Market Overview

The

Global Paperboard Packaging Market is projected to reach

USD 193.5 billion in 2024 and grow at a compound annual growth rate of

4.2% from there until 2033 to reach a value of

USD 279.2 billion.

Paperboard is defined as a board with a grammage above 250 g/m2 and is used to create many products, like rigid boxes, folding cartons, and beverage cartons. Multi-ply boards, mostly made from affordable, low-grade waste materials, are suitable for non-food-contact applications. Folding cartons are made from paperboard sheets cut & scored for bending into shape and have different structures, like coated solid bleached/unbleached boards (SBB/SUB), folding box board (FBB), and white-lined chipboard (WLC).

As per GreenMatch, paperboard packaging is a cornerstone of global sustainability efforts, reflecting Europe's leadership with a 59.9% average recycling rate. In the U.S., paper and paperboard recycling reached nearly 68% in 2022, driven by strong recycling cultures. Recovered paper, a key raw material, accounts for over 70% of fibers in the UK paper and board industry.

Recycling one ton of paper saves 17 trees, 7,000 gallons of water, and 3.3 cubic yards of landfill space while reducing air pollution by 74%. Notably, corrugated boxes achieved a 96.5% recycling rate, showcasing its pivotal role in sustainable packaging solutions globally.

The Paperboard Packaging Market is experiencing rapid growth, driven by demand for sustainable and recyclable materials. Industry conferences like Packaging Innovations and Sustainability in Packaging Europe highlight advancements in eco-friendly solutions and trends in the sector. Recent surveys reveal that over 70% of consumers prefer products with sustainable packaging, influencing brand strategies globally.

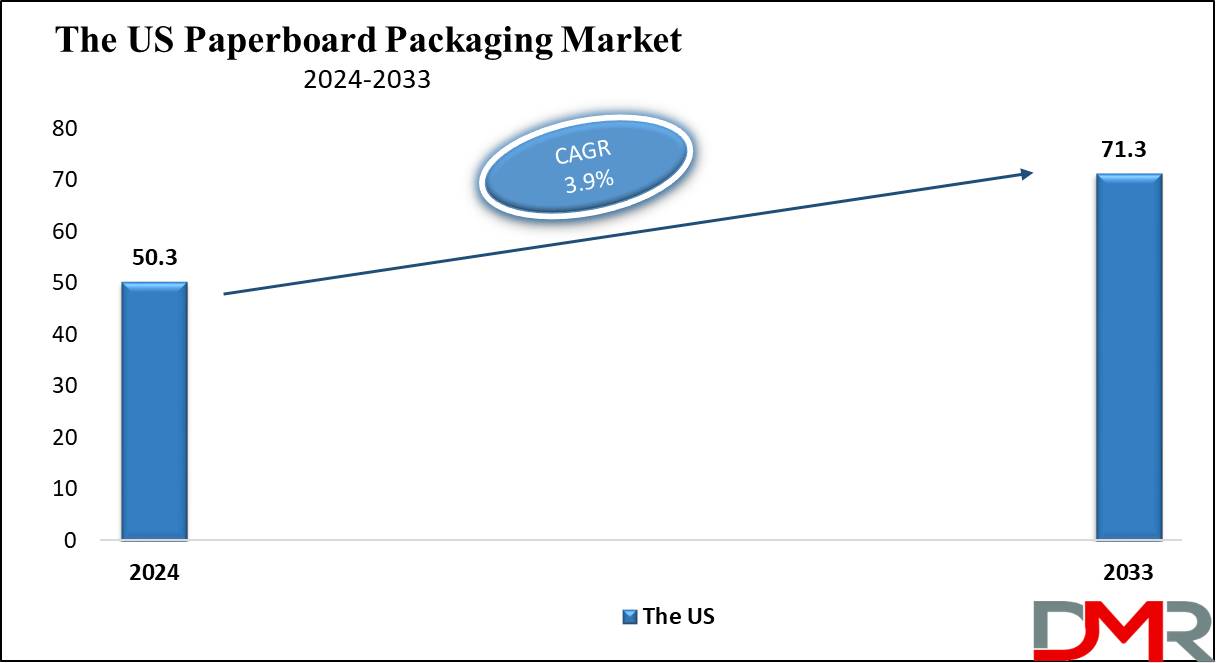

The US Paperboard Packaging Market

The US Paperboard Packaging Market is projected to reach USD 50.3 billion in 2024 at a compound annual growth rate of 3.9% over its forecast period.

The paperboard packaging market in the US provides growth opportunities through the increased need for sustainable packaging solutions, innovations in design, and the expansion of e-commerce. The growth in consumer preference for eco-friendly products and development in technology can lead to the development of customized

packaging options, improving brand visibility and user experience across many sectors, like food, beverages, and personal care.

Further, the key growth driver is the growing demand for sustainable and recyclable packaging solutions, driven by consumer awareness and regulatory pressures. However, a major restraint is the competition from alternative materials, such as plastics, which offer greater durability and versatility, challenging the adoption of paperboard packaging across various industries.

Key Takeaways

- Market Growth: The Paperboard Packaging Market size is expected to grow by USD 78.5 billion, at a CAGR of 4.2% during the forecasted period of 2025 to 2033.

- By Product: The Boxboard segment is anticipated to get the majority share of the Paperboard Packaging Market in 2024.

- By Raw Material: The recycled waste paper segment is expected to be leading the market in 2024

- By Application: The food & beverage segment is expected to get the largest revenue share in 2024 in the Paperboard Packaging Market.

- Regional Insight: Asia Pacific is expected to hold a 41.2% share of revenue in the Global Paperboard Packaging Market in 2024.

- Use Cases: Some of the use cases of Smart Parking systems include sustainable packaging, consumer goods packaging, and more.

Use Cases

- Food & Beverage Packaging: Used for cereal boxes, milk cartons, and frozen food packaging due to its lightweight & moisture-resistant properties.

- Consumer Goods Packaging: Ideal for cosmetics, perfumes, and personal care products, offering high-quality printing for branding & aesthetics.

- E-commerce & Retail Packaging: Standard product boxes for electronics, apparel, and accessories, providing durability while being lightweight for shipping.

- Sustainable Packaging: Highly preferred for eco-friendly packaging, as paperboard is recyclable and biodegradable, aligning with sustainability goals.

Market Dynamic

Driving Factors

Sustainability Trends

The growth in demand for eco-friendly packaging solutions is driving growth in the paperboard packaging market. Consumers & businesses are highly prioritizing recyclable and biodegradable materials, creating a transformation away from plastic packaging.

E-commerce Expansion

The quick growth of the e-commerce sector has highly increased the demand for sturdy and efficient packaging solutions. Paperboard packaging provides excellent protection for products during transit while being lightweight, making it ideal for online retail.

Restraints

Competition from Alternative Materials

The availability of alternative packaging materials, like plastics and flexible packaging, which can provide superior durability, moisture resistance, and affordability, creates a challenge to the growth of the paperboard packaging market.

Raw Material Price Volatility

Fluctuations in the prices of raw materials, like wood pulp and recycled paper, can impact production costs and profitability for manufacturers, making it difficult to maintain consistent pricing & margins in the market.

Opportunities

Innovation in Design and Functionality

Development in technology and design can create the development of more innovative paperboard packaging solutions, like smart packaging with QR codes for consumer engagement or better structural designs for enhanced protection and user convenience.

Growth in Emerging Markets

Growth in economies and a rise in consumer spending in emerging markets provide major opportunities for the paperboard packaging sector. As urbanization and e-commerce grow, there is a rise in the demand for effective packaging solutions, allowing companies to tap into new customer bases.

Trends

Increased Focus on Sustainable Practices

There is an increase in the trend towards using recycled & renewable materials in paperboard packaging. Various companies are adopting sustainable practices, like sourcing FSC-certified paperboard and implementing closed-loop recycling systems to reduce environmental impact.

Customization and Personalization

Brands are mostly looking for customized and personalized packaging solutions to improve consumer experience and brand recognition, which include different designs, printing techniques, and customized packaging sizes, allowing companies to stand out in a competitive market.

Research Scope and Analysis

By Product

The paperboard packaging market is divided into two main categories: boxboard and containerboard. Among these, the boxboard segment is anticipated to take the lead in 2024, with further subdivisions including Folding Boxboard (FBB), Solid Unbleached Board (SUB), Solid Bleached Board (SBB), and White Lined Chipboard (WLC), where Solid Unbleached Board (SUB) is the most dominant type, made from unbleached chemical pulp and mostly includes two or three layers of color coatings. In addition, recycled fibers can replace unbleached pulp. SUB is mostly used for packaging items like beverage carriers, detergents, and toys.

Further, Folding Boxboard is anticipated to experience significant growth within the boxboard segment in the coming years, which can bend without breaking and is made from multiple layers of mechanical and chemical pulps, causing a lightweight yet stiff material. It is ideal for packaging cosmetics, frozen meals, and medicines.

In addition, a Solid Bleached Board (SBB) is another type made from bleached chemical pulp, particularly coated with synthetic or mineral fibers. It has a medium density and is mostly used for packaging sensitive items like cosmetics and cigarettes. Furthermore, the White Lined Chipboard consists of layers of recycled paper and fibers, usually coated on both sides. However, because it contains recycled materials, there are health concerns regarding its use for direct food contact.

By Raw Material

Recycling waste paper is anticipated to account for nearly half of the paperboard packaging market by 2024, as recycled materials can be processed into new paperboard products. At present, paper recycling supplies the majority of the fibers used in global paper production.

The rise in concerns about deforestation and the reduction of forested areas across the world have led paperboard manufacturers to incorporate recycled materials into their products, which is expected to highly contribute to the growth of the paperboard packaging market in the coming years.

Further paper packaging is the most mostly recycled material, far surpassing other types of packaging in recycling rates. Both paper & paperboard enjoy the highest recycling rates across the world, which reflects their popularity and environmental benefits.

As countries like China and other emerging economies constantly develop industrially, the need for paper packaging is anticipated to rise steadily, which highlights the importance of recycling and sustainable practices in the paperboard packaging sector, ensuring that it remains a key player in the packaging market while addressing environmental concerns.

By Application

In terms of application, the food and beverage sector is expected to become the leading application area in the paperboard packaging industry, capturing a major share of the market by 2024, which includes packaging for numerous products like frozen meals, alcoholic and non-alcoholic beverages, sweets, dairy items, fast foods, and fresh produce.

The quick growth of this segment can be due to the excellent properties of paperboard packaging, which is safe for food contact, efficient across a broad range of temperatures, and supports maintaining the flavor and freshness of products over time.

In addition, developments in the

healthcare industry are driving new approaches to medical product packaging. With global healthcare being a top priority, the need for packaging materials in this sector is expanding as the appearance of packaging in pharmacies has become highly important, as it is now viewed not just as functional but also as a marketing tool for over-the-counter products.

Eye-catching packaging for supplements and vitamins has contributed to the growth in sales as consumers become more interested in

health and wellness. Further, the medical application of paperboard packaging is expected to experience substantial growth during the forecast period.

The Paperboard Packaging Market Report is segmented on the basis of the following

By Product

- Boxboard

- Folding Boxboard (FBB)

- Solid Unbleached Board (SUB)

- Solid Bleached Board (SBB)

- White Lined Chipboard (WLC)

- Containerboard

By Raw Material

- Fresh Source

- Recycled Waste Paper

By Application

- Food & Beverages

- Non-durable Goods

- Medical

- Durable Goods

- Others

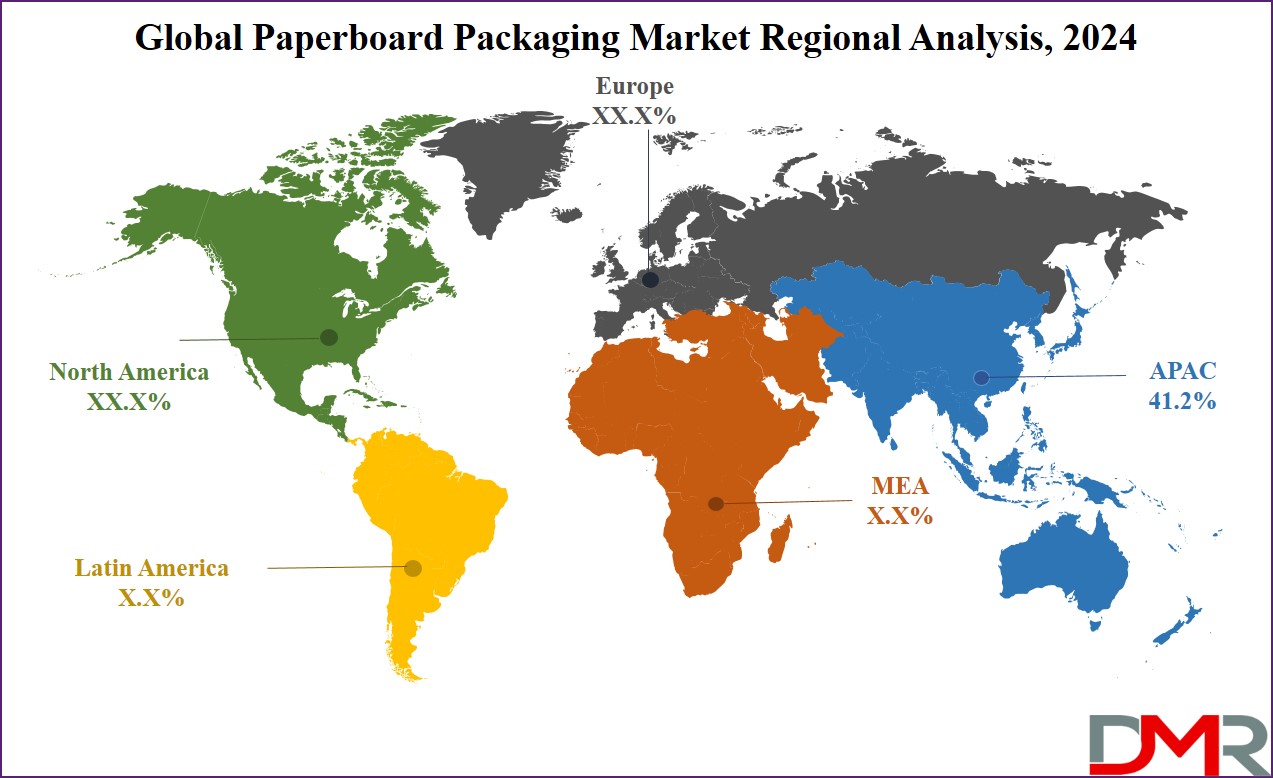

Regional Analysis

The Asia Pacific region is anticipated to lead the paperboard packaging market in 2024, accounting for

41.2% of the share, which is driven by the expansion of the packaged food, cosmetics, and personal care industries. While the demand for paperboard packaging in Asia Pacific is expected to grow at a steady pace, the market is also set to expand rapidly, with Latin America following closely. The growth of e-commerce and the cosmetics sector in countries like India, China, and Japan will further boost the need for paperboard packaging throughout the forecast period.

The rise in disposable income in developing countries is also contributing to this growth, along with a trend of on-the-go consumption in nations like India and China, where food and beverage consumption continues to rise.

Further, Europe and North America are more mature markets for paperboard packaging. In North America, the US remains the dominant part, with food being the major end-user of folding cartons. While these regions show stable needs, the growth potential is not as high as in Asia Pacific, where emerging economies are quickly adopting paperboard solutions. Further, the acceleration of the food and beverage industry in Asia Pacific is expected to drive a major increase in the demand for paperboard packaging during the forecast period.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the paperboard packaging market is characterized by a mix of large, established companies & smaller, innovative firms. Key players aim for sustainability, investing in eco-friendly materials and technologies to meet the growth in consumer demands for environmentally responsible packaging.

Companies are also focusing on product innovation, providing customized solutions that enhance brand visibility and customer engagement. Strategic partnerships & mergers are common as businesses aim to expand their market presence and enhance the supply chain efficiencies.

Some of the prominent players in the Global Paperboard Packaging are:

- WestRock Company

- Nippon Paper Industries

- Mondi Plc

- Mesta Board

- Rengo

- International Paper Company

- DS Smith

- Clearwater Paper Corp

- Smurfit Kappa Group

- Amcor

- Other Key Players

Recent Developments

- In October 2024, Avery Dennison unveiled its first range of INGEDE12-certified paper label solutions, utilizing new adhesive technology to create better quality output for new cardboard and paper production. To meet PPWR guidelines for packaging recyclability, all components of a packaging unit must have a certain design for recycling criteria.

- In September 2024, Nestlé launched a series of paper packaging innovations across brands, like Nescafé and Vital Proteins, focused on supporting the company’s sustainable packaging goals, with goals including a series of targets focused on addressing the environmental footprint of packaging waste, which can include impacts on water and soil quality and biodiversity.

- In May 2024, Mondi launched the latest secondary paper packaging solution, ‘TrayWrap’, to replace plastic shrink film utilized for bundling food and beverage products, made using Mondi’s Advantage StretchWrap range, which is being used by a coffee brand in Sweden to secure 12 coffee packages for transportation purposes.

- In May 2024, Holmen Iggesund launched Invercote Touch, an uncoated paperboard developed to meet the increase in the demand for 'sustainable’ and visually appealing packaging materials while maintaining printability. Further, the new product delivers a natural-looking tactile experience with strength, stiffness, and creasability.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 193.5 Bn |

| Forecast Value (2033) |

USD 279.2 Bn |

| CAGR (2024-2033) |

4.2% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 50.3 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Boxboard and Containerboard), By Raw

Material (Fresh Source and Recycled Waste Paper),

By Application (Food & Beverages, Non-durable

Goods, Medical, Durable Goods, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

SWestRock Company, Nippon Paper Industries, Mondi

Plc, Mesta Board, Rengo, International Paper

Company, DS Smith, Clearwater Paper Corp, Smurfit

Kappa Group, Amcor, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Paperboard Packaging Market size is expected to reach a value of USD 193.5 billion in 2024 and is expected to reach USD 279.2 billion by the end of 2033.

Asia Pacific is expected to have the largest market share in the Global Paperboard Packaging Market with a share of about 41.2% in 2024.

The Paperboard Packaging Market in the US is expected to reach USD 50.3 billion in 2024.

Some of the major key players in the Global Paperboard Packaging Market are WestRock Company, Nippon Paper Industries, Mondi Plc, and others.

The market is growing at a CAGR of 4.2 percent over the forecasted period.