Market Overview

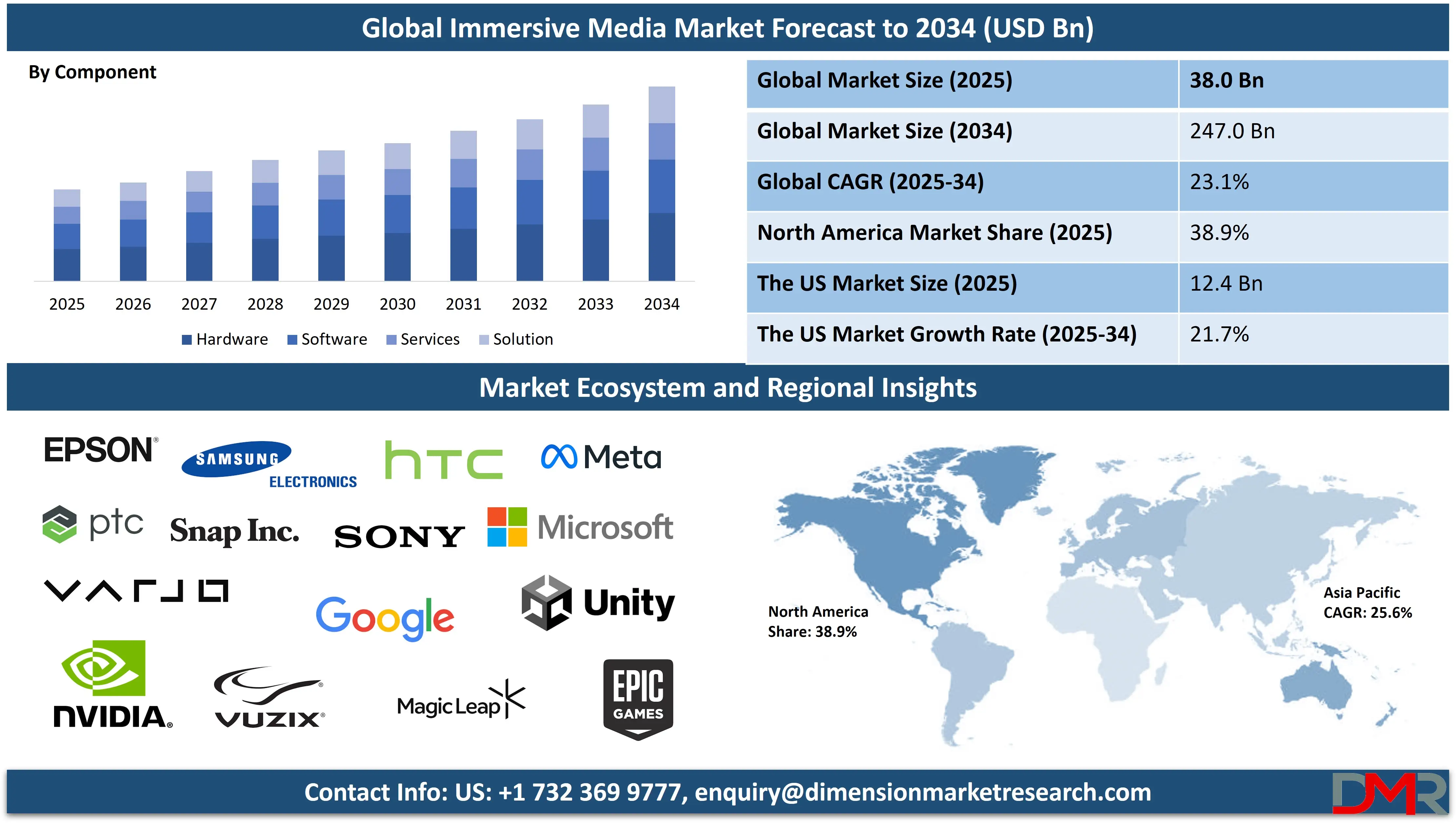

The Global Immersive Media Market is projected to reach USD 38.0 billion in 2025 and grow at a compound annual growth rate of 23.1% from there until 2034 to reach a value of USD 247.0 billion.

The global immersive media market is undergoing rapid transformation, driven by advancements in virtual reality (VR), augmented reality (AR), mixed reality (MR), and extended reality (XR) technologies. Immersive media is reshaping how content is consumed, providing users with highly interactive, engaging, and realistic experiences across entertainment, education, healthcare, and retail sectors.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Increasing adoption of head-mounted displays, affordable hardware, and sophisticated software solutions is expanding market penetration worldwide. Technological convergence with 5G and AI is further accelerating immersive media's reach, allowing real-time, high-fidelity content delivery on various devices. A key growth opportunity lies in enterprise adoption, where immersive simulations enhance training, product development, and remote collaboration, reducing costs and improving operational efficiency. Additionally, immersive media offers untapped potential in location-based entertainment, tourism, and virtual events, which are gaining momentum post-pandemic as audiences seek experiential digital engagement.

However, the market faces constraints including high initial setup costs, lack of standardized content formats, and concerns around user privacy and data security. Limited consumer awareness and discomfort caused by prolonged use of VR headsets also hamper widespread adoption. Despite these challenges, governments and industries worldwide are investing in immersive media infrastructure and research, fostering innovation and ecosystem growth.

The market is expected to grow supported by increasing digital transformation initiatives and evolving content consumption patterns. As immersive media technologies mature, the convergence of hardware affordability, software sophistication, and robust network connectivity will drive mass adoption, fundamentally altering entertainment, education, and enterprise workflows globally.

The US Immersive Media Market

The US Immersive Media Market is projected to reach USD 12.4 billion in 2025 at a compound annual growth rate of 21.7% over its forecast period.

The United States leads the global immersive media landscape, propelled by a strong technology infrastructure, high consumer readiness, and extensive governmental support for digital innovation. The US benefits from widespread broadband availability, with over 90% of households having access to high-speed internet, according to the Federal Communications Commission (FCC). This connectivity supports seamless delivery of immersive experiences such as virtual reality (VR), augmented reality (AR), and mixed reality (MR) across urban and suburban regions. The country’s demographic profile features a large population of technology adopters, particularly among millennials and Generation Z, who are highly engaged with digital content and interactive media.

Federal agencies, including the National Science Foundation (NSF) and the Department of Defense (DoD), invest significantly in immersive media research, particularly for training simulations, remote collaboration, and healthcare applications. Programs such as the NSF’s Smart & Connected Communities initiative encourage the integration of immersive technologies in public services and education, enhancing learning outcomes and emergency response capabilities. Moreover, the US boasts a vibrant innovation ecosystem concentrated in hubs like Silicon Valley, Seattle, and Boston, fostering startups and established companies in immersive hardware, software, and content creation.

Educational institutions across the country increasingly incorporate immersive media into curricula, enhancing STEM education and professional training with interactive simulations. The US workforce’s increasing digital skills support enterprise adoption of immersive solutions in industries such as manufacturing, healthcare, and automotive, where AR and VR facilitate remote assistance, design visualization, and operational training.

Additionally, consumer electronics companies headquartered in the US develop state-of-the-art devices, contributing to growing accessibility and affordability. With ongoing governmental initiatives supporting digital equity and infrastructure expansion, the US immersive media market is well-positioned for sustained growth driven by demographic advantages and robust innovation frameworks.

The Europe Immersive Media Market

The Europe Immersive Media Market is estimated to be valued at USD 5.7 billion in 2025 and is further anticipated to reach USD 23.66 billion by 2034 at a CAGR of 17.0%.

Europe’s immersive media market benefits from strong governmental support, advanced digital infrastructure, and a diverse demographic landscape that fosters technology adoption across multiple sectors. The European Union’s Digital Strategy prioritizes the development and deployment of immersive technologies to drive innovation, productivity, and digital inclusion. Initiatives like Horizon Europe fund research in virtual, augmented, and mixed reality, focusing on applications in healthcare, education, cultural heritage, and industrial digitization. Additionally, many European countries have rolled out extensive 5G networks, facilitating low-latency, high-bandwidth connectivity crucial for immersive media experiences.

Europe’s population presents a unique advantage, with a high proportion of digitally literate citizens spanning younger generations eager for entertainment and education solutions, as well as an aging population benefiting from immersive healthcare applications such as remote rehabilitation and cognitive therapies. Countries like Germany, France, the United Kingdom, and the Nordic nations have strong governmental programs supporting digital innovation hubs and startup ecosystems focused on immersive technology development. For example, the European Institute of Innovation and Technology (EIT) actively promotes cross-border collaboration between academia and industry to accelerate commercialization of immersive content and solutions.

Creative industries across Europe also play a critical role, producing rich virtual museum experiences, interactive storytelling, and location-based entertainment that attract both domestic and international audiences. Moreover, Europe’s stringent data privacy laws, including the General Data Protection Regulation (GDPR), build consumer trust in immersive media applications by ensuring responsible data use and security. Public sector adoption of immersive media in vocational training, emergency services, and urban planning further stimulates demand. With consistent investment in digital skills development and infrastructure, Europe is set to expand its immersive media market steadily, leveraging its demographic diversity and strong institutional frameworks.

The Japan Immersive Media Market

The Japan Immersive Media Market is projected to be valued at USD 1.52 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 10.82 billion in 2034 at a CAGR of 24.0%.

Japan’s immersive media market is distinguished by technological sophistication, high consumer engagement, and proactive governmental initiatives that support digital transformation across industries. The government’s Society 5.0 vision aims to integrate cyberspace and physical space, with immersive technologies like virtual reality (VR), augmented reality (AR), and mixed reality (MR) playing a central role in achieving this future society. Japan is a global leader in broadband penetration and network speed, with extensive 5G deployment enabling real-time immersive experiences crucial for applications ranging from entertainment to industrial automation.

Japan’s demographic structure includes a large youth population highly engaged with gaming and digital content, as well as an increasingly aging population that benefits from immersive healthcare solutions such as virtual rehabilitation and social connectivity for seniors. According to the Ministry of Internal Affairs and Communications, over 80% of Japanese households have internet access, and smartphone usage is nearly ubiquitous, facilitating widespread adoption of mobile-based immersive content. The country’s cultural affinity for innovation in gaming, animation, and robotics fuels consumer demand and supports a thriving content creation industry.

Industrial sectors, including automotive manufacturing and electronics, leverage immersive media for product design, prototyping, and worker training, improving precision and efficiency. Academic institutions and research centers collaborate closely with private companies to advance user interface technology, haptics, and 3D content generation. Public-private partnerships encouraged by the Ministry of Economy, Trade and Industry (METI) provide funding and policy support to startups developing immersive hardware and software solutions. As Japan continues to invest in digital infrastructure and innovation ecosystems, its immersive media market is expected to grow sustainably, driven by a convergence of cultural enthusiasm, demographic advantages, and strategic government support.

Global Immersive Media Market: Key Takeaways

- Global Market Size Insights: The Global Immersive Media Market size is estimated to have a value of USD 38.0 billion in 2025 and is expected to reach USD 247.0 billion by the end of 2034.

- The US Market Size Insights: The US Immersive Media Market is projected to be valued at USD 12.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 72.6 billion in 2034 at a CAGR of 21.7%.

- Regional Insights: North America is expected to have the largest market share in the Global Immersive Media Market with a share of about 38.9% in 2025.

- Key Players: Some of the major key players in the Global Immersive Media Market are Meta Platforms, Sony, Microsoft, Google, HTC, Magic Leap, Snap, Samsung, Unity Technologies, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 23.1 percent over the forecasted period of 2025.

Global Immersive Media Market: Use Cases

- Training & Learning: Immersive media enables realistic simulations for employee training in sectors like healthcare, manufacturing, and aviation, improving skill acquisition and reducing risks. Interactive 3D environments facilitate remote education and upskilling, enhancing learner engagement and retention.

- Emergency Services: AR and VR tools assist first responders in disaster management by simulating hazardous scenarios, improving preparedness and decision-making accuracy while minimizing exposure to real-world dangers.

- Product Development: Automotive and consumer electronics companies leverage immersive prototyping to visualize designs and iterate quickly, reducing time-to-market and enhancing collaboration between geographically dispersed teams.

- Sales & Marketing: Brands create immersive campaigns using AR and VR to offer personalized experiences, virtual try-ons, and interactive storytelling, boosting customer engagement and conversion rates.

- Gaming & Entertainment: Immersive media delivers hyper-realistic gaming environments and interactive content, transforming user experiences through multi-sensory engagement and social connectivity in virtual worlds.

Global Immersive Media Market: Stats & Facts

U.S. Government Accountability Office (GAO)

The GAO surveyed 14 federal civilian agencies to assess the use of immersive technologies across government operations

- These agencies use immersive media for key tasks like workforce training, public outreach, planning, and data visualization.

- Nine agencies plan to use virtual or augmented reality for visualizing data and spatial analysis, including airport traffic simulations and building layouts.

- Eight agencies aim to integrate immersive media into public communication, such as virtual tours at trade expos.

- Seven agencies utilize immersive tech for specialized training in fields like cybersecurity, aviation, and emergency preparedness.

- The Environmental Protection Agency plans to use augmented reality to aid personnel in indoor environmental inspections and sampling.

U.S. Food and Drug Administration (FDA)

The FDA has documented the growing integration of immersive technologies in healthcare

- As of 2024, the FDA had authorized 69 medical devices using VR or AR for diagnostics, treatment planning, rehabilitation, and mental health therapy.

- These devices address needs in neurology, orthopedics, surgical simulation, and pain management, reflecting immersive tech’s acceptance in clinical environments.

National Institute of Standards and Technology (NIST)

NIST has played a leading role in standardizing usability frameworks for immersive technologies

- It introduced a five-part Augmented Reality Usability Evaluation Framework designed to help developers create user-friendly, efficient AR interfaces.

- NIST is actively collecting data from stakeholders to develop cybersecurity and privacy guidelines for immersive technologies.

U.S. Department of Transportation (DOT)

The DOT has explored immersive tools to solve infrastructure challenges

- Augmented reality is being tested in highway construction to improve planning, detect underground utilities, and enhance worker safety.

- AR-enabled mobile devices can project construction plans directly onto work zones, reducing the risk of errors and rework.

Centers for Disease Control and Prevention (CDC)

The CDC has observed increasing use of immersive tools in public health sectors

- Virtual and augmented reality are widely used in ophthalmology for training eye surgeons and simulating vision-related conditions for educational purposes.

- Immersive media is being tested for behavioral health therapy and improving patient engagement in remote diagnostics.

U.S. Department of Veterans Affairs (VA)

The VA has actively piloted immersive solutions to support veterans

- VR and AR are being used in therapy for PTSD, anxiety, and loneliness.

- The VA incorporates immersive media into rehabilitation centers, helping veterans reconnect socially and improve physical recovery outcomes.

Pacific Northwest National Laboratory (PNNL)

PNNL applies immersive technologies to STEM education

- It delivers realistic simulations using virtual reality to teach scientific principles and emergency response procedures.

- VR enhances student understanding of hazardous or complex concepts by providing safe, immersive, hands-on experiences.

National Science Foundation (NSF)

NSF funds multiple immersive visualization research initiatives

- One project used VR to analyze spatial patterns in crime data, helping researchers and students explore criminal justice trends in a 3D environment.

- NSF-backed programs promote collaboration between computer scientists, law enforcement, and urban planners to utilize immersive media in social sciences.

U.S. Environmental Protection Agency (EPA)

The EPA integrates AR in its field operations and plannin

- It developed a mobile AR app that overlays environmental sampling routes and high-water marks on real-world visuals, aiding response teams during site visits.

- The agency supports research on using immersive media to raise public awareness about climate change and pollution.

U.S. Department of Energy (DOE)

The DOE promotes immersive tech for cybersecurity and workforce development

- DOE’s cybersecurity division plans to use immersive simulations to train teams in responding to digital threats.

- It is also testing AR-based remote collaboration tools to enhance maintenance in hazardous environments such as nuclear facilities.

U.S. Geological Survey (USGS)

USGS applies immersive tech to enhance field research

- A high-water mark application developed by USGS uses AR to visualize historic flood levels in real-world settings, supporting hydrologic modeling and disaster readiness.

National Aeronautics and Space Administration (NASA)

NASA uses immersive tools in engineering, research, and public education

- It deploys AR to overlay real-time data on wind tunnel test equipment, allowing engineers to monitor flight dynamics without manual recalibration.

- VR models have been developed for public exhibitions to demonstrate innovations in aeronautics and space exploration.

U.S. Department of Agriculture (USDA)

The USDA provides funding for immersive tech in rural innovation

- Through its education and training grants, USDA supports non-federal organizations in using AR and VR to improve workforce development in agriculture, food safety, and environmental science.

NIST (Cybersecurity Focus)

NIST is actively gathering input to define cybersecurity needs for immersive platforms

- Researchers are analyzing how immersive environments handle personal data, real-time interactions, and user authentication.

- The findings will shape the development of secure immersive applications for both consumer and industrial settings.

Global Immersive Media Market: Market Dynamic

Driving Factors in the Global Immersive Media Market

Increasing Consumer Demand for Immersive Experiences in Entertainment

The surge in demand for rich, multi-sensory digital experiences is significantly driving growth in the immersive media market. Consumers today seek more than just visual entertainment—they want to feel present in virtual environments. This demand is evident in sectors such as gaming, where VR headsets, haptic suits, and spatial audio technologies are redefining gameplay realism. Platforms like PlayStation VR2 and Meta Quest 3 are delivering cinema-quality visuals with intuitive interactivity. Moreover, the music and live events industry is adopting immersive technologies to provide fans with 360-degree concert experiences and virtual meet-and-greets.

Streaming services like Netflix and YouTube have also begun investing in immersive content libraries, offering interactive films and documentaries. In film production, virtual sets are now common, blending CGI and real-time rendering for cost-efficient cinematography. Social media platforms like Instagram and Snapchat are normalizing AR filters, while newer entrants like TikTok and BeReal are experimenting with spatial storytelling. This heightened consumer appetite for immersion is accelerating hardware innovation, software development, and content creation, thereby acting as a powerful market catalyst.

Government and Institutional Support for XR Adoption

Governments and educational institutions are playing a pivotal role in the advancement of immersive media technologies by funding XR adoption in public infrastructure, healthcare, and education. Initiatives like the U.S. Department of Education’s support for VR learning labs in schools or the EU’s Horizon Europe program funding XR research highlight this commitment. Public universities are integrating AR/VR into their engineering and medical curricula, developing future-ready talent with advanced digital skills. Defense departments across the U.S., India, and Europe are investing in XR for tactical simulations, mission rehearsals, and intelligence visualization.

Regulatory bodies such as the U.S. FDA have approved multiple XR-based therapeutic tools, opening doors for innovation in digital health. Additionally, national museums and heritage centers are creating AR-guided experiences to make history and culture more accessible. These government-backed investments not only reduce adoption risks for enterprises and developers but also stimulate ecosystem growth by creating frameworks, funding R&D, and building public trust in immersive technologies.

Restraints in the Global Immersive Media Market

High Hardware Costs and Technical Barriers to Mass Adoption

Despite its promise, immersive media adoption faces major hurdles due to the high upfront cost of VR/AR hardware and the steep technical learning curve associated with its deployment. Advanced headsets, motion sensors, and haptic gear can be prohibitively expensive for small businesses and educational institutions, especially in emerging markets. Beyond cost, the setup of immersive experiences often requires sophisticated spatial mapping, content calibration, and continuous software updates, demanding specialized IT expertise. Compatibility issues across platforms and lack of standardized protocols further slow integration efforts. Consumers may experience motion sickness or eye strain, deterring mainstream use.

Developers face challenges in creating cross-platform content that performs consistently across devices. Moreover, insufficient internet bandwidth in many regions hampers real-time rendering and interactivity, particularly for cloud-based XR platforms. These technical and financial barriers restrict scalability, limiting immersive media’s penetration to well-funded enterprises and niche consumer segments, thereby slowing down its broader market impact despite growing interest.

Data Privacy and Security Concerns in Immersive Environments

Another key restraint for the immersive media market is growing concern over user privacy, data ownership, and cybersecurity within XR platforms. Immersive environments capture a vast amount of biometric, behavioral, and locational data through eye tracking, hand gestures, voice commands, and spatial interactions. Without robust encryption and data governance policies, this information can be exploited for targeted advertising, surveillance, or even identity theft. As XR devices become interconnected with personal ecosystems—phones, wearables, and smart homes—the risk of security breaches increases exponentially.

Moreover, regulations like the EU's GDPR and California’s CCPA demand strict compliance, yet immersive platforms often struggle to meet these standards due to a lack of established privacy frameworks. There is also a legal grey area surrounding virtual harassment and content moderation within shared virtual spaces, which can deter users from participating. Until privacy-by-design protocols, ethical data usage models, and comprehensive digital rights management systems are embedded into XR platforms, market growth will remain restrained.

Opportunities in the Global Immersive Media Market

Integration of Immersive Media in Healthcare Applications

The healthcare sector offers significant growth potential for immersive media technologies. Hospitals, clinics, and therapy centers are increasingly incorporating VR/AR solutions into patient care, diagnostics, and treatment planning. For example, VR is used for pain management, distraction therapy, and phobia treatment, offering non-invasive alternatives to medication. In surgical training, AR overlays allow trainees to view anatomy in 3D, improving precision and reducing risks in real-world operations. Immersive technologies also enhance physical rehabilitation programs by gamifying exercises and enabling remote patient monitoring, especially useful for elderly patients or those in rural areas.

Startups are developing XR-based mental health apps to address anxiety, PTSD, and depression through exposure therapy and mindfulness simulations. Furthermore, immersive telemedicine is enabling virtual consultations in hyper-realistic environments, increasing doctor-patient engagement. With aging populations, the rise of personalized medicine, and a global focus on preventive care, immersive media holds untapped potential to become a mainstream tool across medical pathways. Regulatory clearance and insurance coverage improvements will further unlock this segment.

Expansion of Location-Based Entertainment and Themed Experiences

Location-based entertainment (LBE) venues, such as VR arcades, theme parks, and immersive exhibitions, present a lucrative opportunity for immersive media vendors. Post-pandemic, there is a resurgence in demand for physical experiences that merge digital interactivity with real-world immersion. Attractions like Universal’s Super Nintendo World, Disney’s Star Wars: Galaxy’s Edge, and AR-based museum exhibits offer deeply engaging visitor journeys powered by spatial computing, gesture recognition, and holographic projection. Moreover, travel and tourism brands are deploying immersive storytelling in visitor centers to digitally recreate historical events or simulate eco-tourism in endangered zones.

Hotels and cruise lines are integrating VR experiences for in-room entertainment or destination previews. These installations generate higher ticket sales, repeat visits, and social media buzz, providing both experiential value and marketing ROI. Technological advancements like 5G connectivity, edge computing, and lightweight XR gear further simplify deployment in LBE environments. As cities embrace smart tourism strategies, the intersection of immersive media with physical venues is poised to become a dominant revenue stream.

Trends in the Global Immersive Media Market

Convergence of AI with Immersive Technologies

A major trend shaping the immersive media market is the integration of

artificial intelligence with immersive platforms such as AR, VR, and XR. AI-powered engines are enhancing realism, personalizing content, and enabling dynamic interaction within virtual environments. For instance, AI algorithms can adapt virtual environments in real time based on user behavior or emotional responses, transforming passive content into an interactive experience.

Natural language processing allows users to converse with virtual characters in a human-like manner, making simulations more immersive and suitable for applications like

mental health therapy, education, and military training.

Additionally, generative AI is now capable of creating immersive 3D scenes and avatars at scale, significantly reducing development costs and time. This convergence is helping industries—from e-commerce to defense—deliver emotionally resonant and context-aware experiences that increase engagement, retention, and decision-making efficiency. As AI evolves, we can expect it to serve as the cognitive core of immersive media, unlocking endless possibilities in spatial computing and experiential storytelling.

Rise of Immersive Media in Enterprise Training

Enterprises across sectors are increasingly shifting from traditional training methods to immersive, simulation-based learning environments using VR and AR. This trend is especially prominent in high-risk industries such as oil & gas, aviation, defense, and manufacturing, where safety and precision are paramount. VR simulations can replicate real-life scenarios, allowing employees to practice tasks like machinery handling, emergency response, or tactical decision-making in controlled, risk-free settings. Such platforms enhance learning outcomes by improving knowledge retention, muscle memory, and behavioral readiness.

Moreover, with remote work on the rise, organizations are deploying cloud-based XR platforms for decentralized training programs. These systems offer analytics to assess learner performance, identify gaps, and adapt modules in real-time. Companies like Boeing, Walmart, and Shell have publicly acknowledged the cost-efficiency and effectiveness of immersive training programs, with some reporting training time reductions of up to 40%. As hardware costs decline and platforms become more accessible, immersive learning is becoming an enterprise norm, reinforcing this transformative trend.

Global Immersive Media Market: Research Scope and Analysis

By Component Analysis

Hardware is projected to hold the dominant share in the immersive media market due to its critical role as the enabling foundation of the entire immersive experience. Devices like VR headsets, AR smart glasses, haptic feedback systems, motion trackers, 3D cameras, and immersive display panels form the tangible interface through which users engage with digital environments. As the quality of immersive experiences is directly tied to hardware performance—such as field of view, latency, resolution, and tracking accuracy—manufacturers invest heavily in hardware innovation. Products like Meta Quest 3, Apple Vision Pro, Sony PlayStation VR2, and HTC Vive XR Elite showcase how hardware dictates the realism, interactivity, and adoption potential of immersive platforms.

The hardware segment also benefits from cross-industry demand, not just in gaming or entertainment but also in healthcare, education, military training, and industrial simulations. Institutions and enterprises are rapidly adopting standalone and tethered XR devices for spatial computing and real-time collaboration, fueling further demand. Additionally, advances in edge computing, wireless 6DoF tracking, eye-tracking, and low-latency wireless streaming have made modern immersive hardware more accessible and functional than ever. Governments and enterprises investing in training and simulation programs typically begin by allocating budgets for hardware infrastructure, further reinforcing its dominance. As demand rises for fully immersive and realistic experiences, hardware will remain the cornerstone, driving innovation across the value chain of the immersive media industry.

By Technology Analysis

Virtual Reality (VR) is anticipated to dominates the immersive media market by technology type because it offers the most comprehensive and immersive user experience across a wide range of applications. VR enables users to enter fully simulated digital environments that are both interactive and immersive, making it ideal for sectors like gaming, education, healthcare, military training, and virtual tourism. Unlike Augmented Reality, which overlays digital elements onto the real world, VR creates a controlled, distraction-free environment, perfect for focused learning, therapeutic interventions, and immersive storytelling. This full-immersion capability makes it highly valuable in scenarios that demand deep cognitive or emotional engagement.

The technology has matured significantly, with leading brands such as Meta, Sony, HTC, and Pico advancing the performance, affordability, and usability of VR headsets. Features such as 6DoF tracking, spatial audio, room-scale VR, and haptic feedback enhance realism and boost user retention. In enterprise use cases, VR is helping reduce training costs, improve productivity, and minimize workplace hazards. Military and aviation sectors are increasingly investing in VR for mission simulations and tactical drills. Additionally, the educational sector is leveraging VR for virtual labs and historical reconstructions.

With the global gaming industry and content creators producing high-quality VR titles, user interest continues to rise. The proliferation of 5G networks and cloud rendering is making VR more accessible through streaming. As a result, VR stands out not just as a consumer entertainment medium but also as a transformative technology across professional domains, firmly establishing its leadership in the immersive media technology landscape.

By Application Analysis

Entertainment & Media is projected to remains the leading application segment in the immersive media market due to its early adoption, strong consumer appeal, and consistent investment in immersive content creation. From interactive storytelling and virtual concerts to immersive cinema and 3D video streaming, the sector has pioneered the adoption of VR, AR, and XR experiences. Entertainment companies were among the first to recognize the potential of spatial computing to create emotional and engaging content that cannot be replicated through traditional 2D formats.

Film studios are increasingly using virtual production techniques, blending real-time rendering with motion capture to build dynamic digital sets. Streaming platforms like YouTube and Netflix have started exploring interactive films and 360-degree content. Music artists and record labels are leveraging VR to offer virtual performances, backstage experiences, and fan interactions—expanding revenue streams beyond physical venues. Additionally, gaming, which is a subsegment of entertainment, is a massive driver, with VR game titles gaining mainstream popularity. Platforms such as SteamVR, PlayStation VR, and Oculus Store have seen significant growth in game downloads and user engagement.

Immersive media also enhances user experience in theme parks, museums, and art galleries, which are integrating AR and VR for augmented tours and digital exhibits. The combination of high consumer demand, creative freedom, and rapid technological evolution ensures that Entertainment & Media remains at the forefront of immersive media applications. As monetization models expand and more brands invest in immersive advertising and branded experiences, this segment is expected to maintain its dominance in the foreseeable future.

The Global Immersive Media Market Report is segmented on the basis of the following

By Component

- Hardware

- Head-Mounted Displays (HMDs)

- Gesture Tracking Devices

- Sensors and Cameras

- AR Glasses and Smart Glasses

- Software

- AR/VR Content Management Systems

- 3D Modeling & Simulation

- Game Engines

- Services

- Integration & Deployment

- Support & Maintenance

- Consulting & Training

- Solution

- Immersive Media Platforms

- Content Creation Tools

By Technology

- Virtual Reality (VR)

- Augmented Reality (AR)

- Mixed Reality (MR)

- 360-Degree Video

- Extended Reality (XR)

By Application

- Entertainment & Media

- Training & Learning

- Emergency Services

- Product Development

- Sales & Marketing

- Gaming

- Social Media

- Commercial

- Other Applications

Global Immersive Media Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to lead the immersive media market as it command over 38.9% of market by the end of 2025, due to a robust ecosystem of technology innovators, early adopters, and consistent institutional investment across industries. The U.S. is home to major immersive media hardware and software companies including Meta, Apple, Microsoft, Unity, and NVIDIA—each investing heavily in spatial computing, AR/VR devices, and immersive content development.

Government-funded programs such as those by the U.S. Department of Defense, NASA, and the Department of Education have incorporated VR and AR into training, simulation, and learning applications. Media and entertainment giants headquartered in North America—like Disney, Warner Bros., and Netflix—are investing in virtual production, interactive storytelling, and XR-based audience engagement, accelerating adoption.

The gaming sector, a major driver, is fueled by widespread consumer access to high-performance gaming consoles and VR-ready PCs. Academic institutions and hospitals are also integrating immersive technologies into education and healthcare services, further expanding use cases. The presence of favorable digital infrastructure, strong venture capital networks, and a large tech-savvy population sustains North America's position as the global epicenter for immersive innovation, content generation, and commercial scalability.

Region with the Highest CAGR

Asia Pacific is expected to witness the fastest growth in the immersive media market due to a rapidly expanding middle-class population, increasing smartphone penetration, and aggressive government support for digital transformation. Countries like China, South Korea, Japan, and India are investing heavily in smart cities, 5G infrastructure, and metaverse development—all of which are catalysts for immersive technologies.

China’s government-backed metaverse development policies and the growing presence of companies like ByteDance (Pico), Tencent, and Alibaba in the AR/VR ecosystem contribute to rapid domestic growth. Japan and South Korea have integrated XR technologies in gaming, robotics, and education, with strong support from public-private partnerships. India’s booming ed-tech and healthcare sectors are also embracing immersive media for remote learning and virtual consultations.

As hardware costs decline and local startups enter the XR content space, the affordability and accessibility of immersive media tools will increase. Combined with youthful demographics and a surge in digital content consumption, Asia Pacific’s immersive media market is poised for exponential expansion over the next decade.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Immersive Media Market: Competitive Landscape

The immersive media market is highly competitive, characterized by rapid innovation, cross-industry partnerships, and diverse technological competencies. Leading global players include Meta Platforms, Apple, Sony, Microsoft, Google, and Samsung, each contributing across hardware (like VR/AR headsets), spatial audio, and immersive software ecosystems. Meta's Quest series and Apple’s Vision Pro have intensified hardware competition, while Unity and Unreal Engine dominate the immersive content development space.

Tech giants are continuously enhancing user experience through AI integration, real-time rendering, and cloud streaming capabilities. Meanwhile, companies such as HTC, Varjo, and Magic Leap are pushing the boundaries of enterprise-focused XR solutions. Entertainment and gaming firms—like Epic Games, Niantic, and Valve—are driving immersive media adoption through compelling consumer content.

Startups like Spatial, Bigscreen, and HaptX are innovating in areas like social VR, collaborative XR platforms, and haptic interfaces, backed by increasing venture capital inflows. Strategic collaborations between telecom operators and XR solution providers, especially in the rollout of 5G, are enabling low-latency immersive experiences. The market also sees regional innovation in Asia and Europe, creating a diversified and fast-evolving competitive landscape, where incumbents and disruptors vie to redefine digital interaction and presence.

Some of the prominent players in the Global Immersive Media Market are

- Meta Platforms Inc.

- Sony Corporation

- Microsoft Corporation

- Google LLC

- HTC Corporation

- Magic Leap, Inc.

- Snap Inc.

- Samsung Electronics Co., Ltd.

- Unity Technologies

- Epic Games, Inc.

- PTC Inc.

- NVIDIA Corporation

- Vuzix Corporation

- Varjo Technologies Oy

- Niantic, Inc.

- Autodesk, Inc.

- Qualcomm Technologies, Inc.

- Epson America, Inc.

- Lenovo Group Limited

- RealWear, Inc.

- Other Key Players

Recent Developments in Global Immersive Media Market

- April 2025: Google expanded its Immersive Ads across its platforms and began partnering with Roblox to deliver engaging in-game ad experiences within virtual environments.

- February 2025: Meta showcased the capabilities of its Meta Quest 3 headset at an academic event, highlighting its potential to enhance student learning through mixed reality.

- December 2024: Meta Platforms collaborated with James Cameron’s Lightstorm Vision to develop high-fidelity 3D immersive content for the Meta Quest headset, targeting live entertainment applications.

- September 2024: Meta launched Orion, its most advanced augmented reality glasses, incorporating a lightweight design with holographic displays and contextual artificial intelligence features.

- July 2024: Cosm secured over USD250 million in funding to expand its network of immersive entertainment domes and strengthen its media technology operations worldwide.

- July 2024: Layered Reality entered a strategic collaboration with Technicolor Group to co-create immersive storytelling content using cinematic-quality effects and environments.

- June 2024: FMX 2024, a leading European conference on animation and immersive media, took place in Stuttgart, Germany, drawing major players and innovators in the XR and VFX sectors.

- May 2024: Technicolor Group intensified its expansion into experiential entertainment with a larger creative team and new immersive content offerings for location-based experiences.

- April 2024: Meta signed a partnership with Unity to drive immersive education and training, enabling the development of XR-based learning environments and applications.

- January 2024: Unity Software and Walmart collaborated to integrate Walmart's commerce APIs into Unity-based games and virtual experiences, allowing in-app retail transactions and engagement.

- December 2023: Meta Platforms and Telefónica launched a mixed reality initiative for senior citizens to improve digital inclusion and promote well-being through immersive media.

- December 2023: Samsung Electronics partnered with Netflix to offer immersive streaming experiences for events like “Squid Game: The Trials” using smart displays and XR overlays.

- October 2023: Epic Games and LEGO formed a partnership to co-create digital worlds designed for safe and creative exploration by children, integrating physical and virtual play.

- September 2023: Sony released PlayStation VR2, featuring enhanced haptics, visual resolution, and tracking to target the next generation of immersive gaming users.

- July 2023: Meta launched Meta Quest Pro, a premium VR headset aimed at both enterprise users and high-end consumers, offering better optics, comfort, and processing.

- May 2023: Microsoft completed its acquisition of Activision Blizzard to strengthen its presence in immersive gaming and metaverse development as part of its long-term digital strategy.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 38.0 Bn |

| Forecast Value (2034) |

USD 247.0 Bn |

| CAGR (2025–2034) |

23.1% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 12.4 Bn |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Hardware, Software, Services, Solution), By Technology (Virtual Reality (VR), Augmented Reality (AR), Mixed Reality (MR), 360-Degree Video, Extended Reality), By Application (Entertainment & Media, Training & Learning, Emergency Services, Product Development, Sales & Marketing, Gaming, Social Media, Commercial, Other Applications), By End-Use Industry (Gaming & Design & Architecture, Retail, Automobile, Education, Media & Entertainment, Location-Based Entertainment, Travel & Hospitality, Other End-Use Industries) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Meta Platforms, Sony, Microsoft, Google, HTC, Magic Leap, Snap, Samsung, Unity Technologies, Epic Games, PTC, NVIDIA, Vuzix, Varjo, Niantic, Autodesk, Qualcomm, Epson, Lenovo, RealWear, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Immersive Media Market?

▾ The Global Immersive Media Market size is estimated to have a value of USD 38.0 billion in 2025 and is expected to reach USD 247.0 billion by the end of 2034.

What is the size of the US Immersive Media Market?

▾ The US Immersive Media Market is projected to be valued at USD 12.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 72.6 billion in 2034 at a CAGR of 21.7%.

Which region accounted for the largest Global Immersive Media Market?

▾ North America is expected to have the largest market share in the Global Immersive Media Market with a share of about 38.9% in 2025.

Who are the key players in the Global Immersive Media Market?

▾ Some of the major key players in the Global Immersive Media Market are Meta Platforms, Sony, Microsoft, Google, HTC, Magic Leap, Snap, Samsung, Unity Technologies, and many others.

What is the growth rate in the Global Immersive Media Market in 2025?

▾ The market is growing at a CAGR of 23.1 percent over the forecasted period of 2025.