Market Overview

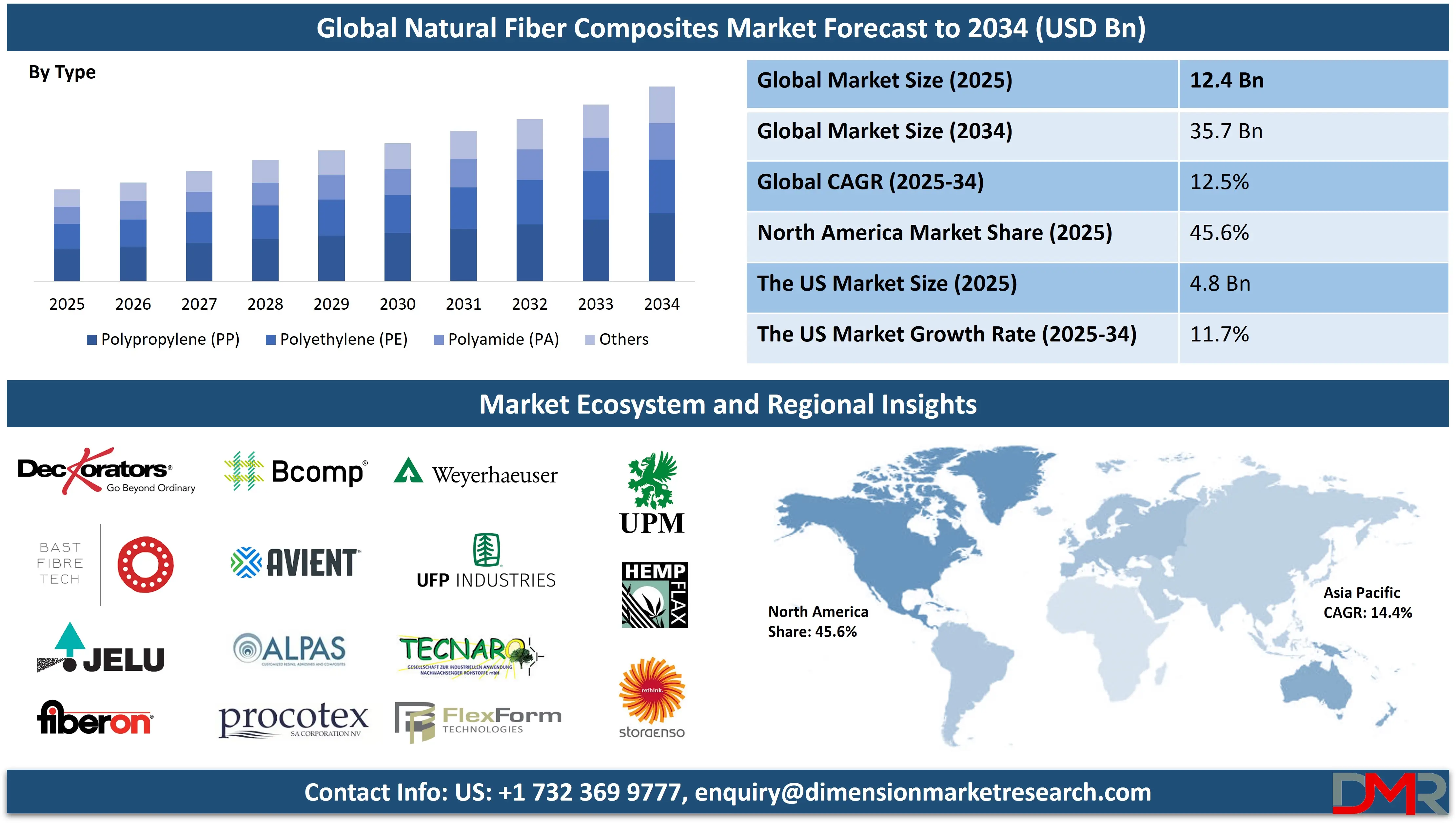

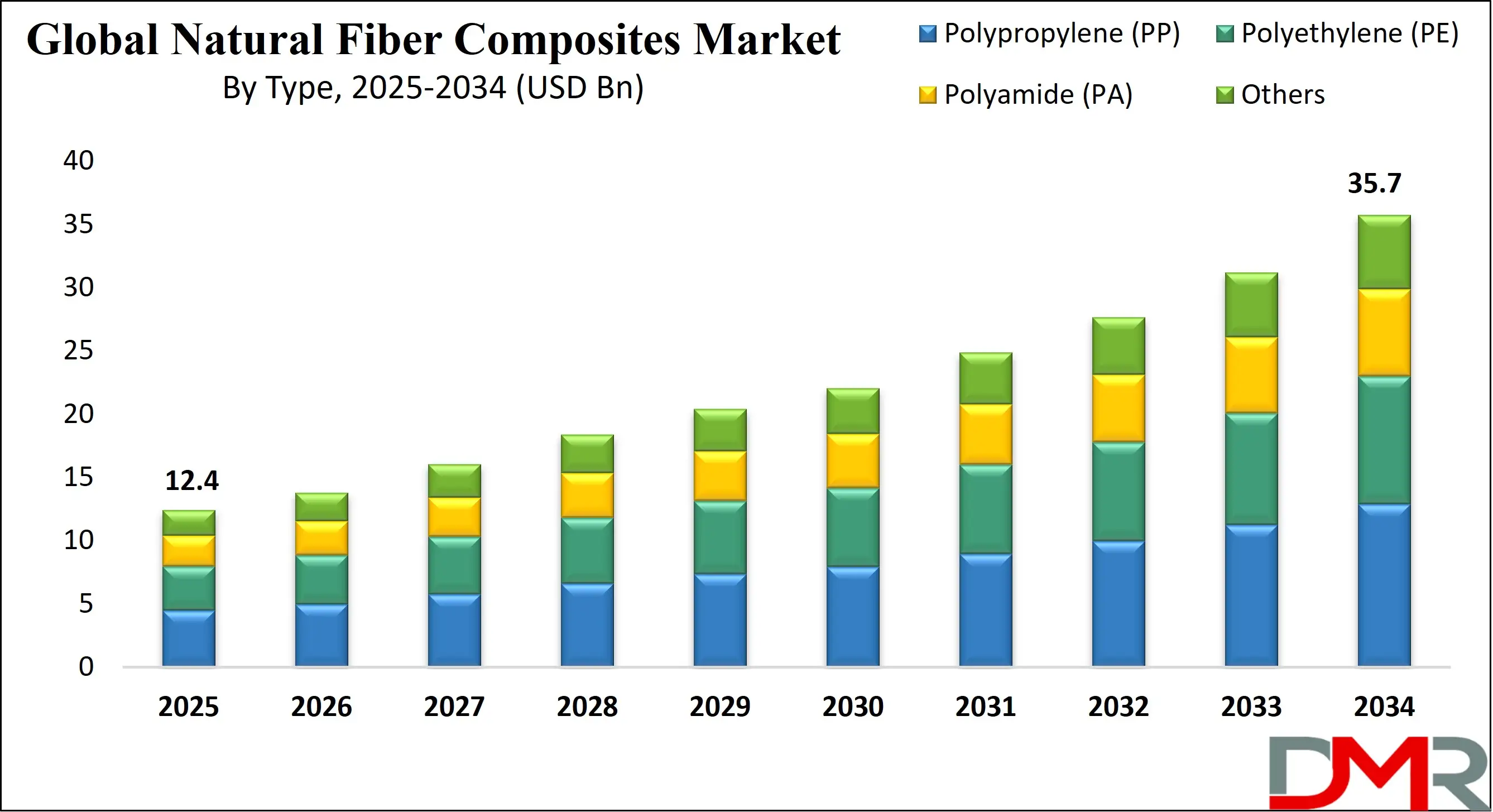

The Global Natural Fiber Composites Market is projected to reach USD 12.4 billion in 2025 and grow at a compound annual growth rate of 12.5% from there until 2034 to reach a value of USD 35.7 billion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global natural fiber composites market is undergoing a rapid transformation, driven by an increasing demand for sustainable and lightweight materials across industries such as automotive, construction, electronics, and packaging. The environmental benefits of using renewable fibers like wood, flax, hemp, cotton, and kenaf over traditional glass and carbon fiber composites are positioning this market as a key enabler of low-emission and circular economy practices. Government regulations, particularly in Europe and North America, that restrict non-biodegradable materials are accelerating the transition toward greener alternatives. Integration with Hybrid Cloud platforms is enabling manufacturers to monitor production, optimize supply chains, and manage composite material performance across multiple sites.

Despite this momentum, the industry faces several challenges. These include mechanical inconsistencies due to natural fiber variability, high moisture absorption, and weaker adhesion to resins compared to synthetic fibers. However, advances in surface treatments, hybrid composites, and polymer-fiber bonding technologies are progressively overcoming these restraints. Emerging economies are investing in fiber crop cultivation, enhancing the supply chain for natural fiber inputs. In addition, rapid innovation in thermoplastics like Polypropylene Compounds and polyamide is making NF composites viable for a broader range of end-use cases. Specialty composites reinforced with Para-aramid Fibers are also being developed for high-strength, impact-resistant applications in automotive and protective equipment.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

A significant opportunity lies in the development of bio-based and recyclable resins, which can further increase the biodegradability and sustainability quotient of these composites. With the growing demand from electric vehicle (EV) makers, sustainable architecture firms, and eco-conscious consumer product manufacturers. The growing adoption of natural fibers offers a cleaner, lighter, and more environmentally aligned future for composite materials. The combination of Polypropylene Compounds with natural fibers is expanding possibilities for lightweight automotive panels, while Hybrid Cloud platforms support design optimization and production monitoring.

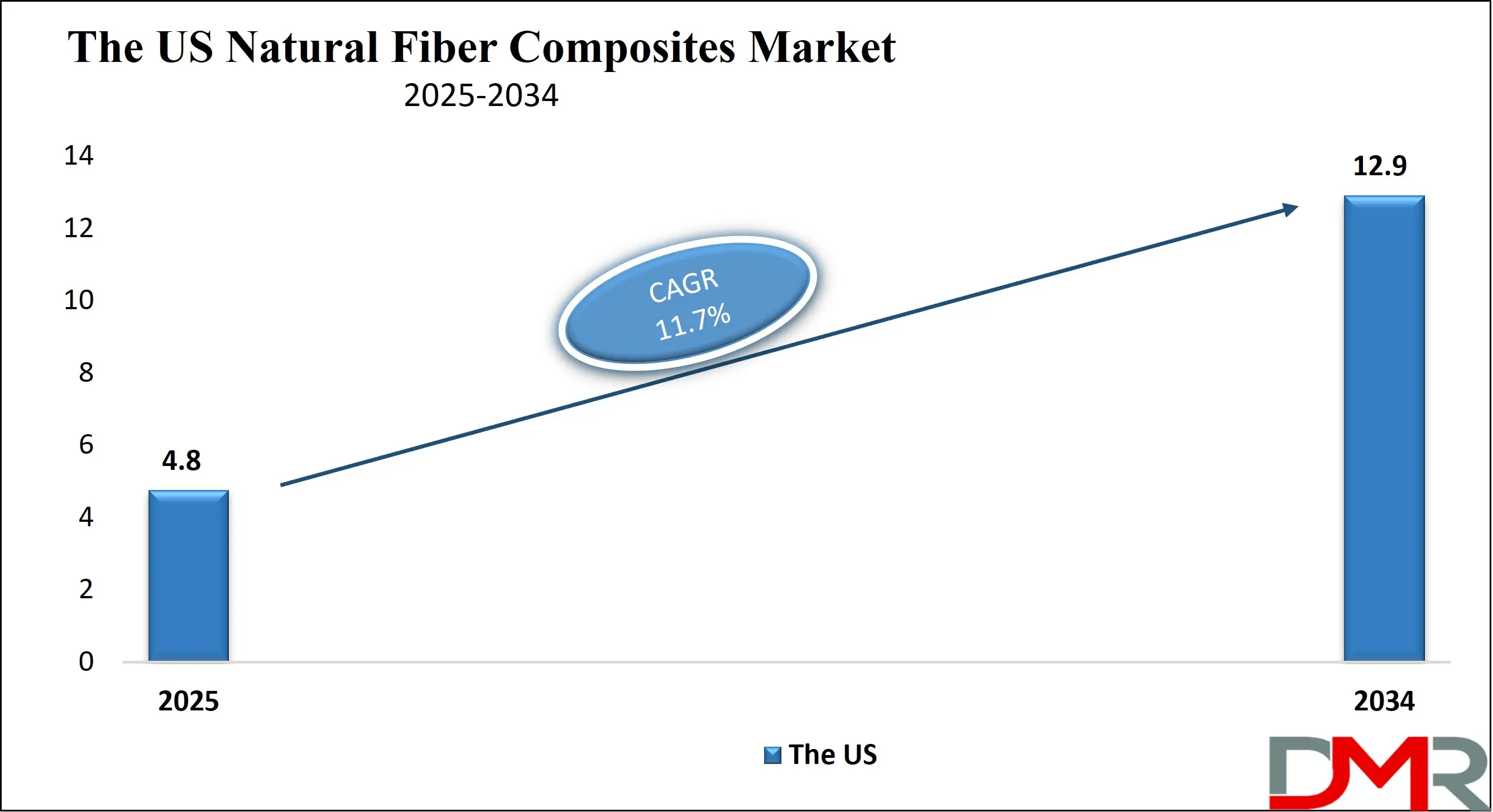

The US Natural Fiber Composites Market

The US Natural Fiber Composites Market is projected to reach USD 4.8 billion in 2025 at a compound annual growth rate of 11.7% over its forecast period.

The United States natural fiber composites market is expanding steadily, supported by strong federal and state-level initiatives promoting sustainable materials, renewable agriculture, and green construction. According to the U.S. Forest Service and the USDA Forest Products Laboratory, extensive research and grants are being provided to develop wood-derived composites and nanocellulose applications. These efforts are directed toward optimizing low-grade biomass from American forests, thereby adding value to underutilized resources while reducing wildfire risks. The integration of Hybrid Cloud systems facilitates real-time monitoring and quality assurance across multiple production facilities.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Demographically, the U.S. benefits from a large base of environmentally aware consumers and a strong DIY culture, particularly among millennials and Gen Z. Their preference for sustainable housing and green mobility solutions is stimulating demand for natural fiber materials in both residential construction and automotive interiors. Furthermore, the U.S. Department of Energy’s Lightweight Materials program encourages automotive manufacturers to reduce vehicle mass through advanced bio-composite materials, thus enabling compliance with federal fuel economy standards.

In the construction sector, the 2022 update of the International Residential Code officially approved hemp-lime (hempcrete) for wall construction, boosting commercial adoption. Moreover, the United States Environmental Protection Agency’s focus on sustainable procurement has catalyzed demand for biodegradable and renewable materials in government buildings and infrastructure projects.

However, challenges persist in scaling fiber crop production and ensuring consistent fiber quality across suppliers. Standardization gaps in testing and certification also limit broader commercial adoption. Despite this, the U.S. remains a key innovation hub for natural fiber composites due to its strong R&D ecosystem, agricultural diversity, and proactive sustainability policies.

The European Natural Fiber Composites Market

The European Natural Fiber Composites Market is estimated to be valued at USD 1.8 billion in 2025 and is further anticipated to reach USD 4.0 billion by 2034 at a CAGR of 9.0%.

Europe is at the forefront of the global natural fiber composites market, driven by rigorous environmental regulations, widespread consumer demand for eco-friendly products, and a well-established agricultural base for flax, hemp, and jute cultivation. The European Union’s Circular Economy Action Plan, the Green Deal, and ecodesign directives actively promote the use of renewable materials in industrial applications, pushing manufacturers to replace synthetic composites with natural alternatives.

Countries such as France, Germany, and the Netherlands are leading producers of natural fibers and house some of the most advanced composite manufacturers, including UPM-Kymmene, Bcomp, and Tecnaro. In the automotive sector, German automakers like BMW and Audi incorporate flax-reinforced polypropylene panels in vehicle interiors, enhancing sustainability while meeting strict emissions and recyclability standards.

In the construction industry, EU recovery funds and green infrastructure plans have accelerated the use of NF composites in insulation panels, roofing, and façades. Public-private R&D programs receive support through Horizon Europe funding, which is facilitating innovation in moisture-resistant coatings and hybrid composite technologies.

European consumers, especially in Scandinavia and Western Europe, demonstrate a strong preference for low-carbon, biodegradable, and responsibly sourced materials in household products, packaging, and electronics. This demand has fostered an ecosystem that supports both industrial scalability and craft-based innovation.

Despite its maturity, the European NF composites market faces ongoing challenges, including high production costs and moisture absorption issues. However, advancements in fiber treatment and continuous policy support position the region for sustained growth and leadership in eco-material innovation.

The Japan Natural Fiber Composites Market

The Japan Natural Fiber Composites Market is projected to be valued at USD 74.0 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 1.7 billion in 2034 at a CAGR of 10.0%.

Japan's natural fiber composites market is growing steadily, shaped by the country’s commitment to sustainable development, circular economy goals, and material innovation. Supported by policies from the Ministry of Agriculture, Forestry, and Fisheries, Japan encourages diversification of agricultural outputs into industrial uses. Kenaf, flax, and hemp cultivation have seen pilot programs, particularly in southern Japan, where climate conditions support fiber crop growth.

Japanese manufacturers have traditionally excelled in high-precision molding technologies such as pultrusion and injection molding, making them ideal for integrating NF composites in electronics, home appliances, and automotive parts. Companies are using hemp and kenaf-reinforced plastics for interior panels and casings in electric vehicles and smart devices, reflecting rising demand for sustainable, lightweight, and durable alternatives.

Demographically, Japan faces an aging population and declining rural economies, leading policymakers to support regional revitalization through biomass utilization. This has spurred investment in decentralized fiber processing units and rural bio-economy clusters. Educational institutions and industrial consortia have also contributed significantly to research in fiber treatment, moisture resistance, and flame retardancy.

In the construction sector, Japan is gradually adopting wood and hemp-based composites in low-rise buildings, particularly as national energy efficiency targets for housing become more stringent. Building material suppliers are innovating hybrid boards that offer both thermal insulation and seismic resilience, critical factors in Japan’s construction environment.

Despite limited arable land for fiber crops, Japan mitigates this by forming strategic trade agreements with fiber-rich countries and investing in vertical supply chain integration. The country’s technological strength and sustainability focus position it well in the Asia-Pacific NF composites market.

Global Natural Fiber Composites Market: Key Takeaways

- Global Market Size Insights: The Global Natural Fiber Composites Market size is estimated to have a value of USD 12.4 billion in 2025 and is expected to reach USD 35.7 billion by the end of 2034.

- The US Market Size Insights: The US Natural Fiber Composites Market is projected to be valued at USD 4.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 12.9 billion in 2034 at a CAGR of 11.7%.

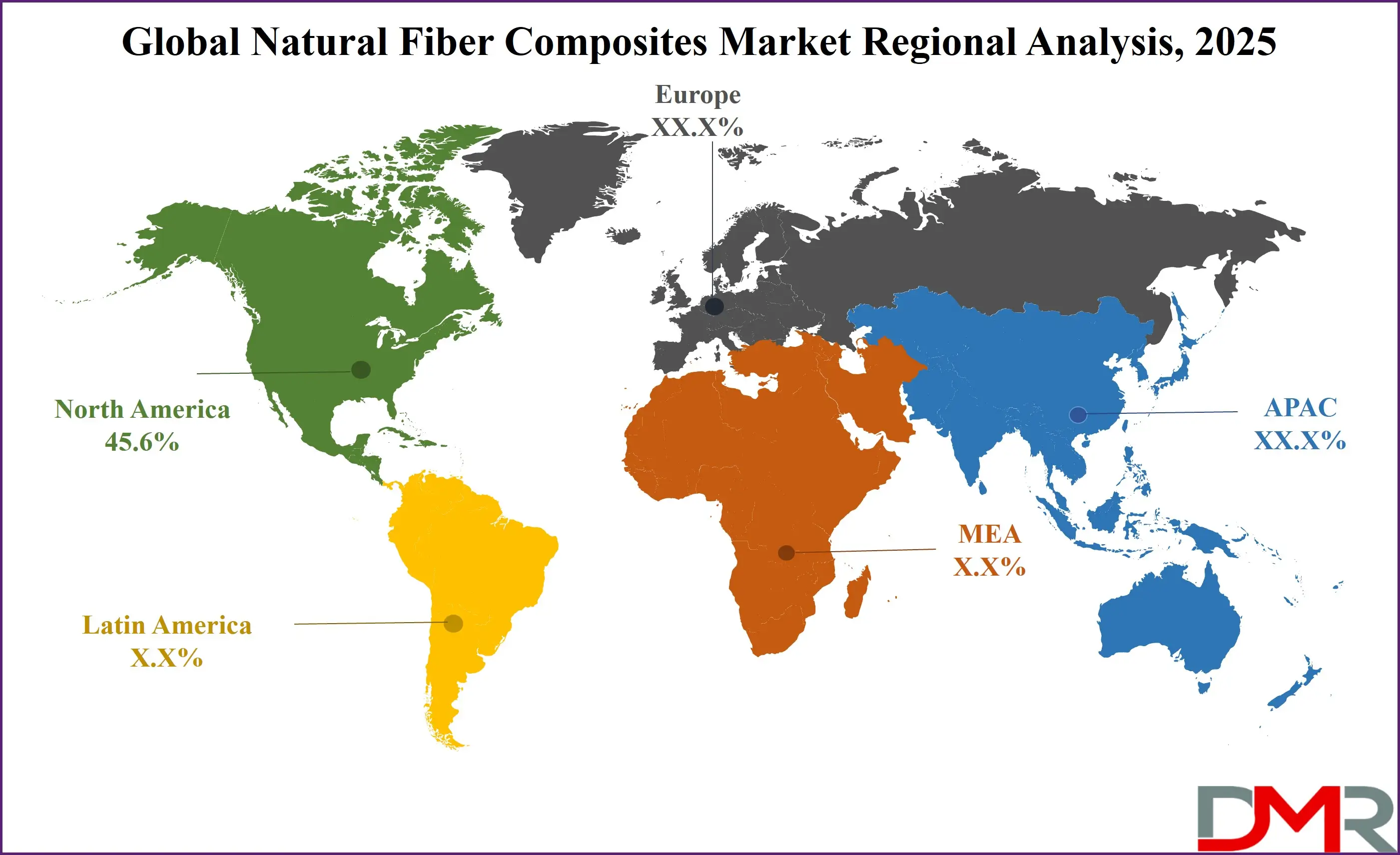

- Regional Insights: North America is expected to have the largest market share in the Global Natural Fiber Composites Market with a share of about 45.6% in 2025.

- Key Players: Some of the major key players in the Global Natural Fiber Composites Market are UPM-Kymmene Corporation, Trex Company Inc., FlexForm Technologies, GreenGran BN, Procotex Corporation SA, Fiberon LLC, Tecnaro GmbH, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 12.5 percent over the forecasted period of 2025.

Global Natural Fiber Composites Market: Use Cases

- Automotive Interiors: Natural fiber composites are widely used in car door panels, dashboards, and seatbacks. Flax, hemp, and kenaf-reinforced polypropylene reduce vehicle weight, enhancing fuel efficiency while meeting sustainability mandates such as Europe’s End-of-Life Vehicle Directive and U.S. CAFÉ standards.

- Eco-Friendly Construction: In green construction, hempcrete blocks and wood-plastic composites offer breathable, fire-resistant, and carbon-negative alternatives to concrete and timber. Builders increasingly use these materials for insulation, wall panels, and decking in net-zero buildings.

- Consumer Electronics: Natural fiber-reinforced casings in speakers, phones, and laptops provide strength, lightweight performance, and aesthetic appeal. With rising e-waste concerns, manufacturers use biodegradable composites to align with circular economy targets and eco-design legislation.

- Furniture Manufacturing: Interior designers prefer natural fiber composites for modern, sustainable furniture. These composites provide a natural finish, durability, and are ideal for molded or minimalistic design pieces such as tables, chairs, and partition walls.

- Sporting Equipment: Flax and hemp-based composites are used in surfboards, snowboards, and bicycles. These materials reduce vibrations and offer improved shock absorption while maintaining high-performance characteristics for professional and recreational athletes alike.

Global Natural Fiber Composites Market: Stats & Facts

USDA Forest Products Laboratory / U.S. Forest Service

- Wood-based composites are used in over 40% of materials in U.S. residential construction, highlighting their structural significance and wide availability.

- The production of composite decking in the U.S. increased from less than 50,000 tons in 1995 to approximately 900,000 tons by 2007, showing the sharp rise in demand for wood-plastic materials.

- Agro-fiber composites such as those using kenaf, jute, and flax are limited by thermal degradation and can be processed only up to 200 °C, restricting certain thermoplastic uses.

- A kenaf–polypropylene blend with 50% fiber by weight absorbs about 1.05% of its weight in water after 24 hours of submersion, demonstrating its moisture sensitivity.

- Automotive panels made with 60% coir fiber and a 3% coupling agent significantly improve both the structural performance and fire resistance of the component.

- Blends containing 25–50% wood flour in polyethylene and 1–2% compatibilizers such as maleic anhydride polyethylene show greatly improved mechanical properties, especially stiffness.

- Tensile and flexural moduli increase with higher natural fiber content; however, tensile strength depends on the presence of surface treatments or coupling agents.

- The U.S. municipal solid waste stream consists of nearly 60% agro-based materials such as wood, paper, yard waste, and textiles, an untapped source of natural fiber feedstock.

European Environmental Agency (EEA) / European Commission / EU Programs

- The per capita CO₂ emissions from textile consumption in the EU were estimated to be about 270 kg per person in 2020, much of which results from synthetic fibers.

- In 2007, EU countries imported €1.7 billion worth of natural fibers, compared to €0.9 billion worth of synthetic fibers, indicating a strong preference for natural materials in certain applications.

- The EU exported €0.6 billion of natural fibers and €0.8 billion of synthetic fibers in the same period, showing a robust internal and external trade network.

- The textile industry in the EU provides 9.5% of total employment across member states but contributes only about 5% of total value added, reflecting lower margins despite high labor intensity.

- The production of composites using wood and natural fibers in the EU increased dramatically from below 50,000 tons in 1995 to approximately 900,000 tons by 2007.

- Germany’s sustainability initiative, known as FONA, funds research into recyclable composite materials, including innovations for better fiber-matrix bonding and biodegradability.

Global and Regional Agricultural or Technical Research Data

- Kenaf crops yield between 1.8 to 2.5 tons per hectare, with yields reaching up to 3.5 tons per hectare under optimal growing conditions.

- The tensile strength of kenaf fiber ranges around 780 megapascals, with an elongation capacity of 9.1% to 12.3% and moisture uptake of 12–14%, making it a competitive reinforcement fiber.

- Kenaf seed oil contains approximately 20.4% oil content by weight, and it is rich in omega-3 and omega-6 fatty acids, providing additional economic utility.

- Hemp cultivation yields typically consist of 1 ton per hectare of bast fiber and 2 to 3 tons per hectare of core fiber, supporting multiple applications from a single harvest.

- In European Union countries, average hemp straw yields range from 6.3 to 7.3 tons per hectare, making it one of the most productive bast fibers.

- In Ontario, Canada, air-dried hemp stalks yielded between 2.6 and 14 tons per hectare, depending on local soil, irrigation, and sunlight conditions, with an average of around 6.1 tons per hectare.

Mechanical and Chemical Properties of Natural Fibers

- The tensile strength of flax fiber ranges between 345 and 1500 megapascals, depending on the treatment and processing conditions.

- Hemp fibers have a tensile strength typically ranging from 550 to 900 megapascals, positioning them well against synthetic fibers in structural applications.

- Jute fibers typically exhibit tensile strengths between 393 and 800 megapascals, though they are more moisture-sensitive than flax or hemp.

- Cotton fibers show tensile strengths between 287 and 597 megapascals, depending on the maturity and processing of the cotton crop.

Innovation Programs and Research Projects (EU and Others)

- The NEWSPEC project in Europe aims to produce carbon fiber from polyethylene at a cost of approximately €10 per kilogram, which is about 30% less expensive than traditional PAN-based carbon fiber.

- The European Union’s “Green Button” ecolabel program promotes sustainable production, including standards for recyclable and bio-based fiber usage.

- Poland’s Institute of Natural Fibres and Medicinal Plants has developed silica-organic fire-retardant coatings for bio-composites and invested in hemp cultivation for degraded land rehabilitation.

- A pilot program in Iceland under the OECD recycled worn textiles into cellulose nanomaterials, demonstrating the potential for high-value recovery from discarded clothing.

Feedstock Usage and Technical Performance Data

- Polyethylene and wood fiber composites using 1–2% maleic anhydride polyethylene as a compatibilizer show marked improvements in mechanical stiffness and reduced water uptake.

- Many agro-based thermoplastic composite panels in construction and automotive applications today use natural fiber contents of up to 60% by weight, balancing sustainability with performance.

Global Natural Fiber Composites Market: Market Dynamics

Driving Factors in the Global Natural Fiber Composites Market

Automotive Industry Lightweighting and Green Procurement Policies

The automotive industry’s ongoing pursuit of weight reduction and sustainability is one of the strongest growth drivers for the natural fiber composites market. As automakers seek to improve fuel efficiency, reduce emissions, and comply with stringent environmental regulations, they are increasingly turning to lightweight, eco-friendly materials. Natural fiber composites such as flax, hemp, and kenaf offer excellent stiffness-to-weight ratios and sound-damping properties while being biodegradable and recyclable. These composites are being used in interior components such as door panels, seat backs, and dashboards in vehicles produced by companies like BMW, Ford, and Mercedes-Benz. With global vehicle emissions standards tightening, such as the EU's CO2 fleet targets and the U.S. EPA’s greenhouse gas regulations, automotive OEMs are adopting NFCs to meet sustainability goals without compromising performance.

Furthermore, the rise of electric vehicles (EVs) is amplifying this need, as EVs demand weight reduction to extend battery range. Government-backed procurement mandates and green public transport initiatives, particularly in Europe and Asia-Pacific, further encourage NFC integration into automotive production. As automotive design shifts toward environmentally responsible materials and lifecycle accountability, the adoption of NFCs in this sector is expected to expand significantly, positioning it as a key engine of growth for the global natural fiber composites industry.

Surge in Sustainable Construction and Green Building Certifications

The construction and infrastructure sector is witnessing a strong shift toward sustainable materials, providing a major growth driver for the natural fiber composites market. Regulatory bodies, urban developers, and architects are increasingly seeking renewable alternatives to synthetic composites for structural and non-structural applications. NFCs offer thermal insulation, acoustic performance, and moisture resistance, making them suitable for ceiling panels, partition boards, wall insulation, and façade systems. Green building certification programs like LEED (Leadership in Energy and Environmental Design), BREEAM (Building Research Establishment Environmental Assessment Method), and India’s GRIHA actively promote the use of bio-based and low-impact construction materials. NFCs also offer an additional advantage: lower embodied energy and carbon emissions compared to materials like fiberglass or aluminum.

Countries like Germany, the Netherlands, and Canada have incorporated NFC-friendly guidelines into their national building codes and infrastructure plans. Additionally, developing economies facing raw material constraints and waste management issues are using agro-residue-based composites as cost-effective construction alternatives. Modular housing projects and prefabricated construction are further driving demand for lightweight and environmentally compatible materials. The rising trend of net-zero buildings and government incentives for green infrastructure globally will continue to stimulate investment and adoption of NFCs in the built environment, accelerating market growth over the next decade.

Restraints in the Global Natural Fiber Composites Market

Variability in Raw Material Quality and Lack of Standardization

One of the primary restraints limiting the large-scale adoption of natural fiber composites is the variability in raw material quality and the lack of international standards. Unlike synthetic fibers, which are engineered under controlled conditions, natural fibers are subject to environmental factors such as soil quality, humidity, harvesting time, and crop species. This variability leads to inconsistencies in fiber length, diameter, moisture content, and tensile strength, affecting composite performance. Moreover, different fibers require customized chemical treatments and compatibilizers to bond effectively with polymer matrices, which complicates mass production. The absence of global standards for testing, classifying, and certifying natural fiber composites further restricts their acceptance in regulated industries like automotive and aerospace.

Manufacturers often face challenges in obtaining consistent fiber batches from suppliers, leading to increased processing times and cost overruns. This unpredictability also deters OEMs from scaling up NFC usage in critical structural applications. Additionally, the storage of natural fibers requires careful environmental control to prevent fungal growth and degradation, increasing logistical costs. Unless uniform processing protocols, fiber grading systems, and international benchmarking standards are widely implemented, the NFC industry will continue to face obstacles in supply chain reliability, product reproducibility, and cross-border regulatory approvals.

Processing Limitations and Compatibility with Thermoplastics

Natural fiber composites face notable processing limitations that constrain their applicability across high-temperature and high-performance environments. Natural fibers such as jute, flax, and hemp begin to degrade thermally above 200°C, restricting their compatibility with several engineering thermoplastics like polycarbonate, polyetheretherketone (PEEK), or polyphenylene sulfide (PPS), which require high processing temperatures. This narrows the choice of usable resins, often confining NFCs to commodity thermoplastics such as polypropylene (PP), polyethylene (PE), or biodegradable alternatives like polylactic acid (PLA). Moreover, natural fibers are hydrophilic, while most polymer matrices are hydrophobic, leading to poor fiber-matrix adhesion without coupling agents or chemical surface treatments.

These additional processes increase production complexity, cost, and energy usage. Moisture absorption by natural fibers during production also causes void formation, swelling, or microbial degradation in the finished product, especially in outdoor or humid environments. In highly regulated sectors like aerospace, marine, or medical, such limitations reduce the confidence in NFC reliability under prolonged stress or exposure. Even in construction, stringent performance benchmarks related to fire resistance, durability, and load-bearing capacity often disqualify NFCs unless hybridized with synthetic reinforcements. These processing and compatibility challenges remain significant technical barriers that must be addressed to enable NFCs to compete with advanced synthetic composite systems.

Opportunities in the Global Natural Fiber Composites Market

Agricultural Waste Utilization and Rural Industrialization

The vast availability of agricultural residues presents an untapped growth opportunity for the natural fiber composites market, especially in regions with strong agricultural bases. Crop residues such as wheat straw, rice husk, sugarcane bagasse, coconut coir, and cotton stalks are currently underutilized or burned, contributing to environmental pollution. By converting these materials into feedstock for composites, industries can address raw material shortages and reduce the environmental burden of agro-waste. Governments in countries like India, Indonesia, Brazil, and Kenya are supporting biomass valorization and rural entrepreneurship through grants, cooperative models, and small-scale industrial units.

Natural fiber processing industries in rural areas offer dual benefits: enhancing local employment and reducing logistics costs for raw material transportation. In addition, startups and research centers are developing mobile fiber extraction units and low-tech composite production models suitable for rural deployment. This approach decentralizes composite manufacturing, opening new value chains in agri-tech, sustainability, and circular economies. Collaborations between agribusinesses, universities, and the private sector can further commercialize these fiber streams and standardize their quality. The potential to convert waste into value-added, high-demand industrial inputs makes this a powerful lever for both economic development and sustainable materials innovation. As such, agricultural waste utilization offers high-impact, scalable opportunities for NFC growth globally.

Expansion into the Packaging and Consumer Goods Industries

The transition toward eco-friendly packaging and sustainable consumer products presents a significant expansion opportunity for the natural fiber composites market. With mounting pressure to reduce plastic pollution and improve product sustainability, industries such as food packaging, retail, cosmetics, and electronics are exploring bio-based alternatives. NFCs offer a viable solution due to their biodegradability, strength, moldability, and potential for aesthetic finishes. Companies are already piloting packaging trays, phone cases, and protective inserts using molded pulp composites reinforced with flax or hemp fibers. In the premium consumer goods sector, brands are incorporating NFCs into furniture, eyewear, accessories, and personal care product designs as part of green branding strategies.

Several jurisdictions, including the European Union, South Korea, and select U.S. states, are implementing bans on single-use plastics and mandating compostable packaging, further catalyzing the need for sustainable materials. Additionally, innovations in plant-based biopolymers such as PLA, PHB, and PBS enhance the compatibility of NFCs in rigid and semi-rigid packaging formats. With major global retailers committing to plastic neutrality and product life cycle transparency, NFCs are well-positioned to enter new B2B and B2C verticals. As consumers increasingly prioritize sustainability and businesses seek alternatives aligned with ESG goals, this segment is poised for rapid and diversified expansion.

Trends in the Global Natural Fiber Composites Market

Rise of Bio-Based and Circular Economy Frameworks Globally

The growing global emphasis on environmental responsibility and carbon-neutral manufacturing is positioning natural fiber composites (NFCs) at the forefront of sustainable materials. As countries adopt circular economy models, especially within the European Union and parts of Asia-Pacific, there is an escalating shift from petroleum-based synthetic composites to renewable, biodegradable alternatives. Natural fibers like flax, hemp, jute, kenaf, and coir are being integrated into biocomposite systems due to their lightweight, recyclability, and lower environmental footprint. With increased scrutiny around Scope 3 emissions and life cycle assessment (LCA) metrics, industries such as automotive, construction, and packaging are rapidly incorporating NFCs in product development.

Automakers, for instance, are using flax or hemp composites to meet lightweighting targets without compromising safety or strength. Legislative frameworks like the EU Green Deal, Canada’s Zero Plastic Waste Agenda, and India's Green Material mandates are directly supporting NFC adoption. The rise of “eco-labels” and product transparency disclosures is also pushing OEMs to source more sustainably, thus accelerating the trend toward NFC usage. These shifts reflect a broader demand for materials that offer performance parity with synthetics while reducing the environmental cost across a product’s lifecycle. As this trend continues, NFCs are expected to gain further prominence, influencing procurement, innovation, and policy design worldwide.

Integration of Advanced Manufacturing and Hybrid Composite Technology

Technological innovation is reshaping the landscape of the natural fiber composites market, particularly through hybrid material systems and advanced manufacturing techniques. Traditional challenges such as poor interfacial bonding between natural fibers and polymer matrices are being addressed through surface treatments, bio-based compatibilizers, and nanocellulose reinforcements. Hybrid composites, where natural fibers are combined with glass, basalt, or carbon fibers, are also growing in popularity, especially in structural and high-load applications. This hybridization enhances strength, dimensional stability, and durability, allowing NFCs to meet stringent industry standards.

Moreover, manufacturing processes such as resin transfer molding (RTM), compression molding, and 3D printing are being adapted for natural fiber usage. These processes ensure better fiber orientation, lower void content, and improved mechanical behavior. In addition, automation and digitalization within molding systems reduce material wastage and improve precision, making NFCs more scalable and industrially viable. R&D efforts across universities and innovation labs in Germany, Canada, and Japan are introducing hybrid NFC prototypes that combine biodegradability with enhanced fatigue resistance and fire retardancy. The convergence of these technologies with sustainable material science is turning NFCs from niche eco-alternatives into high-performance, mainstream engineering materials. As these manufacturing and hybridization trends continue to advance, they will redefine NFC's role in global materials innovation.

Global Natural Fiber Composites Market: Research Scope and Analysis

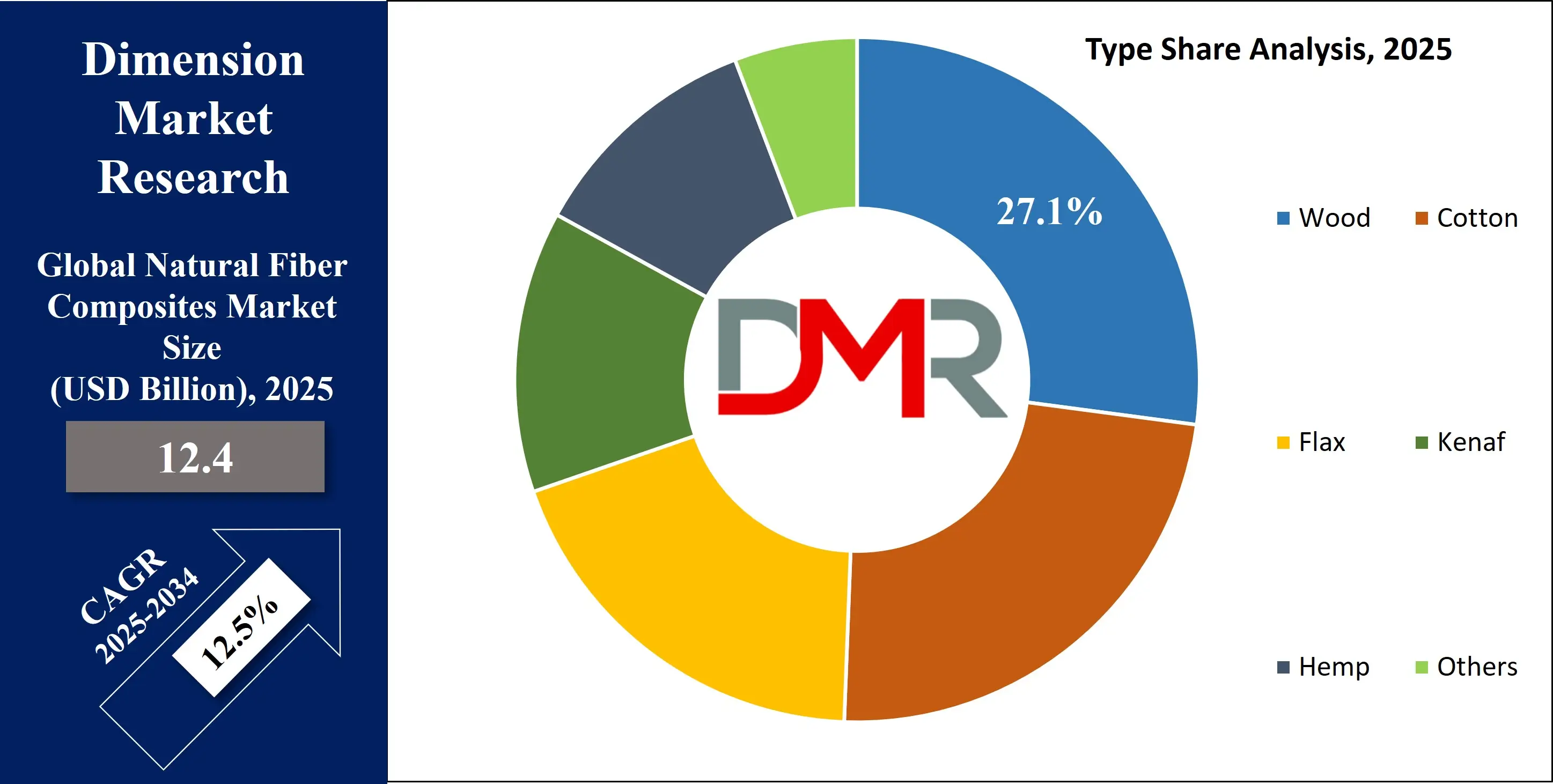

By Type Analysis

Wood-based natural fiber composites are projected to dominate the market with 27.1% of the market share by the end of 2025. It is due to their well-established supply chains, structural versatility, and compatibility with various thermoplastic and thermoset resins. Wood fibers, particularly from species like pine, spruce, and birch, offer consistent mechanical properties, relatively low moisture absorption compared to bast fibers, and better dimensional stability. Their coarse structure allows for high fiber loading and better distribution within polymer matrices, enhancing mechanical performance. In addition, wood fibers are more thermally stable than other plant-based alternatives, which supports better processing during extrusion, compression, and injection molding. Wood-plastic composites (WPCs), a popular subset of NFCs, have gained widespread adoption in applications such as decking, cladding, fencing, door frames, window panels, and outdoor furniture due to their aesthetic wood-like finish, weather resistance, and low maintenance.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Wood is also abundant, affordable, and easily sourced from sawmill residues, forest thinning, or recycled wood waste, aligning well with sustainability objectives. The North American and European construction sectors, where green building codes encourage the use of renewable materials are major consumers of wood-based NFCs. Furthermore, wood fibers bond well with resins like polypropylene, polyethylene, and PVC using standard coupling agents, making them attractive for large-scale industrial production. Their favorable strength-to-weight ratio and processing flexibility also allow wood fiber composites to compete directly with traditional materials like treated lumber and concrete in certain structural applications. As the market continues to move toward renewable materials with minimal performance compromise, the wide availability, established technical reliability, and cost-effectiveness of wood fibers solidify their leadership in the natural fiber composites landscape.

