E-fuels have quickly emerged as a cornerstone of global decarbonization efforts, especially within industries where electrification remains challenging such as aviation, shipping and heavy transport. Produced through water electrolysis with carbon capture using renewable energy sources like hydropower plants or biomass pellets from forests; their compatibility makes e-fuels an attractive near-term option for industries looking for ways to transition toward cleaner energy without significant overhaul of existing systems or engines.

E-fuels hold enormous promise but face significant hurdles, including high production costs and scaling restrictions. E-fuel production remains energy intensive; high renewable energy costs further limit widespread adoption; the short term will probably see their use concentrated within high value sectors like aviation where alternatives fuels may be limited in supply; eventually however advancements in production technology, decreasing cost for renewables energy resources and supportive regulatory environments will unlock wider market potential for this fuel type.

Senior leaders - such as VPs, CEOs and product managers--find that e-fuels present both opportunities and strategic challenges to them in their roles as executives and product managers. Innovation through technologies, partnerships and infrastructure investments will be necessary in this developing sector to capture value as industries seek to meet emissions targets while meeting regulatory pressures; those that adopt and scale e-fuels early may gain an edge by meeting long-term sustainability goals while meeting rising consumer and stakeholder demand for cleaner energy solutions.

Key Takeaways

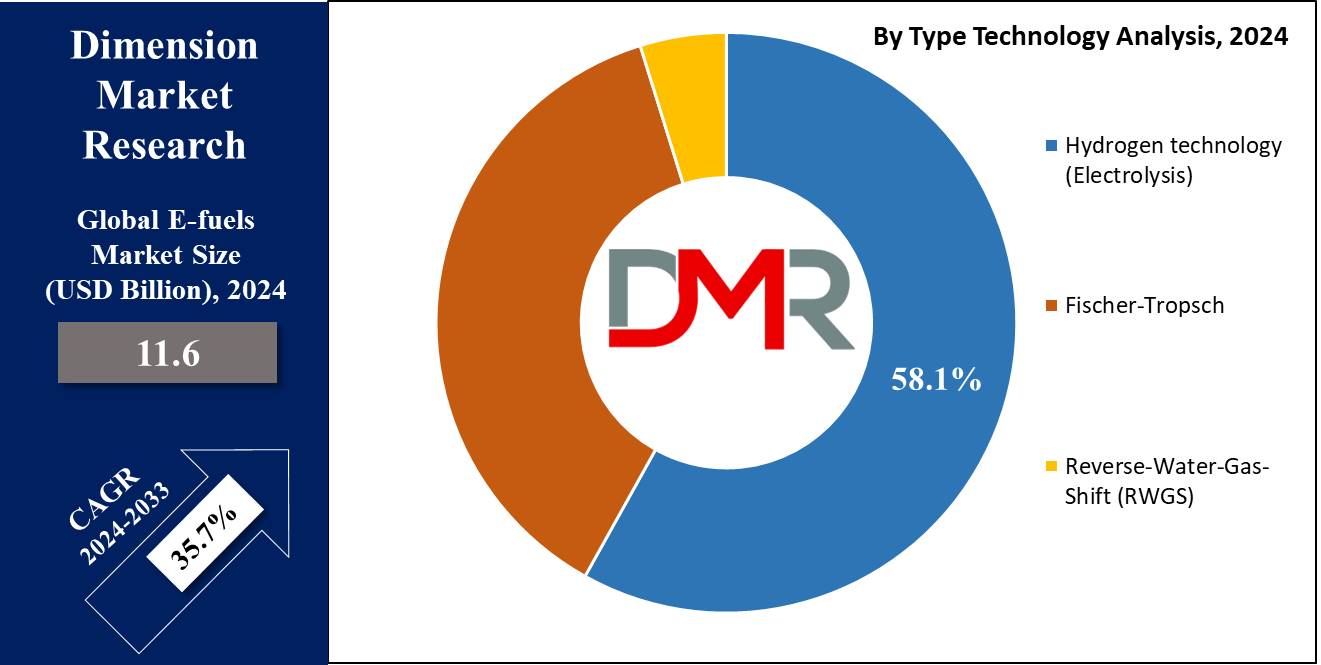

- Global E-fuels Market reach a value of USD 181.2 Bn in 2033 at a CAGR of 35.7%.

- Liquid e-fuels held the largest share, over 78.1% in 2023

- Hydrogen electrolyzer technology was the clear market leader in 2023 with 58.1% market share

- Power-to-liquid technology is dominating the production methods segment, accounting for over 34.1% of the market share in 2023

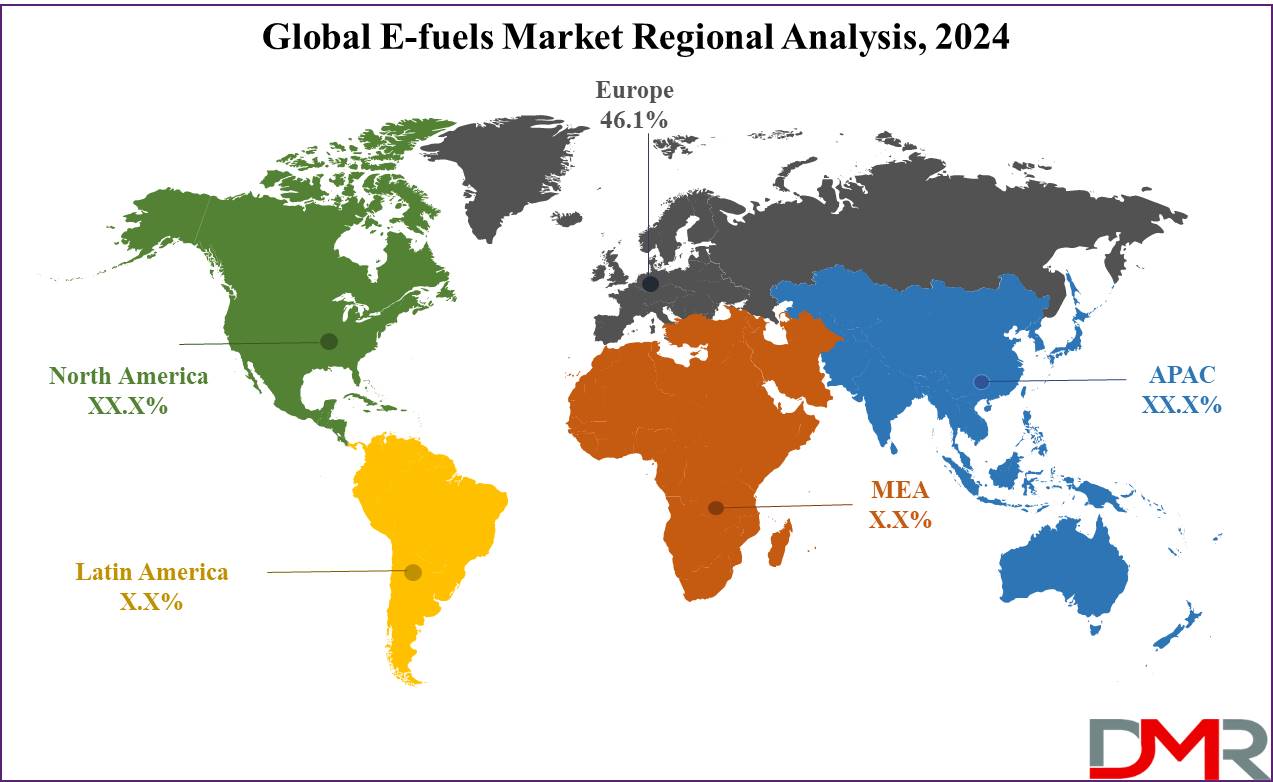

- Europe led the e-fuels market in 2023, capturing 46.1% of the market share

Use Cases

- Aviation: E-fuels reduce emissions in aviation by acting as drop-in replacements for jet fuel and helping airlines meet net-zero targets without engine modifications.

- Shipping: E-fuels such as eMethanol and eDiesel enable sustainable shipping by cutting emissions while using existing engines and infrastructure.

- Industrial Heating: Hydrogen-based e-fuels power high temperature industrial processes while decreasing carbon emissions across steel and chemical production industries.

- Heavy-Duty Transport: E-fuels offer long-haul trucks an alternative fuel that lowers emissions without necessitating new infrastructure investments.

- Remote Power Generation: E-fuels offer remote areas a reliable power solution by storing renewable energy sources while decreasing fossil fuel use.

Driving Factors

Decarbonization Objectives Are Fuelling Demand for Carbon-Neutral Fuels

Global decarbonization efforts, particularly those within transportation and aviation industries, have become a primary force driving growth of e-fuels markets. Many industries face increasing pressure to lower greenhouse gas emissions while meeting stringent regulatory compliance regulations. As part of their plans to achieve net-zero carbon emissions by 2050, airlines should explore sustainable fuels such as e-fuels. As traditional electrification options remain unsuitable for long-haul transport, e-fuels provide a carbon-neutral option which can easily integrate with existing infrastructure. As regulations push adoption of this alternative fuel in higher emission sectors, its adoption could accelerate significantly.

Transition of Energy Drives Interest for Synthetic Fuels

Transition from fossil to renewable sources of energy has also played a pivotal role in fueling growth for e-fuels market. Governments and companies alike are investing in clean energy transitions, with synthetic fuels playing an essential part in decarbonizing sectors which cannot easily be electrified. This change coincides with larger trends toward sustainability, as stakeholders work towards reducing carbon footprints and transitioning toward renewable-based energy systems. By 2030, renewable energy could account for 50% of worldwide electricity production according to estimates by the International Energy Agency (IEA). This shift creates an ideal setting for e-fuels utilizing renewable energy as sources to create sustainable synthetic fuel alternatives.

Increased Renewable Energy Capacity Allows E-fuel Production

Renewable energy infrastructure growth is having a direct effect on the feasibility and scaleability of

electronic fuel production. As countries expand their solar, wind, hydropower capacity to provide renewable electricity needed in water electrolysis process used in producing electronic fuels increases significantly. By 2025 global renewable capacity should have grown 60% as result of government support as well as declining costs of renewable technology; providing producers with access to low carbon sources as they manufacture decarbonizing products that contribute towards global decarbonization goals.

Growth Opportunities

Aviation and Maritime Sectors Offer Significant Opportunities

E-fuels offer an alternative approach for hard-to-decarbonize sectors that cannot currently benefit from electrification due to weight and energy density issues, providing viable decarbonization alternatives with their use being possible within such constraints. Now that the International Maritime Organization (IMO) and International Civil Aviation Organization (ICAO) have set stringent emission reduction goals, e-fuels may play a vital part in helping these industries meet long-term sustainability objectives. As regulations tighten further, demand will undoubtedly grow resulting in potential growth prospects for this market segment.

Rising Demand for Carbon-Neutral Products Fuels Market Expansion

Consumer and corporate demand for carbon-neutral and eco-friendly products continues to soar, creating fertile ground for expansion of the e-fuels market in 2023. Businesses are under greater scrutiny to adopt sustainable practices; many have implemented net zero carbon strategies; this trend is driving cleaner energy sources including e-fuels across various sectors as companies strive to lower their carbon emissions footprints with near-zero emission potential e-fuels offering. E-fuels' appeal also aligns well with emerging sustainability trends establishing them as key players in energy transition processes e-fuels' place among energy transition technologies.

Support From International Climate Funds Decreases Financial Barriers

Accessing international climate finance such as the Green Climate Fund in 2023 represents an extraordinary opportunity for the e-fuels market. Such funds can reduce financial barriers associated with creating electronic fuel production facilities, enabling greater scalability. Likewise, government investments and climate-focused funds should help accelerate commercialization by offsetting high production costs, encouraging innovation, and encouraging greater market adoption of such fuels.

Key Trends

EU's Green Deal Accelerates E-Fuels Development

In 2023, the European Union's Green Deal is a key driver shaping the e-fuels market. As part of its ambitious climate goals - which include reaching carbon neutrality by 2050 - the EU Green Deal puts strong emphasis on decarbonizing hard-to-electrify sectors like transportation and heavy industry, among other measures. Recently-introduced emissions targets affecting aviation and maritime transportation is prompting increased investment into synthetic fuels like e-fuels. The European Commission's "Fit for 55" package, with its goal to reduce greenhouse gas emissions by 55% by 2030, also promotes the use of alternative fuels within their overall clean energy transition strategy. This regulatory momentum in Europe sets off rapid advancements in the production and infrastructure of this renewable form of energy production while offering opportunities for businesses to align themselves to these standards.

Prioritize Renewable Energy Use in Production Processes with Electricification of Production Procedures

A significant trend in 2023 is the growing focus on electrifying e-fuel production processes, utilizing renewable electricity to achieve true carbon neutrality. This shift is most evident in countries boasting abundant renewable energy resources, like those located in Scandinavia and Western Europe. Integrating renewable energies, like solar and wind power, into e-fuel production not only meets global decarbonization goals but can also lower production costs as renewables become more affordable. countries with abundant renewable energy capacity are leading the charge in adopting electrified e-fuel production processes, becoming pioneers of this emerging market and setting benchmarks for responsible global fuel production.

Restraining Factors

High production costs limit market scalability

E-fuel production costs pose a formidable obstacle to market expansion. E-fuel manufacturing involves energy intensive processes like electrolysis and carbon capture that rely on renewable resources as well as advanced technology; both of which come at considerable expense today. Recent estimates reveal that producing electronic fuels could cost as much as four times more than producing conventional ones, due to the high energy input necessary. Although renewable energy prices are slowly declining, their current cost disparity makes e-fuels less cost-competitive compared to traditional fossil fuels, particularly for industries like aviation and shipping that operate with tight margins that are highly price sensitive. Until technological advancements or economies of scale reduce production costs significantly, widespread adoption of e-fuels may remain limited - particularly among markets which place greater value on price sensitivity.

Competition from Carbon Alternatives Retains Demand for Sustainable Transportation Solutions

E-fuels face strong competition from alternative, lower carbon energy solutions like electric vehicles (EVs), hydrogen, and biofuels that offer promising strategies for decarbonization across various sectors.

Electric Vehicles (EVs) have seen rapid adoption within the automotive sector due to falling battery prices, government incentives and growing charging infrastructure. BloombergNEF estimates that by 2040 EV sales could account for 58% of worldwide passenger car sales worldwide and thus reduce demand for e-fuels within road transport. Green hydrogen has recently gained ground as an attractive clean fuel solution in heavy industry and transportation sectors while biofuels continue to make inroads into sectors with mandated blending such as aviation.

Research Scope and Analysis

By State

Liquid e-fuels were the clear market leader in 2023 in the State segment of e-fuels market, accounting for more than 78.1 % market share overall. Their dominance can be attributed to widespread usage as drop-in replacements for traditional liquid fuels in aviation and shipping sectors where infrastructure, combustion technologies and engine systems already support handling liquid fuels; further reinforced by being compatible with storage, distribution and engine systems already present and making them the favored solution in hard-to-decarbonize sectors like aviation or shipping industries that already use liquid fuels exclusively.

Gas-based e-fuels have also experienced impressive growth due to advances in hydrogen and methane-based e-fuel technology that is being increasingly considered for applications like heating industrial facilities or road transportation. Although gas based e-fuels accounted for only a minority share in 2023 state segments, their market presence should increase with ongoing hydrogen infrastructure developments worldwide and continued focus on industrial applications powered by natural gas engines that drive their use - likely driving demand for such gas-powered industrial applications and propelling their use further forward over time.

By Technology

Hydrogen electrolyzer technology was the clear market leader in 2023 for the technology segment of e-fuel market in terms of market share. This can be attributed to increased focus on green hydrogen production as an essential feedstock, using renewable electricity for electrolysis to split water into hydrogen and oxygen using electrolysis technology. Furthermore, increased availability of renewable electricity coupled with advances in electrolysis technology made hydrogen more readily accessible e-fuel options particularly in sectors like aviation and heavy transport where hydrogen plays a crucial role in reaching carbon neutrality goals.

Fischer-Tropsch technology ranks second as a key player in the e-fuels market. This method involves synthesizing liquid hydrocarbons using hydrogen and carbon monoxide, to produce similar to fossil-based synthetic fuels. Fischer-Tropsch process has gained favor for use by aviation and shipping industries to produce high-quality liquid fuels that can be utilized by existing engines and infrastructure; its market share continues to expand due to rising industry investment into low carbon alternatives for fuel.

Reverse-Water-Gas-Shift (RWGS) technology, although representing only a minority share of the market, is quickly growing increasingly popular due to its ability to convert carbon dioxide to carbon monoxide for use alongside hydrogen in Fischer-Tropsch process. RWGS can therefore serve as an essential carbon capture and utilization (CCU) method in E-fuel production to help decrease its overall carbon intensity of supply chain operations.

By Production Method

Power-to-Liquid held an unprecedented 34.1% market share for production method in 2023 in terms of global e-fuel sales, dominating its segment as an Ethanol Fuel Alternative Production Method. This production method involves turning renewable electricity into liquid fuels using hydrogen and carbon dioxide and is rapidly increasing its adoption due to its ability to provide synthetics compatible with existing infrastructure in both aviation and shipping sectors - particularly among aircraft operators and shipping lines. Power-to-Liquid also stands out due its seamless integration into current logistic and storage systems without significant modifications necessary; replacing fossil fuels directly without major modifications necessary in many cases!

Power-to-Gas is becoming an increasingly popular alternative fuel option, particularly among sectors focused on hydrogen and synthetic methane e-fuels such as hydrogen or synthetic methane-based vehicles. This technique involves using renewable electricity to convert it to gaseous fuels like hydrogen or synthetic methane for use in heating industrial settings or road transport vehicles; such technologies have proven important as hydrogen infrastructure expands worldwide - further cementing Power-to-Gas' rise, especially where plentiful renewable resources exist.

GTL technology plays an essential role in the market for electronic fuels. GTL allows manufacturers to convert gaseous hydrocarbons to liquid fuels using Fischer-Tropsch synthesis processes; this method primarily used to manufacture premium liquid fuels used by aviation sectors as it delivers maximum energy density with engine compatibility requirements being of primary concern.

Bioethanols may make up only a minor segment of the market for electronic fuels; nonetheless they contribute by using biomass or organic waste feedstock as production feedstock and thus offering another path toward decarbonisation despite scaling issues and supply constraints.

The E-fuels Market Report is segmented based on the following:

By Renewable Source

By Fuel Type

- E-methane

- E-kerosene

- E-methanol

- E-ammonia

- E-diesel

- E-gasoline

By State

By Technology

- Hydrogen technology (Electrolysis)

- Fischer-Tropsch

- Reverse-Water-Gas-Shift (RWGS)

By Production Method

- Power-to-Liquid

- Power-to-Gas

- Gas-to-Liquid

- Biologically derived fuels

By End-Use Application

- Transportation

- Chemicals

- Power generation

- Others

Regional Analysis

Europe dominated the global e-fuels market in 2023 with 46.1% market share due to strong regulatory support, aggressive decarbonization goals, and advanced infrastructure for renewable energy sources. European Union policies such as Green Deal and "Fit for 55" set stringent emissions targets while increasing investments into production for aviation and maritime applications; countries like Germany, Norway and France lead this region's expansion through improvements to hydrogen infrastructure as well as synthetic fuel technologies.

North America is another key region in terms of e-fuels market size and growth, with both the United States and Canada leading in adopting renewable energy solutions. U.S. investment in clean energy along with incentives for sustainable aviation fuel (SAF) development should help push further market development forward. Furthermore, private players have increasingly shown interest due to favorable policies as demand for carbon neutral fuels continues to increase throughout this region.

Japan, China and South Korea have made impressive advances in e-fuel research and development over recent years, particularly their increasing focus on hydrogen economy development - particularly Japan and South Korea's respective efforts - that make the region key players of tomorrow. Furthermore, China's massive renewable energy expansion further supports production of e-fuels.

Latin America and Middle East/Africa represent emerging e-fuel markets driven by increased renewable energy capacity. Brazil's emphasis on biofuel production, while UAE investments in hydrogen production highlight potential growth prospects within these regions; though they currently make up less market share compared to Europe and North America.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

In 2023, the global e-fuels market is being driven by numerous influential players with each bringing unique technologies, innovations, and strategies that fuel its development. Clean Fuels Alliance America continues to play an essential role, championing initiatives related to biodiesel and renewable diesel which aligns well with this emerging sector's overall goals. Archer Daniels Midland Co is capitalizing on their expertise by integrating bio-based feedstocks into this emerging sector as they aspire to become key players within the biologically derived e-fuels market positioning themselves as key players among biologically produced E-Fuels market participants.

On the technological front, Ballard Power Systems and Ceres Power Holding Plc are making strides forward with their hydrogen fuel cell technologies to support production of hydrogen-based e-fuels, improving both efficiency and scalability in production processes. Meanwhile, Climeworks AG leads in carbon capture technologies, offering essential infrastructure necessary for CO2 capture that plays an integral part of e-fuel synthesis processes.

E-Fuel Corporation and eFuel Pacific Limited specialize in developing scalable e-fuel production technologies with the aim of offering carbon neutral fuels at competitive prices. Meanwhile, Hexagon Agility's gas storage and transportation solutions simplify distribution logistics of such gaseous e-fuels as hydrogen or others.

Neste and Norsk e-Fuel AS stand out for their pioneering efforts in synthetic fuel production. Neste's expertise in renewable diesel production and sustainable aviation fuel, combined with Norsk e-Fuel AS' leadership of Power-to-Liquid technology make them integral parts of market's ongoing evolution.

Some of the prominent players in the Global E-fuels Market are:

- Clean Fuels Alliance America

- Archer Daniels Midland Co.

- Ballard Power Systems, Inc.

- Ceres Power Holding Plc

- Climeworks AG

- E-Fuel Corporation

- eFuel Pacific Limited

- Hexagon Agility

- Neste

- Norsk e-Fuel AS

Recent developments

- In 2024, HIF Global appointed Argentina-based Techint Engineering and Construction (Techint E&C) to design Chile's inaugural large-scale electro-fuel plant; Techint was responsible for conceptual design as well as Front-End Engineering Design (FEED).

- Project Pathfinder by Infinium Energy unveiled a commercially-scale green hydrogen e-fuel production facility, using captured CO2 and green hydrogen produced through an exclusive process in Corpus Christi, Texas in March 2024.

- In 2023, Saudi Aramco and Stellantis joined forces to conduct field trials of electronic fuels at European engine facilities, furthering their work toward finding lower carbon energy solutions for vehicles.

- March 2023: Uniper and Liquid Wind have joined forces to develop carbon-neutral shipping using eMethanol; their first production facility can now be found in Sweden with them being the second-largest investors.

- In 2023, Siemens Energy joined Liquid Wind to produce e-Fuel to reduce shipping emissions while providing investment, technology and expertise toward building an e-Methanol facility.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 11.6 Bn |

| Forecast Value (2033) |

USD 181.1 Bn |

| CAGR (2024-2033) |

35.7% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Renewable Source(Solar, Winds, others), By Fuel Type(E-methane, E-kerosene, E-methanol, E-ammonia, E-diesel, E-gasoline), By State(Gas, Liquid), By Technology(Hydrogen technology (Electrolysis), Fischer-Tropsch, Reverse-Water-Gas-Shift (RWGS)), By Production Method(Power-to-Liquid, Power-to-Gas, Gas-to-Liquid, Biologically derived fuels) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Clean Fuels Alliance America, Archer Daniels Midland Co., Ballard Power Systems, Inc., Ceres Power Holding Plc, Climeworks AG, E-Fuel Corporation, eFuel Pacific Limited, Hexagon Agility, Neste, Norsk e-Fuel AS |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |