AI-powered virtual influencers are gaining popularity due to their engagement with audiences & collaboration with brands. AI uses advanced techniques like neural networks and deep learning to generate fresh and innovative media content similar to human-created content.

AI models transform content creation, consumption, and engagement with audiences in entertainment and media. It is used to smooth the task for creators, enhance audio-visual elements, and deliver personalized, interactive experiences.

These algorithms analyze vast data sets, detect patterns, and generate customized content based on individual preferences and behaviors. Continuous improvements in AI algorithms and computing power have improved the capabilities of generative AI, making it more accessible and effective in media and entertainment applications.

Key Takeaways

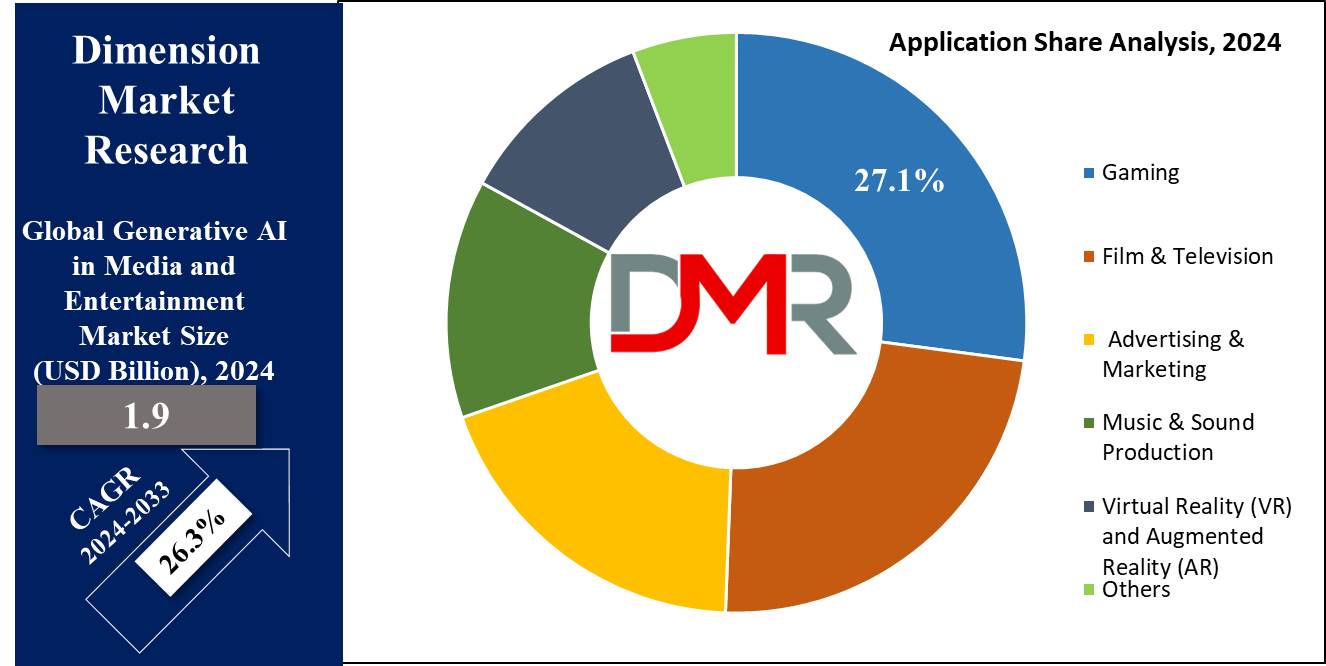

- Market size: The Global Generative AI in Media and Entertainment market is projected to grow by 14.4 billion, at a CAGR of 26.3 % from 2025 to 2033.

- Market Definition: Generative AI in media and entertainment uses the AI algorithm to create new content, images, videos, music, and text based on learned patterns and data inputs.

- Type Analysis: Text-to-image is projected to be the dominant force in the market based on type, capturing the largest revenue share of 32.2% in 2024.

- Deployment Analysis: Cloud-based deployment mode is expected to witness significant growth with the highest revenue share of 53.2% throughout the forecast period.

- Application Analysis: Gaming is forecasted to hold the largest market share of 27.1% and dominate the generative AI in the automation market based on application in 2024.

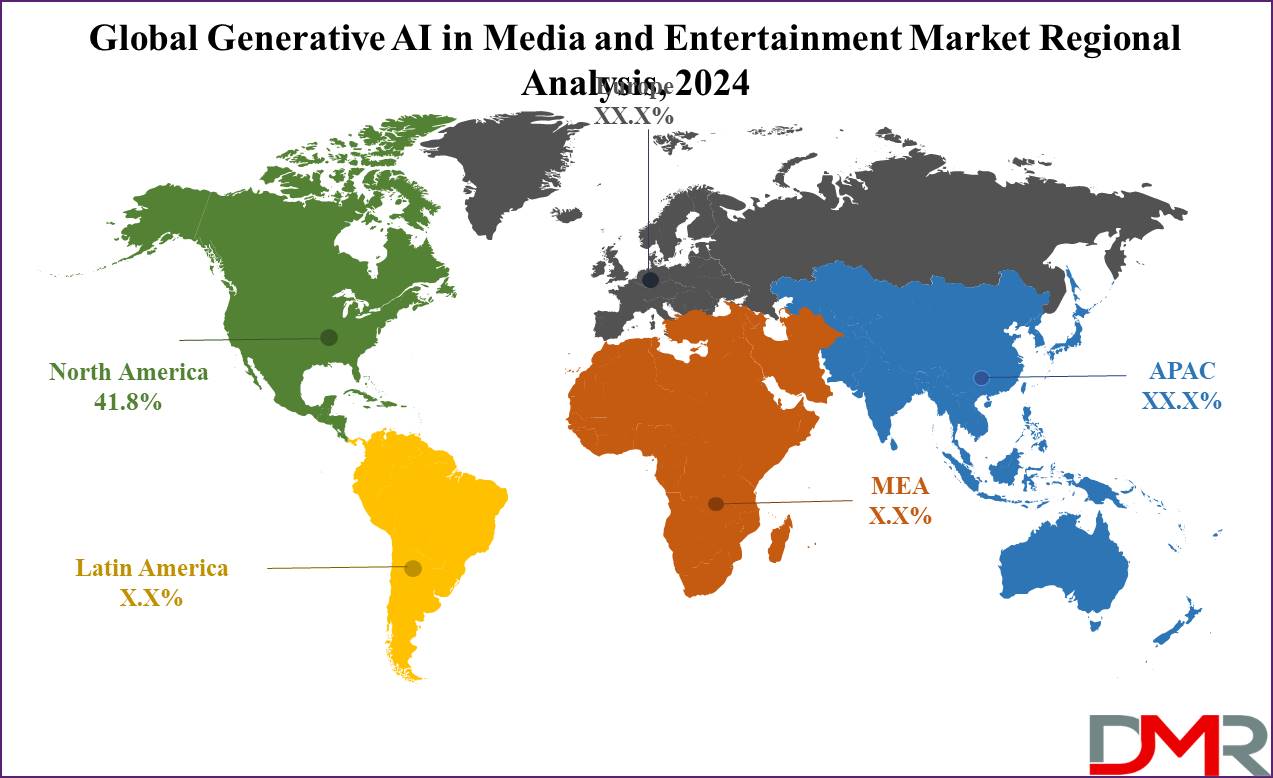

- Regional Analysis: North America is anticipated to dominate the generative AI in the media and entertainment market, capturing a revenue share of 41.8% in 2024.

Use Cases

- Virtual Production and Augmented Reality (AR): AI tools help design virtual sets and environments for movies and TV, making production more efficient in social media platforms, and enabling users to create and share immersive augmented reality experiences.

- Generating marketing content: AI is revolutionizing and automating marketing campaigns across various platforms like social media, blogs, and product descriptions according to brand guidelines, audience preferences, and current trends, ensuring relevance and engagement.

- Content Personalization: Generative AI models are trained to recommend personalized content to users based on their preferences, viewing history, and behavior patterns, which is used in streaming platforms like Netflix and Spotify.

- Visual Effects and Animation: It helps automate the process of animating characters by predicting movements, gestures, and expressions based on input data or desired actions.

Market Dynamic

Drivers

Content creation

Generative AI in the media and entertainment market is experiencing a revolutionary growth period, mainly due to the changing requirements of content creation and improvement. They allow for the development of highly customized content aimed at meeting the diverse preferences of a global audience. A personalized approach in the media landscape helps maintain viewer interest and loyalty, as audience engagement is important and drives the growth of the media and entertainment market.

Further, AI-powered tools offer rapid content creation and significantly reduce time and costs as compared to traditional content development. There is a constant demand for fresh and inventive content in many industries like gaming, film, and advertising. Moreover, AI algorithms can analyze extensive consumer data to forecast trends & preferences, offering invaluable insights for content creators to develop content.

Restraints

Content Authenticity and lack of skilled professionals

The similarity between AI-generated content and human-created content leads to concerns about authenticity and originality, which obstruct the growth of the market. Ineffective implementation and management of generative AI technologies due to a lack of skilled professionals is expected to pose a challenge to the growth of generative AI inthe media and entertainment market.

High Initial Investment Costs

Initial expenses associated with advancements in AI technology are challenging for small and medium-sized enterprises despite the long-term cost-effectiveness.

Opportunities

Virtual influencers and characters

Virtual influencers and characters offer a huge growth opportunity for generative AI in media and entertainment market by bridging the gap between reality and virtual realms, opening up unique avenues for brand partnerships, and delivering consistent, captivating content. Virtual influencers are changing the game in entertainment by breaking old rules and appealing to all kinds of people and interests.

Trend

Collaborations and partnerships

Collaborations and partnerships are getting popular in the global generative AI in the media and entertainment market, representing a significant trend as they use AI's capabilities in crafting unique content. This collaboration uses artistic insights from creators and AI's analytical capabilities which results in groundbreaking advancements in personalized content, music creation, and visual arts. They are constantly expanding their collaboration from music to film and gaming by using AI-generated content which introduces novel storytelling and user interaction.

Research Scope and Analysis

By Type

Text-to-image is expected to dominate the generative AI in the media and entertainment market with the largest revenue share by the end of 2024. The growth of this segment is fueled by to increasing requirement for personalized and dynamic visual content across advertising, film, and digital media industries.

It uses AI to generate visually attractive and relatively fitting images based on written descriptions. Also, advancements in deep learning algorithms and neural networks are improving the accuracy and realism of generated images which makes it similar to human-created visuals.

It offers cost-effectiveness and reduces time as compared to traditional visual content creation methods which attract a majority of businesses and content creators. Image-to-image generation is growing notably particularly in the entertainment industry as it transforms images by altering style or adding new elements, widely used in visual effects, digital art, and animation. It offers a rapid and cost-effective approach to generating high-quality visual content.

Music generation is also gaining momentum growth which allows for music composition based on genres, moods, or replicating specific artists. It is used by streaming services to personalize playlists, leads to improved user experience, and is expected to grow further with advancements in technology and acceptance in the music industry.

By Deployment Mode

Cloud-based deployment mode is likely to dominate the generative AI in media and entertainment, with the largest revenue share of 53.2% in 2024. This deployment is known for its scalability, flexibility, and cost-effectiveness.

Cloud deployment lets Media and entertainment companies access advanced AI capabilities without a huge investment in IT infrastructure. These cloud deployments are beneficial for small and medium-sized enterprises that are looking to innovate without spending a huge amount of money.

It is capable of handling a large amount of data and its strong computational power makes it an ideal platform for AI-driven applications which drives the growth of the media and entertainment market.

AI-driven applications generate personalized content and recommend algorithms for progressive visual effects and animation in movies and games. These deployments fulfill the high processing demand of AI-driven applications which leads to faster rendering times and real-time analytics.

Moreover, these deployments provide collaboration opportunities and allow them to work seamlessly regardless of their location due to data and applications being hosted on the cloud which is a huge requirement for the media and entertainment market. On the other hand, on-premise deployments account for a significant

market share, which attracts organizations who are more focused on data control and security. Large organizations already equipped with the required infrastructure and resources prefer on-premise solutions for in-house AI applications. These deployments are aligned well with the security and compliance needs of companies dealing with sensitive content.

By Application

Gaming is expected to dominate the generative AI in the media and entertainment market, with the largest revenue share of 27.1% by the end of 2024. The rising integration of AI into game development increases the realism and interactivity of gaming experiences.

Dynamic game environments, creating lifelike characters, and personalizing gameplay for individual gamers are gaining popularity in the coming years, which fuels the growth of this segment.

Gaming is further expanded with the introduction of online gaming and eSports, as gaming developers are continuously working on boosting player engagement and competitiveness.

Film & Television is expected to show notable growth by streamlining the production process, from scriptwriting to post-production visual effects. Filmmakers are now creating lifelike visual effects without spending much time and money by using generative AI.

In addition, they are reshaping storytelling techniques and narrative structures in films and television series due to their ability to analyze vast amounts of data, including audience preferences and trends.

It helps predict the latest trends in movies, optimize content, and identify untapped audience segments, which drives the growth of this segment. Further, the growth is driven by a growing demand for immersive, high-quality HD, and engaging content in streaming apps.

The Generative AI in Media and Entertainment Market Report is segmented based on the following:

By Type

- Text-to-Image Generation

- Image-to-Image Generation

- Music Generation

- Video Generation

- 3D Modeling and Animation

- Others

By Deployment Mode

By Application

- Gaming

- Film & Television

- Advertising & Marketing

- Music & Sound Production

- Virtual Reality (VR) and Augmented Reality (AR)

- Others

Regional Analysis

North America is expected to dominate the generative AI in media and entertainment market with the largest revenue share of 41.8% by the end of 2024. This region is leading due to technological infrastructure, cutting-edge research institutions, the presence of leading industry players, and supportive regulatory frameworks.

Rapid integration of generative AI solutions with music, video game design, filmmaking, and virtual reality is increasingly smoothing the operation, which encourages artistic innovation and drives the growth of the market in this region.

The rapid adoption of new technologies in the entertainment and media sectors in this region drives the growth of the market. There is a higher concentration of IT companies and startups in this region, which are actively engaged in ongoing AI research and development, driving the growth of this market.

After North America, Europe is anticipated to grow notably as countries like the UK, Germany, and France are making substantial investments in AI research and development. This region's diverse cultural heritage in media and entertainment, combined with the growing adoption of AI, expanded the market in this region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The generative AI in the Media and Entertainment market is competitive, with established vendors dominating and continually innovating to meet evolving business needs. Key market players like Alphabet, Microsoft, Meta Platforms, Inc., IBM Corporation, Nvidia Corporation, OpenAI Inc., and Epic Games Inc. are leading the market.

These players have a strong global presence and partnerships to serve diverse customer bases. They actively engage in strategic initiatives such as acquisitions, mergers, and market expansions to enhance operational efficiency and cater to a wider audience.

Major players continuously invest in enhancing their AI algorithms, expanding their product portfolios, and forming strategic partnerships to address evolving industry demands and stay ahead in the competitive race.

Some of the prominent players in the global generative AI in Media and Entertainment market are:

- Alphabet Inc.

- Microsoft Corporation

- IBM Corporation

- Samsung

- Nvidia Corporation

- Adobe Inc.

- Autodesk, Inc.

- Unity Software Inc.

- OpenAI, Inc.

- Synthesis AI

- Epic Games, Inc.

- Others

Recent Development

- In March 2024, NAB Show Unveils the Future as Artificial Intelligence Revolutionizes Broadcast, Media, and Entertainment Industry which offers a platform for the media and entertainment professionals to showcase the latest innovations in media industry, including broadcasting, content creation, production, and workflows, forge strategic partnerships and shape the future of content creation.

- In November 2023, Map Book, an innovative 3D generative AI platform, came out of stealth mode after securing approximately USD 6.0 million in initial funding.

- In November 2023, Amazon unveiled its business chatbot powered by generative artificial intelligence. This chatbot can create content, streamline regular communications, and help employees with tasks like producing blog posts.

- In November 2023, Zee Entertainment Enterprises Ltd. (ZEE), a prominent entertainment company in India, teamed up with Nasscom for its newly introduced Generative AI Foundry program, which aims to stimulate innovation and development in the startup community by concentrating on facilitating and backing co-created generative AI solutions specifically tailored for India's media and entertainment sector.

- In September 2023, Google introduced AI-driven features on YouTube aimed at improving the capabilities of video creators. A notable feature, 'Dream Screen,' integrates AI-generated video backgrounds into short video content.