By Resin Type Analysis

Polypropylene (PP) is anticipated to dominate the resin type segment in the natural fiber composites (NFCs) market as it holds 36.0% of the total market share in 2025, due to its cost efficiency, ease of processing, favorable mechanical properties, and excellent compatibility with natural fibers. As a semi-crystalline thermoplastic polymer, PP offers a low density (0.9 g/cm³), good tensile strength, high chemical resistance, and recyclability, making it highly suitable for reinforcing with lignocellulosic fibers. Its low melting point (around 165°C) ensures minimal thermal degradation of natural fibers like flax, hemp, jute, and wood during composite manufacturing, especially in extrusion or compression molding.

PP also demonstrates good adhesion characteristics with treated or surface-modified natural fibers, particularly when used with maleic anhydride-grafted polypropylene (MAPP) as a coupling agent. This compatibility improves stress transfer efficiency between the fiber and matrix, leading to enhanced impact resistance, rigidity, and thermal stability. The automotive industry has been a key driver in this dominance, where PP-based NFCs are used for door panels, trunk liners, seat backs, and dashboards to reduce weight while maintaining structural integrity. The resin’s versatility allows for easy adaptation in processes like injection molding, thermoforming, and 3D printing, which are increasingly used for NFC applications.

Additionally, PP is widely available at a low cost, with mature global supply chains and high recyclability, meeting industry demands for both sustainability and performance. With the rise of circular economy initiatives and the increasing use of recycled polypropylene (rPP), its dominance is further strengthened as it aligns with environmental and regulatory goals without significantly altering processing parameters or final product quality.

By Manufacturing Process Analysis

Compression molding is poised to lead the manufacturing process segment in the natural fiber composites market due to its ability to produce high-strength, uniform components with low material waste and excellent fiber dispersion. This process involves placing the fiber-resin mixture into a heated mold cavity, which is then closed and pressurized to form the desired shape. Compression molding is particularly well-suited for natural fibers because it operates at lower temperatures (usually between 140–200°C), thus preventing fiber degradation and retaining tensile strength.

This method allows for greater fiber loading and improved wetting of the fibers with the resin matrix, enhancing mechanical properties such as stiffness, impact resistance, and dimensional stability. Compression molding also enables the integration of complex geometries and thick-walled sections, making it ideal for structural parts used in automotive, construction, and consumer goods industries. The process yields minimal void content and excellent surface finishes, reducing the need for post-processing, which lowers costs and enhances production speed.

In the automotive sector, for example, door panels, seat backrests, and trunk liners are often made using compression-molded NFCs due to the process’s suitability for medium-to-high volume production with consistent quality. Moreover, the process supports a wide range of thermoplastic and thermoset resins, including PP, PE, and PLA, offering design flexibility. From an environmental perspective, compression molding also generates lower emissions and consumes less energy compared to other high-heat, high-pressure techniques. Its ability to accommodate long, continuous fibers further strengthens the final product’s structural integrity. Collectively, these advantages explain why compression molding dominates NFC manufacturing.

By Application Analysis

The automotive industry is expected to be the dominant application segment in the natural fiber composites market, owing to its high demand for lightweight, eco-friendly, and structurally sound materials that can replace traditional composites and metals. Automakers are increasingly adopting NFCs to meet strict regulatory mandates on vehicle emissions, fuel efficiency, and recyclability. Materials like hemp, kenaf, flax, and jute are used in interior components such as door panels, dashboard backing, seat backs, headliners, and trunk liners, especially in European and Japanese vehicles.

Natural fiber composites offer an excellent stiffness-to-weight ratio, enabling weight reductions of up to 25% compared to conventional glass fiber composites. This directly contributes to enhanced fuel economy and reduced carbon emissions. Moreover, NFCs provide excellent acoustic insulation and vibration dampening desirable properties for enhancing passenger comfort. Car manufacturers like BMW (in the i3), Mercedes-Benz, Ford, and Toyota are already using natural fiber-based parts in various models. For instance, Mercedes integrates kenaf and flax in door modules, while Toyota has explored rice hull and hemp fibers.

In addition to environmental benefits, NFCs are safer in crash situations due to their energy absorption characteristics and lower splintering tendency compared to synthetic fibers. With the global rise of electric vehicles (EVs), where battery efficiency is weight-dependent, NFCs present a strategic material choice. Government regulations such as the EU’s End-of-Life Vehicles (ELV) Directive and similar policies in Japan and the U.S. promote the use of recyclable, bio-based components. Thus, the automotive sector continues to drive the innovation and adoption of NFCs across the value chain.

The Global Natural Fiber Composites Market Report is segmented on the basis of the following

By Type

- Wood

- Cotton

- Flax

- Kenaf

- Hemp

- Others

By Resin Type

- Polypropylene (PP)

- Polyethylene (PE)

- Polyamide (PA)

- Others

By Manufacturing Process

- Compression Molding

- Injection Molding

- Pultrusion

- Others

By Application

- Automotive

- Electronics

- Sporting Goods

- Construction

- Others

Global Natural Fiber Composites Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the global natural fiber composites market as it commands over 45.6% of the total revenue by the end of 2025, due to its strong presence in end-user industries, such as automotive, construction, and aerospace, which are actively adopting sustainable and lightweight materials. Major automotive manufacturers in the U.S., including Ford and General Motors, have integrated natural fiber composites into vehicle components to meet Corporate Average Fuel Economy (CAFE) standards and reduce overall vehicle weight. Furthermore, the region benefits from a well-established infrastructure for R&D and manufacturing of bio-based composites, along with favorable government policies promoting the use of renewable and biodegradable materials.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The U.S. Green Building Council’s push for LEED certification has also increased the demand for sustainable construction materials, supporting market growth. High consumer awareness around sustainability and environmental impact further drives the preference for natural fiber-based products. North America also houses several leading players such as FlexForm Technologies and Trex Company, which continuously innovate in composite technologies. Additionally, supportive federal and state-level incentives for bio-composite adoption enhance market penetration across residential and industrial applications. Collectively, these factors solidify North America’s leadership position in the natural fiber composites market.

Region with the Highest CAGR

Asia Pacific is witnessing the highest compound annual growth rate (CAGR) in the natural fiber composites market due to rapid industrialization, infrastructure development, and expanding automotive production across countries such as China, India, Japan, and South Korea. The growing middle-class population and rising environmental concerns have led to a surge in demand for eco-friendly and cost-effective alternatives to synthetic composites. Governments in the region are introducing policies and incentives encouraging the use of biodegradable materials in manufacturing and construction.

Additionally, the region has abundant availability of natural fibers like jute, coir, hemp, and kenaf, which are low-cost and widely cultivated in countries like India, Bangladesh, and Indonesia. This strong raw material base supports local production and reduces dependency on imports. The ongoing shift of automotive and electronics manufacturing to Asia Pacific for cost advantages is further amplifying demand for lightweight and sustainable materials. With increasing foreign direct investments and technological advancements in composite processing, the region is set to emerge as the fastest-growing market globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Natural Fiber Composites Market: Competitive Landscape

The natural fiber composites market is characterized by a blend of established global players and regional manufacturers focused on innovation, strategic partnerships, and sustainability-driven product development. Leading companies include Trex Company, Inc., FlexForm Technologies, UPM-Kymmene Corporation, Procotex Corporation, Fiberon LLC, and GreenGran BV. These players leverage proprietary technologies to enhance fiber-matrix compatibility, durability, and process efficiency.

Strategic collaborations are prevalent automotive OEMs frequently partner with composite developers to integrate bio-based materials into vehicle interiors and components. For example, FlexForm Technologies has long-standing partnerships with carmakers like Ford and Chrysler for natural fiber composite solutions. Meanwhile, Trex Company leads in WPCs (wood-plastic composites) for outdoor decking, continuously innovating for superior performance in weather and termite resistance.

R&D investments focus on hybrid composites combining natural and synthetic fibers for enhanced mechanical properties. Some companies are also exploring nanocellulose integration to boost strength and functionality. Additionally, regional players in Asia are scaling production capacities, benefiting from low-cost raw materials and labor.

The competitive landscape is intensifying as sustainability becomes a core strategic priority. Companies are also securing certifications such as ISO 14001 and Cradle to Cradle to enhance brand credibility and market appeal in environmentally regulated markets such as Europe and North America.

Some of the prominent players in the Global Natural Fiber Composites Market are

- UPM-Kymmene Corporation

- Trex Company, Inc.

- FlexForm Technologies

- GreenGran BN

- Procotex Corporation SA

- Fiberon LLC

- Tecnaro GmbH

- Jelu-Werk J. Ehrler GmbH & Co. KG

- Bast Fiber Technologies Inc.

- Lingrove Inc.

- Deckorators, Inc.

- Meshlin Composites ZRT

- Stora Enso Oyj

- HempFlax Group B.V.

- Bcomp Ltd.

- PolyOne Corporation (now Avient Corporation)

- Alpas SRL

- Weyerhaeuser Company

- Owens Corning

- Universal Forest Products, Inc. (UFPI)

- Other Key Players

Recent Developments in the Global Natural Fiber Composites Market

June 2024

- BASF's Strategic Investment: The German chemical giant committed €20 million to expand its natural fiber composites production capacity at its Ludwigshafen facility. This expansion focuses on automotive interior components and construction materials, utilizing flax and hemp fibers combined with bio-based resins. The investment supports Europe's transition to sustainable materials in manufacturing.

- Teijin's Automotive Partnership: Teijin Limited formed a strategic alliance with a major European automotive supplier to co-develop lightweight door panels and trunk liners using flax fiber composites. The collaboration aims to reduce vehicle weight by up to 15% while meeting stringent safety standards for electric vehicles.

May 2024

- JEC World Innovations: At the premier composites exhibition in Paris, Mitsubishi Chemical unveiled a new bio-based resin system specifically formulated for natural fiber composites, while Siemens demonstrated automated production techniques that could reduce NFC manufacturing costs by 20%.

- Trex's Strategic Acquisition: The decking materials leader acquired EcoComposites Inc., a startup specializing in rice husk and bamboo fiber composites, for $45 million. This move expands Trex's sustainable product line into indoor furniture and decorative panels.

April 2024

- Composites Europe Showcase: The Stuttgart exhibition featured over 30 exhibitors displaying NFC applications, including a breakthrough demonstration of load-bearing structural elements made from hybrid flax-carbon fiber composites with 90% bio-content.

- DOE Funding Initiative: The U.S. Department of Energy's $5 million grant supports a consortium led by the University of Maine to develop fire-resistant NFC formulations for building insulation and automotive underbody shields.

March 2024

- Ford's Sustainable Interiors: The automaker's partnership with Bcomp will introduce flax fiber-reinforced door cards and center consoles in its 2025 EV lineup, reducing component weight by 30% while maintaining crash performance standards.

February 2024

- GreenJute's Expansion: The Kolkata-based startup will use its $3 million Series A funding to establish a 20,000 sq ft production facility capable of manufacturing 5,000 tons annually of jute-polypropylene composites for export markets.

January 2024

- Bio-Based Materials Conference: Researchers from TU Delft presented a novel enzymatic treatment process that improves the interfacial bonding between natural fibers and biopolymers by 40%, addressing a key technical challenge in NFC performance.

December 2023

- UPM's Biocomposites Push: The Finnish forest industry leader merged with French biocomposites specialist EcoTechnilin, gaining access to proprietary flax fiber processing technology and a production facility near Lyon.

November 2023

- Aerospace Applications at CAMX: Collins Aerospace showcased a helicopter interior panel made from hemp fiber composite that meets FAA flammability requirements while being 25% lighter than conventional materials.

October 2023

- DuPont's Hemp Investment: The new Kentucky facility will produce hemp fiber-reinforced polyamides for under-the-hood automotive applications, with an initial capacity of 15,000 metric tons per year.

September 2023

- BMW's Vegan Interiors: The collaboration with Natural Fiber Welding will produce plant-based leather alternatives for steering wheels and seats in BMW's i-series, using a patented fiber welding technology that requires no synthetic binders.

August 2023

- ECCM Research Highlights: A team from ETH Zurich presented a novel alignment process for flax fibers that increases composite stiffness by 35%, making NFCs competitive with glass fiber in structural applications.

July 2023

- FlexForm's Market Expansion: The acquisition of Natural Composites LLC gives FlexForm access to proprietary fiber treatment technologies and expands its customer base in the marine and RV industries.

June 2023

- EU Horizon Funding: The €15 million program will fund 12 research projects across Europe, including the development of NFCs for wind turbine blades and infrastructure applications like bridges and sound barriers.

May 2023

- Wind Energy Applications: At JEC World, LM Wind Power demonstrated a 15-meter wind turbine blade section made with flax fiber composites, showing comparable performance to fiberglass at lower environmental impact.

April 2023

- Sustainable Sports Equipment: Adidas' new line of flax fiber-reinforced tennis rackets and hockey sticks offers vibration-damping properties 20% better than traditional carbon fiber composites.

March 2023

- Banana Fiber Innovation: The Australian startup developed a proprietary degumming process that transforms banana plantation waste into high-strength fibers suitable for automotive and packaging applications.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 12.4 Bn |

| Forecast Value (2034) |

USD 35.7 Bn |

| CAGR (2025–2034) |

12.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 4.8 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Wood, Cotton, Flax, Kenaf, Hemp, Others), By Resin Type (Polypropylene (PP), Polyethylene (PE), Polyamide (PA), Others), By Manufacturing Process (Compression Molding, Injection Molding, Pultrusion, Others), By Application (Automotive, Electronics, Sporting Goods, Construction, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

UPM-Kymmene Corporation, Trex Company Inc., FlexForm Technologies, GreenGran BN, Procotex Corporation SA, Fiberon LLC, Tecnaro GmbH, Jelu-Werk J. Ehrler GmbH & Co. KG, Bast Fiber Technologies Inc., Lingrove Inc., Deckorators Inc., Meshlin Composites ZRT, Stora Enso Oyj, HempFlax Group B.V., Bcomp Ltd., PolyOne Corporation (now Avient Corporation), Alpas SRL, Weyerhaeuser Company, Owens Corning, Universal Forest Products Inc. (UFPI)., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Natural Fiber Composites Market?

▾ The Global Natural Fiber Composites Market size is estimated to have a value of USD 12.4 billion in 2025 and is expected to reach USD 35.7 billion by the end of 2034.

What is the size of the US natural fiber composites market?

▾ The US Natural Fiber Composites Market is projected to be valued at USD 4.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 12.9 billion in 2034 at a CAGR of 11.7%.

Which region accounted for the largest Global Natural Fiber Composites Market?

▾ North America is expected to have the largest market share in the Global Natural Fiber Composites Market, with a share of about 45.6% in 2025.

Who are the key players in the Global Natural Fiber Composites Market?

▾ Some of the major key players in the Global Natural Fiber Composites Market are UPM-Kymmene Corporation, Trex Company Inc., FlexForm Technologies, GreenGran BN, Procotex Corporation SA, Fiberon LLC, Tecnaro GmbH, and many others.

What is the growth rate in the Global Natural Fiber Composites Market in 2025?

▾ The market is growing at a CAGR of 12.5 percent over the forecasted period of 2025.