Market Overview

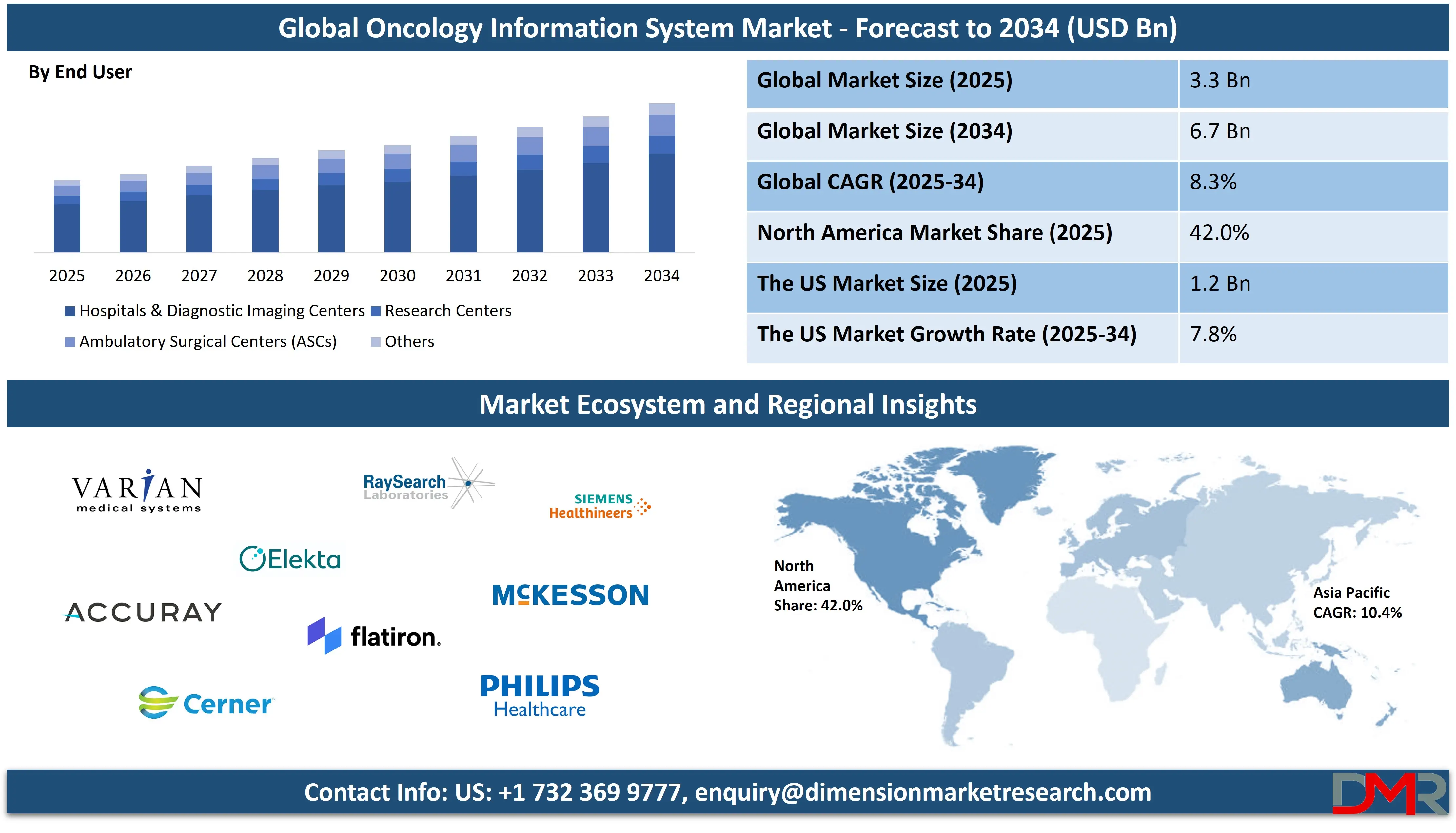

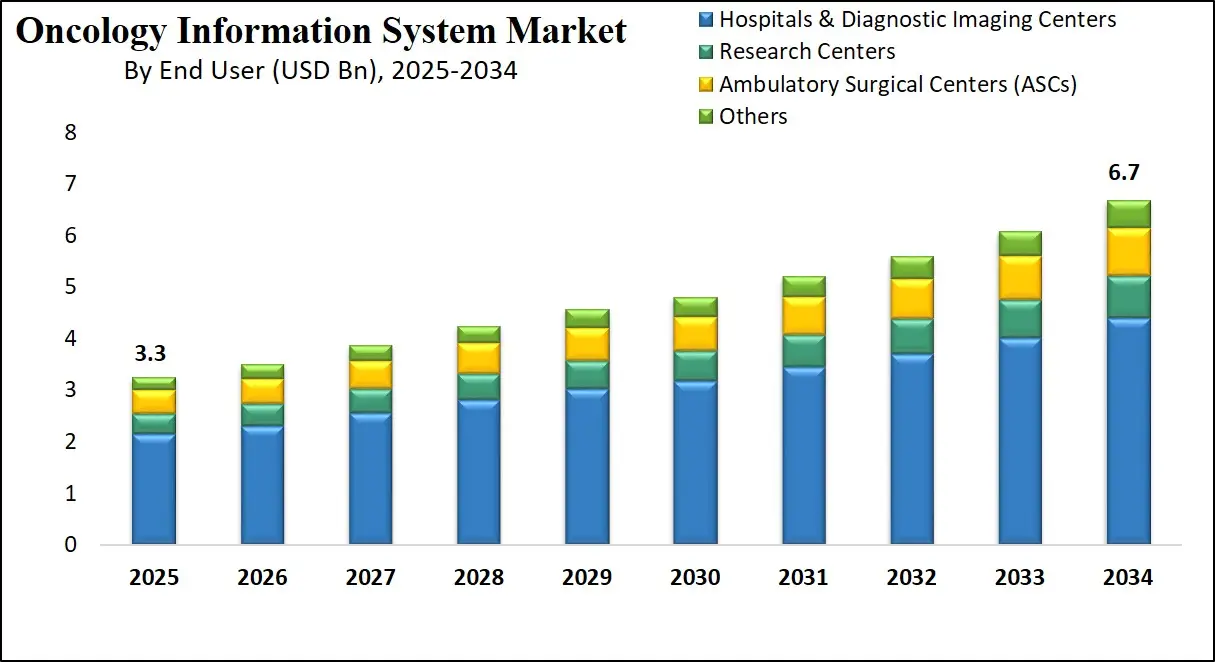

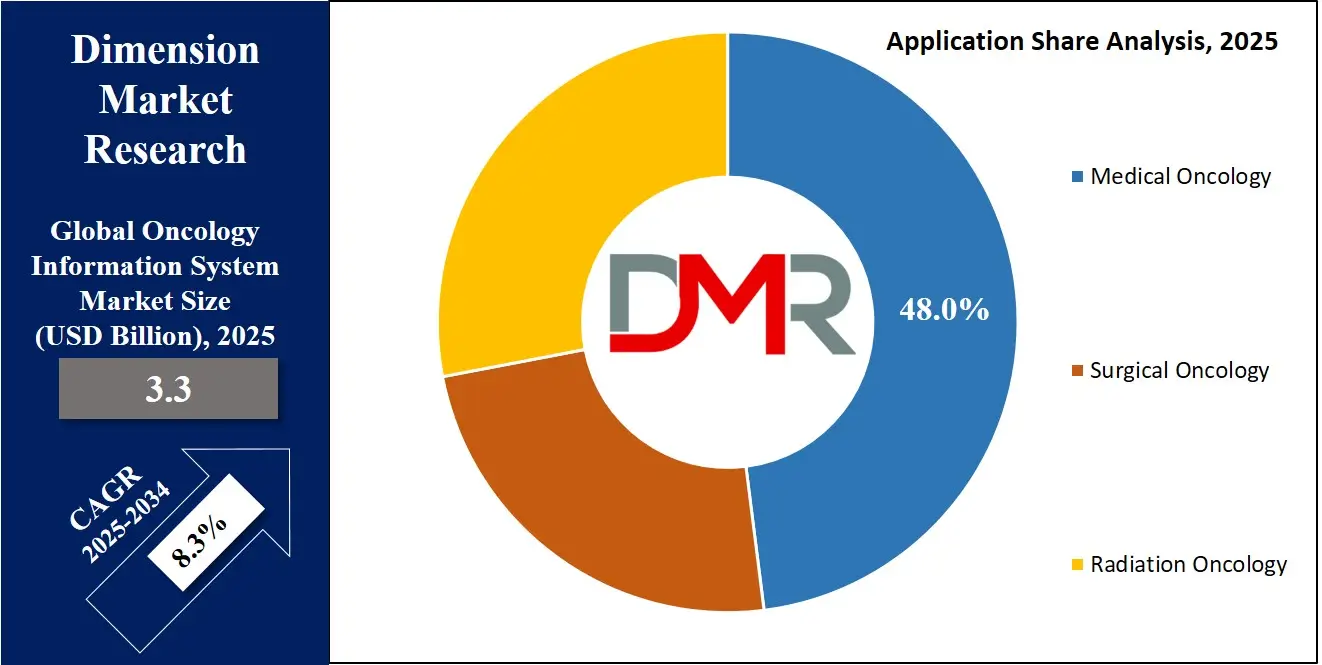

The Global Oncology Information System Market is projected to reach USD 3.3 billion by 2025 and grow to USD 6.7 billion by 2034, expanding at a CAGR of 8.3%. Growth is driven by rising cancer prevalence, adoption of integrated oncology platforms, and growing demand for electronic health records, treatment planning systems, and real-time clinical data solutions.

An Oncology Information System (OIS) is a specialized digital platform designed to manage and streamline clinical, administrative, and operational workflows in oncology care settings. It enables healthcare providers to comprehensively document, plan, and track cancer treatment by integrating various functions such as electronic medical records, treatment planning, image management, scheduling, and billing.

These systems are tailored specifically for the complexities of oncology, offering detailed protocols for chemotherapy, radiation therapy, and surgical procedures. OIS solutions ensure data consistency across multidisciplinary teams, facilitate evidence-based decision-making, and enhance communication between oncologists, radiologists, and pathologists. By centralizing patient data and treatment history, oncology information systems improve treatment accuracy, support personalized medicine, and optimize patient outcomes while maintaining regulatory compliance and interoperability with other healthcare IT systems.

The global oncology information system market refers to the globally industry that develops, distributes, and implements digital platforms and software solutions tailored for managing oncology-specific clinical data and treatment pathways. This market is experiencing steady growth driven by the rising global cancer burden, growing demand for integrated cancer care, and the growing need for real-time data analytics in treatment planning. Adoption is further accelerated by healthcare digitization initiatives, particularly in hospitals, diagnostic imaging centers, and cancer care clinics.

Technological advancements such as cloud-based deployment, artificial intelligence integration, and mobile-accessible interfaces are reshaping the landscape of oncology data management. Additionally, the market is influenced by growing investments in precision oncology, the shift toward outpatient cancer care models, and stringent compliance requirements across developed and developing economies. The market’s evolution underscores a strong emphasis on interoperability, data-driven clinical workflows, and patient-centric cancer care solutions.

Moreover, the oncology information system market is witnessing growing integration with emerging technologies such as artificial intelligence (AI), machine learning (ML), and predictive analytics, enabling clinicians to anticipate disease progression, personalize treatment regimens, and enhance decision-making accuracy. These smart systems are being paired with genomic data platforms and clinical trial databases to support precision oncology efforts.

With the surge in telemedicine and remote monitoring trends, especially post-pandemic, OIS solutions are also evolving to include secure patient portals and mobile access, ensuring continuity of care beyond traditional clinical settings. As value-based care models gain traction, the demand for interoperable, cost-efficient, and outcome-focused oncology IT infrastructure is expected to intensify, making OIS an indispensable component of modern cancer care ecosystems.

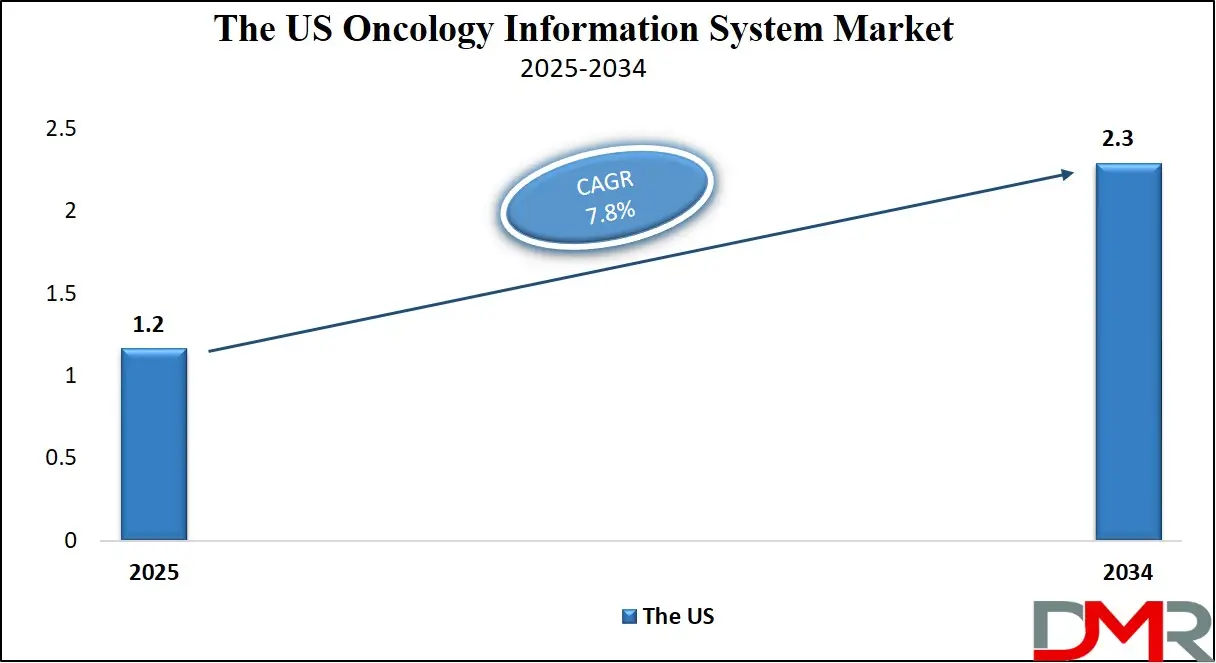

The US Oncology Information System Market

The U.S. Oncology Information System Market size is projected to be valued at USD 1.2 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 2.3 billion in 2034 at a CAGR of 7.8%.

The United States oncology information system market holds a dominant position globally, fueled by a robust healthcare infrastructure, high cancer incidence rates, and early adoption of advanced digital health technologies. Increasing investments in oncology-specific electronic medical records, precision treatment planning tools, and radiation therapy management systems are key contributors to market expansion.

Hospitals, cancer centers, and outpatient oncology clinics across the US are rapidly integrating data-driven platforms to improve clinical efficiency, enhance care coordination, and support value-based care initiatives. Government support through programs like the Cancer Moonshot and widespread adoption of EHR standards such as HL7 and FHIR have further accelerated the deployment of oncology IT solutions. Additionally, the presence of leading health IT vendors and continuous innovation in clinical decision support systems (CDSS) provide a strong foundation for sustained growth.

The market is also witnessing a surge in demand for cloud-based oncology information systems and AI-powered analytics tools that can process complex oncology data, including genomics, radiomics, and patient-reported outcomes. With the shift toward outpatient and home-based cancer care, there's growing emphasis on remote monitoring, tele-oncology, and interoperable health records that ensure continuity of care across settings.

Moreover, rising emphasis on personalized oncology and population health management is pushing healthcare providers to adopt integrated oncology platforms capable of tracking treatment progress, managing toxicities, and aligning with clinical trial protocols. As the U.S. healthcare system continues to prioritize quality outcomes and cost-efficiency, oncology information systems are becoming essential for delivering data-rich, patient-centric cancer care.

The Europe Oncology Information System Market

The European oncology information system market is projected to reach a valuation of approximately USD 900 million in 2025. This strong position is underpinned by the region’s well-developed healthcare infrastructure, growing cancer burden, and proactive digital health policies. Major economies such as Germany, France, the United Kingdom, and the Netherlands have been at the forefront of adopting oncology-specific IT platforms, driven by their focus on improving treatment outcomes, optimizing hospital workflows, and aligning with regulatory mandates such as GDPR and EU MDR. Hospitals and cancer care centers across Europe are investing in integrated systems that can support radiotherapy planning, clinical documentation, and patient data management, leading to widespread OIS deployment.

With a forecast CAGR of 7.5% from 2025 to 2034, Europe’s oncology information system market is poised for steady growth. Factors such as the shift toward personalized medicine, rising uptake of AI-driven clinical decision support tools, and increased interoperability between hospital systems are expected to sustain this momentum. Moreover, the push for cross-border healthcare collaboration and data sharing under the European Health Data Space initiative is encouraging further standardization and integration of oncology IT systems. As value-based care models gain traction and precision oncology becomes a regional priority, demand for robust, compliant, and scalable oncology information systems will continue to expand throughout the European healthcare ecosystem.

The Japan Oncology Information System Market

The oncology information system market in Japan is estimated to reach USD 200 million in 2025. This modest yet significant share reflects Japan’s growing emphasis on healthcare digitization amid a rapidly aging population and rising cancer incidence rates. The country’s leading medical institutions are steadily adopting oncology information systems to streamline complex treatment workflows, integrate imaging and pathology data, and improve care coordination across departments. Japan's strength in advanced diagnostic technologies and precision medicine also supports the integration of oncology IT platforms with genomic data and clinical analytics, enhancing treatment personalization and long-term patient management.

Despite a relatively slower adoption rate compared to North America and Europe, Japan’s oncology IT sector is set to grow at a healthy CAGR of 6.8% through 2034. Factors contributing to this growth include government-backed initiatives to modernize hospital information systems, growing demand for outpatient cancer care, and rising investments by Japanese tech firms in AI-driven oncology platforms. Additionally, the shift toward cloud-based deployments and interoperability between electronic medical records and oncology-specific software is gaining traction in both public and private hospitals. As regulatory frameworks evolve to support digital health innovation and clinical research, Japan is expected to further solidify its position as a key market within the Asia-Pacific oncology information system landscape.

Global Oncology Information System Market: Key Takeaways

- Market Value: The global oncology information system market size is expected to reach a value of USD 6.7 billion by 2034 from a base value of USD 3.3 billion in 2025 at a CAGR of 8.3%.

- By Component Segment Analysis: Software components are anticipated to dominate the component segment, capturing 72.0% of the total market share in 2025.

- By Technology Architecture Segment Analysis: Electronic Health Records (EHR) are expected to dominate the technology architecture segment, capturing 38.0% of the market share in 2025.

- By Deployment Mode Segment Analysis: Cloud-Based deployment mode is poised to consolidate its dominance in the deployment mode segment, capturing 54.0% of the total market share in 2025.

- By Indication Type Segment Analysis: Breast Cancer is expected to maintain its dominance in the indication type segment, capturing 22.0% of the total market share in 2025.

- By Application Segment Analysis: Medical Oncology applications will dominate the application segment, capturing 48.0% of the market share in 2025.

- By End User Segment Analysis: Hospitals & Diagnostic Imaging Centers will capture the major market share in end user segment, capturing 66.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global oncology information system market landscape with 42.0% of total global market revenue in 2025.

- Key Players: Some key players in the global oncology information system market are Varian Medical Systems, Elekta AB, Accuray, Cerner, RaySearch Laboratories, Flatiron Health, Philips, McKesson, Siemens Healthineers, Epic Systems, IBM Watson Health, and Others.

Global Oncology Information System Market: Use Cases

- Streamlining Multidisciplinary Cancer Treatment Coordination: Oncology information systems enable seamless collaboration among various specialists involved in cancer care, including oncologists, radiologists, and pathologists. These systems centralize access to clinical notes, diagnostic reports, lab results, and imaging data, allowing for more effective treatment coordination. With integrated patient profiles and standardized communication channels, care teams can conduct tumor board meetings more efficiently and plan interventions based on up-to-date information. This not only improves continuity of care but also helps reduce errors and enhance treatment accuracy across clinical workflows.

- Enhancing Radiation Therapy and Treatment Planning: Modern oncology platforms offer sophisticated tools for radiotherapy planning by integrating imaging systems and treatment simulators. Clinicians can define precise tumor boundaries, calculate optimal radiation dosages, and adjust treatment parameters based on previous outcomes. These capabilities are especially valuable in complex cases where adaptive radiation therapy is required. By improving the accuracy of radiation delivery and reducing manual errors, oncology information systems contribute to safer and more effective cancer therapy.

- Optimizing Electronic Health Records and Patient Data Management: An oncology information system serves as a central repository for structured patient data, enabling clinicians to access medical histories, ongoing treatments, lab tests, and prescription records in a single view. These systems support the integration of electronic health records (EHRs) with oncology-specific modules, ensuring more efficient patient tracking and follow-ups. The ability to analyze historical data and clinical patterns also aids in improving evidence-based decision-making. With support for HL7 and FHIR standards, these platforms ensure interoperability across departments and healthcare facilities.

- Supporting Clinical Trials and Precision Oncology Initiatives: OIS platforms are being used to manage clinical trial participation and precision oncology programs. By linking patient profiles with genomic data, treatment responses, and eligibility criteria, oncology centers can identify suitable candidates for ongoing trials. This supports personalized treatment plans based on molecular characteristics and helps accelerate drug development. Furthermore, oncology information systems with built-in analytics and reporting tools allow researchers to monitor trial outcomes, adverse events, and patient-reported outcomes in real time, improving trial efficiency and patient safety.

Impact of Artificial Intelligence in Oncology Information System Market

Artificial intelligence is profoundly reshaping the oncology information system market by enhancing the efficiency and precision of cancer care workflows. AI-driven tools assist in the analysis and integration of patient data, from electronic health records and medical imaging to genomics and treatment history, enabling personalized treatment plans and predictive outcome modeling. Machine learning algorithms optimize clinical decision support by identifying trends and recommending therapy adjustments, while natural language processing streamlines documentation and automates medical coding and reporting. Additionally, AI platforms enable real-time monitoring of patient responses and early detection of adverse events, improving treatment safety and efficacy. By reducing administrative burdens and enabling data-driven insights, AI is empowering clinicians, accelerating clinical trials, and ultimately contributing to more effective, patient-centric oncology care.

Global Oncology Information System Market: Stats & Facts

-

U.S. HealthIT.gov (Access & Use of Electronic Health Information by Cancer Patients)

- Nearly 40% of individuals in the U.S. will be diagnosed with cancer in their lifetime

- Between 2020 and 2022, 80% of recently diagnosed cancer patients and 73% of cancer survivors were offered access to online medical records or patient portals

- Of those offered access, 82% of recently diagnosed patients and 71% of survivors accessed their records at least once annually

- 40% of recently diagnosed patients accessed their medical records six or more times per year

- Recently diagnosed patients used an average of 2.2 different portals; survivors used an average of 1.2

- Only 8% of recently diagnosed patients used third-party apps to aggregate health information

-

National Cancer Institute & ONC (SEER Program & Health IT Interoperability)

- 97% of U.S. hospitals and 80% of office-based physicians use ONC-certified EHR systems

- The SEER program has a 2-year delay in reporting cancer data; efforts are underway to integrate real-time electronic pathology reporting

- The 21st Century Cures Act and the Trusted Exchange Framework and Common Agreement (TEFCA) enable secure, nationwide health data exchange

- As of 2024, seven federally designated Qualified Health Information Networks (QHINs) are actively exchanging clinical data for treatment use

-

President’s Cancer Panel & ONC (Data Accuracy and Digital Health Integration)

- Over 80% of EHR medication lists for cancer patients contain at least one error or omission

- Approximately 1.6 million new cancer diagnoses occur annually in the U.S.

- Connected health technologies are being promoted to manage large volumes of patient-generated and clinical data in cancer care

- Improved digital coordination has been prioritized to support navigation and survivorship care planning

-

EHR Use & Operational Efficiency (Government & Public Health Analysis)

- EHR adoption has been shown to reduce medication errors by 55% to 83% in clinical settings

- Implementation of standardized digital records reduced hospital admission identification times by 65%, from 130 to 46 hours

- The Veterans Affairs (VA) health system saw a 6% annual improvement in efficiency from its EHR system

- Despite historical benefits, the national rollout of new EHR platforms in the VA system has experienced operational delays

-

Cancer Survivorship and Patient Portals (National Cancer Institute - HINTS Survey)

- As of January 2022, there were 18.1 million cancer survivors in the U.S.

- This number is projected to rise to 22.5 million by 2032

- Digital health tools, including patient portals and cancer apps, are increasingly being used for follow-up care and survivorship navigation

- The 2024 Cancer Moonshot reinforced national efforts to expand digital engagement tools and improve patient access to personalized data.

Global Oncology Information System Market: Market Dynamics

Global Oncology Information System Market: Driving Factors

Rising Global Cancer Incidence and Demand for Integrated Care

The growing number of cancer diagnoses globally has led to increased demand for efficient, scalable healthcare technologies. Oncology information systems help manage large volumes of patient data, coordinate complex treatment pathways, and support integrated cancer care delivery. These platforms enable healthcare providers to handle clinical documentation, treatment planning, and reporting with greater precision and speed, ultimately improving patient outcomes. The need for streamlined oncology workflow solutions in hospitals and specialty clinics is a major catalyst for market growth.

Advancements in Healthcare IT and Interoperable Infrastructure

Rapid digitization of healthcare systems and the integration of interoperable platforms have created a favorable environment for the adoption of oncology-specific software. Modern oncology information systems support HL7, FHIR, and DICOM standards, allowing for seamless data exchange between radiology, pathology, pharmacy, and clinical oncology departments. Improved connectivity and system integration not only enhance care coordination but also facilitate compliance with regulatory frameworks such as HIPAA and GDPR.

Global Oncology Information System Market: Restraints

High Implementation Costs and Resource Constraints in Developing Regions

Despite their benefits, oncology information systems often involve high upfront costs related to software licensing, hardware upgrades, staff training, and data migration. Smaller hospitals and healthcare providers in low- and middle-income countries may find it difficult to justify or sustain these investments. The lack of IT infrastructure and technical expertise also limits the scalability of these solutions in resource-constrained settings.

Data Privacy Concerns and Regulatory Barriers

Handling sensitive oncology-related health data requires strict adherence to regulatory guidelines. Variations in data protection laws across regions pose challenges for multinational OIS vendors. Additionally, concerns over data breaches, unauthorized access, and lack of cybersecurity readiness can inhibit adoption. Ensuring secure patient information management while enabling system interoperability continues to be a critical restraint for the market.

Global Oncology Information System Market: Opportunities

Growing Adoption of AI and Predictive Analytics in Oncology

The integration of artificial intelligence and machine learning in oncology information systems presents vast opportunities for predictive diagnostics, risk assessment, and treatment optimization. AI-powered platforms can analyze complex datasets including genomics, imaging, and patient-reported outcomes to support evidence-based decision-making. This not only enhances clinical efficiency but also accelerates the shift toward personalized cancer care models.

Expansion of Cloud-Based and Remote Oncology Platforms

The growing use of cloud-based oncology platforms offers cost-effective scalability, remote access, and real-time data synchronization for cancer care providers. These systems are especially useful in tele-oncology, enabling oncologists to consult, plan, and monitor treatments across distributed locations. Cloud deployment models also support disaster recovery, automatic updates, and integration with mobile health applications, opening new avenues for digital cancer care delivery.

Global Oncology Information System Market: Trends

Transition toward Patient-Centric Oncology Platforms

There is a noticeable shift in the market toward patient-centered care models that prioritize transparency, personalized treatment, and continuous engagement. Oncology information systems now offer patient portals, symptom trackers, and shared decision-making tools that empower individuals to be active participants in their treatment journey. This trend reflects the broader movement toward value-based care and improved patient experience in oncology.

Integration of Genomics and Precision Medicine Workflows

Modern oncology IT platforms are evolving to support precision medicine by integrating genomic sequencing data, biomarker analysis, and targeted therapy insights. This integration enables clinicians to design customized treatment regimens based on a patient’s molecular profile. The growing emphasis on data-driven precision oncology is pushing vendors to incorporate advanced analytics and genomic compatibility into their systems, shaping the future of cancer care delivery.

Global Oncology Information System Market: Research Scope and Analysis

By Component Analysis

In the oncology information system market, software components are expected to account for the majority share, capturing approximately 72.0% of the total market by 2025. This dominance is driven by the critical role software plays in managing clinical workflows, storing patient data, and supporting treatment planning in oncology care. Key software solutions include electronic medical records (EMRs), treatment planning systems, and decision support tools that enable oncologists to coordinate care across multidisciplinary teams.

These platforms are integrated with diagnostic imaging systems and laboratory information systems, facilitating a holistic and real-time view of a patient’s cancer journey. The rising demand for interoperable and cloud-based oncology software has further accelerated adoption, especially in large hospital networks and cancer centers that require scalable and secure solutions.

Alongside software, services play a complementary but essential role in the oncology information system ecosystem. These services include implementation, training, technical support, software customization, and system upgrades. As the adoption of advanced oncology platforms grows, healthcare providers often rely on specialized vendors for smooth deployment, staff onboarding, and long-term maintenance.

Professional services are also crucial for integrating oncology systems with existing hospital infrastructure and ensuring compliance with regulatory standards such as HIPAA and GDPR. With growing complexity in oncology IT environments, service providers help institutions maximize the value of their technology investments while minimizing operational disruptions. Though smaller in share compared to software, the services segment is poised for steady growth as it enables seamless functionality and supports the expanding need for managed and consultative support in cancer care technology.

By Technology Architecture Analysis

In the technology architecture segment of the oncology information system market, electronic health records (EHR) are projected to lead, capturing around 38.0% of the total market share in 2025. This dominance stems from the central role EHRs play in compiling and managing patient data throughout the cancer care continuum. EHR systems allow healthcare providers to access a patient's complete medical history, including diagnoses, treatment plans, medications, imaging reports, and lab results, all within a single, unified interface.

Their integration with other oncology IT modules enhances care coordination, reduces redundant testing, and enables real-time clinical decision-making. As cancer care becomes data-driven, the demand for interoperable, oncology-specific EHR platforms is rising, particularly in settings such as academic medical centers and large cancer treatment networks where continuity of care is crucial.

Treatment planning systems represent another vital component of the technology architecture landscape in oncology. These systems are designed to assist radiation oncologists and medical physicists in developing precise and customized treatment plans based on individual patient anatomy and tumor characteristics. By using advanced imaging data, such as CT or MRI scans, treatment planning software enables clinicians to define tumor margins, calculate optimal radiation doses, and simulate the delivery of therapy.

These systems are critical for ensuring accuracy in radiation therapy and minimizing damage to surrounding healthy tissues. With the growing complexity of cancer cases and the shift toward personalized treatment protocols, the adoption of sophisticated treatment planning tools continues to grow. Their integration with oncology information systems enhances clinical workflow, improves treatment outcomes, and supports advanced modalities like intensity-modulated radiation therapy (IMRT) and stereotactic radiosurgery.

By Deployment Mode Analysis

In the deployment mode segment of the oncology information system market, cloud-based solutions are expected to strengthen their lead, accounting for 54.0% of the total market share in 2025. The growing preference for cloud deployment is largely driven by its flexibility, cost-efficiency, and scalability. Cloud-based oncology platforms enable real-time data access across multiple locations, making them ideal for large hospital networks, cancer centers, and organizations with distributed operations.

These solutions reduce the need for extensive in-house IT infrastructure and offer faster implementation, regular updates, and built-in disaster recovery capabilities. Moreover, cloud deployment supports tele-oncology and remote monitoring, which have gained significant traction in recent years due to the rising need for decentralized and accessible cancer care. As data security and regulatory compliance features in cloud technologies continue to improve, more healthcare providers are transitioning to this model to optimize operations and enable interoperability with other health information systems.

On-premises deployment, while gradually declining in share, continues to hold relevance in specific healthcare settings, particularly where data control, security, and regulatory compliance are paramount. This model involves installing and managing the software within the organization’s own data centers, giving hospitals full ownership over data and infrastructure. Institutions dealing with highly sensitive patient data or operating under stringent privacy regulations often prefer on-premises solutions to maintain tighter control over system access and network security.

Additionally, facilities in regions with limited internet connectivity or cloud infrastructure may still rely on on-site deployment to ensure uninterrupted system performance. Despite requiring higher upfront investment and IT resources, on-premises systems offer a level of customization and data sovereignty that remains valuable to certain segments of the oncology care market.

By Indication Type Analysis

In the indication type segment of the oncology information system market, breast cancer is projected to retain its dominant position, capturing approximately 22.0% of the total market share in 2025. This strong foothold is primarily due to the high global prevalence of breast cancer, ongoing awareness campaigns, and widespread screening programs that have increased early detection rates.

Oncology information systems play a pivotal role in managing breast cancer cases by streamlining diagnostic workflows, supporting evidence-based treatment protocols, and enabling long-term follow-up care. These systems assist clinicians in integrating imaging results, biopsy findings, genetic markers, and treatment responses to create personalized care plans. The complexity and chronic nature of breast cancer management, particularly in cases involving surgery, chemotherapy, radiation, and hormone therapy, require robust data coordination and monitoring, which further drives the demand for specialized oncology software in this segment.

Lung cancer represents another significant area within the oncology information system market, accounting for a substantial share due to its high mortality rate and growing incidence globally. Managing lung cancer involves multidisciplinary collaboration across pulmonology, radiology, oncology, and pathology, making streamlined data exchange and clinical coordination essential.

Oncology information systems enhance the management of lung cancer by integrating imaging systems like CT and PET scans, enabling real-time visualization of tumor progression and treatment response. These platforms also support the tracking of molecular testing results, which are crucial for identifying targeted therapy options and immunotherapy suitability. Given the complexity of lung cancer treatment protocols and the urgency for timely interventions, oncology information systems provide a critical infrastructure for improving outcomes and managing patient care effectively throughout the disease cycle.

By Application Analysis

In the application segment of the oncology information system market, medical oncology is expected to dominate, accounting for 48.0% of the total market share in 2025. This leadership is driven by the growing number of cancer patients undergoing chemotherapy, immunotherapy, and targeted drug treatments, all of which require continuous monitoring and complex treatment planning. Oncology information systems tailored for medical oncology help manage detailed patient histories, drug regimens, dosage schedules, and side effect tracking.

These platforms streamline the workflow for oncologists and nursing staff by offering integrated modules for medication management, laboratory test results, and adverse event reporting. As cancer therapies become personalized, the ability of these systems to support genomic data analysis and precision medicine protocols further strengthens their role in modern medical oncology practices. Additionally, the rising burden of chronic cancer types and the trend toward outpatient infusion centers have led to greater adoption of digital systems that can coordinate care efficiently across multiple visits and providers.

Surgical oncology, while smaller in comparison, remains a vital segment within the oncology information system landscape. These systems support surgical teams by managing pre-operative assessments, imaging data, surgical planning, intraoperative documentation, and post-operative outcomes. The integration of OIS with surgical navigation systems, pathology results, and post-surgical monitoring tools helps enhance decision-making and patient safety during cancer-related surgeries.

As more complex tumor resections and minimally invasive procedures become common, oncology information systems enable surgeons to access comprehensive patient data in real time, improving surgical accuracy and continuity of care. Furthermore, surgical oncology benefits from these systems through better coordination with other departments such as radiology, anesthesiology, and post-operative oncology clinics, ensuring a multidisciplinary approach to cancer treatment.

By End User Analysis

In the end user segment of the oncology information system market, hospitals and diagnostic imaging centers are projected to capture the largest share, accounting for 66.0% of the market by 2025. This dominance is primarily due to the high patient volume, complex case management, and advanced infrastructure available in these settings. Hospitals and imaging centers rely heavily on oncology information systems to coordinate multidisciplinary care, manage treatment protocols, and integrate imaging, pathology, and laboratory data into unified patient records.

These institutions often have in-house oncology departments, including radiation therapy and chemotherapy units, which demand robust IT systems for workflow automation, data accuracy, and regulatory compliance. Diagnostic imaging centers, in particular, benefit from the seamless integration of OIS with PACS and radiology information systems, enabling precise diagnosis and treatment planning. As these centers adopt cloud-based solutions and AI-powered diagnostic tools, the need for comprehensive oncology platforms becomes even more critical to support real-time collaboration and efficient care delivery.

Research centers, while representing a smaller segment, play an important role in advancing oncology information systems through clinical trials, translational research, and drug development. These centers use OIS platforms to collect, analyze, and manage large datasets related to patient responses, biomarker studies, and therapy outcomes. The ability to track longitudinal patient data, integrate genomic information, and monitor trial compliance makes oncology information systems a vital tool for cancer research.

Research institutions also contribute to the refinement of oncology software by piloting new features, validating clinical algorithms, and generating evidence that can be translated into everyday clinical practice. As precision oncology and personalized treatment approaches continue to evolve, research centers are expected to increase their reliance on advanced informatics platforms to accelerate innovation and improve cancer care outcomes.

The Oncology Information System Market Report is segmented on the basis of the following

By Component

- Software

- Patient Information Systems

- Treatment Planning Systems

- Services

By Technology Architecture

- Electronic Health Records (EHR)

- Treatment Planning Systems

- Picture Archiving and Communication Systems (PACS)

- Others

By Deployment Mode

By Indication Type

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Prostate Cancer

- Cervical Cancer

- Ovarian Cancer

- Lymphoma

- Others

By Application

- Medical Oncology

- Surgical Oncology

- Radiation Oncology

By End User

- Hospitals & Diagnostic Imaging Centers

- Research Centers

- Ambulatory Surgical Centers (ASCs)

- Others

Global Oncology Information System Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global oncology information system market, contributing 42.0% of the total market revenue in 2025. This regional dominance is attributed to the high prevalence of cancer, well-established healthcare infrastructure, and early adoption of advanced health IT solutions. The presence of major industry players, robust reimbursement frameworks, and widespread implementation of electronic health records further drive the uptake of oncology information systems across the region.

In addition, strong government support for cancer care initiatives, including funding for precision medicine and clinical trials, has accelerated the integration of oncology-specific software in hospitals and research institutions. The growing emphasis on value-based care, integrated with a shift toward cloud-based and AI-driven platforms, continues to strengthen North America’s position at the forefront of digital oncology transformation.

Region with significant growth

The Asia-Pacific region is expected to witness significant growth in the oncology information system market over the forecast period, driven by rising cancer incidence, growing healthcare investments, and expanding adoption of digital health technologies across emerging economies. Countries like China, India, and South Korea are experiencing a surge in demand for modern oncology care solutions as healthcare infrastructure develops and awareness around early cancer detection improves.

Government initiatives to modernize hospital IT systems, integrated with the growing availability of skilled healthcare professionals and rising adoption of cloud-based platforms, are accelerating the deployment of oncology information systems in the region. Additionally, the shift toward personalized medicine and integration of AI and big data analytics in cancer treatment are further fueling market expansion, making Asia-Pacific a key growth engine in the global landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Oncology Information System Market: Competitive Landscape

The global competitive landscape of the oncology information system market is characterized by the presence of several established players competing on the basis of technological innovation, product integration, and strategic partnerships. Leading companies such as Varian Medical Systems, Elekta AB, Siemens Healthineers, and RaySearch Laboratories dominate with comprehensive oncology platforms that offer advanced treatment planning, workflow automation, and real-time data analytics.

These vendors are continuously investing in R&D to enhance AI-powered decision support, interoperability with electronic health records, and integration with imaging and genomic data. In addition, cloud-based deployments and modular solutions tailored for both large hospitals and specialty clinics are gaining traction. Meanwhile, newer entrants and regional players are expanding their footprint through customized solutions, competitive pricing, and collaborations with healthcare providers in emerging markets. As the demand for personalized, data-driven cancer care continues to grow, competition is intensifying around platform scalability, cybersecurity, and regulatory compliance capabilities.

Some of the prominent players in the global oncology information system market are

- Varian Medical Systems

- Elekta AB

- Accuray Incorporaed

- Cerner Corporation

- RaySearch Laboratories

- Flatiron Health

- Philips Healthcare

- McKesson Corporation

- Siemens Healthineers

- Epic Systems Corporation

- IBM Watson Health

- ViewRay Inc.

- MIM Software Inc.

- GE Healthcare

- DOSIsoft SA

- Meditech

- Brainlab AG

- CureMD

- OncoEMR (by Altos Solutions)

- Oracle Health (formerly Cerner)

- Other Key Players

Global Oncology Information System Market: Recent Developments

- May 2024: Elekta AB announced the launch of its upgraded oncology information system, Elekta ONE, which integrates radiation therapy planning, patient scheduling, and AI-powered clinical decision support tools to streamline cancer care workflows across multiple facilities.

- March 2024: RaySearch Laboratories introduced RayCare 6A, the latest version of its oncology information system platform, offering enhanced support for adaptive radiation therapy and improved interoperability with third-party imaging and treatment systems.

- January 2024: Siemens Healthineers completed its acquisition of Intelligencia.AI, a healthcare AI firm, aiming to enhance its oncology information system capabilities by integrating predictive modeling and machine learning algorithms into its oncology software suite.

- October 2023: Oracle Health (formerly Cerner) acquired a minority stake in Flatiron Health to collaborate on developing next-generation oncology IT platforms that unify real-world data, clinical workflows, and research applications.

- August 2023: MIM Software secured a strategic investment from Thoma Bravo to scale its oncology software solutions and expand global market reach, with a focus on enhancing image-guided treatment planning and cloud-based deployments.

- June 2023: CureMD received USD 50 million in Series C funding led by General Catalyst to accelerate the development of its oncology-specific EHR modules, improve integration with genomic data, and expand access to community cancer centers.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3.3 Bn |

| Forecast Value (2034) |

USD 6.7 Bn |

| CAGR (2025–2034) |

8.3% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.2 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Software [Patient Information Systems, Treatment Planning Systems] and Services), By Technology Architecture (Electronic Health Records, Treatment Planning Systems, PACS, Others), By Deployment Mode (Cloud-based, On-premises), By Indication Type (Breast Cancer, Lung Cancer, Colorectal Cancer, Prostate Cancer, Cervical Cancer, Ovarian Cancer, Lymphoma, Others), By Application (Medical Oncology, Surgical Oncology, Radiation Oncology), and By End User (Hospitals & Diagnostic Imaging Centers, Research Centers, Ambulatory Surgical Centers, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Varian Medical Systems, Elekta AB, Accuray, Cerner, RaySearch Laboratories, Flatiron Health, Philips, McKesson, Siemens Healthineers, Epic Systems, IBM Watson Health, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global oncology information system market size is estimated to have a value of USD 3.3 billion in 2025 and is expected to reach USD 6.7 billion by the end of 2034.

The US oncology information system market is projected to be valued at USD 1.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2.3 billion in 2034 at a CAGR of 7.8%.

North America is expected to have the largest market share in the global oncology information system market, with a share of about 42.0% in 2025.

Some of the major key players in the global oncology information system market are Varian Medical Systems, Elekta AB, Accuray, Cerner, RaySearch Laboratories, Flatiron Health, Philips, McKesson, Siemens Healthineers, Epic Systems, IBM Watson Health, and Others.

The market is growing at a CAGR of 8.3 percent over the forecasted period.