Market Overview

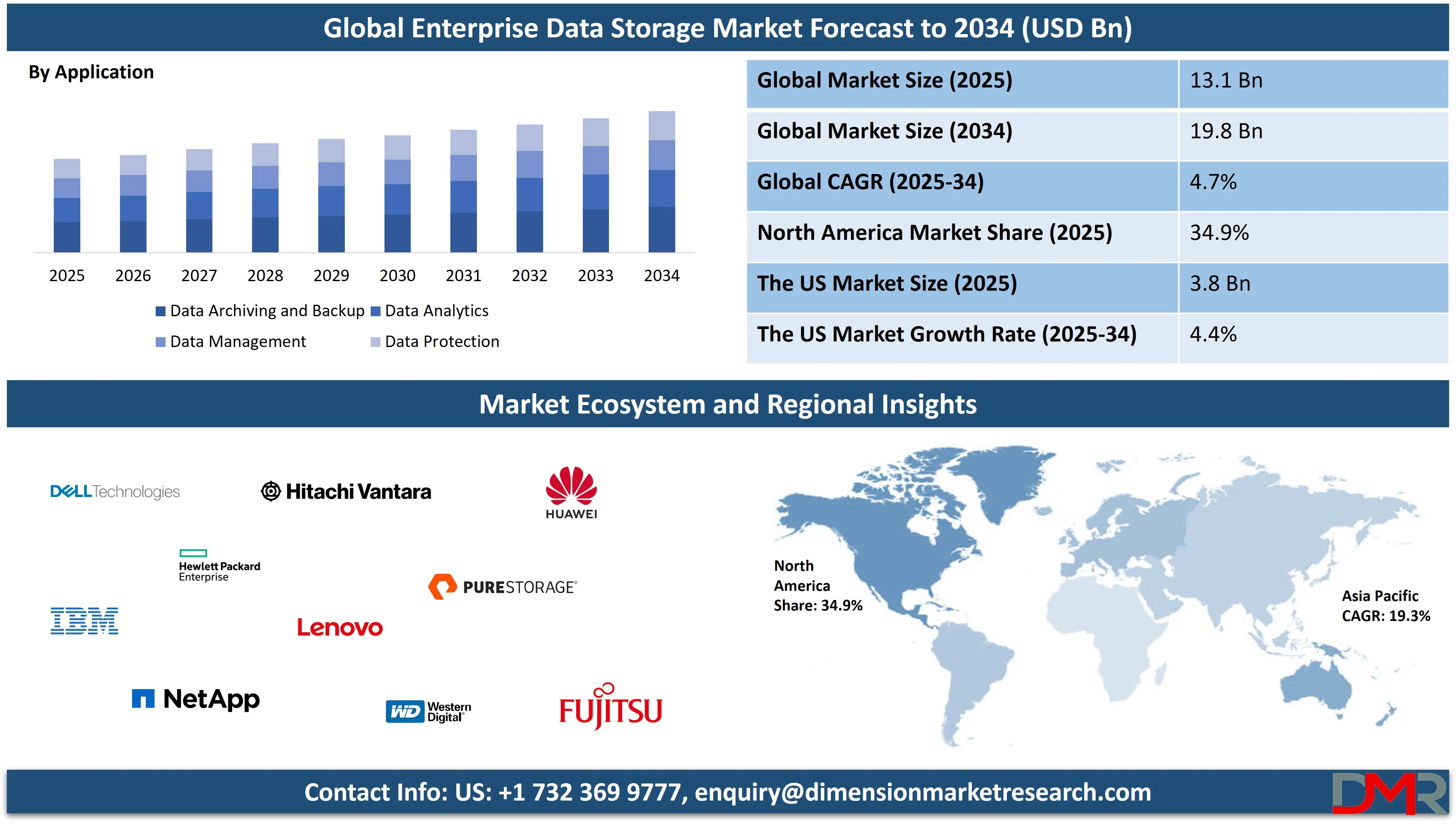

The Global Enterprise Data Storage Market size is projected to surge from

USD 13.1 billion in 2025 to an impressive

USD 19.8 billion by 2034, expanding at a steady

CAGR of 4.7% over the forecast period. This growth underscores the rising enterprise demand for scalable, secure, and intelligent storage solutions amid the explosive rise of big data, cloud adoption, and digital transformation initiatives.

Enterprise data storage refers to the systems and technologies used by organizations to store, manage, and secure vast volumes of digital information generated through various business operations. These storage solutions are designed to support large-scale data needs, ensuring accessibility, scalability, and data integrity across multiple departments and locations. They encompass a range of storage architectures, including network-attached storage, storage area networks, direct-attached storage, cloud-based storage, and hyper-converged systems.

Enterprise data storage is vital for enabling business continuity, supporting real-time data analytics, maintaining regulatory compliance, and protecting sensitive information against breaches or loss. As data volumes grow exponentially, organizations prioritize efficient data storage infrastructure that can accommodate structured and unstructured data while integrating with modern technologies such as virtualization, artificial intelligence, and machine learning.

The global enterprise data storage market is experiencing sustained momentum as businesses across industries increase their reliance on digital ecosystems. The proliferation of big data, IoT devices, and cloud computing has significantly altered how companies manage and store information. Enterprises now require advanced storage systems that can handle high-throughput data processing, multi-cloud integration, and agile scaling.

The demand for hybrid storage models, blending on-premise infrastructure with cloud platforms, is growing as organizations seek flexibility and cost-efficiency. As a result, storage vendors are focusing on offering customizable storage solutions that meet specific enterprise workloads, including high-performance computing, real-time analytics, and virtualized environments.

With the rise in cybersecurity threats, enterprises are placing growing emphasis on robust data protection and recovery mechanisms. Enterprise data storage vendors are investing heavily in security-centric features such as encryption, access control, and ransomware protection. Additionally, the integration of AI and machine learning into storage platforms is enabling predictive maintenance, intelligent data tiering, and autonomous performance tuning. The global enterprise data storage market is becoming a cornerstone of digital infrastructure strategies, underpinning mission-critical applications, regulatory readiness, and enterprise agility in an era defined by data-driven decision-making.

The US Enterprise Data Storage Market

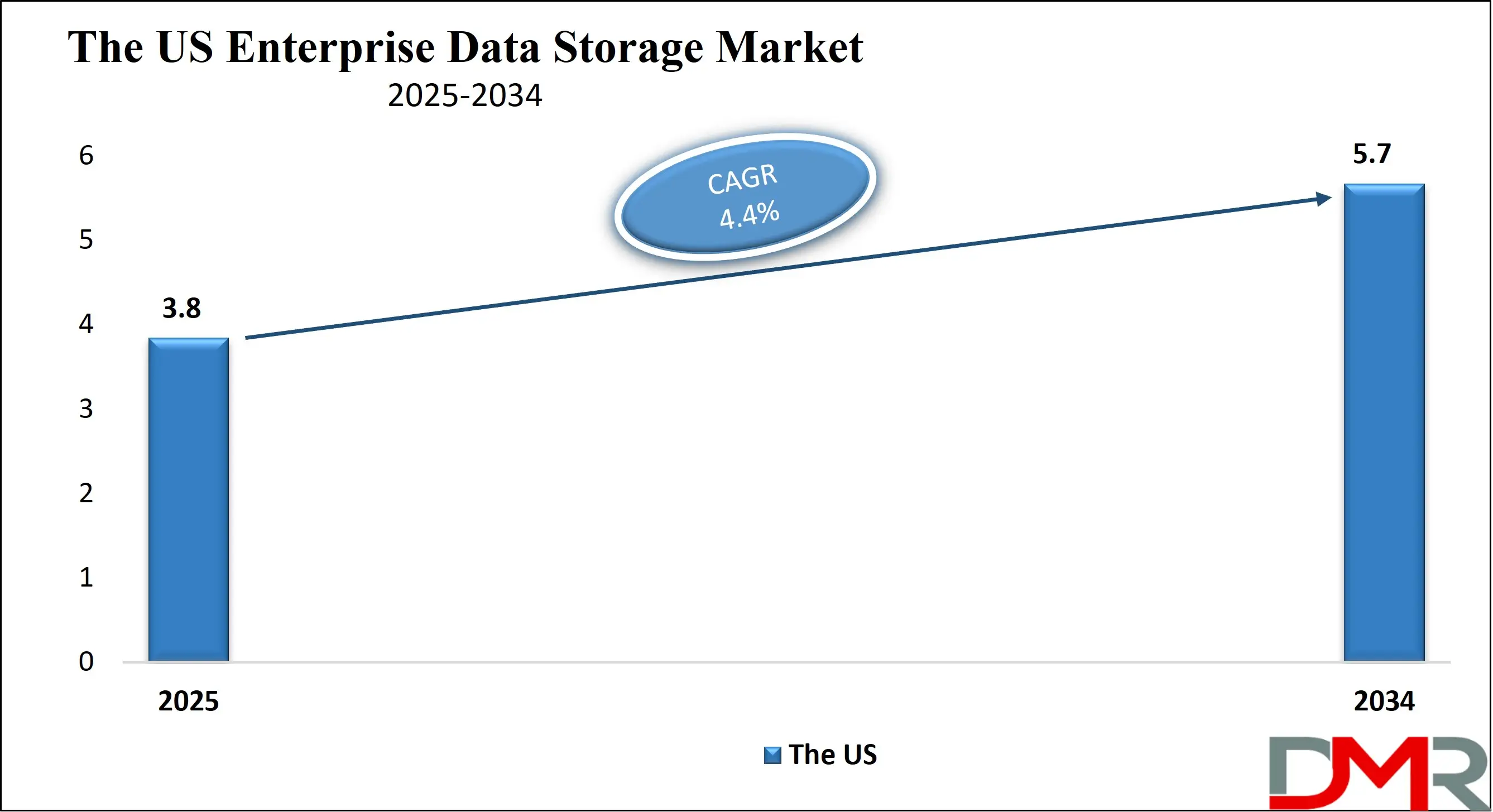

The U.S. Enterprise Data Management Market size is projected to be valued at USD 3.8 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 5.7 billion in 2034 at a CAGR of 4.4%.

The U.S. enterprise data management market is witnessing strong momentum as organizations across sectors recognize data as a critical strategic asset. With the growing complexity of data ecosystems and mounting regulatory pressures, companies are adopting comprehensive data management frameworks to enhance data governance, integrity, and accessibility. The rise of remote work, cloud migrations, and multi-channel operations has amplified the need for unified data platforms that can offer centralized control, scalability, and data visibility across enterprise functions. Regulatory compliance, particularly with acts like the CCPA and HIPAA, has further accelerated the implementation of robust data lifecycle management systems, ensuring accountability, transparency, and risk mitigation.

Driving this evolution is the rapid advancement in technologies such as artificial intelligence, machine learning, and automation, which are being embedded into modern enterprise data management solutions. These tools enable organizations to harness predictive analytics, improve metadata management, automate data cataloging, and uncover actionable insights with minimal manual effort. In industries like healthcare, finance, and e-commerce, the need to process massive, unstructured datasets in real-time has intensified the push for agile and intelligent data infrastructure. Furthermore, the U.S. market is also seeing increased demand for hybrid and cloud-native data management platforms, allowing businesses to adapt to dynamic digital workflows while maintaining data resilience, sovereignty, and operational efficiency.

The European Enterprise Data Storage Market

The European market for enterprise data storage is projected to reach USD 3.3 billion by 2025, growing at a CAGR of 7.1% from 2023 to 2025. This growth is driven by the ongoing digital transformation of businesses across various industries, including banking, retail, manufacturing, and healthcare, which are generating vast amounts of data that need efficient, secure, and scalable storage solutions.

The cloud storage market in Europe is a key contributor to this growth, as companies continue to adopt cloud technologies for data management, backup, and disaster recovery. Additionally, the demand for high-performance storage systems and software-defined storage (SDS) solutions is growing, as businesses seek to optimize their data storage processes while reducing costs. The rise of AI, big data analytics, and IoT applications further fuels the need for advanced data storage infrastructure. As industries such as financial services and healthcare expand their digital operations, they require robust, secure, and compliant data storage systems to adhere to stringent regulatory requirements and protect sensitive information.

Moreover, the European Union’s data protection regulations, such as the General Data Protection Regulation (GDPR), continue to drive the demand for data storage solutions that ensure data security and compliance. Businesses are seeking storage providers that offer end-to-end encryption, data sovereignty, and disaster recovery options to mitigate risks and maintain operational continuity. With the expansion of 5G networks, edge computing, and cloud-native technologies, the European market is well-positioned for continued growth. The region’s strong focus on innovation, coupled with investments in next-gen storage technologies and the growing adoption of hybrid and multi-cloud environments, will ensure that the market continues to evolve and meet the demands of modern enterprises.

The Japan Enterprise Data Storage Market

The Japan enterprise data storage market is expected to reach USD 0.7 billion by 2025, growing at a CAGR of 6.3% from 2023 to 2025. This growth is largely driven by Japan’s rapid adoption of cloud computing, big data analytics, and IoT technologies, as well as the growing demand for data protection and security solutions in both the private and public sectors.

Japan is known for its highly advanced technology infrastructure and is home to a wide range of industries that generate vast amounts of data, including manufacturing, automotive, retail, and telecommunications. The growing reliance on data analytics to optimize operations, improve customer experiences, and drive innovation is fueling the demand for advanced data storage solutions. One significant driver of growth in Japan’s market is the adoption of cloud storage solutions.

As Japanese businesses shift from traditional on-premises data storage to more flexible and scalable cloud-based storage options, there is a rising need for cloud integration, data migration, and disaster recovery solutions. This is particularly important as businesses look to modernize their infrastructure to support hybrid and multi-cloud environments.

Additionally, the Japanese government has been actively promoting digital transformation, and the Society 5.0 initiative, which aims to integrate IoT, artificial intelligence (AI), and big data across various sectors, has increased the demand for robust data storage infrastructures. This initiative has led to investments in edge computing and AI-driven storage solutions, enabling businesses to manage large volumes of real-time data generated by connected devices and sensors.

Global Enterprise Data Storage Market: Key Takeaways

- Market Value: The global enterprise data storage size is expected to reach a value of USD 19.8 billion by 2034 from a base value of USD 13.1 billion in 2025 at a CAGR of 4.7%.

- By Deployment Mode Segment Analysis: Cloud deployment mode is anticipated to maintain its dominance in the deployment mode segment, capturing 63.8% of the total market share in 2025.

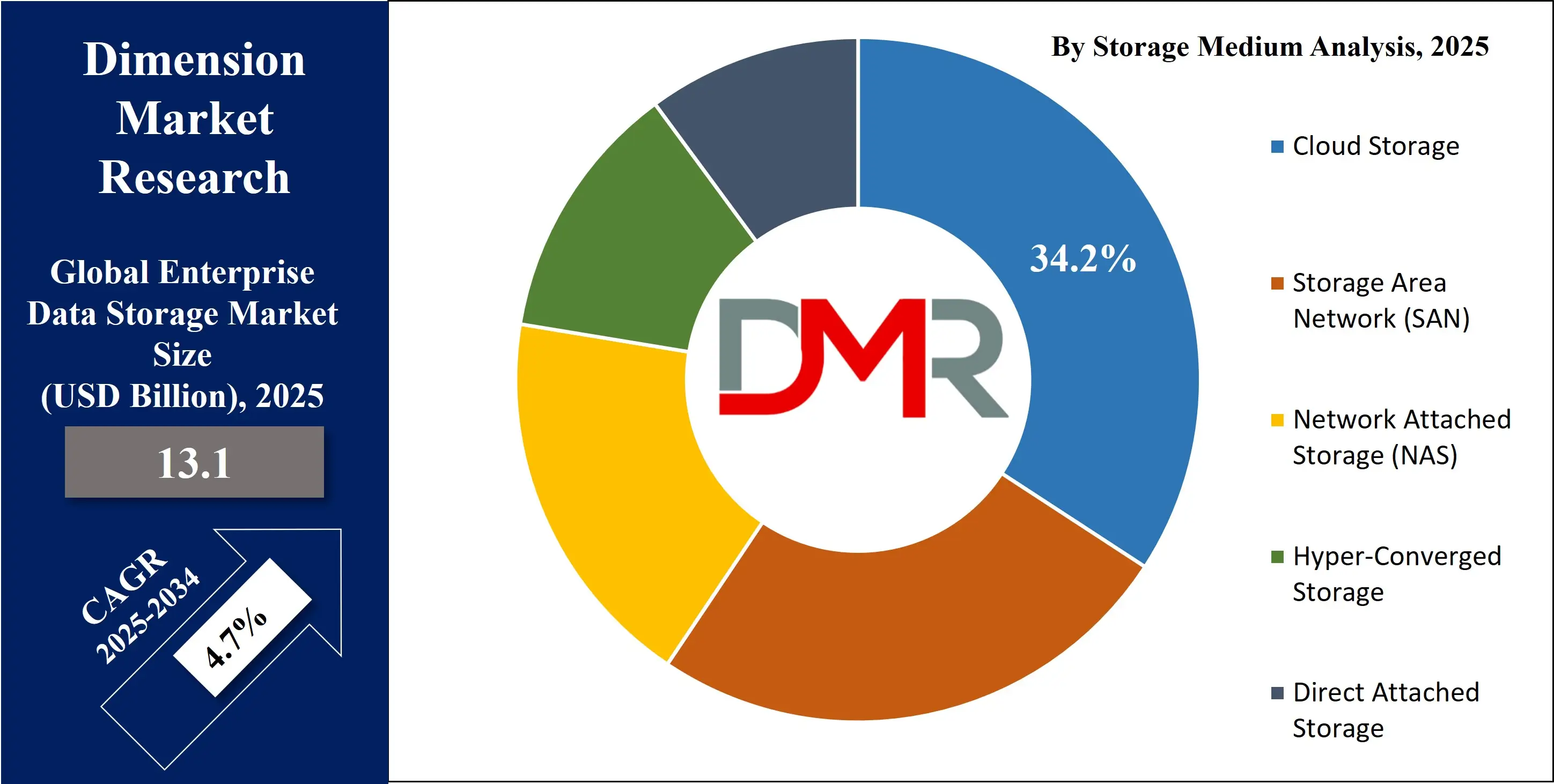

- By Storage Medium Segment Analysis: Cloud Storage is poised to consolidate its dominance in the storage medium type segment, capturing 34.2% of the total market share in 2025.

- By Data Type Segment Analysis: Unstructured Data Type is expected to maintain its dominance in the data type segment, capturing 73.1% of the total market share in 2025.

- By Organization Size Segment Analysis: Large Enterprises are anticipated to maintain their dominance in the organization size segment, capturing 67.6% of the market share.

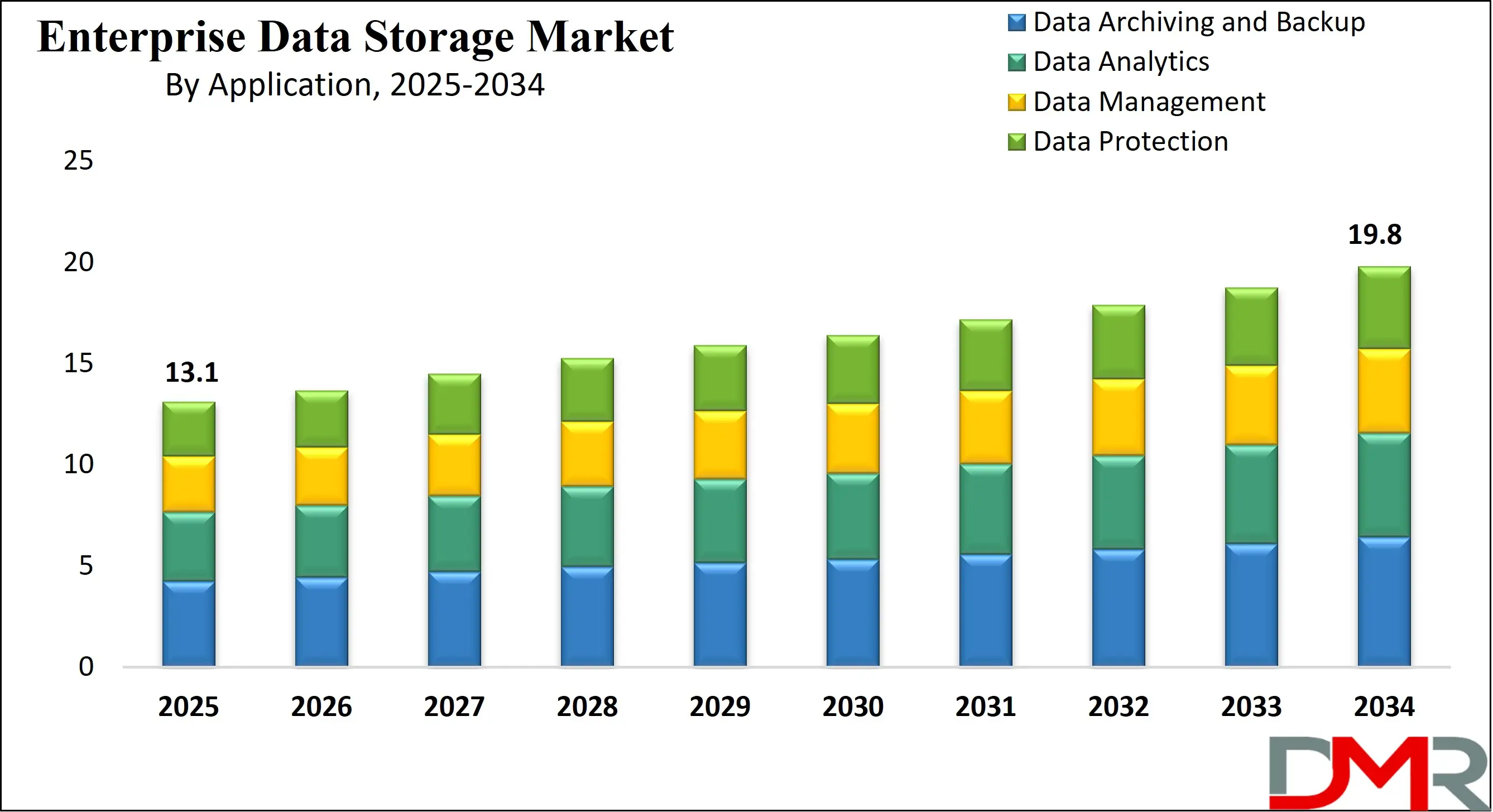

- By Application Type Segment Analysis: Data Archiving and Backup applications are poised to consolidate their market position in the application type segment, capturing 32.4% of the total market share in 2025.

- Regional Analysis: North America is anticipated to lead the global enterprise data storage market landscape with 34.9% of total global market revenue in 2025.

- Key Players: Some key players in the global enterprise data storage market are Dell Technologies, HPE, IBM, NetApp, Hitachi Vantara, Pure Storage, Huawei, Lenovo, Fujitsu, Western Digital, Seagate, Oracle, Cisco, Samsung, Intel, Microsoft, AWS, Google Cloud, NEC, Infinidat, and Other Key Players.

Global Enterprise Data Storage Market: Use Cases

- Mission-Critical Data Archiving for Financial Institutions: In the highly regulated financial sector, institutions such as banks, insurance companies, and trading firms must store massive volumes of historical transaction data for compliance, auditability, and long-term analytics. Enterprise data storage solutions offer high-performance archival systems that support immutable storage, data retention policies, and regulatory compliance (e.g., SOX, GDPR, FINRA). These storage platforms enable seamless data retrieval, multi-site replication, and strong data durability using object-based storage or software-defined storage (SDS) systems.

- AI and Machine Learning Model Training for Healthcare Analytics: With the explosion of digital health records, medical imaging, and real-time patient monitoring systems, healthcare providers rely on enterprise-grade storage to feed vast datasets into AI and machine learning pipelines. Hospitals and biotech firms use high-throughput NAS (Network Attached Storage) and all-flash arrays to process genomic data, radiology images, and drug discovery simulations. These workloads require low-latency access and a scalable storage infrastructure that supports parallel computing and GPU-based processing.

- Media Content Creation and Post-Production for Entertainment Studios: In the film, animation, and gaming industries, creative teams generate and manipulate large multimedia files that demand ultra-fast read/write speeds and collaborative access. Enterprise data storage systems provide shared file storage environments, tiered storage hierarchies, and data redundancy to streamline post-production workflows. Studios often deploy hybrid solutions combining on-premises SAN (Storage Area Networks) with cloud-based cold storage for long-term asset preservation.

- Edge Data Storage for Industrial IoT and Smart Manufacturing: Smart factories and industrial IoT (IIoT) environments generate continuous streams of sensor data from robotics, PLCs, and connected equipment. Enterprise data storage plays a pivotal role in edge computing setups, where data needs to be stored, analyzed, and acted upon locally before being transmitted to the cloud. These solutions must offer real-time data processing, fault tolerance, and ruggedized hardware suitable for harsh operational environments.

Global Enterprise Data Storage Market: Stats & Facts

- U.S. Federal Government Data Storage Initiatives

- Big Data Initiative (2012)

- The U.S. federal government initiated the Big Data Initiative, aimed at leveraging data analytics across various agencies to enhance decision-making and operational efficiency.

- Scalable Data Management, Analysis, and Visualization (SDAV) Institute (2012)

- The Department of Energy committed USD 25 million over five years to establish the SDAV Institute, focusing on developing tools for managing and visualizing data on supercomputers.

- Exascale Computing Initiative (2012)

- The Department of Energy launched the Exascale Computing Initiative, targeting the development of next-generation supercomputers capable of processing exabytes of data.

- AMPLab Grant (2012)

- The National Science Foundation awarded a USD 10 million grant to the AMPLab at the University of California, Berkeley, to develop big data tools for various applications, including traffic prediction and cancer research.

- Utah Data Center (2012)

- The Utah Data Center, constructed by the National Security Agency (NSA), was designed to handle vast amounts of information collected over the Internet, with storage capacity on the order of exabytes.

- Environmental Protection Agency (EPA) - Data Center Energy Efficiency and Growth

- 2000–2006

- Worldwide energy use by data centers doubled, driven by factors such as electronic financial transactions, Internet communication, and electronic medical records.

- 2006

- Federal agencies began considering ways to consolidate data centers to decrease energy use and provide sufficient computing power cost-effectively.

- 2006

- The EPA reported that most data centers exhibit a Power Usage Effectiveness (PUE) of 1.25 to 3.0, indicating room for improvement in energy efficiency.

- U.S. Federal Reserve - Data Storage Equipment Market Insights

- 2010

- The Federal Reserve noted that the areal density of leading-edge magnetic disks increased at a rate of 30% per year from 2003 to 2010, though this has slowed to roughly 10% annual growth since then.

- 2010

- The Federal Reserve observed that feature density in flash chips nearly doubled annually from 2000 to 2010, contributing to increased storage capacities.

- Public Sector Data Storage Trends

- U.S. Federal Government (2023)

- A significant increase in the adoption of Solid State Drives (SSDs) over traditional Hard Disk Drives (HDDs) due to their improved performance, security, and reliability.

- Government agencies are increasingly adopting NVMe PCIe-based SSDs to enhance application performance, particularly for mission-critical tasks such as database queries and data analytics.

- U.S. Department of Agriculture (2023)

- Utilizing edge computing and the Internet of Things (IoT) to monitor and analyze farm conditions requires advanced data storage solutions.

- Federal Emergency Management Agency (FEMA) (2023)

- Employing edge computing for disaster response necessitates efficient data storage and processing capabilities.

- U.S. Postal Service (2023)

- Using edge computing in distribution centers to process packages efficiently, driving the demand for scalable data storage solutions.

- National Institute of Standards and Technology (NIST) - Data Storage Equipment Market Insights

- 2015

- The Hard Disk Drive (HDD) industry shipped 533 exabytes, driven by demand for capacity HDDs to support cloud applications in data centers.

- 2015

- Revenue in the NAND flash memory industry reached approximately USD 31 billion, surpassing revenue in HDDs, and reflecting growth in solid-state drives (SSDs) from client and enterprise segments.

- 2015

- Petabyte shipments into the enterprise storage industry increased by 29% from 2014, indicating a surge in data storage needs.

- 2015

- Hyperscale cloud service providers emerged as the largest drivers of demand growth, building out data center infrastructure to support massive cloud workloads.

- 2015

- Adoption of tiered storage architectures increased, optimizing data storage to the most appropriate storage device and driving demand for high-capacity HDDs and high-performance SSDs.

- U.S. Bureau of Economic Analysis - Data Storage Equipment Pricing Trends

- 2002–2014

- The price index for large-scale data storage systems fell by 27.8%, indicating a significant decrease in storage costs over the period.

- 2004–2009

- The price index for large-scale data storage systems declined by 30.1%, reflecting advancements in technology and increased competition.

- 2009–2014

- The price index for large-scale data storage systems decreased by 21.9%, highlighting ongoing improvements in cost-efficiency.

- U.S. Bureau of Labor Statistics - Data Storage Equipment Pricing Trends

- 2002–2014

- The Bureau of Economic Analysis reported a 5.7% annual decline in investment prices for data storage equipment, suggesting continuous innovation and cost reduction in the industry.

- 2002–2014

- The Bureau of Labor Statistics observed a 6.6% annual decrease in the price index for data storage equipment, indicating enhanced affordability for consumers and businesses.

Global Enterprise Data Storage Market: Market Dynamics

Global Enterprise Data Storage Market: Driving Factors

Exponential Growth in Unstructured Data VolumesThe proliferation of multimedia content, IoT sensor data, social media, and enterprise-generated documents is pushing global organizations to seek high-capacity, scalable storage solutions. Enterprises are investing in object-based storage, scale-out NAS, and cloud-integrated storage systems to manage and analyze unstructured data efficiently. This shift is significantly driving the demand for enterprise-grade storage infrastructure capable of supporting petabyte-scale deployments.

Surge in Cloud Adoption across Business Verticals

As enterprises migrate workloads to the cloud, the demand for hybrid storage architectures and cloud-native storage solutions has surged. Cloud platforms offer agility, cost optimization, and on-demand scalability, encouraging businesses across sectors like retail, education, and logistics to adopt storage-as-a-service (STaaS). This transformation supports remote workforce enablement, disaster recovery, and global collaboration.

Global Enterprise Data Storage Market: Restraints

High Capital Expenditure and Operational Costs

Implementing and maintaining enterprise storage infrastructure requires significant upfront investment in hardware, software licensing, skilled labor, and cooling/power infrastructure. For small and medium-sized enterprises (SMEs), the total cost of ownership (TCO) often becomes a limiting factor, slowing adoption despite clear long-term benefits.

Data Security and Compliance Challenges

Enterprises must navigate a complex landscape of data privacy regulations like GDPR, HIPAA, and CCPA. Managing secure storage environments that protect against ransomware, unauthorized access, and data breaches remains a major concern. Failure to meet compliance requirements can result in hefty penalties and reputational damage, which acts as a deterrent to deploying new or third-party storage solutions.

Global Enterprise Data Storage Market: Opportunities

AI-Driven Storage Optimization and Predictive Analytics

The integration of artificial intelligence into enterprise storage platforms enables smart tiering, predictive maintenance, and performance tuning. Vendors are developing intelligent storage systems that automatically classify, route, and archive data based on usage patterns. This opens up new avenues for enhancing storage efficiency and reducing human oversight in IT operations.

Expansion into Edge and Remote Data Storage Markets

With the rise of edge computing and decentralized data collection, there is a growing demand for compact, high-performance storage solutions deployed at remote or mobile sites. Sectors like oil & gas, defense, agriculture, and mining are investing in ruggedized storage systems that offer real-time analytics and offline data synchronization at the edge, far from traditional data centers.

Global Enterprise Data Storage Market: Trends

Adoption of NVMe and Flash-Based Storage Technologies

Non-volatile memory express (NVMe) and solid-state drives (SSDs) are replacing traditional spinning disk technologies in enterprise environments due to their speed, reliability, and lower latency. NVMe-based storage arrays are becoming essential for high-performance workloads like big data analytics, AI model training, and real-time applications.

Growing Popularity of Storage Virtualization and Software-Defined Storage (SDS)

Organizations are adopting software-defined storage architectures to decouple storage management from hardware. This allows for greater flexibility, centralized control, and hardware-agnostic scalability. Storage virtualization enables efficient utilization of available resources across multi-vendor environments, enhancing operational agility.

Global Enterprise Data Storage Market: Research Scope and Analysis

By Deployment Mode Analysis

The cloud deployment mode is expected to maintain its dominance in the enterprise data storage market, capturing approximately 63.8% of the total market share in 2025. This growth is driven by enterprises prioritizing agility, cost efficiency, and scalability in their IT strategies. Cloud storage enables organizations to dynamically scale their storage capacities without investing in physical infrastructure, making it an attractive option for businesses of all sizes. The flexibility to access data from anywhere and the ability to support distributed workforces further amplify its appeal in today’s digital-first landscape. Cloud-based storage solutions offer enhanced business continuity through integrated disaster recovery, multi-zone redundancy, and backup automation.

Companies benefit from the operational simplicity of cloud environments, where updates, maintenance, and security enhancements are managed by the service provider. These advantages, coupled with strong vendor ecosystems from players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform, have significantly accelerated cloud storage adoption across sectors such as BFSI, healthcare, media, and retail. Additionally, innovations like AI-driven storage tiering and serverless storage models are further strengthening the position of cloud deployment in the enterprise segment.

In contrast, the on-premises deployment mode continues to serve a crucial role in industries where data sovereignty, low-latency performance, and stringent compliance requirements are top priorities. Organizations in sectors such as government, defense, manufacturing, and energy often prefer to retain full control over their data by maintaining storage infrastructure within their facilities. On-premises storage allows for greater customization, robust security configurations, and seamless integration with legacy systems. It is particularly beneficial for workloads that require ultra-fast access speeds or involve sensitive intellectual property.

However, the growth of on-premises storage is being challenged by its high capital expenditure, ongoing maintenance costs, and the need for skilled IT personnel. Despite this, many enterprises are adopting a hybrid deployment strategy, combining the control and performance of on-premises systems with the flexibility and scalability of the cloud. As storage demands continue to grow, the coexistence of both deployment modes is expected, with on-premises storage playing a strategic role in complementing cloud-first initiatives.

By Storage Medium Analysis

The cloud storage medium is projected to solidify its position as a market leader, capturing 34.2% of the total market share in 2025 within the enterprise data storage segment. This surge in cloud storage adoption is largely driven by the ongoing digital transformation across industries, where businesses seek more flexible, scalable, and cost-effective data storage solutions. Cloud storage offers unparalleled elasticity, allowing organizations to seamlessly scale their storage capacity according to fluctuating business needs, without requiring substantial capital expenditure on physical infrastructure. The rise of cloud storage is also fueled by its ability to provide global accessibility, enabling remote workforces and business units across multiple locations to access critical data at any time.

Cloud-native storage services, such as object storage and file storage, allow businesses to store and manage vast amounts of unstructured data, providing the performance and resilience needed for modern applications. Additionally, cloud storage providers offer built-in security features, such as encryption, data redundancy, and compliance with global regulations (e.g., GDPR, HIPAA), making it an attractive solution for enterprises in highly regulated sectors like healthcare, finance, and government.

However, despite the cloud's dominance, Storage Area Networks (SANs) continue to play a significant role in high-performance, data-intensive environments. SAN is a specialized network that provides block-level access to data, connecting servers and storage devices in a dedicated, high-speed network. It is particularly well-suited for large enterprises requiring high throughput, low-latency, and high-availability for their critical applications. SANs support mission-critical workloads that demand consistent performance, such as databases, virtualized environments, and transaction-intensive systems. While cloud storage is popular due to its cost-effectiveness and flexibility, SAN remains indispensable for organizations that need centralized, high-performance storage solutions.

The ability to manage large volumes of data with minimal downtime, coupled with storage virtualization capabilities, makes SAN an ideal choice for environments requiring high-speed data access. However, the upfront costs of SANs, both in terms of hardware and the expertise needed to manage the infrastructure, are notable challenges for small-to-medium enterprises (SMEs).

By Data Type Analysis

The unstructured data type is expected to maintain its dominant position in the enterprise data storage market, capturing a substantial 73.1% of the total market share in 2025. This continued dominance is driven by the exponential growth of multimedia content, including videos, images, audio files, and documents, all of which contribute to the rising volume of unstructured data. With the growing reliance on data analytics, machine learning, and AI technologies, organizations are focusing on data lakes and object-based storage systems to store, manage, and analyze unstructured data.

Unstructured data is often referred to as raw data because it does not follow a predefined data model or structure. It is typically found in formats such as emails, social media posts, audio and video recordings, and sensor data. The ability to process this data, derive insights, and apply machine learning models is becoming crucial across industries like healthcare, retail, entertainment, and social media. As organizations adopt big data technologies, including Hadoop and NoSQL databases, unstructured data will remain a major contributor to the storage market, especially as enterprises seek to harness data-driven decision-making and advanced analytics.

On the other hand, structured data continues to play a critical role in many business operations, but it is expected to capture a smaller portion of the data type segment in the coming years. Structured data is highly organized and resides in relational databases or data warehouses, where it can be easily queried using SQL or similar query languages. Examples include customer records, inventory databases, financial transactions, and other transactional data that follow a fixed schema with defined fields.

Structured data is essential for routine operational processes like order management, payroll processing, and accounting. While structured data remains foundational for business intelligence (BI), enterprise resource planning (ERP) systems, and customer relationship management (CRM) applications, it is often limited by its rigidity and the need for constant updates to schemas as business requirements evolve. In comparison, unstructured data provides organizations with a wealth of untapped opportunities, especially in the realms of predictive analytics, natural language processing (NLP), and image recognition.

By Organization Size Analysis

Large Enterprises are anticipated to retain their dominant position in the organization size segment, capturing approximately 67.6% of the total market share in 2025. This dominance is driven by the significant data storage needs of large organizations across various industries, including banking, healthcare, retail, manufacturing, and technology. These enterprises typically deal with high volumes of complex data, such as transactional data, customer insights, multimedia content, and big data analytics. To manage these data flows effectively, large enterprises often implement high-performance storage systems such as all-flash arrays, scale-out storage systems, and cloud-based storage solutions. The growing reliance on data-driven decision-making and real-time analytics further accelerates the demand for sophisticated data storage solutions.

Large enterprises typically have larger budgets, allowing them to adopt cutting-edge technologies, invest in cloud storage platforms, hybrid storage environments, and software-defined storage (SDS). Their ability to scale infrastructure globally and adopt AI-driven storage management gives them a competitive edge in industries that require data agility, fast processing, and secure storage. Additionally, they benefit from robust data security protocols, compliance with regulatory requirements, and disaster recovery capabilities, all of which make large enterprises major consumers of advanced data storage systems.

Despite the dominance of large enterprises, Small and Medium-sized Enterprises (SMEs) are also emerging as a critical segment in the enterprise data storage market, though they typically represent a smaller share. SMEs often face resource constraints and must make more calculated investments in data storage solutions. These organizations do not have the same scale of operations as large enterprises, but still generate a considerable amount of data from customer interactions, sales transactions, marketing campaigns, and product development processes.

As a result, SMEs are seeking cost-effective, scalable, and secure storage solutions to store their growing datasets while ensuring business continuity. For SMEs, cloud storage has become an attractive option due to its pay-as-you-go pricing model, which provides flexibility and scalability without the need for large upfront investments. This has enabled smaller businesses to move away from traditional on-premises storage systems, which require significant capital expenditures for hardware and IT infrastructure. Additionally, cloud storage services offered by providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud allow SMEs to access enterprise-grade storage capabilities such as data redundancy, automatic backups, encryption, and compliance with data privacy regulations.

By Application Analysis

Data Archiving and Backup applications are set to strengthen their position within the application type segment, capturing 32.4% of the total market share in 2025. The growing importance of data protection and regulatory compliance across industries is the primary driver of this growth. As organizations generate enormous amounts of data, the need for robust data archiving and backup strategies has never been more critical. Data archiving ensures that valuable data is securely stored for long-term retention, enabling businesses to comply with industry regulations such as GDPR, HIPAA, and SOX. Backup applications, on the other hand, protect against data loss, ensuring business continuity in the event of system failures, cyberattacks, or natural disasters.

With the growing threat of cybersecurity breaches, the importance of effective backup solutions has intensified. Enterprises are relying on cloud-based backup solutions, which offer scalable storage, automated backup processes, and enhanced data encryption. These solutions enable organizations to store data in secure off-site locations, minimizing the risk of data loss due to hardware failure or local disasters. Additionally, data archiving solutions allow businesses to retain data over long periods while ensuring that access to archived data remains fast, reliable, and cost-efficient.

On the other hand, Data Analytics applications are also growing in prominence, but their focus differs from archiving and backup. While data archiving and backup are primarily focused on data protection, regulatory compliance, and business continuity, data analytics is centered on extracting value from data to drive business insights. In the context of enterprise data storage, analytics applications are used to derive actionable insights from large volumes of data, enabling organizations to improve decision-making, optimize operations, and enhance customer experiences.

The key distinction between these two application types is that data analytics often involves the processing of both real-time and historical data to derive insights, while data archiving and backup focus on securely storing data for the long term and ensuring that it can be quickly restored in case of loss. For enterprises, the combination of data archiving and backup with data analytics offers a holistic approach to managing data. Data analytics applications can analyze archived data to uncover historical trends, patterns, and insights, while backup solutions ensure that critical business data is always protected and can be restored when needed. Additionally, with cloud storage solutions supporting both archiving and analytics, companies can streamline their data management processes, reducing costs and improving efficiency.

The Enterprise Data Storage Market Report is segmented on the basis of the following

By Deployment Mode

By Storage Medium

- Network Attached Storage

- Direct Attached Storage

- Hyper Converged Storage

- Storage Area Network

- Cloud Storage

By Data Type

- Structured Data

- Unstructured Data

By Organization Size

- Small and Medium Businesses (SMBs)

- Large Enterprises

By Application

- Data Archiving and Backup

- Data Analytics

- Data Management

- Data Protection

Global Enterprise Data Storage Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to maintain its leadership in the global enterprise data storage market, capturing 34.9% of the total global market revenue by 2025. This dominance is driven by the region's robust technological infrastructure, high adoption of cloud storage solutions, and growing demand for data protection and security in sectors such as finance, healthcare, and e-commerce. The presence of leading technology companies like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud further accelerates the market's growth in North America, providing businesses with advanced data storage solutions and managed services.

Additionally, stringent data privacy regulations and the growing need for disaster recovery and data analytics have prompted enterprises to invest heavily in scalable and secure data storage systems, ensuring that North America remains at the forefront of the enterprise data storage market. The region's strong focus on innovation, coupled with its expanding IoT ecosystem and big data analytics applications, solidifies its dominant position in the market.

Region with significant growth

The Asia-Pacific (APAC) region is set to experience the highest CAGR (Compound Annual Growth Rate) in the global enterprise data storage market over the forecast period, driven by rapid digital transformation, increased cloud adoption, and growing demand for big data analytics across diverse industries. As economies in countries like China, India, and Japan continue to expand, there is a surge in data generation from sectors such as e-commerce, manufacturing, financial services, and telecommunications, propelling the need for efficient and scalable data storage solutions.

The region's growing investments in smart city projects, IoT networks, and artificial intelligence further fuel the demand for advanced storage systems capable of handling large volumes of data in real time. Additionally, the adoption of cloud storage and hybrid storage models is accelerating as businesses in APAC look for flexible, cost-effective solutions to manage their data. The growing emphasis on data security, regulatory compliance, and disaster recovery also drives enterprises to invest in secure and resilient data storage systems, making the region a key player in the market's growth trajectory.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Enterprise Data Storage Market: Competitive Landscape

The global competitive landscape of the enterprise data storage market is highly dynamic, characterized by the presence of several well-established players as well as emerging companies offering innovative solutions. This competitive environment is shaped by the growing demand for scalable, secure, and cost-effective storage solutions that can manage the growing volumes of data generated by businesses worldwide. Key market players include global giants like Dell Technologies, Hewlett-Packard Enterprise (HPE), NetApp, IBM, Pure Storage, and Hitachi Vantara, who are dominating the market through a combination of advanced technology offerings, strong brand presence, and strategic acquisitions. These companies leverage their vast experience and resources to provide comprehensive storage solutions, including cloud storage, on-premises storage, data protection, backup, and disaster recovery services, catering to businesses of all sizes.

The competitive advantage of these established players lies in their ability to offer integrated solutions that combine high-performance storage hardware with cloud-based services and managed storage solutions. For instance, Dell Technologies leads with its PowerMax storage arrays and VxRail hyper-converged infrastructure, while NetApp focuses on providing cloud-integrated data management and data protection solutions. These companies are also heavily investing in AI-driven storage management, enabling businesses to improve data lifecycle management, automate workflows, and reduce storage costs.

Some of the prominent players in the global enterprise data storage are:

- Dell Technologies

- Hewlett-Packard Enterprise (HPE)

- IBM

- NetApp

- Hitachi Vantara

- Pure Storage

- Huawei Technologies

- Lenovo

- Fujitsu

- Western Digital

- Seagate Technology

- Oracle

- Cisco Systems

- Samsung Electronics

- Intel Corporation

- Microsoft (Azure Storage)

- Amazon Web Services (AWS Storage)

- Google Cloud (Google Cloud Storage)

- NEC Corporation

- Infinidat

- Other Key Players

Global Enterprise Data Storage Market: Recent Developments

- April 2025: Dell Technologies acquired Pivotal Software, expanding its portfolio of cloud-native storage solutions and data analytics services to further strengthen its hybrid cloud offerings.

- February 2024: Pure Storage acquired Portworx, a leader in cloud-native storage and Kubernetes storage solutions, to enhance its data protection and cloud storage capabilities for modern applications.

- January 2023: Hewlett-Packard Enterprise (HPE) completed its acquisition of Zerto, a company specializing in disaster recovery, backup, and cloud data management, to improve its offerings for enterprise data protection.

- November 2022: IBM acquired Red Hat in a strategic move to bolster its hybrid cloud capabilities and enterprise storage solutions, allowing customers to securely manage data across cloud and on-premises environments.

- August 2021: NetApp acquired Spot, a leader in cloud infrastructure optimization, enhancing NetApp's ability to offer cost-efficient cloud storage solutions and improve data lifecycle management for enterprises.

- May 2021: Vast Data acquired Unity Technologies, a company specializing in high-performance storage systems for AI, big data, and cloud environments, to accelerate its presence in the flash storage market.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 13.1 Bn |

| Forecast Value (2034) |

USD 19.8 Bn |

| CAGR (2025–2034) |

4.7% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 3.8 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Deployment Mode (On-Premises, Cloud), By Storage Medium (Network Attached Storage, Direct Attached Storage, Hyper Converged Storage, Storage Area Network, Cloud Storage), By Data Type (Structured Data, Unstructured Data), By Organization Size (Small and Medium Businesses (SMBs), Large Enterprises), and By Application (Data Archiving and Backup, Data Analytics, Data Management, Data Protection). |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Dell Technologies, HPE, IBM, NetApp, Hitachi Vantara, Pure Storage, Huawei, Lenovo, Fujitsu, Western Digital, Seagate, Oracle, Cisco, Samsung, Intel, Microsoft, AWS, Google Cloud, NEC, Infinidat, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

The global enterprise data storage market size is estimated to have a value of USD 13.1 billion in 2025 and is expected to reach USD 19.8 billion by the end of 2034.

The US enterprise data storage market is projected to be valued at USD 3.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 5.7 billion in 2034 at a CAGR of 4.4%.

North America is expected to have the largest market share in the global enterprise data storage market, with a share of about 34.9% in 2025.

Some of the major key players in the global enterprise data storage market are Dell Technologies, HPE, IBM, NetApp, Hitachi Vantara, Pure Storage, Huawei, Lenovo, Fujitsu, Western Digital, Seagate, Oracle, Cisco, Samsung, Intel, Microsoft, AWS, Google Cloud, NEC, Infinidat, and Other Key Players.

The market is growing at a CAGR of 4.7 percent over the forecasted period.