Market Overview

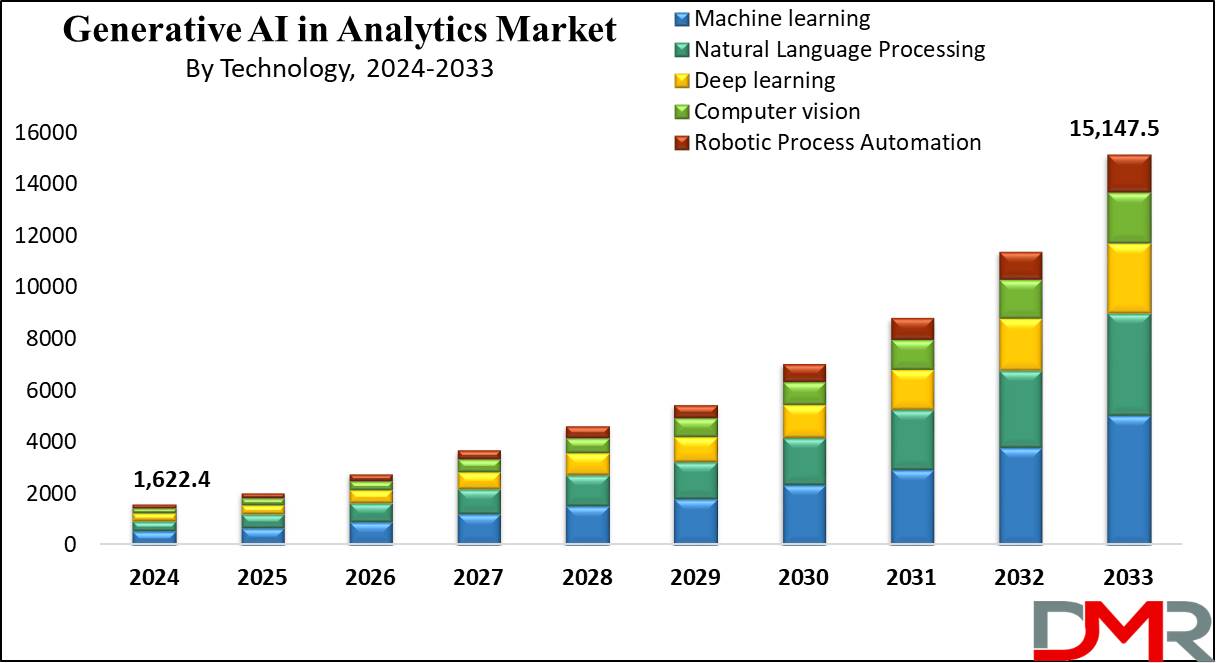

The Global Generative AI in Analytics Market size is estimated to be valued at USD 1,622.4 million in 2024 which is further expected to grow and reach USD 15,147.5 million in 2033 at a CAGR of 28.2% for the forecasted period.

The global generative AI in analytics market is witnessing significant growth pushed with the aid of advancements in machine learning and deep learning technology. This market encompasses a huge variety of applications like data augmentation, anomaly detection, text generation, and simulation forecasting throughout numerous industries which include BFSI, healthcare, retail, manufacturing, telecommunications, and government organizations. The deployment of Generative AI answers varies from cloud-primarily based to on-premise and hybrid models, catering to diverse organizational wishes and possibilities.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Technological advancements in

Natural Language Processing, Computer Vision, and Robotic Process Automation further enhance the abilities of Generative AI structures. Key gamers in the marketplace are investing closely in studies and development to enhance the efficiency and effectiveness of these answers, fostering innovation and competitiveness. With the increasing adoption of AI-pushed analytics solutions for decision-making strategies, the Generative AI in Analytics market is poised for a persevered boom in the foreseeable future.

The rise of Generative AI in analytics is revolutionizing data-driven decision-making, offering businesses powerful tools for predictive insights, automated reporting, and scenario modeling. Conferences and events focused on this field explore cutting-edge applications, such as generating synthetic data for model training, improving customer experience through personalized recommendations, and enhancing operational efficiency.

These gatherings provide opportunities for professionals to network, learn from industry leaders, and discover emerging trends like AI ethics, real-time analytics, and the integration of generative models with traditional BI tools. Staying ahead in this dynamic landscape requires continuous learning and adoption of innovative AI-driven strategies.

As per Explodingtopics, the Generative AI in Analytics Market is rapidly evolving, with 92% of Fortune 500 companies having adopted this transformative technology. Nearly 9 in 10 American jobs could be influenced by generative AI, and by 2025, 95% of customer interactions are projected to involve AI.

Currently, 73% of marketing departments utilize generative AI, with image generation (69%), text creation (58%), and audio production (50%) being key applications. Notably, 44% of businesses leverage it for cloud pricing optimization, while 41% use it for conversational AI. Gartner reports a potential 24.69% productivity boost within 18 months, underscoring AI's business value.

Key Takeaways

- Market Value: The market size is projected to reach a market value of USD 2,033.2 million in 2025, compared to USD 15,147.5 million in 2033 at a CAGR of 28.2%.

- Market Definition: Generative AI in analytics refers to algorithms that create new data or content material primarily based on patterns learned from existing data, allowing tasks that include data augmentation and synthetic data generation.

- Technology Segment Analysis: Machine learning is projected to exert prominence in the technology segment with 33.2% of market share in 2024.

- Deployment Segment Analysis: Cloud-based is expected to exert its dominance in the deployment segment with 63.1% of market share in 2024.

- Application Segment Analysis: Cybersecurity organizations are projected to command the generative AI in analytics market with the highest market value in 2024.

- End-user Segment Analysis: Banking, financial services, and insurance (BFSI) are projected to command the generative AI in analytics market with the highest market value in 2024.

- Regional Analysis: North America is predicted to dominate the global generative artificial intelligence analytics market with 50.6% of the market share in 2024.

Use Cases

- Data Augmentation: Generative AI is used to create synthetic data, which can be utilized to reinforce existing datasets for existing system datasets for training machine learning models. This allows for improving model performance and robustness.

- Anomaly Detection: Generative AI models can pick out anomalies in various datasets, including fraud detection in economic transactions, intrusion detection in cybersecurity, and prediction of equipment failures in manufacturing industries.

- Text Generation: Generative AI techniques like recurrent neural networks (RNNs) and transformer models are used for generating natural language text. This is useful in applications together with chatbots, content creation, and automated report writing.

- Simulation and Forecasting: Generative AI is utilized for simulating complex structures and forecasting future traits. For example, in economic markets, demand forecasting in retail, and weather forecasting, generative models assist in predicting outcomes based on historical data patterns.

- Computer Vision: Generative AI plays a critical position in computer vision tasks such as image generation, style transfer, and image-to-image translation. These programs find use in areas like autonomous cars, medical imaging, and enjoyment.

Market Dynamic

Drivers

- Escalating Availability of Data: The proliferation of digital transactions has resulted in an abundance of data, enabling deep insights into consumer behavior and market trends. Generative AI models leverage this data to improve precision and relevance, driving their continuous development and application in analytics across various industries, including finance.

- Advanced Risk Modeling and Fraud Detection: Generative AI, especially Simulation AI, allows the synthesis of various economic scenarios for chance modeling and pressure trying out. Moreover, it enhances fraud detection algorithms by way of schooling them with synthetic facts, thereby bolstering businesses' abilities to stumble on and prevent fraudulent activities effectively.

- Personalized Customer Services: Analyzing customer facts empowers businesses to offer tailor-made economic products and services, improving consumer satisfaction & engagement. Generative AI allows the customization of offerings based totally on consumer choices, contributing to the growth of the global generative AI in analytics market, especially inside the fintech sector.

