Market Overview

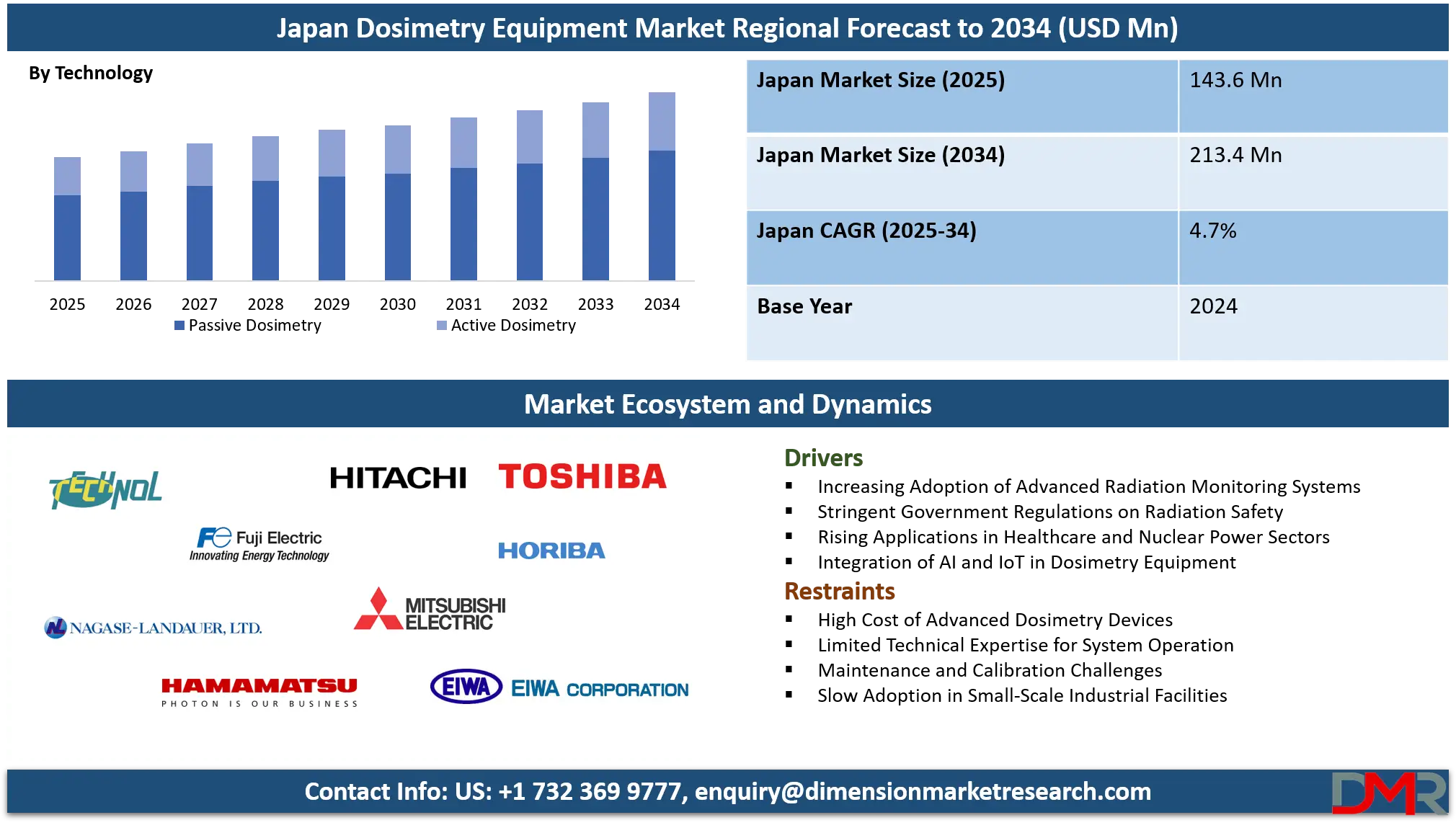

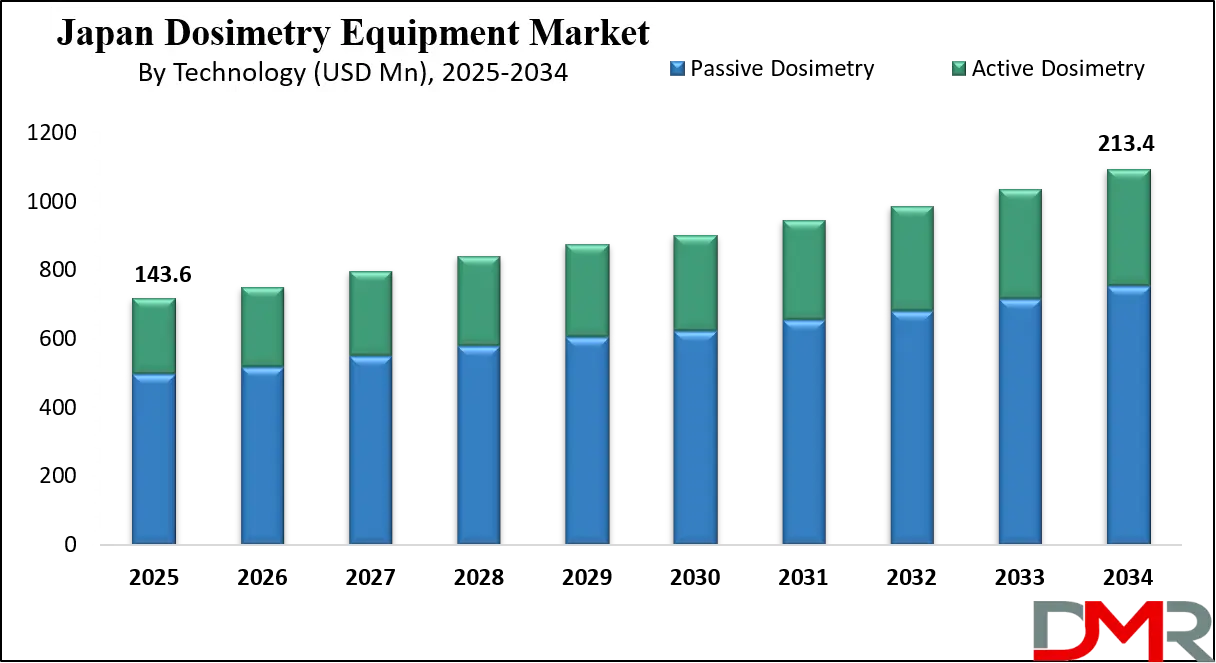

The Japan dosimetry equipment market is projected to reach USD 213.4 million by 2034 from an estimated USD 143.6 million in 2025, expanding at a CAGR of 4.7%. Growth is driven by increasing radiation safety standards, rising adoption of digital dosimeters, and the growing use of radiation monitoring devices across healthcare, nuclear power, and industrial sectors.

Dosimetry equipment refers to specialized instruments and devices used to measure, monitor, and record the amount of ionizing radiation absorbed by individuals or materials over a specific period. These systems include electronic personal dosimeters, thermoluminescent dosimeters, optically stimulated luminescence dosimeters, and film badges that track exposure levels for workers in nuclear power plants, medical imaging, radiotherapy, research laboratories, and industrial environments.

The equipment ensures radiation safety compliance and helps assess occupational exposure limits while maintaining health standards. It plays a vital role in radiation protection programs and contributes to quality assurance in radiological practices and nuclear operations.

The Japan dosimetry equipment market represents a mature and technologically advanced segment driven by the country’s strong emphasis on radiation protection, nuclear energy safety, and healthcare modernization. Japan has one of the most comprehensive radiation monitoring frameworks globally, supported by stringent government regulations and continuous innovation in radiation detection technologies. The market growth is propelled by rising adoption of advanced digital dosimeters, expanding use in medical imaging facilities, and increasing awareness about occupational health and safety among radiation professionals.

In addition, the market benefits from ongoing R&D activities, collaborations between public research institutions and private manufacturers, and Japan’s strategic initiatives toward developing sustainable nuclear and radiological infrastructure. The expanding applications of dosimetry equipment across environmental monitoring, defense, and industrial inspection are enhancing demand consistency. Moreover, the integration of IoT and cloud-based data management in dosimetry systems is transforming real-time exposure analysis, creating a more connected and intelligent radiation monitoring ecosystem across the country.

Japan Dosimetry Equipment Market: Key Takeaways

- Market Value: The Japan Dosimetry Equipment market size is expected to reach a value of USD 213.4 million by 2034 from a base value of USD 143.6 million in 2025 at a CAGR of 4.7%.

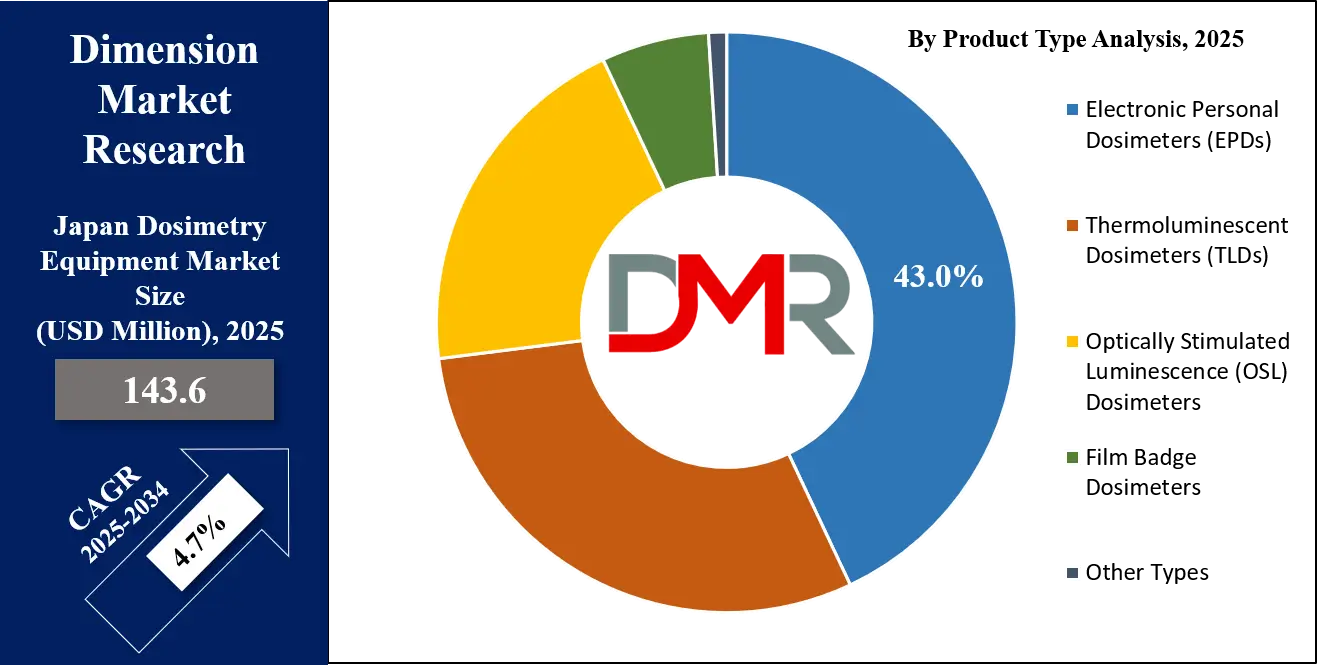

- By Product Type Segment Analysis: Electronic Personal Dosimeters (EPDs) are expected to maintain their dominance in the product type segment, capturing 43.0% of the total market share in 2025.

- By Technology Segment Analysis: Passive Dosimetry will dominate the technology segment, capturing 69.0% of the market share in 2025.

- By Application Segment Analysis: Medical applications are anticipated to dominate the application segment, capturing 53.0% of the total market share in 2025.

- By End-User Segment Analysis: Healthcare Facilities will dominate the end-user segment, capturing 37.0% of the market share in 2025.

- Key Players: Some key players in the Japan Dosimetry Equipment market include Chiyoda Technol Corporation, Fuji Electric Co. Ltd., Nagase Landauer Ltd., Hamamatsu Photonics K.K., Hitachi Ltd. (Hitachi Aloka), Mitsubishi Electric Corporation, Toshiba Corporation, Horiba Ltd., Eiwa Corporation, Azbil Corporation, Ohyo Koken Kogyo Co. Ltd., Acrorad Co. Ltd., and Others.

Japan Dosimetry Equipment Market: Use Cases

- Medical Imaging and Radiotherapy Applications: Dosimetry equipment in Japan plays a crucial role in ensuring patient and staff safety within diagnostic imaging centers and radiotherapy departments. Hospitals and clinics use personal and area dosimeters to monitor radiation doses during CT scans, X-rays, and cancer treatments. Advanced digital dosimeters and thermoluminescent dosimeters help maintain precise radiation exposure levels, improving treatment accuracy while adhering to Japan’s strict healthcare safety regulations.

- Nuclear Power and Energy Sector Monitoring: Japan’s nuclear facilities rely heavily on dosimetry equipment to safeguard workers from ionizing radiation exposure. Following enhanced post-Fukushima safety measures, power plants use electronic personal dosimeters and area monitoring systems for real-time radiation detection. These devices support compliance with Japan Atomic Energy Agency guidelines, enabling accurate radiation mapping and early warning alerts within nuclear plants and waste management sites.

- Industrial and Manufacturing Radiation Inspection: Dosimetry systems are increasingly deployed across Japan’s manufacturing, non-destructive testing, and material inspection industries. Radiation detection devices ensure safety during processes involving X-ray fluorescence and industrial radiography. Companies employ portable dosimeters and remote monitoring systems to verify radiation containment, minimize risks, and meet Japan’s occupational safety standards for industrial workers.

- Research and Environmental Radiation Monitoring: Research institutions and environmental agencies in Japan utilize dosimetry equipment for radiation measurement in laboratories, universities, and field monitoring stations. These systems track environmental radiation levels, assess contamination risks, and support scientific studies related to radiological safety and nuclear physics. The integration of Internet of Things-based dosimetry networks enables continuous data collection and analysis, reinforcing Japan’s leadership in precision radiation monitoring and research innovation.

Impact of Artificial Intelligence on the Japanese Dosimetry Equipment market

Artificial intelligence (AI) is transforming the Japan dosimetry equipment market by enhancing the precision, efficiency, and predictive capabilities of radiation monitoring systems. AI-powered algorithms enable automated analysis of radiation exposure data, allowing faster detection of abnormal patterns and early risk identification. This innovation supports hospitals, nuclear plants, and industrial facilities in optimizing radiation safety protocols and reducing human error in exposure measurement.

In healthcare, AI-integrated dosimetry systems assist in personalizing radiation therapy by accurately predicting patient dose distribution, improving treatment outcomes while minimizing side effects. Within nuclear energy and industrial environments, AI enhances real-time monitoring through adaptive learning models that adjust sensitivity levels based on working conditions, ensuring continuous safety compliance.

Moreover, the combination of AI and IoT in dosimetry devices allows seamless cloud connectivity, enabling remote data visualization and predictive maintenance. Japanese manufacturers are increasingly adopting AI-driven analytics to improve sensor calibration, extend device life cycles, and support regulatory reporting automation. As a result, AI is driving the evolution of Japan’s dosimetry equipment market toward smarter, data-centric, and highly responsive radiation safety solutions.

Japan Dosimetry Equipment Market: Stats & Facts

Ministry of Economy, Trade and Industry (METI)

- Japan's nuclear industry continues to prioritize the development of advanced radiation detection technologies to enhance safety and compliance with international standards.

- The government is actively supporting the expansion of nuclear energy utilization, emphasizing the importance of reliable radiation monitoring systems in maintaining public and environmental safety.

- Efforts are underway to strengthen international cooperation in nuclear safety, including the sharing of best practices in radiation protection and dosimetry.

- Japan is enhancing its nuclear supply chain, focusing on the development and deployment of advanced radiation monitoring equipment to support the safe operation of nuclear facilities.

- The government is investing in research and development to advance radiation detection technologies, aiming to improve the accuracy and reliability of dosimetry equipment.

- Japan is promoting the adoption of digital dosimetry systems in healthcare and industrial sectors to enhance real-time radiation monitoring capabilities.

- The Ministry is facilitating the development of portable radiation monitoring devices to support emergency response and environmental monitoring efforts.

- Japan is collaborating with international partners to standardize dosimetry protocols and ensure consistency in radiation exposure assessments.

- The government is supporting the integration of artificial intelligence in dosimetry equipment to enhance data analysis and predictive capabilities.

- Japan is encouraging the development of radiation monitoring systems that are compatible with Internet of Things (IoT) technologies for improved connectivity and data sharing.

- The Ministry is promoting the use of dosimetry equipment in various sectors, including healthcare, nuclear energy, and manufacturing, to ensure comprehensive radiation safety measures.

- Japan is enhancing its regulatory framework to support the safe use of radiation and the effective deployment of dosimetry equipment across industries.

- The government is investing in training programs to develop a skilled workforce capable of operating and maintaining advanced dosimetry equipment.

- Japan is supporting the development of radiation monitoring systems that can operate in extreme environments, such as those found in nuclear power plants.

- The Ministry is facilitating the exchange of knowledge and expertise in radiation protection and dosimetry through international seminars and workshops.

- Japan is promoting the adoption of advanced dosimetry equipment to support the country's commitment to nuclear non-proliferation and safety standards.

- The government is encouraging the development of radiation monitoring systems that are cost-effective and accessible to a wide range of users.

- Japan is investing in the development of dosimetry equipment that can provide real-time feedback to users, enhancing situational awareness and safety.

- The Ministry is supporting the integration of dosimetry equipment into broader environmental monitoring systems to assess and manage radiation exposure in various settings.

- Japan is promoting the use of dosimetry equipment in research and development activities to advance the understanding of radiation effects and improve safety protocols.

- The government is facilitating the development of dosimetry equipment that is user-friendly and suitable for deployment in diverse environments.

- Japan is supporting the development of radiation monitoring systems that can be easily integrated into existing infrastructure and workflows.

- The Ministry is promoting the adoption of dosimetry equipment that complies with international standards and best practices in radiation protection.

- Japan is investing in the development of dosimetry equipment that can provide accurate and reliable measurements across a wide range of radiation types and energies.

- The government is encouraging the development of dosimetry equipment that is durable and capable of withstanding challenging environmental conditions.

- Japan is supporting the development of radiation monitoring systems that can be remotely operated and monitored, enhancing flexibility and efficiency.

- The Ministry is facilitating the development of dosimetry equipment that can be easily calibrated and maintained, ensuring long-term reliability and performance.

- Japan is promoting the adoption of dosimetry equipment that can provide real-time data analytics and reporting, supporting informed decision-making and timely interventions.

- The government is investing in the development of dosimetry equipment that can be seamlessly integrated with other safety and monitoring systems.

- Japan is supporting the development of radiation monitoring systems that can be easily scaled to meet the needs of different applications and environments.

Japan Dosimetry Equipment Market: Market Dynamics

Japan Dosimetry Equipment Market: Driving Factors

Stringent Radiation Safety Regulations and Compliance Standards

Japan’s dosimetry equipment market is driven by the government’s strict radiation safety norms and occupational exposure limits. Agencies such as the Nuclear Regulation Authority (NRA) and the Japan Atomic Energy Agency (JAEA) mandate continuous radiation monitoring in medical, industrial, and nuclear sectors. These regulatory frameworks have accelerated the adoption of advanced dosimetry systems, including electronic personal dosimeters and automated radiation detection networks, ensuring safety and compliance in high-risk environments.

Growing Demand from the Healthcare and Nuclear Power Sectors

Increasing applications of ionizing radiation in medical imaging, radiotherapy, and nuclear power operations are fueling market expansion. Japan’s aging population has boosted diagnostic and therapeutic procedures involving radiation, thereby increasing the need for precise dose measurement tools. Similarly, the country’s reliance on nuclear energy for sustainable power generation has created consistent demand for radiation monitoring devices and personal dosimetry solutions.

Japan Dosimetry Equipment Market: Restraints

High Equipment Costs and Maintenance Challenges

The high cost associated with advanced dosimetry devices and their calibration services poses a challenge for small healthcare facilities and industrial users. Maintenance requirements, software updates, and periodic sensor replacement add to operational expenses, limiting adoption among budget-constrained institutions. These cost-related barriers slow down the market’s overall penetration, especially in low-volume facilities outside metropolitan regions.

Limited Technical Expertise and Integration Complexity

Although Japan is technologically advanced, some facilities face challenges integrating modern AI and IoT-based dosimetry systems with legacy radiation monitoring infrastructure. The shortage of trained personnel to manage complex digital interfaces and interpret real-time data analytics limits system optimization. This skill gap hinders the full utilization of intelligent dosimetry technologies across various industries.

Japan Dosimetry Equipment Market: Opportunities

Adoption of AI and Cloud-Connected Dosimetry Systems

The integration of artificial intelligence, big data, and cloud platforms presents a major opportunity for the Japan dosimetry equipment market. AI-enabled predictive analytics can detect radiation anomalies faster and automate exposure reporting, improving workplace safety. Cloud-based data management allows centralized radiation monitoring across multiple facilities, aligning with Japan’s digital transformation and smart infrastructure initiatives.

Rising Investment in Research and Defense Radiation Monitoring

Growing investments in defense research and radiation protection initiatives open new avenues for market expansion. The use of dosimetry systems in military bases, environmental surveillance, and radiological emergency response units supports the demand for robust, portable, and high-precision radiation monitoring devices. Collaboration between domestic manufacturers and public agencies further enhances innovation and export potential.

Japan Dosimetry Equipment Market: Trends

Shift toward Wearable and Real-Time Monitoring Devices

Japanese manufacturers are increasingly focusing on compact, wearable dosimeters that offer continuous radiation tracking and instant exposure alerts. These devices integrate Bluetooth and wireless communication for real-time data transmission to centralized monitoring systems. The trend aligns with Japan’s emphasis on worker safety, mobility, and smart workplace technologies across medical and industrial environments.

Integration of IoT and Data Analytics in Radiation Management

IoT-enabled dosimetry solutions are revolutionizing radiation monitoring by connecting devices across hospitals, laboratories, and nuclear plants. The use of advanced analytics and sensor fusion technologies allows continuous exposure assessment, predictive maintenance, and automated compliance reporting. This trend supports Japan’s move toward connected safety ecosystems and data-driven radiation management frameworks.

Japan Dosimetry Equipment Market: Research Scope and Analysis

By Product Type Analysis

Electronic Personal Dosimeters (EPDs) are expected to remain the leading product type in Japan’s dosimetry equipment market, accounting for nearly 43.0% of the total market share in 2025. Their dominance is attributed to their high accuracy, real-time monitoring capabilities, and ability to record cumulative radiation doses instantly. EPDs are widely adopted across hospitals, nuclear facilities, and research institutions in Japan due to their digital display, wireless connectivity, and data storage features that simplify radiation exposure tracking and compliance reporting.

The integration of Bluetooth and cloud-based systems in EPDs has further enhanced their functionality, enabling centralized monitoring of multiple personnel in high-risk radiation zones. The growing emphasis on workplace safety, coupled with Japan’s strict radiation control regulations, continues to drive the demand for advanced and user-friendly EPDs across medical, industrial, and energy sectors.

Thermoluminescent Dosimeters (TLDs) also play a vital role in Japan’s dosimetry equipment market, serving as a reliable and cost-effective solution for long-term radiation monitoring. TLDs are particularly valued for their precision and stability in recording accumulated radiation doses over time, making them suitable for routine environmental and occupational exposure assessments. Their use is prevalent in hospitals, universities, and government laboratories where passive dosimetry is sufficient for compliance and research purposes.

Although TLDs do not provide instant readings like EPDs, their durability, low maintenance requirements, and reusability make them an essential part of Japan’s radiation monitoring ecosystem. The continued demand for TLDs is supported by their accuracy in dose reconstruction and their compatibility with regulatory monitoring programs across the country.

By Technology Analysis

In the technology segment of Japan’s dosimetry equipment market, passive dosimetry is expected to dominate, accounting for approximately 69.0% of the market share in 2025. Passive dosimeters, such as thermoluminescent dosimeters and film badges, are widely used because they provide reliable, cumulative measurements of radiation exposure over time without the need for continuous power or real-time monitoring.

Their simplicity, cost-effectiveness, and long-term stability make them ideal for routine monitoring in hospitals, research laboratories, and nuclear facilities. Passive dosimetry is particularly favored in environments where regulatory compliance and accurate dose recording are essential, enabling organizations to maintain safety standards efficiently.

Active dosimetry, on the other hand, provides real-time monitoring of radiation exposure through electronic personal dosimeters and other sensor-based devices. This technology allows immediate alerts if radiation levels exceed safe thresholds, making it essential in high-risk areas such as nuclear plants, medical imaging units, and industrial radiography sites.

Active dosimeters offer enhanced functionality, including wireless data transmission, integration with cloud-based monitoring systems, and the ability to track multiple personnel simultaneously. While more expensive than passive systems, the growing focus on worker safety, rapid data analysis, and regulatory compliance in Japan is driving the adoption of active dosimetry in critical applications where instant radiation awareness is necessary.

By Application Analysis

In the application segment of Japan’s dosimetry equipment market, medical applications are expected to dominate, accounting for approximately 53.0% of the total market share in 2025. The high demand is driven by the widespread use of ionizing radiation in diagnostic imaging procedures such as X-rays, CT scans, and nuclear medicine, as well as in therapeutic applications like radiotherapy for cancer treatment.

Hospitals, diagnostic centers, and oncology clinics increasingly rely on electronic personal dosimeters and thermoluminescent dosimeters to monitor and record radiation exposure for both patients and medical staff. The growing emphasis on patient safety, regulatory compliance, and precision in treatment planning has further reinforced the adoption of advanced dosimetry equipment in healthcare settings, making medical applications the largest contributor to the market.

Industrial applications also play a significant role in the Japan dosimetry equipment market, with usage spanning manufacturing, non-destructive testing, and material inspection processes. Industries employing X-ray fluorescence, industrial radiography, and nuclear technology rely on both active and passive dosimeters to monitor radiation exposure and ensure worker safety.

Dosimetry equipment in these environments helps maintain compliance with occupational health standards while enabling accurate assessment of cumulative radiation doses. The adoption of portable and wearable dosimeters in industrial settings allows real-time exposure monitoring and alerts in high-risk areas, supporting operational safety and efficient risk management across the sector.

By End-User Analysis

In the end-user segment of Japan’s dosimetry equipment market, healthcare facilities are expected to dominate, accounting for around 37.0% of the market share in 2025. Hospitals, diagnostic centers, and oncology clinics are the primary consumers of dosimetry equipment due to the extensive use of radiation in medical imaging and radiotherapy.

The focus on patient and staff safety, compliance with stringent national radiation regulations, and the need for precise dose measurement drive the adoption of both electronic personal dosimeters and thermoluminescent dosimeters. Advanced monitoring systems, including real-time and cloud-connected solutions, are increasingly deployed to track exposure, manage cumulative doses, and ensure accurate reporting, making healthcare facilities the largest end-users in the market.

Industrial applications, particularly in non-destructive testing and manufacturing, also represent a significant end-user segment in Japan. Dosimetry equipment is essential for monitoring radiation exposure in environments where X-ray inspection, radiography, and other industrial processes involving ionizing radiation are conducted.

Both passive and active dosimeters are utilized to ensure worker safety, maintain compliance with occupational exposure limits, and prevent radiation-related hazards. Portable and wearable devices enable continuous monitoring in high-risk areas, supporting real-time alerts and data collection. The growing industrial adoption is driven by Japan’s emphasis on workplace safety, quality assurance, and efficient risk management in manufacturing and inspection operations.

The Japan Dosimetry Equipment Market Report is segmented on the basis of the following:

By Product Type

- Electronic Personal Dosimeters (EPDs)

- Thermoluminescent Dosimeters (TLDs)

- Optically Stimulated Luminescence (OSL) Dosimeters

- Film Badge Dosimeters

- Other Types

By Technology

- Passive Dosimetry

- Active Dosimetry

By Application

- Medical

- Industrial

- Nuclear Power

- Environment Monitoring

- Others

By End-User

- Healthcare Facilities

- Industrial (NDT & Manufacturing)

- Nuclear Facilities

- Research Institutes

- Others

Japan Dosimetry Equipment Market: Competitive Landscape

The competitive landscape of the Japan dosimetry equipment market is characterized by intense innovation, technological advancement, and strategic collaborations. Market players are increasingly focusing on developing high-precision, AI-enabled, and IoT-integrated dosimetry solutions to meet the growing demand for real-time monitoring and compliance with stringent radiation safety regulations.

Companies are investing in research and development to enhance device accuracy, portability, and connectivity, while also expanding their service offerings such as calibration, maintenance, and data analytics support. Strategic partnerships, product customization, and adoption of digital platforms for remote monitoring are key strategies driving market competitiveness, enabling players to cater to diverse applications across healthcare, nuclear energy, industrial, and research sectors.

Some of the prominent players in the Japan Dosimetry Equipment market are:

- Chiyoda Technol Corporation

- Fuji Electric Co., Ltd.

- Nagase Landauer, Ltd.

- Hamamatsu Photonics K.K.

- Hitachi, Ltd. (Hitachi Aloka)

- Mitsubishi Electric Corporation

- Toshiba Corporation

- Horiba, Ltd.

- Eiwa Corporation

- Azbil Corporation

- Ohyo Koken Kogyo Co., Ltd.

- Acrorad Co., Ltd.

- Technohill Co., Ltd.

- ALOKA Co., Ltd.

- PerkinElmer, Inc. (Japan operations)

- Mirion Technologies, Inc. (Japan operations)

- Radia Industry Co., Ltd.

- JEOL Ltd.

- Mitutoyo Corporation

- Rigaku Corporation

- Other Key Players

Japan Dosimetry Equipment Market: Recent Developments

- August 2025: Japan's AMED announced a 'Double Match Up' grant program, offering biopharma startups up to USD 44.5 million in non-dilutive funding. This initiative supports innovation in medical device development, including radiation-related technologies.

- August 2025: The Japanese government allocated a grant of approximately USD 7.4 million to support victims of nuclear tests at the Semipalatinsk test site. The funds will be used to purchase modern medical equipment for radiation treatment and diagnostics.

- May 2025: IBA Dosimetry introduced the myQA Blue Phantom³, a versatile water phantom designed for radiation therapy quality assurance. It offers rapid auto-leveling, Wi-Fi connectivity, and high-precision measurements, enhancing workflow efficiency in C-arm, O-shape, and robotic linacs.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 143.6 Mn |

| Forecast Value (2034) |

USD 213.4 Mn |

| CAGR (2025–2034) |

4.7% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Electronic Personal Dosimeters, Thermoluminescent Dosimeters, Optically Stimulated Luminescence Dosimeters, Film Badge Dosimeters, Other Types), By Technology (Passive Dosimetry, Active Dosimetry), By Application (Medical, Industrial, Nuclear Power, Environment Monitoring, Others), and By End-User (Healthcare Facilities, Industrial - NDT & Manufacturing, Nuclear Facilities, Research Institutes, Others). |

| Regional Coverage |

Japan |

| Prominent Players |

Chiyoda Technol Corporation, Fuji Electric Co. Ltd., Nagase Landauer Ltd., Hamamatsu Photonics K.K., Hitachi Ltd. (Hitachi Aloka), Mitsubishi Electric Corporation, Toshiba Corporation, Horiba Ltd., Eiwa Corporation, Azbil Corporation, Ohyo Koken Kogyo Co. Ltd., Acrorad Co. Ltd., and Others.

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Japan Dosimetry Equipment market is projected to be valued at USD 143.6 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 213.4 million in 2034 at a CAGR of 4.7%.

Some of the major key players in the Japan Dosimetry Equipment market are Chiyoda Technol Corporation, Fuji Electric Co. Ltd., Nagase Landauer Ltd., Hamamatsu Photonics K.K., Hitachi Ltd. (Hitachi Aloka), Mitsubishi Electric Corporation, Toshiba Corporation, Horiba Ltd., Eiwa Corporation, Azbil Corporation, Ohyo Koken Kogyo Co. Ltd., Acrorad Co. Ltd., and Others.