The global LoRa and LoRaWAN IoT market is experiencing robust growth, driven by the growing need for long-range, low-power communication solutions throughout various sectors. LoRa (Long Range) and LoRaWAN (Long Range Wide Area Network) technology permit IoT devices to communicate over large distances with minimal energy consumption, making them perfect for applications in smart agriculture, smart towns, commercial automation, and asset tracking. The market's growth is fueled by the growing adoption of IoT devices, improvements in network infrastructure, and developing recognition of the benefits of LoRaWAN's low cost, scalability, and simplicity of deployment.

Key players in the market include Semtech Corporation, Cisco Systems, and Actility, which are investing in R&D and strategic partnerships to enhance their product offerings. Geographically, North America and Europe lead the market due to their advanced technological ecosystems and strong cognizance of IoT innovations. Meanwhile, Asia-Pacific is predicted to witness considerable growth, pushed through growing urbanization, smart city projects, and supportive authorities’ initiatives.

Key Takeaways

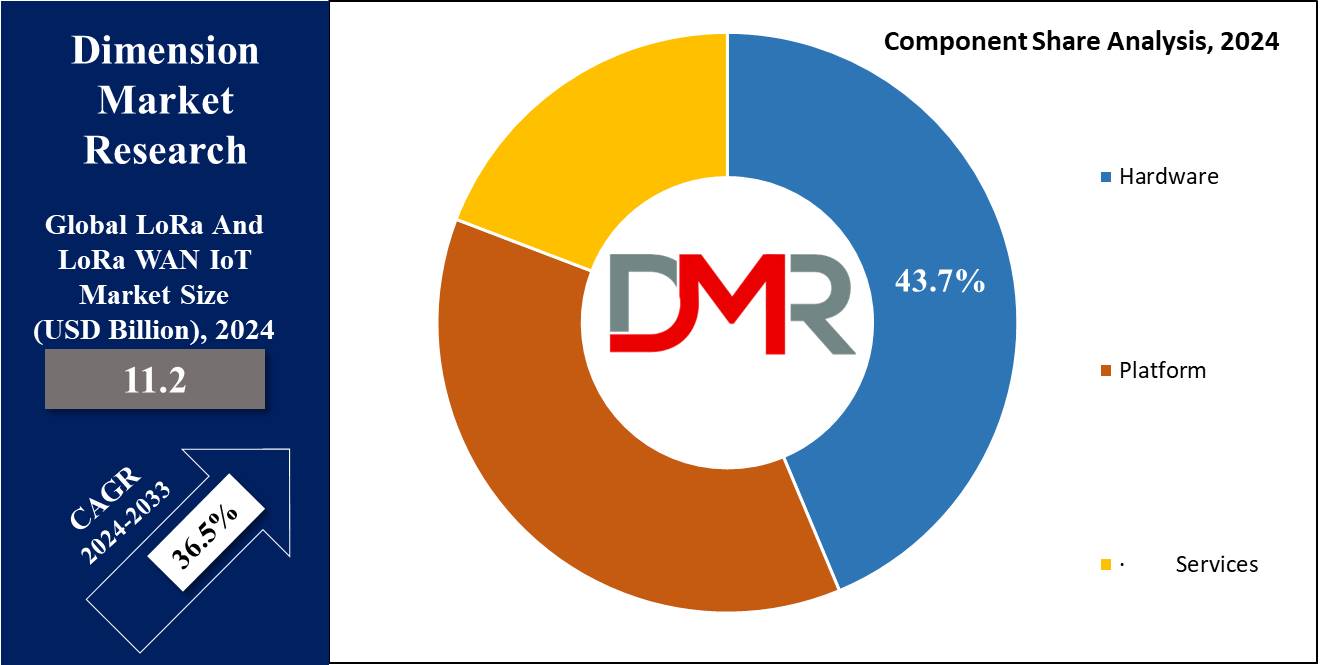

- Market Value: The market size is projected to reach a market value of USD 183.9 billion in 2033, in comparison to USD 11.2 billion in 2024 at a CAGR of 36.5%.

- Market Definition: LoRa is a low-energy, long-range wireless communication technology, whilst LoRaWAN is a network protocol allowing extensive-area IoT applications, helping devices with minimal energy consumption over significant distances.

- By Component Segment Analysis: Hardware is expected to exert its dominance in the component segment with the 43.7% market share by the end of 2024.

- By Network Architecture Segment Analysis: Public LoRaWAN networks are projected to exert prominence in this segment with the highest market share in 2024.

- By End User Segment Analysis: The manufacturing sector is projected to exert their dominance in the end-user segment with 28.0% of market value by the end of 2024.

- Regional Analysis: North America is projected to dominate the global LoRa and LoRaWAN IoT market with 40.1% of the market share in 2024.

Use Cases

- Smart Agriculture: LoRaWAN sensors screen soil moisture, temperature, and crop fitness, enabling farmers to optimize irrigation, lessen water utilization, and boost crop yield efficiently.

- Smart Cities: LoRa networks manage street lighting, waste collection, and air high-quality monitoring, enhancing city infrastructure, reducing energy consumption, and enhancing residents' quality of life.

- Asset Tracking: LoRaWAN devices track the location and status of assets in real time, providing valuable data for logistics, inventory management, and theft prevention across various industries.

- Environmental Monitoring: LoRa sensors collect data on weather conditions, water quality, and wildlife activity, facilitating early detection of environmental.

Market Dynamic

Trends

Growing Adoption of LPWAN TechnologiesThe increasing need for low-power wide area network (LPWAN) technologies, like LoRa, is a considerable trend. LPWANs are essential for IoT programs that require wide coverage and energy efficiency. This trend is propelled with the aid of the need to assist diverse packages, from smart cities to industrial IoT (IIoT), that demand lengthy-range communique with minimal energy consumption, driving the increase of the LoRa and LoRaWAN IoT market.

Integration with Other Wireless TechnologiesAnother trend is the combination of LoRaWAN with different wi-fi technologies, which include 5G and Wi-Fi. This convergence allows seamless connectivity and improved coverage, supporting a broader range of IoT applications. It enhances the flexibility and scalability of IoT networks, taking into consideration extra robust and comprehensive IoT solutions that can operate efficiently in numerous environments, consequently bolstering market enlargement.

Growth Drivers

Increasing Smart City InitiativesInvestments in smart city initiatives are a major growth driver. It is intended to improve urban residing through intelligent solutions for transportation, strength, fitness, and waste management. The rising demand for high-speed, energy-efficient conversation networks in

smart towns fosters the adoption of LoRa and LoRaWAN technologies, driving marketplace increase with the aid of permitting scalable and cost-effective IoT deployments.

Demand for Long-Distance, Low-Power Connectivity

The want for efficient, long-distance conversation in IoT packages drives the demand for LoRaWAN's low-electricity, wide-area community connectivity. This is particularly critical in sectors like agriculture, logistics, and industrial automation, where battery conservation and price performance are paramount. The precise potential of LoRaWAN to provide dependable, long-range communication even as minimizing electricity use underpins its increasing adoption and market growth.

Growth Opportunities

Expansion in Industrial IoT

The industrial IoT (IIoT) sector offers many opportunities for LoRa and LoRaWAN technology. The need for strong, scalable, and low-energy communication solutions in production and logistics drives the adoption of LoRaWAN. These technologies facilitate real-time monitoring and automation, enhancing operational performance and productiveness.

Emergence of Smart Agriculture

Smart agriculture is another promising area for growth. LoRa and LoRaWAN technologies allow specific tracking and management of agricultural sources by IoT devices, enhancing crop yields and resource performance. The ability to cover large, rural areas with minimum infrastructure investment makes these technologies ideal for agricultural applications, offering massive market growth opportunities.

Restraints

Data Security and Privacy Concerns

Data safety and privacy issues pose sizable restraints. As IoT devices become major targets for cyberattacks, ensuring secure data transmission is crucial. LoRaWAN networks face demanding situations along with potential encryption vulnerabilities and susceptibility to denial-of-service (DoS) attacks. These security concerns can prevent the widespread adoption and growth of LoRa and LoRaWAN technology, as end users demand robust security measures.

Regulatory and Spectrum Challenges

Compliance with evolving regulatory standards and spectrum policies is another restraint. LoRaWAN deployments need to adhere to stringent rules governing spectrum utilization, which could range across areas. Navigating those regulatory landscapes requires continuous monitoring and adoption, posing demanding situations for market players and probably slowing down the deployment and expansion of LoRaWAN networks globally.

Research Scope and Analysis

By Component

In the LoRa and LoRaWAN IoT market, the hardware, encompassing system on chip (SoC), connectivity modules, and networking gateways, is projected to dominate this market with 43.7% of the market share in 2024. This section's dominance is attributed to the foundational function hardware performs in organizing and expanding IoT networks. During the forecast period, the market size for hardware is projected to develop substantially, pushed by the increasing adoption of IoT solutions throughout diverse industries.

Hardware components are important for enabling wide-area network connectivity and ensuring reliable communication between IoT devices. SoCs and connectivity modules facilitate the combination of LoRa and LoRaWAN technology into a wide range of IoT applications, from industrial IoT to smart agriculture. Networking gateways are essential for connecting these devices to the cloud, allowing real-time data transmission and control.

The global forecast for the LoRaWAN IoT marketplace size suggests that as end user, which includes smart cities and smart homes, hold to enforce IoT solutions, the need for robust hardware will increase. The growth of the marketplace is similarly supported by improvements in IoT technology and the need for scalable, cost-effective solutions. Thus, hardware remains a key market segment within the global LoRa and LoRaWAN IoT industry, driving innovation and adoption throughout diverse programs.

By Network Architecture

Public LoRaWAN networks are expected to dominate the LoRa and LoRaWAN IoT marketplace because of their expansive coverage, cost-efficiency, and capacity to support large-scale IoT deployments. These networks provide large-location network connectivity, which is crucial for connecting a range of IoT devices across vast geographical areas. During the forecast period, the marketplace size for public LoRaWAN networks is projected to see extensive growth, driven by their scalability and flexibility.

The adoption of public LoRaWAN networks allows end users, such as smart towns and industrial IoT applications, to leverage existing infrastructure without the need for huge investment in private network development. This is especially advantageous for smart city initiatives wherein a wide variety of IoT applications, from smart lights to environmental tracking, require dependable and considerable coverage.

Furthermore, public LoRaWAN networks facilitate the integration of several IoT devices and sensors, assisting the numerous needs of various sectors, inclusive of smart homes, smart agriculture, and smart

healthcare. The ability to speedy and effectively deploy IoT solutions over public networks contributes to their dominant market proportion.

Overall, the public LoRaWAN IoT market size is strengthened by the growing demand for efficient, large-scale IoT deployments, making it a key market section within the global LoRa and LoRaWAN IoT landscape.

By Application

Asset monitoring is projected to dominate the LoRa and LoRaWAN IoT market due to its critical function in improving operational efficiency and lowering losses throughout various industries. This software leverages the wide-area network community connectivity supplied by LoRaWAN to provide real-time visibility and control of assets, that are vital for sectors like logistics, manufacturing, and supply chain management.

The capability to monitor asset location, status, and condition by IoT devices and sensors significantly improves stock management, reduces robbery, and optimizes asset utilization. For example, in the logistics industry, asset monitoring solutions enable corporations to monitor the motion of goods in transit, ensuring well-timed deliveries and minimizing disruptions. In manufacturing, those solutions help track the location and utilization of tools and equipment, improving productivity and lowering downtime.

During the forecast period, the market size for asset tracking solutions is predicted to develop notably due to the increasing adoption of IoT technologies aimed toward enhancing operational transparency and performance.

The integration of LoRa and LoRaWAN technologies in asset tracking offers a scalable, cost-effective solution with long battery life and extensive coverage, making it the biggest market section within the global LoRa and LoRaWAN IoT industry. This growth is similarly driven with the aid of the demand for reliable, real-time asset management solutions that support large-scale IoT deployments.

By End User

In the LoRa and LoRaWAN IoT market, the manufacturing sector is expected to hold the highest market share of about 28.0% in 2024, pushed through the huge benefits these technologies provide to industrial IoT applications.

During the forecast period, the marketplace size for LoRa and LoRaWAN IoT solutions in manufacturing is projected to experience a rapid increase. The integration of LoRa and LoRaWAN technology enables manufacturers to establish wide-area network connectivity, facilitating real-time monitoring and management of various processes.

Manufacturing operations benefit from the deployment of IoT devices and sensors, which improve performance, lessen downtime, and optimize resource usage. The capability to track assets, monitor device fitness, and predict maintenance needs by IoT application contributes to progressed productiveness and financial savings. As a key marketplace player in the worldwide LoRa and LoRaWAN IoT industry, the manufacturing area leverages this technology to transform traditional factories into clever factories, aligning with Industry 4.0 initiatives.

The adoption of LoRaWAN networks in manufacturing supports massive-scale IoT deployments, providing scalable and stable connectivity solutions. This marketplace phase's boom is in addition supported by the growing need for smart solutions in manufacturing environments, making production the most important market inside the global LoRa and LoRaWAN IoT landscape.

The LoRa and LoRa WAN IoT Market Report is segmented on the basis of the following

By Component

- Hardware

- System on Chip

- Connectivity Modules

- Networking Gateways

- Platform

- Services

- Professional Services

- Consulting

- Deployment and Integration

- Support and Maintenance

By Network Architecture

- Public LoRaWAN Networks

- Private LoRaWAN Networks

By Application

- Asset Tracking

- Industrial IoT

- Smart Agriculture & Livestock Management

- Smart Buildings

- Smart Cities

- Smart Healthcare

- Others

By End User

- Manufacturing

- Retail

- Transportation & Logistics

- Energy & Utilities

- Government & Public Safety

- Enterprise

- Others

Regional Analysis

North America is projected to dominate the global LoRa and LoRa WAN IoT market

with 40.1% of the market share in 2024 because of numerous key elements. This region's sturdy IoT ecosystem, characterized by major technological advancements and wide adoption of IoT solutions, drives its leadership.

Major market players in North America, along with Semtech and Amazon Web Services (AWS), continuously innovate and amplify the abilities of LoRa and LoRa WAN technologies. The presence of superior infrastructure supports large-scale IoT deployments, together with smart city projects and industrial IoT applications, contributing to the regions holding the largest market percentage.

During the forecast period, North America's market growth is fueled by growing investments in smart healthcare, smart homes, and smart agriculture, leveraging LoRaWAN networks for more improved connectivity and efficiency. The integration of LoRa and LoRaWAN technologies throughout diverse market segments, from commercial IoT to smart city packages, ensures the region maintains the largest market size. Moreover, end users in North America gain from an extensive range of IoT devices and sensors, supported by a strong network infrastructure, facilitating seamless IoT deployments and operations.

Overall, the comprehensive adoption of IoT technologies and the proactive approach to implementing smart city initiatives position North America as the biggest marketplace inside the global LoRa and LoRaWAN IoT industry.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The LoRa and LoRaWAN IoT market is characterized by strict competition, pushed with the aid of fast technological advancements and various programs throughout various industries. Key players like Semtech Corporation, the inventor of the LoRa technology, lead the marketplace with continuous innovation, including the LoRa Connect LR1121 transceiver and the XCVR Development Board. Amazon Web Services (AWS) has significantly enhanced its IoT offerings through partnerships, along with its collaboration with Semtech for LoRa Cloud GNSS services and Everynet for public LoRaWAN network support.

Other distinguished competitors consist of Sierra Wireless, which collaborates with major telecom operators like Orange to amplify IoT connectivity solutions, and Nwave, which gives specialized IoT solutions like wireless parking guidance systems. Advantech and Altizon's joint efforts aim to streamline industrial IoT applications, emphasizing factory transformations. Additionally, Lacuna Space and Omnispace are pioneering direct-to-satellite IoT connectivity, broadening the marketplace's reach. This competitive landscape fosters innovation and expansion, making the LoRa and LoRaWAN market dynamic and highly competitive.

Some of the prominent players in the Global LoRa and LoRa WAN IoT Market are

- Semtech Corporation

- Advantech Co. Ltd.

- NEC Corporation

- Tata Communications Limited

- Nwave Technologies, Inc.

- Orange S.A.

- Bosch Sensortec GmbH (Robert Bosch GmbH)

- Amazon Web Services Inc.

- Datacake GmbH

- RAKwireless Technology Limited

- Other Key Players

Recent Developments

- In June 2023, Nwave launched a wireless Parking Guidance Solution that provides real-time data on parking space availability, helping drivers find parking more efficiently. The solution includes sensors, smart mobile applications, and real-time data tracking.

- In May 2023, Orange entered into an agreement with Eyesye, a company offering edge mobile IoT connectivity solutions. This agreement will allow Eyesye to leverage Orange's IoT Roaming solution through their global connectivity agreement.

- In March 2023, Semtech Corporation launched the LoRa Connect LR1121, a transceiver offering enhanced RF performance with multi-band diversity. This low-power chip supports global connectivity and is designed for IoT endpoints that require long-range communication.

- In April 2023, Advantech partnered with Altizon and Datonis Digital Factory to release a joint solution aimed at transforming operations into smart factories with minimal capital investment and rapid modernization.

- In April 2023, Semtech Corporation introduced the XCVR Development Board and Reference Design, integrating the LoRa® Sub-GHz Radio Transceiver. This new development board aims to simplify the development process and reduce time-to-market for solutions in various sectors, including supply chain, logistics, building management, industrial control, and agriculture.

- In April 2023, AWS IoT Core for LoRaWAN, in collaboration with Everynet's publicly accessible LoRaWAN networks, introduced public network support for IoT systems based on the LoRaWAN standard. This update allows users to easily connect their IoT devices to the cloud, register them through the AWS IoT console, and start receiving data quickly.

- In January 2023, Sierra Wireless and Orange partnered to enhance connectivity for users and bolster Smart Connectivity services. The collaboration aims to provide more reliable and expansive IoT solutions.

- In January 2023, Comcast and Toto deployed Comcast's MachineQ platform to install IoT products in smart restrooms across high-traffic public areas. This initiative is expected to improve maintenance efficiency and user experience in these restrooms.

- In November 2022, Semtech entered a strategic agreement with Amazon Web Services (AWS) to license its LoRa Cloud global navigation satellite system (GNSS) geolocation services, enhancing AWS's IoT capabilities.