Advancements in touchscreen technology, particularly in capacitive and resistive systems, play a pivotal role in driving the growth of the interactive display market. These technologies enable more intuitive and responsive interfaces, which are critical in applications requiring high levels of user interaction.

For instance, capacitive touchscreens, known for their sensitivity to light touches, facilitate smoother user experiences in devices ranging from personal tablets to advanced interactive kiosks. On the other hand, resistive touchscreens, valued for their durability and ability to recognize input from various objects, are widely utilized in industrial settings and consumer electronics.

This technological evolution enhances the functionality and reliability of interactive displays, making them increasingly attractive for a variety of applications. As these displays become more user-friendly, sectors such as retail, education, and public services are more likely to adopt this technology, thereby expanding the market reach and increasing the volume of deployments.

The education sector has emerged as a significant growth driver for the interactive display market. Interactive displays are being integrated into classrooms at an increasing rate, transforming traditional learning environments into modern, interactive hubs. These tools facilitate a more collaborative and engaging learning experience, allowing for real-time content sharing, digital whiteboarding, and interactive lessons that cater to various learning styles.

In the retail and hospitality industries, interactive displays are becoming indispensable tools for engaging customers and delivering personalized experiences. These displays are used for a variety of purposes, including wayfinding, product information kiosks, and as digital signage for advertising. The ability of interactive displays to attract customer attention and provide tailored information makes them highly valuable in these settings.

The integration of interactive displays in retail stores and hotels helps businesses enhance customer interactions, promote products more effectively, and increase the time customers spend in-store, all of which can lead to higher sales and improved customer satisfaction. Moreover, the use of advanced analytics through these displays allows for the collection of customer data, enabling businesses to optimize their marketing strategies and improve overall service delivery.

Growth Opportunities

High Cost of Advanced Display Technology

The interactive display market is significantly influenced by the high cost associated with the procurement and implementation of cutting-edge display technologies. Advanced interactive displays often incorporate sophisticated technologies such as OLED, 4K Ultra HD resolution, and multi-touch capabilities, which entail substantial manufacturing and development costs. These high costs are typically passed on to the consumer, making these technologies less accessible for budget-conscious educational institutions, small businesses, and developing regions.

The financial burden can therefore act as a primary restraint on the expansion of the market, as potential users may opt for less expensive, non-interactive alternatives or older technologies. Market analysis suggests that the cost barrier not only affects immediate sales but also slows the overall adoption rate, as it limits the market to higher-end consumers and organizations with larger IT budgets.

Impeding User Adoption and Satisfaction

Technical challenges and the necessity for frequent maintenance are significant deterrents in the adoption of interactive displays. Users frequently encounter issues such as software compatibility problems, system bugs, and hardware malfunctions, which can severely impair the functionality and reliability of interactive display systems.

Moreover, the need for regular updates and maintenance can result in additional operational costs and downtime, detracting from the overall user experience. Such technical impediments can lead potential customers to perceive these technologies as unreliable and inefficient investments.

This perception is particularly damaging in sectors where dependable performance is crucial, such as in corporate settings and critical public service areas. Consequently, these technical and maintenance challenges can restrain market growth by reducing customer satisfaction and loyalty, ultimately influencing the market’s ability to attract new users and retain existing ones.

Key Trends

Enhancing User Engagement and Content Relevance

The integration of artificial intelligence (AI) and

machine learning (ML) into interactive displays is poised to transform the market landscape significantly in 2023. These technologies enable interactive displays to offer predictive analytics, which anticipates user preferences and behaviors, thereby delivering more personalized and relevant content. The adoption of AI and ML not only enhances user engagement but also increases the functionality of interactive displays, making them more valuable across various applications. This integration serves as a critical driver for market growth, as industries seek innovative ways to improve customer interaction and satisfaction.

Capitalizing on Digital Transformation

Emerging markets represent a fertile ground for the expansion of the interactive display market, attributed primarily to the rapid pace of digitalization. As these regions continue to embrace digital technology, the demand for advanced interactive solutions in the educational, commercial, and public sectors is expected to rise. This shift offers substantial opportunities for market players to introduce interactive displays that cater to the unique needs of these burgeoning markets, potentially leading to increased market penetration and revenue streams.

Adoption in Outdoor and Public Spaces

The application of interactive displays in outdoor and public spaces presents a novel opportunity for market growth. These displays can be utilized for a range of purposes, from advertising and information dissemination to public engagement and entertainment. The expansion into outdoor environments not only broadens the application spectrum but also introduces interactive displays to a wider audience, thereby enhancing visibility and usage. This trend is expected to open new avenues for market expansion, as more sectors recognize the benefits of employing interactive technology in high-traffic areas.

Restraining Factors

Transition to 4K and 8K Resolutions

The global interactive display market is witnessing a significant shift towards ultra-high-definition resolutions, including 4K and 8K. This transition is driven by the demand for sharper, more detailed visual content, enhancing user engagement through superior clarity and depth.

As industries such as retail, education, and entertainment increasingly adopt these high-resolution displays, the market is expected to experience growth in sectors where visual impact is a key component of user interaction. The enhanced visual quality not only improves the aesthetic appeal but also supports more complex and detailed content, making these displays more effective for professional and educational applications.

Expanding Application in Dynamic Environments

Interactive video walls are becoming increasingly popular in various sectors, including corporate, retail, and public installations. These large-scale displays are used to create immersive environments that captivate audiences and facilitate interactive learning and collaboration.

The growth of this segment is fueled by technological advancements that allow for more seamless and scalable installations, making the

interactive video wall a versatile tool for enhancing customer and user experiences in expansive settings.

Touchless Interaction Technologies

The adoption of touchless interaction technologies is accelerating within the interactive display market, especially in response to heightened health and hygiene concerns. Technologies such as gesture recognition and voice control are being increasingly integrated into interactive displays to provide users with safer alternatives to touch-based interaction.

This trend is particularly relevant in public spaces, healthcare settings, and areas where cleanliness is paramount. The shift towards touchless interfaces not only mitigates health risks but also offers a more accessible user experience, broadening the appeal of interactive displays across various user demographics.

Research Scope and Analysis

By Display

In terms of display types, the interactive display market consists of interactive video walls, whiteboards, kiosks, monitors, &

interactive tables. Among all these, interactive display kiosks leads the market by holding a significant revenue share in 2023, & this dominance is expected to further grow during the forecasted period.

Interactive kiosks are specialized computer terminals contained with hardware & software designed to provide access to information & applications for communication, commerce, entertainment, or education. Mainly situated in high-traffic locations such as hotel lobbies, retail stores, & airports, these kiosks can be personalized with components like coin hoppers, card readers, bill acceptors, & thermal printers to meet specific needs.

Further, its dominance is owing to its remarkable versatility, efficiency enhancements, data-driven insights, customer engagement, & branding opportunities. Across numerous industries, interactive kiosks allow businesses to customize functionality, design, & content to match their unique requirements, leading to enhanced efficiency, affordability, data analytics, improved customer service, branding & promotion, seamless integration with other technologies, and remote management & analytics. With businesses highly recognizing their value & benefits, interactive kiosks are anticipated for continued popularity & market expansion.

By Panel Size

The interactive display market classifies panels into three different sizes, which are 17 to 32 inches, 32 to 65 inches, & 65 inches & above, with the 65 inches & above panel size taking the lead, by having the major market revenue share in 2023. These larger interactive displays find their place in spaces requiring high visibility, like conference halls, auditoriums, &

digital signage installations.

Further, their engaging capabilities allow users to be engrossed with content from a distance, making them well-suited for impactful visual experiences. Whether as part of interactive video walls or in digital billboards, these large panels build a seamless & attention-grabbing visual environment, cementing their leading position in the interactive display market.

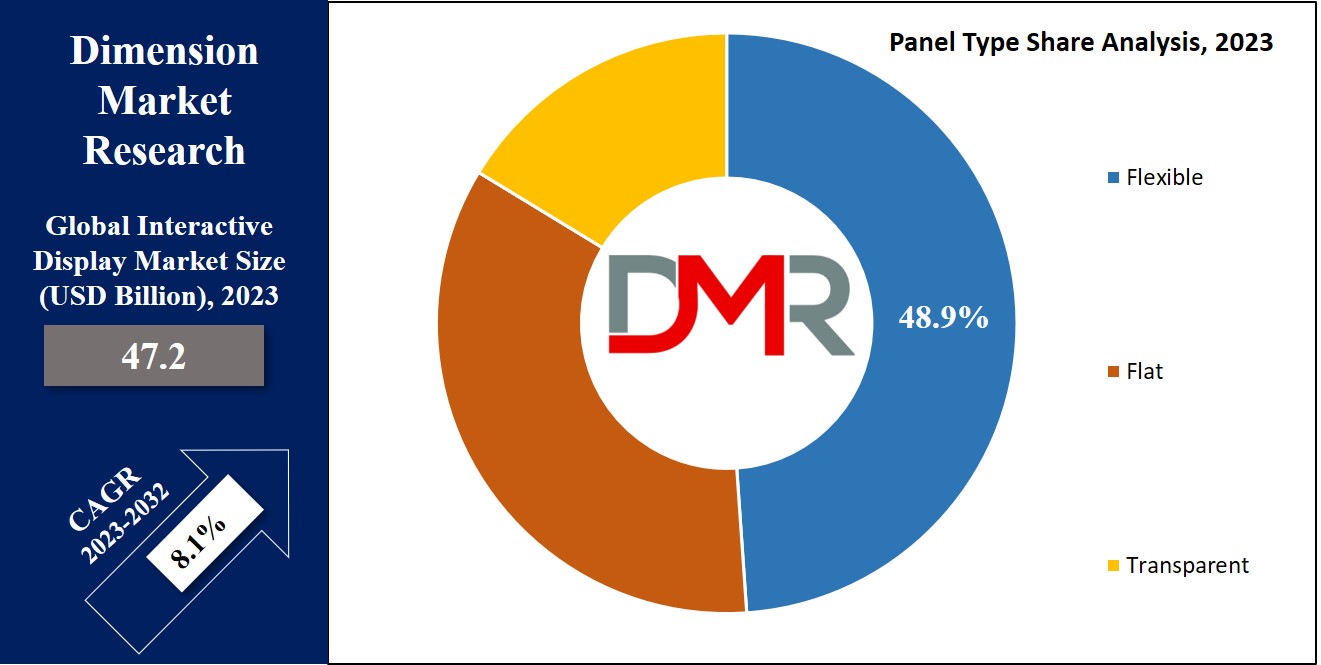

By Panel Type

The interactive display market classifies panel types into flat, flexible, & transparent categories, with flexible displays anticipated to dominate throughout the forecasted period. These flexible panels, also known as flexible OLED displays, have unique characteristics that make them different from conventional rigid displays, as they can bend, curve, or even roll up, allowing innovative applications such as wraparound screens, curved displays, & immersive user experiences.

Further, the lightweight & slim profile makes them well-suited for applications where & and thickness are critical considerations. Furthermore, these displays show high durability, & resistance to damage, & deliver better viewing angles with bold color contrast, establishing their dominance in the interactive display market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Technology

Based on technology, the interactive display market is segmented into LCD, LED, and OLED, where, LCD technology takes the lead & is expected to maintain its dominance throughout the forecasted period, mainly due to its versatility, energy efficiency, scalability, high image quality, reliability, durability, cost-efficiency, wide viewing angles, & compatibility with a range of input sources & software platforms.

LCDs come in different panel sizes, resolutions, & aspect ratios, making them suitable for numerous applications in hospitality, education, retail, and healthcare. Their broad production & availability result in competitive pricing & easy accessibility for consumers & businesses, solidifying their position at the forefront of the market.

By Application

The interactive display market is segmented into various sectors, like transportation, education, retail, hospitality, healthcare, BFSI & more. Among all these, the BFSI sector emerges as the major driving force in the interactive display market in 2023, as it supports interactive displays to improve customer experiences by delivering dynamic content, interactive applications, & user-friendly interfaces.

These displays serve various functions like information dissemination, self-service, transaction automation, compliance adherence, queue management, privacy & security measures, training, & fostering innovation. Further, they play an essential role in ensuring regulatory compliance & granting customers access to vital information, cementing their critical role in the BFSI industry.

The Global Interactive Display Market is segmented on the basis of the following:

By Display

By Panel Size

- 17 to 32 inches

- 32 to 65 inches

- 65 inches & above

By Panel Type

- Flexible

- Flat

- Transparent

By Technology

By Application

- Retail

- Education

- BFSI

- Healthcare

- Travel & Transportation

- Hospitality

- Others

Regional Analysis

North American region leads the interactive display market with a commanding 42.0% market share in terms of revenue in 2023, which is due to the rise in demand for immersive & engaging technologies across different sectors, driven by developments in touch technology. Interactive displays have gained broad popularity, mainly in North America, where businesses, educational institutions, & government agencies have rapidly adopted them to encourage communication & collaboration capabilities.

The education sector has played a major role in this growth, with many schools & universities integrating interactive displays to improve classroom engagement, facilitate collaborative learning, & deliver more effective feedback to students, contributing to the region's market leadership.

Moreover, the Asia Pacific region is anticipated for rapid growth, with interactive displays expected to exhibit high & sustained expansion during the forecast period, which is driven by growth in demand in education, corporate, & healthcare sectors.

Technological advancements, growth in educational investments, & the increase in the need for interactive communication tools are the major factors fueling the adoption of interactive displays in this region, particularly in countries like Japan, China, and South Korea, known for their technological innovation & advanced display technologies. Further, these countries have become major global exporters of interactive display technology, meeting the growing demand from the region & beyond.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The interactive display market is quite fragmented, as the market comprises various market players competing to lead the market, and these players are constantly enhancing their technologies to outperform one another & ensure their products are efficient, reliable, & safe. They achieve this by applying strategies like partnerships, enhancing their products, & working together, all in an effort to gain a competitive advantage over their competitors & have a major portion of the market.

Like, in February 2023, SMART Technologies announced its new interactive displays for educational purposes at the 2023 TCEA Convention & Exposition in San Antonio, Texas. These displays, which have the SMART Board MX (V4) series & SMART Board GX (V2) series, allow multiple users to write, erase, & make gestures at once across various software & applications. They come with advanced features like zero bonded glass & an enhanced touch system, making touch & inking more accurate & improving the overall experience of the user. SMART's interactive technology, powered by iQ, helps collaborative & active learning & provides built-in activities to engage with devices

.

Some of the prominent players in the Global Interactive Display Market are:

- BenQ Corp

- Crystal Display Systems Ltd

- LG Display

- Samsung

- Planar System

- NEC Display Solutions

- IDEUM

- Sharp Corp

- Box Light Corp

- Horizon Display Inc

- Other Key Players

Recent Developments

- February 2025: Google is expected to deepen its ecosystem integration by announcing new partnerships with major interactive display manufacturers (e.g., Samsung, LG) to have "Google Meet Assistant" built directly into the firmware, using on-device AI to automate meeting notes and action items, targeting a 15% increase in enterprise market share.

- January 2025: Samsung launched its new Q-series Interactive Display at Integrated Systems Europe (ISE) 2025, featuring a quantum dot-enhanced panel for superior color accuracy and a new "Samsung Workplace" platform that aggregates various meeting apps into a single, unified interface.

- March 2024: Samsung unveiled the 2024 Flip Pro (WM75B), featuring a 4K UHD display and new AI-powered software that automates tasks like handwriting-to-text conversion, aiming to capture a larger share of the corporate market, which is expected to grow at a CAGR of over 9% through 2030.

- January 2024: Google launched its first-ever Google for Education Device Manager for interactive displays, enabling centralized management of over 100,000 devices from partners like BenQ and Philips, directly targeting the $4.5 billion educational technology segment.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 47.2 Bn |

| Forecast Value (2032) |

USD 95.2 Bn |

| CAGR (2023–2032) |

8.1% |

| Historical Data |

2017 – 2022 |

| Forecast Data |

2023 – 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Display (Interactive Video Wall, Interactive Kiosk, Interactive Tables, Interactive Whiteboard, and Interactive Monitor), By Panel Size (17 to 32 inches, 32 to 65 inches, and 65 inches & above), By Panel Type (Flexible, Flat, and Transparent), By Technology (LCD, LED, OLED, and Others), By Application (Retail, Education, BFSI, Healthcare, Travel & Transportation, Hospitality, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

BenQ Corp, Crystal Display Systems Ltd, LG Display, Samsung, Planar System, NEC Display Solutions, IDEUM, Sharp Corp, Box Light Corp, Horizon Display Inc, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |