in 2024, fueled by growth in the semiconductor and solar industries.

- Segment Dominance: The Semiconductor application segment leads with a 42% market share, highlighting the importance of diamond wire saws in high-precision wafer production.

- Technological Innovation: Rising R&D investments are enhancing diamond wire saw performance, focusing on improved coatings and wire strength.

- Regional Trends: North America and Europe, holding 25% and 20% of the market share respectively, face market saturation challenges, while emerging markets in Asia Pacific, Latin America, and the Middle East & Africa show potential for gradual growth.

Use Cases

- Semiconductor Manufacturing: Key to cutting silicon wafers with high levels of accuracy, diamond wire saws drive the expansion of the semiconductor industry as demand for advanced electronic components rises.

- Solar Energy Production: Essential in the slicing of silicon ingots into wafers for photovoltaic cells, diamond wire saws help to ensure the supply of highly effective solar panels as well as meet this fast-growing solar industry.

- High-Tech Ceramics: Used in the cutting of aerospace and automotive engineering ceramics, diamond wire saws ensure that these high-technology materials are used to exact standards of precision and quality.

- Medical Component Production: The place where valuable precision cuts of high-end medical devices are made underscores the specialized and highly accurate applications for which the saws are intended.

- Emerging Markets: Increased demand for diamond wire saws from growth areas of heavy industry in Asia-Pacific and Latin America provides a basis for market expansion, as well as technological progress.

Driving Factors

Increasing Demand in the Semiconductor Industry

Rising semiconductor demand is one of the primary forces fueling the growth of the Diamond Wire Saw (OD below 0.5mm) market. Semiconductors play an essential role in electronic devices of all kinds ranging from consumer electronics to advanced computing systems; with their wide application comes an ever-increasing demand for precision cutting tools capable of producing high-quality wafers used to construct these devices - diamond wire saws have become indispensable tools in cutting silicon wafers with high accuracy while minimal material loss - their precision cutting tools help produce high-quality wafers essential to manufacturing these devices - while their accuracy makes them perfect tools to assembling high-quality wafers from raw silicon materials!

Growing Applications in the Solar Industry

Rising applications within the solar industry also play a vital role in driving diamond wire saw sales forward. Photovoltaic cells rely heavily on high-efficiency silicon wafers; with increased renewable energy demand comes more high-quality silicon wafers required to produce efficient solar panels; accordingly, more precise diamond wire saw cutting tools must be utilized accurately cut silicon ingots into thin wafers to produce long-lasting solar panels for lasting performance and durability.

Rising Investment in Research and Development

Research and development expenditure (R&D) investments are another crucial element contributing to the expansion of the diamond wire saw market. Increased research into cutting technology and material science leads to advancements that improve performance and efficiency for these saws, such as innovative diamond coatings, improved wire strength, and more effective cooling techniques that directly improve the effectiveness and lifespan of saws.

Growth Opportunities

Aftermarket Services and Consumables

Aftermarket services and consumables have become a key driver of growth for diamond wire saw markets, given their role in precision applications in sectors like semiconductors and solar energy. Companies offering maintenance, repair, or replacement parts can capitalize on this trend to generate recurring revenue streams while simultaneously increasing customer loyalty by maintaining the operational efficiency of diamond wire saws over time.

Sustainability and environmentally friendly are important concerns

Environmental responsibility has quickly become an imperative in manufacturing. Diamond wire saws, known for their precision and minimal material waste output, perfectly embody this shift towards green practices. Their energy-saving technology supports larger environmental goals while their ability to minimize waste contributes significantly towards meeting them. Companies that emphasize their commitment to environmental practices stand out in an otherwise competitive market by drawing customers who prioritize eco-friendly solutions as customers.

Customization and Tailor-Made Solutions for Our Businesses

The changing demands of different industries create an opportunity for customization and tailored solutions in the diamond wire saw market. As sectors demand more specialized cutting tools, providers that specialize their tools to meet specific application requirements can gain an edge against their competition by tailoring products specifically to materials or processes - an edge that will enable companies to capture niche markets while driving innovation while creating unique niches within an industry through customization.

Key Trends

Expanding into Emerging Markets

By 2024, the global diamond wire saw market (OD below 0.5mm) is becoming increasingly focused on expanding into emerging markets such as Asia-Pacific, Latin America, and Africa which are experiencing rapid industrial development and technological progress - leading to greater demand for high-precision cutting tools such as diamond wire saws. As these regions advance their semiconductor and solar energy industries, demand increases even further for advanced manufacturing equipment like diamond wire saws. Companies entering these regions can take advantage of both their growing industrial needs as well as relatively lower competition by quickly becoming market leaders by becoming market leaders establishing themselves and tapping new revenue streams by entering these regions with their strong market presences firmly entrenchment as established market leaders within them.

Focus on Aftermarket Services

Another significant trend is the emphasis on aftermarket services. Diamond wire saws are essential tools for precision applications, and their optimal performance is integral to producing quality output. As companies strive to extend the operational lifespan of their equipment while simultaneously increasing customer satisfaction and creating additional revenue opportunities through providing robust aftermarket support, companies are becoming increasingly committed to offering comprehensive maintenance, repairs, consumables, and consumable support; providing these comprehensive maintenance, repair, consumable and repair programs is becoming more pronounced and providing robust aftermarket support strengthens not only value proposition but also customer loyalty and market position.

Rising Investment in Research and Development

Companies are allocating significant resources towards research and development (R&D), with investments directed towards cutting technologies, materials improvements, and coating innovation. R&D investments aim to enhance the performance, efficiency, and longevity of diamond wire saws while keeping pace with changing demands from industries like semiconductors and solar energy production. Through R&D advances manufacturers meet these demands more effectively while remaining competitive by meeting this need for cost-effective cutting solutions with higher precision than ever before.

Restraining Factors

Competition from alternative technologies

Alternative technologies pose a substantial restraining factor to the diamond wire saw (OD below 0.5mm) market. As precision cutting applications grow, various cutting technologies like laser cutting, abrasive wire saws, and water jet cutting may offer cost advantages or better efficiency depending on material and application; laser cutting may offer high precision with reduced waste while certain hard materials might benefit more from an abrasive wire saw than another technique.

Market Saturation in Developed Regions

Saturation is another challenge to the growth of the diamond wire saw market, particularly in regions like North America and Europe with mature semiconductor and solar industries where demand for diamond wire saws is already well established and penetration levels have already reached high levels, thus restricting growth opportunities within these areas.

Maintenance and Operational Costs

Maintenance and operational costs remain one of the primary barriers to the growth of the diamond wire saw market. While providing high precision, these saws require regular maintenance which results in significant operational expenses; additionally, consumable costs like diamond wire may pose additional hurdles for companies operating on tight budgets or in cost-sensitive industries.

