Market Overview

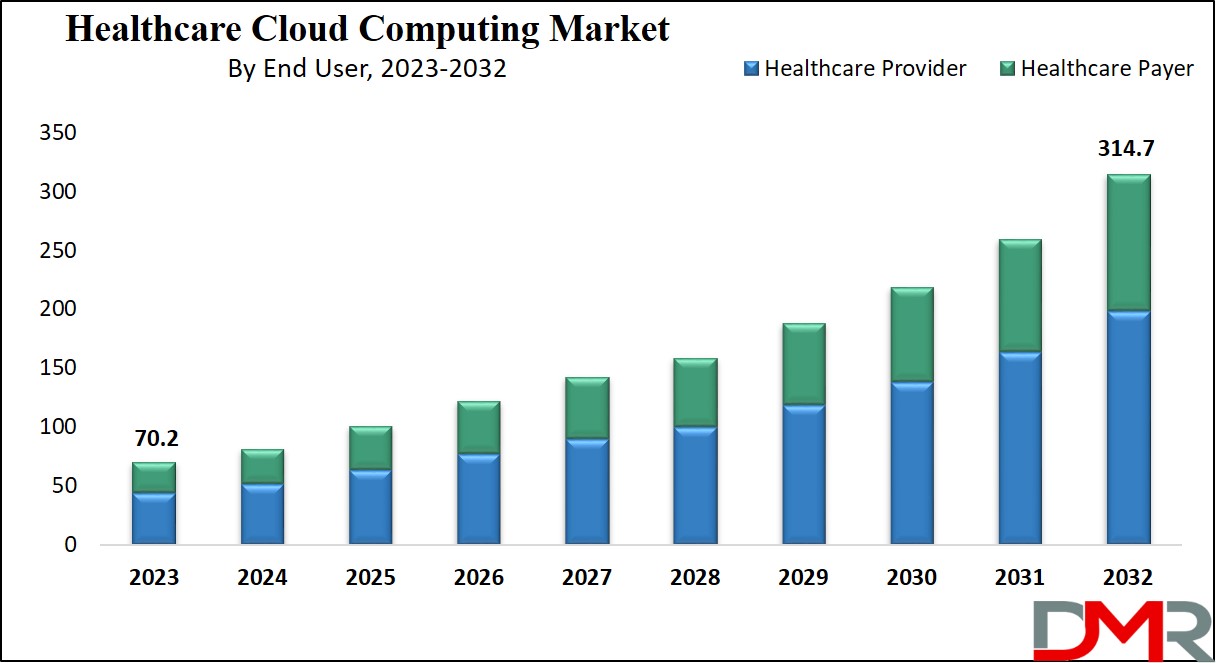

The Global

Healthcare Cloud Computing Market is expected to reach a value of

USD 70.2 billion in 2023, and it is further anticipated to reach a market value of

USD 314.7 billion by 2032 at a

CAGR of 18.1%.

The international healthcare cloud computing market entails the extensive use of cloud technology and offerings within the

healthcare zone worldwide. This encompasses the deployment of cloud-based total answers, systems, and infrastructure to manipulate, method, and examine healthcare information, assisting numerous applications in healthcare shipping, management, and studies.

Key additives in this market include Software as a Service (SaaS), Infrastructure as a Service (IaaS), and Platform as a Service (PaaS), with packages ranging from

Clinical Information Systems (CIS) like Electronic Health Records to Non-medical Information Systems (NCIS) for revenue cycle management. The market caters to healthcare carriers and payers, driven by using the adoption of virtual technology to beautify patient care, operational performance, and data-pushed choice-making.

Since 2012, global chronic disease prevalence has skyrocketed, including cancer, cardiovascular diseases (CVD), and diabetes. According to WHO in 2016, CVD was identified as the primary cause of global death with 17.3 million deaths each year attributable to coronary heart disease (7.4 million deaths) and stroke (6 million deaths). GLOBOCAN predicts an annual increase from 14.1 million cancer cases reported annually to 19.3 million by 2025 - more than double from its current levels (14.1 million cases).

Key takeaways

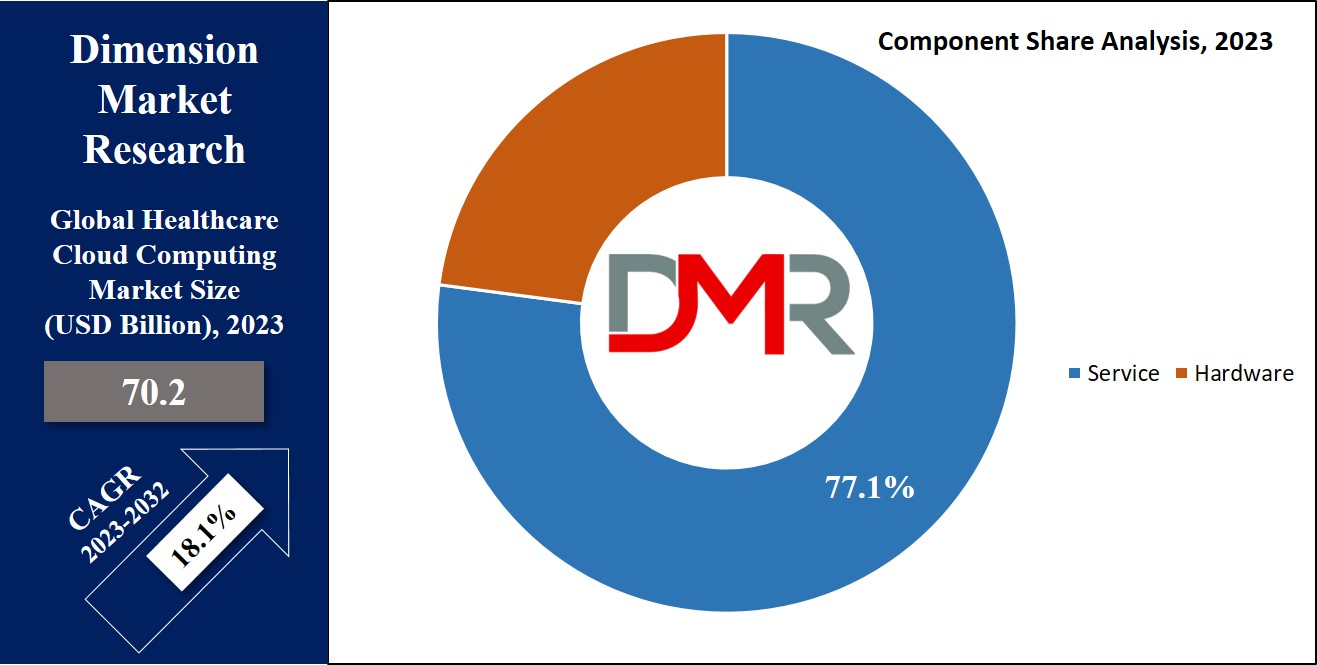

- Based on components, service dominates this segment as they hold 77.1% of the market share in 2023.

- In terms of application. Clinical Information Systems (CIS) dominate this segment of the healthcare cloud computing market, primarily due to their vital role in advancing patient care, streamlining workflows, and boosting overall efficiency in 2023.

- based on end users, healthcare providers dominate this segment as it holds 63.1% of the market share in 2023 and is projected to show subsequent growth in the forthcoming period of 2023 to 2032.

