This global market offers network security solutions that provide protection to computer network and their data from unauthorized access, misuse, modification, or disruption. This market provides policies that safeguard the confidentiality, integrity, and availability of network resources. The network security monitors the authentication and authorization of data and sometimes they even restrict access of users if their action seems suspicious. The firewall service provided by network security filter the unwanted traffic for the user on the basis of the security threat they are posing.

As per AIMultiple, the Network Security Market is rapidly evolving due to escalating cyber threats and growing organizational reliance on digital ecosystems. In 2023, the average cost of a data breach reached a record $4 million, reflecting a 15% increase over three years. Notably, 90% of organizations experienced at least one data breach or cyber incident, and 80% of breaches involved a human element. Moreover, the average employee's access to approximately 11 million files highlights critical vulnerabilities.

The market is projected to grow at an annual rate of 15%, reaching $40 billion by 2028. In the U.S., revenue is expected to grow at a 10% annual rate, climbing from $9 billion in 2023 to $15 billion by 2028. Currently, the U.S. leads the North American network security market, accounting for 80% of the region’s cybercrime incidents. These dynamics emphasize the urgency of robust security measures, with 95% of executives prioritizing IT resilience.

Network security is witnessing rapid growth, fueled by increasing cyber threats and digital transformation. Mergers and acquisitions in the sector are rising, with tech giants and startups joining forces to expand capabilities and market reach. Key deals in 2024 include acquisitions targeting AI-driven threat detection, cloud security, and zero-trust frameworks.

Opportunities lie in integrating advanced technologies like machine learning, blockchain, and IoT security. Trends show a shift towards managed security services and hybrid cloud solutions, reflecting growing enterprise demand. Companies investing in cybersecurity partnerships and innovations are poised to gain a competitive edge in this dynamic, high-demand industry.

Key Takeaways

- In the context of component, solutions are projected to dominate this segment in the network security market in 2024.

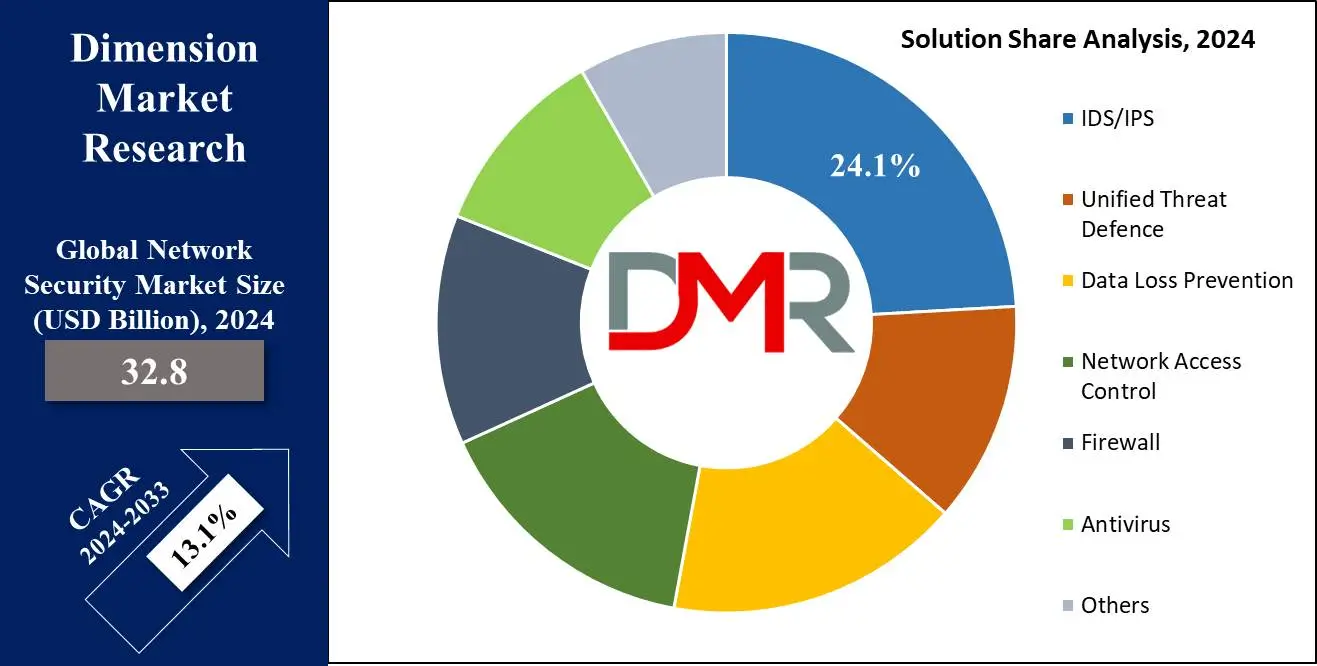

- Intrusion detection systems (IDS) and intrusion prevention systems (IPS) is expected to hold the highest market share of 24.1% in the term of solution in 2024.

- Based on deployment, cloud is projected to lead this segment in 2024.

- The banking, financial services, and insurance (BFSI) industry is projected to lead the vertical segment with 31.2% of the market share in 2024.

- North America is projected to lead the global network security market with 35.2% of the market share in 2024.

Use Cases

- The network security manages authentication, authorization, and access restrictions where it can access that user data against security threat.

- Firewalls in network security act as a barriers between networks that filter traffic based on predefined security rules, preventing unauthorized access and blocking potentially harmful incoming and outgoing traffic.

- Antivirus and antimalware software provided in this market detect and remove harmful software which can pose problem to the network security.

- In the market, programs are encoded in such a way that only authorized users can access it so they can maintain the confidentiality of sensitive information as it travels across the network.

- This market offers patch management where it ensures that all network devices, servers, and software applications are up-to-date with the latest security updates to address known vulnerabilities.

Market Dynamic

The growing prevalence of 5G technology in the network security market is due to its fast data transfer speed and facilitating in

machine learning, the internet of things, and

artificial intelligence. The integration of the 5G network with IoT will improve the data transfer in various cases like in driverless cars, robotics, VR, AR, and smart cities that require high-speed connections to function properly. The rise in cased of cyber-attacks, treats and breaches has highlighted the need for a full-proof network security solution which can protect the user data from hackers and protect their information.

Compliance with these regulations often drives the adoption of specific network security technologies and practices to ensure data confidentiality, integrity, and availability. Additionally, ongoing digital transformation initiatives, in the network security market include the adoption of cloud, IoT (Internet of Things) proliferation, and remote work trends, which aim to expand the attack surface and create new security challenges. Organizations need to secure distributed environments, hybrid infrastructures, and interconnected devices, leading to increased demand for cloud security, IoT security, and endpoint protection solutions.

Research Scope and Analysis

By Component

In terms of components, solutions are expected to lead the network security segment in 2024, as they encompass a broad range of offerings such as firewalls, intrusion detection and prevention systems, secure web gateways, virtual private networks, cloud security, and even applications within

Virtual Production. These solutions are extensively deployed across the technological landscape to safeguard data from external threats. For instance, firewall solutions protect user data by acting as a perimeter defense, monitoring and regulating incoming and outgoing traffic based on predefined security rules.

While, Intrusion Detection and Prevention Systems (IDPS) solutions monitor the data and network traffic of the user for suspicious activities or patterns which can be an indication of potential security breaches or attacks. These solutions play a crucial role in security threat detection where they alert the administrators of suspicious behavior and automatically taking action to block or mitigate threats.

By Solution

Intrusion detection systems (IDS) and intrusion prevention systems (IPS) is expected to hold the highest market share of 24.1% in the term of solution in 2024. These solutions are gaining recognition globally as they monitor network traffic and system activities for signs of unauthorized access, misuse, or security policy violations. The intrusion detection system analyzes network patches, logs and other data sources where these solutions detect suspicious patterns or anomalies that may indicate potential security incidents.

IDS is further divided into two main types: Network-based Intrusion Detection Systems (NIDS) and Host-based Intrusion Detection Systems (HIDS) where NIDS analyze network traffic in real-time to detect suspicious activities at the network perimeter, while HIDS monitor activities within individual host systems for signs of compromise or unauthorized access. Intrusion detection systems generate alerts for user when suspicious activity is detected, which allow the security analysts to investigate & respond to potential security threats promptly.

By Deployment

Based on deployment, cloud is projected to lead this segment in 2024 as the network security applications utilized by cloud service providers provide an encryption or authentication layer within their web portals or through private links. Applications are accessible in a SaaS model or PaaS and they guarantee the best characteristics of scalability, elasticity, adaptability, and flexibility, allowing the effortless changes of required hardware resources.

By subscription model of hiring, they are cost-effective because there is no outpouring of the upfront financial expenses. Global infrastructure exploiting them is used to reach distributed sites, giving them the possibility to be integrated within cloud services for complete coverage. Thus, we provide a solution that covers all possible requirements of the organization and does not divvy language or geographical borders in users' access and data protection issues.

By Vertical

The banking, financial services, and insurance (BFSI) industry is projected to lead the vertical segment with 31.2% of the market share in 2024 as this sector is operated under tight security regulations like PCI DSS, GLBA, and financial regulations such as the Dodd-Frank Act, example. Network security solutions are the necessary ones meant to incorporate compliance, data protection, and fraud prevention. Ensuring privacy and reliability against DDoS attacks, like other cyber threats is of key importance.

The fact that mobile banking and digitalization happening at the same time as the security of mobile devices and APIs is on priority. The skill of managing third-party risks and developing an appropriate incident response is essential. The incorporation of fintech innovations and upcoming technologies in BFSI represents a paradigm shift that calls for the designing of security solutions that can guarantee a safeguard of financial transactions and data.

The Network Security Market Report is segmented on the basis of the following:

By Component

By Solution

- IDS/IPS

- Unified Threat Defense

- Data Loss Prevention

- Network Access Control

- Firewall

- Antivirus

- Others

By Deployment

By Vertical

- BFSI

- IT and Telecommunication

- Retail and E-commerce

- Healthcare

- Manufacturing

- Government

- Others

Regional Analysis

North America is projected to lead the global network security market

with 35.2% of the market share in 2024 as this market is expected to the market size is likely to exhibit positive growth owing to the increased demand for network security products and services of the

banking, financial services, and insurance (BFSI),

government,

healthcare,

education,

IT,

telecom and other

industries. A lot of time data thefts and cybercriminals direct their attacks at those business spheres since information stored in the networks and devices of companies from the region are of high value.

These two variables are listed as main forces of the development of the North American market so put as much detail as you can. The well developed technology ecosystem of this market is expected to further boost the growth of this region in network security market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the global network security market is highly competitive with the presence of various major companies that are heavily investing in research and development to produce solutions that can keep up with the rising cyber security threats and attacks. Some of the major key players in the Global Network Security Market are Palo Alto Networks, Fortinet, Cisco, CrowdStrike, IBM Corporation, Trend Micro, and many others. These companies are further boosting their position in this market by utilizing various strategies like partnerships, acquisitions, mergers, and collaborations. Their focus on development is primarily pushed forward due to the heavy investment by the major tech giants.

Some of the prominent players in the Global Network Security Market are

- Palo Alto Networks

- Fortinet

- Cisco

- CrowdStrike

- IBM Corporation

- Trend Micro

- Rapid7

- Check Point

- Microsoft Corporation

- Sophos

- Broadcom

- VMware

- Trellix

- Proofpoint

- Akamai Technologies

- Other Key Players

Recent Development

- In April 2023, Trellix, a cyber-security firm, has launched its Security Endpoint Suite, offering advanced XDR technology for enhanced detection and response. It provides SOC analysts with improved visibility and control for proactive endpoint security checks.

- In March 2023, Fortinet, a cybersecurity leader, supplied its SD WAN to enhance operational effectiveness for Emirates National Oil Company Limited (ENOC), a Dubai government-owned subsidiary. The SD WAN improved security controls, safeguarding ENOC's brand and assets.

- In January 2023, Symphony Technology Group (STG) launched Trellix, offering XDR solutions to businesses, accelerating innovation with automation and machine learning.

- In June 2022, AWS re:Inforce 2023 unveiled new security tools like Amazon CodeGuru Security, Verified Access, and Verified Permissions, along with expanding Amazon Security Lake.

- In July 2023, Microsoft Entra is expanding into Security Service Edge and rebranding Azure AD to Microsoft Entra ID, aiming to unify identity and network access.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 32.8 Bn |

| Forecast Value (2033) |

USD 99.1 Bn |

| CAGR (2023-2032) |

13.1% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Solution, and Services), By Solution (IDS/IPS, Unified Threat Defense, Data Loss Prevention, Network Access Control, Firewall, Antivirus, and Others), By Deployment (On-premise, and Cloud), By Vertical (BFSI, IT and Telecommunication, Retail and E-commerce, Healthcare, Manufacturing, Government, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Palo Alto Networks, Fortinet, Cisco, CrowdStrike, IBM Corporation, Trend Micro, Rapid7, Check Point, Microsoft Corporation, Sophos, Broadcom, VMware, Trellix, Proofpoint, Akamai Technologies, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |