Market Overview

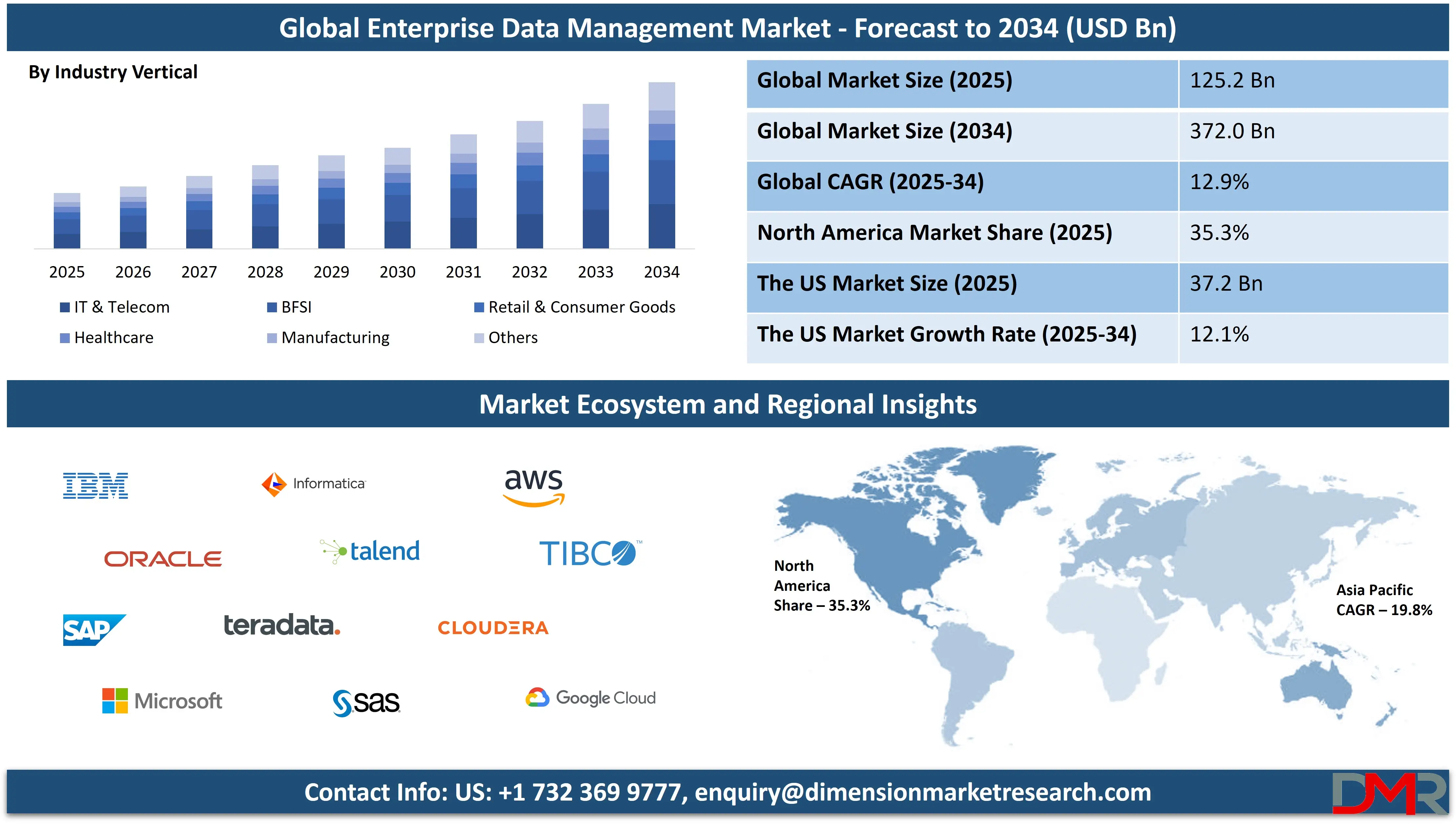

The Global

Enterprise Data Management (EDM) market is poised for significant expansion over the coming decade. According to market projections, the market size is anticipated to grow from

USD 125.2 billion in 2025 to approximately

USD 372.0 billion by 2034, registering a compound annual growth rate

(CAGR) of 12.9% during the forecast period.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Enterprise Data Management (EDM) refers to the structured framework and strategic processes used by organizations to manage their data assets efficiently across the enterprise. It involves a spectrum of practices, including data integration, data governance, data quality assurance, master data management, and metadata management, all working together to ensure data consistency, accuracy, and availability. EDM enables a cohesive environment where data is treated as a critical business asset, allowing different departments to access unified and reliable data for operations, analytics, and compliance. The focus is not only on storing data but also on enhancing its value through standardization, governance, and alignment with organizational goals.

The global enterprise data management market has been gaining significant traction due to the mounting volume of data generated by digital platforms, IoT devices, and enterprise applications. This surge in data has created an urgent need for systems that can organize, secure, and utilize data effectively across diverse channels. Companies are turning to EDM solutions to break down data silos, increase operational agility, and drive better business outcomes. With the rising popularity of cloud-native technologies and data lakes, organizations now demand scalable, flexible, and cost-efficient EDM platforms that can support hybrid and multi-cloud environments. Moreover, advancements in artificial intelligence and automation are further enhancing EDM capabilities by streamlining workflows and reducing manual intervention.

Another critical factor contributing to the expansion of the EDM market is the tightening regulatory landscape. Sectors like healthcare, finance, and government are under growing pressure to comply with strict data protection laws and industry standards, prompting them to adopt robust data governance frameworks. Tools that offer advanced features like data lineage tracking, access control, and auditability are becoming essential. Additionally, businesses are investing in real-time analytics and metadata management tools to gain faster insights and ensure data trustworthiness. The integration of EDM with evolving paradigms such as data mesh and data fabric is also becoming more common, enabling decentralized and domain-oriented approaches to data management.

The US Enterprise Data Management Market

The U.S. Enterprise Data Management Market size is projected to be valued at USD 37.2 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 104.0 billion in 2034 at a CAGR of 12.1%.

The U.S. Enterprise Data Management (EDM) market represents the largest and most mature regional segment within the global landscape, and it continues to serve as a critical hub for innovation, adoption, and deployment of advanced data management solutions. Fueled by an expansive digital economy, stringent data compliance regulations, and the presence of leading technology vendors, the U.S. market is expected to maintain its dominant position over the forecast period. Enterprises across sectors such as financial services, healthcare, manufacturing, retail, and government are prioritizing data as a strategic asset, driving demand for integrated platforms that ensure data accuracy, governance, security, and usability at scale.

A key growth driver in the U.S. EDM market is the regulatory landscape, which includes frameworks like the Health Insurance Portability and Accountability Act (HIPAA), the California Consumer Privacy Act (CCPA), and other emerging state-level privacy laws. These regulations compel organizations to invest in enterprise-grade data governance, data lineage, access control, and audit trail capabilities. As a result, U.S. companies are not only deploying EDM solutions to improve operational efficiency but also to mitigate legal risks and ensure compliance with complex data privacy standards.

Japan Enterprise Data Management Market

The Japan Enterprise Data Management (EDM) market is poised for substantial growth, projected to reach a market size of USD 5.62 billion in 2025. Over the forecast period, the market is expected to expand at a robust CAGR of 13.5%, driven by the country's growing demand for comprehensive data governance, cloud adoption, and the growing need for advanced data integration platforms.

As Japan continues to digitize its industrial sectors, including manufacturing (aligned with Industry 4.0), healthcare, and finance, the adoption of data management solutions is becoming critical for enterprises to maintain operational efficiency, comply with data regulations, and leverage real-time analytics for business growth. The rise of cloud technologies, IoT, and AI integration is further accelerating the adoption of sophisticated EDM tools that support scalability and flexibility for businesses operating in this highly competitive market.

With Japan's strong emphasis on innovation, particularly in technology and manufacturing, the market for enterprise data management solutions is expected to see high demand for data quality management, real-time analytics, and data security technologies. The market will be characterized by a continued focus on data-driven decision-making, compliance with evolving regulations, and the need for seamless data integration across diverse business functions and industries.

Europe Enterprise Data Management Market

The European Enterprise Data Management (EDM) market is expected to reach a market size of USD 33.75 billion in 2025, with an impressive CAGR of 11.8% during the forecast period from 2025 to 2034. The steady growth of this market is being driven by the growing demand for data governance, data security, and compliance with stringent data privacy regulations such as the General Data Protection Regulation (GDPR), which has heightened the need for effective data management strategies across the region.

Europe's market is seeing robust adoption of cloud-based data management platforms, especially within industries such as finance, healthcare, and manufacturing, which are highly regulated and require stringent data governance practices. The region’s growing focus on digital transformation initiatives, coupled with the growing volume of structured and unstructured data, is further fueling the need for advanced data integration and analytics solutions.

As European enterprises continue to embrace digitalization and data-centric strategies, the demand for unified data ecosystems that ensure data quality, accessibility, and security will remain a key factor. With organizations looking to enhance their decision-making processes, improve operational efficiency, and remain compliant with evolving data regulations, the EDM market in Europe is set to experience steady, sustained growth throughout the forecast period.

Global Enterprise Data Management Market: Key Takeaways

- Market Value: The global enterprise data management size is expected to reach a value of USD 372.0 billion by 2034 from a base value of USD 125.2 billion in 2025 at a CAGR of 12.9%.

- By Component Type Segment Analysis: Software Components are expected to maintain their dominance in the component type segment, capturing 70.5% of the total market share in 2025.

- By Deployment Type Segment Analysis: Cloud Deployment is poised to consolidate its market position in the deployment type segment, capturing 64.8% of the total market share in 2025.

- By Enterprise Size: Large Enterprises are anticipated to maintain their dominance in the enterprise size segment, capturing 80.9% of the total market share in 2025.

- By Industry Segment Analysis: The IT & Telecom industry is anticipated to maintain its dominance in the industry segment, capturing 27.0% of the total market share in 2025.

- Regional Analysis: North America is anticipated to lead the global enterprise data management market landscape with 35.3% of total global market revenue in 2025.

- Key Players: Some key players in the global enterprise data management market are IBM, Oracle, SAP, Microsoft, Informatica, SAS Institute, Teradata, Talend, Cloudera, AWS, Google Cloud, TIBCO Software, Hitachi Vantara, Qlik, Snowflake, Collibra, Alteryx, Micro Focus, Reltio, NetApp, and Other Key Players.

Global Enterprise Data Management Market: Use Cases

Data Governance and Compliance in Healthcare

Healthcare organizations are adopting Enterprise Data Management solutions to ensure compliance with stringent regulations like HIPAA and GDPR. EDM systems enable these organizations to establish robust data governance frameworks that ensure patient data security, streamline audit trails, and provide clear data access controls. This ensures healthcare providers maintain accurate, secure, and compliant records while facilitating better decision-making through real-time analytics.

Data Integration for Real-Time Business Intelligence in Retail

Retailers are using EDM platforms to integrate disparate data sources, such as customer transaction histories, inventory levels, and supply chain data. By consolidating these data points in a unified system, businesses gain valuable insights for real-time business intelligence. This enables them to personalize marketing efforts, optimize inventory management, and improve the customer experience through data-driven strategies.

Master Data Management in Financial Services: Financial institutions utilize Master Data Management (MDM) as part of their EDM strategy to maintain a single, accurate view of their clients, transactions, and other critical financial data. MDM ensures that data is consistent and synchronized across various departments, reducing redundancies and errors, and enhancing decision-making. This use case is especially critical for banks and insurance firms looking to comply with regulatory frameworks and enhance their operational efficiency.

Cloud Data Management for Manufacturing Optimization: Manufacturers are leveraging cloud-based EDM solutions to manage the vast amounts of data generated from IoT-enabled devices on the factory floor. These systems collect, process, and analyze data in real-time to optimize production processes, reduce downtime, and predict equipment failures before they occur. By integrating these insights with enterprise resource planning (ERP) systems, manufacturers improve supply chain management, operational efficiency, and product quality.

Global Enterprise Data Management Market: Stats & Facts

🇪🇺 European Union: Advancing Digital Transformation

- Cloud Computing Adoption

- In 2023, 45.2% of EU enterprises purchased cloud computing services, marking a 4.2 percentage point increase from 2021.

- Among large EU enterprises, 77.6% utilized cloud computing services in 2023.

- In the same year, 59% of medium-sized and 41.7% of small EU enterprises adopted cloud services.

- Enterprise Software Utilization

- As of 2023, 43.3% of EU enterprises employed Enterprise Resource Planning (ERP) software.

- ERP adoption was highest among large enterprises at 86.3%, compared to 37.9% for small enterprises.

- 25.8% of EU enterprises used Customer Relationship Management (CRM) software in 2023.

- Business Intelligence (BI) software was utilized by 15.3% of EU enterprises in the same year

- Artificial Intelligence Integration

- In 2023, 8% of EU enterprises with 10 or more employees used Artificial Intelligence (AI) technologies.

- AI was used in production processes by 34.65% of large and 21.62% of small EU enterprises.

- For logistics, AI adoption stood at 15.85% for large and 4.48% for small enterprises.

- Internet of Things (IoT) Deployment

- In 2021, 29% of EU enterprises utilized IoT devices, primarily for premises security.

- IoT usage was reported by 48% of large and 26% of small EU enterprises.

🇺🇸 United States: Strategic Data Management and R&D Investment

- Data Management Practices

- The U.S. Department of Energy's Enterprise Data Strategy outlines a roadmap for managing the data lifecycle, ensuring appropriate use, and enabling advanced analytics.

- The U.S. Securities and Exchange Commission's Data Management Board provides oversight for the agency's data management program, aligning data initiatives with the SEC's mission.

- Research and Development (R&D) Investments

- The U.S. Business Enterprise Research and Development (BERD) Survey is the primary source of information on R&D expenditures and employees in for-profit businesses.

- The BERD Survey collects data on R&D performed or funded by U.S. businesses domestically and abroad, providing insights into industry-specific R&D activities.

🇮🇳 India: Emphasizing Data Governance and Classification

- Data Governance and Strategy

- India's Inter-Ministerial Committee on Energy Data Management highlights the decentralized nature of energy data collection and the need for a legal framework to standardize data management practices.

- Data Classification Importance

- An article from IndiaAI discusses the importance of data classification in modern enterprises, emphasizing its role in organizing structured and unstructured data for better data security and governance.

🇯🇵 Japan: Digital Transformation and AI Adoption

- Cloud Computing Adoption

- Japan’s Ministry of Internal Affairs and Communications reports that 50% of Japanese companies have fully implemented cloud computing services in 2023. The government is heavily promoting cloud adoption through its digital transformation initiatives.

- AI Integration in Business

- The Japanese Government’s Cabinet Office revealed that 24% of Japanese companies have adopted AI technologies as of 2023. A major focus is on growing AI adoption in industries like healthcare and manufacturing.

- IoT Deployment in Industry

- The Ministry of Economy, Trade and Industry (METI) reports that 18% of Japanese companies have implemented Internet of Things (IoT) solutions in their operations, with a significant push toward smart manufacturing applications.

Global Enterprise Data Management Market: Market Dynamics

Global Enterprise Data Management Market: Driving Factors

Rapid Adoption of Cloud Computing Technologies

One of the key driving factors in the global Enterprise Data Management market is the rapid adoption of cloud computing technologies. As organizations move towards digital transformation, the need for scalable and flexible data management solutions has become paramount. Cloud-based EDM systems allow businesses to store vast amounts of data efficiently, ensure seamless integration across multiple platforms, and facilitate real-time access to critical information. This shift towards cloud platforms is further supported by advancements in artificial intelligence and machine learning, which enable smarter data processing and decision-making.

Increasing Importance of Data Privacy and Regulatory Compliance

Another significant factor driving market growth is the growing importance of data privacy and regulatory compliance. With data protection laws like GDPR and CCPA being enforced globally, businesses are under pressure to adopt comprehensive data governance frameworks to mitigate risks associated with non-compliance. EDM solutions that provide robust data security measures, track data lineage, and maintain clear audit trails are becoming essential for organizations seeking to ensure data integrity and avoid hefty penalties. This heightened focus on regulatory adherence has led to a surge in demand for specialized EDM solutions across highly regulated industries such as finance, healthcare, and government.

Global Enterprise Data Management Market: Restraints

Data Integration Complexity

A key restraint in the global enterprise data management market is the complexity associated with integrating data from disparate sources. As organizations continue to generate massive volumes of structured and unstructured data across various platforms, integrating this data into a cohesive and unified system becomes challenging. Traditional data management systems often struggle to handle the variety and volume of data, leading to inefficiencies in processing, data inconsistency, and increased operational costs. The complexity of seamless integration across legacy systems, cloud platforms, and emerging technologies remains a significant barrier for many enterprises in adopting comprehensive EDM solutions.

High Implementation and Maintenance Costs

Another major constraint is the high implementation and ongoing maintenance costs associated with deploying Enterprise Data Management solutions. For many organizations, especially small to medium-sized enterprises (SMEs), the initial investment required for software, hardware, and personnel training can be prohibitive. Additionally, maintaining these systems over time, including regular updates, data migrations, and troubleshooting, can add significant operational expenses. These costs may discourage businesses from fully adopting advanced EDM systems or prompt them to opt for less comprehensive solutions, which may not fully meet their data management needs.

Global Enterprise Data Management Market: Opportunities

Growth of Artificial Intelligence and Machine Learning in Data Management

One of the key opportunities in the global enterprise data management market is the integration of artificial intelligence (AI) and machine learning (ML) technologies. As businesses rely on data-driven insights for decision-making, AI and ML can significantly enhance the capabilities of EDM solutions. These technologies enable more efficient data processing, automated data cleansing, predictive analytics, and anomaly detection. By leveraging AI and ML, enterprises can gain deeper insights from their data, improve decision-making accuracy, and enhance operational efficiency, all while reducing the manual effort required in data management tasks.

Expansion in Emerging Markets

Another significant opportunity lies in the expansion of enterprise data management solutions within emerging markets. As digital transformation accelerates in regions such as Asia-Pacific, Latin America, and the Middle East, businesses in these regions are recognizing the importance of managing large volumes of data securely and efficiently. With the rise of cloud adoption, mobile computing, and IoT, the need for robust EDM solutions is expected to grow substantially. Additionally, regulatory frameworks are beginning to tighten in these regions, which further drives the demand for data governance and compliance solutions. Vendors who focus on tailoring EDM products to meet the unique needs and regulatory challenges of emerging markets stand to capitalize on this growing opportunity.

Global Enterprise Data Management Market: Trends

Adoption of Cloud-Native Data Management Solutions

A significant trend driving the global Enterprise Data Management market is the growing adoption of cloud-native data management solutions. As businesses continue to migrate to the cloud, there is a growing preference for EDM platforms that are built specifically for cloud environments. Cloud-native solutions offer enhanced scalability, flexibility, and cost efficiency compared to traditional on-premises systems. These platforms allow organizations to manage large volumes of data without the constraints of physical infrastructure, enabling them to scale up or down as needed. Additionally, the integration of cloud-native EDM with other cloud services such as data analytics, AI, and machine learning provides businesses with a unified, efficient approach to data management.

Rise of Data-Driven Decision Making

Another key trend is the shift towards data-driven decision-making across industries. As more companies recognize the strategic value of data, there is a growing emphasis on leveraging advanced analytics, real-time data processing, and business intelligence (BI) tools. EDM systems that support this transition enable organizations to collect, store, manage, and analyze data in real time, providing decision-makers with the insights needed to make informed business choices.

This trend is particularly prominent in sectors such as finance, retail, and healthcare, where data-driven insights directly impact profitability, customer experience, and operational efficiency. The continued rise of data-centric business models presents a significant growth opportunity for EDM providers.

Global Enterprise Data Management Market: Research Scope and Analysis

By Component Analysis

In the global Enterprise Data Management (EDM) market, software components are expected to maintain a dominant position, capturing 70.5% of the total market share in 2025. This dominance is primarily attributed to the growing reliance on advanced software solutions that offer capabilities such as data integration, data governance, master data management (MDM), data quality management, and analytics. The growing complexity of data environments and the need for scalable, secure, and agile data management tools make software components essential for enterprises seeking to leverage real-time data processing and data-driven decision-making.

Software components in EDM systems provide the core functionality for automating, organizing, and securing data workflows. These solutions enable businesses to streamline data operations, enhance compliance with regulatory frameworks (such as GDPR), and maintain high levels of data integrity. As organizations adopt cloud technologies and integrate artificial intelligence (AI) and machine learning (ML) into their operations, software solutions will continue to play a pivotal role in optimizing data management processes. The integration of AI and ML algorithms into EDM software also enhances data analytics capabilities, enabling businesses to gain deeper insights, improve operational efficiency, and predict future trends.

While software components dominate, the services segment plays an equally crucial role in ensuring the successful implementation, customization, and ongoing support of EDM solutions. Services components typically encompass a range of offerings, including consulting, system integration, managed services, and training. These services are essential for organizations that require expertise in deploying and optimizing their EDM systems to meet specific business needs and regulatory requirements. Consulting services help enterprises design and implement effective data management strategies customized to their specific business operations and industry demands.

These services provide insights into best practices for data governance, integration, and compliance, ensuring that the EDM solutions align with organizational goals. System integration services are critical for seamlessly incorporating EDM solutions with existing IT infrastructure, such as ERP, CRM, and data analytics platforms. This ensures smooth data flow across various systems, helping businesses achieve an integrated approach to data management.

By Deployment Analysis

In the global Enterprise Data Management (EDM) market, cloud deployment is set to further consolidate its dominant position, capturing 64.8% of the total market share in 2025. This trend is primarily driven by the growing adoption of cloud computing technologies across industries seeking scalable, flexible, and cost-effective solutions for managing their data. The rise of cloud infrastructure providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud has further propelled this shift, enabling businesses to leverage cloud-based EDM platforms that offer enhanced data accessibility, collaboration, and security. Cloud deployment in EDM solutions offers significant advantages over traditional models, particularly in terms of cost-efficiency and scalability.

As enterprises handle growing volumes of structured and unstructured data, cloud solutions provide the ability to scale their storage and computing needs on demand without investing in costly on-premises infrastructure. The cloud's flexibility also supports the seamless integration of advanced data analytics, machine learning, and artificial intelligence tools, which help businesses derive actionable insights from their data.

Despite the rising dominance of cloud deployment, on-premises deployment continues to hold relevance in certain segments of the Enterprise Data Management market. On-premises deployment refers to solutions where the EDM software is installed and operated within the organization's physical infrastructure, giving businesses full control over their data management systems.

This type of deployment remains a viable option for enterprises that prioritize data sovereignty, security, and compliance with strict regulatory requirements. For industries like banking, government, and defense, where sensitive data is subject to strict privacy laws and must remain within specific geographical or legal boundaries, on-premises deployment provides the advantage of enhanced control and oversight. Organizations with highly sensitive or proprietary data may prefer on-premises systems to ensure that all data resides within their secure infrastructure, minimizing exposure to external risks associated with third-party cloud providers.

By Enterprise Size Analysis

In the global Enterprise Data Management (EDM) market, large enterprises are projected to dominate the enterprise size segment by capturing an impressive 80.9% of the total market share in 2025. This dominance is largely driven by the scale and complexity of data ecosystems within large corporations, which demand sophisticated and comprehensive EDM solutions. These organizations typically operate across multiple geographies and business verticals, generating vast volumes of structured and unstructured data from disparate sources, including CRM systems, ERP platforms, IoT devices, and third-party applications.

Large enterprises possess the necessary resources, both financial and technical, to invest in robust EDM infrastructures. Their needs go beyond basic data storage they require advanced capabilities such as data integration, metadata management, data lineage tracking, regulatory compliance tools, and real-time analytics to ensure a unified and secure data environment.

Additionally, large companies are often subject to stricter data privacy regulations (such as GDPR, CCPA, or SOX) and face higher risks from non-compliance, making enterprise-wide data governance a critical requirement.

While large enterprises lead in terms of market share, small and medium-sized enterprises (SMEs) represent a growing and dynamic segment within the EDM market. Although SMEs currently hold a smaller portion of the market, their participation is expanding rapidly due to the growing affordability and accessibility of cloud-based EDM solutions. These cloud-native platforms offer cost-effective, scalable, and subscription-based models that eliminate the need for heavy upfront capital investments, making them particularly attractive to smaller businesses with limited budgets.

For small enterprises, data management is becoming vital as they seek to compete in digital marketplaces and build data-driven growth strategies. Whether it's customer relationship data, sales performance, or website analytics, SMEs now recognize the importance of centralizing and managing their data assets for improved operational efficiency, customer engagement, and market responsiveness.

By Industry Vertical Analysis

The IT & Telecom industry is poised to maintain its leadership in the global Enterprise Data Management (EDM) market, capturing an estimated 27.0% of the total market share in 2025. This dominance is driven by the industry’s inherently data-intensive nature, where enormous volumes of structured and unstructured data are generated daily from sources like mobile networks, cloud services, internet usage, and connected devices. With digital communication platforms, 5G infrastructure, and cloud computing driving innovation, IT and telecom companies require highly scalable and agile data management systems to ensure real-time data processing, data integration, and network analytics.

The sector's rapid evolution demands robust EDM solutions that can manage high-velocity data while ensuring data consistency, reliability, and compliance with regulations such as ISO/IEC 27001, PCI DSS, and regional telecom privacy laws. EDM platforms in this sector are also instrumental in supporting customer data platforms (CDPs), enabling telecom operators and IT service providers to deliver personalized experiences, enhance churn prediction models, and optimize operational efficiency through predictive analytics.

The Banking, Financial Services, and Insurance (BFSI) sector represents another critical vertical within the Enterprise Data Management market, characterized by a complex regulatory environment and a high dependency on accurate, timely, and secure data. Financial institutions generate massive amounts of transactional, customer, and compliance-related data daily, making data governance, lineage tracking, and data quality assurance indispensable components of their operations.

In this context, EDM solutions play a pivotal role in helping BFSI institutions comply with global financial regulations such as Basel III, MiFID II, SOX, and FATCA. These solutions enable firms to maintain data auditability, risk management, and regulatory reporting while safeguarding sensitive customer information against cyber threats. EDM tools also streamline the process of know-your-customer (KYC) and anti-money laundering (AML) procedures by consolidating and validating data from multiple internal and external sources.

The Enterprise Data Management Market Report is segmented on the basis of the following:

By Component

- Software

- Data Security

- Master Data Management

- Data Integration

- Data Migration

- Data Warehousing

- Data Governance

- Data Quality

- Others

- Services

- Managed Services

- Professional Services

- Consulting

- Deployment and Integration

- Support and Maintenance

By Deployment

By Enterprise Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Industry Vertical

- IT & Telecom

- BFSI

- Retail & Consumer Goods

- Healthcare

- Manufacturing

- Others

Global Enterprise Data Management Market: Regional Analysis

Region with the Largest Revenue Share

North America is anticipated to dominate the global Enterprise Data Management (EDM) market, commanding approximately

35.3% of the total global market revenue in 2025. This leadership position stems from the region’s well-established digital infrastructure, high concentration of global technology leaders, and proactive adoption of advanced data management practices across key industries, including IT & telecom, BFSI, healthcare, and retail. The United States, in particular, plays a pivotal role in driving regional dominance, fueled by heavy investments in cloud computing, data governance frameworks, and artificial intelligence (AI) integration within enterprise systems.

North American enterprises are at the forefront of adopting data-centric business models, where EDM solutions are core to enabling real-time analytics, regulatory compliance, data monetization, and intelligent automation. Moreover, the region benefits from the presence of major EDM software vendors and cloud service providers, such as Microsoft, Oracle, IBM, and Amazon Web Services, which continuously innovate and expand their product offerings.

Region with significant growth

The Asia Pacific (APAC) region is projected to register the highest compound annual growth rate (CAGR) in the global enterprise data management (EDM) market during the forecast period, reflecting the region’s dynamic digital transformation journey and rapid enterprise adoption of data-centric technologies. While North America currently holds the largest market share, Asia Pacific’s exponential growth trajectory is being propelled by a combination of economic expansion, technological modernization, and rising awareness of data governance across emerging and developed economies.

Key economies such as China, India, Japan, South Korea, and Australia are spearheading this surge, each investing heavily in smart infrastructure, cloud computing, AI-driven analytics, and enterprise digitalization. The widespread deployment of 5G, along with increased penetration of IoT devices and mobile applications, is contributing to massive data generation at both consumer and enterprise levels. This is compelling businesses to adopt robust EDM platforms to manage, store, and extract insights from their vast and growing datasets efficiently.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Enterprise Data Management Market: Competitive Landscape

The global enterprise data management (EDM) market is characterized by an intensely competitive and evolving landscape, driven by the convergence of advanced technologies, growing regulatory compliance needs, and the expanding scope of enterprise data ecosystems. The market comprises a diverse mix of established technology conglomerates, specialized data management vendors, and emerging innovators, each striving to offer differentiated value through scalable platforms, AI-powered features, and end-to-end data governance capabilities.

At the forefront of the competitive arena are global giants such as IBM Corporation, Oracle Corporation, Microsoft Corporation, SAP SE, and Amazon Web Services (AWS). These companies have built robust ecosystems of enterprise data management solutions integrated into their broader cloud and analytics platforms. Their global presence, deep R&D capabilities, and long-standing relationships with enterprise clients give them a considerable edge in terms of market reach and technological depth. These vendors continuously invest in platform modernization, cloud-native solutions, metadata management, and AI/ML integration, enabling customers to unify their data assets and gain real-time insights at scale.

Some of the prominent players in the Global Enterprise Data Management are:

- IBM

- Oracle

- SAP

- Microsoft

- Informatica

- SAS Institute

- Teradata

- Talend

- Cloudera

- AWS (Amazon Web Services)

- Google Cloud

- TIBCO Software

- Hitachi Vantara

- Qlik

- Snowflake

- Collibra

- Alteryx

- Micro Focus

- Reltio

- NetApp

- Other Key Players

Global Enterprise Data Management Market: Recent Developments

- December 2024: Thoma Bravo completed the acquisition of a majority stake in USU Product Business, an IT management solutions provider.

- August 2024: HCLSoftware announced its intent to acquire French metadata management platform startup Zeenea for €24 million, aiming to enhance its data and analytics division.

- August 2024: HCLTech agreed to acquire select assets of Hewlett-Packard Enterprise's Communications Technology Group for USD 225 million, expanding its capabilities in enterprise data services.

- June 2024: Databricks announced the acquisition of data-management startup Tabular for over USD 1 billion, aiming to bolster its AI application development offerings.

- May 2024: Perficient agreed to be acquired by Swedish private equity firm EQT for approximately USD 3 billion, enhancing EQT's portfolio in digital consulting and data management services.

- April 2024: IBM announced a deal to acquire HashiCorp, developer of the Terraform infrastructure-as-code platform, for USD 6.4 billion, aiming to strengthen its hybrid cloud and AI-driven application management capabilities.

- March 2024: Cisco completed its USD 28 billion acquisition of Splunk, a leader in data observability and security analytics, marking the largest deal in Cisco's history.

- September 2023: Arlington Capital Partners announced it had acquired Exostar, a software company specializing in secure enterprise data management, from Thoma Bravo.

- June 2023: IBM agreed to acquire cloud cost control specialist Apptio for USD 4.6 billion, aiming to integrate its offerings into IBM's IT automation portfolio.

- June 2023: Databricks acquired MosaicML, an AI startup, for USD 1.3 billion, enhancing its capabilities in building large language models and AI infrastructure.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 125.2 Bn |

| Forecast Value (2034) |

USD 372.0 Bn |

| CAGR (2025–2034) |

12.9% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 37.2 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

By Component (Solutions and Services), By Deployment (On-Premises and Cloud), By Organization Size (Small & Medium-Sized Organizations and Large Organizations), and By Industry Vertical (IT & Telecom, BFSI, Retail & Consumer Goods, Healthcare, Manufacturing, and Others) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

IBM, Oracle, SAP, Microsoft, Informatica, SAS Institute, Teradata, Talend, Cloudera, AWS, Google Cloud, TIBCO Software, Hitachi Vantara, Qlik, Snowflake, Collibra, Alteryx, Micro Focus, Reltio, NetApp., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|