Market Overview

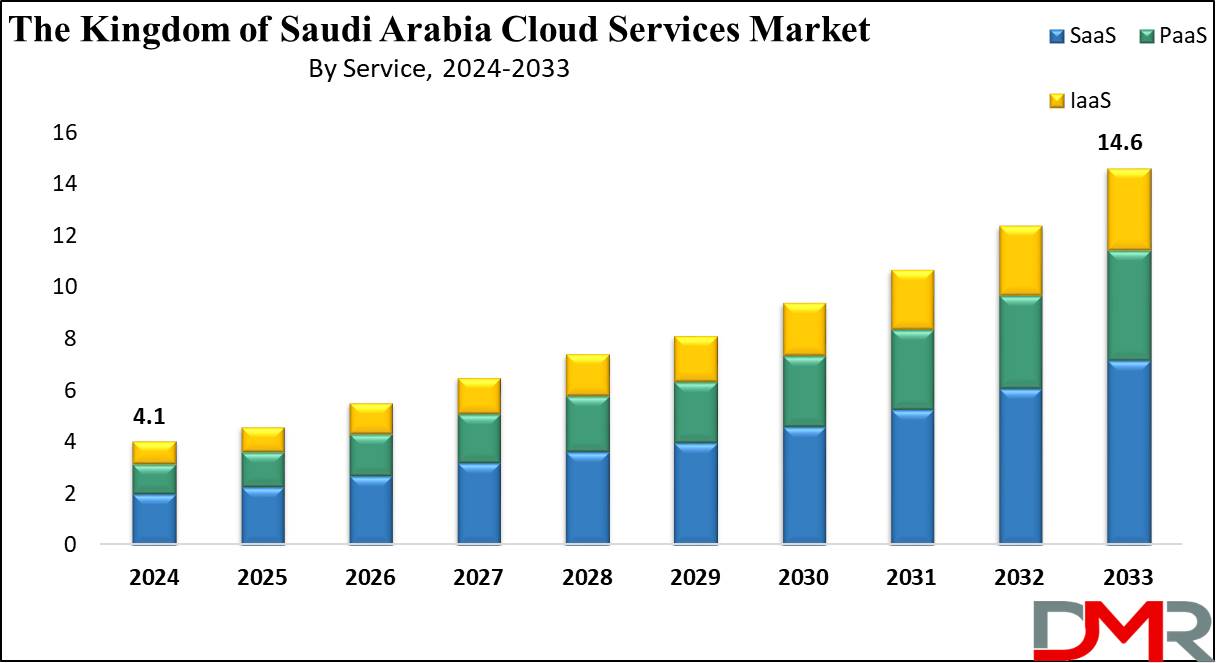

The

Kingdom of Saudi Arabia Cloud Services Market is projected to reach

USD 4.1 billion in 2024 and grow at a compound annual

growth rate of 15.3% from there until 2033 to reach a

value of USD 14.6 billion.

The Kingdom of Saudi Arabia (KSA) cloud services market is a vital part of the nation’s ongoing digital transformation. Cloud services a platforms that allow businesses and individuals to store, manage, and process data on remote servers through the Internet, rather than on local computers or data centers. These services are categorized into three models: Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS), which allow organizations to operate effectively by reducing costs, enhancing scalability, and ensuring accessibility to data and applications from anywhere, which aligns perfectly with Saudi Arabia’s Vision 2030 and focuses on innovation and economic diversification through technology.

Further, the demand for

cloud services in Saudi Arabia has been skyrocketing owing to the growth in the adoption of digital tools and technologies. Also, various factors contribute to this growth, like the increase in remote work, the demand for secure and scalable IT solutions, and government initiatives like the Cloud First Policy, which allows government agencies and businesses to prioritize cloud-based infrastructure over traditional IT systems. Additionally, industries like healthcare, banking, telecommunications, and retail are adopting cloud solutions to improve customer experiences, streamline operations, and enhance decision-making processes.

Moreover, in recent years, various events have driven the growth of cloud services in Saudi Arabia. Major global cloud service providers, like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, have established regional data centers in the country to comply with local regulations and meet the growing demand. These investments also help in data sovereignty, ensuring that data generated in Saudi Arabia remains within the country. On the national front, local players like STC Cloud and Salam have played a major role in delivering customized cloud solutions to meet the distinct needs of Saudi businesses and government organizations. The rise of

The Kingdom of Saudi Arabia (KSA) Cloud Computing ecosystem has further accelerated innovation and competitiveness across various industries.

Further, the market has also seen major trends shaping its development. Hybrid cloud solutions, which are distinctive public and private cloud services, are gaining popularity among businesses for their flexibility and security. In addition, industries are investing in SaaS applications like Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) to improve productivity. Cybersecurity has become a top priority, with companies adopting advanced measures to protect their cloud-based systems against cyber threats. These trends indicate that cloud technology is becoming a cornerstone of Saudi Arabia’s digital infrastructure.

Key Takeaways

- Market Growth: The Kingdom of Saudi Arabia Cloud Services Market size is expected to grow by 10.0 billion, at a CAGR of 15.3% during the forecasted period of 2025 to 2033.

- By Service: The SaaS segment is anticipated to get the majority share of the Kingdom of Saudi Arabia Cloud Services Market in 2024.

- By Organization Size: The large enterprises segment is expected to be leading the market in 2024

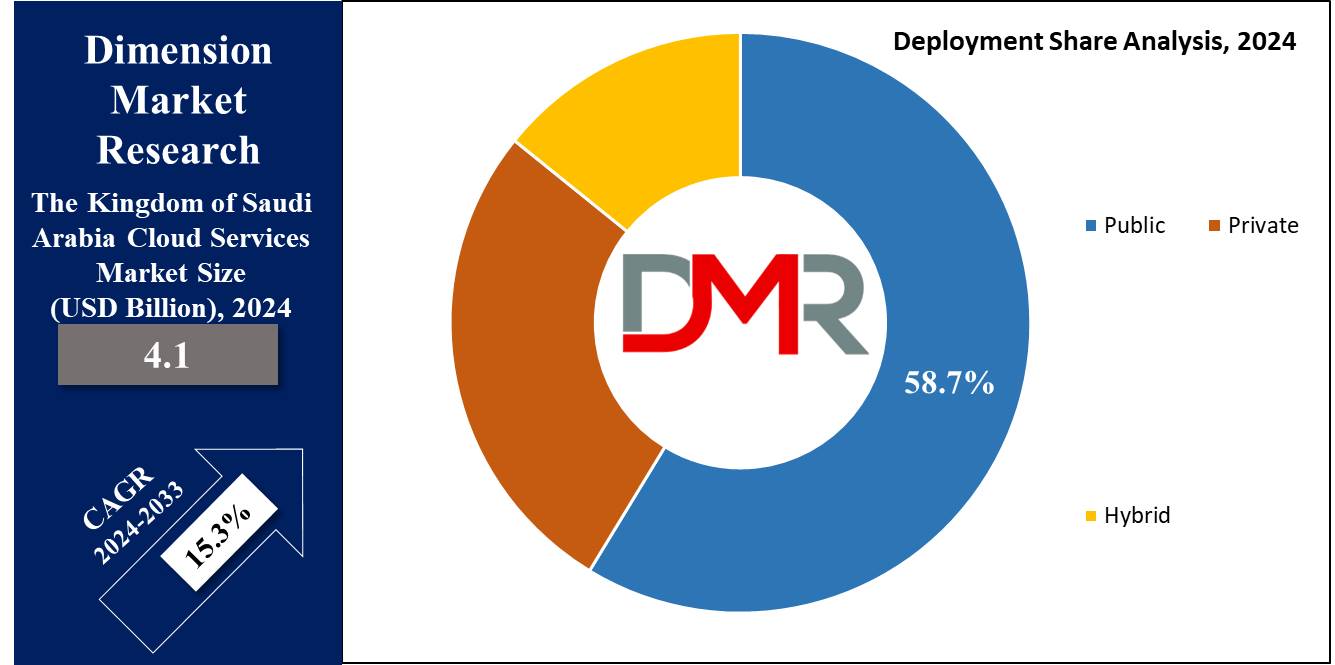

- By Deployment: The Public segment is expected to get the largest revenue share in 2024 in the Kingdom of Saudi Arabia Cloud Services Market.

- Use Cases: Some of the use cases of The Kingdom of Saudi Arabia Cloud Services include luxury & entertainment tourism, adventure & eco-tourism, and more.

Use Cases

- Smart City Development (NEOM and The Line): Cloud services power the infrastructure for smart cities, allowing advanced technologies like Artificial Intelligence (AI), Internet of Things (IoT), and live data analytics to enhance urban planning, energy efficiency, and citizen services.

- Healthcare Digitization: Hospitals & clinics use cloud solutions to store patient records, allow telemedicine, and use advanced analytics for customized care, aligning with government efforts to modernize the healthcare sector.

- Banking and Financial Services (BFSI): Cloud services are utilized for secure and scalable banking operations, fraud detection, customer relationship management (CRM), and compliance with regulatory frameworks.

- E-Government Initiatives: The Saudi government uses cloud platforms to provide public services, streamline administrative processes, and ensure secure data storage as part of its Vision 2030 goals for digital transformation.

Market Dynamic

Driving Factors

Government-Led Digital Transformation InitiativesThe Saudi government’s Vision 2030 and the Cloud First Policy are major drivers of cloud adoption, focusing on digital transformation across sectors. Major projects like NEOM, The Line, and e-government services depend on cloud infrastructure to enhance efficiency, improve citizen services, and attract global tech investments.

Rising Demand for Scalable IT SolutionsThe rise in the demand for flexible, affordable, and secure IT infrastructure is driving cloud adoption among businesses. Factors like remote work, e-commerce growth, and the adoption of advanced technologies like Artificial Intelligence (AI) and Internet of Things (IoT) further drives the demand for cloud services in the region, especially among sectors like

The Kingdom of Saudi Arabia (KSA) Real Estate and tourism.

Restraints

Data Sovereignty and Regulatory ComplianceStringent data localization laws in Saudi Arabia demand cloud providers to ensure that data remains within the country's borders, which can limit the ability of global providers to expand freely and may increase operational costs for businesses looking for compliance with local regulations.

Cybersecurity ConcernsThe growing adoption of cloud services raises concerns about data breaches, hacking, and cyberattacks. Organizations hesitant to transfer sensitive data to the cloud may delay adoption due to perceived risks, mainly in sectors like BFSI and government where

The Kingdom of Saudi Arabia (KSA) Cybersecurity requirements are highly stringent.

Opportunities

Expansion of Smart City ProjectsThe development of advanced smart cities like NEOM and The Line creates many opportunities for cloud service providers. These projects depend on advanced cloud-based solutions for IoT, AI, and real-time data analytics, providing immense potential for innovation and long-term partnerships in Saudi Arabia.

Rising Adoption by SMEs

Small and Medium-sized Enterprises (SMEs) in Saudi Arabia are largely adopting cloud services to enhance scalability and minimize operational costs. Customized cloud solutions for SMEs provide an untapped market for providers, making these businesses compete in a digital-first economy while promoting sector-wide growth.

Trends

Adoption of Hybrid and Multi-Cloud Solutions

Businesses in Saudi Arabia are majorly adopting hybrid and multi-cloud environments to balance the flexibility of public clouds with the security of private clouds, which is driven by the need for customized solutions, better data control, and improved disaster recovery strategies.

Focus on Cloud Security and Compliance

As cloud adoption grows, organizations are investing in advanced cybersecurity measures and compliance solutions, which include encryption, identity management, and adherence to local data sovereignty laws, ensuring that cloud operations remain secure and aligned with regulatory requirements.

Research Scope and Analysis

By Service Analysis

SaaS (Software as a Service) plays a crucial role in the growth of Saudi Arabia's cloud services market in 2024 by providing businesses with affordable and scalable software solutions. Companies no longer need to invest in expensive hardware or worry about maintaining complex IT systems. SaaS allows easy access to applications like Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP) through the internet, helping organizations to simplify their processes and enhance efficiency. As businesses in sectors like retail, healthcare, and finance use digital transformation, the need for SaaS solutions continues to rise, driving cloud adoption and contributing majorly to the expansion of the Saudi cloud services market.

Further, IaaS (Infrastructure as a Service) contributes significantly to the growth of Saudi Arabia's cloud services market and is expected to grow significantly in the coming years by providing businesses with flexible, scalable, and affordable IT infrastructure. Instead of investing in expensive hardware, companies can rent computing resources like storage, servers, and networks from cloud providers, which minimizes operational costs and allows businesses to quickly scale their IT capabilities based on demand. As more organizations in Saudi Arabia adopt digital solutions, the need for IaaS continues to grow, driving the cloud services market forward.

By Deployment Analysis

Public cloud deployment play a key role in the growth of Saudi Arabia's cloud services market, as it held a majority share in 2024 by providing businesses with an affordable and scalable way to access computing resources. In a public cloud, services, and infrastructure are shared between many users, which helps to keep costs low and allows businesses to easily scale up or down based on their needs, which is mainly beneficial for startups, small and medium-sized enterprises (SMEs), and even large organizations seeking flexibility without the need for heavy capital investment. As more Saudi businesses use digital transformation, the adoption of public cloud services constantly rises, driving market growth and helping the nation’s broader technology goals.

Further, hybrid cloud deployment helps Saudi Arabia’s cloud services market by combining the benefits of both public and private clouds. Businesses can store sensitive data on private clouds for security while using public clouds for scalability and cost-efficiency. This flexibility allows organizations to optimize their IT resources, meet regulatory requirements, and improve performance, making hybrid cloud adoption a key driver of growth in Saudi Arabia’s cloud services sector.

By Organization Size Analysis

Large enterprises lead the growth of Saudi Arabia's cloud services market in 2024 by driving early adoption of advanced technologies. With higher IT budgets and complex needs, these organizations look for scalable, secure, and efficient cloud solutions for operations like data management, analytics, and customer engagement. By adopting cloud services, large enterprises simplify processes, reduce costs, and enhance agility. Their investment in cloud technologies not only expands digital transformation but also sets an example for smaller businesses, promoting wider cloud adoption across the country and contributing to the overall expansion of the Saudi cloud services market.

Further small and medium-sized enterprises (SMEs) are also vital to the growth of Saudi Arabia's cloud services market, as they use cloud solutions to minimize costs and enhance efficiency. With limited IT resources, SMEs benefit from the scalability and flexibility of cloud services, which enables them to access advanced tools without heavy upfront investments. As more SMEs adopt cloud technologies for operations, collaboration, and data storage, their increase in demand fuels the expansion of the cloud services market in Saudi Arabia.

By Application Analysis

Enterprise Resource Planning (ERP) led to the growth of Saudi Arabia's cloud services market in 2024 by helping businesses streamline their operations. Cloud-based ERP systems allow organizations to manage key functions like finance, human resources, inventory, and supply chain more efficiently, all from one platform. By transforming ERP to the cloud, companies minimize the need for expensive hardware and IT infrastructure, cutting costs and increasing flexibility. Cloud ERP systems also provide live data and insights, supporting businesses make faster, more informed decisions.

As Saudi Arabian businesses, like SMEs and large enterprises, constantly embrace digital transformation, the adoption of cloud-based ERP solutions is driving the growth of the cloud services market in the country. Further, asset management applications play a major role in the growth of Saudi Arabia's cloud services market by allowing businesses to efficiently track, manage, and optimize their physical and digital assets.

Cloud-based asset management solutions provide live visibility, enhance maintenance scheduling, and reduce operational costs. As companies in sectors like manufacturing, energy, and healthcare highly adopt these solutions, the demand for cloud services continues to rise, driving market growth and supporting better asset use and decision-making.

By Industry Vertical Analysis

The telecommunications industry is dominant in 2024 towards the growth of Saudi Arabia's cloud services market by providing the important infrastructure needed to help cloud-based solutions. Telecom companies are mainly providing cloud services, like IaaS, PaaS, and SaaS, to meet the growing demand for reliable, high-speed internet connections and data storage. They also allow businesses to utilize cloud technologies for better communication, collaboration, and customer service.

Telecom providers in Saudi Arabia are expanding their networks, ensuring high bandwidth and low latency, which are vital for the smooth delivery of cloud services. As more businesses and government sectors depend on cloud-based solutions, the telecom industry's involvement helps drive the adoption of cloud services, contributing to the complete growth of the cloud market in the country.

The government and public sector play a major role in driving the growth of Saudi Arabia's cloud services market by adopting cloud technologies for many public services and operations. Government initiatives like Vision 2030 promote digital transformation, with cloud solutions enhancing efficiency, security, and citizen services. The government's investment in e-governance and smart city projects further fuels demand for cloud infrastructure, accelerating market growth and technological innovation in the country.

The Kingdom of Saudi Arabia Cloud Services Market Report is segmented on the basis of the following

By Service

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

By Deployment

By Organization Size

- Small & Medium-sized Enterprises (SMEs)

- Large Enterprises

By Application

- Asset Management

- Customer Relationship Management (CRM)

- Enterprise Resource Management (ERP)

- Supply Chain Management (SCM)

- Project and Portfolio Management

- Business Intelligence

- Others

By Industry Vertical

- BFSI

- Telecommunications

- IT and ITeS

- Government and Public Sector

- Retail and Consumer Goods

- Manufacturing

- Energy and Utilities

- Media and Entertainment

- Healthcare and Life Sciences

- Others

Competitive Landscape

The competitive landscape of Saudi Arabia's cloud services market is dynamic, with both local and international players actively expanding their presence. International cloud providers provide advanced solutions and global infrastructure, attracting large enterprises and government sectors. At the same time, local providers are enhancing their offerings, aiming at customization and compliance with regional regulations. The market is characterized by a mix of established global giants and emerging local players, developing a competitive environment that promotes innovation, drives down costs, and allows the adoption of cloud services across many industries in Saudi Arabia.

Some of the prominent players in the The Kingdom of Saudi Arabia Cloud Services are

- AWS

- Google

- IBM

- Oracle

- Saudi Telecom Company

- Integrated Telecom Company (Salam)

- Etihad Etisalat Company (Mobily)

- Novasoft FZCO

- Raqmiyat LLC

- Injazat Data Systems

- Other Key Players

Recent Developments

- In December 2024, Microsoft updates on the progress of its data center region in the Kingdom of Saudi Arabia, following a recent site visit by a delegation of government officials from the Saudi Ministry of Communications and Information Technology (MCIT) along with Microsoft executives from the company’s headquarters and Saudi Arabia. The global technology company announced the completion of construction on all three Azure availability zones, with availability anticipated in 2026.

- In August 2024, Oracle announced the opening of its second public cloud region in Saudi Arabia, which will help public and private sector organizations transform all types of workloads to Oracle Cloud Infrastructure (OCI), giving them access to numerous cloud services to modernize their applications and innovate with data, analytics, and AI. Center3 is the host partner for the new Oracle Cloud Riyadh Region. Further, part of Oracle’s distributed cloud strategy and Oracle’s USD 1.5 billion investment to expand cloud infrastructure capabilities in the Kingdom, the new region will boost the Kingdom’s AI economy, which is expected to reach USD 135.2 billion by 2030.

- In April 2024, Saudi Telecom Company announced its plans to make sovereign cloud services available in Saudi Arabia with Oracle Alloy, which is a complete infrastructure platform that allows organizations to become cloud providers. STC will extend its cloud services business by providing more than 100 Oracle Cloud Infrastructure services to public sector and enterprise customers in Saudi Arabia. STC will run these services from data centers located in the country, allowing customers to transform their systems more quickly to the cloud while offering features to support data residency and data sovereignty requirements.

- In April 2024, Informatica launched its AI-powered Intelligent Data Management Cloud (IDMC) in Saudi Arabia, a first for the Kingdom, which includes establishing a new Point of Delivery (PoD) in Riyadh and reflects a commitment to help local, scalable, cloud-first data management services.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 4.1 Bn |

| Forecast Value (2033) |

USD 14.6 Bn |

| CAGR (2024-2033) |

15.3% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Service (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS)), By Deployment (Public, Private, and Hybrid), By Organization Size (Small & Medium-sized Enterprises (SMEs), Large Enterprises), By Application (Asset Management, Customer Relationship Management (CRM), Enterprise Resource Management (ERP), Supply Chain Management (SCM), Project and Portfolio Management, Business Intelligence, and Others), By Industry Vertical (BFSI, Telecommunications, IT and ITeS, Government and Public Sector, Retail and Consumer Goods, Manufacturing, Energy and Utilities, Media and Entertainment, Healthcare and Life Sciences, and Others) |

| Regional Coverage |

Saudi Arabia |

| Prominent Players |

AWS, Google, IBM, Oracle, Saudi Telecom Company, Integrated Telecom Company (Salam), Etihad Etisalat Company (Mobily), Novasoft FZCO, Raqmiyat LLC, Injazat Data Systems, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Kingdom of Saudi Arabia Cloud Services Market size is expected to reach a value of USD 4.1 billion in 2024 and is expected to reach USD 14.6 billion by the end of 2033.

Some of the major key players in the Kingdom of Saudi Arabia Cloud Services Market are AWS, Google, IBM, and others

The market is growing at a CAGR of 15.3 percent over the forecasted period.