Market Overview

The Global Light Gauge Steel Framing Market is expected to reach a value of USD 39.9 billion in 2023, and it is further anticipated to reach a market value of USD 63.4 billion by 2032 at a CAGR of 5.3%. The market has seen a significant increase in the recent past and is predicted to grow significantly during the forecasted period as well.

Light-gauge steel framing systems include structural frames made from cold-formed steel sections. These frames, mostly coated with a zinc-aluminum mix or zinc for corrosion protection, serve many purposes within a structure, including load-bearing exterior walls, non-load-bearing interior walls, roof trusses, curtain walls, & floor joists.

The growth of construction activities, covering both developing & developed nations, plays a major role in driving the growth of the light-gauge steel construction industry. Advancements in technology, leading to stronger, safer, & more stable products, integrated with strict governmental regulations promoting advanced construction techniques, further boost the market's growth.

Light Gauge Steel Framing (LGSF) continues to experience growth as more construction professionals recognize its numerous advantages for cost-cutting, durability and energy savings projects. LGSF is quickly becoming a mainstream choice among residential, commercial and industrial projects alike due to its many beneficial properties.

Market demand for steel fabrication materials has seen steady increases over time due to rapid urbanization and infrastructure development in emerging economies. Technological advancements, automation in steel fabrication, and efficiency gains have further enhanced this material's popularity across various sectors, complementing trends in

Construction Equipment adoption for modern building solutions.

LGSF market opportunities are quickly expanding, particularly in regions focused on green building initiatives and sustainable development. Prefabricated and modular construction techniques have created new avenues for LGSF in residential housing as well as commercial real estate properties. As environmental impact awareness rises, their role in reducing carbon footprints and improving energy performance creates compelling growth prospects in this segment of the market.

The Light Gauge Steel Framing (LGSF) Market has recently seen a surge in demand due to its sustainability and cost-effective benefits. In 2024, several key players in the construction industry have adopted LGSF for both residential and commercial projects, owing to its speed of installation and superior strength-to-weight ratio.

Key Takeaways

- Strong Market Growth Outlook: The Global Light Gauge Steel Framing Market is valued at USD 39.9 billion in 2023 and is projected to reach USD 63.4 billion by 2032, expanding at a CAGR of 5.3%. Growth is driven by increasing construction activity, sustainability trends, and demand for faster, cost-effective building methods.

- Leading Market Segments: By type, wall-bearing steel framing holds the largest share in 2023, primarily used in residential projects. However, long-span steel framing is expected to witness faster growth, favored in commercial and industrial applications such as malls, factories, airports, and gyms due to its versatility.

- Commercial Sector Driving Demand: Among end users, the commercial segment (hospitals, schools, malls) is anticipated to experience the fastest growth, supported by cost-effectiveness, fire resistance, and durability. The industrial sector is also adopting light gauge framing for warehouses and factories, enabled by advancements in fire resistance and sound performance. The integration of Healthcare IT Solutions and digital building management technologies is further enhancing efficiency in commercial spaces where LGSF is deployed.

- Regional Market Performance: Asia Pacific dominates with a 37.5% revenue share in 2023, led by China, India, and Southeast Asia. The region benefits from robust infrastructure investment and large-scale construction activities. North America and Europe remain important markets, with growing adoption in earthquake-prone regions like Japan and Indonesia due to LGSF’s resilience.

Use Cases

- Residential Housing: LGSF is widely adopted in low-rise and mid-rise housing projects due to its cost-effectiveness, faster installation, and superior durability. Prefabricated LGSF components are increasingly used in apartments, retirement homes, and student accommodations to reduce construction timelines.

- Commercial Buildings: Malls, hospitals, schools, and office spaces leverage LGSF for its fire resistance, safety features, and design flexibility. The ability to support wide spans without compromising structural integrity makes it suitable for large-scale commercial properties, particularly in projects linked to Education & Learning Analytics and smart campuses.

- Industrial Infrastructure: Warehouses, factories, and airports benefit from long-span steel framing that provides spacious layouts, strength, and adaptability for heavy-duty operations. LGSF also enhances safety compliance in industrial environments.

- Green & Sustainable Construction: LGSF supports green building initiatives by reducing carbon footprint and improving energy performance. Modular and prefabricated applications make it a preferred choice for eco-friendly, sustainable urban projects.

- Seismic & Disaster-Resilient Structures: In earthquake-prone regions like Japan and Indonesia, LGSF is increasingly used for its gradual deformation under stress, which enhances safety and evacuation time during seismic events.

Market Dynamic

In the construction sector, meeting constrained project timelines is critical. Light gauge framing's quick installation has significantly lowered project completion times, aligning with customer expectations. This technology has acquired ground in projects such as skyscrapers & multi-story buildings due to its benefits.

The flexibility of light gauge frames secures cracking under pressure, & their gradual deformation during earthquakes allows residents a lot of escape time. In addition, earthquake-prone countries such as Japan & Indonesia are anticipated to quickly adopt light gauge framing for better construction resilience. These trends & factors are anticipated to further drive the market over the forecasted period.

However, the market's expansion is challenged by steel's significant thermal conductivity. Various alternatives to light gauge steel framing, like lumber framing & traditional/RCC construction, also limit growth. To overcome this, light gauge steel framing is galvanized for enhanced fire insulation, making it a preferable choice over other methods. It is endorsed for its quick deployment, cost-effectiveness, strong resistance to termites, & flexibility.

Research Scope and Analysis

By Type

Categorized by type, the market is segmented into three parts which are wall-bearing steel framing, skeleton steel framing, & long-span steel framing. In 2023, the wall-bearing framing type contributes the largest portion of the market, a trend expected to sustain throughout the forecast period. Wall-bearing frame structures find a wide range of applications in residential settings.

They drive the load of a building's floors or roofs, making them particularly appropriate for low-rise constructions. These frames require substantial strength to effectively withstand lateral loads. However, the inapplicability of wall-bearing frames for multi-story buildings has grown due to the necessity of expanding the bearing size to accommodate the loads imposed by such structures.

Further, major growth in the long-span steel framing type is also anticipated owing to growing use in multi-story structures. This framing suits spacious demand in commercial & industrial buildings. Its versatility excels in creating visually appealing architecture such as churches, gyms, and malls. Long-span framing comprises trusses, girders, arches, & rigid frames, serving numerous construction purposes efficiently.

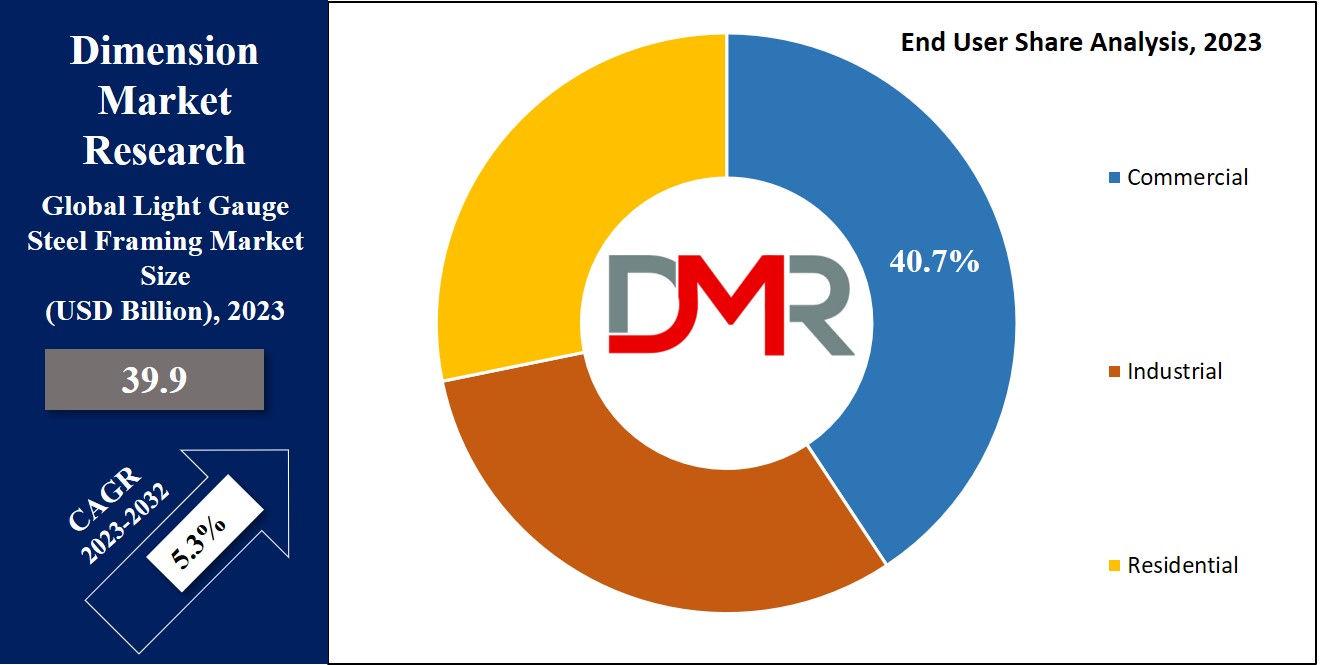

By End User

The market is divided by its main users industrial, commercial, & residential. Among these, the commercial sector, which includes places like hospitals, malls, and schools, is set to experience the fastest growth. Hospitals & malls, in particular, are expected to make good use of light gauge framing due to its cost-effectiveness, safety features, & fire resistance. These advantages are driving the demand for commercial construction using these framing methods.

Moreover, in the coming years, the industrial sector is also anticipated to adopt light gauge steel framing. Technological progress has strengthened the fire resistance & sound performance of this framing method, driving its growth in industrial construction like airports, warehouses, and factories. Primarily, long-span and skeleton steel frames take the lead in constructing industrial buildings, with strong potential for integration into

Steam Education campuses and innovation hubs.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Global Light Gauge Steel Framing Market Report is segmented on the basis of the following:

By Type

- Skeleton Steel Framing

- Wall Bearing Steel Framing

- Long Span Steel Framing

By End User

- Residential

- Industrial

- Commercial

Regional Analysis

In 2023, the Asia Pacific region secures a significant market share, contributing

about 37.5% of the total revenue in the Global Light Gauge Steel Framing Market. The regional market is on a growing trajectory, majorly due to the growth in construction activities, mainly in the commercial & industrial sectors. Further, major markets in this context include influential players like China, India, & various Southeast Asian nations.

Notably, these regions are noticing significant public & private investments focusing on improving infrastructure & constructing commercial spaces. These investments are acting as major drivers significantly fueling the growth of the regional market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Major players within the global light gauge steel framing market contain a range of strategies for growth. These include both organic & inorganic methods, including partnerships, collaborations, mergers, acquisitions, joint ventures, & the constant development of new products. By incorporating these approaches, these market players efficiently enhance their positions & capitalize on emerging opportunities within the industry.

For instance, in June 2023, Etex Group, operating across 45 countries, including the UK, introduced the Remagin brand, with an initiative to merge three existing steel frame manufacturers, namely Sigmat from Yorkshire, EOS based in County Durham, & Horizon in Ireland, to give a complete, end-to-end service to clients. With an aim on diverse residential projects including houses, flats, retirement living, care homes, hotels, & student accommodations along with ventures in education & healthcare, while doubling Remagin's turnover by 2030.

Some of the prominent players in the Global Light Gauge Steel Framing Market are:

Recent Developments

- 2025 (H1): Genesis Homes unveiled a complete modular house system built using light-gauge steel framing with advanced robotic assembly methods, enabling mass housing complexes with substantial labor cost and construction time savings.

- 2024: BlueScope Steel introduced a new high-strength, lightweight steel alloy for framing applications, enhancing load-bearing capacity while maintaining flexibility—ideal for seismic-prone areas.

- June 2025: A consortium led by Venture First and TYP64 acquired Scottsdale Construction Systems (Australian manufacturer of LGSF roll-forming equipment), securing critical upstream manufacturing capabilities and enhancing vertical integration in component production.

- August 2024: Etex, a global off-site construction specialist, acquired Sigmat, a UK-based leader in light-gauge steel framing with integrated design-to-installation services, strengthening its UK/Ireland presence and end-to-end delivery in LGSF.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 39.9 Bn |

| Forecast Value (2032) |

USD 63.4 Bn |

| CAGR (2023-2032) |

5.3% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Skeleton Steel Framing, Wall Bearing Steel Framing and Long Span Steel Framing), By End User (Residential, Industrial and Commercial) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Intelligent Steel Solution Ltd, Precision Walls Inc, Metek UK Ltd, FRAMECAD Ltd, QSI Interiors Ltd, CEMCO, Carco Manufacturing Inc, Steel Frame Solutions, The Steel Network Inc, Hadley Group, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Light Gauge Steel Framing Market?

▾ The Global Light Gauge Steel Framing Market is estimated to reach USD 39.9 billion in 2023, which is

further expected to reach USD 63.4 billion by 2032.

Which region accounted for the largest Global Light Gauge Steel Framing Market?

▾ Asia Pacific dominates the Global Light Gauge Steel Framing Market with a share of 37.5% in 2023.

Who are the key players in the Global Light Gauge Steel Framing Market?

▾ Some of the major key players in the Global Light Gauge Steel Framing Market are CEMCO, Metek UK

Ltd, FRAMECAD Ltd, and many others.

What is the growth rate in the Global Light Gauge Steel Framing Market?

▾ The market is growing at a CAGR of 5.3 percent over the forecasted period.