Market Overview

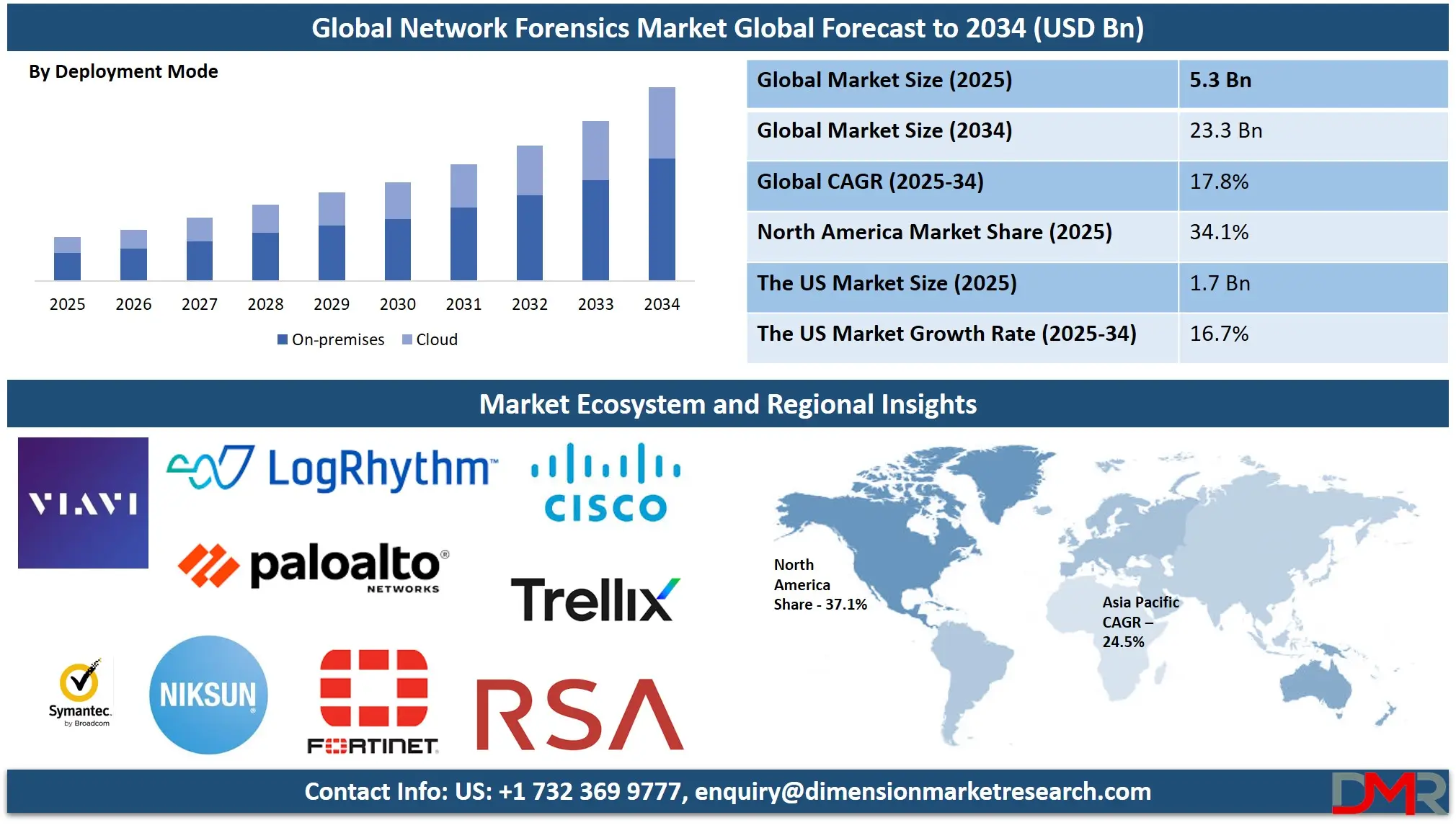

The Global

Network Forensics Market is predicted to be valued at

USD 5.3 billion in 2025 and is expected to grow to

USD 23.3 billion by 2034, registering a compound annual growth rate

(CAGR) of 17.8% from 2025 to 2034.

Network Forensics (NF) is an essential aspect of cybersecurity that involves monitoring, capturing, and analyzing network traffic to detect security risks and vulnerabilities. As organizations expand into IoT devices and connected infrastructures with weak security protocols in these devices, new security issues arise that need to be managed effectively to remain compliant and safe for enterprise networks. Network forensics plays a pivotal role here by detecting any unauthorized access attempts, malware intrusion attempts, or data breaches and protecting enterprise networks as a whole from being breached in their entirety.

As cyber-attacks and sophisticated malware continue to overwhelm traditional security tools, the demand for network forensics solutions has skyrocketed. Hackers increasingly target enterprises; network forensics helps enterprises identify vulnerabilities and reduce risks by pinpointing weaknesses within the infrastructure and mitigating risks with precision. Cloud services and Bring Your Device policies add even further growth opportunities as companies require flexible security solutions without incurring additional infrastructure costs. In addition, the rise of

Content Delivery Networks (CDN) increases the need for advanced network forensics, especially in the context of high-traffic web services.

With the rise in remote work and cloud computing, enterprises are seeing an increasing need for advanced network security solutions. Traditional measures often fail to recognize emerging cyber threats; therefore real-time traffic analysis and forensic investigation become essential tools of defense against emerging threats. Small and midsize businesses (SMBs), who are particularly susceptible to these cyber risks, have increasingly turned to managed security services due to affordability concerns; this trend has led to their increasing reliance on network forensics as an integral component of defense against them.

The network forensics market is projected to experience rapid expansion over the coming years due to increasing investments in cybersecurity and the increasing complexity of cyber threats. Cloud-based security solutions with demand-driven pricing models are helping drive this expansion further; while challenges associated with lack of skilled expertise or storage limitations could impede market expansion. Yet network forensics stands poised to become an integral component in modern security frameworks.

The US Network Forensics Market

The

US Network Forensics market is projected to be valued at

USD 1.7 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds

USD 6.6 billion in 2034 at a

CAGR of 16.7%.

The U.S. network forensics market is driven by the increasing sophistication of cyber threats, prompting organizations to adopt advanced security solutions. The presence of leading vendors and solution providers fuels continuous innovation, ensuring businesses have access to cutting-edge tools like AI-driven analytics and real-time threat detection.

Regulatory compliance requirements and the growing adoption of cloud computing further accelerate market growth. Additionally, the rising reliance on digital transformation across industries increases the demand for effective forensic solutions to safeguard critical data and infrastructure. The increasing significance of

wireless network security solutions is also contributing to this demand, particularly in remote work setups.

The U.S. network forensics market is witnessing key trends, including the integration of AI and machine learning to enhance threat detection and response capabilities. The rise of cloud-based forensic solutions is gaining traction as organizations shift to hybrid and multi-cloud environments. Increased adoption of automation in forensic analysis is improving efficiency and accuracy. Moreover, the growing importance of Zero Trust security frameworks is driving the demand for sophisticated forensic tools to monitor and analyze network activities in real-time.

Network Forensics Market: Key Takeaways

- Market Growth: The Global Network Forensic Market is anticipated to expand by USD 17.1 million, achieving a CAGR of 17.8% from 2025 to 2034.

- Component Analysis: Solutions are likely to dominate the global network forensics market with a revenue share of 65.2% by the end of 2025.

- Deployment Mode Analysis: On-premises deployment is anticipated to dominate the network forensics market with the largest revenue of 67.8% by the end of 2025.

- Organization Size Analysis: Large enterprises are expected to lead the network forensic market with the highest revenue share of 71.2% in 2025.

- Application Analysis: Endpoint security is projected to dominate the network forensic market with a revenue share of 35.6% at the end of 2025.

- Vertical Analysis: BFSI segment is projected to dominate the network forensic market with a 25.6% revenue share by 2025.

- Regional Analysis: North America is predicted to lead the global Network Forensic Market with a revenue share of 37.1% in 2025.

- Prominent Players: Some of the major key players in the Global Network Forensics Market are Cisco Systems, Inc., Palo Alto Networks, Inc., Fortinet Inc., and many others.

Network Forensics Market: Use Cases

- Incident Response and Cybercrime Investigation – Network forensics helps organizations and law enforcement agencies investigate cybercrimes such as hacking, data breaches, and malware attacks by analyzing network traffic to identify the source and nature of the attack.

- Insider Threat Detection – By monitoring internal network activity, network forensics can detect suspicious behavior from employees or contractors who may be exfiltrating sensitive data, violating security policies, or engaging in unauthorized activities.

- Advanced Persistent Threat (APT) Identification – Network forensics is crucial in detecting and mitigating APTs, where attackers infiltrate a network and remain undetected for an extended period to steal sensitive information or disrupt operations.

- Regulatory Compliance and Auditing – Organizations use network forensics to ensure compliance with industry regulations such as GDPR, HIPAA, and PCI-DSS by maintaining detailed logs of network activities and identifying any unauthorized access or data leaks.

Network Forensics Market: Stats & Facts

- Data Breach Report: Infosec Institute defines Network Forensics as a process to collect and analyze organizations’ traffic data to detect any potential cyberattack or investigate any cybercrime. According to the 2023 Annual Data Breach Report, there was a staggering increase of 78 percent in data compromises as the number went from 1,801 in 2022 to 3,205 in 2023.

- Cybercrime Growth: As cybercrime damages are projected to reach $10.5 trillion annually by 2025, network forensics is essential for detecting, analyzing, and mitigating cyber threats before they cause severe financial and operational damage.

- Incident Response Time: It takes an average of 277 days to detect and contain a data breach, network forensics helps security teams accelerate threat detection, identify attack origins, and respond faster to minimize damage.

- Packet Capture Size: Large enterprises generate over 10 TB of network traffic logs daily, requiring network forensics to filter, analyze, and reconstruct network activity for investigating anomalies and detecting malicious activity.

- DDoS Attacks: With DDoS attacks averaging 2.3 Gbps and peaking at 3.5 Tbps, network forensics is used to monitor traffic patterns, detect volumetric attacks, and identify the attack sources for mitigation strategies.

- Ransomware Detection: Around 66% of organizations reported ransomware attacks in 2023, network forensics helps trace attack vectors, detect suspicious file movements, and uncover lateral movement within networks to stop ransomware before encryption occurs.

- Log Data Volume: As 90% of organizations store log data for over 12 months, network forensics enables long-term threat analysis, compliance auditing, and historical investigations to uncover hidden breaches and insider threats.

Network Forensics Market: Market Dynamic

Driving Factors in the Network Forensics Market

Growing Cyber Threats and Sophisticated Attacks

With the rapid digital transformation and increasing reliance on interconnected networks, cyber threats have become more advanced and persistent. Organizations face risks from sophisticated attacks such as ransomware, phishing, and insider threats, necessitating robust security measures. Network forensics plays a critical role in identifying, analyzing, and mitigating such threats by providing deep visibility into network activities. It enables organizations to detect anomalies, trace attack sources, and respond to security incidents efficiently. As cybercriminals continue to exploit vulnerabilities, the demand for network forensics solutions will surge, driving market growth in the coming years.

Compliance and Regulatory Requirements

With the rise in data breaches and cyber threats, governments and regulatory bodies worldwide have enforced stringent data protection laws such as GDPR, HIPAA, and CCPA. Organizations must comply with these regulations to avoid hefty penalties and reputational damage. Network forensics aids in ensuring compliance by monitoring network traffic, detecting anomalies, and providing audit trails for security incidents. As regulatory frameworks evolve, businesses will increasingly invest in network forensics solutions, fueling market growth.

Restraints in the Network Forensics Market

Shortage of Skilled Network Forensics Professionals

The lack of adequately trained network forensics professionals remains a significant restraint in the market. Investigators require specialized knowledge to capture, process, store, and analyze digital evidence across networks, cloud environments, and mobile devices. However, deficiencies in standardized training programs, tools, and resources hinder the development of skilled professionals. Organizations struggle to find qualified experts to handle complex cybercrime investigations effectively. Despite the rising demand for cybersecurity professionals, the industry continues to face a shortage of trained forensic investigators, limiting market growth and slowing down the resolution of network-related crimes.

Challenges in Managing and Storing Large-Scale Digital Evidence

The increasing complexity of cyberattacks requires investigators to collect vast amounts of data from various network sources. However, traditional forensic tools often struggle with scalability and efficiency in handling large datasets. Digital evidence must be stored securely while ensuring its integrity and accessibility for analysis. Organizations face challenges in maintaining multi-terabyte storage systems that meet regulatory and legal requirements. Additionally, sensitive data must be preserved without unauthorized access or loss, making data management a critical challenge. The inability to efficiently store and retrieve evidence affects forensic investigations and delays legal proceedings.

Opportunities in the Network Forensics Market

Adoption of AI and Machine Learning

The integration of AI and machine learning in network forensics is transforming cybersecurity by enabling real-time threat detection and automated response. AI-driven analytics help identify unusual patterns, detect anomalies, and predict potential cyber threats before they cause damage. Machine learning algorithms enhance the accuracy of network forensics by continuously learning from data and improving threat intelligence.

Automated response mechanisms reduce the time required for incident investigation, allowing organizations to mitigate security risks efficiently. As cyber threats become more sophisticated, leveraging AI and machine learning in network forensics presents a significant opportunity to enhance cybersecurity resilience and proactive threat management.

Cloud-Based Security Solutions

The rapid shift to cloud computing and remote work has increased the demand for scalable network forensics solutions tailored for cloud environments. Traditional security measures often fall short in securing cloud-based infrastructure, making network forensics crucial for detecting and analyzing cyber threats in distributed networks.

Cloud-based forensics tools offer real-time monitoring, log analysis, and threat intelligence, helping organizations maintain data integrity and compliance. As businesses continue to migrate to cloud platforms, investing in advanced cloud security solutions will be essential to combat evolving cyber threats, creating a significant growth opportunity in the network forensics market.

Trends in the Network Forensics Market

Rising Adoption of Cloud-Based Network Forensics Solutions

Cloud infrastructure and services have led to an exponential rise in the adoption of network forensics solutions via cloud services, particularly by smaller organizations (SMEs). Businesses of all kinds - particularly SMEs - are turning more frequently to cloud security because it offers greater scalability, cost-effectiveness, and ease of deployment as Internet of Things devices proliferate and mobile connectivity increases further still, demand for cloud-integrated forensic solutions continues to surge cloud network forensics offers real-time threat detection as well as visibility management to provide organizations with robust cybersecurity measures thus driving immense growth of this industry sector over the coming years.

Integration of AI and Machine Learning in Network Forensics

Artificial Intelligence (AI) and Machine Learning (ML) technologies have transformed cybersecurity. Their use in network forensics is revolutionizing cybersecurity capabilities by automating threat detection and response without manual analysis, saving both time and resources compared with human analysis methods. AI/ML network forensic solutions have proven essential in combatting sophisticated cyber threats like ransomware or advanced persistent threats more efficiently while cutting incident response times down and decreasing human intervention; contributing significantly to market expansion worldwide.

Network Forensics Market: Research Scope and Analysis

By Components

Due to an increase in cybersecurity threats such as data breaches, ransomware attacks, and APTs, solutions are likely to dominate the global network forensics market with a revenue share of

65.2% by the end of 2025. Organizations require advanced tools for real-time network monitoring, threat identification, and incident response to proactively mitigate risks. As cloud and hybrid environments proliferate, demand is surging for cloud-native network forensics solutions that offer efficient threat detection across networks, providing visibility across networks while assuring robust data security and compliance.

Organizations prioritize comprehensive network forensics solutions as cyber threats evolve - strengthening their cybersecurity posture with comprehensive network forensics solutions.

Professional services are projected to expand at an impressive compound annual growth rate due to regulations like GDPR and HIPAA that necessitate stringent compliance and security measures.

Organizations, particularly small to midsized enterprises (SMEs), lack in-house expertise for handling network forensics solutions effectively; this leads to demand for consulting and implementation services. Managed services have gained momentum as companies search for cost-effective ways to monitor threats continuously and conduct threat analyses.

Cybersecurity professionals assist businesses by providing them with tools, ensuring regulatory adherence, and increasing incident response capabilities - fuelling professional services' rapid expansion. The need for external experts with extensive expertise to meet ever-evolving threats and mandates drives this explosive growth of professional services.

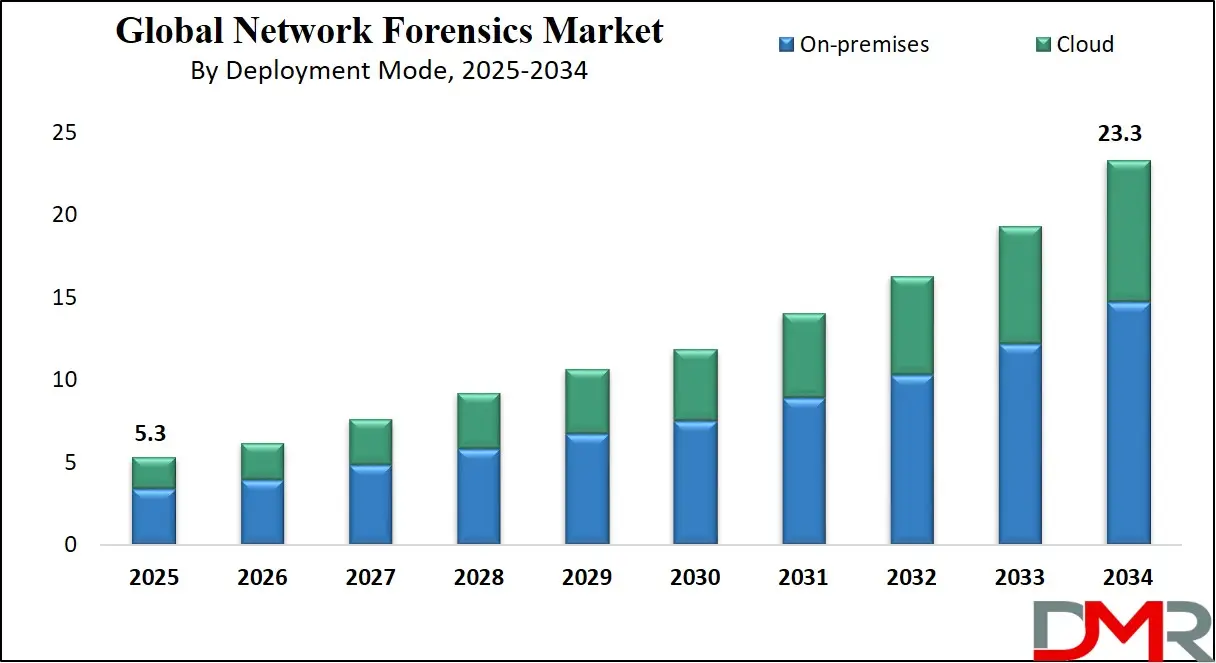

By Deployment Mode

On-premises deployment is anticipated to dominate the network forensics market with the largest revenue of 67.8% by the end of 2025, due to its enhanced control, security, and customization. On-premise solutions are typically the preference for large organizations and industries with stringent compliance regulations because they offer seamless integration with existing infrastructure while maintaining data sovereignty.

On-premise solutions offer enhanced security from cyber threats by enabling organizations to tailor forensic tools as per their particular security demands, independent of any third-party reliance and cloud vulnerability, and while maintaining control internally while being interoperable with legacy systems - two attributes of success that on-premises network forensics solutions boast.

Cloud deployment models have experienced expedited development due to their scalability, cost-effectiveness, and ability to secure distributed environments. As organizations migrate infrastructures to cloud environments, cloud-native network forensics solutions become the de facto tools for real-time monitoring and threat detection across various locations.

Cloud solutions allow organizations to scale security functionality without making significant investments in upfront hardware expenses, with remote access, seamless updates and simplicity of integration into modern cybersecurity architectures. Cloud forensics especially benefits small and medium-sized enterprises (SMEs), offering enterprise-grade security features with reduced operational complexity and a lower total cost of ownership compared to on-premise solutions.

By Organization Size

Large enterprises are expected to lead the network forensic market with the highest revenue share of 71.2% in 2025, due to their complex IT infrastructures and increased cybersecurity risks. They store huge volumes of sensitive information that make them prime targets for cyber threats - so large enterprises invest heavily in advanced network forensic solutions to detect real-time threat detection, incident response management, and compliance with stringent regulations.

Furthermore, these global enterprises possess dedicated cybersecurity teams as well as financial resources necessary for sophisticated forensic tools that ensure real-time threat detection, incident response management, and regulatory compliance - further driving up demand for robust network forensic solutions as security against threats as protection for digital assets as well as business continuity purposes.

Small and Medium-sized Enterprises (SMEs) have increasingly turned to network forensic solutions due to increasing cyber threats and regulatory compliance needs, yet are limited by budget constraints and IT expertise, making deployment difficult for advanced tools.

Many SMEs rely on cloud-based security solutions with cost-effective security features for enhanced network visibility and threat detection cyber-attacks become more sophisticated over time so SMEs prioritize cybersecurity investments to protect customer data while upholding business credibility however, their overall adoption remains lower due to financial and technical restrictions compared with large enterprises.

