Market Overview

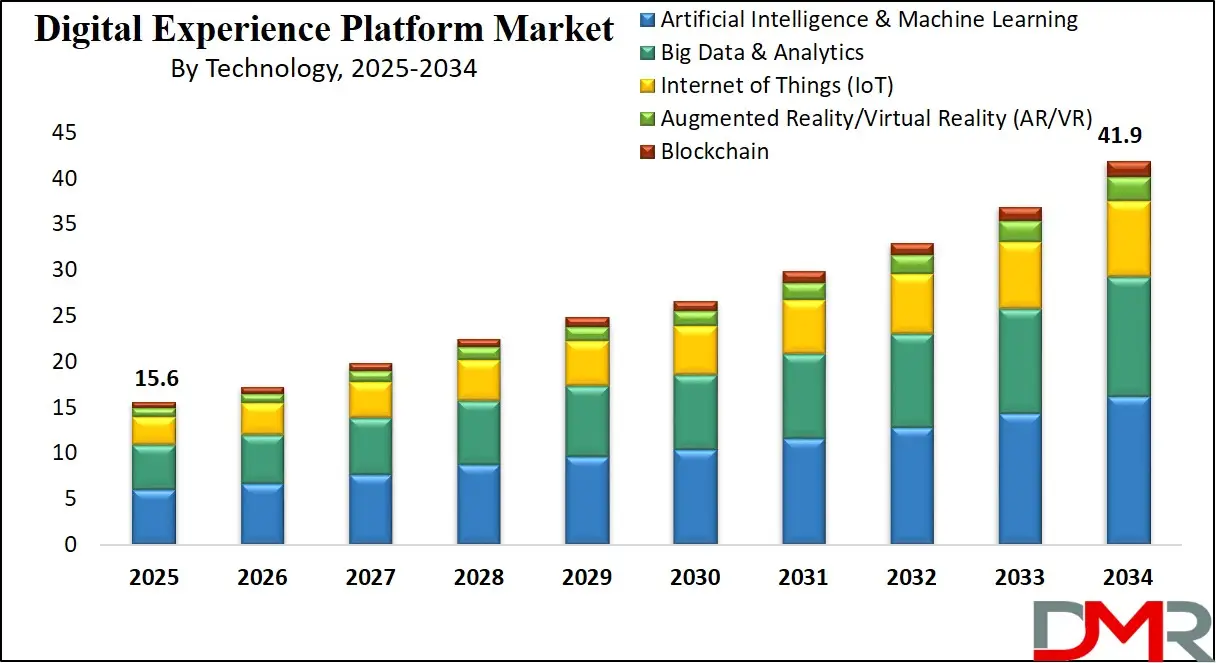

The Global Digital Experience Platform (DXP) Market size is on a rapid growth trajectory, projected to soar from

USD 15.6 billion in 2025 to an impressive

USD 41.9 billion by 2034, expanding at a robust

CAGR of 11.6%.

This surge reflects the rising demand for personalized customer journeys, omnichannel engagement, and next-gen digital transformation across industries. As businesses increasingly invest in AI-powered content management, cloud-native platforms, and data-driven marketing automation, DXPs are becoming the cornerstone of seamless digital experiences and brand loyalty in the competitive digital economy.

A Digital Experience Platform (DXP) is a comprehensive software solution designed to enable organizations to deliver consistent, personalized, and integrated digital experiences across multiple touchpoints. These platforms bring together various technologies such as content management systems (CMS), customer data platforms (CDP), analytics, personalization engines, AI-driven automation, and omnichannel delivery capabilities into a unified interface.

The core purpose of a DXP is to orchestrate seamless customer journeys by collecting data from various sources, analyzing behavior in real-time, and adapting content dynamically to match individual user needs. DXPs empower enterprises to create connected and immersive digital environments, bridging the gap between IT and marketing by providing the flexibility to manage web, mobile, social, and IoT interactions within a single platform. As digital expectations continue to evolve, DXPs offer the agility and scalability required to keep pace with rapid technological shifts and user-centric innovation.

The global Digital Experience Platform market is witnessing substantial growth, fueled by the rising demand for personalized customer engagement, dynamic content delivery, and digital-first business strategies. With more organizations shifting towards cloud-native infrastructures and adopting AI-powered customer analytics, DXPs have become pivotal in reshaping enterprise digital transformation initiatives.

This market is being propelled by industries such as retail, BFSI, healthcare, and telecom, all striving to enhance customer loyalty through meaningful and interactive online experiences. The need for real-time personalization and context-aware content has amplified the role of DXPs in creating unified brand experiences across web, mobile apps, kiosks, and wearable technologies, helping businesses stay competitive in a hyperconnected digital economy.

As enterprises increasingly prioritize customer-centric digital operations, the demand for scalable and intelligent DXP solutions has surged. Vendors are now focusing on modular and API-first architectures that support seamless integrations with martech stacks, CRMs, and eCommerce platforms, enabling businesses to optimize their digital presence while maintaining operational efficiency. The integration of machine learning and predictive analytics allows these platforms to anticipate user behavior and deliver tailored interactions, thereby boosting customer satisfaction and conversion rates. Additionally, the emergence of headless and composable DXPs is offering greater flexibility to developers and marketers alike, promoting faster innovation cycles and enhanced digital agility.

The US Digital Experience Platform Market

The U.S. Digital Experience Platform Market size is projected to be valued at USD 5.3 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 13.4 billion in 2034 at a CAGR of 10.9%.

The U.S. Digital Experience Platform (DXP) market stands at the forefront of digital transformation, driven by a highly competitive business environment and a tech-savvy consumer base that demands personalized, intuitive, and seamless digital interactions. Enterprises across sectors, retail and financial services to healthcare and media, are increasingly embracing DXPs to unify customer touchpoints, enhance engagement strategies, and build lasting brand loyalty. These platforms are instrumental in enabling real-time content personalization, data-driven decision-making, and adaptive user interfaces, which are essential for meeting the rapidly evolving expectations of modern consumers in the United States.

A major factor fueling the adoption of DXPs in the U.S. is the strategic shift toward omnichannel customer experiences. Businesses are no longer just focused on optimizing websites; they are creating interconnected digital ecosystems that span mobile apps, social media, customer portals, and even emerging technologies like augmented reality and voice interfaces.

The integration of artificial intelligence, machine learning, and customer journey analytics within DXPs allows organizations to anticipate customer needs, deliver relevant content, and foster deeper engagement across every interaction. This customer-centric approach has become a key differentiator in highly saturated U.S. markets where digital experience is often the deciding factor in brand preference.

The European Digital Experience Platform Market

In 2025, Europe is projected to capture a market share of 4.2 billion USD in the global digital experience platform market, with a CAGR of 11%.

This growth reflects the increasing demand for comprehensive, scalable digital experiences across various industries in the region. As European businesses continue their digital transformation journeys, the focus is shifting toward platforms that can provide seamless integration of customer data, content management, AI-driven personalization, and omnichannel capabilities. The region's strong emphasis on data privacy regulations, such as GDPR, also drives the adoption of secure and compliant digital solutions that align with customer expectations for privacy and transparency.

The 11% CAGR is indicative of the growing investments from enterprises seeking to modernize their digital strategies. Key sectors, including retail, banking, finance, healthcare, and manufacturing, are prioritizing DXPs to enhance customer engagement, improve digital marketing effectiveness, and offer personalized, real-time experiences across websites, mobile apps, and other digital touchpoints.

The growing trend of e-commerce, which is expected to continue expanding in Europe, further supports the adoption of digital experience platforms as businesses strive to meet the evolving expectations of online shoppers, such as fast load times, personalized recommendations, and efficient user journeys.

Additionally, European businesses are embracing AI and machine learning technologies integrated into their DXPs, enhancing the personalization of customer experiences by delivering content, products, and services tailored to individual preferences and behaviors. As the region sees more cross-industry collaborations and the rapid adoption of cloud-based solutions, the European digital experience market is expected to continue thriving, driven by a need for innovation, scalability, and seamless digital customer journeys.

The Japanese Digital Experience Platform Market

In 2025, Japan is expected to capture a market share of 0.8 billion USD in the global digital experience platform market, with a CAGR of 10.4%.

This growth highlights Japan's commitment to digital transformation and the increasing demand for advanced digital experiences across industries such as retail, finance, manufacturing, and technology. Japan has long been a leader in technological innovation, and this trend continues as businesses within the region increasingly adopt digital experience platforms to enhance their customer engagement and streamline their operations.

The 10.4% CAGR reflects a steady but significant increase in the adoption of DXPs, driven by several key factors. The rise of mobile-first consumers, the growth of eCommerce, and Japan's strong focus on integrating AI and IoT into business operations are all contributing to the growing demand for these platforms. Japanese companies are looking to DXPs to enable better personalization, enhance omnichannel marketing strategies, and improve customer service across digital touchpoints. As a result, businesses are investing in platforms that allow for real-time, data-driven decision-making, ensuring a more tailored, seamless, and efficient customer experience.

Moreover, Japan's highly competitive market, coupled with the country’s advanced infrastructure, makes it an attractive environment for digital experience innovations. The country’s strong manufacturing and technology sectors are driving the need for more sophisticated customer engagement strategies, making DXPs an essential tool for businesses to maintain competitive advantage.

The increasing emphasis on AI, automation, and data analytics within Japanese enterprises further accelerates the adoption of these platforms. As companies in Japan strive to meet the expectations of their digitally savvy consumers and improve operational efficiency, the demand for Digital Experience Platforms is expected to continue growing at a robust pace.

Global Digital Experience Platform Market: Key Takeaways

- Market Value: The global digital experience platform size is expected to reach a value of USD 41.9 billion by 2034 from a base value of USD 15.6 billion in 2025 at a CAGR of 11.6%.

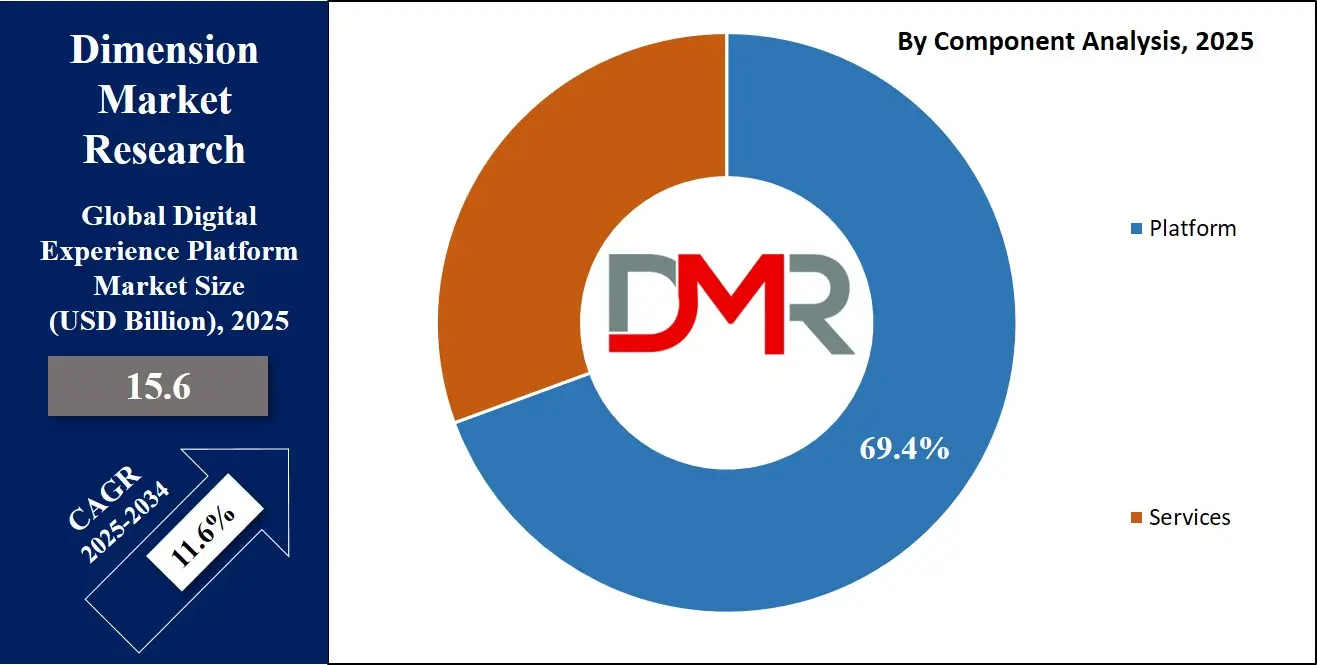

- By Component Type Segment Analysis: Platforms are poised to consolidate their dominance in the component type segment, capturing 69.4% of the total market share in 2025.

- By Deployment Mode Segment Analysis: On-premises mode is anticipated to maintain its dominance in the deployment mode segment, capturing 57.3% of the total market share in 2025.

- By Technology Type Segment Analysis: Artificial Learning (AI) is expected to maintain its dominance in the technology type segment, capturing 38.6% of the total market share in 2025.

- By Interaction Channel Type Segment Analysis: The web channels are anticipated to maintain their dominance in the interaction channel type segment, capturing 35.2% of the market share.

- By Application Type Segment Analysis: Business-to-Consumer (B2C) applications are poised to consolidate their market position in the application type segment, capturing 56.8% of the total market share in 2025.

- By End-Use Segment Analysis: The Retail industry is anticipated to maintain its dominance in the end-use segment, capturing 30.3% of the total market share in 2025.

- Regional Analysis: North America is anticipated to lead the global digital experience platform market landscape with 40.3% of total global market revenue in 2025.

- Key Players: Some key players in the global digital experience platform market are Adobe, Salesforce, SAP, Oracle, Sitecore, Acquia, Optimizely, Liferay, OpenText, Kentico, Bloomreach, Progress (Sitefinity), Microsoft (via Dynamics 365 and Azure integrations), HCL Software (DX), IBM (via Watson and hybrid cloud offerings), Contentful, CoreMedia, SDL (now part of RWS), Crownpeak, Magnolia, and Other Key Players.

Global Digital Experience Platform Market: Use Cases

- Personalized Omnichannel Customer Engagement: In the global Digital Experience Platform market, one of the most prominent use cases is enabling personalized omnichannel customer engagement. As consumers interact with brands through various channels such as web, mobile apps, social media, and voice assistants, businesses need to ensure consistent messaging and seamless transitions across platforms. DXPs allow organizations to harness real-time data, behavioral analytics, and AI-powered personalization to deliver tailored content and experiences based on individual preferences, location, and past interactions. This approach not only enhances customer satisfaction but also boosts conversion rates and brand loyalty by creating a unified digital journey that aligns with user expectations across every touchpoint.

- Digital Transformation in Healthcare: Healthcare providers around the world are leveraging DXPs to modernize patient engagement, streamline communication, and improve overall service delivery. From appointment scheduling via chatbots to personalized health portals and mobile apps that offer real-time updates, DXPs empower healthcare institutions to offer patient-centric digital experiences. Integration of secure data management, multilingual content delivery, and HIPAA-compliant features helps organizations build trust while providing easy access to critical health information. This use case underscores how digital experience platforms support telemedicine, patient education, and proactive care delivery through advanced content management and seamless digital interfaces.

- Next-Generation eCommerce Experiences: Retailers and eCommerce brands are utilizing DXPs to elevate the digital shopping experience and compete in a crowded global marketplace. By integrating product catalogs, customer data platforms, and personalization engines, businesses can offer dynamic product recommendations, targeted promotions, and immersive user experiences. DXPs support headless commerce models that separate the frontend experience from backend operations, allowing for greater design flexibility and faster time to market. With features like A/B testing, predictive analytics, and omnichannel inventory visibility, retailers can craft engaging digital storefronts that respond to consumer behavior in real-time and drive sustained revenue growth.

- Employee Experience and Internal Portals: Another vital use case for digital experience platforms lies in enhancing employee experience through modern intranets and internal communication portals. Large enterprises are adopting DXPs to centralize knowledge management, streamline onboarding processes, and promote collaboration among distributed teams. These platforms integrate with existing enterprise systems like ERP and HR software to deliver personalized dashboards, task automation, and self-service capabilities. By improving access to resources, aligning internal communication strategies, and fostering a digital-first workplace culture, DXPs contribute to higher employee satisfaction, productivity, and organizational agility in the era of hybrid work.

Global Digital Experience Platform Market: Stats & Facts

- European Union Initiatives:

- The European Commission has introduced the Digital Markets Act (DMA) to regulate large online platforms, aiming to ensure fair competition and prevent market dominance by major tech companies.

- India's Digital Transformation:

- The Government of India's 'Digital India' initiative focuses on transforming the country into a digitally empowered society. This includes enhancing digital infrastructure, increasing internet connectivity, and promoting digital literacy, all of which contribute to the growing demand for digital platforms and services.

- Australia's Regulatory Measures:

- o The Australian government has empowered the Australian Competition and Consumer Commission (ACCC) with new regulatory authorities to oversee digital platforms, ensuring consumer protection and fair competition in the digital space.

Global Digital Experience Platform Market: Market Dynamics

Global Digital Experience Platform Market: Driving Factors

Rising Demand for Personalized Digital ExperiencesOne of the primary drivers fueling the global Digital Experience Platform market is the growing demand for highly personalized digital experiences across every stage of the customer journey. Consumers today expect real-time personalization, predictive content recommendations, and seamless interactions across channels like web, mobile, and social media. DXPs enable organizations to aggregate customer data from diverse sources, analyze behavioral patterns using AI and machine learning, and deliver context-aware content tailored to individual needs. This increasing need for dynamic, customer-centric engagement strategies has positioned DXPs as essential tools for digital marketing, brand experience management, and customer lifecycle optimization.

Rapid Digital Transformation across Industries

Enterprises across multiple sectors including retail, finance, healthcare, education, and manufacturing are accelerating their digital transformation initiatives to remain competitive. Digital Experience Platforms provide the technological backbone for delivering scalable and integrated digital services, supporting cloud-native deployments, API-first development, and omnichannel experience management. With growing pressure to modernize legacy systems and adopt future-ready digital infrastructure, businesses are investing heavily in DXPs to enhance customer engagement, operational efficiency, and innovation readiness, contributing significantly to the market’s global expansion.

Global Digital Experience Platform Market: Restraints

High Implementation and Integration Costs

Despite their strategic value, DXPs often come with high implementation costs, especially for small and medium-sized enterprises. Customizing and integrating these platforms with existing legacy systems, CRMs, and third-party applications can be resource-intensive and require specialized expertise. The need for continuous updates, licensing fees, and technical support further adds to the total cost of ownership. This financial burden can act as a significant barrier to entry, particularly in developing regions where budget constraints limit the adoption of advanced digital technologies.

Complexity in Managing Multi-Channel Experiences

Managing consistent digital experiences across multiple channels and devices can be a complex challenge, even with robust DXP solutions. The need to maintain content consistency, synchronize customer data in real time, and adapt interfaces for varying user contexts can overwhelm organizations without a mature digital infrastructure. Additionally, the learning curve associated with platform features and the need for ongoing staff training can slow down implementation, reducing the overall agility and effectiveness of digital experience strategies.

Global Digital Experience Platform Market: Opportunities

Integration of Artificial Intelligence and Predictive Analytics

The growing integration of artificial intelligence and predictive analytics into DXPs presents a significant opportunity for innovation and value creation. AI-powered DXPs can analyze vast datasets to forecast user behavior, recommend optimized content, and automate customer journeys with precision. This intelligent automation enhances personalization at scale, improves customer engagement metrics, and empowers marketers with data-driven insights. Vendors that incorporate advanced AI capabilities into their platforms can differentiate their offerings and cater to the rising expectations of tech-savvy enterprises worldwide.

Expansion into Emerging Economies

The digital acceleration in emerging economies across Asia-Pacific, Latin America, and Africa offers a lucrative growth opportunity for DXP providers. As businesses in these regions digitize their operations and customer engagement models, the demand for scalable and localized digital experience solutions is rising. Governments and private sectors are investing in digital infrastructure, internet accessibility, and e-governance initiatives, further fueling the need for platforms that can manage multilingual content, regional compliance, and mobile-first experiences. This untapped potential is expected to open new revenue streams for global vendors and encourage tailored DXP deployments in diverse markets.

Global Digital Experience Platform Market: Trends

Shift toward Headless and Composable Architectures

A major trend shaping the global DXP landscape is the shift toward headless and composable architectures. Unlike traditional monolithic platforms, headless DXPs decouple the frontend presentation layer from the backend logic, offering greater flexibility, scalability, and speed in digital experience delivery. Composable DXPs allow enterprises to select and integrate best-of-breed components based on specific needs, enabling a modular and agile approach to digital transformation. This architectural evolution aligns with modern development practices such as microservices and API integrations, helping businesses respond quickly to market changes and deliver innovation faster.

Focus on Data Privacy and Compliance-Driven Experiences

As data privacy regulations like GDPR, CCPA, and other regional frameworks become more stringent, organizations are increasingly focusing on creating privacy-first digital experiences. DXPs are evolving to include robust data governance, consent management, and compliance tracking capabilities. Customers are more conscious about how their data is used, and businesses are responding by making transparency and ethical data use a part of their digital experience strategy. This trend is driving the adoption of secure, compliant, and trustworthy digital experience platforms that not only protect user data but also strengthen brand credibility in a privacy-conscious digital era.

Global Digital Experience Platform Market: Research Scope and Analysis

By Component Analysis

In the component type segment of the global Digital Experience Platform market, platforms are poised to consolidate their dominance by capturing 69.4 percent of the total market share in 2025. This strong market position reflects the growing reliance of enterprises on centralized, feature-rich platforms that facilitate the delivery of cohesive and personalized digital experiences across various customer interaction channels. These platforms integrate multiple functions including content creation, AI-driven personalization, real-time analytics, and omnichannel distribution within a unified environment.

Their ability to support scalable and agile digital strategies makes them a preferred choice for organizations undergoing digital transformation. The demand is especially pronounced among large enterprises seeking robust infrastructure to manage complex digital ecosystems and ensure consistency in user experience across web, mobile, social media, and voice-enabled devices.

In parallel, the services segment continues to play a crucial role in supporting the successful implementation and optimization of these platforms. Services in the Digital Experience Platform market typically encompass consulting, integration, deployment, support, and managed services. Consulting services help businesses align platform capabilities with specific digital strategies and user experience goals. Integration and deployment services ensure seamless connectivity between the DXP and existing IT systems such as CRMs, ERPs, and marketing automation tools, enabling organizations to create unified customer views and synchronized content flows.

Post-deployment, ongoing support and maintenance services are essential for resolving technical issues, updating system functionalities, and optimizing performance. Additionally, managed services are increasingly being adopted by organizations that seek to outsource platform operations and focus on core business growth. These services ensure continuous improvement of the digital experience while reducing internal resource burdens and accelerating time to value.

By Deployment Mode Analysis

In the deployment mode segment of the global Digital Experience Platform market, the on-premises model is anticipated to maintain its dominance, capturing

57.3 percent of the total market share in 2025. This sustained preference for on-premises deployment is largely driven by enterprises with strict data governance policies, industry-specific compliance requirements, and the need for full control over digital infrastructure. Sectors such as banking, government, and healthcare often rely on on-premises DXPs to ensure the highest levels of data security, privacy, and customization.

These organizations prioritize the ability to tailor platform configurations, integrate deeply with legacy systems, and exercise granular control over how data is stored and processed. Despite the growing popularity of cloud-native technologies, on-premises platforms continue to be favored by companies with robust internal IT teams capable of managing the operational demands of maintaining infrastructure in-house.

While on-premises deployment leads in overall market share, cloud deployment is experiencing significant growth due to its flexibility, scalability, and cost-efficiency. Cloud-based Digital Experience Platforms allow businesses to deploy solutions faster, scale resources based on demand, and benefit from continuous updates and innovation without the burden of maintaining physical servers. This deployment model is particularly appealing to small and mid-sized enterprises, as well as global businesses with distributed operations that require seamless access to digital tools from any location.

Cloud DXPs support agile methodologies and API-first architectures, making them ideal for organizations looking to rapidly innovate, launch new digital products, and experiment with emerging technologies such as artificial intelligence and machine learning. Moreover, cloud deployments reduce upfront capital expenditures and offer predictable subscription-based pricing models, which further accelerate their adoption across various industries aiming for cost-effective digital transformation.

By Technology Analysis

In the technology type segment of the global Digital Experience Platform market, artificial intelligence is expected to maintain its dominance by capturing 38.6 percent of the total market share in 2025. The integration of AI technologies into DXPs is transforming how businesses deliver hyper-personalized and real-time digital experiences. With capabilities such as predictive analytics, intelligent content recommendations, sentiment analysis, and automated customer segmentation, AI enables platforms to interpret vast volumes of behavioral and contextual data to anticipate user needs and tailor interactions accordingly.

Enterprises are leveraging AI-powered DXPs to automate workflows, optimize marketing strategies, and enhance user engagement without manual intervention. This technological edge not only improves the accuracy and relevance of digital experiences but also significantly reduces operational complexity. As customer expectations continue to evolve rapidly, AI is becoming a cornerstone technology for businesses striving to remain agile, proactive, and customer-focused in a highly competitive digital environment.

Alongside AI, the Internet of Things is emerging as a transformative force in the DXP landscape by connecting digital experiences with physical devices and environments. IoT enables businesses to gather and act upon real-time data from smart devices such as wearables, connected cars, home automation systems, and retail sensors. In the context of digital experience platforms, IoT integration allows for context-aware personalization, where user interactions can be tailored based on environmental cues, device usage patterns, and location-specific data.

This is particularly impactful in industries such as retail, healthcare, and smart cities, where customer touchpoints extend beyond traditional screens. For example, retailers can use IoT data to personalize in-store experiences through digital signage, while healthcare providers can enhance patient journeys through connected health devices. By bridging the digital and physical realms, IoT-equipped DXPs enable more immersive, responsive, and data-rich customer experiences that align with the increasing demand for intelligent, real-time engagement across all channels.

By Interaction Channel Analysis

In the interaction channel type segment of the global Digital Experience Platform market, web channels are anticipated to maintain their dominance, capturing 35.2 percent of the total market share in 2025. This continued leadership stems from the web's foundational role in digital engagement strategies across nearly every industry. Websites act as the primary interface for customer interaction, brand storytelling, and transactional activities, serving as a centralized hub for both information dissemination and eCommerce.

Digital Experience Platforms enhance the web experience by enabling dynamic content delivery, real-time personalization, search engine optimization, and seamless user navigation tailored to individual behavior. With increasing emphasis on responsive design, accessibility, and integrated analytics, the web remains the most versatile and scalable channel for delivering consistent, brand-aligned experiences to a global audience. Enterprises invest heavily in web-based DXPs to ensure fast load times, intuitive user journeys, and effective lead capture mechanisms that drive measurable business outcomes.

Alongside web, social media has become a vital and fast-evolving interaction channel within the Digital Experience Platform market. Platforms such as Instagram, LinkedIn, Facebook, TikTok, and X serve not only as content distribution points but also as rich engagement ecosystems where consumers expect direct interaction with brands in real time. Social media's integration into DXPs enables businesses to monitor sentiment, analyze audience behavior, and distribute targeted content based on user preferences and social signals.

Unlike static digital touchpoints, social media offers dynamic, community-driven engagement where trends can shape brand perception instantly. DXPs empower marketers to orchestrate unified campaigns across social and other channels, ensuring tone, timing, and messaging remain consistent. Furthermore, the use of social commerce, influencer marketing, and live content strategies is growing rapidly, positioning social media as both a branding tool and a conversion channel. This interactive and data-rich environment makes social media indispensable in a multichannel digital strategy supported by a robust DXP framework.

By Application Analysis

In the application type segment of the global Digital Experience Platform market, Business-to-Consumer applications are poised to consolidate their market position by capturing 56.8 percent of the total market share in 2025. This dominance reflects the intensifying focus of consumer-facing brands on delivering immersive, personalized, and seamless digital experiences that align with rapidly evolving customer expectations. B2C organizations operate in highly competitive environments where user attention spans are short and loyalty is increasingly linked to the quality of digital interactions.

DXPs enable these businesses to craft emotionally resonant and data-driven customer journeys across multiple channels, including web, mobile, social media, and emerging touchpoints such as voice assistants. From eCommerce and online banking to travel and entertainment platforms, B2C brands use digital experience platforms to deliver rich media content, interactive interfaces, real-time personalization, and customer service automation, all of which contribute to higher engagement, lower churn, and increased revenue per user.

On the other hand, Business-to-Business applications in the Digital Experience Platform market are gaining momentum as enterprises recognize the need to modernize how they interact with clients, partners, and internal stakeholders. B2B environments typically involve longer sales cycles, higher-value transactions, and complex decision-making processes that demand targeted and context-aware digital experiences. DXPs in this segment support personalized content delivery for different buyer personas, role-based access to resources, and integration with backend systems such as CRMs, ERPs, and partner portals.

They also facilitate the automation of lead nurturing, product information management, and client onboarding workflows. In B2B, the emphasis is not only on delivering visually compelling interfaces but also on ensuring functionality, efficiency, and trust-building through consistent and reliable digital experiences. As digital maturity accelerates across B2B sectors, DXPs are being increasingly leveraged to streamline communication, enhance collaboration, and drive measurable business value in a multi-stakeholder environment.

By End-Use Analysis

In the end-use segment of the global Digital Experience Platform market, the retail industry is anticipated to maintain its dominance by capturing 30.3 percent of the total market share in 2025. This leadership is driven by the retail sector’s continued push toward digital-first engagement models, where customer experience is central to brand differentiation and revenue generation. Retailers are leveraging Digital Experience Platforms to create immersive, personalized shopping journeys that span both online and in-store touchpoints.

From AI-powered product recommendations and real-time inventory visibility to dynamic content delivery and omnichannel loyalty programs, DXPs empower retailers to meet customer expectations with precision and agility. The growing adoption of mobile shopping, social commerce, and interactive interfaces such as virtual try-ons further reinforces the role of DXPs in enhancing customer satisfaction and driving conversion rates. As consumer behavior becomes more unpredictable and fragmented, the retail sector continues to invest heavily in digital infrastructure that ensures consistent, data-informed, and emotionally resonant experiences across all brand interactions.

In the banking, financial services, and insurance sector, Digital Experience Platforms are increasingly being adopted to address the rising demand for seamless, secure, and personalized financial services. The BFSI industry operates in a highly regulated and competitive landscape where customer trust and digital convenience are equally important. DXPs support financial institutions in delivering unified digital journeys across mobile banking apps, customer portals, insurance platforms, and advisory services.

These platforms help orchestrate interactions by integrating backend systems like core banking software and customer data platforms, ensuring clients receive timely updates, personalized product recommendations, and self-service capabilities. Advanced features such as biometric authentication, chatbot support, and multilingual content management are enhancing user engagement while maintaining compliance with data privacy and security regulations. For BFSI providers, the ability to provide frictionless onboarding, real-time support, and cross-channel continuity through DXPs is becoming a critical driver of customer retention and operational efficiency in the digital age.

The Digital Experience Platform Market Report is segmented on the basis of the following:

By Component

By Deployment Mode

By Technology Type

- Artificial Intelligence & Machine Learning

- Internet of Things (IoT)

- Augmented Reality/Virtual Reality (AR/VR)

- Big Data & Analytics

- Blockchain

By Interaction Channel

- Web

- Social Media

- Email

- Kiosks & Digital Signage

- Chatbots & Voice Assistants

By Application

- Business-to-Consumer

- Business-to-Business

- Others

By End-Use

- BFSI

- Healthcare

- IT & Telecom

- Manufacturing

- Retail

- Others

Global Digital Experience Platform Market: Regional Analysis

Region with the Largest Revenue Share

North America is anticipated to lead the global digital experience platform market landscape by capturing 40.3 percent of the total global market revenue in 2025, reflecting the region’s strong digital infrastructure, early technology adoption, and mature enterprise landscape. The dominance of North America is fueled by the presence of major technology vendors, widespread cloud adoption, and the strategic prioritization of customer-centric digital transformation by both large enterprises and mid-sized businesses. Organizations across industries such as retail, finance, healthcare, and media are actively investing in AI-driven personalization, omnichannel engagement, and advanced analytics to deliver superior digital experiences.

The U.S., in particular, continues to be at the forefront of innovation, with high consumer expectations and competitive pressures pushing businesses to deploy scalable and agile Digital Experience Platforms. Additionally, the region benefits from a supportive ecosystem of digital agencies, developers, and cloud providers that accelerate the deployment and optimization of DXP solutions tailored to diverse user needs.

Region with significant growth

Asia Pacific is projected to register the highest compound annual growth rate in the global digital experience platform market, driven by rapid digital transformation, expanding internet penetration, and a booming population of digitally connected consumers. Emerging economies such as China, India, Indonesia, and Vietnam are witnessing accelerated adoption of digital technologies as businesses across sectors strive to modernize customer engagement and stay competitive in an increasingly experience-driven economy.

The rise of mobile-first consumers, particularly in urban centers, is fueling demand for personalized, seamless digital interactions across apps, websites, and social platforms. Governments across the region are also playing a crucial role by promoting digital infrastructure development and regulatory frameworks that encourage innovation and data security. Additionally, the region is home to a growing number of tech-savvy startups and eCommerce players who are leveraging Digital Experience Platforms to build agile, scalable, and user-centric digital ecosystems. As enterprises in Asia Pacific continue to prioritize omnichannel strategies and customer personalization, the region is set to emerge as a key engine of growth in the global DXP landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Digital Experience Platform Market: Competitive Landscape

The global competitive landscape of the digital experience platform market is characterized by a dynamic and highly competitive environment, with numerous players vying for market share across various industries. Leading companies in the market include major technology vendors, SaaS providers, and cloud service providers who have developed comprehensive, feature-rich DXPs designed to meet the evolving needs of businesses seeking to enhance customer experiences. These companies leverage advanced technologies such as artificial intelligence, machine learning, and cloud computing to deliver personalized, omnichannel solutions that enable businesses to engage with customers seamlessly across web, mobile, social, and other digital touchpoints.

The competitive landscape is also influenced by innovation in areas such as AI-driven personalization, content management, and customer data integration, with vendors striving to differentiate themselves through specialized capabilities, better integration with existing business systems, and flexible deployment models (on-premises vs. cloud). Companies like Adobe, Salesforce, SAP, and Oracle have solidified their positions as dominant players, offering end-to-end solutions that integrate content management, analytics, eCommerce, and marketing automation into a unified platform. These global giants continue to expand their offerings through strategic partnerships, acquisitions, and investments in R&D to maintain a competitive edge in the market.

Some of the prominent players in the Global Digital Experience Platform are:

- Adobe

- Salesforce

- SAP

- Oracle

- Sitecore

- Acquia

- Optimizely

- Liferay

- OpenText

- Kentico

- Bloomreach

- Progress (Sitefinity)

- Microsoft

- HCL

- IBM

- Contentful

- CoreMedia

- SDL (now part of RWS)

- Crownpeak

- Magnolia

- Other Key Players

Global Digital Experience Platform Market: Recent Developments

- April 2025: Adobe acquired Figma, a collaborative design platform, to enhance its digital experience capabilities, particularly in real-time design collaboration for enterprises.

- March 2024: Sitecore acquired Moosend, a marketing automation platform, to strengthen its personalized content management and customer engagement features within its DXP offerings.

- January 2024: Acquia acquired the digital experience management company, Acquia Cloud Site Factory, to expand its cloud-based platform solutions for enterprises looking to scale and optimize their digital experiences.

- November 2023: Salesforce acquired Slack Technologies to enhance its digital experience platform by integrating advanced collaboration tools to improve customer engagement and team communication.

- September 2023: SAP acquired Emarsys, a leading provider of marketing automation and customer engagement solutions, to strengthen its capabilities in delivering personalized customer journeys across multiple touchpoints.

- June 2023: Oracle acquired Moat, an AI-powered marketing analytics company, to enhance its data-driven customer engagement and personalized experience offerings within its DXP portfolio.

- April 2022: Microsoft acquired LinkedIn’s Talent Solutions to expand its enterprise DXP capabilities, providing businesses with better customer data insights and integrated communication tools.

- February 2022: Liferay acquired Nuxeo, a digital asset management platform, to broaden its content management and experience orchestration offerings within the enterprise digital ecosystem.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 15.9 Bn |

| Forecast Value (2034) |

USD 41.9 Bn |

| CAGR (2025–2034) |

11.6% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 5.3 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Platform and Services), By Deployment Mode (On-Premises and Cloud), By Technology Type (Artificial Intelligence & Machine Learning, Internet of Things (IoT), Augmented Reality/Virtual Reality (AR/VR), Big Data & Analytics, and Blockchain), By Interaction Channel (Web, Social Media, Email, Kiosks & Digital Signage, and Chatbots & Voice Assistants), By Application (Business-to-Consumer, Business-to-Business, and Others), and By End-Use Industry (BFSI, Healthcare, IT & Telecom, Manufacturing, Retail, and Others) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Adobe, Salesforce, SAP, Oracle, Sitecore, Acquia, Optimizely, Liferay, OpenText, Kentico, Bloomreach, Progress (Sitefinity), Microsoft (via Dynamics 365 and Azure integrations), HCL Software (DX), IBM (via Watson and hybrid cloud offerings), Contentful, CoreMedia, SDL (now part of RWS), Crownpeak, Magnolia, and Other Key Players, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

The global digital experience platform market size is estimated to have a value of USD 15.6 billion in 2025 and is expected to reach USD 41.9 billion by the end of 2034.

The US digital experience platform market is projected to be valued at USD 5.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 13.4 billion in 2034 at a CAGR of 10.9%.

North America is expected to have the largest market share in the global digital experience platform market, with a share of about 40.3% in 2025.

Some of the major key players in the global digital experience platform market are Adobe, Salesforce, SAP, Oracle, Sitecore, Acquia, Optimizely, Liferay, OpenText, Kentico, Bloomreach, Progress (Sitefinity), Microsoft (via Dynamics 365 and Azure integrations), HCL Software (DX), IBM (via Watson and hybrid cloud offerings), Contentful, CoreMedia, SDL (now part of RWS), Crownpeak, Magnolia, and Other Key Players.

The market is growing at a CAGR of 11.6 percent over the forecasted period.