Organic Pet Food Market Overview

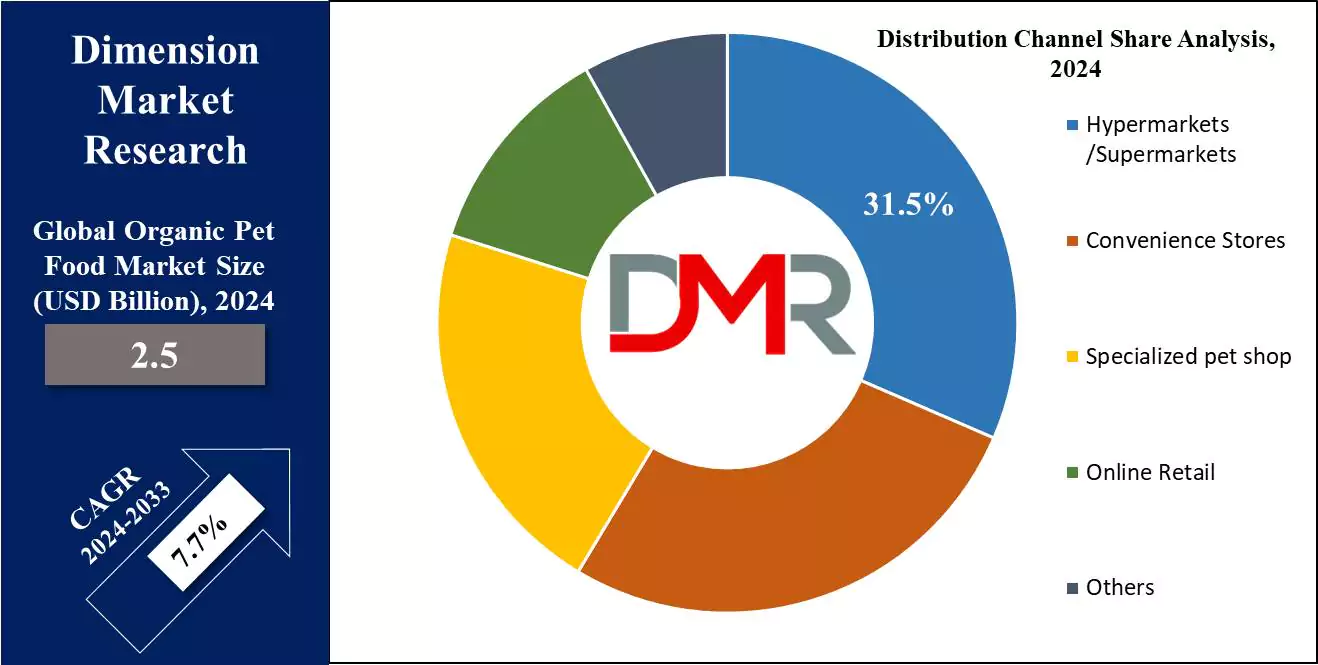

The Global Organic Pet Food Market size is anticipated to be valued at USD 2.5 billion in 2024 and is further predicted to reach USD 4.8 billion by 2033, at a CAGR of 7.7 %.

Organic pet foods are products eaten by pets and are made without using synthetic fertilizers, pesticides, genetically modified organisms, antibiotics, & artificial additives. These foods are rich in nutrients and include organic meats, fruits, vegetables, minerals, & vitamins. It can improve the appearance of skin and coat, increase energy levels, & support healthier weights in pets.

It also contains essential amino acids, and fatty acids, offering superior health benefits compared to regular pet food. The organic pet food market is experiencing rapid growth due to increasing focus on pet health and adopting them as a family member. In addition, pet owners are now becoming more aware of health issues like skin allergies, arthritis, brain aging, digestive disorders, & obesity in pets, which leads them to search for healthier and more nutritious organic food options. These food products are also rising due to the increasing per capita income of the customers.

As per the World Animal Foundation, the Organic Pet Food Market is witnessing robust growth driven by shifting consumer preferences. Approximately 61% of U.S. pet owners prioritize nutritious food for their pets, contributing to the market's valuation of $2,318.5 million. The increasing trend of premiumization is evident, with 43% of dog owners and 41% of cat owners opting for high-quality pet food. Additionally, the demand for raw dog food has surged by 147% over the past five years.

Pet ownership remains high, with over 66% of U.S. households owning at least one pet. Among these, 80% of dogs and 20% of cats are insured. Millennials, a key demographic, show strong purchasing power—69% express interest in organic pet food, and 51% regularly buy gifts for their pets. The digital channel is also a significant driver, with nearly 40% of pet owners purchasing food and treats online across a market with over 630 brands.

An exciting deal has been finalized in the organic pet food industry with the merger of two leading brands, Nature's Feast and PurePaws Organics. This strategic partnership, announced at the Organic Pet Care Expo 2024, aims to revolutionize the market by combining their expertise in premium, sustainable pet nutrition.

Together, they plan to expand their product range, increase distribution globally, and set new benchmarks in organic pet care standards. The merger promises innovative, eco-friendly offerings tailored to meet the growing demand for healthier pet food, marking a significant milestone for the pet food industry and eco-conscious pet owners.

Organic Pet Food Market Key Takeaways

- Market size: The Global Organic Pet Food Market is expected to grow by 2.1 billion, at a CAGR of 7.7% during the forecasted period of 2025 to 2033.

- Market Definition: Organic pet foods are food products eaten by pets that are made from organic ingredients.

- Pet Type segment: In terms of pet type, the dog segment is expected to dominate the market with the largest revenue share in 2024.

- Pet Age segment: Based on the pet Age, adult pets are predicted to lead the organic pet food market with the highest revenue share in 2024.

- Packaging Type segment: The Dry & Dehydrated segment is anticipated to dominate the organic pet food market based on packaging type with the largest revenue share in 2024.

- Distribution Channel: In the context of distribution channels, supermarkets/ hypermarkets are anticipated to lead the market with the largest revenue share in 2024.

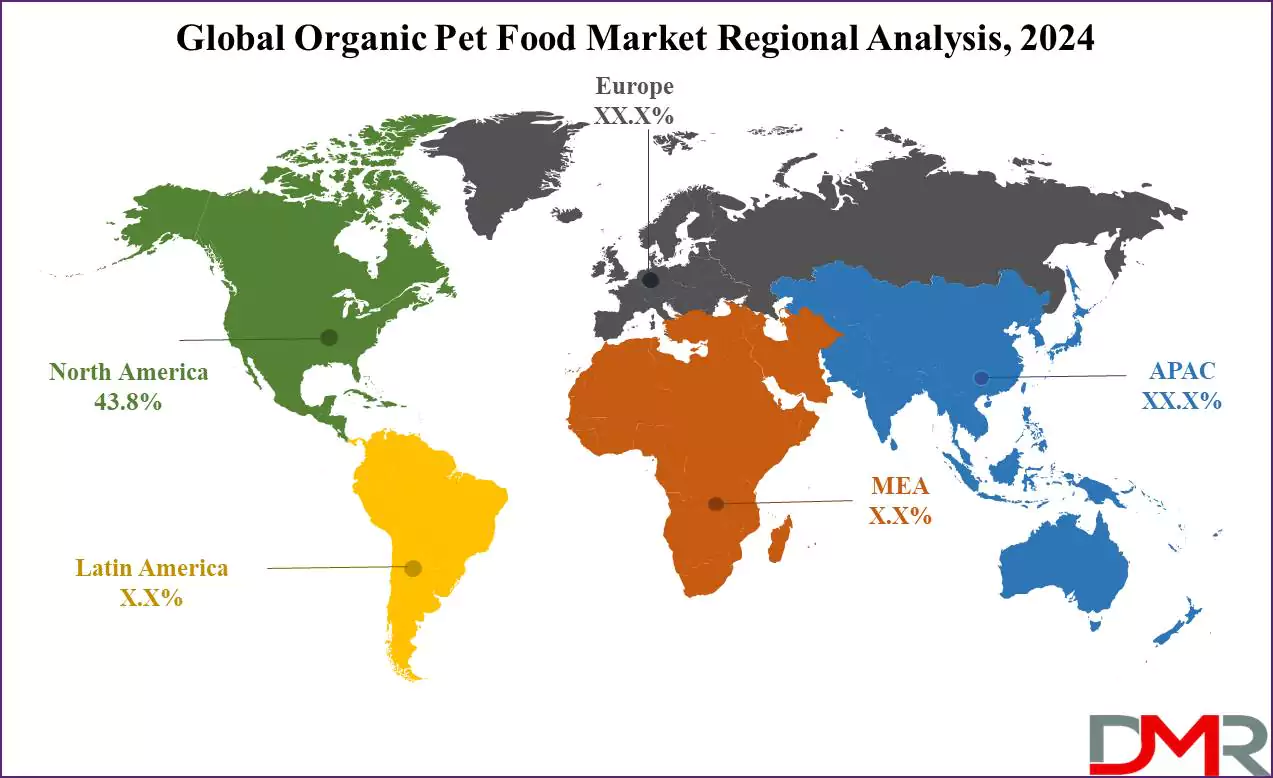

- Regional Analysis: North America is expected to dominate the organic pet food market with a revenue share of 43.8% in 2024.

Organic Pet Food Market Use Cases

- Weight Management: Organic pet food contains higher nutritional value with fewer fillers and artificial additives which are beneficial for pets to maintain a healthy weight or lose excess pounds.

- Healthier Ingredients: These organic foods are made from high-quality ingredients that are free from synthetic pesticides, hormones, antibiotics, and genetically modified organisms which are helpful in overall health for pets, including better digestion, increased energy levels, and a shiny coat.

- Environmental Sustainability: Production of this food requires sustainable farming like crop rotation, and natural pest control methods practices which reduce environmental impact.

- Allergy Management: Pets are often allergic to some ingredients that are advantageous for organic pet food growth as they help to reduce allergic reactions and improve skin and coat health.

Organic Pet Food Market Dynamic

The organic food pet market is growing mainly due to people adopting more pets and there is a growing concern for their well-being. Manufacturer continuously includes multi-functional and innovative ingredients in their products which drive the growth of this market. These organic products offer a variety of flavors and essential ingredients like probiotics and antioxidants, which expands the growth of this market.

Further, the availability of ready-to-eat pet food significantly fuels the growth of the market. Further, strict regulation and certification by the US Department of Agriculture, & the European Union, needed for organic food products play an important role in shaping the market. Consumers are choosing foods from organic farming as they are more environmentally friendly and sustainable compared to conventional farming methods, a principle that aligns with the

Green Technology & Sustainability Market. The market is boosted by the improvement in the overall digestion and performance of pet animals due to the consumption of organic nutritious food.

However, a lack of awareness about organic pet food and the increasing cost associated with it is hindering the growth of this market. Also, these organic products are rarely available in the market due to strict government regulations, fewer marketing campaigns, and the unavailability of raw materials obstructing the growth of this market.

Organic Pet Food Market Research Scope and Analysis

By Pet Type

The organic pet food market as a pet type is divided into categories like dogs, cats, birds, & others. The dog segment is expected to dominate the market with the largest revenue share in 2024. This dominance is driven by the increasing adoption of dogs as a pet due to their friendly nature, loyalty, and attentiveness. The increasing popularity of nuclear families and people's inclination towards dogs for security and companionship contributes to the adoption of dogs as a pet.

Further, owners require high-quality pet food that contains essential nutrients to ensure their pets' health. The demand for organic pet food is increasing due to high spending on dog care and maintenance, including products from the

Pet Insurance Market. There is also a growing focus on managing and enhancing dog weight due to increasing awareness among consumers regarding pet health issues.

Cats are anticipated to lead the organic pet food market as they are low-maintenance pets and friendly towards humans. Owners are favoring organic food to support their overall health, including a shiny coat, healthy weight, and improved digestion. Birds are becoming popular which include parrots, cockatiels, and other pet birds.

By Pet Age

Adult pets are predicted to dominate the organic pet food market in 2024 due to factors like the increasing focus on natural and wholesome nutrition by owners as adult pets need quality food to grow. They require more consistent dietary for long-term organic feeding. Puppy plays an important role in driving the growth of this market due to the increasing adoption of pets at this Age. Pet owners are concerned about providing them with organic nutrition to support healthy growth and development as they are at their crucial development stages.

The old segment is anticipated to lead the organic pet food market due to the benefits offered by organic ingredients, like improved digestion, joint health, and overall well-being, which help pets in old age. Old-age pet owners are ready to spend more money on high-quality, healthy food, so there are now many organic pet foods made just for older pets, often utilizing specialized Packaging Market solutions to maintain freshness.

By Pet Size

Based on the pet size, the market is divided into small, medium, or large segments which plays an important role in shaping the growth of the global organic pet food market. The medium pet size segment is expected to dominate the market with the largest revenue share in 2024 as it includes cats, & dogs. There is a need for new organic pet food formulations that serve the dietary requirements of these medium-sized pets.

Manufacturers are responding to these needs by offering a wide range of organic options, including grain-free formulas, limited ingredient diets, and breed-specific formulations. Small pet sizes are anticipated to be the fastest growing segment during the forecasted period as they include birds, small mammals, and reptiles, who often need particular diets that are rich in nutrients and free from harmful additives. As a result, there is a growing demand for organic pet food tailored to the unique nutritional needs of these smaller animals. This segment of the market is expected to witness significant growth as more pet owners focus on the health and well-being of their smaller companions.

By Packaging Type

Dry & Dehydrated segment is expected to dominate the organic pet food market in 2024 due to increased focus on premium dry food by pet food manufacturers. They normally have low moisture content and are processed through baking which includes kibble and pellets that are convenient and have a longer shelf life compared to wet or canned options. On the other hand, dehydrated organic food is a healthier option as it retains more natural nutrients, making it increasingly popular among pet owners who are searching for organic and natural options for their pets.

Liquid & Gravy as a packaging type is expected to grow with a high CAGR as they include products like broths, soups, and liquid supplements, which are gaining popularity due to their hydration benefits and ease of consumption, particularly for those needing extra moisture in their diets. On the other hand, gravy foods contain flavored moisture sausage or topping that improves the taste of dry or raw food for pets.

By Flavor

The flavored segment is expected to dominate the organic food market in 2024 driven by increasing demand for variety among pet owners. It includes bacon, beef, chicken, duck, cheese, fruit, berries, lamb, salmon, shrimp, pork, liver, mint, peanut butter, cod, fish, egg, seafood, and other unique combinations to provide their pet more enjoyable eating experience.

This segment is growing as it serves the pets' specific taste preferences, ensures their satisfaction, and improves their overall well-being through flavorful and nutritious organic food options, driving the growth of this market. Meanwhile, the unflavored segment is growing rapidly as owners are searching for simple and natural options for pet food added flavors or ingredients, driven by the increasing demand for minimalistic and clean-label products.

By Distribution Channel

Supermarkets/Hypermarkets are expected to dominate the organic pet food market with the largest revenue share in 2024 driven by the increasing preference of customers to buy products from large retail stores, which offer a wide range of choices in terms of prices and breed of pet. Also, the specialized pet shops are fueling the growth of the market as these shops offer a wide range of organic pet food products, catering specifically to pet owners who prioritize natural and nutritious options for their pets.

On the other hand, the online channel is experiencing rapid growth in the global organic pet food market mainly due to the easy accessibility of organic pet foods across many online platforms, ranging from modern trade to specialized online sales channels. The market's expansion is further supported by the increasing penetration of retail sales and the convenience provided by e-commerce platforms, allowing owners to shop without physical constraints. Additionally, e-commerce platforms allow customers to conduct thorough research, compare prices and benefits, and evaluate the overall value of their purchase before finalizing it.

The Global Organic Pet Food Market Report is segmented based on the following

By Pet Type

By Pet Age

By Pet Size

By Packaging Type

- Dry & Dehydrated

- Liquid & Gravy

- Frozen & Freeze-Dried

By Flavor

By Distribution Channel

- Hypermarkets /Supermarkets

- Specialized pet shops

- Convenience Stores

- Online Retail

- Others

How Does Artificial Intelligence Contribute To Improve Organic Pet Food Market ?

- Personalized Nutrition Plans: AI analyzes pet health data, breed, age, and dietary needs to recommend tailored organic pet food options for optimal nutrition.

- Ingredient Quality Monitoring: AI-powered sensors and predictive analytics ensure the highest quality organic ingredients by detecting contaminants and optimizing sourcing.

- Supply Chain Optimization: AI enhances logistics by predicting demand, reducing food waste, and ensuring timely delivery of organic pet food products.

- Consumer Behavior Analysis: AI-driven insights help brands understand pet owners' preferences, improving marketing strategies and product development.

- Automated Production & Sustainability: AI streamlines manufacturing processes, minimizing waste and ensuring sustainability in organic pet food production.

- AI-Powered Chatbots & Customer Support: Virtual assistants provide instant recommendations and answer pet owners' queries about organic pet food benefits and usage.

- E-commerce & Smart Retail Optimization: AI enhances online shopping experiences with personalized recommendations and subscription-based organic pet food services.

Organic Pet Food Market Regional Analysis

North America is expected to dominate the global organic pet food market with a revenue

share of 43.8% in 2024. This dominance is attributed to increasing pet ownership, customer awareness of pet health, treating pets like family, and the modern trend of adopting organic farming. Also, the entrance of private-label retail brands, along with the rise in urbanization and disposable income levels are some of the significant factors influencing the growth of the market through the forecasted period.

The availability of pet food stores is widely accessible through many distribution channels, with the emergence of e-commerce platforms further helping market expansion. Further, the rising demand for personalized pet food diets and doorstep delivery services in this region is fueling the growth of online organic pet food stores, which driving the growth of this market.

Europe is expected to lead as the second-largest revenue share globally attributed to the humanization of pets and the increasing demand for premium food products, particularly organic, raw, and natural options based on customer choice.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Organic Pet Food Market Competitive Landscape

Major market participants commonly employ strategies such as introducing new products and expanding through investments. Manufacturers and suppliers are focusing on logistical improvements and strengthening distribution channels as part of their business growth strategies. These initiatives are improving the product adoption rates among global consumers. Industry participants are inclined toward investing heavily in research and technology to advance processes and create new recipes, which are manufactured with varied and special ingredients.

The organic pet food market is fragmented due to many participants, and it is anticipated that there will be moderate to intense competition among the companies. The market is dominated by companies specializing in organic pet food products, which is still in its developmental stages with continual new experiments. Some of the prominent key players in the organic pet food market include Nestle SA, Primal Pet Foods, and Mars Incorporated.

Some of the prominent players in the global organic pet food market are

- Purina PetCare (Nestle)

- Biopet Pet Care Pty Ltd

- Evanger's Dog & Cat Food Company, Inc.

- Newman's Own, Inc.

- Castor & Pollux Natural Petworks

- PetGuard Holdings, LLC

- Lily’s Kitchen

- Harrison’s Bird Foods

- Hill’s Pet Nutrition, Inc.

- Mars, Incorporated

- Diamond Pet Foods, etc

- Others

Organic Pet Food Market Recent Development

- In September 2023, a British alternative-protein pet food startup, introduced a nutritionally balanced, oven-baked dehydrated dog food crafted from ingredients like peanut butter and sweet potato.

- In February 2023, Fera Pet Organics introduced two new supplements for cats and dogs: Calming Support and Liver Support which are formulated with probiotic strains to support animal health and are supported by science.

- In February 2023, AlphaPet Ventures completed the acquisition of Herrmann’s Manufaktur brand from Herrmann GmbH as it improved AlphaPet's position and strategic growth plans for its premium brand portfolio.

- In June 2022, Mars Incorporated announced that it has achieved its target to source fish in its pet products.

Organic Pet Food Market Report Details

| Report Characteristics |

| Market Size (2024) |

USD 2.5 Bn |

| Forecast Value (2033) |

USD 4.8 Bn |

| CAGR (2023-2032) |

7.7% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Pet Type (Dog, Cat, Bird, & Others), By Pet stage (Adult, Kitten/ Puppy, and Others), By Pet Size (Small, Medium, Large, and Others), By Packaging Type (Dry & Dehydrated, Liquid & Gravy, Frozen & Freeze-Dried, and Others), By Flavor (Unflavored, Flavored), By Distribution Channel (Hypermarkets /Supermarkets, Specialized pet shops, Convenience Stores, Online Retail, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Purina PetCare, Biopet Pet Care Pty Ltd, Evanger's Dog & Cat Food Company, Inc., Newman's Own Inc., Castor & Pollux Natural Petworks, PetGuard Holdings LLC, Lily’s Kitchen, Harrison’s Bird Foods, Hill’s Pet Nutrition, Inc., Mars Incorporated, Diamond Pet Foods, etc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Organic Pet Food Market size is estimated to have a value of USD 2.5 billion in 2024 and is expected to reach USD 4.8 billion by the end of 2033.

North America has the largest market share for the Global Organic Pet Food Market with a share of about 43.8 % in 2024.

Some of the major key players in the Global Organic Pet Food Market are Nestle SA, Primal Pet Foods, and Mars Incorporated., and many others.

The market is growing at a CAGR of 7.7 percent over the forecasted period.