Market Overview

The Global

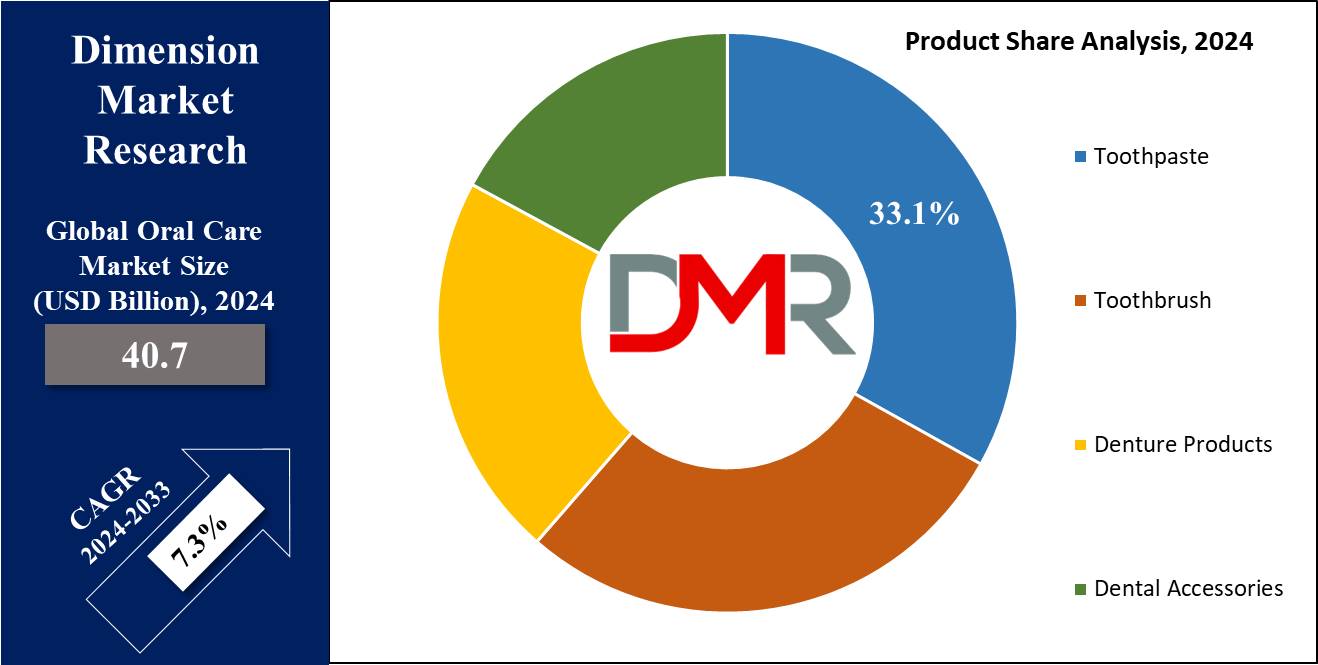

Oral Care Market size is expected to hold a market

value of USD 40.7 billion in 2024 and is projected to show subsequent growth with a market value of

USD 76.6 billion by the end of 2033 at a CAGR of 7.3%.

The global oral care industry is involved with a wide selection of goods and services that are targeted towards the care and

health of the mouth globally. This market comprises products like toothpaste, toothbrushes, denture products, and dental accessories available in different outlets like supermarkets, e-retailers, and specialty stores.

In recent times, several changes have been seen in the markets to focus on natural and organic products, which include the advancement of technology and smart toothbrushes, and the need for preventive healthcare oral hygiene.

Commitment to maintaining health and embracing well-being concepts, as well as adherence to legal requirements that govern the treatment of oral health products, advancements in technologies, and consumer awareness and understanding of the value of caring for oral health on a worldwide basis, create the global oral care market’s relevance and instability.

The oral care market is a fast-growing market that is driven by factors such as; health consciousness and consumers’ preference to use natural and organic products. Cosmetic dentistry is on the rise, this explains the growth of the oral care market. Such innovations as the emergence of smart brushes, innovative technologies in teeth whitening, and general developments in dental treatments help in influencing the consumer market and thus fuel the market’s expansion.

The emergence of e-commerce throughout the globe has implied the altered shopping preferences of clients and has affected oral care quite considerably. Natural and organic profiling is also on the rise here. Growing customer consciousness regarding oral health boosted by the cascades of education campaigns push the demand for a wide range of oral care products among consumers across the world. Due to the global nature of the Oral Care market, cultural influences and current trends of the specific region are quite impacting at the time of product development and promotion.

The increasing consciousness of the environment leads oral care brands and companies to use environmentally friendly packaging and produce green products based on the consumers’ demand. Such issues are critical in comprehending the patterns of this market and consequently, for the companies that seek to thrive within it.

Key Takeaways

- Market Value: The Global Oral Care Market is projected to hold a market value of USD 76.6 billion in 2033 from a base value of USD 40.7 billion in 2024 at a CAGR of 7.3%.

- Definition: The oral care market encompasses products and services aimed at retaining oral hygiene, together with toothbrushes, toothpaste, mouthwashes, dental floss, and professional dental offerings for the prevention and treatment of oral illnesses.

- By Product Segment Analysis: In terms of products in the global oral care market, toothpaste is projected to dominate this segment as it holds 33.1% of the market share in 2024.

- By Type Segment Analysis: Based on the type, cordless is anticipated to dominate this segment as they hold 67.2% of the market share in 2024.

- By Application Segment Analysis: Based on application, the home is projected to dominate this segment as it holds the highest market share in 2024.

- By Distribution Channel Segment Analysis: The dominance of specialty stores in the oral care market is due to various factors that distinguish these retail channels.

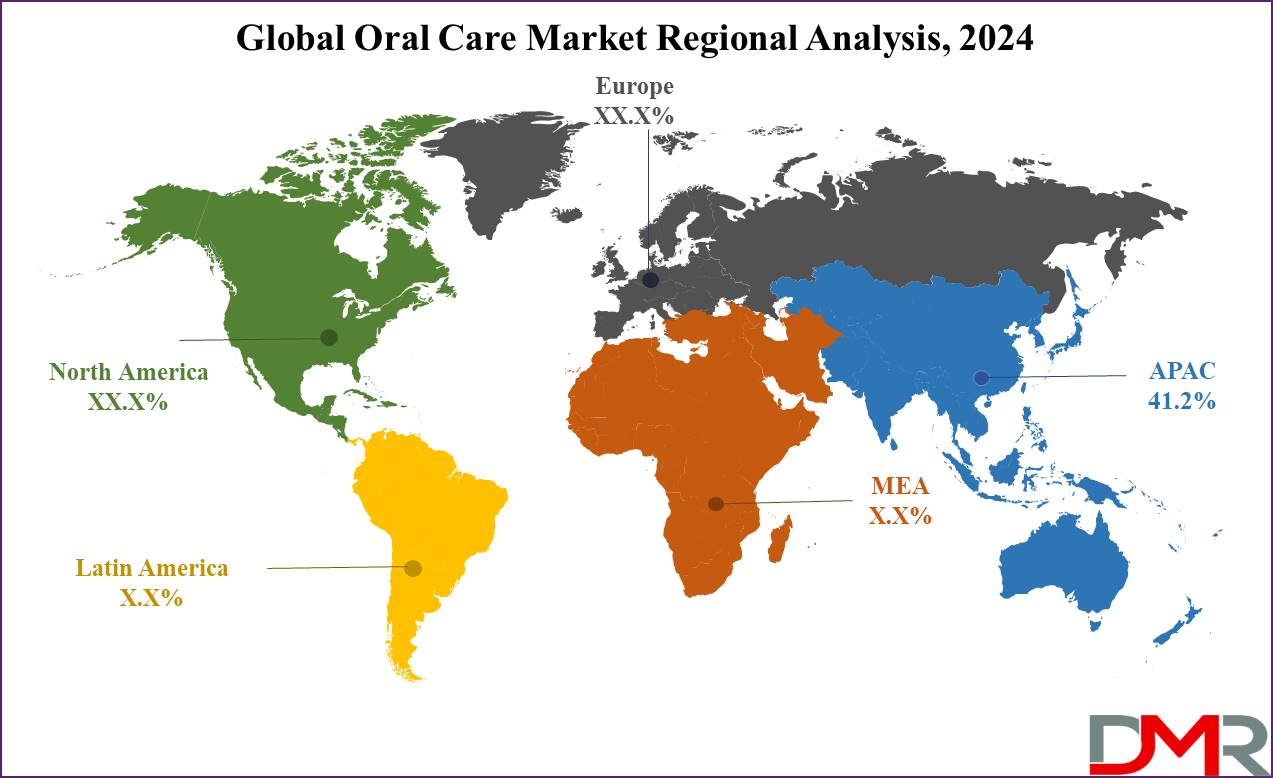

- Regional Insights: Asia Pacific is projected to dominate the global oral care market as it holds 41.2% of the market share in 2024.

Use Cases

- Daily Oral Hygiene: Products like toothbrushes, toothpaste, and mouthwash help individuals maintain daily oral hygiene by removing plaque, preventing cavities, and freshening breath, promoting overall dental health.

- Orthodontic Care: Specialized tools and products, consisting of braces, retainers, and cleansing devices, help with the alignment of enamel and upkeep of oral hygiene all through orthodontic treatment, improving dental shape.

- Professional Dental Services: Dentists and hygienists provide preventive and corrective treatments, including cleanings, fillings, and surgeries, addressing dental issues and promoting long-term oral health through professional care.

- Whitening and Cosmetic Products: Whitening toothpaste, strips, and professional bleaching services cater to cosmetic needs, enhancing the appearance of teeth, boosting confidence, and offering aesthetic dental solutions.

Market Dynamic

Trends

Rising Demand for Organic ProductsOrganic and natural products have gained immense popularity in the global oral care market and its products. Consumers wish to buy products with no synthetic chemicals and additives which is a general trend towards a healthier living and a green lifestyle. It is also contributing to the growth of the market and the kind of approaches implemented by market leaders that involve the need to introduce new lines of organic products into the marketplace.

Technological Advancements in Oral Care Products

Innovation of oral health care products like electric toothbrushes and smart dental appliances are already trends in the oral care market. They present, improved oral hygiene solutions, better ease and convenience, and real-time feedback on oral health, which collectively helped in improving the size of the market during the period of forecast. Market entities are allocating resources to research and development to remain relevant as well as adverse to market changes.

Growth Drivers

Increasing Awareness of Oral Hygiene

Increased consciousness about dental health and its associative role in availing health is a primary factor that fuels the global oral care market share. Campaigns and organizations mostly run by health and governments are creating awareness in society, hence increasing the use of oral care products. This way, the evolution of awareness of consumers to the brands promotes the growth of the market since more consumers are persuaded to spend on oral hygiene products.

Rising Prevalence of Oral Diseases

Oral diseases including cavities, gum diseases, and oral cancer are on the increase and this is one of the major factors driving the global market for dental prosthetics. As various diseases and disorders affect the teeth and gums, people need an efficient method of oral care. This factor contributes to the development of the oral care market since more individuals demand preventive and therapeutic products for oral illnesses.

Growth Opportunities

Expansion in Emerging Markets

The largest consumption increases for oral care products are expected to happen in the Asia-Pacific and Latin America regions. The factors that contribute to these regions are rising disposable income, urbanization, and consumers’ knowledge of oral health. There is greater emphasis on extending the coverage and distribution channels in these potential markets to have a better slice of the market.

Innovations in Product Development

New product development is another growth factor that has been brought into the scene by innovations such as individual oral care products and premium denture products. A few current trends that will help the firms to make a niche in the market are the development of new and advanced oral health products and investing heavily in research and development. These innovations relate to specific consumer needs and wants and thereby fuel the market.

Restraints

High Cost of Advanced Oral Care Products

Expensive products like electric toothbrushes and other dental products could also act as a constraint in the growth of the respective market. However, these products are rather helpful, although not always available for the average consumer, especially in developing countries. Such price sensitivity may slow down the consumption of new oral care solutions and affect the future enhancement of the market. A significant problem affecting the people of developing regions is their restricted to access dental care resources.

Limited Access to Dental Care in Developing Regions

Lack of access to dental health and dental-related products is a major constraint mainly in third-world countries. Lack of infrastructure, ignorance as well as poverty remains some of the challenges that limit access to and usage of oral care products. This limitation can be observed in inflation of the growth rate within the reach of the forecast period where the market players are not able to effectively expand on the untouched markets.

Research Scope and Analysis

By Product

In terms of products in the global oral care market, toothpaste is projected to dominate this segment as it holds 33.1% of the market share in 2024 and is expected to show subsequent growth in the forthcoming period of 2024 to 2033. Toothpaste stands as a cornerstone in the oral care market, owing to its universal acceptance and indispensable role in oral hygiene. The diverse formulations available, including gel, polish, paste, and powder, cater to an array of consumer preferences and oral health needs, fostering widespread market penetration. Gel toothpaste, known for its smooth texture and various flavors, attracts those seeking a unique sensory experience. Polish toothpaste, with its abrasive action and focus on stain removal, appeals to consumers desiring a brighter smile.

The traditional paste formulation, a common and widely used option, comes in various formulas catering to specific concerns such as sensitivity and enamel protection while powder toothpaste, though less conventional, gains popularity among those preferring alternative textures and natural,

organic options. The dominance of toothpaste is underscored by its status as an essential oral care product, addressing a variety of oral health concerns with targeted solutions. The global acceptance and usage of toothpaste across diverse demographics, coupled with brand loyalty and marketing emphasizing regular use, further solidify its central role in oral care practices worldwide. The continuous innovation in ingredients and flavor varieties contributes to consumer satisfaction, ensuring toothpaste remains a vital and versatile component of oral care routines.

By Type

Based on the type, cordless is projected to dominate this segment as

they hold 67.2% of the market share in 2024 and are expected to show subsequent growth in the forthcoming period from 2024 to 2033. This dominance of cordless in the oral care market is driven by a variety of factors that resonate with consumer preferences and technological advancements. Their portability and travel-friendly nature, enabled by battery-powered operation, make them highly convenient for users on the go. Cordless models boast user-friendly designs with simplified controls and easy charging options.

Technological advancements, including improved battery performance and smart features, contribute to their popularity. Consumer preferences for cordless operation align with the modern lifestyle, emphasizing flexibility and maneuverability during brushing. Market trends indicate a growing demand for cordless electric toothbrushes, driven by innovation and manufacturers' focus on meeting evolving consumer expectations. Additionally, the ease of maintenance, hygienic design, and environmental considerations, such as the use of rechargeable batteries, further contribute to their dominance and solidify their position as a leading choice in the oral care segment.

By Application

Based on application, the home is anticipated to dominate this segment as it holds the highest market share in 2024 and is projected to show subsequent growth in the forthcoming years of 2024 to 2033. The dominance of the home segment in the oral care market is supported by several factors that align with consumer preferences and behaviors. Home oral care products, including toothpaste and toothbrushes, offer convenience and accessibility and have become an integral component of daily routines. Emphasizing preventive care, these products are cost-effective solutions compared to professional dental treatments, appealing to consumers seeking affordable and accessible options.

The privacy and autonomy provided by home oral care contribute to its prevalence, with individuals preferring the comfort of managing routine dental care activities at home. The prevalence of basic oral care products, availability over the counter, and technological advancements, such as electric and smart toothbrushes, further solidify the dominance of the home segment. The global trend toward self-care and the adaptability of home-based oral care health further boost the growth of this market.

By Distribution Channel

The dominance of specialty stores in the oral care market is due to various factors that distinguish these retail channels. One of the major reasons for this dominance is the presence of knowledgeable staff who offer expert guidance, enhancing the consumer's shopping experience. Specialty stores offer a wide product range, consisting of exclusive and premium brands not readily found elsewhere. This, coupled with a focus on health and wellness, attracts consumers seeking a holistic approach to their well-being. The emphasis on customer service, personalization, and the cultivation of brand loyalty further contributes to their market dominance. Educational initiatives and a commitment to innovation position specialty stores as leaders in introducing new oral care products.

The upscale shopping environment appeals to consumers by associating it with higher-quality items. Additionally, strategic alignment with specific demographics and preferences allows these stores to capture distinct consumer segments. While specialty stores play a significant role, the oral care market remains diverse, with the dominance of these outlets subject to regional variations, consumer behaviors, and the competitive landscape.

The Oral Care Market Report is segmented based on the following

By Product

- Toothpaste

- Toothbrush

- Manual

- Electric (Rechargeable)

- Battery-Powered (Non-rechargeable)

- Others

- Denture Products

- Cleaners

- Fixatives

- Floss

- Others

- Dental Accessories

- Cosmetic Whitening Products

- Fresh Breath Dental Chewing Gum

- Tongue Scrapers

- Fresh Breath Strips

- Others

By Type

By Application

By Distribution Channel

- Specialty Stores

- Hypermarket & Supermarkets

- Drug Stores & Pharmacies

- Convenience Store

- Online Retailers

- Others

Regional Analysis

Asia Pacific is projected to dominate the global oral care market as it

holds 41.2% of the market share in 2024 and is expected to show significant growth in the upcoming period of 2024 to 2033. Asia's substantial influence on the global oral care market can be attributed to various factors massive population base, particularly in countries like China and India, the region represents a significant consumer market for oral care products. The rapid urbanization and evolving lifestyles in many Asian nations have heightened awareness about personal care, including oral health. Economic growth and rising disposable incomes in several Asian countries have led to increased spending on personal care items.

A growing emphasis on health and beauty consciousness, coupled with a cultural focus on appearance and grooming, has fueled demand for a variety of oral care products. Innovations tailored to local preferences, government initiatives promoting oral health awareness, and the surge of e-commerce platforms have further expanded the market reach. The presence of both global and local players, along with dietary and lifestyle factors, contributes to a dynamic and competitive landscape in the Asian oral care market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

In the oral care market, major players like Procter & Gamble, Colgate-Palmolive, Johnson & Johnson, GlaxoSmithKline, Unilever, and Church & Dwight Co., Inc., hold significant positions in this market. Notable market trends involved in this market include a surge in technological innovations, with the introduction of smart toothbrushes and advanced toothpaste formulations. The market also reflects a growing global awareness of oral health, particularly in emerging markets, contributing to increased demand for oral care products. Consumers' rising interest in natural and organic options has prompted key players to incorporate such products into their portfolios.

The growth of e-commerce has reshaped distribution channels, while strategic collaborations, acquisitions, and mergers remain prominent strategies for market expansion. Furthermore, companies are focusing on emerging markets with expanding middle-class populations and disposable incomes. Educational initiatives aimed at raising awareness about oral health underscore the commitment of market players to consumer well-being.

Some of the prominent players in the Global Oral Care Market are

- Procter & Gamble Company

- Johnson & Johnson Services Inc.

- Colgate-Palmolive Company

- GlaxoSmithKline Plc.

- Church & Dwight Co. Inc.

- Dr. Fresh LLC

- Dentaid

- Lion Corporation

- Sunstar Suisse S.A.

- Henkel AG & Co. KGaA

- Unilever PLC

- DABUR INDIA LTD.

- ULTRADENT PRODUCT

- Other Key Players

Recent Developments

- In December 2023, OraQ announced the official launch of its commercial operations in North America, introducing a clinical decision support system for dentists. Unlike other AI platforms, OraQ's FDA and Health Canada-approved platform is a comprehensive treatment planning technology that analyzes the complete patient profile to uncover treatment opportunities. The platform features an interactive patient portal, contributing to improved patient engagement, trust, and transparency, resulting in a better experience for both patients and clinicians.

- In November 2023, Dentalkart, India's leading dental products and services provider, collaborates with Germany's Baldus Sedation Systems to introduce innovative dental solutions in India. Dentalkart achieved a turnover of 100 crores, signaling its commitment to revolutionize dental care in India, with a focus on PAN-India expansion. Dentalkart's mobile app, with over 2 lakh downloads, serves a dedicated customer base of more than 90,000 loyal clients each quarter.

- In October 2023, The ADA and Forsyth Institute announced the formation of the ADA Forsyth Institute, aiming to combine talent, research opportunities, and innovation for advancing oral health through scientific research. The collaboration brings together the ADA's expertise and the Forsyth Institute's leadership in oral health research, intending to accelerate scientific discovery and innovation. The new institute will build on the achievements of the ADA Science & Research Institute (ADASRI), including groundbreaking research like mapping every cell in the oral cavity and maintaining the ADA Seal of Acceptance program.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 40.7 Bn |

| Forecast Value (2033) |

USD 76.6 Bn |

| CAGR (2024-2033) |

7.3% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Toothpaste, Toothbrush, Denture Products and Dental Accessories), By Type (Cordless and Countertop), By Application (Home and Dentistry), By Distribution Channel (Specialty Stores, Hypermarket & Supermarkets, Drug Stores & Pharmacies, Convenience Stores, Online Retailers and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Procter & Gamble Company, Johnson & Johnson Services Inc., Colgate-Palmolive Company, GlaxoSmithKline Plc., Church & Dwight Co. Inc., Dr. Fresh LLC, Dentaid, Lion Corporation, Sunstar Suisse S.A., Henkel AG & Co. KGaA, Unilever PLC, DABUR INDIA LTD., ULTRADENT PRODUCT, and Other Key Players |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |

Frequently Asked Questions

The Global Oral Care Market size is estimated to be USD 40.7 billion in 2024 and is expected to reach USD 76.6 billion by the end of 2033.

Asia Pacific is projected to have the largest market share in the Global Oral Care Market with a share of about 41.2% in 2024.

Some of the major key players in the Global Oral Care Market are Procter & Gamble Company, Johnson & Johnson Services Inc., Colgate-Palmolive Company, GlaxoSmithKline Plc., Church & Dwight Co. Inc., Dr. Fresh LLC, Dentaid, Lion Corporation, Sunstar Suisse S.A., Henkel AG & Co. KGaA, Unilever PLC, DABUR INDIA LTD., ULTRADENT PRODUCT and many others.

The market is growing at a CAGR of 7.3 percent over the forecasted period.