Overview

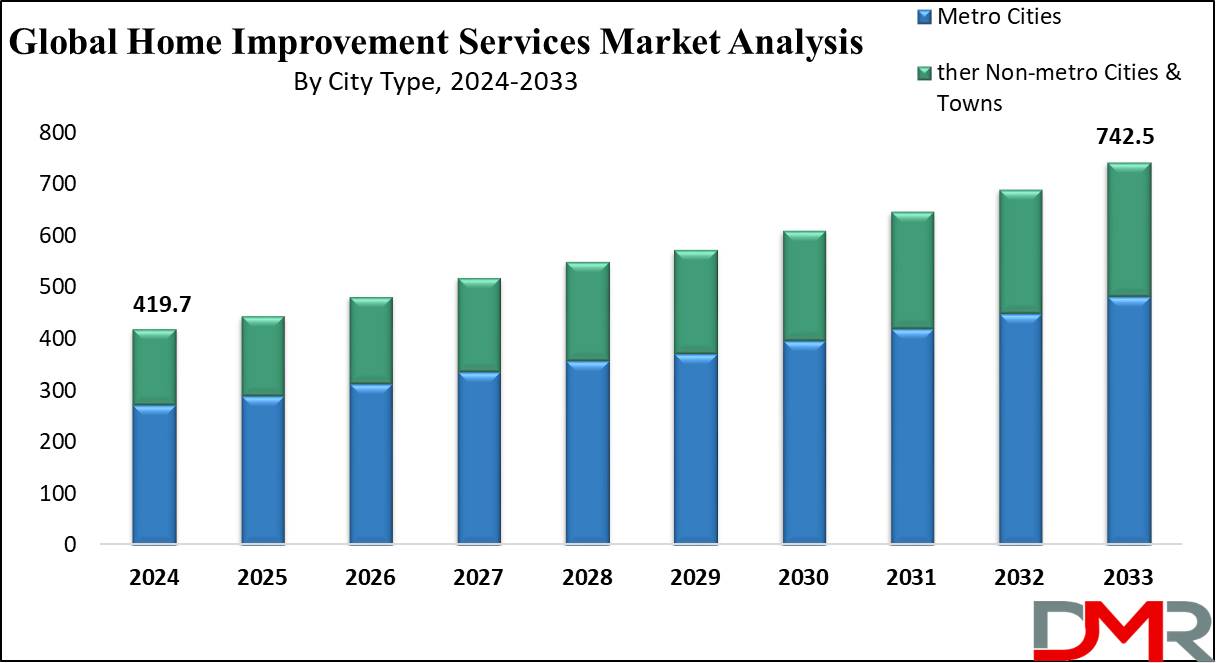

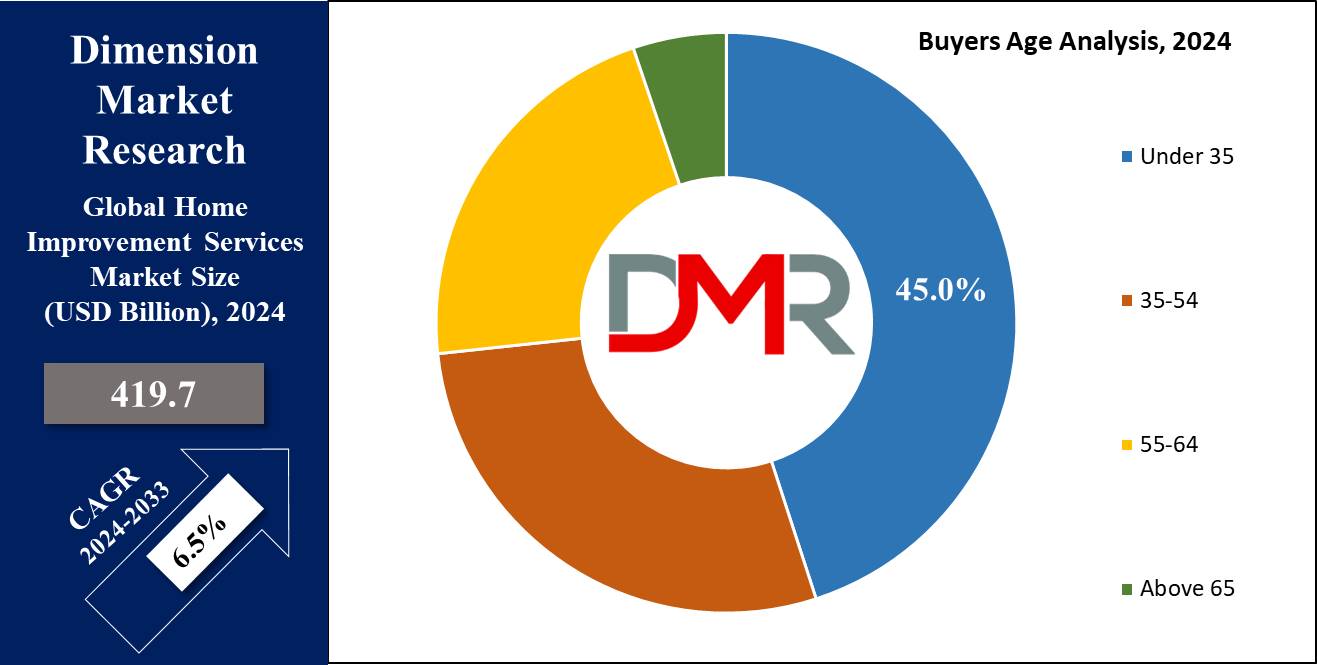

Global Home Improvement Services Market size is estimated to reach USD 419.7 Billion in 2024 and is further anticipated to value USD 742.5 Billion by 2033, at a CAGR of 6.5%.

This report presents revenue generated by companies providing home improvement services like cleaning, renovation and restoration to residential customers. The home improvement services market encompasses fees charged by professional service providers for design, construction and installation work.

Global growth of the home improvement services market is being propelled by rapid urbanization, rising income levels and changing living standards. Homeownership fosters pride and responsibility among its inhabitants; those who become homeowners often invest in improvement projects to beautify their property aesthetically as well as build equity for potential sale at potentially higher prices in the future.

Urbanization is one of the primary drivers of market expansion. As cities expand and adapt, demand for modern, efficient living spaces increases - home improvement services respond by adapting homes to fit urban lifestyles while improving aesthetic and functional aspects.

According to World Economic Forum data, 55% of humanity already lived in urban areas as of 2017, which is expected to rise to 80% by 2050 - this dramatic surge is driving explosive growth within home improvement services market.

Key Takeaways

- Market Size & Share: Home Improvement Services Market size is estimated to reach USD 419.7 Billion in 2024 and is further anticipated to value USD 742.5 Billion by 2033, at a CAGR of 6.5%.

- Type Analysis: Exterior & Interior Replacements emerged as the leader segment in 2023 with approximately 40% market share.

- Buyers Age Analysis: In 2023, those aged 35-54 accounted for nearly 45% of buyers

- City Type Analysis: Metro Cities dominated the home improvement services market in 2023, accounting for around 65% of total revenue.

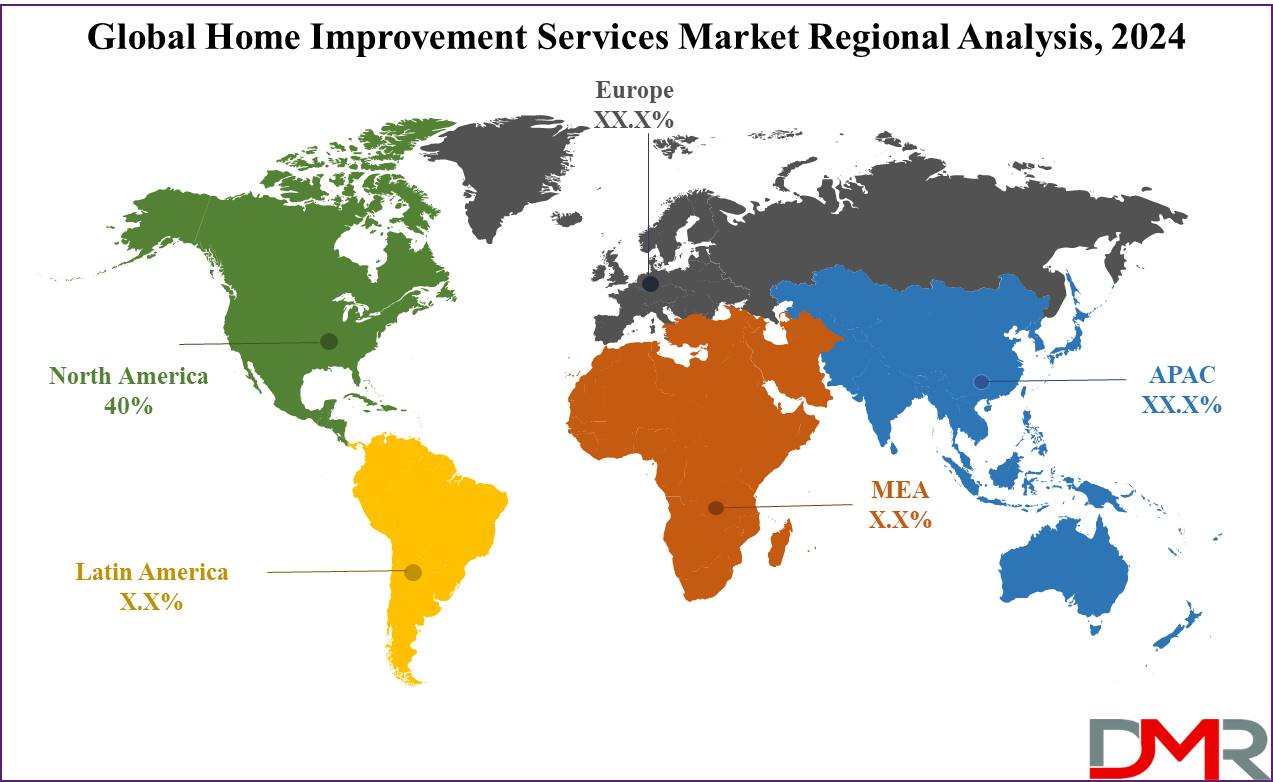

- Regional Analysis: North America led in 2023 with approximately 40% market share.

- Popular Services: Key services include renovations, replacements, and system upgrades. Exterior and Interior Replacements emerged as the dominant segment, accounting for about 40% of market share.

- Technology Trends: The adoption of energy-efficient and smart home solutions is rising, with homeowners seeking eco-friendly and cost-saving upgrades.

Use Cases

- Kitchen and Bathroom Remodeling: Homeowners frequently invest in kitchen and bathroom remodeling projects to upgrade appliances, enhance functionality, and increase aesthetic appeal - upgrades which not only increase daily living standards but also property values significantly.

- Energy-Efficiency Upgrades: With increasing environmental consciousness among many homeowners, home improvement services often install energy-efficient upgrades such as solar panels, smart thermostats, windows and insulation upgrades that save energy consumption while decreasing utility bills and increasing home sustainability. These installations help lower utility bills while simultaneously increasing home sustainability.

- Home Additions and Expansions: As families expand or homeowners search for additional space, adding extra rooms like extra bedrooms, home offices or entertainment spaces has become a highly requested home improvement service. These expansions meet changing household needs while also increasing a home's overall square footage and market value.

- Exterior Renovations and Landscaping: Professional services offer numerous ways to increase curb appeal of a home through exterior renovations such as siding replacement, roof repair or landscaping projects that create visually pleasing and well-kept exteriors, improving first impressions while increasing property values.

- Smart Home Installation: With the popularity of smart home technology has come an increase in demand for services providing home automation systems like smart lighting, security cameras and connected appliances - providing enhanced convenience, security and energy management and making homes more modern and cutting-edge.

Report Dynamics

Drivers: Urbanization and Rising Income Levels

Rising urbanization and incomes are major drivers of the home improvement services market. As more people migrate into cities, demand for modern, efficient living spaces grows as demand for comfortable, functional living spaces increase.

Increased disposable income allows homeowners to invest in home renovation projects designed to increase comfort, functionality and aesthetics - this transformation in urban housing aligns with changing lifestyle preferences such as energy-efficient upgrades or smart home technology upgrades.

This creates demand in this market as individuals look for ways to upgrade the value and aesthetic appeal of their living spaces as individuals seek ways to improve their living standards through investments that boosts this market further.

Trend: Adopting Sustainable and Energy-Efficient Solutions

One key trend affecting home improvement services market is the surge in adopting eco-friendly upgrades such as solar panels, energy-efficient windows, and smart home systems that reduce energy consumption and utility bills.

This trend is propelled by increasing environmental awareness, government incentives, and an emphasis on green living; more homeowners are turning to home improvement services to make their homes more sustainable as energy efficiency becomes an everyday focus, reflecting an overall shift toward environmental responsibility and long-term cost savings.

Restraints in Home Improvement Services Market

One of the main impediments to home improvement services market growth is high renovation project costs and skilled labor shortage, which may discourage many homeowners from making major upgrades. Prices have skyrocketed for materials, skilled labor and professional services which makes significant upgrades financially prohibitive for some consumers.

Furthermore, skilled labor shortages in sectors like construction and home improvement only compound this issue by creating delays and increasing costs, slowing market expansion particularly in regions with high demand.

Opportunity: An Increase in Demand for Smart Home Upgrades

Technology's proliferation into residential spaces presents home improvement services companies with an attractive opportunity. Residents increasingly look for upgrades such as automation systems, security cameras, connected appliances and energy management solutions as part of an effort to increase comfort, security and energy efficiency in their living environments.

Thanks to advances in IoT-enabled smart home technology installations - service providers who specialize in smart installations can capitalize on an ever-expanding interest for tech-enabled living spaces!

Research Scope and Analysis

Type Analysis:

The Kitchen Renovation & Addition and Bathroom Renovation & Addition are both popular categories due to their high return on investment (ROI), as they can increase property values significantly.

Exterior & Interior Replacements emerged as the leader segment in 2023 with approximately 40% market share due to high demand for aesthetic and structural upgrades such as roof repairs, window replacements, facade enhancements that improve curb appeal and energy efficiency of a home.

System upgrades (HVAC, plumbing, and electrical systems) are experiencing sustained growth thanks to an increasing emphasis on energy-saving smart home technologies. Meanwhile, "others" category includes minor home improvement services like flooring and painting which contribute to market expansion but represent only a smaller share.

Buyers Age Analysis:

In 2023, those aged 35-54 accounted for nearly 45% of buyers. This demographic tends to be in their prime earning years and are likely investing in home renovations to accommodate growing families, modernize living spaces or increase property value. Furthermore, homeowners in this age group generally have sufficient financial stability for major projects like kitchen remodels, bathroom renovations and energy efficient upgrades.

The 55-64 demographic is another key group, often prioritizing projects to improve comfort, accessibility, and prepare homes for retirement. Meanwhile, younger buyers aged 35 or below tend to invest in small but cost-effective home improvements while those 65+ typically focus on maintenance or accessibility upgrades to support independent aging in place.

City Type Analysis:

Metro Cities dominated the home improvement services market in 2023, accounting for around 65% of total revenue. Their market dominance can be attributed to rapid urbanization, higher income levels and an increasing prevalence of modern housing - factors such as rapid urbanization, income levels and an influx of modern homes in these areas.

Homeowners living here tend to prioritize aesthetic upgrades, smart home installations and energy-saving solutions in order to meet urban living standards - driving demand even further for home improvement services due to dense populations with multiple homeowners living there.

Other non-metro cities & towns represent approximately 35% of the market. While this segment is experiencing growth due to increased homeownership rates and renovation projects in more affordable suburban areas, overall demand remains lower due to limited access to specialized services and lower disposable incomes in comparison with metro regions.

The Global Home Improvement Services Market Report is segmented based on the following:

By Type

- Kitchen Renovation & Addition

- Bathroom Renovation & Addition

- Exterior & Interior Replacements

- System Upgrades

- Others

By Buyers Age

- Under 35

- 35-54

- 55-64

- Above 65

By City Type

- Metro Cities

- Other Non-metro Cities & Towns

Regional Analysis

Regional analysis of the home improvement services market illustrates its diversity by looking at demand across geographic regions. North America led in 2023 with approximately 40% market share driven by high disposable incomes, strong homeownership rates and increasing energy-efficient upgrades and smart home technology adoption - particularly within the U.S. where significant investments were made into home improvement projects.

Europe and Asia-Pacific followed with modernization efforts underway especially among developing nations; yet North America continued as the top contributor due to its mature housing market and renovation trends.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Home improvement services market is highly competitive, with key players providing renovations, restorations and system upgrades across a wide spectrum of services such as renovations, restorations and system upgrades. Companies focus on expanding their service offerings with skilled labor while adopting energy-efficient systems and smart home solutions to keep up with customer demand.

Strategic partnerships, mergers, and acquisitions help these players expand their market presence and reach more customers; additionally digital platforms are often utilized by market leaders that enable homeowners to schedule services easily while tracking project progress more closely for enhanced overall customer experience and satisfaction.

Some of the prominent players in the global Home Improvement Services Market are:

Recent Development

- DKI Ventures, LLC and Servpro have continued to expand their restoration services, focusing on responding to natural disasters such as floods and fires. Their robust networks and fast mobilization in emergencies have positioned them as leaders in this niche, leveraging their expertise in repairs and restoration efforts.

- Rainbow Restoration has enhanced its service offerings in water and fire damage restoration, aiming to deliver faster response times and cutting-edge restoration techniques.

- Coit Services, Inc. has diversified its cleaning and restoration services, emphasizing air duct cleaning and mold remediation, driven by increasing awareness of indoor air quality concerns.

- Crane Renovation Group is expanding its range of services, particularly in home remodeling and storm damage restoration, further increasing its presence in both residential and commercial sectors.

- Mr. Handyman has seen steady growth in offering a wide variety of home repair services, from small repairs to larger projects, tapping into the increasing trend of home maintenance and renovation needs.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 419.7 Bn |

| Forecast Value (2033) |

USD 742.5 Bn |

| CAGR (2024-2033) |

6.5% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Kitchen Renovation & Addition, Bathroom Renovation & Addition, Exterior & Interior Replacements, System Upgrades, Others) By Buyers Age (Under 35, 35-54, 55-64, Above 65) By City Type (Metro Cities, Other Non-metro Cities & Towns) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

DKI Ventures, LLC, Rainbow Restoration, Servpro, Power Home Remodeling Group, LLC, Coit Services, Inc., Crane Renovation Group, Mr. Handyman, FirstService Corporation, Belfor, Venturi Restoration |

| |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |