Market Overview

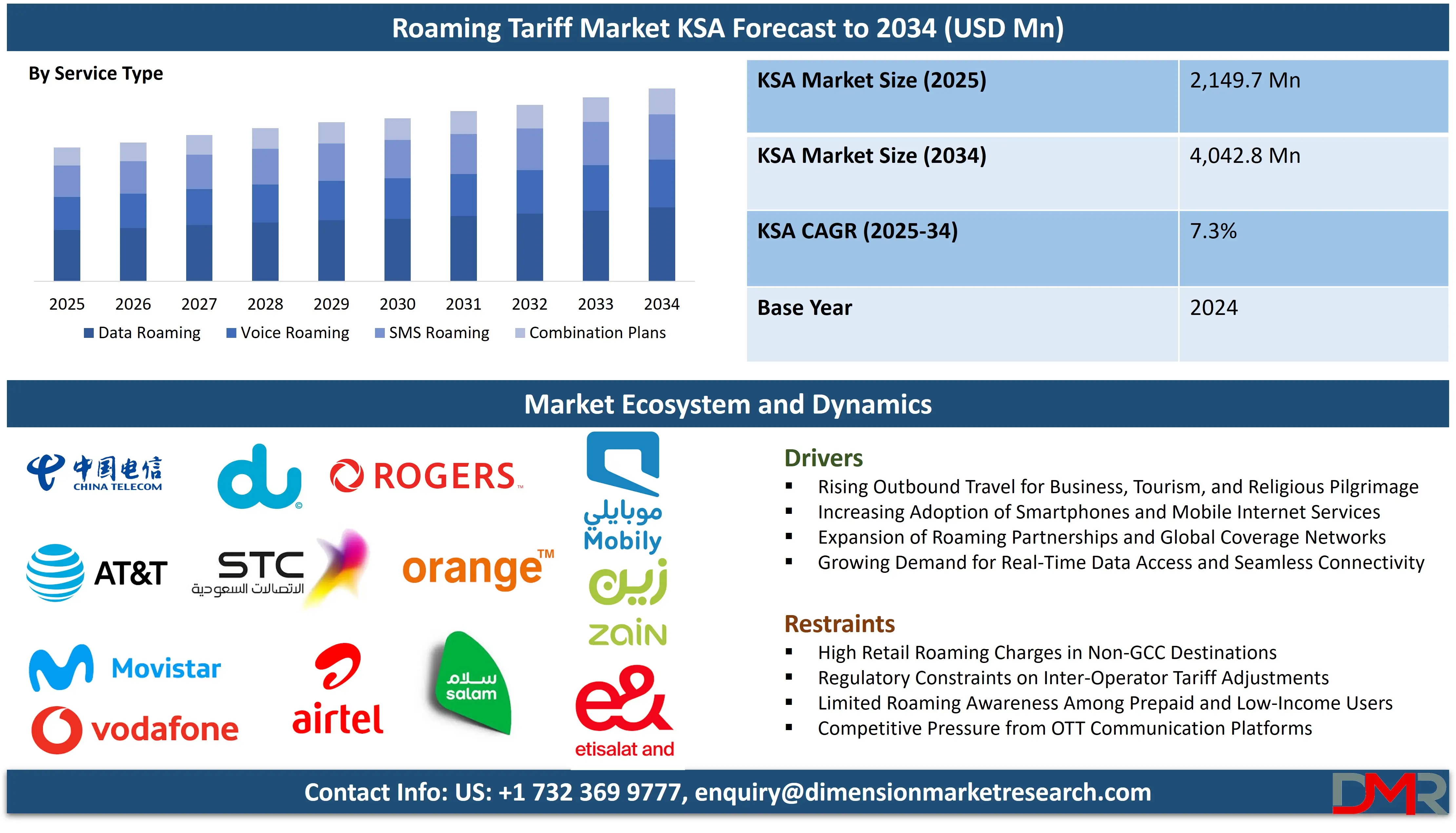

The

Roaming Tariff Market is projected to reach

USD 2,149.7 million in 2025 and grow at a

compound annual growth rate of 7.3% from there until 2034 to reach a value of

USD 4,042.8 million.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The KSA roaming tariff market is undergoing rapid transformation driven by the Kingdom’s expanding digital infrastructure, increasing outbound travel, and its growing influx of international tourists and expatriates. The government's push for Vision 2030 has spurred significant telecom sector investments, creating a fertile ground for roaming service innovation. As mobile penetration surpasses 135%, demand for seamless cross-border connectivity continues to escalate. Leading telecom providers are enhancing tariff offerings, optimizing network coverage, and incorporating user-centric features to cater to a more tech-savvy population. The prevalence of smartphones, coupled with increasing reliance on mobile data during international travel, is intensifying focus on affordable and flexible roaming options across Saudi Arabia.

A major trend in the market is the rising popularity of roaming bundles and unlimited daily passes tailored for frequent travelers. These plans offer cost predictability and convenience, aligning with the habits of business users and digital nomads. Operators are also exploring AI-driven data management tools and real-time billing transparency to improve the user experience. Additionally, strategic partnerships with international telecom providers are helping Saudi operators broaden roaming reach and offer competitive rates. Demand for hybrid plans that integrate voice, SMS, and data services into a single package is also gaining momentum, especially among enterprise users who prioritize seamless communication while abroad.

The market presents strong opportunities for telecom operators to innovate through the introduction of app-based self-service roaming management and tailored packages for Hajj and Umrah pilgrims. These high-traffic seasons provide an ideal opportunity for launching short-term, high-data-usage bundles. Furthermore, the increasing corporate travel from KSA to regional and global business hubs opens space for negotiated enterprise tariffs with real-time usage controls and analytics dashboards, appealing to companies aiming for cost efficiency.

Despite growth potential, the market is restrained by inconsistent roaming agreements, high inter-operator charges, and limited public awareness about tariff options. Additionally, over-reliance on retail roaming limits scalability in some areas. Regulatory complexities and a lack of transparency in billing also hinder user trust and adoption.

The KSA roaming tariff market is projected to witness steady growth over the next five years, supported by 5G rollout, growing international mobility, and policy efforts aimed at enhancing digital connectivity. As competition intensifies, providers that deliver affordable, flexible, and data-driven solutions will gain a competitive edge in an evolving and increasingly interconnected market.

Roaming Tariff Market: Key Takeaways

- Strong Market Growth Trajectory: The KSA Roaming Tariff Market is projected to grow significantly from USD 2,149.7 million in 2025 to USD 4,042.8 million by 2034, reflecting increased travel demand, digital roaming needs, and strategic tariff innovations.

- Stable and Promising CAGR: The market is set to expand at a CAGR of 7.3% during the forecast period (2025–2034), driven by rising outbound mobility, digital consumer behavior, and demand for seamless global connectivity.

- Dominance of Roaming Bundles and Add-ons: Among tariff types, roaming bundles and add-ons dominate due to their affordability, simplified activation, and user-centric design, especially popular during Hajj, Umrah, and regional leisure travel.

- High Usage of Data Roaming Services: Data roaming leads the service type segment, as travelers prioritize mobile data for apps, navigation, communication, and streaming over traditional voice or SMS services.

- International Roaming Holds Largest Share: The majority of roaming traffic is international, supported by frequent Saudi travel to destinations like the UAE, Turkey, UK, and Egypt for business, education, and tourism.

- Top Players Leading Innovation: Key market players such as STC, SALAM, Mobily, Zain KSA, and Vodafone are driving innovation through AI-powered services, dynamic pricing, and multi-country roaming agreements.

- AI is Reshaping Roaming Services: Artificial Intelligence is playing a transformative role by enabling real-time analytics, fraud detection, personalized bundles, and intelligent customer support, enhancing overall roaming efficiency and experience.

Roaming Tariff Market: Use Cases

- Hajj and Umrah Pilgrimage Connectivity: Pilgrims visiting Saudi Arabia use short-term roaming plans for seamless voice and data access during Hajj and Umrah. Operators offer tailored packages with unlimited local calling, international minutes, and high-speed data to ensure continuous communication with family and travel coordinators across borders during their religious journey.

- Corporate Travel Solutions: Business travelers benefit from negotiated roaming tariffs that include bundled data, voice, and SMS services for frequent cross-border meetings. These plans ensure uninterrupted connectivity, real-time communication, and expense control for enterprises, especially with growing business ties between KSA and regional hubs like the UAE, Egypt, and Europe.

- Tourism-Driven Packages: Tourists entering KSA can access prepaid roaming bundles offering affordable internet, international calling, and map/GPS usage. These short-term passes are essential for navigation, digital bookings, and social sharing, improving travel experiences and promoting longer stays in key tourist zones like Riyadh, Jeddah, and AlUla.

- Expat Family Communication: Expatriates use roaming add-ons to stay in touch with families in their home countries while traveling abroad. These bundles reduce the cost of international calling and messaging, allowing for consistent communication, especially during holidays or emergencies, without switching to third-party applications or incurring excessive charges.

- Border Zone Roaming (National Roaming): In border regions near the UAE, Bahrain, or Kuwait, national roaming allows users to maintain stable service by connecting to nearby domestic networks. This ensures uninterrupted connectivity without the user unintentionally incurring international roaming charges, especially for logistics workers, truck drivers, and frequent intercity travelers.

Roaming Tariff Market: Stats & Facts

Communications, Space & Technology Commission (CST)

- According to CST, internet penetration in Saudi Arabia stood at 98.6% in 2022, reaching close to 99% by 2024, showcasing the country’s extensive digital access.

- CST data reveals that 99.4% of total internet usage is conducted through mobile devices, underlining Saudi Arabia’s mobile-first digital economy.

- A CST report highlights that average monthly mobile data consumption per person climbed to 37 GB in 2022 and further rose to 48 GB in 2024, driven by video streaming and app usage.

- As per CST rankings, Saudi Arabia secured a spot among the top 5 G20 nations for mobile internet speed, indicating superior telecom performance.

- Speed metrics published by CST show that average mobile download speeds were 180.2 Mbps in 2022, moderating to 129.2 Mbps by late 2024 due to traffic adjustments.

- The CST also confirmed that fixed broadband speeds improved from 103.5 Mbps in 2023 to 120.4 Mbps in 2024, reflecting continued infrastructure upgrades.

- Based on CST’s findings, domain registration in Saudi Arabia is growing at an annual rate of 25%, which is eight times higher than the global average.

- CST's international benchmarking places Saudi Arabia as the 2nd-ranked G20 country in the ITU’s ICT Development Index, highlighting its regulatory and digital progress.

World Bank, ITU

- World Bank statistics indicate that Saudi Arabia is the 8th leading nation globally in internet usage as a percentage of the population.

- ITU estimates show that Saudi Arabia's internet user base grew from 16 million in 2013 to 32 million in 2023, achieving near-total national coverage.

ICLG on Network Infrastructure

- Insights from ICLG show that telecom giants STC, Mobily, and Zain dominate Saudi Arabia’s telecom revenues, shaping the competitive landscape.

SAMENA Council & OECD – Roaming and Tourism Intelligence

- SAMENA Council reported that CST mandated national roaming implementation in remote regions within 60 days to ensure universal access starting January 2018.

- OECD documents explain that Saudi authorities use roaming data analytics to track tourist movement, particularly during the Hajj and Umrah seasons, for real-time crowd monitoring.

Latham & Watkins – Data Privacy and Compliance

- As outlined by Latham & Watkins, violations of the Personal Data Protection Law (PDPL) may incur fines up to 5 million SAR, depending on the severity.

- The legal advisory also warns that leaking sensitive personal data could lead to 2 years imprisonment or a 3 million SAR fine under PDPL.

- Latham & Watkins further notes that non-compliant international data transfers can result in 1 year's imprisonment or a fine of 1 million SAR.

CST & Government Announcements – 5G Expansion

- CST disclosed that by the end of 2023, over 85% of populated areas had 5G coverage, pushing the country into the global top tier of mobile readiness.

- As of mid-2024, CST reported the rollout of 13,000+ 5G towers across Saudi Arabia, enabling advanced roaming and IoT connectivity.

- Government sources note that 5G download speeds in cities like Riyadh and Jeddah averaged 336 Mbps, elevating user experience for roaming customers.

Ministry of Communications and Information Technology (MCIT)

- MCIT reported that more than 4 million students in Saudi Arabia accessed mobile internet for remote learning in 2023, highlighting dependence on mobile connectivity.

- The MCIT also announced that its Universal Service Program delivered mobile internet to over 500,000 people in rural zones, enhancing nationwide digital equity.

OECD – Smart Use of Roaming Data

- According to the OECD, Saudi Arabia is among the few nations integrating mobile roaming data into urban planning and tourism strategies, especially for Hajj season logistics and safety optimization.

Roaming Tariff Market: Market Dynamics

Driving Factors in the Roaming Tariff Market

Surge in Outbound Travel and Cross-Border MobilityOne of the primary growth drivers of the KSA roaming tariff market is the steady rise in outbound travel by Saudi citizens, residents, and business professionals. With the Kingdom easing travel restrictions and increasing international engagements as part of its Vision 2030 objectives, the number of Saudis traveling abroad for business, education, tourism, and religious reasons has increased significantly. Popular destinations include the UAE, Egypt, Turkey, the UK, and the United States, among others.

For these travelers, reliable and affordable roaming services are critical for maintaining communication, accessing digital services, and conducting business activities while abroad. The government’s push to promote international trade, diplomatic missions, and bilateral investments has also led to a surge in official travel.

Furthermore, Saudi students studying abroad and expatriates visiting their home countries add to the growing base of roaming users. This demographic is data-hungry and values uninterrupted mobile access. Roaming tariffs that provide seamless coverage and integrated bundles are being favored in response to this demand. As international mobility continues to rise in post-pandemic times, supported by a strong national carrier network, roaming usage is poised to grow. The expansion of roaming coverage into emerging destinations further enables telecom operators to scale their offerings, driving market revenues and service innovation.

Technological Advancements and 5G Expansion

The expansion of 5G networks and associated digital infrastructure across Saudi Arabia is acting as a strong catalyst for the growth of the roaming tariff market. Telecom operators have invested significantly in building nationwide 5G coverage, and this extends into roaming services as Saudi consumers begin to expect ultra-fast connectivity even while traveling abroad. Through bilateral agreements, KSA-based operators are ensuring 5G roaming availability in key partner countries, allowing subscribers to experience consistent high-speed data on international networks. This development is particularly significant for business travelers, content creators, and digital nomads who require uninterrupted and high-throughput internet access.

Moreover, advanced technologies such as AI-based traffic management, real-time billing systems, and integrated roaming apps have enabled operators to provide more transparent and user-controlled roaming experiences. These innovations reduce bill shock, empower users to monitor data usage, and allow for one-click activation of roaming plans. Additionally, the use of eSIM and cloud-native roaming platforms simplifies plan switching and provisioning, enhancing user convenience. These technological enablers are transforming roaming from a passive, backend function into an active, user-driven digital service. As 5G access becomes the standard, the demand for high-performance, flexible roaming plans will continue to rise, powering long-term market expansion.

Restraints in the Roaming Tariff Market

High Inter-Operator Charges and Regulatory Complexity

One of the critical restraints facing the KSA roaming tariff market is the persistent issue of high inter-operator wholesale charges, which significantly increase the end-user cost of roaming. Roaming services require telecom operators to establish bilateral agreements with foreign networks, and these agreements often involve costly settlement rates for data and voice services. In many cases, Saudi operators are charged premium rates by host networks, especially in high-demand markets like Europe and North America. These costs are either passed on to the consumer or force operators to absorb the loss, impacting profitability. Furthermore, the lack of harmonized regulatory standards across regions complicates roaming service management and cost control.

While regional collaborations exist in the GCC, comprehensive roaming standardization at a global scale remains limited. These complications affect pricing flexibility and reduce the attractiveness of roaming packages, particularly for price-sensitive segments. In addition, regulatory burdens in terms of data privacy, taxation, and service disclosures vary from country to country, making compliance an ongoing operational challenge. Unless addressed through international frameworks or bulk-negotiation coalitions, high interconnection costs and regulatory fragmentation will continue to limit roaming market scalability and reduce the competitiveness of roaming offerings from Saudi operators.

Limited Consumer Awareness and Roaming Misconceptions

Another key restraint in the KSA roaming tariff market is the limited consumer awareness regarding the availability, cost structure, and activation process of roaming services. Many users, especially first-time international travelers or lower-income segments, associate roaming with unpredictable bills and hidden fees. This perception often discourages roaming activation, even when affordable packages are available. Despite major telecom operators promoting daily passes, regional bundles, and real-time monitoring features, a sizable portion of the population remains unaware of these options. Moreover, language barriers, poor onboarding experiences, and a lack of proactive communication from providers exacerbate this issue.

In many cases, users rely on third-party Wi-Fi hotspots or purchase local SIMs abroad due to fear of overcharging, resulting in revenue loss for Saudi operators. Compounding the issue is the underutilization of self-service apps and roaming calculators that could empower users to make informed decisions. Without targeted digital literacy campaigns, retail staff training, and multilingual support interfaces, misconceptions around roaming will persist. This limitation affects uptake across both prepaid and postpaid segments. Overcoming these barriers will require a focused strategy combining education, transparency, and real-time user engagement to build confidence and boost roaming plan adoption across all customer segments.

Opportunities in the Roaming Tariff Market

Roaming Products for Hajj and Umrah Pilgrims

An exceptional growth opportunity in the KSA roaming tariff market lies in the development of customized roaming packages for Hajj and Umrah pilgrims. Every year, millions of Muslims travel to Saudi Arabia for religious purposes, and most of them arrive from countries such as Indonesia, Pakistan, Egypt, Turkey, and India. These travelers often require short-term yet data-intensive mobile services for navigation, communication, booking management, and religious app usage.

Telecom operators can capitalize on this seasonal demand by offering specialized roaming bundles that activate upon arrival, providing regional data access, unlimited calls to home countries, and multilingual app support. The integration of these services into visa issuance platforms or digital wallets enhances user adoption.

Additionally, pilgrims returning home can benefit from reverse roaming offers, where their Saudi SIMs remain active for a limited period in their home countries. These types of roaming innovations create mutual value for inbound and outbound travel. Operators can further partner with travel agencies and airlines to co-market these packages, expanding their reach and distribution. With the expected rise in religious tourism under Vision 2030 goals, including plans to host over 30 million pilgrims annually, tailored roaming solutions during the Hajj and Umrah seasons can become a high-volume revenue stream and a brand differentiation lever.

Enterprise Roaming Solutions for Corporates and SMEs

The corporate sector in Saudi Arabia presents a significant untapped opportunity for roaming tariff expansion, particularly through customized enterprise plans targeted at large corporations and SMEs. With the government fostering global trade relations, Saudi businesses are increasingly participating in international events, investments, and expansion initiatives.

This rising cross-border corporate engagement requires employees to stay connected across multiple geographies, often for extended durations. Telecom providers can develop enterprise-grade roaming solutions that offer pooled data access, centralized billing, real-time usage monitoring, and cybersecurity features. Such plans enable organizations to control costs, allocate usage by department, and ensure data integrity while maintaining employee productivity abroad.

Additionally, value-added features like unified communications, mobile VPN access, and cloud collaboration tools can be bundled within roaming packages to appeal to tech-forward enterprises. Government and semi-government bodies with frequent diplomatic missions or overseas training programs also fall into this high-consumption category.

By offering scalable and secure roaming services with predictable pricing, telecom providers can differentiate themselves and penetrate the lucrative B2B market. The adoption of eSIMs and multi-device support further enhances service continuity for executives and field personnel. As Saudi businesses become increasingly global, tailored corporate roaming services will emerge as a vital growth avenue.

Trends in the Roaming Tariff Market

Shift Toward Bundled and Unlimited Roaming Plans

The Saudi roaming market is witnessing a shift toward bundled and unlimited roaming plans as consumers demand more transparent and predictable billing models. Traditionally, roaming was associated with high charges and fragmented billing structures. However, telecom operators like STC, Mobily, and Zain are now launching roaming bundles with fixed pricing models that include voice, SMS, and data access in specific regional zones. These bundles are especially popular among business travelers and frequent flyers who require reliable international connectivity.

The growing adoption of these plans is being driven by the demand for simplified service experiences, rising cross-border travel, and consumer backlash against bill shock from per-MB pricing. Daily passes, regional add-ons, and unlimited roaming schemes are further streamlining international usage without complex configuration or contract extensions.

Such plans are also being promoted during peak travel periods like Hajj and Umrah, where pilgrims benefit from one-click activation and region-specific offers. This trend is creating strong competitive differentiation among operators and enhancing subscriber loyalty. Furthermore, the integration of AI-based usage monitors within apps enables real-time insights and optimizations for roaming usage, strengthening user trust and encouraging higher data consumption abroad. These bundled plans represent a major shift toward consumer-centric models, improving affordability, convenience, and overall satisfaction in the roaming tariff landscape.

Strategic International Partnerships to Expand Coverage

A notable trend reshaping the KSA roaming tariff market is the rise in international partnerships between Saudi telecom providers and foreign network operators. These alliances are crucial for extending roaming coverage, reducing interconnection costs, and improving network reliability in foreign destinations frequently visited by Saudi residents and businesses.

Operators such as STC and Zain are forging roaming agreements with carriers in the GCC, Europe, Southeast Asia, and North America to provide seamless services to their customers abroad. These partnerships enable operators to offer lower latency, higher-speed roaming services, and access to next-generation networks like 5G in destination countries. For end-users, this translates into fewer dropped calls, faster mobile data, and uninterrupted access to digital services while traveling.

These international roaming alliances also include preferential rates for enterprise clients, tourism sectors, and government delegations, helping Saudi telecoms tap into high-ARPU segments. Additionally, multi-lateral roaming agreements are increasingly backed by regional regulatory bodies such as the GCC Telecommunications Office, enhancing mutual network coordination and dispute resolution. By strategically leveraging such cross-border collaborations, KSA operators are strengthening their value propositions in an increasingly globalized mobile environment, where roaming services are no longer optional but essential for consumer retention and digital lifestyle continuity.

Roaming Tariff Market: Research Scope and Analysis

By Tariff Type Analysis

Roaming bundle and add-on plans are projected to emerge as the dominant tariff type in the KSA Roaming Tariff Market due to their ability to simplify the roaming experience while delivering price predictability and ease of use. In a market historically marred by confusion over roaming costs and excessive per-minute/per-megabyte charges, bundled plans have reshaped customer expectations. These bundles are pre-structured packages combining a defined amount of voice minutes, SMS messages, and mobile data at a fixed cost, valid for specific regions or countries over a set duration. This model not only reduces the chance of unexpected bills commonly referred to as "bill shock" but also helps users plan their connectivity usage while traveling.

Saudi telecom operators such as STC, Mobily, and Zain KSA offer a wide array of roaming bundles targeting key travel corridors like the GCC, Europe, and Southeast Asia. These bundles are usually activated via SMS, app, or USSD code, and cater to both prepaid and postpaid customers. For instance, daily passes for GCC countries, Umrah-specific roaming packs for pilgrims, and business bundles with higher data caps have become standard offerings.

Moreover, the integration of AI-powered apps allows real-time usage tracking, auto-renewal, and plan suggestions based on travel behavior, making the customer journey highly personalized. These plans are especially in demand during Hajj and Umrah when millions of pilgrims from and to KSA require short-term, high-volume roaming services. With the growing appetite for uninterrupted social media sharing, online navigation, streaming services, and mobile banking, bundled roaming plans strike the right balance between affordability, utility, and control.

Their success also reflects a broader global telecom trend: the shift from transactional pricing to subscription-like experiences. As competition intensifies, further innovation is expected through gamified rewards, OTT bundling, and dynamic pricing models that will cement the dominance of roaming bundles in Saudi Arabia’s roaming landscape.

By Service Type Analysis

Data roaming is anticipated to dominate the service type segment of the KSA Roaming Tariff Market due to the explosive growth in mobile internet consumption and the increasingly data-centric lifestyle of Saudi consumers. In the digital era, traditional voice and SMS services have taken a back seat to data as smartphones, tablets, and wearables become the primary devices for communication, entertainment, navigation, and productivity. With more than 48 GB of mobile data consumed per user per month (CST, 2024), the reliance on data services both domestically and while abroad is profound and growing.

Today’s travelers demand continuous access to services like WhatsApp, Zoom, Google Maps, Instagram, Snapchat, YouTube, and cloud storage. Whether it’s a student studying abroad attending virtual classes, a business executive on a video conference, or a tourist navigating with Google Maps, data is indispensable. For pilgrims during Hajj or Umrah, data roaming is crucial for translation tools, religious app guides, online hotel check-ins, and digital payments.

Telecom providers in Saudi Arabia have responded by designing region-specific and unlimited data roaming plans that offer flexible pricing tiers and generous data caps. Additionally, 5G deployment and partnerships with foreign operators ensure high-speed roaming experiences in popular destinations. Data-only roaming plans are often priced attractively and include real-time usage alerts, daily caps, throttling beyond the limit, and auto-renewal options, making them manageable and secure.

As cloud computing, video streaming, social commerce, and remote work become mainstream, the demand for reliable, fast, and affordable data while roaming will continue to rise. Operators that fail to deliver competitive data roaming offers risk churn, especially among Gen Z and millennial users who are hyper-connected. Thus, data roaming not only leads in current usage but also holds the key to future innovation and customer retention in the Saudi roaming market.

By Roaming Type Analysis

International roaming is poised to hold a dominant position in the KSA Roaming Tariff Market because of the high volume of outbound travel from Saudi Arabia and the country's increasingly globalized citizenry and workforce. Whether it’s for religious obligations, academic pursuits, tourism, or business expansion, Saudi citizens and residents frequently travel abroad, making international connectivity a necessity rather than a luxury. More than 7 million Saudis travel internationally every year, according to national travel data, and this number continues to grow as the country opens up new visa partnerships and direct flight routes with global destinations.

Popular travel destinations for Saudi residents include the UAE, Egypt, Turkey, Jordan, the United Kingdom, and the United States regions where the demand for reliable international roaming is exceptionally high. International roaming services allow customers to stay connected using their home SIM cards, avoiding the hassle of buying and setting up local SIMs or depending on inconsistent public Wi-Fi. For business travelers and government delegations who need encrypted, uninterrupted access to enterprise tools and email while abroad, international roaming becomes indispensable.

Operators like STC and Zain have capitalized on this demand by launching competitively priced roaming bundles that support seamless international coverage, auto-activation upon landing, and access to 4G/5G networks through partner operators. These partnerships are often backed by roaming alliances and multilateral agreements, which ensure quality of service and billing transparency. The focus has also expanded to include inbound international roaming packages for tourists and pilgrims visiting KSA, particularly during the Hajj and Umrah seasons. The continued growth of international roaming is not just a reflection of travel patterns but of the broader vision of positioning Saudi Arabia as a connected global hub, both for outbound and inbound mobility.

By Business Model Analysis

Retail roaming is expected to be the dominant business model in the KSA Roaming Tariff Market as it caters directly to end-users who make individual purchasing decisions for roaming services. Unlike wholesale roaming, which functions in the background between carriers and is geared toward MVNOs or corporate-level network leasing, retail roaming is consumer-facing. It encompasses daily passes, prepaid data bundles, country-specific offers, and flexible add-ons activated via mobile apps, portals, or USSD codes. The immediacy and control offered by this model perfectly align with the evolving preferences of today’s mobile-savvy consumers in Saudi Arabia.

The Saudi telecom market has seen a remarkable digital transformation, with more than 90% of the population accessing telecom services via mobile. As a result, operators like Mobily, STC, and Zain KSA have invested heavily in digital platforms that allow users to explore, compare, and activate roaming plans within seconds. These platforms often include AI-powered suggestions, usage dashboards, real-time alerts, and auto-renewal options. Retail roaming not only empowers users to control their spending but also enables telecom providers to personalize offers, gather usage data, and build loyalty through promotional bundles and tiered pricing.

Retail roaming also dominates during peak travel seasons such as Hajj, Umrah, and school holidays, when tourists and families make independent roaming choices. With a growing emphasis on digital literacy, convenience, and transparency, the retail model supports mass-market scalability while minimizing overhead. Furthermore, the retail structure allows for agile product innovation, whether it's launching a roaming pack for a newly added travel corridor or bundling it with entertainment subscriptions. For Saudi telecom operators, retail roaming represents not only the dominant business model today but also the most lucrative path to future revenue growth in a consumer-driven telecom landscape.

By Customer Segment Analysis

Individual consumers are projected to dominate the customer segment of the KSA Roaming Tariff Market due to their sheer numbers, frequency of travel, and personal reliance on mobile connectivity abroad. This segment includes a broad spectrum of users such as Saudi citizens traveling for leisure or education, expatriates visiting their home countries, Umrah and Hajj pilgrims, digital nomads, and solo tourists. These users are often responsible for activating and managing their roaming services and are particularly price-sensitive, which makes them highly responsive to flexible offers like daily passes and country-specific bundles.

Unlike enterprise or corporate users who typically have roaming embedded in managed contracts, individual consumers make discretionary decisions based on utility, value, and convenience. They actively compare roaming rates, seek ease of activation, and require tools for real-time usage tracking to avoid overspending. With more than 30 million mobile users in Saudi Arabia and outbound travel steadily increasing post-COVID, this segment commands the largest share of the roaming market.

The growing availability of self-service platforms, eSIM capabilities, and AI-enhanced mobile apps has further empowempowered individual users to manage their roaming preferences.

Additionally, the Kingdom's high smartphone penetration, exceeding 95% ensures that nearly all travelers are potential roaming users. Seasonal trends also influence individual consumption patterns; for instance, students activating roaming while studying abroad, or families traveling during summer holidays.

Moreover, operators often create marketing campaigns, loyalty discounts, and bonus data incentives specifically targeted at this group. As the roaming market becomes more personalized and app-based, individual consumers remain the central revenue source and innovation driver. Their behaviors and expectations not only define product development strategies but also influence how telecom operators structure cross-border partnerships and roaming infrastructures.

The Roaming Tariff Market Report is segmented on the basis of the following

By Tariff Type

- Roaming Bundle/Add-ons

- Pay-As-You-Go

- Flat Rates/Unlimited Roaming Plans

- Daily Passes

- Negotiated Corporate Tariffs

By Service Type

- Data Roaming

- Voice Roaming

- SMS Roaming

- Combination Plans

By Roaming Type

- International Roaming

- National Roaming

By Business Model

- Retail Roaming

- Wholesale Roaming

By Customer Segment

- Individual Consumers

- Business Enterprises

- Tourists

Impact of Artificial Intelligence on the KSA Roaming Tariff Market

- Personalized Roaming Packages and Predictive Offers: AI algorithms, trained on customer usage patterns, travel history, device preferences, and destination data, enable telecom operators such as STC, Mobily, and Zain KSA to offer hyper-personalized roaming bundles. These systems use machine learning to predict when a user is likely to travel and automatically suggest relevant data/voice packs tailored to specific countries or roaming zones. For instance, a frequent UAE traveler may receive automated prompts for 5-day unlimited data passes the moment they land in Dubai without needing to search or activate manually.

- Real-Time Roaming Analytics and Dynamic Pricing: AI-powered analytics platforms are used by operators to monitor roaming traffic in real-time, track user QoE (quality of experience), and assess inter-operator costs. This helps optimize tariffs dynamically based on network load, destination congestion, or user priority class. Dynamic pricing models driven by AI can temporarily adjust bundle pricing, extend validity, or throttle speeds based on customer segmentation and real-time demand patterns, maximizing ARPU while preventing bill shock.

- Fraud Detection and Network Security: AI tools such as anomaly detection models and behavioral analytics are now essential in identifying roaming-related fraud (e.g., SIM box usage, location spoofing, and signaling abuse). Telecoms use AI to flag and block suspicious usage across international networks, thereby improving revenue assurance and regulatory compliance. This is particularly critical in Saudi Arabia’s high-value business and religious tourism segments.

- Roaming Experience Optimization: AI also enhances network and service orchestration, ensuring optimal signal strength and reduced latency through intelligent selection of partner networks abroad. It minimizes call drops, data packet loss, and delays by auto-switching roaming connections using AI-based routing and performance scoring mechanisms. This is vital during high-congestion periods such as Hajj and Umrah.

- Chatbots and Digital Customer Assistance: AI-enabled virtual assistants and chatbots embedded within STC or Mobily apps now handle roaming queries, suggest plans, troubleshoot service issues, and even activate roaming bundles via natural language interfaces, significantly improving self-care adoption and customer satisfaction among users, especially tourists and first-time travelers.

- Forecasting and Roaming Revenue Management: AI helps telecom finance and commercial teams forecast roaming demand trends per region, season, or customer segment. These insights are essential in aligning roaming partnerships, negotiating IOT rates, and managing wholesale settlement traffic with foreign operators, especially as GCC roaming regulatory reforms continue to evolve.

Roaming Tariff Market: Competitive Landscape

The KSA Roaming Tariff Market is characterized by intense competition among domestic telecom giants and growing strategic alignment with international operators. Leading players such as STC (Saudi Telecom Company), Mobily (Etihad Etisalat), and Zain KSA dominate the national market, offering diverse roaming bundles, flat-rate packages, and tailored services for pilgrims, tourists, and corporate clients. These operators continuously invest in expanding bilateral roaming agreements, particularly across the GCC, Europe, and Asia, to enhance coverage and reduce latency for outbound users. Integrated Telecom Company (Salam) is also strengthening its position by focusing on data-centric roaming products and B2B packages for SMEs and public institutions.

On the global front, major roaming enablers and partner networks include Vodafone Group, Etisalat Group, Orange S.A., and Telefónica, facilitating extended international connectivity for Saudi subscribers. Roaming cost optimization through wholesale agreements, cloud-based platforms, and AI-powered analytics has become a key differentiator. The presence of MVNOs and niche providers is expanding, driven by regulatory support and the demand for hyper-personalized roaming plans.

Innovation, pricing flexibility, customer experience, and regional network partnerships remain the pillars of competitive advantage. As roaming becomes integral to digital lifestyles, operators are intensifying their efforts to deliver seamless, scalable, and secure roaming experiences tailored to evolving user expectations.

Some of the prominent players in the Roaming Tariff Market are:

- STC (Saudi Telecom Company)

- Integrated Telecom Company (SALAM)

- Mobily (Etihad Etisalat)

- Zain KSA

- Vodafone Group

- Etisalat Group

- du (Emirates Integrated Telecommunications)

- Orange S.A.

- Telefónica (Movistar)

- AT&T Mobility

- Verizon Communications

- BT Group (EE)

- China Mobile

- China Telecom Global

- MTN Group

- Airtel Group

- Tele2 AB

- Telstra Corporation

- Telenor Group

- Rogers Communications

- Other Key Players

Recent Developments in Roaming Tariff Market

July 2025 – Development

- STC launched a real-time adaptive roaming engine leveraging AI to optimize roaming bundles dynamically based on user location, usage pattern, and device type, aiming to reduce churn and improve QoE (Quality of Experience) for outbound travelers during peak Hajj traffic.

June 2025 – Collaboration

- Zain KSA entered a multi-country roaming partnership with Orange Group to expand LTE and 5G roaming coverage across North Africa and Western Europe, offering Saudi postpaid users improved speeds, latency, and lower interconnection costs via direct IOT (Inter-Operator Tariff) settlements.

May 2025 – Investment

- Mobily invested SAR 180 million in its roaming platform modernization program, deploying an eSIM and unified policy control system to enable seamless service continuity for enterprise and retail customers during cross-border handoffs.

April 2025 – Expo

- At the Saudi Mobile Future Forum 2025 (Riyadh), STC showcased its Smart Roaming Analytics Dashboard, which integrates billing systems, partner roaming APIs, and real-time user traffic data to dynamically trigger roaming bundle promotions.

March 2025 – Conference

- During the GCC Roaming Regulation Symposium held in Jeddah, the Communications, Space & Technology Commission (CST) proposed a harmonized roaming rate framework among GCC states to align IOT ceilings, enhancing tariff transparency and consumer trust.

January 2025 – Development

- Integrated Telecom Company (Salam) upgraded its wholesale roaming exchange with a cloud-native Diameter routing solution, improving signaling efficiency and reducing latency for international roaming sessions.

November 2024 – Collaboration

- Zain KSA signed a preferred roaming agreement with Airtel Africa, enabling seamless roaming for Saudi expatriates and business travelers in 14 African markets with bundled tariffs and high-speed access to 4G networks.

October 2024 – Conference

- During the Middle East Telecom Operators Summit 2024 (Dammam), Mobily unveiled its B2B Roaming-as-a-Service (RaaS) model, aimed at providing white-labeled roaming solutions for SMEs and government clients with centralized billing and policy enforcement.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 2,149.7 Mn |

| Forecast Value (2033) |

USD 4,042.8 Mn |

| CAGR (2024-2033) |

7.3% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Tariff Type (Roaming Bundles/Add-ons, Pay-As-You-Go, Flat Rates/Unlimited Plans, Daily Passes, Negotiated Corporate Tariffs), By Service Type (Data Roaming, Voice Roaming, SMS Roaming, Combination Plans), By Roaming Type (International Roaming, National Roaming), By Business Model (Retail Roaming, Wholesale Roaming), By Customer Segment (Individual Consumers, Business Enterprises, Tourists) |

| Regional Coverage |

The Kingdom of Saudi Arabia (KSA) |

| Prominent Players |

Saudi Telecom Company (STC), Integrated Telecom Company (SALAM), Etihad Etisalat (Mobily), Mobile Telecommunications Company Saudi Arabia (Zain KSA), Vodafone Group Plc, Emirates Telecommunications Group Company PJSC (Etisalat Group), Emirates Integrated Telecommunications Company PJSC (du), Orange S.A., Telefónica S.A. (Movistar), AT&T Mobility LLC, Verizon Communications Inc., BT Group plc (EE), China Mobile Communications Group Co., Ltd., China Telecom Global Limited, MTN Group Limited, Bharti Airtel Limited, Tele2 AB, Telstra Corporation Limited, Telenor Group, and Rogers Communications Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |