Market Overview

The Global Driver Drowsiness Detection System Market is projected to reach

USD 10.1 billion in 2025 and grow at a compound annual growth rate of

12.2% from there until 2034 to reach a value of

USD 28.7 billion.

The global driver drowsiness detection system market is witnessing robust growth, driven by a rising emphasis on road safety and increasing vehicle automation. With the escalation of fatigue-related accidents, these systems are becoming essential across the automotive sector. Advanced driver-assistance systems (ADAS) increasingly incorporate fatigue monitoring solutions, using infrared sensors, eye-tracking cameras, and steering behavior analytics to assess driver alertness in real-time. Automakers are integrating these tools to comply with evolving safety regulations and consumer expectations. The market is further supported by increasing production of passenger and commercial vehicles, particularly in emerging economies where long-haul transport is prevalent.

Opportunities in the market are broadening due to the expansion of semi-autonomous and fully autonomous vehicle technologies. These vehicles demand advanced in-cabin monitoring systems capable of real-time physiological and behavioral assessment. Automotive OEMs and Tier 1 suppliers are investing heavily in AI and machine learning to enhance detection accuracy. Additionally, government-led initiatives promoting road safety are fueling demand, with countries in Europe, Asia, and North America mandating fatigue detection features in new vehicles, particularly commercial fleets and public transportation systems.

Nevertheless, certain restraints persist. The high upfront cost of hardware components such as high-resolution cameras, integrated processing units, and biometric sensors can hinder adoption, especially in low- and middle-income economies. Small manufacturers may also face challenges in system integration with legacy vehicle architectures. Data privacy concerns regarding continuous driver monitoring and facial recognition usage remain key hurdles in gaining user trust and regulatory approvals.

Driver fatigue monitoring systems are most commonly adopted in commercial vehicles, where prolonged hours on the road elevate accident risk. Among detection types, eye-tracking and lane departure warning technologies are prevalent, accounting for a sizable share of system installations. North America and Europe lead the global market, supported by advanced automotive manufacturing ecosystems and stringent road safety norms. However, the Asia Pacific region is witnessing the fastest growth due to the booming automotive industry in countries such as China, India, and South Korea, along with increasing awareness of vehicular safety features.

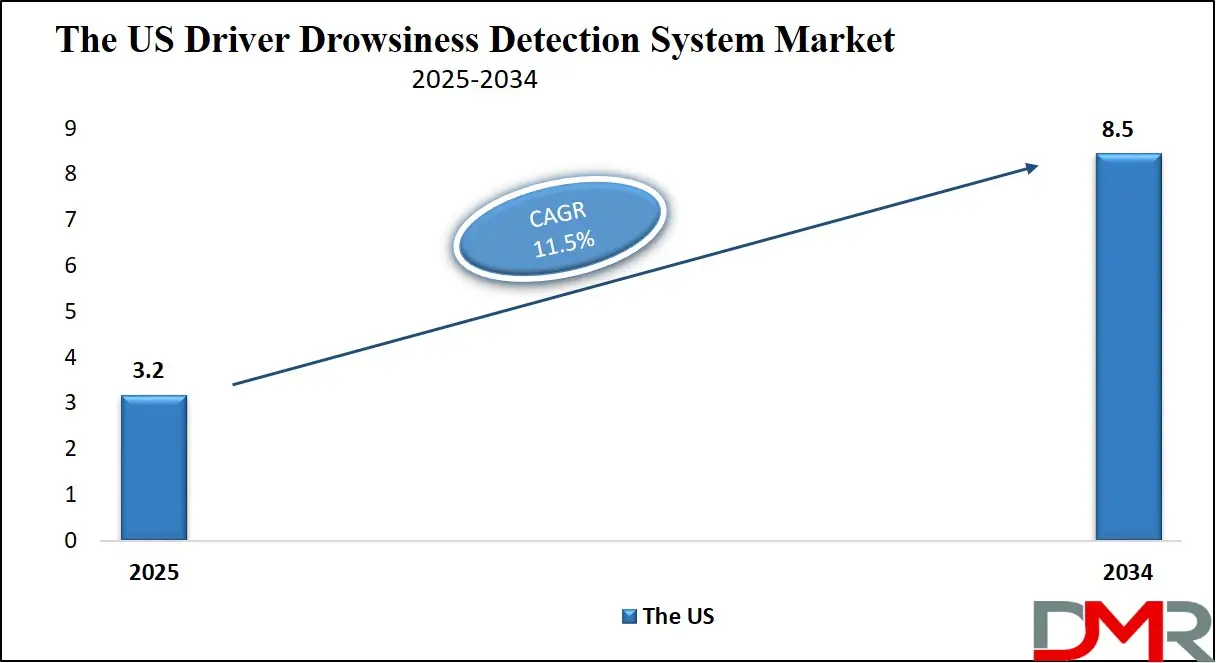

The US Driver Drowsiness Detection System Market

The US Driver Drowsiness Detection System Market is projected to reach USD 3.2 billion in 2025 at a compound annual growth rate of 11.5% over its forecast period.

In the United States, the driver drowsiness detection system market is growing in tandem with increasing attention toward road safety, automation, and driver health. The U.S. has long struggled with fatigue-related accidents, especially among long-distance drivers, night-shift workers, and those with untreated sleep conditions. Government estimates have identified drowsy driving as a critical public safety concern, contributing to thousands of crashes and preventable fatalities annually.

The U.S. demographic and geographic landscape adds complexity to this issue. A high volume of cross-country highway systems, long commutes in suburban and rural areas, and a significant percentage of commercial freight moved by road increase the risk of fatigue-induced incidents. With an aging population and a sizable workforce engaged in shift-based and transportation-related occupations, the need for proactive driver safety systems is substantial. Drowsiness detection technologies are now becoming standard in higher-end vehicles, with broader implementation expected as costs decline and regulations evolve.

Federal bodies and transportation agencies have begun exploring mandates for impaired and drowsy driving detection systems in all new passenger vehicles. These systems may include real-time monitoring of driver head position, eye movement, and steering behavior to detect early signs of fatigue or distraction. In parallel, commercial carriers and logistics companies are integrating these systems to comply with regulatory guidelines on hours-of-service (HOS) and to enhance safety scores under federal oversight.

The U.S. automotive sector's advanced R&D infrastructure, coupled with high consumer adoption of safety technologies, positions the country as a leader in integrating drowsiness detection systems into vehicle platforms. Emerging electric and autonomous vehicle manufacturers are particularly focused on using these systems to ensure fail-safe manual handovers and maintain driver readiness. Additionally, growing partnerships between automakers, tech companies, and AI developers are spurring the development of cost-effective and accurate detection systems for mass-market vehicles.

Looking forward, the U.S. market is likely to benefit from government-backed initiatives promoting safer roads, the expansion of connected vehicle platforms, and rising consumer awareness about the risks of fatigue. These factors, alongside favorable insurance and liability frameworks, are set to drive widespread adoption and innovation in drowsiness detection systems.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Driver Drowsiness Detection System Market

The Europe Driver Drowsiness Detection System Market is estimated to be valued at

USD 1.78 billion in 2025 and is further anticipated to reach

USD 3.55 billion by 2034 at a

CAGR of 8.0%.

The European market for driver drowsiness detection systems is rapidly maturing, fueled by progressive safety regulations, consumer demand for intelligent driving technologies, and the continent’s strategic goal of reducing traffic fatalities. Europe has been at the forefront of road safety innovation, with regulatory mandates requiring new vehicles to include advanced safety systems such as fatigue detection, automatic emergency braking, and lane-keeping assistance. This has led to a widespread and standardized integration of driver monitoring technologies across vehicle classes.

Demographically, Europe faces challenges such as urban congestion, aging populations, and extensive cross-border transportation, all of which elevate the need for proactive driver assistance systems. Long-haul truck drivers, bus operators, and night-shift employees represent a significant proportion of road users, heightening the risk of fatigue-related incidents. Countries like Germany, France, the Netherlands, and Sweden have robust transportation sectors, making them key adopters of these systems.

Automotive manufacturers in Europe, many of which are global leaders in innovation and safety, have accelerated the deployment of fatigue monitoring technologies. These include systems that track driver facial expressions, blink rates, and steering movements, providing visual and auditory alerts before drivers become dangerously fatigued. Integration with digital dashboards and navigation systems ensures that alerts are timely, non-intrusive, and easy to interpret.

In addition to legislative backing, public awareness campaigns across Europe emphasize the dangers of drowsy driving, encouraging voluntary use of such systems even in markets where regulations are not yet mandatory. National transport bodies are also supporting pilots and subsidies for commercial operators to adopt these technologies.

The Japan Driver Drowsiness Detection System Market

The Japan Driver Drowsiness Detection System Market is projected to be valued at USD 606 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 1.37 billion in 2034 at a CAGR of 9.5%.

Japan presents a unique and compelling case for the adoption of driver drowsiness detection systems, shaped by both demographic realities and its highly technological society. One of the most aging populations in the world, Japan is experiencing a rising number of road incidents involving elderly drivers. This demographic shift has pushed national and local governments to implement stringent vehicle safety initiatives, including policies promoting the integration of intelligent driver-monitoring systems.