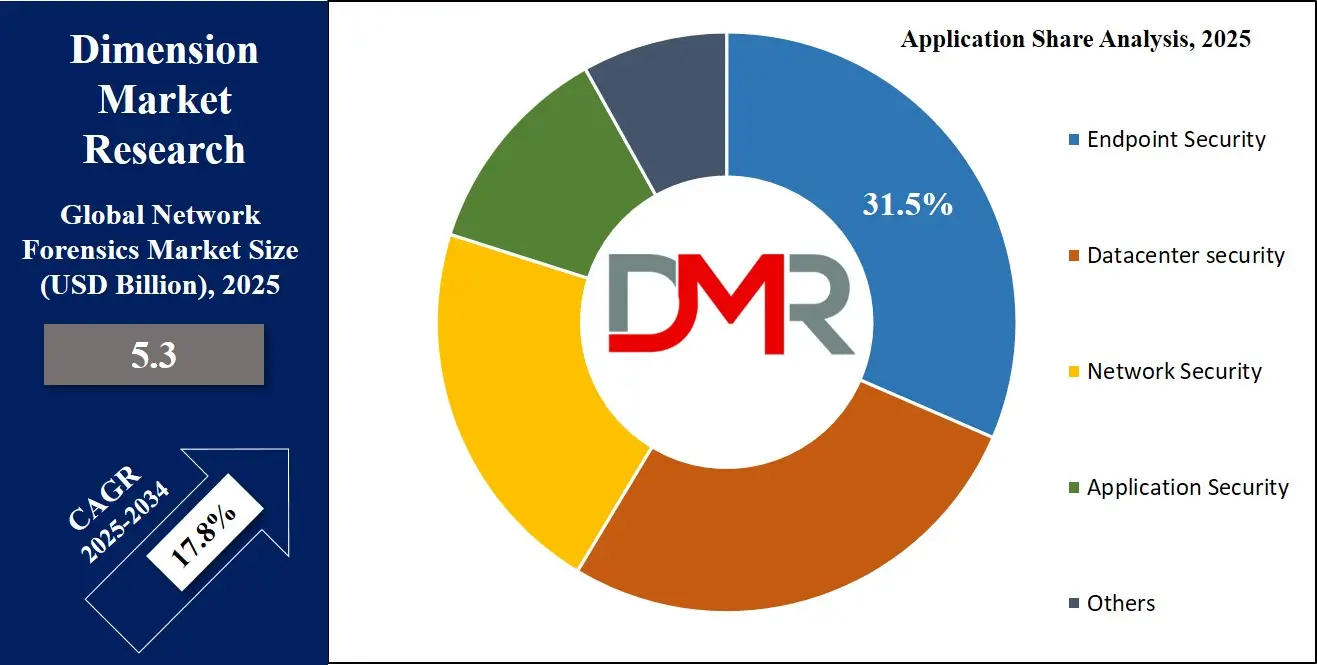

By Application

Endpoint security is projected to dominate the network forensic market with a revenue share of 35.6% at the end of 2025 due to the increasing volume and sophistication of cyber threats targeting devices like laptops, smartphones, and workstations. Traditional security measures struggle to counter evolving threats such as ransomware, malware, and phishing.

Advanced endpoint security solutions leverage real-time threat detection, behavior analysis, and automated response to protect critical devices and data. As organizations prioritize endpoint protection to mitigate security breaches, the demand for robust network forensic tools continues to rise, ensuring comprehensive monitoring and rapid incident response for safeguarding sensitive information against ever-growing cyber risks.

Data center security is crucial for protecting vast amounts of sensitive data stored by organizations. As cyber threats, including DDoS attacks and ransomware, grow in frequency and complexity, data centers become prime targets for hackers. Advanced security solutions, particularly network forensics, play a vital role in monitoring, detecting anomalies, and preventing breaches in real-time.

These tools provide deep visibility into network activity, helping organizations mitigate risks and ensure data integrity. The increasing reliance on cloud computing and big data further drives the demand for enhanced security measures, making data center protection an essential component of modern cybersecurity strategies.

By Vertical

BFSI segment is projected to dominate the network forensic market with a

25.6% revenue share by 2025 due to their increased exposure to cyber-attacks, financial frauds, and regulatory requirements such as PCI-DSS, GDPR, SOX, etc. As they deal with sensitive data such as identity theft or cyberattacks that pose potential vulnerabilities more cybercriminals target this industry. Cases of identity theft drive BFSI firms towards adopting advanced forensic solutions capable of real-time threat detection and investigation.

Stringent regulations such as PCI-DSS GDPR SOX mandate tightened security measures while digital banking or fintech solutions increase this need even further for reliable network forensic tools that ensure cybersecurity measures against attacks by providing real-time threat detection/investigation capabilities to detect threats.

IT and ITeS (Information Technology and IT-enabled Services) firms are expected to experience the highest CAGR due to rapid digital transformation, cloud adoption, and increasing cyber threats. A rise in remote workforces, IoT devices, and cloud platforms has opened up multiple attack surfaces that require advanced forensic solutions. In addition, GDPR, CCPA, and HIPAA laws enforce stringent security measures ensuring IT/ITeS firms become prime targets of cybercriminals while growing investments in AI-driven cybersecurity analytics also drive demand in this sector.

The Network Forensics Market Report is segmented based on the following:

By Components

- Professional Services

- Consulting

- Training and Education

- Design and Integration

- Support and Maintenance

By Deployment Mode

By Organization Size

By Application

- Endpoint Security

- Datacenter security

- Network Security

- Application Security

- Others

By Vertical

- BFSI

- Government and Defense

- Healthcare

- IT and ITeS

- Manufacturing

- Retail

- Telecommunications

- Transportation

- Other verticals

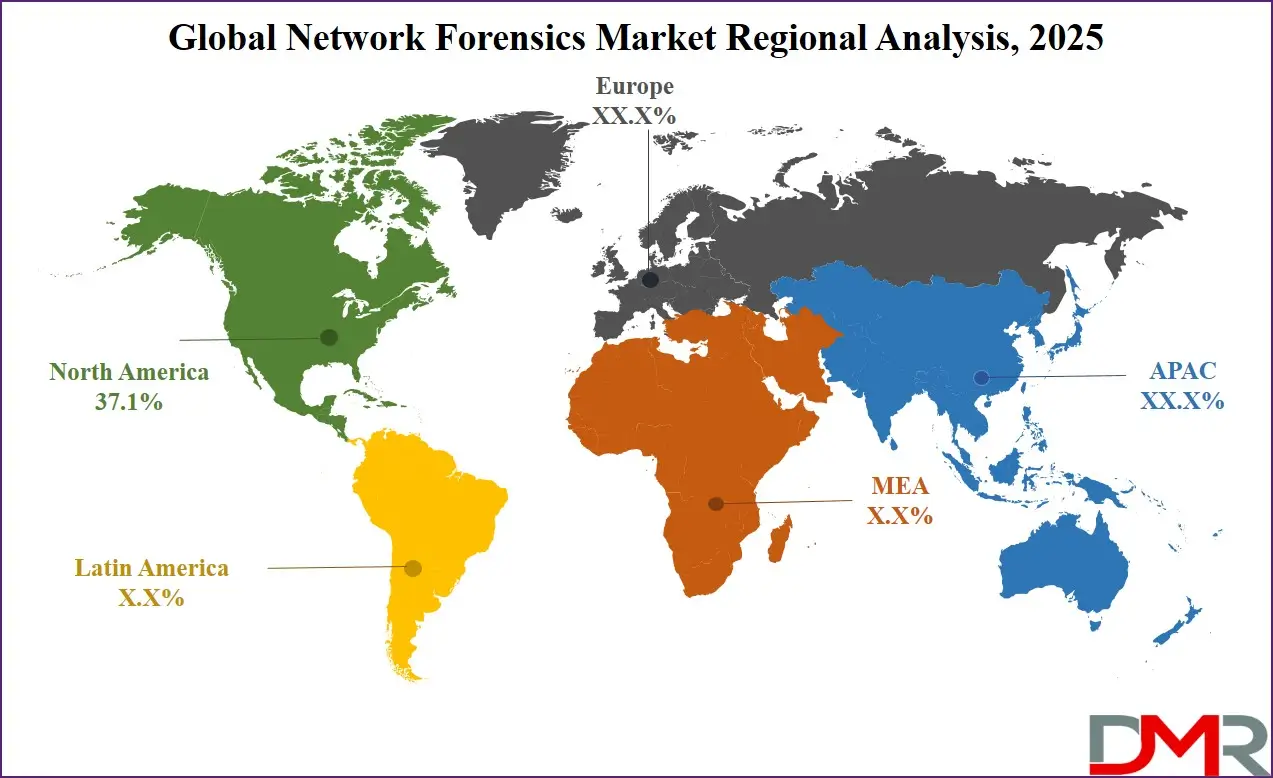

Regional Analysis

Region with the largest Share

North America is predicted to lead the global network forensics market with a revenue share of

37.1% by the end of 2025, due to the high frequency of sophisticated cyber threats such as ransomware, APTs, and data breaches.

The increasing reliance on digital infrastructure and stringent regulatory frameworks drive demand for advanced network forensics solutions. Organizations in the region prioritize cybersecurity investments to detect, analyze, and mitigate security incidents effectively. Additionally, the presence of key cybersecurity vendors and government initiatives further boosts market growth, ensuring North America retains the largest revenue share.

Region with Highest CAGR

Asia Pacific is experiencing rapid growth in the network forensics market due to increasing cloud adoption, digital transformation, and expanding IT infrastructure. The shift towards cloud-native security solutions is essential to protect complex multi-cloud and hybrid environments. Rising cyber threats, coupled with stringent data protection regulations, drive the demand for advanced forensic tools.

Additionally, increasing investments in cybersecurity by enterprises and governments in countries like China, India, and Japan contribute to the region’s high CAGR. This rapid growth highlights the region’s evolving cybersecurity needs and its emphasis on advanced threat detection solutions.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Leading companies in the Network Forensics market are making significant investments in research and development to enhance their product offerings, driving further market growth. To expand their global presence, industry players are engaging in strategic initiatives such as new product launches, mergers and acquisitions, contractual agreements, increased investments, and partnerships with other organizations. To thrive in an increasingly competitive market, the Network Forensics sector must focus on providing cost-effective solutions.

One key strategy employed by manufacturers is local production, which helps reduce operational costs while benefiting customers and strengthening the market. In recent years, the Network Forensics industry has played a crucial role in advancing data security. Prominent market players, including Broadcom Inc., VIPRE Security Group, Cisco Systems Inc., IBM Corporation, Netscout Systems Inc., Viavi Solutions Inc., Accenture Federal Services, Symantec Corporation, Trustwave Holdings Inc., Packet Forensics LLC, and Dell Technologies, are actively investing in research and development to drive market demand and innovation.

Some of the prominent players in the global network forensics market are:

- Cisco Systems, Inc.

- IBM Corporation

- Symantec Corporation (Broadcom Inc.)

- Trellix

- RSA Security LLC

- Palo Alto Networks, Inc.

- LogRhythm, Inc.

- Viavi Solutions Inc.

- NIKSUN

- Fortinet, Inc.

- Other Key Players

Recent Developments

- In May 2024, Palo Alto Networks partnered with IBM to enhance AI-driven cybersecurity. IBM will integrate Palo Alto’s security platforms, train 1,000+ consultants, and contribute watsonx AI models. Palo Alto will acquire IBM’s QRadar SaaS assets to boost AI capabilities, streamlining security operations and innovation.

- In June 2024, Cisco introduced AI-powered updates to its Security Cloud, including Cisco Hypershield for data centers, a next-gen firewall, and AI-driven Security Cloud Control. These advancements improve threat detection, hybrid security management, and zero trust frameworks through partnerships like Google.

- In May 2024, Palo Alto launched Precision AI-powered solutions like AI Access Security, AI-SPM, and AI Runtime Security to protect AI infrastructures. Using ML, deep learning, and generative AI, these tools mitigate zero-day threats, DNS hijacking, and compliance risks, ensuring secure AI adoption.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 5.3 Bn |

| Forecast Value (2034) |

USD 23.3 Bn |

| CAGR (2025-2034) |

17.8% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.7 Bn |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Components (Solution, Professional Services), By Deployment Mode (On-premises, and Cloud), By Organization Size (SMEs, and Large Enterprises), By Application (Endpoint Security, Datacenter security, Network Security, Application Security, and Others), By Vertical (BFSI, Government and Defense, Healthcare, IT and ITeS, Manufacturing, Retail, Telecommunications, Transportation, and Other verticals) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Cisco Systems, Inc., IBM Corporation, Symantec Corporation (Broadcom Inc.), Trellix, RSA Security LLC., Palo Alto Networks, Inc., LogRhythm, Inc., Viavi Solutions Inc., NIKSUN, Fortinet, Inc.and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Network Forensics Market size is estimated to have a value of USD 5.3 billion in 2025 and is expected to reach USD 23.3 billion by the end of 2034.

North America is expected to be the largest market share for the Global Network Forensics Market with a share of about 37.1% in 2025.

Some of the major key players in the Global Network Forensics Market are Cisco Systems, Inc., Palo Alto Networks, Inc., Fortinet, Inc., and many others.

The market is growing at a CAGR of 17.8 percent over the forecasted period.

The US Network Forensics Market size is estimated to have a value of USD 1.7 billion in 2025 and is expected to reach USD 6.6 billion by the end of 2034.