Market Overview

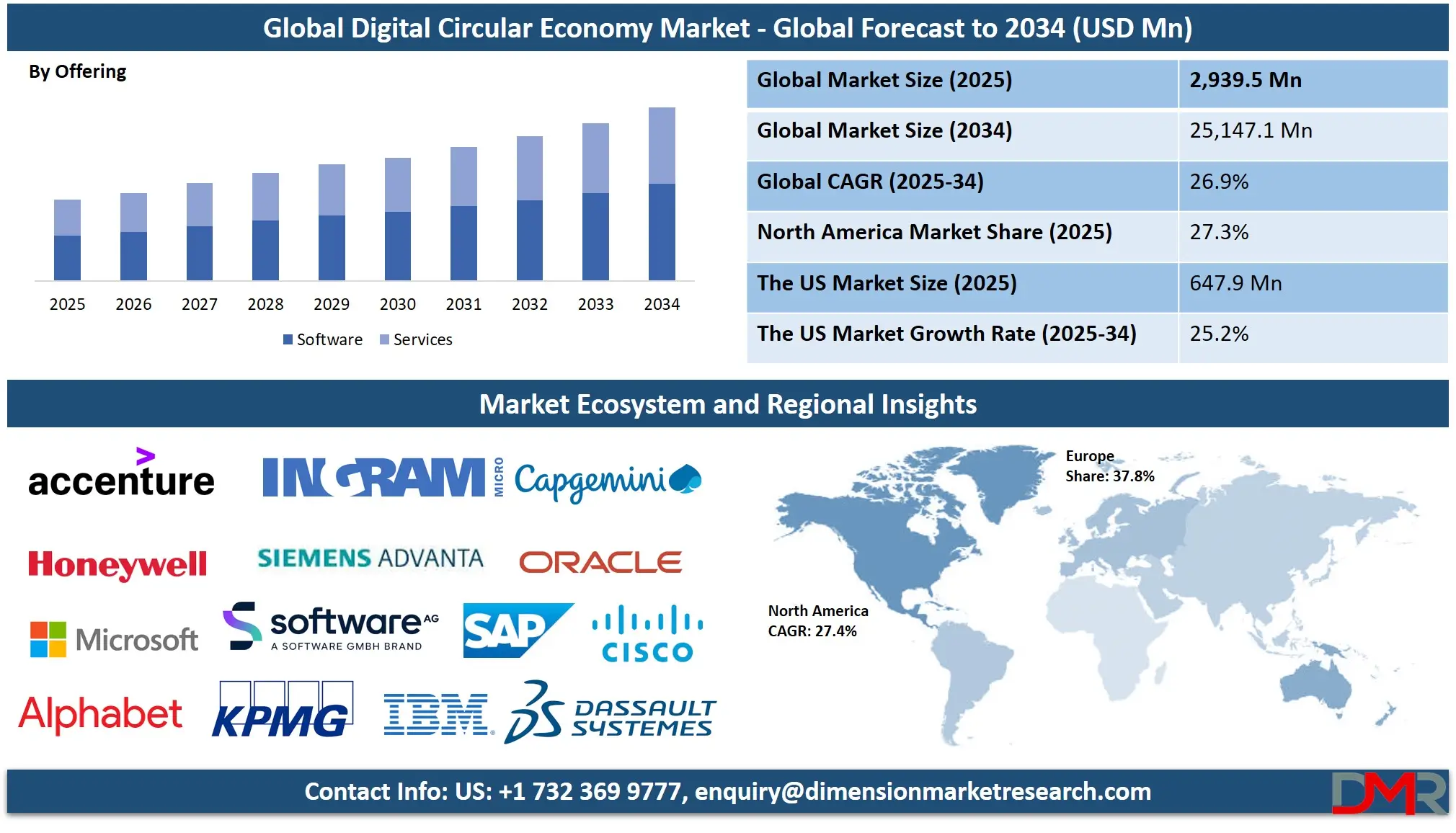

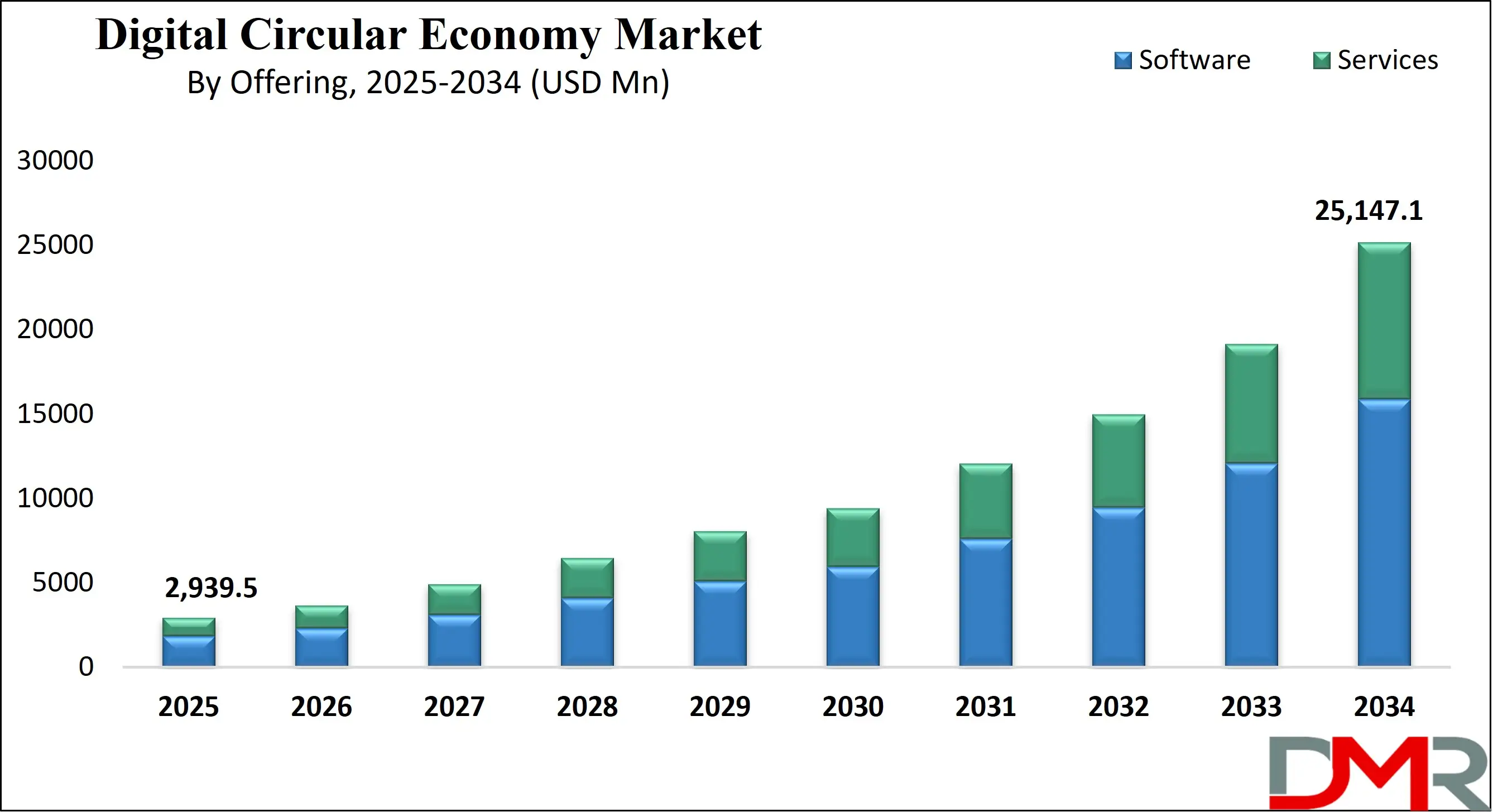

The Global Digital Circular Economy Market is projected to reach USD 2,939.5 million in 2025 and grow at a compound annual growth rate of 26.9% from there until 2034 to reach a value of USD 25,147.1 million.

The global digital circular economy market is undergoing a robust transformation, driven by accelerating digitalization across waste management systems, product lifecycle analytics, and sustainable supply chains. Governments and enterprises are rapidly adopting smart solutions that integrate artificial intelligence (AI), blockchain, and IoT to monitor, optimize, and reduce material usage, transforming traditional linear value chains into circular frameworks.

According to estimates, digital solutions can potentially enable reductions of up to 45% in material waste through real-time data sharing and predictive analytics. Businesses are embedding digital twins and cloud-based platforms to track product use and end-of-life processes, supporting zero-waste goals and ESG mandates aligned with green technology initiatives.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

One of the significant trends includes the emergence of Product-as-a-Service (PaaS) models, especially in industrial equipment and electronics. This is fostering the reuse and refurbishment of components, supported by digital logistics platforms that ensure traceability and quality assurance.

There is a growing opportunity in sectors like construction, fashion, and automotive, where smart reverse logistics and lifecycle assessment tools are being used to close the loop. Governments worldwide are launching digital passports for products to ensure transparency in carbon footprint and recyclability, creating demand for waste recycling services and traceability networks.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

However, data standardization remains a key restraint. The lack of unified frameworks across jurisdictions limits cross-border circular data exchange. High integration costs and cybersecurity concerns also hamper adoption.

Nonetheless, the growth prospects remain strong as global policy alignment toward net-zero and circular production intensifies. Emerging economies are embracing digital circularity to address resource scarcity and waste, while mature markets focus on full-spectrum digitization of their circular value chains.

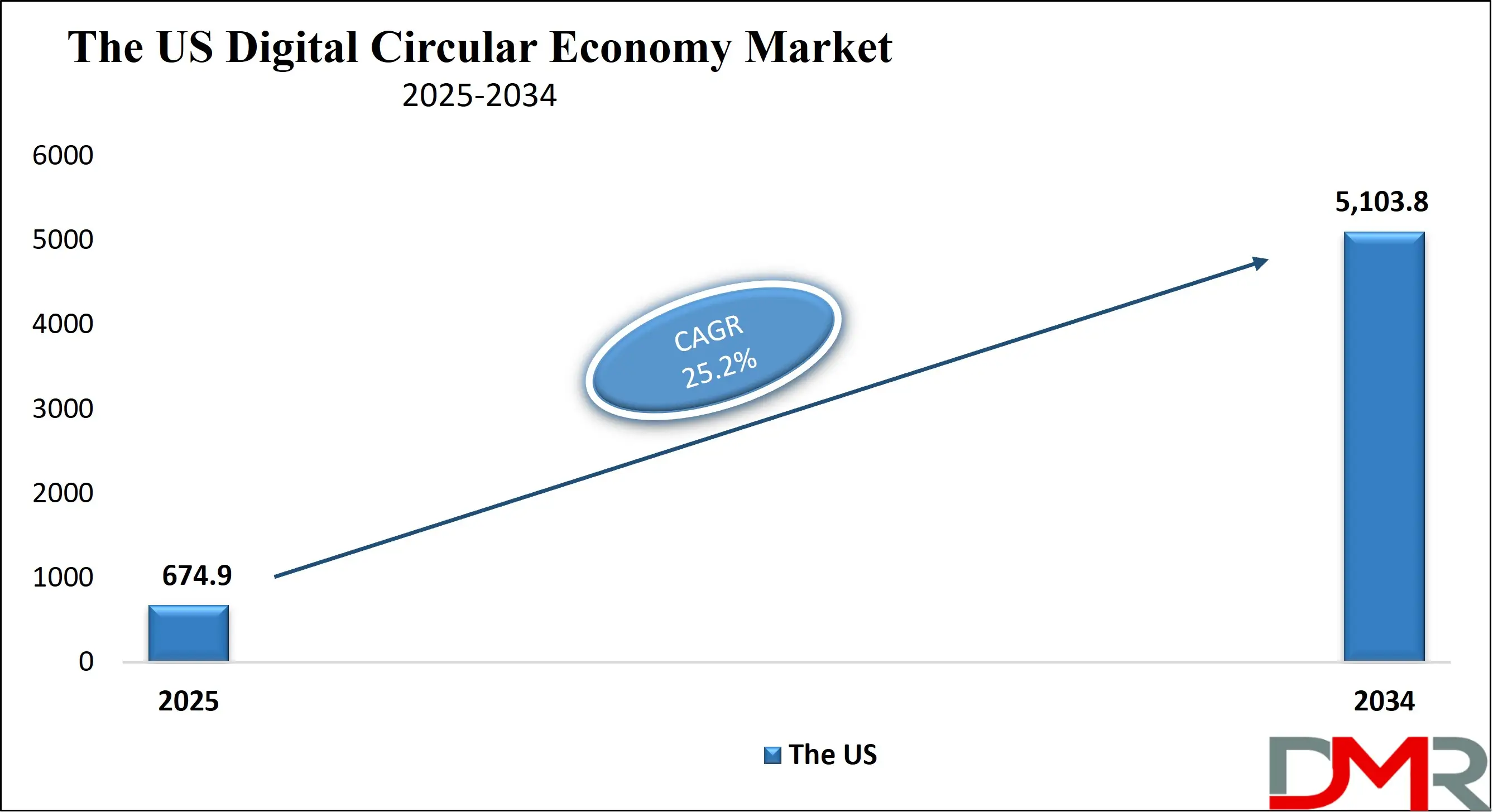

The US Digital Circular Economy Market

The US Digital Circular Economy Market is projected to reach USD 674.9 million in 2025 at a compound annual growth rate of 25.2% over its forecast period.

The United States is witnessing an increasing shift toward circular economic principles, bolstered by digital innovation and regulatory support. The U.S. Environmental Protection Agency (EPA) has prioritized a circular economy in its National Recycling Strategy and sustainable materials management roadmap, encouraging industries to digitize product lifecycle tracking and waste reduction practices. With high internet penetration and a strong industrial base, the U.S. is well-positioned to scale digital platforms that drive circularity across manufacturing, retail, and logistics sectors.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Federal and state-level initiatives such as the DOE’s Advanced Manufacturing Office promote the development of smart factories equipped with digital twins and AI systems that enable reuse, repair, and remanufacturing.

U.S. startups and tech companies are pioneering AI-enabled resale platforms, E-waste management systems, and blockchain for traceability. Furthermore, the U.S. Department of Energy's ReCell Center supports digitalization in battery recycling to establish a closed-loop system for electric vehicle components and strengthen US waste management practices.

The country’s robust logistics infrastructure, along with the growing presence of green procurement policies and circular public-private partnerships, facilitates widespread deployment of digital circular technologies. Urban areas such as San Francisco, New York, and Seattle are adopting smart municipal waste programs that utilize IoT, AI, and data analytics to optimize resource flows and reduce landfill use.

Universities and R&D bodies, like MIT and the National Institute of Standards and Technology (NIST), are actively engaged in developing interoperable digital frameworks that can standardize the circular economy. Demographically, high digital literacy and environmental consciousness among millennials and Gen Z further propel market expansion.

The Japan Digital Circular Economy Market

The Japan Digital Circular Economy Market is projected to be valued at USD 176.3 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 1,166.1 million in 2034 at a CAGR of 24.0%.

Japan’s digital circular economy market is evolving rapidly, supported by the government’s "Green Growth Strategy" and Society 5.0 vision, which integrates digital technologies into resource-efficient systems.

The Ministry of Economy, Trade and Industry (METI) is advancing policies to promote smart recycling infrastructure, digital product lifecycle tracking, and AI-driven circular business models. Japan’s Compact City Model further encourages digitized urban planning for sustainable consumption and waste recovery.

Japan has a long-standing culture of reuse and minimalism, which provides a strong social foundation for circularity. Digitally advanced cities like Tokyo and Osaka are deploying AI and robotics in material sorting and reuse logistics.

The country’s Home Appliance Recycling Law enforces traceability in electronics, enabling digital platforms to streamline collection and recycling workflows. The Ministry of the Environment (MoE) has launched initiatives like the Plastic Smart Campaign that support digital waste recycling services and citizen engagement under green technology & sustainability frameworks.

In addition, Japan's strengths in electronics and automotive manufacturing make it ideal for deploying digital twins and IoT systems that extend product lifespans. Industrial giants are investing in blockchain to verify the sustainability of components and track carbon footprint across global supply chains. Universities such as the University of Tokyo are developing AI-based platforms to optimize the reuse of construction materials and rare metals.

Japan's high-speed connectivity and aging population create unique opportunities for digital circular services, such as app-based collection systems and smart appliances with built-in reuse alerts. With growing collaboration between ministries, academia, and private enterprises, Japan is poised to become a global leader in digital circular economy integration.

Global Digital Circular Economy Market: Key Takeaways

- Global Market Size Insights: The Global Digital Circular Economy Market size is estimated to have a value of USD 2,939.5 million in 2025 and is expected to reach USD 25,147.1 million by the end of 2034.

- The US Market Size Insights: The US Digital Circular Economy Market is projected to be valued at USD 674.9 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 5,103.8 million in 2034 at a CAGR of 25.2%.

- Regional Insights: Europe is expected to have the largest market share in the Global Digital Circular Economy Market with a share of about 37.8% in 2025.

- Key Players: Some of the major key players in the Global Digital Circular Economy Market are SAP SE, Capgemini SE, Dassault Systèmes SE, Cisco Systems Inc., International Business Machines Corporation (IBM), Oracle Corporation, KPMG International Limited, Software AG, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 26.9 percent over the forecasted period of 2025.

Global Digital Circular Economy Market: Use Cases

- Smart Waste Management Platforms: Municipalities are using AI-enabled waste sorting systems that identify recyclable materials and optimize collection schedules, reducing landfill dependency and enhancing recycling efficiency. Digital platforms also enable citizens to track disposal habits and earn rewards, fostering a community-led circular ecosystem powered by data science platforms and business intelligence insights aligned with waste management modernization.

- Digital Product Passports: Electronics manufacturers are embedding QR-based digital product passports to trace material composition, usage history, repair events, and recyclability. This enables better component recovery, reduces e-waste, and supports compliance with environmental regulations across supply chains in the EU and beyond.

- Blockchain for Reverse Logistics: Blockchain-powered platforms facilitate secure tracking of goods returned for recycling, refurbishment, or resale. These systems enable authentication of reused parts, incentivize sustainable returns from consumers, and create transparent audit trails across global logistics networks for circular goods.

- IoT in Predictive Maintenance: IoT sensors in industrial equipment track wear-and-tear in real-time, enabling predictive maintenance and longer product lifecycles. These insights reduce unnecessary replacements, support remanufacturing, and conserve resources by extending asset utility in circular economy-driven industries.

- Fashion-as-a-Service Platforms: Fashion brands are adopting digital rental and resale platforms powered by AI to offer circular clothing models. These systems track garment lifecycle, facilitate returns, and manage logistics, contributing to reduced textile waste and enabling consumers to make sustainable style choices.

Stats & Facts

United Nations Conference on Trade and Development (UNCTAD) & UN Institute for Training and Research

- Only 7.2% of the global economy is circular: This figure indicates that less than a tenth of the global materials in use are being reused, recycled, or reintegrated into new products, showing significant room for growth in circular practices and digital enablement to scale such operations.

- Just 24% of global electronic waste is formally collected: Despite the increasing digitization and the rise in consumer electronics, less than one-fourth of all e-waste is managed through official channels, leaving the majority subject to informal or unsafe disposal methods, and highlighting the urgent need for smart tracking and recycling infrastructures.

- Electronics recycling is projected to grow substantially: As nations push for stricter e-waste regulations and sustainable tech adoption, the electronics recycling sector is expected to triple in value between 2022 and 2030. Growth is largely led by advanced economies like the United States and China, which are also leading in digital recycling innovation.

European Parliament & Circle Economy

- Circular strategies could eliminate 22.8 billion tonnes of CO₂ emissions: Circular economy adoption, if implemented globally and effectively, could reduce almost 40% of 2019’s carbon emissions, particularly by redesigning industrial systems and extending product lifecycles using digital technologies.

- Nine billion tonnes of CO₂e can be cut from five core industries: If circular economy methods such as material reuse, recycling, and remanufacturing are applied in the cement, steel, plastics, aluminum, and food sectors, the world could reduce nearly half the emissions associated with the global transportation industry.

- Only 8.6% of all materials used globally are reused: This low material circularity rate signifies that over 90% of raw materials are extracted, consumed, and discarded without re-entering the production cycle. It reveals the critical gap in resource efficiency that digital tracking systems could address.

- The EU circularity rate reached 11.5% in 2022: Europe is showing leadership in circularity. The 11.5% figure indicates the proportion of total material use that comes from recycled sources. Despite being the highest among global regions, there is still considerable scope for improvement.

- Europe generates over 2 billion tonnes of waste annually: On average, every EU citizen contributes nearly 5 tonnes of waste each year. The largest share comes from construction, mining, and industrial production, requiring digital tools like material passports and AI-driven reuse systems to better manage this volume.

U.S. Department of Energy (DOE) and Office of Energy Efficiency & Renewable Energy (EERE)

- The U.S. circularity rate fell from 9.1% in 2018 to 7.2% in 2023: While global momentum toward circularity grows, the U.S. saw a decline in material reuse rates. This drop suggests inefficiencies in material recovery systems and underscores the need for better digital infrastructure to track and recirculate resources.

- Discrete manufactured tech products contribute to 6.9% of U.S. environmental impacts: Products like smartphones, laptops, and smart appliances, central to the digital economy, have a large footprint. Designing them with circularity and digital tracking in mind can significantly reduce this impact.

- All discrete products combined account for 14.2% of U.S. environmental harm: Beyond tech gadgets, discrete items such as vehicles, tools, and machinery contribute to nearly one-sixth of environmental degradation. Incorporating digital twin and IoT technologies can enhance reuse, repairability, and recyclability.

National Institute of Standards and Technology (NIST)

- Extending product life by 50% reduces environmental impact by about 33%: Increasing the durability and reuse potential of consumer and industrial goods can drastically cut emissions and raw material demand. Lifecycle modeling supported by digital systems like predictive maintenance and smart asset management plays a pivotal role.

- NIST’s circularity programs focus on digital lifecycle interoperability: One of NIST’s key initiatives is to establish a standard framework for capturing and exchanging lifecycle data, enabling better integration of circularity practices across manufacturing ecosystems through digital threads and IoT platforms.

- Ongoing work on circularity standards via ISO and ASTM: NIST supports global collaboration to develop harmonized digital circularity standards like ISO 59010, 59004, and 59020. These standards aim to create shared data protocols and lifecycle performance metrics for sustainable manufacturing.

National Renewable Energy Laboratory (NREL)

- RFID and IoT enable real-time monitoring of reuse and recovery: Technologies such as radio frequency identification (RFID) and IoT sensors are used to track product location, condition, and lifecycle stage. This makes material recovery more intelligent and responsive, especially in construction, textiles, and electronics.

City of Austin (Texas), USA

- Austin’s circular economy sector generates over USD 1 billion annually: Local reuse, recycling, and upcycling businesses contribute significantly to the city’s GDP. Digital marketplaces and inventory-tracking systems are key to enabling small enterprises to participate in circular commerce.

Taiwan Smart Cities Initiative

- Taipei and other cities employ AI and IoT for sustainable urban management: Taiwan's leading smart cities have deployed air-quality sensors, intelligent traffic systems, and automated resource-use platforms. These initiatives serve as blueprints for digitally powered urban circular ecosystems.

Irish Government Procurement (Circular Computing Initiative)

- Over 60,000 remanufactured laptops procured through public contracts: The Irish government awarded multi-year contracts that supported the reuse of electronics in public institutions. Digital auditing and certification of components ensured transparency and performance guarantees.

- Environmental impact savings from this procurement: The initiative saved approximately 19 million kilograms of carbon emissions, conserved 72 million kilograms of raw materials, and reduced freshwater consumption by about 11 billion liters, highlighting the real-world sustainability benefits of digital circular procurement.

Global Digital Circular Economy Market: Market Dynamics

Driving Factors in the Global Digital Circular Economy Market

Regulatory Mandates and Government Circular Economy Roadmaps

One of the strongest growth drivers for the digital circular economy market is the wave of policy frameworks and regulatory mandates being introduced globally. Governments are implementing circular economy action plans integrating climate risk management, green ammonia innovation, and digital solutions to enforce sustainability across product life cycles.

For example, the European Union has made it mandatory under its Circular Economy Action Plan that certain products must include digital product passports by 2026. These regulations are pushing companies to digitize their supply chain management, material sourcing, and recycling workflows using Industry 5.0 technologies.

Countries like Japan, the Netherlands, and Singapore are embedding digital circularity into their smart city strategies, integrating IoT and AI for waste reduction and reuse at the urban scale. These policies not only create direct demand for software platforms, cloud services, and traceability tools but also unlock government grants and green procurement incentives for firms that adopt digital circular tools.

Moreover, global collaboration on sustainability disclosures, such as the EU’s CSRD or the ISSB framework, is compelling multinational enterprises to adopt data-driven circular economy practices to maintain compliance and competitiveness in international markets.

Corporate ESG Commitments and Digital Sustainability Transformation

A surge in corporate Environmental, Social, and Governance (ESG) initiatives is playing a crucial role in driving the adoption of digital circular economy tools. Companies across the manufacturing, retail, electronics, and automotive industries are under immense pressure from stakeholders, investors, and consumers to demonstrate sustainability performance.

To meet net-zero goals and comply with carbon accounting mandates, organizations are deploying cloud-based lifecycle management software, digital twin platforms, and blockchain traceability systems. These solutions help them calculate material use intensity, emissions at each stage, and post-use recovery rates, aligning with global reporting frameworks like the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB).

Furthermore, digital circularity allows brands to build transparency and customer loyalty. For instance, in the fashion and consumer electronics sectors, brands are using QR codes on packaging and product interfaces to provide real-time information on repair, return, and reuse options. Such initiatives not only reduce environmental footprints but also create secondary revenue streams through refurbished and subscription-based models.

As companies digitize their sustainability roadmaps, demand is surging for interoperable circular economy solutions that integrate across procurement, logistics, and after-sales services. This wave of ESG-led digital transformation is accelerating the expansion of the digital circular economy from pilot projects to enterprise-wide deployments.

Restraints in the Global Digital Circular Economy Market

Lack of Interoperable Standards and Fragmented Digital Infrastructure

A key restraint facing the digital circular economy market is the lack of standardized, interoperable data systems across regions, industries, and platforms. The circular economy relies heavily on material traceability, lifecycle documentation, and transparent data exchange. However, the absence of unified digital standards, such as for digital product passports, lifecycle assessment (LCA) data formats, or material identification protocols, creates barriers to scalability.

For example, product information collected by a manufacturer may not be readable by recycling partners or government regulators due to incompatible software, terminology, or data schemas. This results in inefficiencies, redundant data collection, and limited real-time visibility. SMEs, in particular, struggle to adopt circular platforms that require integration with proprietary systems.

Moreover, the variation in digital readiness across regions, particularly between developed and developing markets, limits the global deployment of circular solutions. While regions like the EU are advancing digital compliance frameworks, other jurisdictions are yet to align their digital ecosystems for circular interoperability.

This fragmentation not only delays implementation timelines but also increases compliance costs and inhibits international cooperation on circular trade. Without coordinated action to harmonize standards and build an inclusive digital infrastructure, the true potential of a globally networked digital circular economy will remain underutilized.

High Implementation Costs and Organizational Change Barriers

Despite the long-term savings and sustainability benefits of digital circular economy models, the upfront investment required for deployment remains a major barrier, particularly for small and medium enterprises (SMEs).

Implementing IoT systems, blockchain solutions, AI-driven lifecycle management tools, and cloud-based recycling platforms involves significant costs in terms of hardware, software, system integration, and workforce training. Moreover, many organizations lack the in-house expertise to design and manage data-intensive circular solutions.

The transition also demands a complete shift in business models from product ownership to service-based or usage-based paradigms, which requires stakeholder buy-in, new revenue logic, and customer education. Resistance to change, both from leadership and frontline employees, can impede adoption and operationalization.

Additionally, uncertainty regarding return on investment, data privacy concerns, and cybersecurity risks discourage organizations from digitizing their circular strategies. For companies in highly regulated or resource-constrained industries, these barriers are even more pronounced.

Public funding mechanisms and industry incentives are often insufficient to support large-scale transformation, especially in developing regions. Therefore, despite the technological readiness and consumer interest, cost and change management barriers remain substantial hurdles to the widespread adoption of the digital circular economy.

Opportunities in the Global Digital Circular Economy Market

Rising Adoption in Emerging Economies through Circular Technology Leapfrogging

Emerging markets present a high-potential growth area for digital circular economy solutions, particularly because they can bypass waste-intensive industrial models through green outsourcing in BPO and digital freight management solutions.

Countries in Asia, Africa, and Latin America are rapidly urbanizing and digitalizing, making them ideal candidates for circular economy leapfrogging. Governments in these regions are embracing mobile-first and platform-based systems to manage waste management and recycling with limited legacy infrastructure.

These digital platforms offer inclusive growth by formalizing the vast informal recycling economies in developing nations. The growing availability of affordable smartphones, cloud infrastructure, and open-source platforms is making digital circularity accessible to even micro-enterprises. Development agencies and multilateral institutions are funding circular startups focused on e-waste, agriculture, and water reuse.

As governments deploy digital public infrastructure like digital IDs, payments, and data registries, circular solutions can integrate into national digital ecosystems. This creates a massive opportunity for solution providers to deliver scalable, modular circular software tailored for emerging market contexts and needs.

Expansion into Consumer-Oriented Platforms and Digital Circular Marketplaces

The digital circular economy is seeing explosive opportunity in the consumer space, particularly with the rise of circular marketplaces, rental platforms, and digital resale ecosystems. Consumers, especially Gen Z and millennials, are increasingly prioritizing sustainability, transparency, and cost-effectiveness, leading to a surge in demand for platforms that enable renting, refurbishing, repairing, and reselling products. This consumer shift is especially evident in industries like fashion, electronics, furniture, and home appliances.

Companies are responding by developing AI-driven resale apps, cloud-based inventory systems for rental services, and customer portals offering product diagnostics, repair guides, and return scheduling. Digital platforms also facilitate reverse logistics and condition-based pricing, enhancing profitability for sellers and accessibility for buyers.

For example, smart labeling using QR or NFC tags helps customers access information about the product’s origin, maintenance history, and end-of-life options. In parallel, peer-to-peer sharing economy models are gaining traction, enabled by digital trust systems, ratings, and blockchain authentication. This not only reduces environmental burden but also stimulates circular consumption behavior.

As consumer trust in digital ecosystems grows, traditional retailers are entering the circular commerce space by partnering with tech startups or launching in-house platforms. The consumerization of circularity thus presents a high-growth opportunity for software vendors, logistics integrators, and platform aggregators alike.

Trends in the Global Digital Circular Economy Market

Integration of AI, IoT, and Blockchain into Circular Supply Chains

A major trend in the digital circular economy market is the convergence of artificial intelligence (AI), IoT, and blockchain technology in BFSI to optimize material reuse and waste reduction. AI-powered predictive analytics forecast demand and extend product lifecycles by enabling intelligent remanufacturing, repair, and preventive maintenance. IoT sensors embedded in industrial machinery help track degradation, improving industrial automation – manufacturing processes and promoting green technology & sustainability in production systems.

For instance, in the electronics sector, blockchain-based digital product passports store data on component origin, toxicity, carbon footprint, and end-of-life recyclability, enabling efficient collection and reuse. Similarly, smart factories use IoT for inventory management and material utilization tracking. This integration supports real-time decision-making, enabling decentralized circular models at scale.

These digital layers also enhance customer engagement by providing users with insights into product sustainability and return value. The fusion of AI, IoT, and blockchain is not just improving operational efficiencies but also enabling new business models such as "product-as-a-service" and decentralized recycling ecosystems. As infrastructure and standards mature, this trend is expected to become a default circular economy enabler across industries.

Emergence of Digital Product Passports and Lifecycle Management Systems

The implementation of digital product passports (DPPs) and lifecycle management systems is becoming increasingly mainstream in the digital circular economy landscape. These systems provide detailed information about a product's material composition, origin, repair history, environmental footprint, and recyclability, enabling end-to-end visibility for both consumers and businesses.

Digital product passports are especially gaining traction in regions like the European Union, where they are becoming a regulatory requirement under the Ecodesign for Sustainable Products Regulation (ESPR). These DPPs enhance circularity by supporting better sorting, reuse, and recycling at the end-of-life phase and by enabling refurbishers and recyclers to assess the value of returned products accurately.

Lifecycle management systems, on the other hand, digitize and centralize data from design through end-of-use, empowering businesses to make real-time sustainability decisions. This helps manufacturers reduce overproduction, manage product take-back programs, and comply with sustainability disclosures. These tools are integrated with cloud platforms and AI to offer predictive modeling and cost optimization across the product lifecycle.

For example, in the fashion and textile industry, DPPs allow brands to share data with customers about fiber content, repair options, and resale value, improving transparency and trust. As companies prioritize ESG performance, DPPs and lifecycle management tools are rapidly becoming essential features of competitive and sustainable digital supply chains.

Global Digital Circular Economy Market: Research Scope and Analysis

By Offering Analysis

Software is projected to dominate the digital circular economy market by serving as the backbone for lifecycle management, traceability, and sustainable decision-making across industries. As companies aim to decouple economic growth from resource consumption, cloud-based software platforms are increasingly used to monitor product usage, emissions, and end-of-life processes in real time.

These platforms integrate AI, machine learning, and analytics tools to assess lifecycle impact, track circular KPIs, and automate compliance with regulations like the EU Ecodesign Regulation and global ESG mandates. The dominance of software is also attributed to its scalability and interoperability, allowing integration with existing enterprise systems such as ERP, CRM, and product lifecycle management (PLM) tools.

Digital Product Passports (DPPs), which require robust software systems to host and manage data, are fast becoming a regulatory requirement in multiple economies. Software solutions enable the generation, sharing, and verification of DPP data covering material composition, energy usage, recycling history, and repair instructions, thus promoting transparency and reuse. Circular marketplaces, resale platforms, and reverse logistics apps also run on customizable software infrastructure, making it indispensable to consumer-facing circular models.

Moreover, software solutions reduce the need for capital-intensive hardware investments, making them accessible to startups and SMEs. They offer real-time dashboards, lifecycle mapping tools, predictive analytics, and cloud collaboration features that empower businesses to design, produce, and recover products more efficiently. The ability of software to serve multiple use cases from product-as-a-service models to condition-based asset recovery cements its leadership in enabling scalable, measurable, and intelligent circular economy operations across sectors.

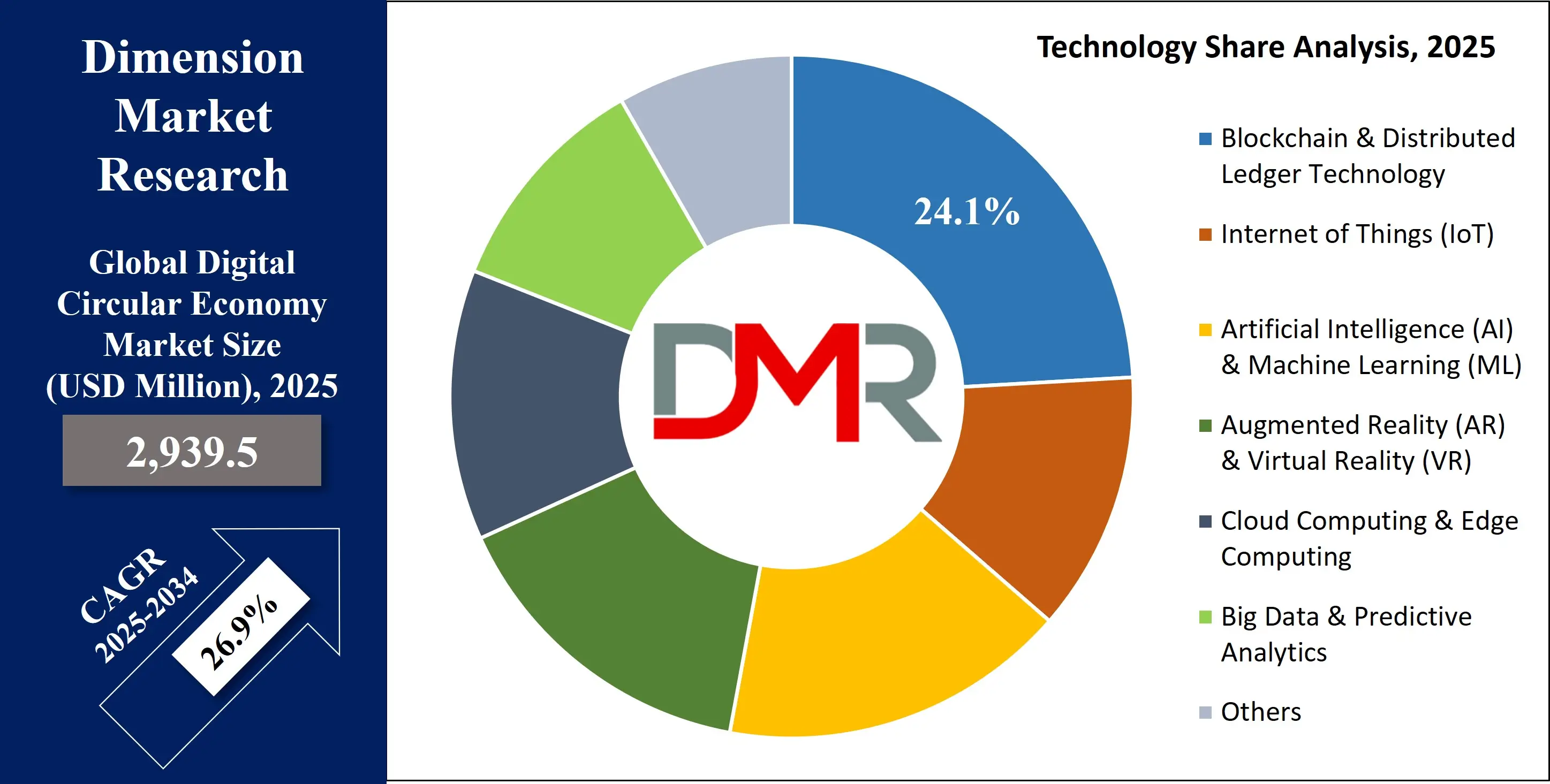

By Technology Analysis

Blockchain and distributed ledger technology (DLT) are predicted to dominate the digital circular economy technology segment due to their unmatched ability to ensure data integrity, traceability, and trust across complex value chains.

In a circular economy, where materials and products pass through multiple stakeholders, manufacturers, refurbishers, recyclers, retailers, and consumers, verifiable and transparent data is crucial. Blockchain enables tamper-proof recording of every transaction, material origin, usage lifecycle, and recycling event, eliminating the ambiguity and fraud that often hinder material reuse and reverse logistics.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Blockchain platforms facilitate the development and deployment of digital product passports (DPPs), which rely on distributed systems to store lifecycle data securely. Each product, tagged with a unique digital identity or QR/NFC code, can have its materials tracked from extraction to end-of-life recovery, enabling compliance with evolving regulations like the EU’s ESPR and CSRD.

Furthermore, smart contracts automate blockchain-based protocols, streamlining processes like warranty validation, asset transfer, and reverse logistics, enhancing circularity while minimizing administrative costs.

DLT is particularly valuable in global supply chains where disparate players need a single source of truth without centralized control. It enhances interoperability across platforms and geographies, enabling cross-border circular commerce. In e-waste, for instance, blockchain ensures compliance with Extended Producer Responsibility (EPR) regulations by creating a verifiable chain of custody. In agriculture and fashion, it tracks origin and environmental impact, allowing brands to validate sustainability claims.

As trust, security, and traceability become non-negotiable in circular economies, blockchain and DLT stand out as the dominant enablers of scalable, verifiable, and decentralized digital circular ecosystems.

By Application Analysis

Supply chain and material tracking are expected to dominate the application segment of the digital circular economy market as they form the foundation for closing resource loops. Effective circularity requires real-time visibility into product lifecycles through digital experience platforms and IoT semiconductor systems that collect and transmit data. These technologies allow manufacturers, retailers, and recyclers to trace the flow of materials, optimize recovery, and implement digital logistics and reverse logistics more efficiently.

Digital supply chain tracking helps companies shift from linear inventory management to circular supply loops. By using IoT sensors, RFID tags, and blockchain-enabled ledgers, businesses can record every touchpoint in the journey of a product from sourcing and production to consumption and reclamation.

This data enables predictive analytics for demand forecasting, repair scheduling, and parts harvesting, thereby reducing waste and improving operational efficiency. Cloud-based dashboards and AI-powered insights further aid sustainability managers in making informed decisions regarding material circularity, carbon emissions, and resource optimization.

Regulatory mandates such as Extended Producer Responsibility (EPR), the EU’s Digital Product Passport framework, and global ESG disclosures necessitate transparent material tracking systems. Companies unable to track and report on circularity will face legal and reputational risks. Moreover, circular procurement, waste audits, and closed-loop logistics all hinge on accurate supply chain data.

Given the rising pressure for transparent, traceable, and resilient value chains, especially post-pandemic supply chain and material tracking has become the single most critical application driving digital circular economy adoption across verticals.

By End User Analysis

The consumer electronics sector is projected to dominate the end-user segment in the digital circular economy market due to its high product turnover, complex supply chains, and increasing environmental scrutiny. With millions of smartphones, laptops, televisions, and appliances sold globally each year, the sector generates vast amounts of e-waste estimated to exceed 60 million tonnes annually.

Digital circular economy solutions in this sector are critical to reduce environmental impact, enhance product lifecycle visibility, and comply with global e-waste regulations such as the WEEE Directive and Extended Producer Responsibility (EPR) schemes.

Electronics manufacturers are adopting digital product passports, blockchain traceability, and IoT-enabled diagnostics to support remanufacturing, resale, and recycling. Consumers are increasingly offered repair guides, trade-in programs, and resale platforms integrated via mobile apps and QR codes.

Leading OEMs like Apple, Dell, and HP are deploying lifecycle assessment (LCA) software and AI-powered refurbishment systems to reduce raw material dependency and extend product utility. This reduces e-waste generation while creating new revenue streams from subscription and buy-back models.

Furthermore, electronic components such as rare earth elements and lithium are resource-intensive to mine and process. Digital tracking of these materials allows for more efficient recovery and reuse, aligning with resource security policies. The growing demand for transparency in product sustainability, combined with regulatory and investor pressure, makes digital circular strategies not only feasible but essential for the electronics industry.

Due to its volume, environmental impact, and digital maturity, the consumer electronics sector is at the forefront of circular transformation, making it the dominant end-user driving digital circular economy innovation and investment.

The Global Digital Circular Economy Market Report is segmented based on the following

By Offering

- Circularity Analytics Platforms

- Digital Twin Platforms

- Lifecycle Assessment Software

- Circular Supply Chain Management Software

- Consulting & Implementation

- Integration & Deployment

- Support & Maintenance

- Training & Education

By Technology

- Blockchain & Distributed Ledger Technology

- Internet of Things (IoT)

- Artificial Intelligence (AI) & Machine Learning (ML)

- Augmented Reality (AR) & Virtual Reality (VR)

- Cloud Computing & Edge Computing

- Big Data & Predictive Analytics

- Others

By Application

- Supply Chain & Material Tracking

- Resource Optimization & Efficiency

- Digital Resale & Reuse

- Reverse Logistics & Remanufacturing

- Circular Economy Reporting & Compliance

- Circular Waste Management & Recycling

- Smart Material Selection & Testing

- Others

By End User

- Consumer Electronics

- Information Technology & Telecom

- Automotive & Transportation

- Industrial Manufacturing

- Construction & Building Materials

- Retail & E-Commerce

- Others

Impact of Artificial Intelligence on the Global Digital Circular Economy Market

- Predictive Waste Management: AI algorithms analyze consumption and disposal patterns to forecast waste generation accurately, enabling smart recycling routes, optimized collection schedules, and reduced landfill reliance, key pillars in advancing a circular economy at scale.

- Enhanced Resource Optimization: AI-powered analytics identify inefficiencies in resource usage across production cycles, ensuring better input-output balance, reducing raw material dependency, and facilitating reuse and remanufacturing processes to close the resource loop efficiently.

- Smart Material Tracing: AI-driven blockchain and sensor technologies enhance material tracking throughout product lifecycles, enabling transparency, authentication, and traceability necessary for effective recycling, refurbishing, and reverse logistics systems within the circular framework.

- Product Lifecycle Extension: AI predicts product wear and tear, suggesting timely maintenance and upgrades. This extends asset lifespans, curbs overproduction, and fosters sustainable consumption by prioritizing reuse and repair over disposal.

- Circular Supply Chain Automation: AI streamlines reverse logistics, automates product take-back mechanisms, and helps design closed-loop supply chains that prioritize sustainability, waste minimization, and economic efficiency through intelligent decision-making and demand forecasting.

- Sustainable Design Innovation: AI supports eco-design by simulating environmental impacts, testing alternative materials, and recommending circular-friendly structures, accelerating innovation in sustainable product development and reducing ecological footprints from the start.

Global Digital Circular Economy Market: Regional Analysis

Region with the Largest Revenue Share

Europe is poised to dominate the digital circular economy market with 37.8% of the total market revenue by the end of 2025, supported by strong waste recycling services, advanced infrastructure, and institutional commitment to sustainability.

The European Union has been a global leader through its Green Deal, promoting initiatives in post-consumer recycled plastics, recycled ocean plastics, and fiber-reinforced plastic (FRP) recycling. These frameworks strengthen Europe’s leadership in green technology & sustainability through widespread adoption of biodegradable packaging and recycled terephthalic acid materials.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Countries like Germany, the Netherlands, and the Nordic nations have embedded digital circularity into public procurement and smart city development. Additionally, the European Investment Bank (EIB) and Horizon Europe have provided substantial funding to support circular innovation, particularly in electronics, textiles, and the automotive sectors.

The presence of numerous industry coalitions, research institutions, and eco-conscious consumers further reinforces Europe’s leadership. Corporations operating in Europe are early adopters of ESG reporting and digital twin technology, which enhances their ability to measure, manage, and monetize circular value. These factors collectively make Europe not only the largest but also the most mature market for digital circular economy solutions globally.

Region with the Highest CAGR

North America is expected to register the highest CAGR in the digital circular economy market, driven by rapid digital transformation, increased ESG investments, and growing regulatory alignment. The United States, in particular, is witnessing accelerated adoption of AI, IoT, and blockchain in manufacturing and logistics, core enablers of circularity.

The rise in federal and state-level initiatives supporting e-waste recycling, sustainable procurement, and extended producer responsibility (EPR) is creating fertile ground for digital circular platforms. Programs from agencies like the U.S. Department of Energy (DOE) and the National Institute of Standards and Technology (NIST) are funding lifecycle assessment tools, reverse logistics software, and material tracking platforms.

Tech giants in the U.S., including Amazon, Google, and Apple, are pioneering internal circular models that utilize digital product data for refurbishment, buybacks, and reuse. In parallel, ESG-focused investment funds and shareholder activism are pushing companies to disclose resource efficiency and circularity metrics, most of which require digital tracking systems.

The region’s strong venture capital ecosystem and startup culture also support the development of AI- and cloud-driven circular marketplaces. Moreover, growing consumer awareness about sustainable consumption, especially among Gen Z and millennial demographics, is accelerating demand for digital resale and repair platforms. These dynamics are fueling North America’s leading growth trajectory.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Digital Circular Economy Market: Competitive Landscape

The digital circular economy market is highly competitive and fragmented, with a mix of large technology firms, sustainability-driven startups, and industry-specific solution providers. Key players are focusing on platform interoperability, AI-powered lifecycle analytics, and blockchain-based material traceability to differentiate their offerings.

Major global players include IBM Corporation, SAP SE, Microsoft Corporation, Cisco Systems, Inc., and Oracle Corporation, which provide integrated circular economy modules within their enterprise software suites. These companies are enabling manufacturers and retailers to optimize waste reduction, asset recovery, and end-of-life value through cloud-based lifecycle tools.

Innovative startups such as Circularise, iPoint-systems, and Everledger are gaining traction with blockchain traceability platforms that offer transparency in sourcing and recycling. Companies like Sourcemap and Rheaply are specializing in supply chain circularity and resource exchange networks, respectively.

Partnerships and pilot projects are common strategies among market participants to co-develop standards for Digital Product Passports and improve circular compliance. In addition, several firms are collaborating with governments and research institutions to launch open data platforms and public circular procurement systems.

Competitive intensity is expected to increase as ESG disclosure mandates and DPP regulations tighten globally. To stay ahead, firms are investing in AI, real-time data ecosystems, and industry-specific software-as-a-service (SaaS) platforms.

Some of the prominent players in the Global Digital Circular Economy Market are

- SAP

- Capgemini

- Dassault Systèmes

- Cisco Systems

- IBM

- Oracle

- KPMG

- Software AG

- Siemens Advanta

- Ingram Micro

- Microsoft

- Google (Alphabet)

- Huawei

- Alibaba

- Accenture

- AWS (Amazon Web Services)

- Honeywell

- Landbell Group

- Anthesis Group

- CircularIQ

- Other Key Players

Recent Developments in the Global Digital Circular Economy Market

- June 2025: Chile’s environment ministry added textiles to its Extended Producer Responsibility law. This requires importers of used clothing to report and manage waste, addressing mounting environmental concerns in the Atacama Desert. The policy supports the integration of digital traceability tools in textile recycling and reuse systems.

- May 2025: Project Re: claim and the Circular Fashion Innovation Network unveiled plans for a polyester recycling plant and an automated sorting facility. Backed by Innovate UK, this initiative aims to enable digital circularity in fashion through smart sorting and lifecycle tracking systems.

- April 2025: At PACK EXPO in Chicago, Dow led sustainability efforts by diverting nearly 285 tons of waste, saving 2 million gallons of water, and conserving 1 million kWh of energy. The initiative used digital waste tracking technologies and circular event management platforms.

- October 2024: The European Union passed a regulation mandating Digital Product Passports for all goods by 2030. Pilot projects began rolling out traceability systems, standardization tools, and circular lifecycle platforms to support compliance and transparency.

- July 2024: The UK government approved USD 5.5 million to develop a recycling center focused on industrial and aerospace equipment. The facility will implement digital material tracking and smart recovery technologies for reuse and remanufacturing.

- June 2024: The Irish government partnered with Circular Computing to procure 60,000 remanufactured laptops over four years. This digital circular initiative is expected to save 19 million kg of CO₂, 72 million kg of materials, and over 11 billion liters of water.

- January 2024: Deloitte announced a strategic alliance with Circle Economy Consulting to scale circular adoption globally. The partnership focuses on reducing primary resource extraction, integrating digital circular tools, and supporting ESG-aligned job creation.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2,939.5 Mn |

| Forecast Value (2034) |

USD 25,147.1 Mn |

| CAGR (2025–2034) |

26.9% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 674.9 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Offering (Software, Services), By Technology (Blockchain & Distributed Ledger Technology, Internet of Things (IoT), Artificial Intelligence (AI) & Machine Learning (ML), Augmented Reality (AR) & Virtual Reality (VR), Cloud Computing & Edge Computing, Big Data & Predictive Analytics, Others), By Application (Supply Chain & Material Tracking, Resource Optimization & Efficiency, Digital Resale & Reuse, Reverse Logistics & Remanufacturing, Circular Economy Reporting & Compliance, Circular Waste Management & Recycling, Smart Material Selection & Testing, Others), and By End User (Consumer Electronics, Information Technology & Telecom, Automotive & Transportation, Industrial Manufacturing, Construction & Building Materials, Retail & E-Commerce, Others). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

SAP SE, Capgemini SE, Dassault Systèmes SE, Cisco Systems Inc., International Business Machines Corporation (IBM), Oracle Corporation, KPMG International Limited, Software AG, Siemens Advanta Consulting, Ingram Micro Inc., Microsoft Corporation, Alphabet Inc. (Google), Huawei Technologies Co., Ltd., Alibaba Group Holding Limited, Accenture plc, Amazon Web Services Inc. (AWS), Honeywell International Inc., Landbell Group GmbH, Anthesis Group Limited, and CircularIQ B.V, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Digital Circular Economy Market?

▾ The Global Digital Circular Economy Market size is estimated to have a value of USD 2.3 billion in 2023

and is expected to reach USD 17.1 billion by the end of 2032.

Which region accounted for the largest Global Digital Circular Economy Market?

▾ Europe has the largest market share for the Global Digital Circular Economy Market with a share of

about 35.7% in 2023.

Who are the key players in the Global Digital Circular Economy Market?

▾ Some of the major key players in the Global Digital Circular Economy Market are SAP, Capgemini, IBM,

and many others.

What is the growth rate in the Global Digital Circular Economy Market?

▾ The market is growing at a CAGR of 25.2 percent over the forecasted period.