Restraints

Data Security and Privacy Concerns: The sensitive nature of financial data raises concerns concerning protection and privacy. Fintech companies employing generative AI have to navigate stringent rules to mitigate the risks of data breaches and misuse, which could have adverse consequences for both businesses and consumers.

Integration Challenges and Technical Complexity: Integrating generative AI solutions into current fintech infrastructures poses demanding situations due to technical complexities and compatibility issues with legacy systems. Overcoming those hurdles requires vast investments in time and resources, leading to delays and escalated implementation expenses for fintech businesses.

Opportunities

Investment in Research and Development: Major industry players are heavily making an investment in enhancing the utility of generative AI in analytics, particularly in the fintech sector. This investment underscores the growing prominence of generative AI and its potential to drive innovation in financial services, imparting lucrative opportunities for market players.

Enhanced Customer Experience: Generative AI allows the interpretation of customer data to supply personalized advice and offers, thereby improving consumer satisfaction and retention. Fintech companies specializing in surpassing industry requirements in AI development can secure a significant marketplace proportion by prioritizing customer experience through generative AI analytics.

Trends

Algorithmic Trading and Portfolio Optimization: Generative AI is increasingly more deployed in algorithmic trade and portfolio optimization, leveraging its potential to analyze large economic datasets and generate predictive models. These AI-powered systems enhance investment performance and risk management by autonomously executing trades and adapting to changing market conditions in real-time.

Fraud Detection and Risk Management: Fintech companies are leveraging generative AI techniques which include deep learning and neural networks to enhance fraud detection and risk management systems. By studying complex financial transactions, those AI models detect anomalous patterns with greater accuracy and velocity, enabling efficient mitigation of economic losses and regulatory compliance.

Research Scope and Analysis

By Technology

Machine learning is projected to dominate the technology segment with 33.2% of the market share in 2024 due to its versatility and effectiveness in extracting insights from vast datasets. Leveraging algorithms that enhance automatically through experience, machine learning permits accurate predictions and decision-making in various applications.

In finance,

machine learning enables risk modeling, fraud detection, and personalized consumer services with the aid of analyzing transactional information and consumer behavior patterns. Its adaptability to distinctive information types and scalability make it imperative for fintech organizations striving to enhance operational performance and consumer experience.

Moreover, machine learning strategies which include supervised learning, unsupervised learning, and reinforcement learning empower economic institutions to find hidden patterns and trends, riding innovation and competitive advantage. With ongoing advancements in machine learning models and algorithms, its dominance in the analytics segment is expected to persist, shaping the future of data-driven decision-making in the finance sector.

By Deployment

Cloud-based deployment is projected to dominate the deployment segment with 63.1% of the market share in 2024. This dominance is mainly due to its flexibility, scalability, and cost-effectiveness. Cloud computing offers businesses access to a substantial array of computing sources, including storage and processing power, without the need for investing in and maintaining on-premise infrastructure.

This enables companies, including fintech organizations, to rapidly deploy analytics solutions and scale them according to fluctuating demand. Moreover, cloud-based deployment presents greater accessibility and collaboration skills, as users can get access to analytics systems from everywhere with an internet connection.

This accessibility fosters real-time decision-making and helps collaboration among geographically dispersed teams. Additionally, cloud-based solutions provide improved security measures and compliance requirements, as professional cloud providers invest closely in robust security protocols and regulatory certifications.

This mitigates security risks and ensures data protection, essential factors within the finance industry wherein information privacy and confidentiality are paramount.

Overall, the flexibility, scalability, accessibility, safety, and fee-effectiveness presented by cloud-based deployment make it the preferred choice for organizations seeking for to harness the power of analytics inside the fintech sector and beyond.

By Application

Data augmentation is expected to stand out as a dominant application segment with the highest market share in 2024. This is due to its transformative impact on improving data quality and amount. Generative AI techniques permit the advent of synthetic data that closely mirror real-world scenarios, addressing demanding situations that include data scarcity and imbalance normally encountered in analytics tasks.

In the fintech sector, in which precision and reliability are paramount, data augmentation performs an important role in training machine learning models for anomaly detection, fraud detection, and equipment failure prediction. By synthesizing various datasets with variations and anomalies, generative AI empowers organizations to build more robust and accurate models, ultimately enhancing risk control and operational efficiency.

Moreover, data augmentation helps in the development of labeled datasets for supervised learning tasks, allowing corporations to train models efficiently for specific use instances along with fraud detection in financial transactions. Additionally, in scenarios in which privacy concerns restrict access to sensitive data, generative AI permits the introduction of privacy-preserving synthetic data, making sure of compliance with policies while nonetheless allowing advanced analytics and model training.

Overall, data augmentation emerges as a fundamental application in the generative AI in analytics market, driving innovation and permitting organizations to unlock the full potential of their data assets in the fintech industry and beyond.

By End User

In the generative AI in analytics market, the banking, financial services, and insurance (BFSI) dominate in the end-user segment because of the unique challenges and opportunities it presents for leveraging generative AI technology. Within BFSI, generative AI plays a pivotal role in improving risk management, fraud detection, and customer experience.

By analyzing huge quantities of economic data,

generative AI models assist in identifying potential anomalies and fraudulent activity in real-time, safeguarding financial establishments and their clients from monetary losses. Moreover, in the highly aggressive land of BFSI, personalized services are essential for attracting and retaining clients. Generative AI enables the customization of financial products and services primarily based on their preference and behaviors, leading to advanced customer satisfaction and loyalty.

Overall, the BFSI sector's reliance on data-driven decision-making, coupled with its stringent regulatory requirements and focus on customer-centricity, positions it as a key driver in the adoption and development of generative AI in analytics market. As economic establishments continue to prioritize innovation and efficiency, the demand for generative AI solutions inside BFSI is predicted to stay strong.

The Generative AI in Analytics Market Report is segmented on the basis of the following:

By Technology

- Machine learning

- Natural Language Processing

- Sentiment Analysis

- Named Entity Recognition

- Topic Modeling

- Language Translation

- Deep learning

- Convolutional Neural Networks (CNN)

- Recurrent Neural Networks (RNN)

- Generative Adversarial Networks (GANs)

- Transformer Models

- Computer vision

- Robotic Process Automation

- Process Automation

- Task Automation

- Workflow Automation

- By Deployment

- Cloud-Based

- On-premise

By Application

- Data Augmentation

- Anomaly Detection

- Fraud Detection

- Intrusion Detection

- Equipment Failure Prediction

- Text Generation

- Simulation and Forecasting

- Financial Market Forecasting

- Demand Forecasting

- Weather Forecasting

- Other

By End User

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Retail & E-commerce

- Manufacturing

- Telecommunications

- Government and Defense

- Other

Regional Analysis

North America is projected to dominate the global generative AI in analytics

with 50.6% of the market share in 2024. The prominence of North America in this market is rooted in its superior technological infrastructure, robust funding environment, and early adoption of AI technologies.

Firstly, North America boasts an incredibly developed technological landscape, with numerous tech giants, education institutions, and numerous startups driving innovation in AI and analytics. This environment fosters the development and deployment of generative AI solutions, attracting talent and investment from around the world.

This region with a strong investment ecosystem, together with venture capital firms, accelerators, and government initiatives, provides sufficient investment and help for AI startups and research initiatives. This economic backing enables corporations to develop modern generative AI technology and bring it to the market quickly.

Furthermore, North America's early adoption of AI technology in diverse industries, together with finance, healthcare, and retail, has created a fertile floor for the growth of generative AI in the analytics marketplace. Enterprises throughout sectors apprehend the value of AI-driven insights and are eager to leverage generative AI for improved decision-making and competitive advantage.

Lastly, North America's regulatory surroundings, though complicated, usually foster innovation and entrepreneurship, providing a conducive environment for the development and deployment of generative AI solutions.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the global generative AI in the analytics market is characterized with the aid of extreme competition amongst key gamers striving to innovate and differentiate their offerings. Established tech giants consisting of Google, Microsoft, and IBM leverage their tremendous resources and research capabilities to increase advanced generative AI solutions tailored for analytics applications. Meanwhile, specialized AI startups like OpenAI and DataRobot focus on niche segments within the market, driving innovation and agility.

Additionally, a myriad of smaller players and emerging startups make a contribution to the competitive dynamics by introducing novel technology and disrupting conventional business models. Strategic partnerships, mergers, and acquisitions are major well-known strategies used by companies who are trying to amplify their market presence and enhance their product portfolios.

Overall, the aggressive landscape is dynamic and fast-paced, pushed by rapid technological advancements and evolving consumer demands within the swiftly growing generative AI in analytics market.

Some of the prominent players in the global Generative AI in Analytics market are

- General Electric

- IBM Corporation

- Microsoft

- Opower

- Eneco

- Salesforce, Inc

- Adobe

- NVIDIA Corporation

- Hugging Face

- Tesla

- Other Key Players

Recent Developments

- In March 2024, Amazon's investment of USD 2.75 billion in Anthropic reflects the AI gold rush, marking its largest venture deal in this year and highlighting tech giants' focus on this rapidly growing market with endless potential.

- In September 2023, SAS announced a strategic partnership with Microsoft, focusing on generative AI integration. SAS leads in trustworthy AI solutions, including synthetic data, digital twins, and large language models.

- In September 2023, Accenture Ventures invested in Writer, a platform using generative AI to aid enterprises in content creation. Writer's AI tools enhance productivity, align with brand guidelines, and integrate securely into workflows.

- In July 2023, Wipro pledged USD 1.0 billion investment in AI over three years, launching Wipro ai360 which aims to train 250,000 employees, collaborate with startups, and enhance generative AI capabilities.

- In June 2023, ThoughtSpot acquires Mode Analytics for USD 200.0 million, aiming to enhance business intelligence. The merger will integrate Mode's code-first approach with ThoughtSpot's AI, enabling faster data insights and better collaboration.

- In June 2023, Databricks unveiled Lakehouse AI innovations at the Data + AI Summit, streamlining generative AI development with Vector Search, AutoML fine-tuning, and MLflow updates for effective large language models open-source models (LLMOps) management.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 1,622.4 Mn |

| Forecast Value (2033) |

USD 15,147.5 Mn |

| CAGR (2023-2032) |

28.2% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Deployment (Cloud-Based, and On-premise) By Technology (Machine learning, Natural Language Processing, Deep learning, Computer vision, and Robotic Process Automation), By Application (Data Augmentation, Anomaly Detection, Text Generation, Simulation and Forecasting, and Other), By End User (Banking, Financial Services, and Insurance (BFSI), Healthcare, Retail & E-commerce, Manufacturing, Telecommunications, Government and Defense, and Other) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

General Electric, IBM Corporation, Microsoft, Opower, Eneco, Salesforce. Inc, Adobe, NVIDIA Corporation, Hugging Face, Tesla, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Generative AI in Analytics Market?

▾ The Global Generative AI in Analytics Market size is estimated to have a value of USD 1,622.3 billion in 2024 and is expected to reach USD 15,147.5 billion by the end of 2033.

Which region accounted for the largest Global Generative AI in Analytics Market?

▾ North America has the largest market share for the Global Generative AI in Analytics Market with a share of about 50.6% in 2024.

Who are the key players in the Global Generative AI in Analytics Market?

▾ Some of the major key players in the Global Generative AI in Analytics Market are General Electric, IBM Corporation, Microsoft, and many others.

What is the growth rate in the Global Generative AI in Analytics Market?

▾ The market is growing at a CAGR of 28.2 percent over the forecasted period.