Research Scope Analysis

By Type

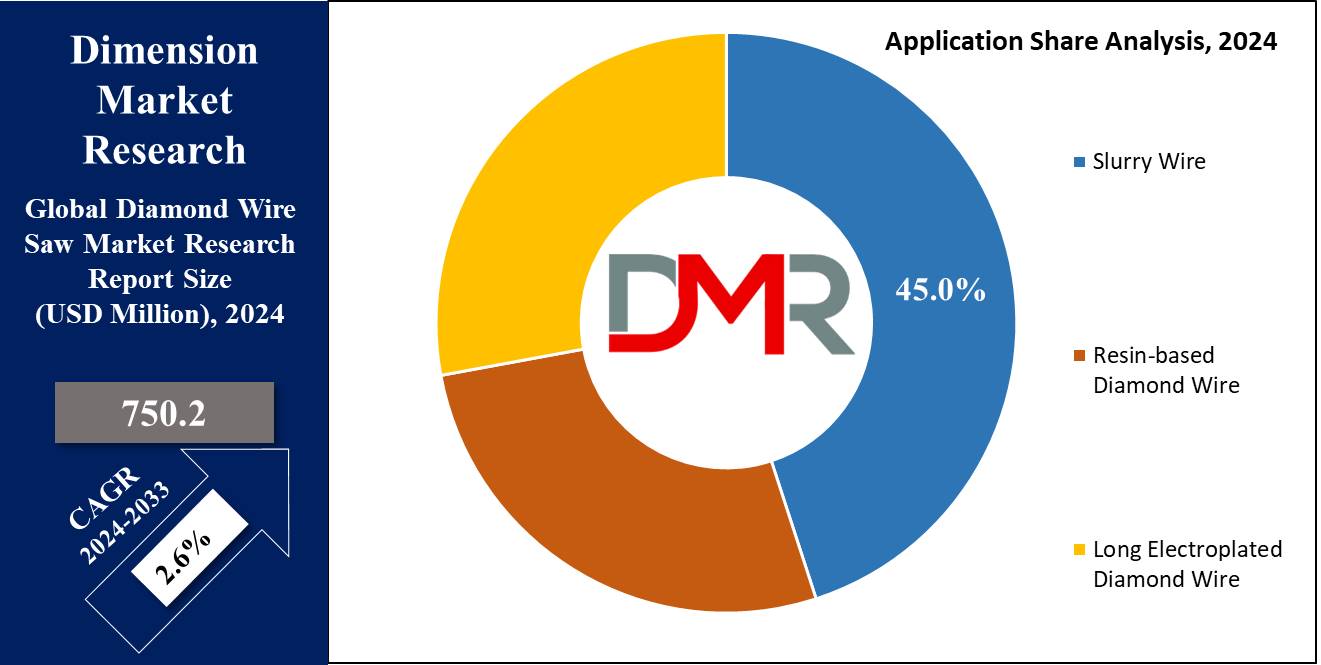

In 2023, Slurry Wire held an uncontested leadership position in the Product Type segment of the Diamond Wire Saw (OD below 0.5mm) market. Representing approximately 45% of the total market share, it demonstrated widespread adoption and preference across different applications due to its efficiency and precision; its significant share is further reinforced by its use for high-precision cutting applications within the semiconductor and solar industries where minimal kerf loss and superior cutting quality were of particular concern.

Resin-Based Diamond Wire held approximately 30% of the market share. Resin-based diamond wire saws are valued for their adaptability, making them suitable for various applications across several sectors - particularly automotive and electronics manufacturing. Their growing use can be attributed to advances in resin formulations that improve cutting performance and durability; which in turn appeals to manufacturers searching for cost-effective yet high-performing solutions.

Long Electroplated Diamond Wire captured approximately 25% of the market share in the

Construction Equipment Market. This segment can be distinguished by its use in applications requiring extended wire lengths for large-scale cutting tasks, with high cutting speeds and longer operational lifespans. These advantages make e-plated diamond wires an excellent choice for demanding applications in the Construction Equipment Market, particularly in construction and materials processing industries, where efficiency and durability are critical.

Overall, the diamond wire saw market (OD below 0.5mm) can be divided into distinct categories that each have its own market dynamics and applications. Slurry Wire dominates among these, due to its critical role in high-precision industries; Resin-based and Long Electroplated Diamond Wire are more suitable to different needs and applications within various industries; understanding these segments provides invaluable insight into trends and growth opportunities within this industry.

By Application

In 2024, the Semiconductor segment held a dominant market position within the Product Type segment of the Diamond Wire Saws (OD below 0.5mm) market with approximately 42% market share. This success can be attributed to diamond wire saws' essential role of precisely cutting silicon wafers - an essential step in semiconductor manufacturing - using diamond wire saws. Furthermore, its growth may also be attributable to rising consumer electronics sales, automotive sales, and telecom demands that necessitate more advanced semiconductor devices like those used within this segment.

High-tech ceramics made up around 25% of the market share. Diamond wire saws have become an invaluable tool for cutting these tough ceramics due to their superior hardness and temperature resistance; further driving its growth are applications like aerospace, automotive, and industrial use of these high-tech ceramics requiring precise cutting precision.

Compound Semiconductors held a 15% market share. Materials like gallium nitride and silicon carbide are essential components in high-power electronic devices; with diamond wire saws being the preferred tool for cutting through these difficult substances with precision, contributing significantly to this segment's prominence in the market.

Electronics represented approximately 10% of the Electronic Display Market. This segment includes various electronic components for which diamond wire saws are utilized for precision cutting and shaping purposes, particularly in the manufacturing of displays and microelectronics. Growth in this sector was spurred by the increasing complexity and miniaturization of electronic devices, driven by rising demand in the

Electronic Display Market for high-resolution screens and advanced semiconductor applications.

Medical Devices comprised about five percent of the market share. Diamond wire saws are utilized in manufacturing precision components for medical devices; this segment, however, remains relatively smaller due to its niche applications.

Other segments, including Precious Metal Machining, Thermo-Electric Devices, and Magnetic Devices contributed to the remaining market share. Each used diamond wire saws for specific applications involving high-value materials and components demonstrating their versatility and precision across various industrial processes.

The Diamond Wire Saw (OD below 0.5mm) Market Report is segmented based on the following

By Type

- Slurry Wire

- Resin-based Diamond Wire

- Long Electroplated Diamond Wire

By Application

- Optical

- High Tech Ceramics6

- Semiconductor

- Compound Semiconductors

- Electronics

- Medical Devices

- Magnetic Devices

Regional Analysis

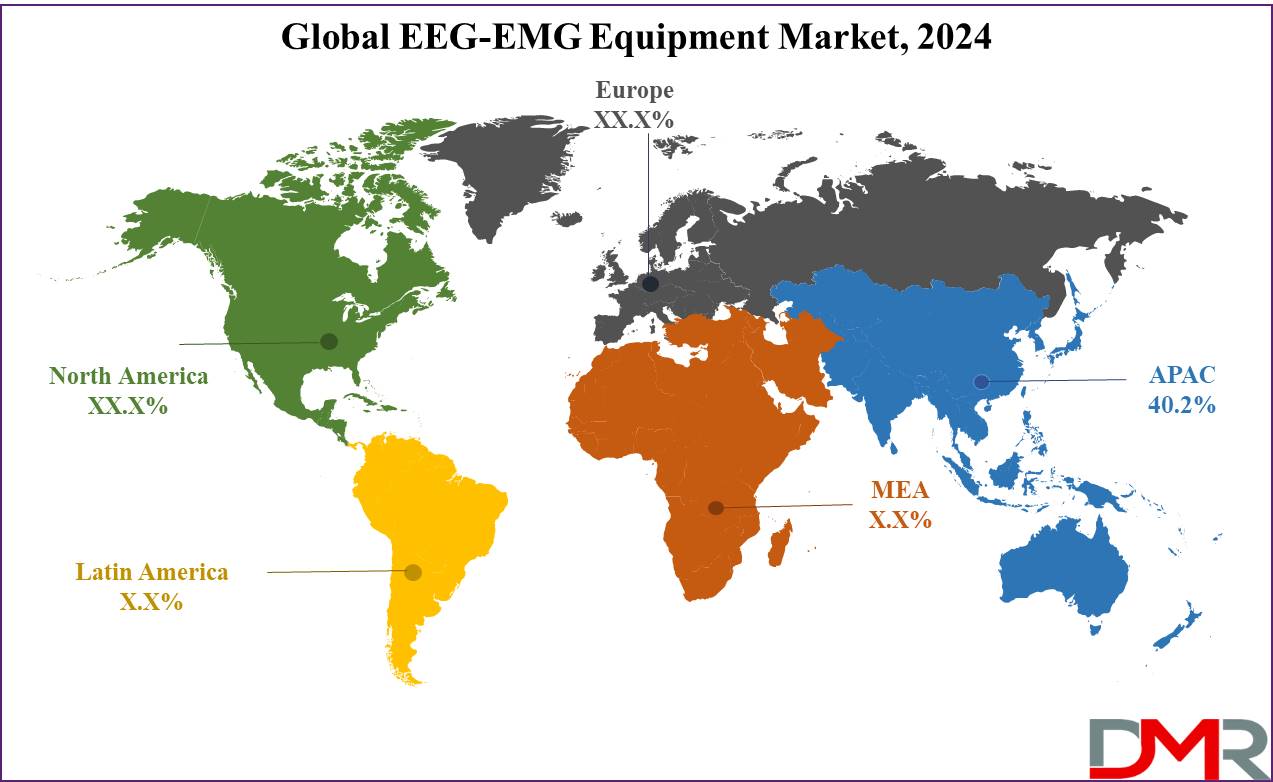

Asia Pacific is projected to hold approximately 40.2% of the Diamond Wire Saw (OD below 0.5mm) market by 2024, due to the region's robust growth in semiconductor and solar industries - major consumers of diamond wire saws. Rapid industrialization, technological advancements and growing investments in manufacturing capabilities across countries like China, Japan, and South Korea all play a role in the Asia Pacific becoming the market leader; its expanding electronics and high-tech sectors further fuel demand for precision cutting tools.

North America accounts for roughly 25% of the global diamond wire saw market, with the United States and Canada accounting for most of this share. Both are key players in the semiconductor and

medical device industries that drive demand for high-precision diamond wire saws. Technological innovation and advanced manufacturing processes help build this region's strong presence, yet its growth remains restricted due to high competition and mature market conditions.

Europe represents approximately 20% of the market.

Europe is supported by significant investments in high-tech manufacturing in countries like Germany, France, and the UK; demand for diamond wire saws in automotive and electronics manufacturing industries and commitments towards sustainable practices are what drive Europe's market share; yet challenges arise due to regional saturation and economic fluctuations that threaten this role in the market.

Middle East & Africa and Latin America represent smaller segments of the market, accounting for 10% and 5% respectively. Growth is being spurred by increasing infrastructure projects and technology advancements, while Latin America's expansion can be attributed to expanding industrial sectors but remains limited compared to other regions. Both regions should experience gradual expansion due to rising industrial activities and investments in advanced manufacturing technologies.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

In 2024, the global Diamond Wire Saw (OD below 0.5mm) market is significantly shaped by leading players such as Takatori, PSS (MeyerBurger), and Linton, WEC Group. Takatori's prominence is driven by its advanced diamond wire saw technologies that cater to high-precision industries like semiconductors and high-tech ceramics. The company's focus on innovation and performance enhances its market position, ensuring it meets the stringent demands for accuracy and durability. Meanwhile, PSS (MeyerBurger) stands out for its emphasis on efficiency and sustainability, aligning with the growing trend towards environmentally friendly manufacturing processes. Their technological advancements help address the industry's need for reliable and eco-conscious solutions.

MTI, Logomatic, and Wells also play critical roles in the market. MTI, Logomatic's cutting-edge technologies support high-demand sectors such as semiconductor manufacturing, where precision is key. Their solutions are integral to maintaining high performance and operational efficiency in challenging applications. Similarly, Wells is recognized for its robust wire saws designed for specialized applications like precious metal machining and thermo-electric components. Their focus on quality and reliability ensures they meet the needs of niche markets that require high-performance cutting tools.

HCT, NTC, and Logitech further contribute to the market's dynamics by offering advanced and customizable diamond wire saw solutions.

HCT's commitment to tailoring products for specific industrial applications enhances its appeal across various sectors. NTC and Logitech are notable for their continued investment in research and development, which drives innovation and keeps them competitive in the rapidly evolving market. Collectively, these key players are shaping the diamond wire saw market by addressing diverse industry requirements, advancing technology, and maintaining a competitive edge through strategic innovations.

Some of the prominent players in the Global Diamond Wire Saw (OD below 0.5mm) Market are:

- Takatori

- PSS (MeyerBurger)

- Linton, WEC Group

- MTI, Logomatic

- Wells

- HCT

- NTC

- Logitech

Recent developments

- In 2024, July

Advancements in diamond coating and wire strength have boosted the durability and efficiency of ultra-thin diamond wire saws, enhancing performance and reducing operational costs.

- In 2024, March

increased semiconductor industry investments have driven demand for next-gen diamond wire saws, supporting the production of miniaturized, high-performance electronic components.

- In 2023, November

new resin-based diamond wire saws with improved flexibility and cutting efficiency have expanded their use across high-tech ceramics and automotive applications.

- In 2023, June

Innovative cooling systems have been integrated into diamond wire saws, reducing thermal damage and enhancing cutting accuracy for precision industries.

- In 2022, September

Eco-friendly diamond wire saws have been introduced, offering reduced waste and better environmental sustainability, aligning with industry trends toward greener solutions.

- In 2022, January

The solar energy sector's growth has increased demand for diamond wire saws capable of efficiently slicing silicon wafers for high-performance photovoltaic cells.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 750.2 Mn |

| Forecast Value (2032) |

USD 953.7 Mn |

| CAGR (2024-2033) |

2.6% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Slurry Wire, Resin-based Diamond Wire, Long Electroplated Diamond Wire), By Application (Optical, High Tech Ceramics, Semiconductor, Compound Semiconductors, Electronics, Medical Devices, Precious Metal Machining, Thermo-Electric, Magnetic Devices) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Takatori, PSS (MeyerBurger), Linton, WEC Group, MTI,Logomatic, Wells, HCT, NTC, Logitech |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |