Liquid Biopsy Market Overview

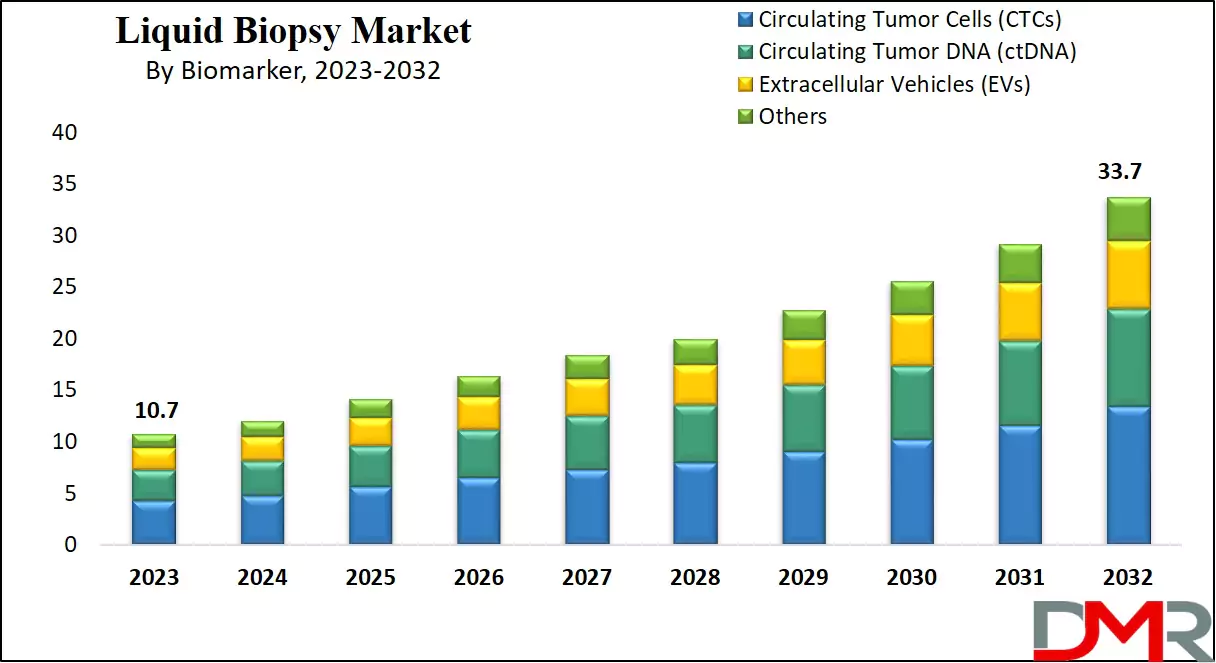

The Global Liquid Biopsy Market is expected to reach a value of USD 10.7 billion in 2023, and it is further anticipated to reach a market value of USD 33.7 billion by 2032 at a CAGR of 13.6%.

The market has seen a significant increase in the recent past and is predicted to grow significantly during the forecasted period as well. Liquid biopsy is a non-invasive diagnostic or testing method that involves analyzing various biomarkers, such as circulating tumor DNA, circulating tumor cells, and other cells that are obtained from a patient's blood or other bodily fluids. This testing method is primarily used for cancer detection, monitoring, & treatment.

This market has been showing rapid growth in recent years as it is used in the diagnosis of

oncology patients. These tests are done by using a wide range of products and services, such as blood collection devices, sample processing, and diagnostic tests.

This market has been growing rapidly due to its potential to revolutionize the healthcare sector by diagnosing cancer at early stages and monitoring it. This method also offers a less invasive and more convenient alternative to traditional tissue biopsies.

Also, Liquid biopsy technology is revolutionizing

cancer diagnostics by offering non-invasive ways of detecting and monitoring cancer through biomarker analysis of bodily fluids. With cancer rates continuing to skyrocket globally (as highlighted by WHO in February 2024, with 20 million new cancer cases and

9.8 million deaths), early detection tools like liquid biopsy are becoming increasingly accessible - leading to reduced cancer-related mortality rates and contributing significantly towards improving survival rates.

Personalized oncology and targeted therapies have spurred the adoption of companion diagnostic tests using liquid biopsy. With government policies like regulatory approvals and reimbursement frameworks encouraging its integration into regular oncology care, liquid biopsy has quickly become part of routine oncology care.

With increased awareness about early cancer detection and non-invasive testing techniques slated to increase significantly as awareness continues to spread, the liquid biopsy market should experience significant expansion while technological innovations provide increased precision, accessibility, and effectiveness when diagnosing cancer and treating its treatment.

Liquid Biopsy Market Key Takeaways

- Market Size & Share: Global Liquid Biopsy Market is expected to reach a value of USD 10.7 billion in 2023, and it is further anticipated to reach a market value of USD 33.7 billion by 2032 at a CAGR of 13.6%.

- Sample Type Analysis: Blood samples dominate this segment as they contain a wide variety of biomarkers

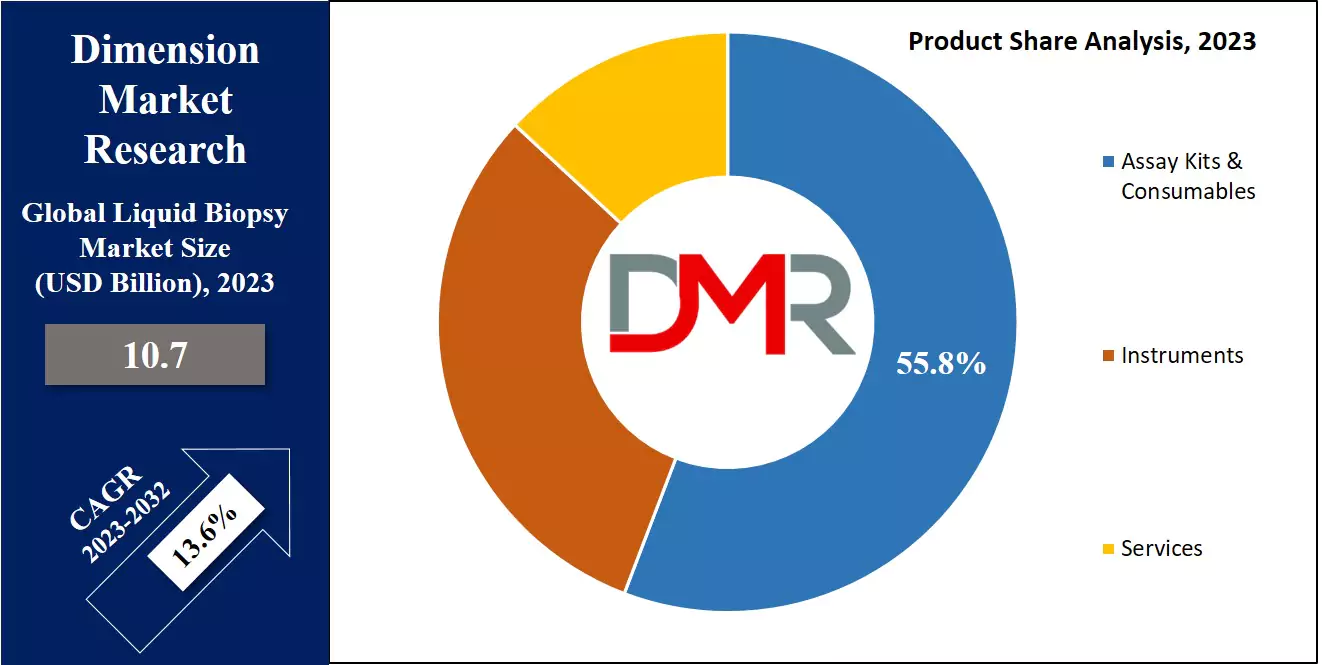

- Product Analysis: Assay kits and consumables dominate the liquid biopsy market as they hold 55.8% of the market share in 2023

- Biomarker Analysis: Circulating Tumor Cells (CTCs) dominate this market in the case of biomarkers as they hold 39.6% of the market share in 2023.

- End-User Analysis: Hospitals and healthcare centers dominate the liquid biopsy market in terms of end users as they hold the highest portion of this segment in 2023

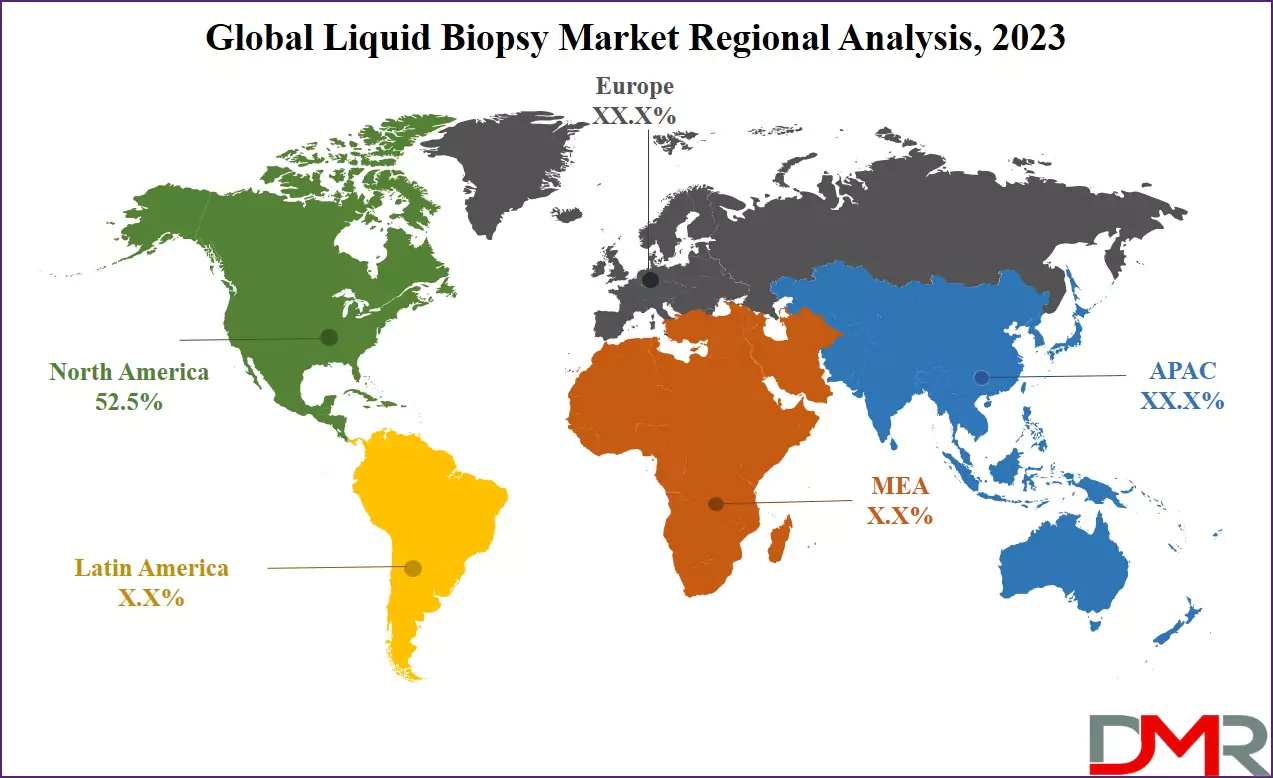

- Regional Analysis: North America dominates the global liquid biopsy market as it holds 52.5% of the market share in 2023

Liquid Biopsy Market Use Cases

- Early Cancer Detection: Liquid biopsy enables the early detection of cancer by analyzing circulating tumor DNA (ctDNA) and other biomarkers in the blood. This non-invasive approach helps identify cancers at an early stage, improving treatment success rates and patient survival.

- Treatment Monitoring & Therapy Selection: Oncologists use liquid biopsy to track tumor progression and assess treatment response in real time. It helps in adjusting therapies based on genetic mutations and emerging resistance, leading to personalized cancer treatments.

- Minimal Residual Disease (MRD) Detection: Liquid biopsy is used to detect minimal residual disease (MRD) after cancer treatment, identifying traces of tumor DNA that could indicate potential relapse. This helps in early intervention and recurrence prevention.

- Non-Invasive Alternative to Tissue Biopsy: Traditional tissue biopsies can be invasive and risky. Liquid biopsy offers a safer, less painful alternative for patients, particularly those unsuitable for surgical biopsy due to location or health conditions.

- Screening for Genetic Mutations & Hereditary Cancer Risk: Liquid biopsy helps identify genetic predispositions to cancer by detecting hereditary mutations. This aids in risk assessment and preventive care, guiding patients toward early interventions and lifestyle modifications.

Liquid Biopsy Market Dynamics

The global liquid biopsy market is notably dynamic as it is usually advancing, with new technology and methodologies being developed for the sensitivity, specificity, and range of applications. These improvements lead to the development of innovative products and services within the global liquid biopsy. The increasing number of cancer sufferers is one of the most important drivers for the growth of the liquid biopsy marketplace.

The rise in demand for the detection of cancer cells inside the initial stages for its proper tracking fuels the demand for liquid biopsy checks. Also, the non-invasive and convenient approach of pattern collection in liquid biopsy checks has made it ideal for healthcare companies compared to conventional tissue biopsies. These elements together contribute to the developing adoption and acknowledgment of liquid biopsy assessments inside the global hospital and healthcare area.

Furthermore, the global liquid biopsy marketplace is regularly expanding its variety of packages past most cancer detection, to new regions like prenatal checking out, infectious ailment monitoring, and organ transplant rejection. The use of liquid biopsy in new scientific domain names will extend the market vicinity and improve the growth of the liquid biopsy marketplace similarly.

Liquid Biopsy Market Research Scope and Analysis

By Sample Type

Blood samples hold the highest market share in the global liquid biopsy market on the basis of sample type in 2023 and is projected to show significant growth in the forthcoming years as well. Blood samples dominate this segment as they contain a wide variety of biomarkers, including circulating tumor DNA (ctDNA), circulating tumor cells (CTCs), proteins, and other molecules that can provide valuable information about cancer cells and various types of hemolytic diseases.

Blood contains various type of cell with versatile nature that provides precise information about the patient's present condition. Also, blood samples are relatively easy to collect and can be routinely obtained by trained healthcare professionals. This convenience and accessibility make blood the preferred sample type for liquid biopsy tests in most cases, ensuring that a larger pool of patients can undergo testing.

By Product

Assay kits and consumables dominate the liquid biopsy market as they hold 55.8% of the market share in 2023 and are projected to show significant growth in the forecasted period of 2023 to 2032. These products have a critical function in the global liquid biopsy marketplace as they may be an important aspect that is required for performing liquid biopsy tests.

Bioassay kits and consumables are vital for sample collection, instruction, and analysis. These kits contain various additives such as reagents, cartridges, and tubes. These consumables are used in huge quantities and require normal replenishment, developing a consistent call for manufacturers. The requirement for these consumables is increasing due to its easy handling method.

This versatility in the application of these kits allows pharmaceutical companies to produce these products to serve various clinical and research needs, making them indispensable in the hospital and healthcare industry.

By Biomarker

Circulating Tumor Cells (CTCs) dominate this market in the case of biomarkers as they hold 39.6% of the market share in 2023 and are expected to show subsequent growth in the upcoming years of 2023 to 2032. Circulating tumor cells dominate this segment because they provide detailed clinical information on cancer progression, metastatic potential, & tumor biology is provided.

It also provides information on early-stage cancer and metastasis, which is important to understand its staging and prognosis. Circulating tumor cell analysis enables real-time monitoring of response to cancer therapy useful for appropriate planning for cancer patients.

Furthermore, changes in the number of circulating tumor cells & their morphology determine the effect of treatment, which is why healthcare professionals often monitor circulating tumor cells in cancer patients during treatment.

Circulating tumor cells are increasingly used in cancer research to study the molecular and genetic characteristics of early and late tumors now researchers have focused primarily on the analysis of circulating tumor cells to provide tumor differentiation is well understood and therapies can be developed for this chronic disease. Therapeutic resources are indicated.

By End-User

Hospitals and healthcare centers dominate the liquid biopsy market in terms of end users as they hold the highest portion of this segment in 2023 and are expected to show significant growth in the upcoming years of 2023 to 2032. The reason hospitals and healthcare centers dominate this market as they are at the forefront of this market as they immediately diagnose and deal with patients who are diagnosed with cancers.

A liquid biopsy is a crucial tool for oncologists and healthcare specialists working in hospitals and healthcare centers, as it is able to detect most cancer cells in their early tiers which may be a lifesaver for the patient. Liquid Biopsy has the ability that revolutionize the healthcare industry. Liquid biopsy's non-invasive nature and specific outcomes make it a viable option for healthcare companies and patients to apply in habitual medical checkups.

Moreover, hospitals and healthcare centers have most of the necessary infrastructure, and, professional clinical specialists are required to perform liquid biopsy checks efficiently and correctly. That is why hospitals and healthcare centers dominate this segment based on end users.

The Liquid Biopsy Market Report is segmented based on the following

By Sample Type

- Blood

- Urine

- Saliva

- Cerebrospinal Fluid

By Product

- Assay Kits & Consumables

- Instruments

- Services

By Biomarker

- Circulating Tumor Cells (CTCs)

- Circulating Tumor DNA (ctDNA)

- Extracellular Vehicles (EVs)

- Others

By End-User

- Hospital and Healthcare Centers

- Academic and Research Centers

How Does Artificial Intelligence Contribute To Improving the Liquid Biopsy Market?

- Enhanced Biomarker Detection & Analysis: AI-powered algorithms can analyze large datasets of circulating tumor DNA (ctDNA), circulating tumor cells (CTCs), and extracellular vesicles with higher precision. This improves early cancer detection, even at ultra-low concentrations.

- Faster & More Accurate Diagnosis: AI accelerates data interpretation from liquid biopsy tests, reducing the time required for cancer diagnosis. Machine learning models enhance the differentiation between benign and malignant mutations, minimizing false positives and false negatives.

- Personalized Treatment & Predictive Analytics: AI helps identify specific genetic mutations and tumor profiles, aiding in personalized therapy selection. Predictive analytics further guide oncologists in forecasting disease progression and adjusting treatment strategies accordingly.

- Automated Workflow & Cost Efficiency: AI streamlines the workflow by automating data processing, reducing human error, and lowering operational costs. This increases scalability, making liquid biopsy more accessible and affordable.

- Improved Minimal Residual Disease (MRD) Detection: AI enhances the detection of minimal residual disease (MRD) by identifying subtle tumor DNA traces in blood samples, allowing for early intervention and relapse prevention.

Liquid Biopsy Market Regional Analysis

North America dominates the global liquid biopsy market as it

holds 52.5% of the market share in 2023 and is expected to show great growth in the years of 2023 to 2032. This region dominates the global liquid biopsy market as it is the home of a well-developed hospital and healthcare infrastructure that has various sources of investment, which provide it with an ideal ecosystem for research & and development. These highly developed facilities support the development and growth of advanced diagnostic technologies like liquid biopsy.

Moreover, this region also fosters leading

biotechnology & pharmaceutical companies and academic research centers, which further boost the development of liquid biopsy technologies. These industries and institutions are actively involved in the growth of this market as they offer investments to drive the development of highly effective & and precise liquid biopsy tests and products.

In the initial phase of this market, North America was the first to adapt and clinically validate the liquid biopsy techniques, leading to the integration of this market in the healthcare sector for clinical practice and cancer diagnostics. This initiative taken by this region in the early phase of the global liquid biopsy market created a strong foundation for this market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Liquid Biopsy Market Competitive Landscape

The competitive landscape of the global liquid biopsy market is driven by various established players healthcare companies & and startups, competing with each other to gain a competitive edge over others in this rapidly growing industry. These companies offer an extensive range of services and products for liquid biopsy tests, like blood collection devices, sample processing for diagnostic tests, and related studies within the global liquid biopsy market.

This market is led by a few major pharmaceutical giants like Roche, Illumina, Thermo Fisher Scientific, and Qiagen, which have dominated a significant portion of this market. These groups offer a wide range of products that strengthen their market position. This competition between various healthcare & and pharmaceutical giants is further pushing the ongoing research and development, and mergers which are driving the growth of this market.

The use of liquid biopsy for diagnostics of numerous ailments, no longer simply most cancer detection, is expected to push the competitive panorama of the global liquid biopsy market in the coming years. Some of the major key players in the Global Liquid Biopsy Market are ANGLE p.C, Oncimmune, Thermo Fisher Scientific Inc., Epigenomics AG, and plenty of others.

Some of the prominent players in the Global Liquid Biopsy Market are:

- Thermo Fisher Scientific Inc.

- Oncimmune

- Guardant Health Inc.

- Myriad Genetics Inc.

- Biocept Inc.

- Lucence Health Inc.

- Freenome Holdings Inc.

- QIAGEN

- Illumina Inc.

- Epigenomics AG

- Other Key Players

Liquid Biopsy Market Report Details

| Report Characteristics |

| Market Size (2023) |

USD 10.7 Bn |

| Forecast Value (2032) |

USD 33.7 Bn |

| CAGR (2023-2032) |

13.6% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Sample Type (Blood, Urine, Saliva and Cerebrospinal Fluid), By Product (Assay Kits & Consumables, Instruments and Services), By Biomarker (Circulating Tumor Cells (CTCs), Circulating Tumor DNA (ctDNA), Extracellular Vehicles (EVs)and Others), By End-User (Hospital and Healthcare Centers and Academic and Research Centers) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Thermo Fisher Scientific Inc., Oncimmune, Guardant Health Inc., Myriad Genetics Inc., Biocept Inc., Lucence Health Inc., Freenome Holdings Inc., F. Hoffmann-La Roche Ltd., QIAGEN, Illumina Inc., Epigenomics AG, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Liquid Biopsy Market is estimated to reach USD 10.7 billion in 2023, which is further

expected to reach USD 33.7 billion by 2032.

North America dominates the Global Liquid Biopsy Market with a share of 52.5% in 2023.

Some of the major key players in the Global Liquid Biopsy Market are ANGLE plc, Oncimmune, Guardant

Health, Inc., Myriad Genetics Inc., Biocept Inc., Lucence Health Inc., Freenome Holdings Inc., F.

Hoffmann-La Roche Ltd., QIAGEN, Illumina Inc., Thermo Fisher Scientific Inc., Epigenomics AG and many

others.

The market is growing at a CAGR of 13.6 percent over the forecasted period.