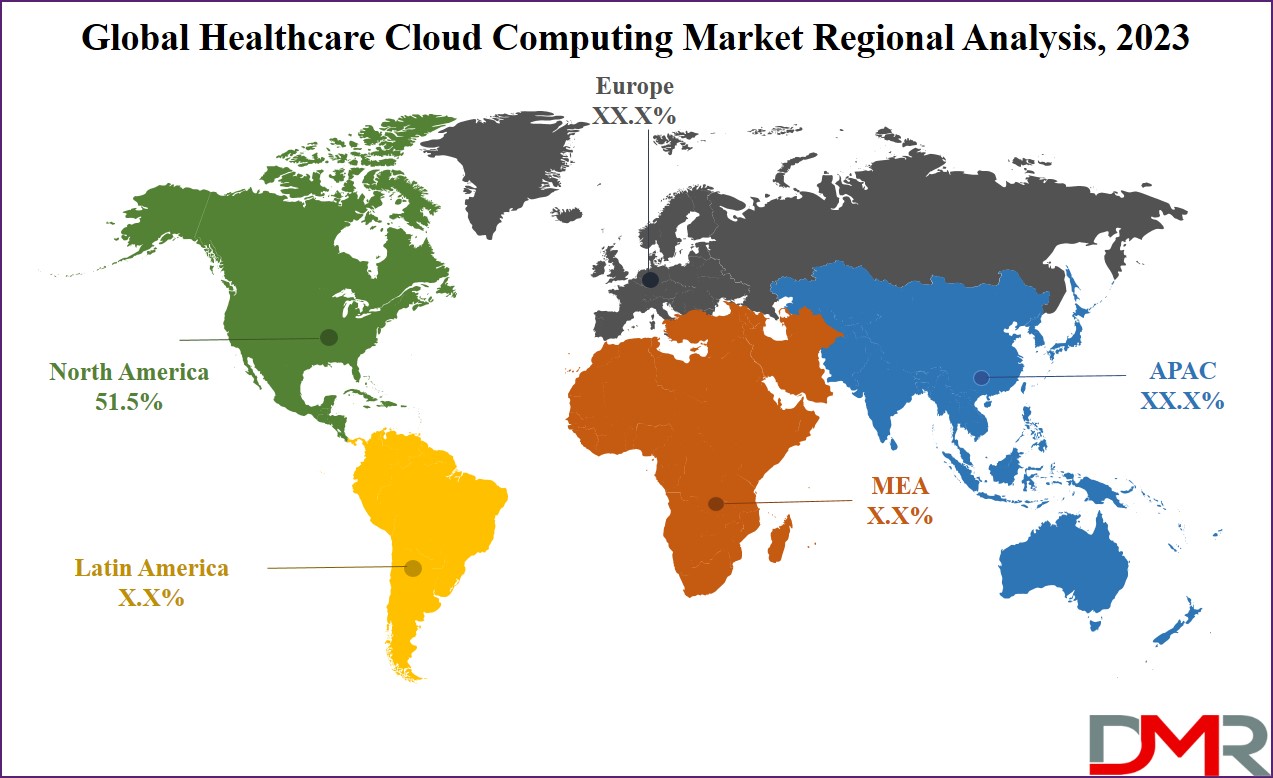

- North America has asserted dominance in the healthcare cloud computing market as it holds 51.5% of the market share in 2023.

Market Dynamic

Recent improvements in technology, coupled with heightened security features, have considerably increased the attraction of cloud computing for healthcare establishments. Innovations like remote monitoring, natural language processing APIs, and telehealth are constantly evolving to satisfy the needs of virtual health scenarios.

According to a HIMSS Analytics Survey, more than 83% of healthcare corporations now utilize cloud offerings. Healthcare facilities are striving to decorate their cloud computing utilization using integrating modern technology.

Rather than virtually transferring information to the cloud, structures are evolving to investigate and method data at the point of collection. The giant availability of high-speed internet and supportive regulatory measures are anticipated to gasoline boom inside the worldwide healthcare cloud computing marketplace.

Nevertheless, challenges related to statistics portability, privacy worries, and more and more cloud information breaches are impeding the worldwide development of healthcare cloud computing. Additionally, a shortage of skilled IT specialists is slowing down the adoption of this technology.

Driving Factors

The Healthcare Cloud Computing Market is propelled by rising adoption of electronic health records (EHRs) and telehealth solutions, making cloud platforms increasingly essential to modern healthcare operations. They enable secure data storage, sharing, and real time access; essential features of modern healthcare operations.

Cloud adoption has increased due to increasing demands for cost effective IT infrastructure that meets user needs, interoperability, data driven decision making and collaboration driving healthcare providers towards cloud computing for analytics and collaboration purposes.

Furthermore,

chronic diseases and an aging population has forced healthcare providers to use cloud solutions as analytics and collaboration platforms increasing efficiency, patient outcomes and accessibility within global healthcare ecosystems.

Trend

A significant trend in the Healthcare Cloud Computing Market is the increasing use of artificial intelligence (AI) and machine learning (ML), combined with cloud platforms, to manage, analyze, and secure vast amounts of healthcare data.

Furthermore, hybrid cloud solutions have gained steam; this allows healthcare providers to balance data security with accessibility more easily while edge computing provides real time processing of critical healthcare applications this trend demonstrates an ever increasing demand for advanced, flexible cloud solutions tailored specifically to meeting healthcare delivery and innovation challenges.

Restraint

Restrictions One major barrier in the Healthcare Cloud Computing Market is data privacy and security issues. Healthcare information is highly confidential and subject to stringent regulations like HIPAA and GDPR; cyber threats like ransomware attacks pose real threats for cloud adoption.

Furthermore, high initial migration costs and integration complexity with legacy systems hinder market expansion; limited technical expertise as well as resistance from healthcare providers can exacerbate these challenges, slowing adoption in certain regions or segments.

Opportunity

With the rapid proliferation of

telemedicine and remote patient monitoring services, healthcare cloud computing markets offer ample opportunity. Cloud based platforms facilitate seamless connectivity and data exchange that are essential for virtual care delivery. Emerging markets with evolving healthcare infrastructures present immense opportunity for cloud adoption as providers seek scalable and cost efficient solutions.

As personalized medicine and

genomic research become more prevalent, cloud platforms that can effectively manage and analyze large scale healthcare data are in high demand. Collaborations between cloud service providers and healthcare organizations to develop customized, secure, interoperable solutions further expand growth prospects in this dynamic market.

Research Scope and Analysis

By Components

Based on components, service dominates this segment as they hold

77.1% of the market share in 2023 and are expected to show subsequent growth in the forthcoming period. The dominance of services, like Software as a Service (SaaS), Infrastructure as a Service (IaaS), and Platform as a Service (PaaS), in healthcare's digital landscape is rooted in their ability to address the industry's unique challenges.

These services offer cost-efficient alternatives, allowing healthcare organizations to avoid upfront expenses and predictably manage subscription fees over time. Accessibility is enhanced, particularly with SaaS, enabling secure access to patient information from various locations which is crucial for remote care and telehealth. Cloud services adapt to the dynamic healthcare environment, providing scalability without overburdening organizations with excessive hardware.

Rapid deployment and updates, handled by cloud providers, significantly impact patient care, while outsourcing IT tasks allows healthcare professionals to focus on delivering quality care. Interoperability tools, reduced IT complexity, robust security measures, and access to innovations without heavy investments further solidify the appeal of cloud services, creating a flexible and dynamic IT infrastructure that supports high-quality patient care.

By Application

Clinical Information Systems (CIS) dominate this segment of the healthcare cloud computing market, usually because of their essential role in advancing patient care, streamlining workflows, and boosting standard efficiency. This dominance is rooted in the extensive adoption of Electronic Health Records (EHRs), a key element of CIS, which allows digital garage, control, and sharing of affected person health records. Cloud-based EHR solutions offer accessibility and actual-time updates, enabling seamless coordination across various healthcare settings.

The performance of statistics management is in addition more advantageous through cloud computing's scalable and centralized platform, critical for informed choice-making via healthcare specialists. Interoperability is supported, fostering the seamless trade of health records among exceptional structures and agencies.

Additionally, cloud solutions optimize Picture Archiving and Communication Systems (PACS) and Radiology Information Systems (RIS), permitting collaboration on scientific pics. The incorporation of Computerized Physician Order Entry (CPOE) structures electronically streamlines medical orders, enhancing communique and reducing mistakes. Real-time collaboration, scalability, protection, and cost-efficiency further make contributions to the dominance of CIS within the healthcare cloud computing panorama.

By End User

On the basis of end users, healthcare providers dominate this segment as it holds 63.1% of the market share in 2023 and is projected to show subsequent growth in the forthcoming period of 2023 to 2032.

Healthcare providers, comprising hospitals, diagnostics and imaging centers, and ambulatory centers, have extensively embraced cloud computing to raise affected person care and operational efficiency.

For hospitals, cloud-primarily based Electronic Health Records (EHR) facilitate secure garage and clean access to affected person’s information, fostering collaboration amongst healthcare professionals.

The use of cloud structures for statistics storage and analytics complements diagnostic processes and supports research in treatment making plans. In diagnostics and imaging centers, cloud answers effectively shop and percentage huge clinical photo documents, bearing in mind collaborative real-time evaluations through radiologists and experts, ensure compliance with healthcare regulations.

Ambulatory facilities advantage of cloud-primarily based exercise management structures, allowing streamlined scheduling, file control, and billing tactics. The cellular accessibility of patient statistics and cost-efficient IT infrastructure, scalable to the centers' desires, further reveal the adaptability and blessings of cloud solutions.

The Healthcare Cloud Computing Market Report is segmented on the basis of the following

By Component

- Service

- Software as a Service (SaaS)

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS) Payers

- Hardware

By Application

- Clinical Information Systems (CIS)

- Electronic Health Record (EHR)

- Picture Archiving and Communication System (PACS)

- Radiology Information System (RIS)

- Computerized Physician Order Entry (CPOE)

- Other

- Non-clinical Information Systems (NCIS)

- Revenue Cycle Management (RCM)

- Automatic Patient Billing (APB)

- Payroll Management System

- Others

By End User

- Healthcare Providers

- Hospitals

- Diagnostics & Imaging Centers

- Ambulatory Centers

- Healthcare Payers

- Private Payers

- Public Payers

Regional Analysis

North America has asserted dominance in the healthcare cloud computing market as it holds 51.5% of the market share in 2023 and is expected to show subsequent growth in the upcoming year as well. This dominance is commonly driven by advanced healthcare infrastructure, early-generation adoption, and positive regulatory surroundings.

The region's robust IT environment and way of life of embracing innovation have facilitated the speedy integration of cloud computing into healthcare practices.

Regulatory frameworks, which include HIPAA, help the implementation of cloud answers, ensuring adherence to crucial requirements. Significant investments in studies and development, coupled with a huge quantity of various healthcare providers, create a massive marketplace for cloud solutions. Strategic partnerships between cloud service providers and healthcare companies have caused tailor-made solutions that cope with quarter-precise needs.

The North American cognizance of interoperability, statistics alternate, marketplace opposition, and continuous innovation further solidifies its management in the healthcare cloud computing panorama. While North America currently dominates, other regions are also witnessing growth, influenced by regulatory frameworks, technological readiness, and healthcare IT maturity.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The healthcare cloud computing market functions as a competitive panorama with key gamers providing various offerings and answers. Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) have been the foremost cloud provider providers, each presenting a variety of healthcare-focused offerings together with records storage, analytics, and gadget learning.

IBM Cloud and Oracle Cloud additionally had a presence, emphasizing statistics protection and healthcare-unique programs. Salesforce, broadly speaking recognized for CRM answers, entered the healthcare space with tools for patient engagement and health data management. Companies such as Cerner Corporation, Allscripts Healthcare Solutions, Epic Systems Corporation and Athenahealth specialize in healthcare statistics technology, electronic health information (EHR) solutions based on the cloud operating under conditions of order.

Additionally, these businesses use organic and inorganic approaches for their market growth. The organic strategies focus on collaboration, mergers & acquisitions while the inorganic strategies involve improved product catalogs and innovation.

Some of the prominent players in the Global Healthcare Cloud Computing Market are

- Cisco Systems Inc.

- Allscripts Healthcare Solution Inc.

- Microsoft Corp

- Iron Mountain Inc.

- Qualcomm Inc.

- Athena Health Inc.

- GNAX Health

- Dell Inc.

- EMC Corporation

- IBM Corporation

- VMware Inc.

- Oracle Corp

- Other Key Players

COVID-19 Pandemic & Recession: Impact on the Global Healthcare Cloud Computing Market

The outbreak of COVID-19 and the resulting financial crisis transformed significantly in the global healthcare cloud computing marketplace. The catastrophic event brought about the worldwide adoption of telehealth offerings that motivated healthcare vendors to reveal cloud solutions for remote consultation, patient monitoring and telemedicine applications.

The pandemic underscored the healthcare quarter's need for efficient facts storage and control, with cloud computing imparting scalable and secure answers to deal with the surge in records. Cloud technology facilitates remote collaboration among healthcare professionals, enabling secure sharing of patient data and research findings. Additionally, it played a crucial role in supporting data analytics and research related to COVID-19, offering computational power for complex studies.

Cloud solutions contributed to operational resilience by allowing organizations to scale resources based on demand and providing infrastructure redundancy. Despite financial challenges from the economic recession, the market was poised for growth, driven by the cost-efficiency, flexibility, and long-term benefits of cloud adoption, although security and compliance concerns were addressed through enhanced measures by service providers.

Recent Developments

- In October 2023, Hackensack Meridian Health is undergoing cloud and data modernization with Google Cloud in which the migration strategy aims to enhance innovation, and efficiency, and deploy new technologies like analytics and artificial intelligence (AI).

- In July 2023, Amazon Web Services (AWS) introduced new healthcare AI products, including HealthScribe for doctor visit summaries. AWS offers chatbot tools, attracting interest from companies like 3M Health Information Systems Inc., Babylon Health, and ScribeEMR.

- In April 2023, Cognizant and Microsoft are expanding their healthcare collaboration to provide easy access to technology solutions for healthcare payers and providers that aims to optimize business operations, enhance interoperability, and improve patient and member experiences in the healthcare sector.

- In March 2023, Fujitsu launched a new cloud-based platform for the healthcare sector in Japan, focusing on personalized healthcare and drug development which allows secure collection and utilization of health-related data, promoting digital transformation in the medical field.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 70.2 Bn |

| Forecast Value (2032) |

USD 314.7 Bn |

| CAGR (2023-2032) |

18.1% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Service and Hardware), By

Application (Clinical Information Systems and Non-

clinical Information Systems), By End User

(Healthcare Providers and Healthcare Payers) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Cisco Systems Inc., Allscripts Healthcare Solution Inc.,

Microsoft Corp, Iron Mountain Inc., Qualcomm Inc.,

Athena Health Inc., GNAX Health, Dell Inc., EMC Corp,

IBM Corporation, VMware Inc, Oracle Corp, and

Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Healthcare Cloud Computing Market size is estimated to have a value of USD 70.2 billion in

2023 and is expected to reach USD 314.7 billion by the end of 2032.

North America has the largest market share for the Global Healthcare Cloud Computing Market with a

share of about 51.5% in 2023.

Some of the major key players in the Global Healthcare Cloud Computing Market are Cisco Systems Inc.,

Allscripts Healthcare Solution Inc., Microsoft Corp, Iron Mountain Inc., Qualcomm Inc., Athena Health

Inc., GNAX Health, Dell Inc., EMC Corp, IBM Corporation, VMware Inc, Oracle Corp, and many others.

The Healthcare Cloud Computing market is growing at a CAGR of 18.1% over the forecasted period.