Market Overview

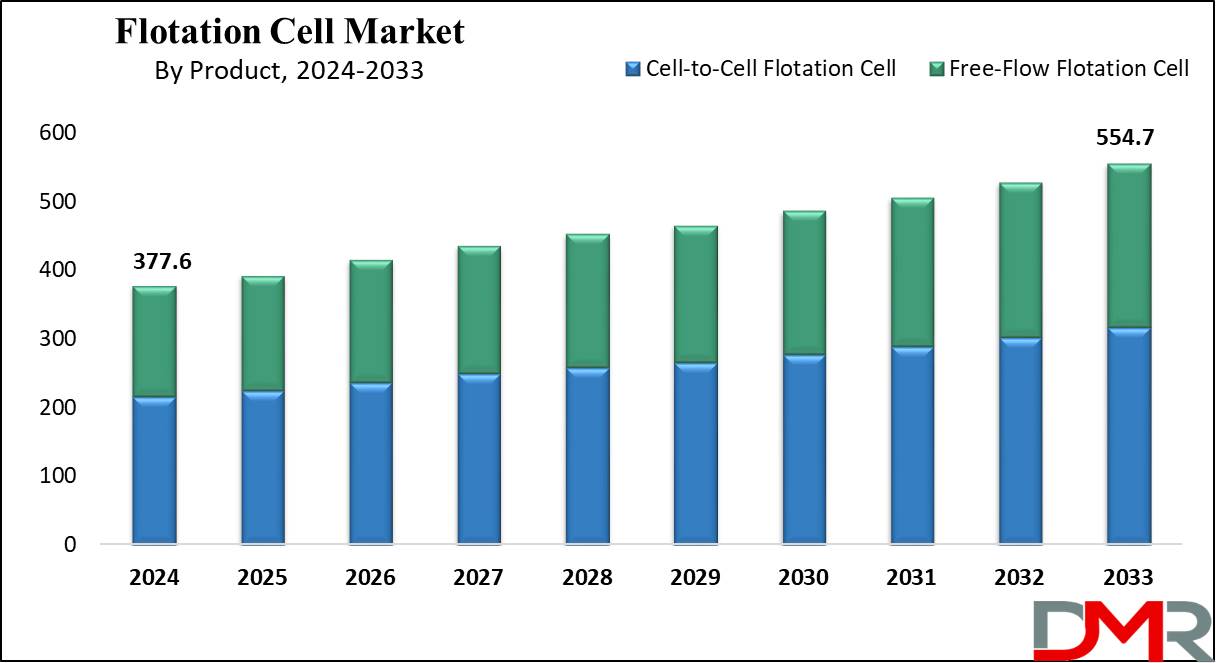

The

Global Flotation Cell Market is projected to

reach USD 377.6 million in 2024 and grow at a compound annual

growth rate of 4.4% from there until 2033 to reach a

value of USD 554.7 million.

A flotation cell is a vital component of mineral processing, utilized to separate valuable minerals from waste rock or gangue based on their differences in surface properties. It uses the principles of froth flotation, where chemicals are added to a slurry to selectively adhere to desired mineral particles. Air is injected to develop bubbles that carry the hydrophobic particles to the surface, forming a froth that is skimmed off while hydrophilic particles sink and are removed as tailings.

Further, the demand for flotation cells is growing due to increasing mineral extraction activities, mainly in copper, gold, and other precious metal mining. The drive for sustainable practices and energy efficiency also drives innovation in cell design, with manufacturers focusing on improving recovery rates and minimizing water and power usage.

Further, the adoption of larger, more efficient flotation cells enhances throughput and reduces operational costs. Advanced technologies like automated control systems, machine learning for process optimization, and environmentally friendly

flotation reagents are reshaping the market, which aims to meet growing sustainability goals while maintaining productivity.

Moreover, the flotation cell market is expected to grow, driven by expanding the mineral demand and the need for more efficient processing solutions. Manufacturers are investing in R&D to stay competitive, addressing challenges like more complexity and stringent environmental regulations. Research in areas such as

cell culture and biological processing also opens new interdisciplinary applications where flotation principles may overlap with bioprocessing techniques.

The US Flotation Cell Market

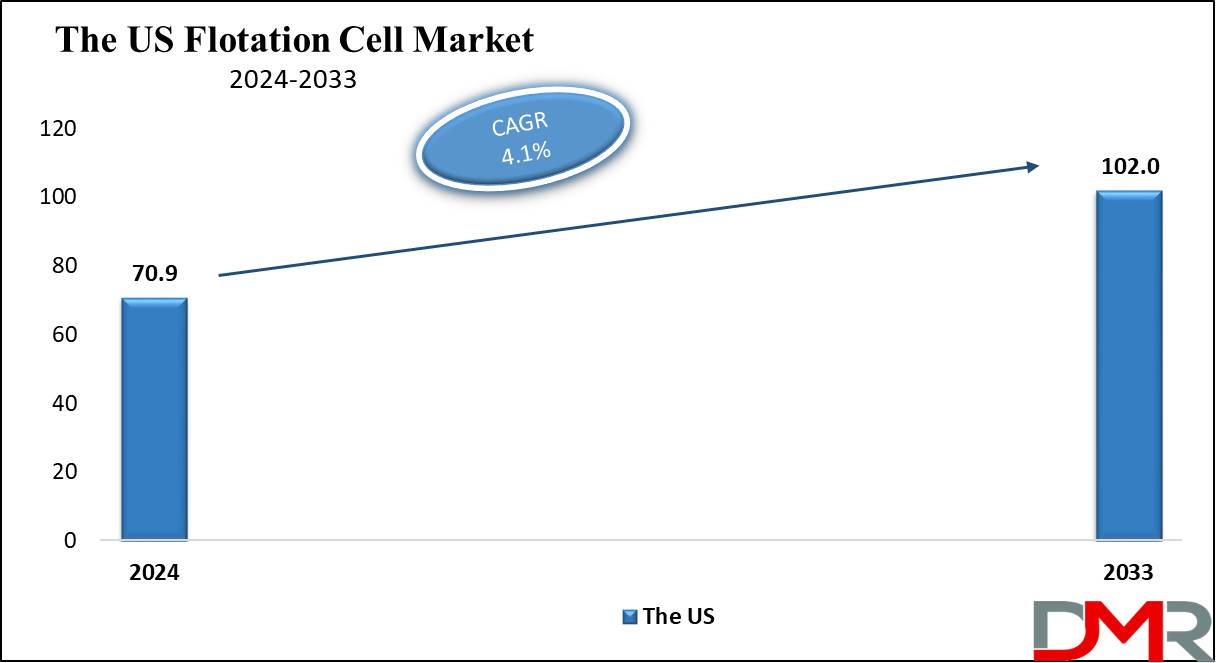

The

US Flotation Cell Market is projected to

reach USD 70.9 million in 2024 at a compound annual growth

rate of 4.1% over its forecast period.

The flotation cell market in the US provides growth opportunities driven by development in mining technology, water treatment solutions, and industrial recycling. With the growing demand for metals like copper and gold, the need for efficient flotation cells in mineral extraction is growing. In addition, stricter environmental regulations in wastewater management drive adoption in industrial sectors, creating a stronger market for innovative, eco-friendly flotation technologies.

Further, the market is driven by increasing mining activities and the rising demand for sustainable water treatment solutions. The demand for efficient mineral extraction and stricter environmental regulations act as key growth drivers. However, high initial costs and ongoing maintenance requirements may act as restraints, limiting market expansion for smaller companies or projects.

Key Takeaways

- Market Growth: The Flotation Cell Market size is expected to grow by 162.3 million, at a CAGR of 4.4% during the forecasted period of 2025 to 2033.

- By Product: The cell-to-cell flotation segment is anticipated to get the majority share of the Flotation Cell Market in 2024.

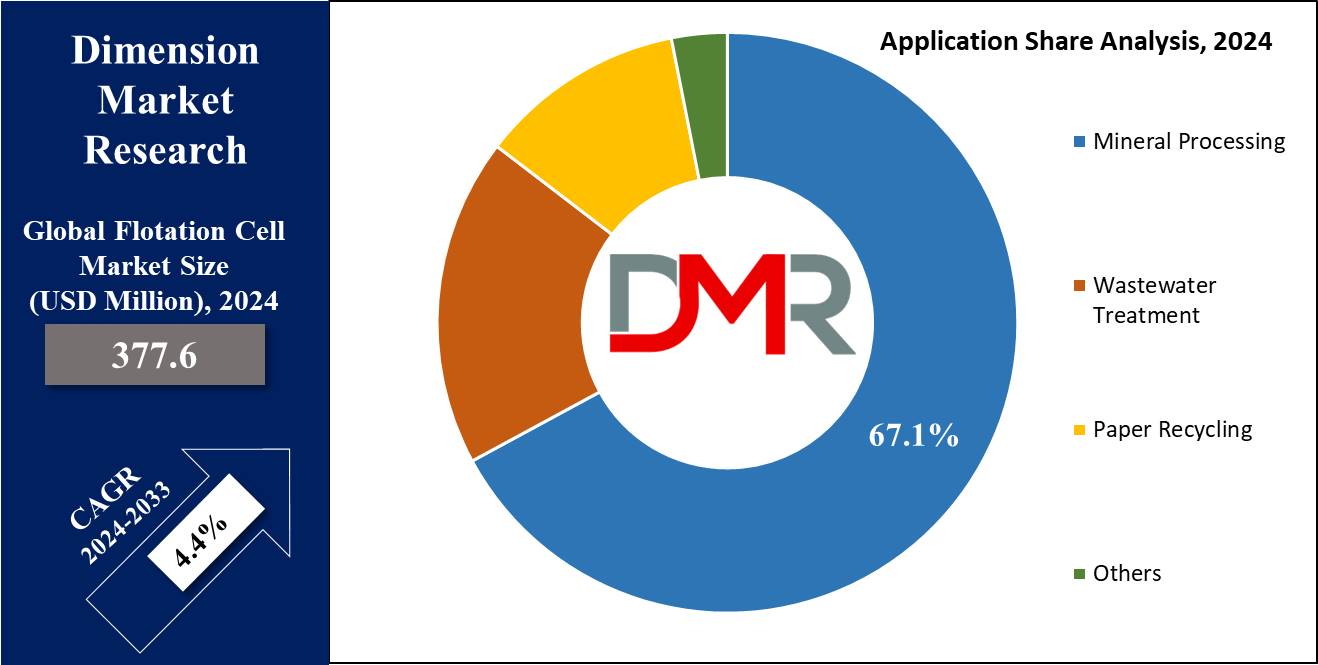

- By Application: The mineral processing segment is expected to be leading the market in 2024

- By End User: The Mining and metallurgy segment is expected to get the largest revenue share in 2024 in the Flotation Cell Market.

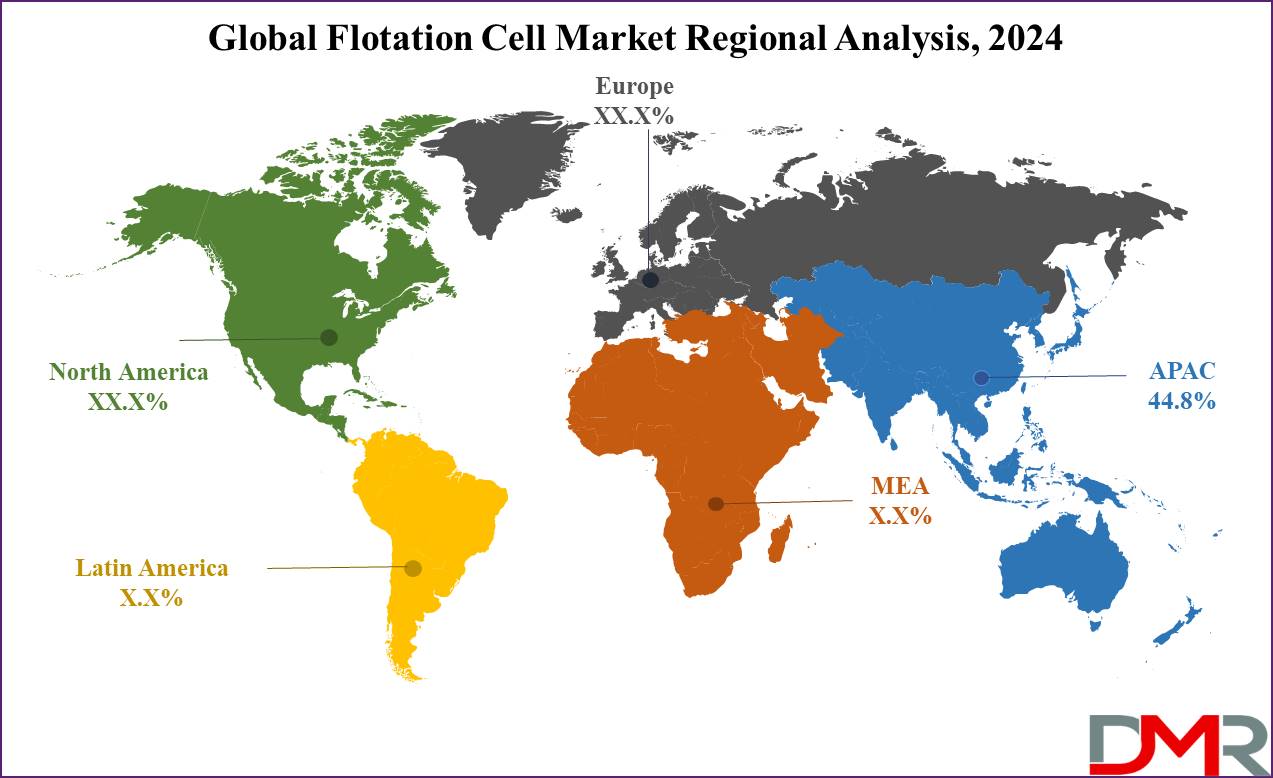

- Regional Insight: Asia Pacific is expected to hold a 44.8% share of revenue in the Global Flotation Cell Market in 2024.

- Use Cases: Some of the use cases of Flotation Cell include mineral processing, paper recycling, and more.

Use Cases

- Mineral Processing: Flotation cells are broadly used to separate valuable minerals like copper, gold, and silver from ore, maximizing recovery and grade.

- Wastewater Treatment: Applied in industrial wastewater treatment to remove oils, greases, and other hydrophobic contaminants through dissolved air flotation.

- Paper Recycling: Used in the paper industry to eliminate ink and impurities from recycled paper fibers during deinking processes.

- Coal Beneficiation: Used in coal preparation plants to enhance coal quality by separating ash-forming minerals from coal particles.

Market Dynamic

Driving Factors

Increasing Mineral DemandThe growth in global demand for minerals like copper, gold, and lithium, driven by expanding industries like electronics, renewable energy, and automotive, boosts the demand for efficient flotation cells to improve mineral recovery rates and meet production targets.

Technological Advancements and Sustainability Focus

Innovations like larger, more energy-efficient flotation cells, automation, and the use of eco-friendly reagents are driving market growth. These technologies reduce operational costs, energy consumption, and environmental impact, aligning with sustainability goals and regulatory compliance.

Restraints

High Initial Costs and Maintenance

Flotation cells include major upfront investments, like procurement, installation, and infrastructure setup. In addition, ongoing maintenance and the demand for skilled operators can pose financial and operational challenges, mainly for small and medium-sized enterprises.

Stringent Environmental Regulations

Highly strict environmental policies regarding water usage, chemical discharges, and energy consumption can restrict market growth. Compliance with these regulations mostly requires costly upgrades or process modifications, impacting the overall profitability of flotation cell operations.

Opportunities

Emerging Markets and Mining Projects

The rise in industrialization in emerging economies and the development of new mining projects develop various opportunities for flotation cell adoption. These regions often have untapped mineral reserves, driving the need for efficient processing technologies.

Adoption of Digital Solutions

The incorporation of automation, IoT, and AI in flotation cells provides opportunities to optimize operations. Real-time monitoring, predictive maintenance, and process optimization can improve efficiency, reduce costs, and enhance sustainability, attracting investments in advanced flotation systems.

Trends

Focus on Larger Flotation Cells

The industry is transforming toward the usage of larger flotation cells to higher efficiency and reduce operational costs. These larger units allow for large throughput, enhancing overall productivity and making them ideal for large-scale mining operations, which aligns with the rise in demand for affordable mineral processing solutions.

Integration of Smart Technologies

The development of automation and live monitoring systems is highly being incorporated into flotation cells. These technologies use AI and IoT for process optimization, allowing better control over flow stability, particle recovery, and reagent use, which helps the industry's goals of improving efficiency and sustainability while reducing downtime and maintenance costs.

Research Scope and Analysis

By Product

Cell-to-cell flotation cells are expected to dominate the flotation cell market in 2024 by providing higher separation efficiency in mineral processing. These cells are developed with multiple individual compartments that allow better control over the flotation process, allowing for better recovery of valuable minerals. By providing consistent and predictable results in numerous ore types, they help boost productivity while minimizing operational costs.

Their scalability makes them ideal for both small-scale and large-scale mining operations, which drives the need across industries. In addition, their ability to compare with advanced automation and monitoring technologies helps more efficient resource management and helps meet sustainability goals

Further, free-flow flotation cells are vital for the flotation cell market's growth are are projected to grow significantly due to their simplicity and efficiency in handling large volumes of slurry.

These cells are developed for continuous flow, which reduces the need for complex internal baffles, making them affordable and easy to operate. They are mainly suitable for processing coarse particles and enhancing mineral recovery rates. As mining operations grow larger and more demanding, the adoption of free-flow flotation cells is increasing to meet throughput requirements while optimizing resource extraction.

By Application

Mineral processing is a major application driving the growth of the flotation cell market and is set to dominate the market in 2024. As the need for metals like copper, gold, and lithium increases, efficient mineral extraction methods become essential. Flotation cells separate valuable minerals from waste material by using bubbles to float hydrophobic particles to the surface, where they can be collected, which is critical in improving ore quality and maximizing resource recovery.

With the global mining sector expanding, the demand for advanced, energy-efficient flotation cells continues to grow, supporting market growth Further, paper recycling will glow significantly over the coming years in flotation cells, which are crucial for removing ink and other contaminants from recycled paper fibers, improving the quality of the recycled paper, and making it suitable for reuse in new paper products. As the need for sustainable practices increases, the demand for effective recycling methods like flotation cells, continues to grow, driving market expansion in both recycling and environmental sectors.

By End User

Mining and metallurgy are vital end users in the growth of the flotation cell market, as these industries depend heavily on flotation technology for mineral extraction and refining. Flotation cells support separating valuable metals like copper, gold, and silver from ore by using differences in surface properties. As the global need for metals rises due to industrial and technological needs, mining operations are adopting advanced flotation systems to enhance recovery rates and processing efficiency. Efficient ore processing directly fuels the demand for innovative flotation cells, supporting market growth across the mining and metallurgy sectors.

Further, water treatment is a growing end-user for flotation cells, as these systems are used to remove oils, solids, and other contaminants from industrial wastewater. Flotation cells, mainly dissolved air flotation (DAF) units, help separate impurities efficiently, making them important in industries like food processing, chemical manufacturing, and municipal water treatment. As environmental regulations become stricter, the need for effective water treatment solutions is growing, driving the adoption of flotation cells to improve water quality and sustainability. Additionally, water purity and separation techniques from flotation are being explored in life science sectors such as

cell therapy manufacturing and bioprocessing.

The Flotation Cell Market Report is segmented on the basis of the following

By Product

- Cell-to-Cell Flotation Cell

- Free-Flow Flotation Cell

By Application

- Mineral Processing

- Wastewater Treatment

- Paper Recycling

- Others

By End User

- Mining & Metallurgy

- Paper & Pulp

- Water Treatment

- Oil & Gas

Regional Analysis

Asia Pacific plays a major role in the growth of the flotation cell market, which is expected to have

44.8% of the market share in 2024 due to its booming mining, industrial, and water treatment sectors. Countries like China, India, and Australia are major contributors, with mining activities in these regions driving the need for flotation cells used in mineral processing.

In addition, the rapid industrialization and urbanization in the Asia Pacific increase the demand for water treatment solutions, where flotation cells are vital in removing contaminants from wastewater. With the rise in infrastructure development and growth in environmental awareness, the need for efficient flotation systems is expected to continue expanding in this region, Further, North America is expected to grow steadily in the flotation cell market over the forecasted period, driven by its advanced mining, recycling, and water treatment industries.

The United States and Canada are key players, with large-scale mining operations that need flotation technology to extract minerals like copper, gold, and nickel. In addition, stricter environmental regulations are increasing the need for effective water treatment, where flotation cells help remove contaminants. The region’s emphasis on sustainability and innovation further supports the growth of flotation cell adoption.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The flotation cell market is highly competitive, with various global and regional players providing a variety of products to cater to mining, water treatment, and other industrial sectors. Companies are aiming at innovation, like developing larger, more efficient flotation cells and integrating automation and advanced monitoring systems to enhance operational efficiency.

Sustainability is a major trend, with firms focusing on energy-efficient and environmentally friendly solutions. Strategic partnerships, mergers, and acquisitions are common as companies look to expand their market presence and access new technologies. Intense competition is driven by the need for cost-effective, high-performance flotation systems.

Some of the prominent players in the global Flotation Cell are

- GEA Group

- Mesto Outotec

- FLSmidth

- WEMCO

- Xinhai Mining Technology & Equipment

- Denver Equipment

- Groninger

- Zoneding

- SGS SA

- Mitsubishi Materials Corporation

- Other Key Players

Recent Developments

- In November 2024, Lundin Gold Inc. expanded its operations at the Fruta del Note gold mine in Ecuador by integrating Jameson flotation cells, which is part of a large expansion plan, and upgrading the processing capabilities to handle increased throughput, as it anticipates that implementation of the cells at Fruta del Norte will yield several positive impacts.

- In September 2024, TAKRAF Group announced the successful signing of a cooperation agreement between TAKRAF Group and PSI Minerals Technologies, which marks the beginning of a new chapter of collaboration between both organizations while focusing on TAKRAF’s DELKOR brand and its liquid/solid separation and wet processing equipment, which are particularly designed for the needs of the mining industry.

- In September 2024, Metso launched its latest innovative solution, the FloatForce®+ mixing mechanism. With FloatForce®+, part of Metso’s Planet Positive offering, Metso launched a plug-and-play solution that maximizes metallurgical recovery, boosts pumping efficiency, and reduces energy consumption, supporting customers recover valuable materials and increasing revenue.

- In July 2024, Bendito Resources reported the financing support of MK Metals Trading Mexico, as it finalized the purchase of a partially used 500 tpd zinc, lead, and silver flotation plant for the Oposura Project located near Moctezuma, Sonora State, Mexico. Further, it also acquired stationary and mobile equipment, like laboratory equipment, primary and secondary mining equipment, blast hole and exploration drills, and other necessary support equipment typically used at mine sites.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 377.6 Mn |

| Forecast Value (2033) |

USD 554.7 Mn |

| CAGR (2024-2033) |

4.4% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 70.9 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Cell-to-Cell Flotation Cell and Free-Flow Flotation Cell), By Application (Mineral Processing, Wastewater Treatment, Paper Recycling, and Others), By End User (Mining & Metallurgy, Paper & Pulp, Water Treatment, and Oil & Gas) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

GEA Group, Mesto Outotec, FLSmidth, WEMCO, Xinhai Mining Technology & Equipment, Denver Equipment, Groninger, Zoneding, SGS SA, Mitsubishi Materials Corporation, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Flotation Cell Market size is expected to reach a value of USD 377.6 million in 2024 and is expected to reach USD 554.7 million by the end of 2033.

Asia Pacific is expected to have the largest market share in the Global Flotation Cell Market with a share of about 44.8% in 2024.

The Flotation Cell Market in the US is expected to reach USD 70.9 million in 2024.

Some of the major key players in the Global Flotation Cell Market are GEA Group, Mesto Outotec, FLSmidth, and others.

The market is growing at a CAGR of 4.4 percent over the forecasted period.