The Japanese automotive sector is globally renowned for its innovation, with major automakers investing heavily in AI and biometric technologies. These advancements enable the development of fatigue monitoring solutions that analyze facial movements, eye closure rates, and even heart rate variability to detect early signs of drowsiness. Many Japanese passenger vehicles, especially premium and hybrid models, are already equipped with such systems, often integrated into broader ADAS suites that include lane-keeping and adaptive cruise control.

Commercial and public transportation operators in Japan are also adopting these systems to reduce fatigue-related risks among bus drivers, taxi operators, and logistics personnel. Given the country's high-density urban corridors and extensive intercity road network, driver alertness is critical to avoiding accidents and maintaining transit punctuality.

Japan’s emphasis on smart mobility and connected infrastructure further supports the integration of fatigue detection into next-generation vehicles. The government’s vision of creating a “Society 5.0”—where AI, IoT, and robotics are embedded into daily life—has accelerated funding for pilot projects and public-private partnerships aimed at advancing transportation safety technologies.

Additionally, Japan has cultivated a culture of preventive care and safety-first attitudes, making drivers more receptive to adopting new technologies. Local automakers are also exploring cloud-based systems that use driver behavior data to update fatigue risk models, offering proactive suggestions and alert mechanisms.

Global Driver Drowsiness Detection System Market: Key Takeaways

- Global Market Share Insights: The Global Driver Drowsiness Detection System Market size is estimated to have a value of USD 10.1 billion in 2025 and is expected to reach USD 28.7 billion by the end of 2034.

- The US Market Share Insights: The US Driver Drowsiness Detection System Market is projected to be valued at USD 3.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 8.5 billion in 2034 at a CAGR of 11.5%.

- Regional Insights: North America is expected to have the largest market share in the Global Driver Drowsiness Detection System Market with a share of about 37.5% in 2025.

- Key Players: Some of the major key players in the Global Driver Drowsiness Detection System Market are Bosch, Continental, Denso, Valeo, Autoliv, Magna, Aisin, Delphi, HELLA, ZF, Panasonic, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 12.2 percent over the forecasted period of 2025.

Global Driver Drowsiness Detection System Market: Use Cases

- Commercial Fleets: Fleet operators integrate driver drowsiness detection systems to monitor long-haul truck drivers in real-time. These systems help reduce accidents, improve driver accountability, and lower insurance costs, enhancing fleet safety and compliance with transport regulations.

- Consumer Vehicles: Automakers equip mid- to high-end vehicles with driver fatigue detection systems to enhance safety and user experience. These systems utilize steering inputs and facial tracking to alert drivers before fatigue-induced behavior causes potential hazards on highways or during night driving.

- Public Transportation: Municipal bus and rail operators deploy fatigue monitoring systems to ensure public safety. Real-time feedback mechanisms detect lapses in alertness, preventing drowsiness-related accidents and maintaining schedule reliability during long service hours or cross-regional operations.

- Healthcare and Sleep Clinics: Driver fatigue monitoring tools are used in medical rehabilitation programs, especially for patients with sleep disorders or neurological issues. Simulated driving tests with embedded detection systems help evaluate recovery progress and inform safe driving readiness assessments.

- Insurance and Telematics: Insurers use data from fatigue detection systems as part of telematics platforms to assess driver risk profiles. By offering lower premiums for safe driving behavior, companies incentivize adoption while also minimizing claims related to fatigue-driven road incidents.

Global Driver Drowsiness Detection System Market: Stats & Facts

National Highway Traffic Safety Administration (NHTSA), U.S. Department of Transportation

- Drowsy driving was responsible for 91,000 crashes, 50,000 injuries, and 800 deaths in the U.S. in 2017 alone.

- NHTSA estimates that fatigue-related crashes represent 2% of all accidents but are severely underreported, meaning the real number may be significantly higher.

- The highest risk group for drowsy driving is drivers under 25 years old, accounting for nearly 50% of drowsy-driving-related crashes.

European Commission – Mobility and Transport

- As part of the General Safety Regulation, the EU made it mandatory for all new cars sold in Europe from July 2022 onward to be equipped with driver drowsiness and attention warning systems.

- Fatigue contributes to 10% to 20% of all road crashes across Europe, according to EU transport safety reports.

- Driver Monitoring Systems (DMS) are considered essential for Level 2 and above automated driving, and their rollout is key to the EU’s Vision Zero plan, which targets zero road fatalities by 2050.

World Health Organization (WHO): Global Status Report on Road Safety

- WHO recognizes driver fatigue as a major behavioral risk contributing to road crashes, especially in low- and middle-income countries.

- Road traffic crashes are the leading cause of death among people aged 5–29, and fatigue is increasingly being studied as a key contributing factor.

- WHO has emphasized the importance of in-vehicle technologies like fatigue detection as part of the Decade of Action for Road Safety 2021–2030.

Japan National Police Agency (NPA)

- In 2022, approximately 3,590 road accidents in Japan were officially attributed to driver fatigue or sleepiness.

- The NPA reported that drivers over age 65 were involved in 58% of these fatigue-related incidents, highlighting the aging driver challenge.

Australian Transport Safety Bureau (ATSB)

- Fatigue is identified as a contributing factor in up to 30% of fatal road accidents in Australia.

- More than 80% of drivers involved in fatigue-related accidents had been driving continuously for more than 2 hours.

Transport Canada

- Driver fatigue contributes to approximately 20% of all fatal motor vehicle collisions in Canada each year.

- Transport Canada estimates that fatigue-related crashes result in over 400 deaths and 2,100 serious injuries annually.

International Transport Forum (ITF), OECD

- The ITF notes that advanced driver monitoring systems could reduce driver fatigue-related crashes by over 40%, especially in long-haul trucking.

- The organization encourages mandatory fatigue detection features in commercial vehicles by 2030 to meet sustainability and safety goals.

• Road Safety Authority (RSA), Ireland

- An RSA survey found that 1 in 5 drivers admitted to nodding off behind the wheel at least once.

- The risk of a fatigue-related crash increases fourfold after driving more than 4 hours without a break.

Global Driver Drowsiness Detection System Market: Market Dynamic

Driving Factors in the Global Driver Drowsiness Detection System Market

Mandatory Safety Regulations by Global and Regional Authorities

The implementation of binding safety regulations by regional and international transport authorities is a significant growth driver for the global driver drowsiness detection system market. The European Union’s General Safety Regulation mandates that all new passenger cars and light commercial vehicles sold from mid-2022 must include advanced safety features such as driver drowsiness and attention warning systems. Similarly, Japan’s Ministry of Land, Infrastructure, Transport and Tourism (MLIT) is pushing for expanded use of in-vehicle driver monitoring systems, especially for aging drivers and public transport operators. In the U.S., while not yet federally mandated, the National Transportation Safety Board (NTSB) has urged automakers to install drowsiness detection systems voluntarily as part of crash mitigation strategies.

These regulatory movements are propelling both original equipment manufacturers (OEMs) and Tier-1 suppliers to integrate fatigue-detection solutions across a wide range of vehicles, from entry-level sedans to luxury and commercial vehicles. The mandates are also driving innovation among component makers, encouraging the development of scalable, low-cost detection modules that comply with ISO 26262 and other automotive safety integrity level standards. As compliance becomes non-negotiable in multiple jurisdictions, automakers are investing in collaborative research and development efforts with AI firms and sensor manufacturers to embed intelligent drowsiness recognition into their digital cockpit architecture, creating a ripple effect across the entire automotive value chain.

Increasing Road Accidents Due to Fatigue and Behavioral Risk Factors

A sharp rise in global road accidents linked to fatigue and behavioral risks such as prolonged driving, insufficient rest, and distracted attention is catalyzing demand for robust drowsiness detection systems. According to various national road safety bodies such as NHTSA (U.S.), Transport Canada, and the Japan National Police Agency, fatigue is directly implicated in a significant share of serious road crashes, particularly those involving commercial and heavy-duty vehicles. Sleep-deprived drivers pose a similar risk profile to intoxicated drivers, with comparable levels of delayed reaction time, reduced attention span, and impaired judgment. In rapidly urbanizing economies, where longer commute times and 24/7 work schedules are common, the prevalence of driver fatigue is exacerbated by modern lifestyle stressors.

This driver behavior profile has become a key concern for public health and safety regulators, pushing automotive OEMs and technology suppliers to prioritize the deployment of real-time fatigue detection and intervention systems. Additionally, the growing awareness among consumers about the consequences of micro-sleep incidents, amplified by media coverage and public education campaigns, is translating into stronger consumer demand for vehicles equipped with fatigue monitoring. With AI and sensor miniaturization reducing the cost and complexity of implementation, these systems are becoming standard even in mid-range passenger vehicles, reinforcing their adoption and driving market expansion globally.

Restraints in the Global Driver Drowsiness Detection System Market

High Cost and Complexity of Advanced Drowsiness Detection Systems

Despite growing demand, the high initial cost and technological complexity of sophisticated driver drowsiness detection systems remain significant barriers to widespread adoption, particularly in price-sensitive markets. Systems that integrate high-resolution infrared cameras, AI-driven emotion recognition software, and multi-sensor fusion capabilities entail substantial hardware and software investments.

These solutions often require calibration, secure power management, real-time processing units, and integration with the vehicle’s CAN (Controller Area Network) bus and infotainment systems. For mid-tier and budget vehicle segments, the cost burden translates into either increased sticker price or reduced manufacturer margins, making OEMs hesitant to adopt such systems at scale.

Additionally, aftermarket deployment in existing vehicles is often limited by compatibility challenges, lack of retrofitting standards, and inadequate installation expertise. The integration of fatigue detection into ADAS frameworks or digital cockpits also introduces regulatory and cybersecurity compliance complexities, including GDPR adherence and OTA update vulnerabilities. Smaller vehicle manufacturers and commercial fleet operators may also lack the technical skill sets or financial capacity to implement these systems across their platforms.

Although the cost curve is expected to flatten as economies of scale are realized and AI chipsets become more affordable, the current high capital and integration requirements restrict the democratization of drowsiness detection technologies, limiting their reach primarily to premium automotive and enterprise fleet segments.

Privacy Concerns and Data Sensitivity Around Biometric Monitoring

One of the critical challenges facing the global driver drowsiness detection system market is growing public and institutional concern over privacy and ethical implications of biometric data collection. These systems, especially those equipped with facial recognition, eye-tracking, and pulse-monitoring sensors, collect continuous personal data that could potentially be misused if not adequately secured. In regions such as the European Union, where data privacy is strictly governed by the General Data Protection Regulation (GDPR), the use of in-cabin cameras and real-time biometric feedback must comply with strict consent and data processing laws.

Vehicle owners and drivers often express discomfort with the idea of being constantly recorded or monitored, fearing data breaches, misuse by insurers or employers, or potential surveillance overreach. These concerns have led to growing scrutiny over how fatigue data is stored, transmitted, and used—particularly in fleet management and ridesharing operations. Manufacturers and software providers must therefore invest in robust encryption, local (edge) processing architectures, and user-controlled data access settings to mitigate backlash.

Moreover, ethical debates are emerging around algorithmic bias in fatigue detection models trained on limited demographic datasets, raising questions about fairness, accuracy, and accountability. Unless these privacy issues are addressed through transparent policies and secure design practices, public hesitation may slow adoption rates, especially in democracies with strong civil liberty protections.

Opportunities in the Global Driver Drowsiness Detection System Market

Integration with Advanced Driver Assistance Systems (ADAS) and Autonomous Vehicles

The convergence of drowsiness detection systems with Advanced Driver Assistance Systems (ADAS) and autonomous vehicle frameworks represents a massive growth opportunity in the global market. As vehicles progress through various levels of autonomy, particularly Level 2 and Level 3, ensuring continuous driver engagement remains critical for system handover scenarios where human intervention is still necessary.

Drowsiness detection systems, especially those using eye-tracking, head-position analysis, and biometric inputs, are increasingly being incorporated as core modules within ADAS architectures. These systems are critical for monitoring driver alertness during highway autopilot operations, parking assistance, and lane centering functions. In the event of driver fatigue, systems can initiate alerts, gradual speed reduction, or even autonomous emergency braking.

Automakers like Tesla, BMW, Toyota, and Volvo are integrating fatigue detection with semi-autonomous driving features to ensure fail-safe operations and regulatory compliance. The growing research into human-machine interaction (HMI) in automotive design is also opening avenues for more intuitive drowsiness alerts using haptic steering, sound cues, and cabin lighting adjustments. Furthermore, the integration of fatigue detection with over-the-air (OTA) updates and cloud-based data analytics platforms provides automakers with a scalable method for continuous software improvement and user behavior analytics. As

autonomous vehicles become mainstream, the role of intelligent driver monitoring systems will only expand, making this integration a key opportunity area.

Expanding Use in Railways, Aviation, and Industrial Machinery Operations

Beyond the automotive sector, the application of driver drowsiness detection systems is expanding rapidly across other transportation and industrial verticals, including railway operations, aviation ground handling, and heavy machinery industries. In the rail sector, train operators often face extended working hours and high mental loads, particularly on overnight routes or in freight operations. Rail authorities in Europe, India, and Japan are piloting fatigue detection systems within locomotives to monitor train engineers and reduce human error-induced derailments and collisions. In aviation, drowsiness detection technologies are being adapted for ground vehicle operators on runways and for fatigue assessment in cockpit crew scheduling software.

Meanwhile, in the industrial domain, companies involved in mining, construction, oil & gas, and shipping are embedding fatigue detection sensors in control cabins of cranes, bulldozers, and marine vessels to prevent occupational hazards due to inattentiveness. Wearables integrated with cloud dashboards are being used to monitor biometric fatigue indicators like pulse rate, skin conductance, and eye closure frequency among shift workers. These multi-sector use cases provide enormous growth headroom for technology developers and sensor manufacturers, encouraging cross-sector partnerships and R&D diversification.

Trends in the Global Driver Drowsiness Detection System Market

Integration of AI-Powered Eye-Tracking and Facial Recognition Technologies

A major trend driving innovation in the global driver drowsiness detection system market is the integration of AI-based eye-tracking and facial recognition technologies into advanced driver monitoring systems (DMS). These systems use near-infrared cameras, facial mapping algorithms, and biometric analytics to track eyelid movement, eye closure duration (PERCLOS), head positioning, and facial expressions in real time.

The AI engine processes subtle variations in driver behavior to issue fatigue or micro-sleep alerts before a critical loss of alertness occurs. This trend is particularly significant in luxury vehicles and commercial fleets, where enhanced safety and predictive analytics are paramount. Automakers are integrating such intelligent systems not only for drowsiness detection but also for driver engagement evaluation in semi-autonomous and ADAS-enabled vehicles.

Leading manufacturers are adopting sensor fusion techniques, combining data from interior cameras, steering patterns, and biometric feedback to enhance accuracy and responsiveness. With regulatory authorities such as the EU mandating the installation of DMS in all new cars from 2022 onward, the demand for smart, AI-powered detection technologies is expected to surge. Additionally, automakers in Asia-Pacific and North America are embedding these systems into electric vehicles (EVs) and connected car platforms as part of broader digital cockpit upgrades, further reinforcing the trend toward proactive, intelligent safety systems that can anticipate and prevent fatigue-related crashes with minimal false positives.

Rise of Drowsiness Detection Systems in Commercial and Fleet Vehicles

The growing implementation of driver drowsiness detection systems in commercial and logistics fleets marks a pivotal trend reshaping the market. Transportation and logistics companies are increasingly adopting these technologies to ensure driver vigilance during long-haul operations, reduce accidents caused by fatigue, and comply with tightening regulatory safety norms. In sectors such as mining, oil & gas, freight, and public transit, operators are under pressure to reduce liability and safeguard personnel operating heavy machinery or buses over extended periods. Drowsiness detection systems in this segment often include cabin-facing cameras, ECG-based wearables, and connected cloud platforms to monitor driver alertness in real time and notify fleet managers in case of detected fatigue.

Real-time alerts are further analyzed through telematics platforms, enabling predictive scheduling, optimized rest periods, and incident risk reduction. Additionally, several insurance providers are offering reduced premiums for fleets equipped with fatigue monitoring, pushing broader adoption. This trend is also driven by government incentives and regulatory push in countries like Japan, Australia, Germany, and the U.S., where fatigue-related accidents are a major concern. The trend is especially prevalent in autonomous delivery vehicle prototypes and logistics automation trials, where human oversight is still required for intervention. The increasing intersection of fleet management systems, safety protocols, and biometric monitoring highlights the crucial role of drowsiness detection systems in enterprise mobility and logistics innovation.

Global Driver Drowsiness Detection System Market: Research Scope and Analysis

By Product Type Analysis

The hardware devices segment is expected to dominate the global driver drowsiness detection system market due to its critical role in real-time data acquisition and precise detection. Hardware components such as steering sensors, cameras, eye-tracking sensors, and pressure sensors offer immediate, tangible interaction with the vehicle environment, enabling accurate and continuous monitoring of driver behavior. These sensors track indicators like eye closure rate, head position, lane deviation, and steering patterns to determine fatigue levels, thus facilitating early warning mechanisms. The high sensitivity and real-time responsiveness of hardware solutions ensure their central role in systems designed to prevent accidents caused by drowsiness.

Additionally, advancements in embedded vision systems, image recognition processors, and biometric sensors have further strengthened the demand for hardware-based solutions. Automotive OEMs integrate these components into advanced driver assistance systems (ADAS) to comply with regulatory mandates focused on road safety. For example, the European Union’s General Safety Regulation mandates the integration of driver drowsiness warning systems in all new vehicle types from 2022, with hardware components being the primary enablers of compliance.

Moreover, hardware devices offer high reliability and low latency, making them preferable over software-only solutions, especially in critical safety applications. Although software is essential for analysis and alert logic, it depends on the robust data flow from hardware components. Fleet operators and premium passenger car manufacturers prioritize hardware-intensive systems to enhance road safety, minimize liability, and build consumer trust. As a result, the hardware devices segment continues to dominate the product type category of this market.

By Vehicle Type Analysis

The passenger cars segment is projected to dominate the global driver drowsiness detection system market primarily due to increased consumer awareness of road safety, regulatory mandates, and the growing integration of advanced driver assistance systems (ADAS) in private vehicles. With rising concerns about fatigue-related accidents, especially during long commutes or nighttime driving, automakers have increasingly adopted drowsiness detection systems in mid-range and premium passenger vehicles. This is further driven by the prioritization of safety features among consumers who are willing to invest in advanced technologies to protect themselves and their families.

In many developed markets such as North America, Europe, and Japan, government regulations require or recommend the inclusion of driver monitoring systems in newly manufactured passenger vehicles. For instance, the European Union’s 2022 General Safety Regulation has made driver drowsiness detection mandatory in all new vehicle types, with a particular focus on passenger cars that constitute the largest share of on-road vehicles. The regulatory push, combined with consumer preference for smart safety solutions, has catalyzed widespread adoption.

Moreover, luxury and premium car manufacturers such as BMW, Audi, Volvo, and Mercedes-Benz have been pioneers in integrating drowsiness detection systems, creating a trickle-down effect across the automotive industry. As more affordable models adopt these features, the passenger car segment continues to capture the largest market share. Additionally, the increase in urbanization, disposable income, and vehicle ownership in emerging markets is further boosting the sales of passenger cars equipped with such safety systems. Thus, this segment leads due to a combination of regulatory pressure, consumer demand, and OEM commitment to safer driving experiences.

By System Type Analysis

The lane departure warning (LDW) system type is poised to dominate the global driver drowsiness detection system market because of its effective method for identifying fatigue-induced driving behavior and its widespread adoption in ADAS packages. LDW systems use cameras mounted on the windshield or rear-view mirror to monitor road markings and determine whether a vehicle is unintentionally drifting out of its lane—a common indicator of drowsiness. These systems offer real-time alerts via visual, audible, or haptic feedback, such as steering wheel vibrations, enabling immediate driver correction.

One of the key reasons for LDW dominance is its integration into a wide range of vehicle classes—from entry-level to luxury models. LDW technology has matured to become highly reliable and cost-effective, making it a preferred choice for manufacturers aiming to meet safety mandates without significantly increasing production costs. The European Union’s and NHTSA’s vehicle safety regulations strongly advocate the adoption of lane-keeping and departure warning systems, making LDW a core component of compliance strategies in both developed and emerging markets.

Moreover, LDW systems offer dual functionality: while primarily developed to ensure lane discipline, they also act as indirect fatigue detectors by flagging erratic driving patterns. This multi-purpose capability enhances their value proposition and return on investment. Automakers often integrate LDW with other drowsiness detection technologies such as steering pattern monitoring and biometric analysis, creating a comprehensive driver monitoring system. Given their efficacy, affordability, and regulatory support, lane departure warning systems have emerged as the dominant system type in the global market for driver drowsiness detection technologies.

The Global Driver Drowsiness Detection System Market Report is segmented on the basis of the following:

By Product Type

- Hardware Devices

- Software Systems

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By System Type

- Lane Departure Warning

- Driver Fatigue Monitoring

- Driver Distraction Monitoring

Global Driver Drowsiness Detection System Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to dominates the global driver drowsiness detection system market as it holds 37.5% of market share by the end of 2025, due to its early adoption of advanced driver assistance systems (ADAS), strong automotive manufacturing base, and stringent safety regulations. The United States, in particular, has prioritized road safety through various National Highway Traffic Safety Administration (NHTSA) initiatives that promote the integration of drowsiness detection technologies in new vehicles. A high rate of private vehicle ownership, long-distance commuting patterns, and a large aging driver population further amplify the need for fatigue monitoring systems.

Automakers such as General Motors, Ford, and Tesla have embedded driver monitoring capabilities in their semi-autonomous and electric vehicle lineups, expanding market penetration. Moreover, the region’s mature infrastructure supports the widespread deployment of camera-based and sensor-based systems, and insurance companies are increasingly offering premium discounts for cars equipped with such technologies. Fleet operators and logistics companies are also investing heavily in safety upgrades to mitigate liability and protect driver welfare, reinforcing North America’s leadership in market revenue share.

Region with the Highest CAGR

Asia-Pacific is witnessing the highest compound annual growth rate (CAGR) in the driver drowsiness detection system market, driven by rapid urbanization, increasing vehicle production, and heightened government focus on road safety. Countries like China, India, Japan, and South Korea are experiencing a surge in vehicle ownership, leading to a growing demand for in-vehicle safety features.

Governments across the region are launching initiatives to mandate ADAS features in new vehicles, including drowsiness detection systems. For example, Japan has adopted stricter safety protocols, and China is actively pushing for smart vehicle technologies as part of its intelligent transport system (ITS) development.

Additionally, rising disposable incomes and increasing awareness about accident prevention are encouraging consumers to opt for safety-enhanced vehicles. The rapid expansion of ride-hailing services and commercial logistics is also fueling demand for fatigue monitoring tools in fleet management. Combined with the region’s dynamic automotive sector and ongoing smart mobility projects, Asia-Pacific is set to record the fastest market expansion over the forecast period.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Driver Drowsiness Detection System Market: Competitive Landscape

The competitive landscape of the global driver drowsiness detection system market is characterized by a mix of well-established automotive suppliers, OEMs, and tech firms competing on innovation, integration capabilities, and regulatory compliance. Leading players such as Bosch, Continental AG, Denso Corporation, Valeo, and Aptiv dominate the space with comprehensive portfolios of driver monitoring systems embedded within broader ADAS suites.

These companies leverage strong R&D investments and long-standing relationships with major automotive manufacturers to secure high-volume contracts and pilot emerging sensor technologies like in-cabin radar, infrared cameras, and facial recognition.

Startups and niche firms specializing in AI-driven fatigue detection such as Smart Eye, Seeing Machines, and Affectiva—are also gaining traction, particularly in the premium and electric vehicle segments where human-machine interaction is central. Competitive differentiation is increasingly defined by algorithm accuracy, system responsiveness, and cross-functional integration with infotainment and autonomous driving systems.

Strategic collaborations between Tier 1 suppliers and automakers are accelerating product commercialization and regulatory alignment, especially in markets enforcing ADAS mandates. As automotive technology converges with AI and IoT, the competitive focus is shifting toward scalable, cloud-enabled, and driver-adaptive solutions, driving continuous innovation in this rapidly evolving market landscape.

Some of the prominent players in the Global Driver Drowsiness Detection System Market are:

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Valeo

- Autoliv Inc.

- Magna International Inc.

- Aisin Seiki Co., Ltd.

- Delphi Technologies

- HELLA GmbH & Co. KGaA

- ZF Friedrichshafen AG

- Panasonic Corporation

- Aptiv PLC

- Visteon Corporation

- Harman International Industries, Inc.

- Hyundai Mobis

- Gentex Corporation

- Faurecia

- Seeing Machines Ltd.

- Smart Eye AB

- Tobii AB

- Other Key Players

Recent Developments in Global Driver Drowsiness Detection System Market

April 2025

- Denso Corporation showcased its upgraded in-cabin driver monitoring platform during the Auto Shanghai 2025 Expo, integrating fatigue recognition via infrared and facial expression mapping.

- Hyundai Mobis announced the investment of USD32 million into its advanced sensing R&D division, accelerating drowsiness detection algorithms tailored for Level 2+ autonomous vehicles.

February 2025

- Continental AG partnered with Seeing Machines to integrate AI-powered eye and head movement tracking into its multi-modal driver alert systems aimed at EV and premium passenger car markets.

- Smart Eye AB launched its Driver Monitoring Software 3.5, offering enhanced sleepiness scoring accuracy based on biometric deviations and prolonged eyelid closure.

November 2024

- The ITS World Congress 2024 (Dubai) spotlighted next-gen driver state monitoring technologies, with live demonstrations from Bosch, Magna, and Valeo, emphasizing modular integration with existing ADAS architectures.

- Affectiva, a subsidiary of Smart Eye, entered a strategic partnership with Mitsubishi Electric, aiming to expand AI-driven drowsiness detection into mass-market Asian vehicles by 2026.

September 2024

- Magna International Inc. acquired a minority stake in a Japan-based sensor fusion startup focusing on low-light driver fatigue detection, expanding its footprint in Asia-Pacific smart mobility.

- Nissan initiated in-vehicle pilot testing of next-gen driver alert systems embedded with machine learning capabilities that predict micro-sleep patterns using long-term biometric data.

July 2024

- The Euro NCAP Summer Session 2024 outlined its roadmap for mandatory DMS inclusion by 2026, directly influencing Tier 1 suppliers and OEMs to advance non-intrusive driver drowsiness solutions.

- Bosch introduced a hybrid hardware-software cockpit platform capable of running real-time fatigue prediction models, targeting deployment in 2025 vehicle series.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 10.1 Bn |

| Forecast Value (2034) |

USD 28.7 Bn |

| CAGR (2025–2034) |

12.2% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 3.2 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Hardware Devices And Software Systems), By Vehicle Type (Passenger Cars And Commercial Vehicles) And By System Type (Lane Departure Warning, Driver Fatigue Monitoring, And Driver Distraction Monitoring) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Bosch, Continental, Denso, Valeo, Autoliv, Magna, Aisin, Delphi, HELLA, ZF, Panasonic, Aptiv, Visteon, Harman, Hyundai Mobis, Gentex, Faurecia, Seeing Machines, Smart Eye, and Tobii., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the Global Driver Drowsiness Detection System Market?

▾ The Global Driver Drowsiness Detection System Market size is estimated to have a value of USD 10.1 billion in 2025 and is expected to reach USD 28.7 billion by the end of 2034.

Who are the key players in the Global Driver Drowsiness Detection System Market?

▾ Some of the major key players in the Global Driver Drowsiness Detection System Market are Bosch, Continental, Denso, Valeo, Autoliv, Magna, Aisin, Delphi, HELLA, ZF, Panasonic, and many others.