Market Overview

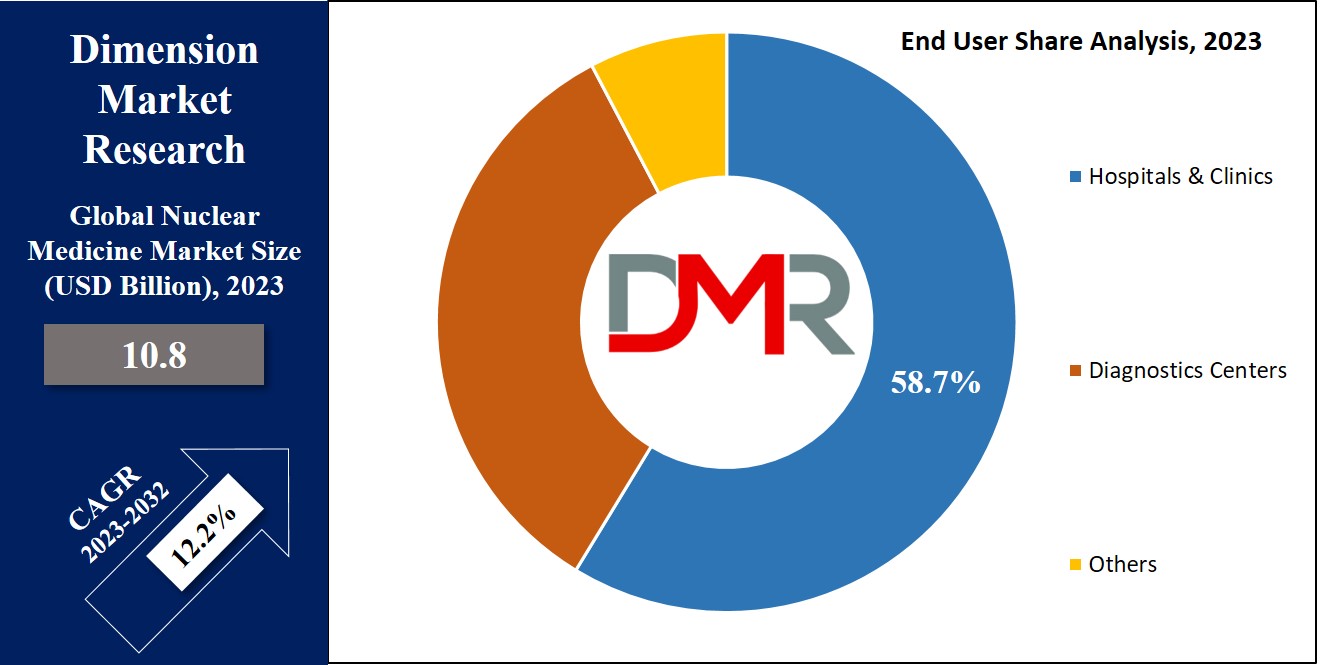

The Global

Nuclear Medicine Market is expected to reach a value of

USD 10.8 billion in 2023, and it is further anticipated to reach a market value of

USD 30.6 billion by 2032 at a

CAGR of 12.2%.

Nuclear medicine, a medical discipline, includes radioactive substances (

radiopharmaceuticals) for diagnosing & treating conditions like cancer, cardiac disease, &

neurological disorders, as well as monitoring the path of radioactive tracers, assisting medical professionals. The major imaging methods in nuclear medicine include positron emission tomography (PET) & single-photon emission computed tomography (SPECT) examinations, contributing to accurate medical diagnoses & treatments.

According to the World Health Organization (WHO), 2022 saw approximately 20 million new cancer cases and 9.7 million cancer-related deaths globally. Additionally, 53.5 million individuals were living within five years of a cancer diagnosis. About 1 in 5 people develop cancer during their lifetime, with 1 in 9 men and 1 in 12 women succumbing to the disease.

Nuclear medicine offers a critical advantage in cancer treatment by delivering radiation directly to tumor sites while sparing healthy tissues, reducing side effects, and enhancing treatment efficacy through its targeted approach.

The market benefits from a robust product pipeline and supportive government initiatives aimed at improving access to nuclear medicine. Products like Betalutin, Yttrium-90 microspheres, PNT2003, and 177LuPNT2002 are under clinical trials. Notably, in December 2023, Lantheus Holdings, Inc. and POINT Biopharma Global Inc. announced positive results from the Phase 3 SPLASH study.

This trial evaluated 177Lu-PNT2002, a PSMA-targeted radioligand therapy, for treating metastatic castration-resistant prostate cancer (mCRPC) after progression on androgen receptor pathway inhibitors (ARPI). Increasing investments in nuclear medicine research are expected to drive market expansion.

Favorable reimbursement policies also boost growth, particularly in the U.S. For instance, in 2020, the Centers for Medicare & Medicaid Services (CMS) introduced a $10 add-on payment for Tc-99m derived from non-highly enriched uranium (HEU) in hospital outpatient settings, supplementing imaging procedure payments. These initiatives have significantly improved patient access to essential nuclear diagnostic tools for life-threatening conditions, further driving market growth.

Key Takeaways

- By Product, Diagnostics leads in 2023 & is anticipated to dominate throughout the forecasted period.

- In addition, Therapeutic is expected to have significant growth over the forecasted period.

- By Application, Oncology takes the lead & drives the market in 2023.

- Further, By End User, Hospital & Clinics accounts for major revenue share in 2023.

- North America has a 46.8% share of revenue in the Global Nuclear Medicine Market in 2023.

Market Dynamic

The growth in the global elderly population, both in developed & developing nations, has led to a growth in cardiovascular diseases, which has generated a significant demand for nuclear medicine. In addition, the rise in the occurrence of cancer worldwide, a higher ailment requiring nuclear medicine, highlights its crucial role in cancer detection & treatment. Further, nuclear medicine plays a vital role in identifying tumors & addressing cell growth, contributing highly to

cancer therapy.

Moreover, the growing incidence of such diseases is expected to drive market growth in the coming future, although the primary markets for nuclear medicine currently lie in cancer & various cardiovascular diseases.

However, the market has experienced a slowdown in recent years due to saturation due to stringent regulatory guidelines and the high costs associated with therapeutic and diagnostic instruments and procedures are anticipated to pose challenges to market expansion.

Driver

The rising incidence of chronic diseases like cancer and cardiovascular disorders is driving nuclear medicine market growth. Imaging techniques like PET and SPECT scans offer precise diagnostic capabilities that enable early detection and tailored treatment plans, increasing demand for these technologies in an ageing population more susceptible to such ailments.

Governments and private sectors alike are investing in nuclear medicine technologies to enhance healthcare infrastructure while advances in radiopharmaceuticals enhance both diagnostic accuracy and therapeutic efficacy while supporting market expansion.

Trend

The nuclear medicine market is witnessing an exciting surge in innovation in radiopharmaceuticals and imaging technologies. Targeted radiopharmaceutical therapies (TRTs) have become more widely available, offering precise cancer and disorder treatments with fewer side effects, and hybrid imaging systems such as PET/MRI and PET/CT are growing increasingly popular due to their superior diagnostic accuracy.

Furthermore, research into theranostics, which combines therapy and diagnostics into one approach to care delivery is revolutionizing nuclear medicine by improving outcomes while driving adoption across medical institutions.

Restraint

The high cost of nuclear medicine equipment and radiopharmaceuticals presents a major impediment to market expansion. Modern imaging systems and production of radiopharmaceuticals often require significant investments that reduce accessibility in developing regions. Regulators frameworks regarding radioactive materials only compound market entry difficulties, leading to delays in product approval and adoption.

Nuclear medicine's widespread deployment may be limited by its cost-intensive facilities and skilled personnel requirements, creating financial and logistical hurdles to its deployment that have limited healthcare providers' use of this promising technology despite its significant potential.

Opportunity

Nuclear medicine markets stand to benefit significantly from personalized medicine's growing prominence. Radiopharmaceuticals can offer tailor-made diagnostic and therapeutic approaches that meet specific patient needs; providing targeted precision treatment. Investment in cancer research and targeted therapies continues to rise, as do collaborations between

pharmaceutical companies and research institutions that drive innovations in theranostics that expand nuclear medicine applications.

Emerging markets with their expanding healthcare infrastructure and increased awareness present significant unrealized potential. As patient needs for targeted treatments increase, nuclear medicine industry players are poised to play an essential role in providing precision healthcare solutions.

Research Scope and Analysis

By Product

The diagnostic segment claims the largest market share in 2023 and is expected to have sustained dominance, driven by the development of advanced technologies supporting accurate illness detection. The sector's growth is further fueled by a growth in patients suffering from cardiovascular diseases & cancer.

In addition, the need for radioisotopes has significantly risen, indicating an anticipated growth in diagnostics during the forecast period. Also, technological development, particularly in the use of radiotracers, contributes significantly to tumor detection, propelling market expansion.

Further, the therapeutic segment shows promising growth prospects, which can be seen during the forecasted period. Government interventions & approvals for several nuclear medicines have led to their commercialization in treating diverse diseases.

Also, growth in the supply chain & optimal infrastructure for production are expected to drive market growth, which is supported by growing radioisotope production & the growing use of radiation therapy, featuring different alpha emitters like actinium & terbium, reflecting ongoing R&D activities. Overall, both diagnostic & therapeutic segments are poised for robust growth in the coming years.

By Application

The nuclear medicine market includes applications like oncology, neurology, cardiology, thyroid, lymphoma, & others, among these the oncology segment led the market in 2023, due to a rise in conditions driven by factors like poor diet, smoking, & unhygienic living conditions, which is further boosted by major investments in research that allows organizations to create high-tech nuclear therapies for cancer treatment, which is expected to contribute highly to the growth of the market.

Moreover, the cardiology segment is expected to have high growth, driven by the need for cardiovascular disease diagnosis, along with the growing awareness about heart health, as there is a high demand for advanced diagnostic tools in cardiology, which is anticipated to fuel the growth of the segment over the forecast period.

By End User

Hospitals & Clinics are the major driving factor as they command a major market share in 2023, which is due to the major presence of SPECT/PET scanners within hospitals, allowing a higher volume of nuclear medicine procedures, as these highly contribute to the growth in the need for diagnostic radiopharmaceuticals, mainly in hospitals.

Further, according to the World Nuclear Association, about 10,000 hospitals around the world use radioisotopes for diagnostic purposes, with Technetium-99 being a highly used diagnostic radioisotope, assisting over 40 million procedures per year.

Also, hospitals are expected to show high during the forecast period, driven by the focus on therapeutic nuclear medicine procedures mainly conducted within hospital settings, which highlights the importance of hospitals in advancing & expanding the applications of nuclear medicine for both diagnostic & therapeutic purposes.

The Nuclear Medicine Market Report is segmented on the basis of the following:

By Product

- Diagnostic Products

- Therapeutic Products

By Application

- Oncology

- Neurology

- Cardiology

- Thyroid

- Lymphoma

- Others

By End User

- Hospitals & Clinics

- Diagnostic Centers

- Others

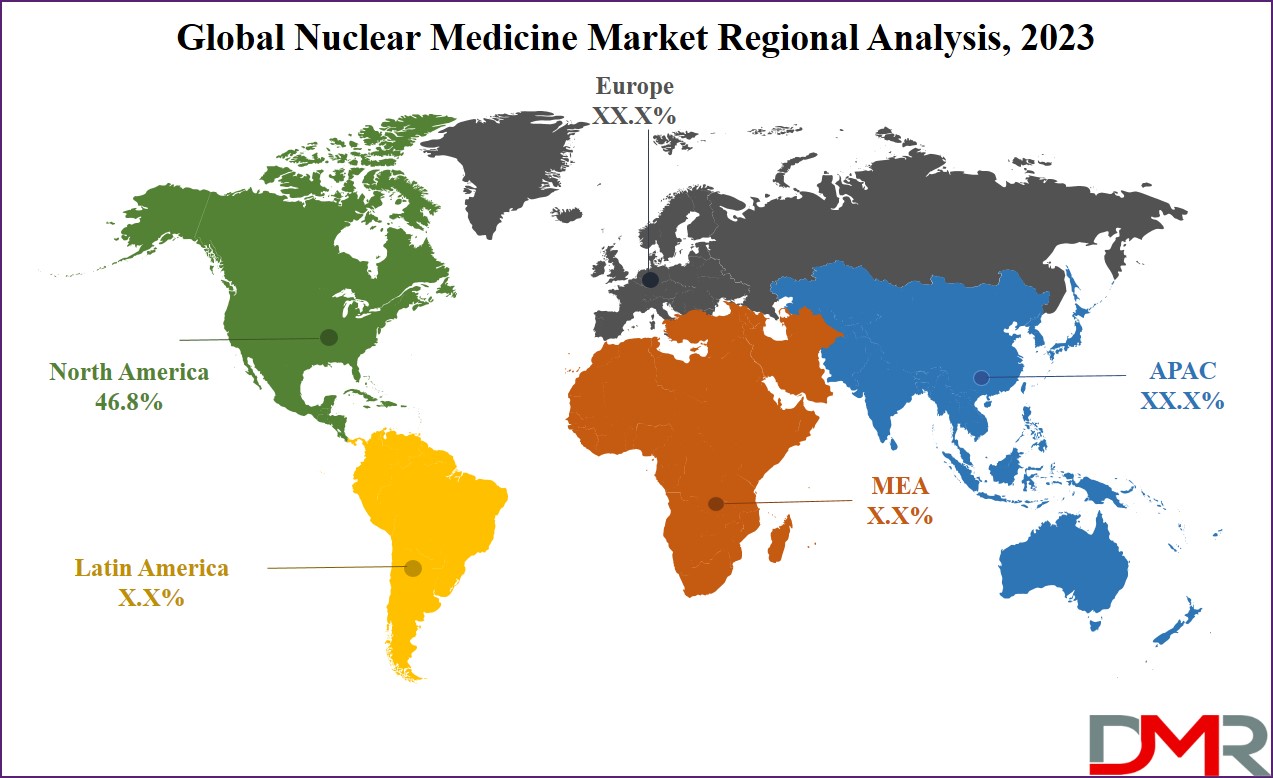

Regional Analysis

North America commands the nuclear medicine market, holding a substantial

46.8% share in 2023, and is expected to have significant growth in the forecast period, which is driven by growing investments in R&D, a considerable volume of nuclear medicine procedures, and a strong healthcare infrastructure within the region. The significant market share highlights North America's leadership in advancing & adopting nuclear medicine technologies.

Moreover, the Asia Pacific region emerges as the fastest-growing sector, driven by a growing awareness of nuclear medicine therapies & a rising influx of investments in the nuclear medicine domain, which is indicative of a growing interest & adoption of nuclear medicine applications, boosted by a combination of advancing healthcare awareness & strategic investments, which acts as a key player in the evolving landscape of nuclear medicine practices.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global nuclear medicine market experiences moderate fragmentation with intense competition among players. However, competition is not alone based on pricing or product differences. Major pharmaceutical & biotechnology players with major capital reserves are entering the market, growing the competitive landscape, which highlights the challenging & evolving nature of competition within the industry.

In April 2023, the US FDA approved the Novartis Milburn facility for the commercial production of Pluvicto, which plays a key role in supplying the product commercially, commencing from the Q3 of 2023 onward, which also signifies a major milestone for Novartis in advancing the commercialization of Pluvicto.

Some of the prominent players in the global Nuclear Medicine Market are:

- Bracco

- NTP Radioisotopes

- GE Healthcare

- Cardinal Health

- Eckert & Ziegler

- Jubilant Life Sciences

- Mallinckrodt

- Nordion Inc

- Siemens Healthineers

- Bayer

- Other Key Players

COVID-19 Pandemic & Recession: Impact on the Global Nuclear Medicine Market:

The global nuclear medicine market experienced a major impact from the COVID-19 pandemic and the following economic recession, which caused delay in the selection procedures in many nuclear medicine diagnostics & therapies. Restrictions on non-essential activities & switches in healthcare priorities influenced market dynamics. Also, economic downturns caused budget restrictions for healthcare expenditures, affecting the adoption of nuclear medicine technologies.

However, as the world passed through the pandemic, there emerged importance of nuclear medicine mainly in disease diagnosis and treatment. The market demonstrated resilience, with recovery anticipated as healthcare systems adapted & investments in R&D for nuclear medicine technologies continued, highlighting their importance in managing & understanding various health conditions.

Recent Development

- In March 2022, Penang Adventist Hospital introduced a new private nuclear medicine center in northern Thailand, highlighting a positive impact on the Asian market, which is expected to enhance accessibility & contribute to the advancement of nuclear medicine services in the region, potentially influencing the broader healthcare landscape in Asia.

- In January 2022, ITM Isotope Technologies Munich SE commenced the COMPOSE phase 3 trial for 177lu-edotreotide, aiming to assess the product's effectiveness in treating patients with neuroendocrine tumors, which represents a significant step in evaluating the potential of 177lu-edotreotide as a treatment option for individuals facing neuroendocrine tumors, marking a noteworthy development in the field.

- In February 2022, SNMMI introduced a program empowering nuclear medicine facilities to attain designation as certified Centers of Excellence in Radiopharmaceutical Therapy, which undergoes rigorous evaluation based on regulatory compliance, training, qualification, experience, & performance criteria, to ensure stringent standards, enhancing patient outcomes through effective selection & administration of radiopharmaceutical therapy.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 10.8 Bn |

| Forecast Value (2032) |

USD 30.6 Bn |

| CAGR (2023-2032) |

12.2% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Diagnostic Products and Therapeutic

Products), By Application (Oncology, Neurology,

Cardiology, Thyroid, Lymphoma, and Others), By End

User (Hospitals & Clinics, Diagnostic Centers, and

Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

sBracco, NTP Radioisotopes, GE Healthcare, Cardinal

Health, Eckert & Ziegler, Jubilant Life Sciences,

Mallinckrodt, Nordion Inc, Siemens Healthineers,

Bayer, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Nuclear Medicine Market size is estimated to have a value of USD 10.8 billion in 2023 and is

expected to reach USD 30.6 billion by the end of 2032.

North America has the largest market share for the Global Nuclear Medicine Market with a share of

about 46.8% in 2023.

Some of the major key players in the Global Nuclear Medicine Market are Bracco, NTP Radioisotopes, GE

Healthcare, and many others.

The market is growing at a CAGR of 12.2 percent over the forecasted period.