Market Overview

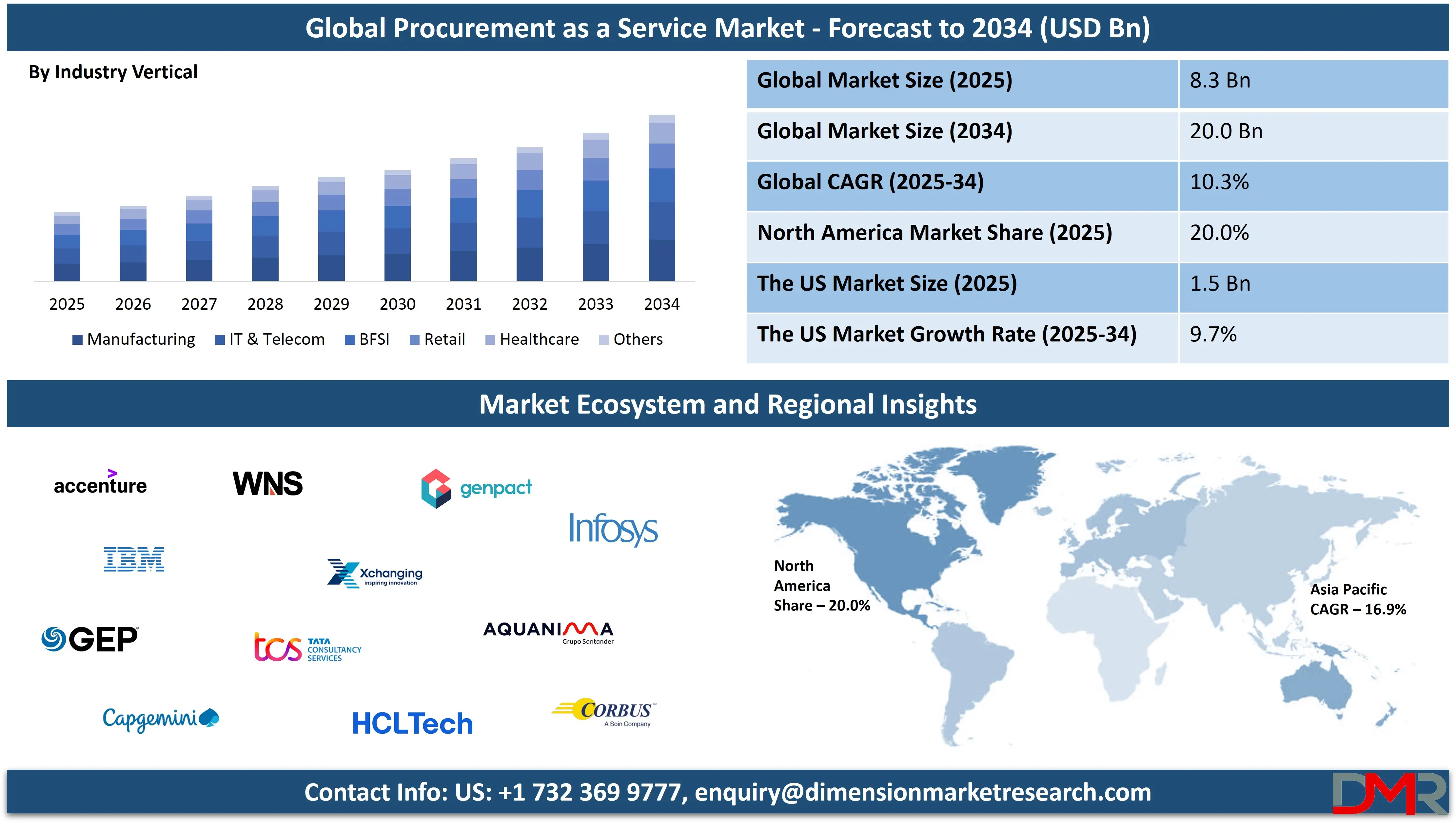

The Global

Procurement as a Service Market size is projected to surge from

USD 8.3 billion in 2025 to

USD 20.0 billion by 2034, growing at a robust

CAGR of 10.3%, driven by AI-powered sourcing, cloud procurement platforms, and strategic spend management.

Procurement as a Service (PaaS) is a strategic outsourcing model that enables organizations to streamline and optimize their procurement functions by leveraging external expertise, technology, and processes. Unlike traditional procurement, which is often managed in-house, PaaS provides a flexible, scalable approach to sourcing and supplier management, allowing businesses to access specialist skills and tools without incurring the cost of building internal capabilities.

This model typically includes services such as spend analysis, strategic sourcing, supplier management, contract management, and transactional procurement. Companies adopting PaaS benefit from improved cost efficiency, risk mitigation, process standardization, and faster procurement cycles. The modular nature of PaaS allows businesses to customize solutions to their specific needs, aligning procurement functions more closely with business goals while enhancing agility and innovation.

The global Procurement as a Service market has experienced rapid growth in recent years, driven by growing demand for cost reduction, operational efficiency, and digital transformation. As businesses across industries seek to manage complex supply chains and volatile market dynamics, the adoption of PaaS has emerged as a strategic enabler. The rise of cloud-based platforms and advanced analytics has further accelerated this trend, offering real-time visibility into procurement activities and facilitating data-driven decision-making. Additionally, the growing emphasis on sustainability and compliance has pushed organizations to seek expert procurement partners who can align sourcing practices with regulatory and environmental goals.

The growing need for scalability and specialization is also fueling market expansion. Companies operating across diverse geographies and sectors are recognizing the value of tapping into domain-specific procurement knowledge without the constraints of full-time internal teams. This shift is particularly evident in sectors such as manufacturing, retail, healthcare, and financial services, where procurement complexity is high and the need for strategic sourcing is critical. By outsourcing procurement services, organizations can focus more on core business functions while leveraging external capabilities to gain a competitive edge.

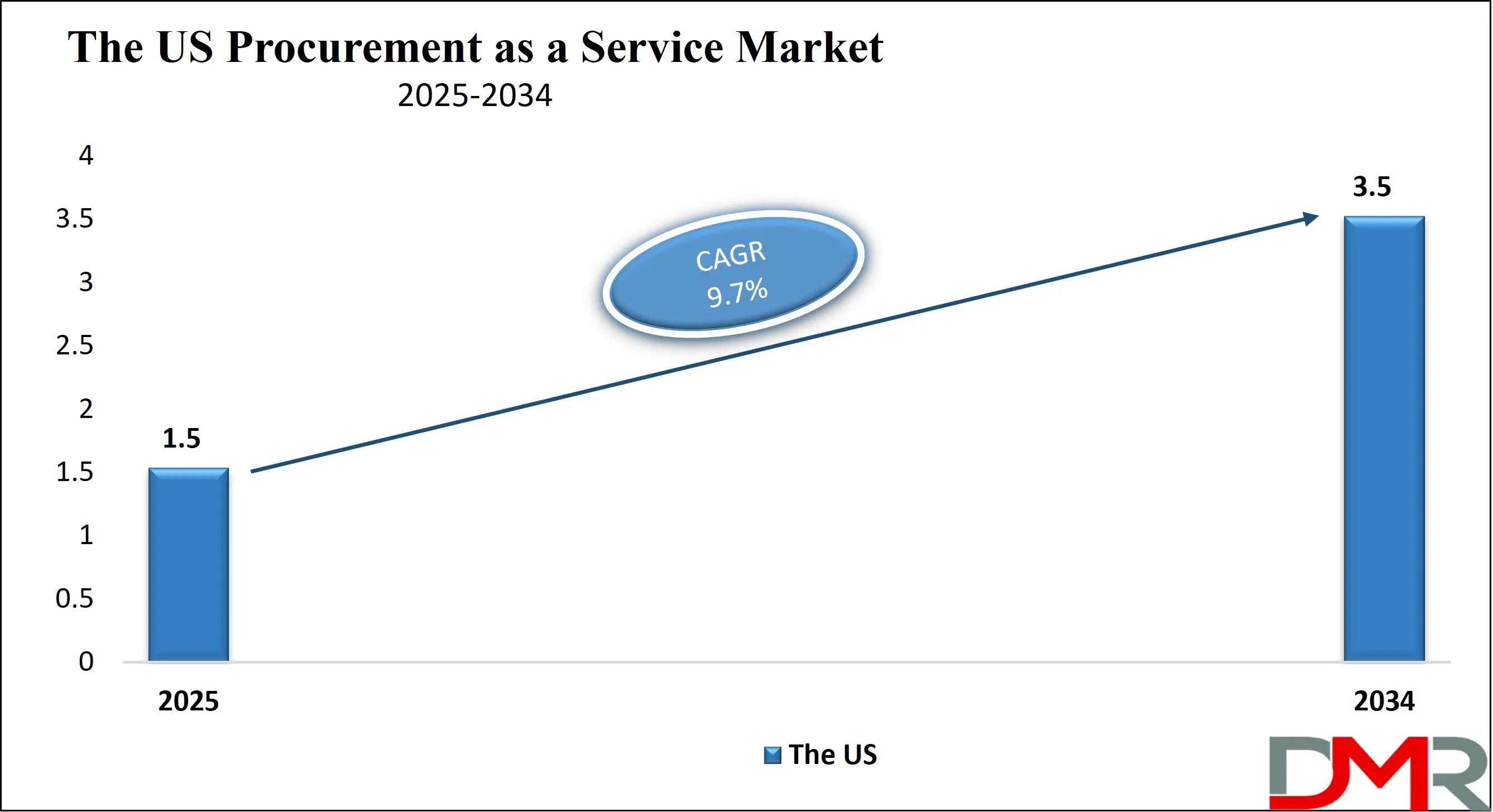

The US Procurement as a Service Market

The U.S. Procurement as a Service Market size is projected to be valued at USD 1.5 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 3.5 billion in 2034 at a CAGR of 9.7%.

In the U.S., the Procurement as a Service (PaaS) market is undergoing significant transformation as organizations seek more agile, cost-efficient, and technology-driven solutions to manage their procurement operations. With the U.S. being a hub for both global enterprises and fast-scaling startups, there is growing recognition of the strategic value procurement can deliver when optimized through outsourced services. American businesses are leveraging PaaS models not only to reduce overhead costs but also to gain access to deep industry insights, advanced procurement technologies, and best-in-class practices that may be otherwise difficult to maintain in-house. This trend is especially prominent in industries like healthcare, manufacturing, defense, and IT services, where procurement complexity and regulatory compliance demands are high.

Technology plays a central role in the evolution of the PaaS market in the U.S., with significant investments being made in AI-powered analytics, cloud-based procurement platforms, and robotic process automation (RPA). U.S.-based service providers and technology vendors are leading the charge in innovation, offering highly customized and scalable solutions that help companies enhance spend visibility, automate routine processes, and drive supplier collaboration. As data becomes a vital asset, American firms are also focused on leveraging predictive analytics and machine learning to make procurement more proactive and aligned with business outcomes. The push toward digital transformation, driven by a competitive business environment, has accelerated the shift to service-based procurement models across the country.

Global Procurement as a Service Market: Key Takeaways

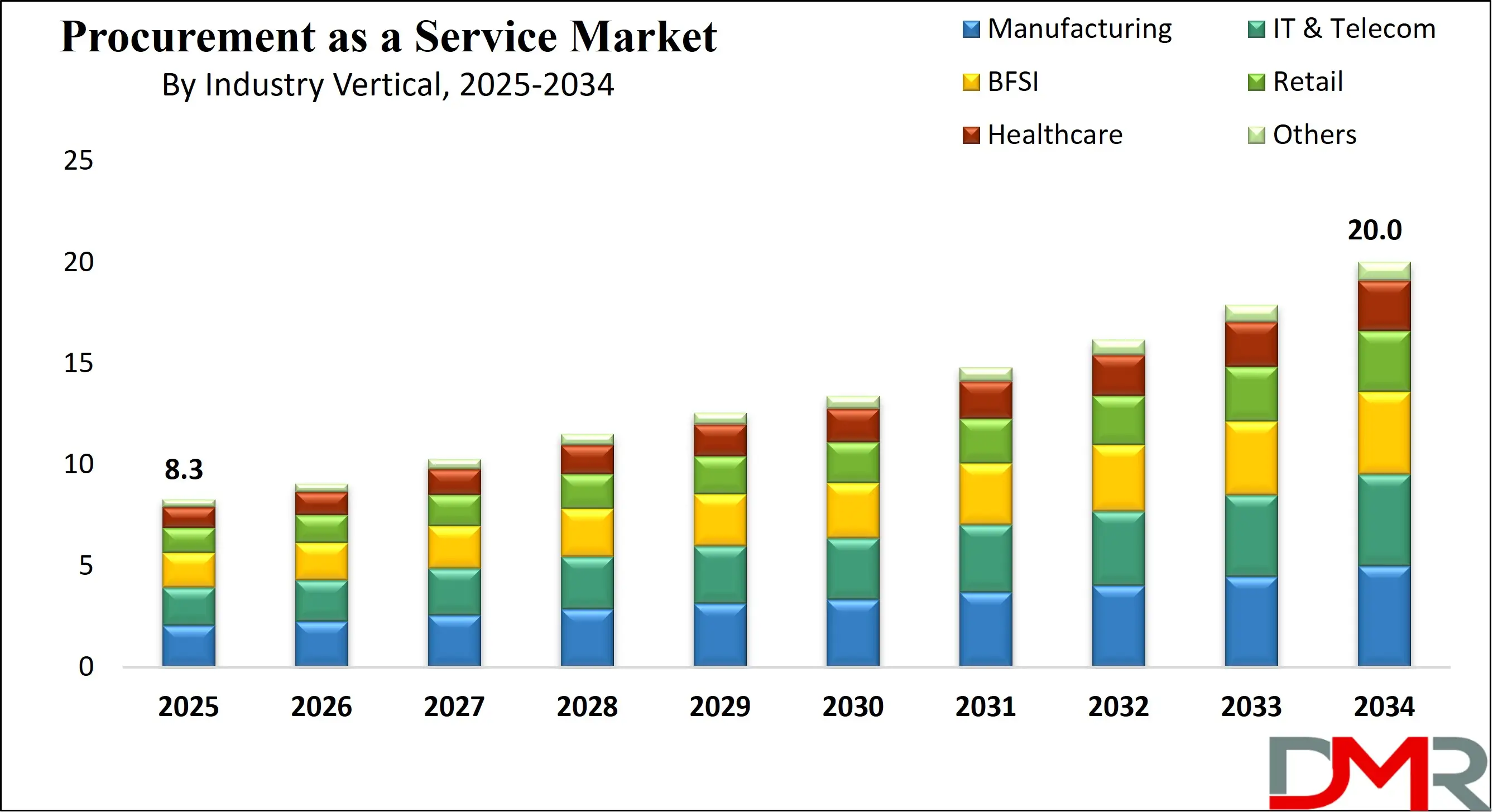

- Market Value: The global procurement as a service size is expected to reach a value of USD 20.0 billion by 2034 from a base value of USD 8.3 billion in 2025 at a CAGR of 10.3%.

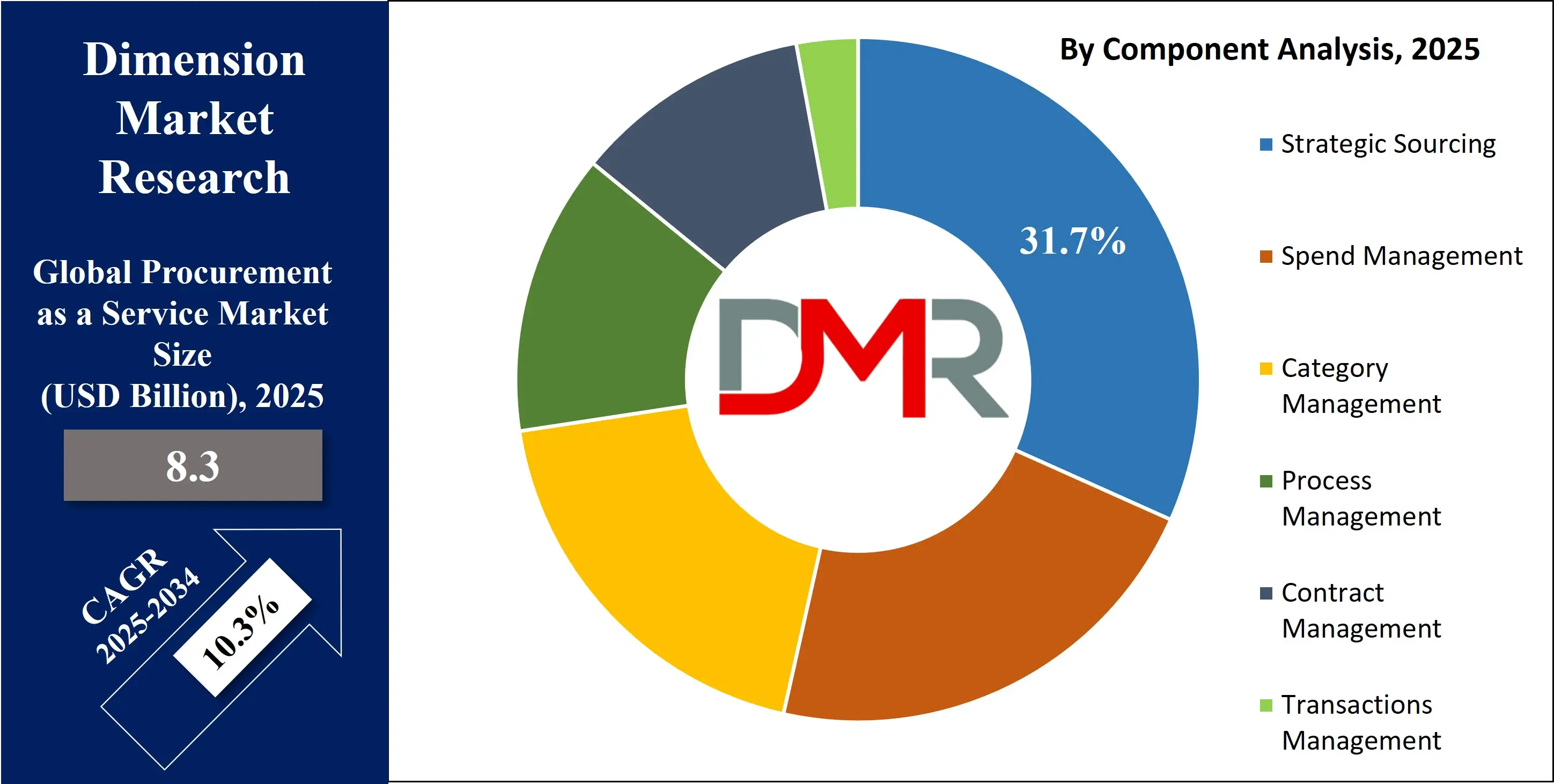

- By Component Type Segment Analysis: Strategic Sourcing components are poised to consolidate their dominance in the component type segment, capturing 31.7% of the total market share in 2025.

- By Organization Size Segment Analysis: Large Enterprises are anticipated to maintain their dominance in the organization size segment, capturing 70.5% of the total market share in 2025.

- By Industry Vertical Segment Analysis: The Manufacturing industry is anticipated to maintain its dominance in the industry vertical segment, capturing 24.9% of the total market share in 2025.

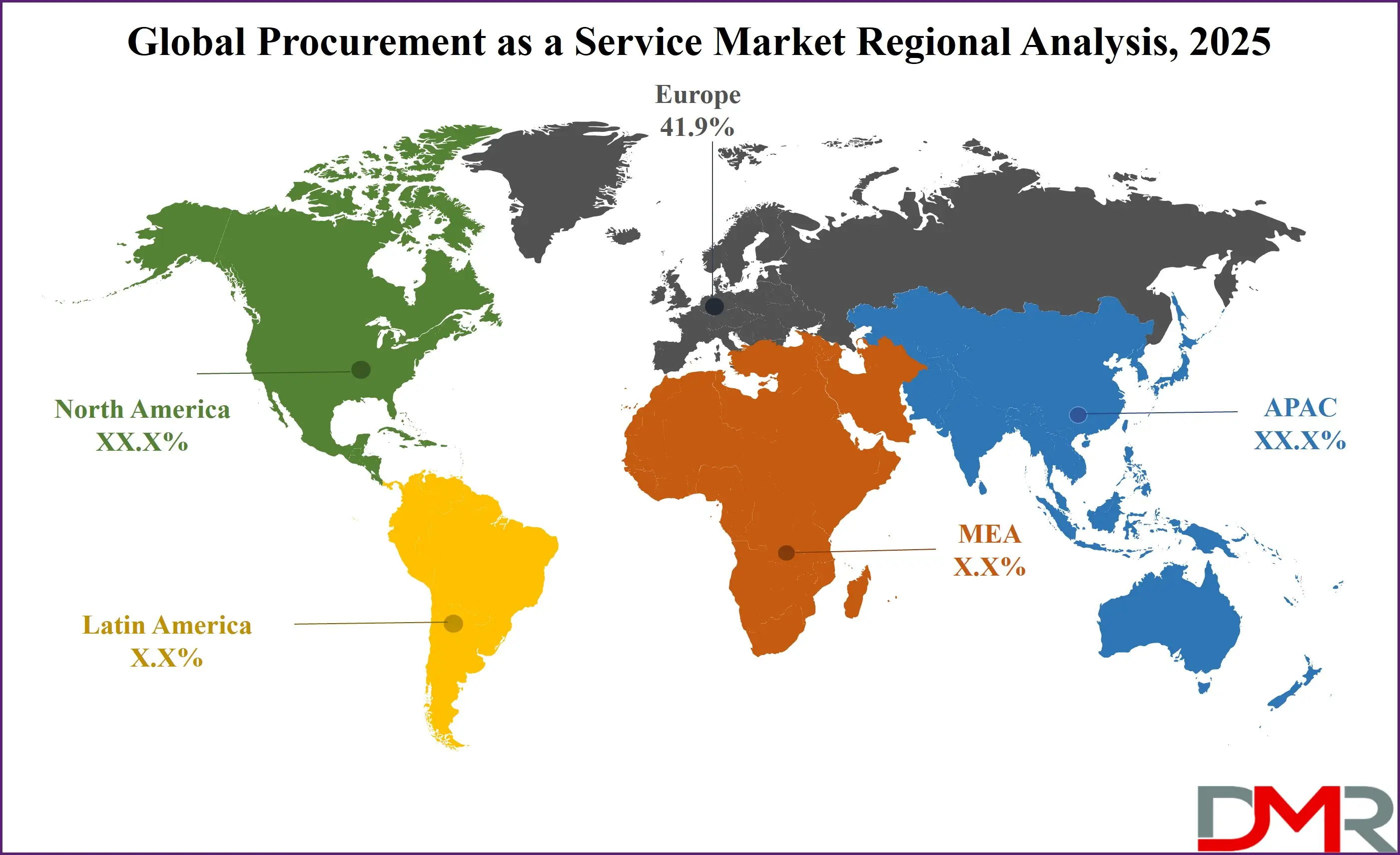

- Regional Analysis: Europe is anticipated to lead the global procurement as a service market landscape with 41.9% of total global market revenue in 2025.

- Key Players: Some key players in the global procurement as a service market are Accenture, IBM, GEP, Capgemini, WNS, Genpact, Infosys, HCL Technologies, TCS, Xchanging, Corbus, Aquanima, Proxima, Denali, Aegis Limited, ChainIQ, Source One, Zycus, Jaggaer, LogicSource, and Other Key Players.

Global Procurement as a Service Market: Use Cases

- Strategic Sourcing Optimization for Manufacturing Enterprises: Global manufacturing companies face the constant challenge of managing large-scale procurement operations across multiple regions. Procurement as a Service enables these enterprises to enhance their sourcing strategy by leveraging real-time spend analytics, supplier relationship management, and category spend optimization. Through sourcing automation and digital procurement tools, manufacturers can consolidate suppliers, reduce procurement cycle times, and drive cost efficiency. This approach also improves supplier performance visibility and ensures better alignment with production schedules, creating a more resilient and responsive supply chain.

- Tail-Spend Management in Large Retail Corporations: Retail businesses, especially those with widespread store networks and diverse inventories, often struggle to control tail spend, those numerous low-value, decentralized purchases that escape traditional procurement processes. Procurement as a Service provides comprehensive tail spend management by using AI-powered spend visibility tools and robust contract lifecycle management systems. By centralizing procurement operations and rationalizing the supplier base, retailers can reduce maverick spending, enforce compliance, and improve operational efficiency across indirect procurement categories.

- Compliance and Risk Mitigation in the Healthcare Sector: Healthcare organizations must navigate strict compliance regulations while managing a critical supply chain for medical equipment and pharmaceuticals. Procurement as a Service ensures that sourcing practices align with regulatory standards like HIPAA and FDA guidelines through automated supplier audits, certification tracking, and risk assessment protocols. These services help healthcare providers mitigate supply chain disruptions, uphold ethical procurement standards, and ensure continuity in patient care. By adopting PaaS, hospitals and clinics also gain better control over vendor performance and contract compliance.

- Agile Procurement Transformation in the Technology Sector: Fast-growing technology firms often require agile procurement frameworks to scale quickly without being weighed down by heavy procurement infrastructure. Procurement as a Service enables these companies to implement flexible sourcing models for SaaS subscriptions, IT hardware, and software licenses. Through vendor onboarding automation, procurement digitization, and real-time analytics dashboards, tech companies can streamline purchasing decisions and reduce procurement lead times. This agile procurement model supports innovation and speed-to-market while maintaining transparency and spend control.

Global Procurement as a Service Market: Stats & Facts

- Public Procurement Spending as a Key Economic Driver

- European Commission

- Public procurement in the EU accounts for approximately 13.6% of the EU's GDP, valued at around €2 trillion annually. This reflects the economic importance of procurement in the region, managed by over 250,000 public authorities.

- U.S. Government

- Procurement expenditure in the U.S. federal government has been estimated to represent about 12% of GDP, with government contracts totaling approximately USD 500 billion annually.

- Procurement in India’s Public Sector

- Government of India

- The Government e-Marketplace (GeM), launched by the Government of India, hosts over 66,000 buyer organizations and around 5.9 million sellers. It is a crucial platform for public procurement.

- Procurement in China and the Asia-Pacific Region

- Chinese Government

- The Chinese government’s procurement market is vast, with state procurement programs contributing significantly to GDP. Specific government procurement figures reflect growth as China emphasizes transparency and digital procurement.

- Asia-Pacific Government Procurement

- The Asia-Pacific region has been increasing public sector procurement as a percentage of GDP, with countries like India and China focusing on digitalization and transparency in procurement. This transformation is driven by government initiatives to optimize and streamline procurement functions.

- Procurement Efficiency via Digital Platforms

- U.S. General Services Administration

- The U.S. General Services Administration (GSA) has been leading efforts in modernizing government procurement with e-procurement systems that save up to 10-15% on government procurement costs annually.

- EU Digital Procurement Initiatives

- The European Union is working toward enhancing digital procurement platforms to increase efficiency by 25%, targeting improvements in procurement processes across member states.

- Impact of Procurement on Sustainable Development Goals (SDGs)

- United Nations

- Sustainable procurement practices are being integrated globally to help achieve the United Nations Sustainable Development Goals (SDGs). Governments are increasingly adopting responsible procurement policies aimed at reducing the environmental impact and promoting ethical business practices.

- Procurement and Economic Development

- World Bank

- Public procurement represents a significant portion of GDP for many developing countries. Sub-Saharan African countries spend 10-15% of their GDP on procurement systems, significantly impacting economic development.

- Key Insights from EU Public Procurement Rules

- European Union

- The EU has set procurement rules for public authorities to ensure that at least 30% of public contracts involve SMEs, ensuring inclusivity and supporting small businesses.

Global Procurement as a Service Market: Market Dynamics

Global Procurement as a Service Market: Driving Factors

Digital Transformation and Technological AdvancementsThe accelerating pace of digital transformation across industries is a major driving factor in the global Procurement as a Service (PaaS) market. As businesses seek greater efficiency and agility in managing their procurement processes, they are turning to cloud-based solutions, artificial intelligence (AI), machine learning, and robotic process automation (RPA). These technologies enable automated procurement workflows, enhanced spend visibility, and predictive analytics, allowing companies to make more informed, data-driven decisions.

With digital procurement platforms providing real-time insights into supplier performance and contract compliance, organizations are now able to streamline operations, reduce costs, and improve strategic sourcing. The shift towards digital procurement solutions is particularly evident in sectors like retail, healthcare, and manufacturing, where the need for scalability, process automation, and enhanced supplier collaboration is paramount.

Increasing Focus on Cost Optimization and Operational Efficiency

As companies face pressures to enhance operational efficiency and reduce overhead costs, Procurement as a Service is becoming an attractive model for achieving these goals. Organizations are outsourcing their procurement functions to third-party providers to access specialized expertise and advanced procurement technologies without the burden of maintaining large in-house teams. PaaS solutions offer significant cost-saving opportunities by consolidating procurement activities, eliminating manual processes, and streamlining supplier management. With the ability to analyze spend data and identify areas for cost reduction, businesses can drive savings through strategic sourcing, supplier negotiations, and improved procurement governance.

Global Procurement as a Service Market: Restraints

Data Security and Privacy Concerns

One of the key restraints in the global Procurement as a Service (PaaS) market is the growing concern over data security and privacy, particularly when organizations outsource sensitive procurement data to third-party service providers. With the growing reliance on cloud-based platforms and digital procurement tools, companies are wary of potential data breaches and unauthorized access to confidential information. Strict data protection regulations, such as GDPR in Europe and CCPA in California, add complexity for organizations looking to integrate PaaS solutions while maintaining compliance. Ensuring secure access controls, encryption, and regular audits is critical, yet it remains a significant challenge.

Integration Challenges with Existing Systems

Another major restraint in the global Procurement as a Service market is the difficulty companies face when integrating PaaS solutions with their existing enterprise resource planning (ERP) and procurement management systems. Many organizations have legacy systems that are not easily adaptable to cloud-based platforms or modern procurement tools, leading to compatibility issues and extended implementation times. The integration process can be complex, requiring substantial time and resources to ensure seamless data transfer, workflow synchronization, and system alignment. Furthermore, businesses may experience resistance from internal stakeholders who are accustomed to traditional procurement methods and systems.

Global Procurement as a Service Market: Opportunities

Expansion of Artificial Intelligence and Automation Capabilities

A significant opportunity in the global Procurement as a Service (PaaS) market lies in the ongoing integration of artificial intelligence (AI) and automation technologies. As businesses seek to optimize their procurement processes, AI-powered tools can offer enhanced spend analysis, predictive analytics, and supplier performance evaluation. Automation also allows organizations to streamline routine tasks such as purchase order creation, invoice processing, and contract management, leading to faster procurement cycles and reduced human error. The growth of machine learning algorithms and AI-driven procurement platforms provides companies with opportunities to make smarter, data-driven decisions, ultimately improving efficiency and cost management.

Growing Demand for Sustainable and Ethical Sourcing

The growing global emphasis on sustainability and corporate social responsibility (CSR) presents a valuable opportunity for the Procurement as a Service market to align with evolving business priorities. Organizations are now under greater pressure to ensure that their procurement practices are environmentally responsible and ethically sound, particularly regarding supplier selection and materials sourcing. PaaS providers can leverage sustainability-focused procurement strategies to help companies source products from ethical suppliers, comply with environmental regulations, and reduce their carbon footprints. By offering tools that enable businesses to track the environmental and social impact of their supply chains, PaaS solutions can support companies in achieving their sustainability goals.

Global Procurement as a Service Market: Trends

Shift Toward Cloud-Based Procurement Platforms

One of the most prominent trends in the global Procurement as a Service (PaaS) market is the rapid shift toward cloud-based procurement platforms. As businesses seek greater flexibility, scalability, and accessibility, cloud technology has become a key enabler for procurement transformation. Cloud-based platforms provide real-time data access, allow for seamless collaboration among global teams, and enable integration with various enterprise systems, making procurement processes more agile and efficient. This shift also reduces the need for expensive infrastructure investments, enabling businesses to adopt pay-per-use models. The growing adoption of cloud solutions in procurement management is particularly evident in industries like retail, IT, and manufacturing, where global supply chain complexities require centralized, digitalized systems.

Increased Focus on Supplier Diversity and Inclusion

A significant trend in the global PaaS market is the growing emphasis on supplier diversity and inclusion. As organizations recognize the importance of supporting minority-owned, women-owned, and small businesses, they are actively seeking procurement solutions that promote a more diverse and inclusive supplier base. PaaS providers are offering tools that allow companies to identify, evaluate, and integrate diverse suppliers into their procurement strategies, ensuring that procurement decisions align with corporate social responsibility (CSR) goals. This focus on diversity is driven by both ethical considerations and the potential to unlock innovation and access unique products or services from underrepresented suppliers.

Global Procurement as a Service Market: Research Scope and Analysis

By Component Analysis

The strategic sourcing component is expected to maintain its leadership in the global Procurement as a Service (PaaS) market, capturing 31.7% of the total market share in 2025. This dominance is primarily driven by the growing need for businesses to optimize their procurement functions through data-driven, supplier-focused strategies. Strategic sourcing enables organizations to identify and engage with the most cost-effective and reliable suppliers, which not only reduces procurement costs but also enhances overall supply chain efficiency. As companies continue to face complex and dynamic supply chains, the need for enhanced visibility, market intelligence, and long-term supplier relationships is pushing the demand for strategic sourcing solutions. These solutions are further supported by advanced technologies such as artificial intelligence (AI) and machine learning, which help organizations forecast demand, assess supplier performance, and streamline the procurement process.

In this market, Spend Management is also a critical subsegment, which refers to the process of monitoring, controlling, and analyzing organizational spending to identify opportunities for cost savings and optimization. The integration of spend management tools within PaaS solutions allows companies to have a comprehensive view of their procurement activities, enabling them to make more informed and strategic purchasing decisions. Spend management solutions include capabilities such as spend visibility, category management, supplier performance tracking, and contract compliance.

These tools empower businesses to consolidate spend across departments, negotiate better pricing with suppliers, and reduce maverick buying, leading to improved cost control and budget alignment. Moreover, the emphasis on automation within spend management allows for seamless workflows, reducing manual efforts and accelerating procurement cycles. As organizations strive to improve cost efficiency and transparency, spend management solutions are becoming essential to the PaaS offering, driving their growth in this segment.

By Organization Size Analysis

Large enterprises are expected to continue their dominance in the global Procurement as a Service (PaaS) market, capturing 70.5% of the total market share in 2025. This dominance can be attributed to the complex and expansive procurement needs of large organizations, which require robust, scalable, and efficient solutions to manage a wide range of suppliers, products, and procurement processes.

Large enterprises benefit from the ability to leverage economies of scale, allowing them to negotiate better deals and streamline their procurement functions through sophisticated PaaS offerings. Additionally, the adoption of PaaS in large enterprises is driven by their need for enhanced visibility, improved spend management, and the ability to integrate procurement processes across multiple departments and geographic locations. With global supply chains becoming more intricate, large organizations are turning to PaaS solutions to ensure greater operational efficiency, supplier compliance, and faster decision-making.

On the other hand, the Small and Medium Enterprises (SMEs) subsegment is also experiencing growth within the PaaS market, although to a lesser extent compared to large enterprises. SMEs typically face unique challenges, such as limited resources, budget constraints, and a smaller procurement team, making it difficult to manage procurement processes efficiently. Despite these constraints, SMEs are adopting PaaS solutions as a way to level the playing field with larger competitors. By utilizing PaaS, SMEs can gain access to advanced procurement tools, such as spend analysis, supplier performance tracking, and automated procurement workflows, without the high upfront costs associated with building an in-house procurement infrastructure.

These solutions allow SMEs to improve their procurement efficiency, reduce costs, and gain better visibility into their spending, all while maintaining flexibility and scalability. Moreover, the ease of integration with existing systems and the availability of pay-per-use models make PaaS solutions highly attractive to SMEs.

By Industry Vertical Analysis

The Manufacturing industry is expected to maintain its dominance in the global Procurement as a Service (PaaS) market, capturing 24.9% of the total market share in 2025. This dominance is driven by the complexity and scale of procurement operations within the manufacturing sector, which typically involves a large network of suppliers, raw materials, components, and logistics providers. Manufacturing companies face growing pressure to optimize their supply chains, reduce costs, and improve operational efficiency in a competitive global market.

PaaS solutions enable manufacturers to streamline procurement processes, gain greater visibility into supplier performance, and enhance their sourcing strategies. The integration of advanced technologies such as artificial intelligence (AI), machine learning, and predictive analytics within PaaS platforms further supports manufacturing companies by offering insights into demand forecasting, production scheduling, and inventory management. By automating procurement workflows and centralizing procurement data, manufacturers can reduce lead times, mitigate risks, and achieve greater cost control.

In contrast, the IT & Telecom industry is also experiencing significant growth within the PaaS market, driven by its own set of unique needs. The IT and Telecom sector is characterized by rapidly changing technologies, high-value contracts, and complex supplier relationships, making procurement management a critical function. PaaS solutions offer IT and Telecom companies the ability to manage large volumes of software licenses, hardware procurement, and service contracts efficiently.

These businesses benefit from enhanced spend visibility, supplier collaboration, and contract compliance, allowing them to optimize their procurement activities and reduce costs. Additionally, the growing adoption of cloud-based services and software-as-a-service (SaaS) solutions requires telecom and IT firms to rethink their procurement strategies, especially in terms of scaling vendor management and managing recurring subscriptions. PaaS solutions help streamline the procurement of these services by offering real-time data, enabling these businesses to better negotiate contracts, manage renewals, and ensure compliance with licensing agreements.

The Procurement as a Service Market Report is segmented on the basis of the following

By Component

- Strategic Sourcing

- Spend Management

- Category Management

- Process Management

- Contract Management

- Transactions Management

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Industry Vertical

- Manufacturing

- IT & Telecom

- BFSI

- Retail

- Healthcare

- Others

Global Procurement as a Service Market: Regional Analysis

Region with the Largest Revenue Share

Europe is anticipated to maintain its leadership in the global Procurement as a Service (PaaS) market, capturing 41.9% of the total global market revenue in 2025. This dominance is largely due to Europe’s advanced business infrastructure, widespread adoption of digital technologies, and a highly competitive business environment. The region's mature markets, particularly in countries like Germany, the UK, and France, have recognized the value of streamlining procurement functions through the adoption of cloud-based solutions. As European companies continue to prioritize operational efficiency, cost reduction, and enhanced supplier relationships, PaaS platforms provide them with the tools to meet these demands. The integration of advanced analytics, AI-driven insights, and automation within PaaS solutions allows businesses in Europe to improve decision-making, reduce procurement cycles, and gain better control over spend management.

Region with significant growth

The Asia Pacific (APAC) region is poised to experience the highest compound annual growth rate (CAGR) in the global Procurement as a Service (PaaS) market in the coming years. This surge can be attributed to several key factors that are driving the adoption of PaaS solutions across diverse industries in the region. One of the primary catalysts is the rapid pace of economic growth in APAC, particularly in countries such as China, India, Japan, and South Korea, where businesses are scaling operations and focusing on optimizing their supply chains. As these economies continue to expand, the demand for advanced procurement solutions that can streamline processes, reduce costs, and improve efficiency has skyrocketed. Another significant factor contributing to the high growth in APAC is the growing digital transformation initiatives across the region. Businesses are rapidly adopting cloud-based procurement solutions to enhance transparency, improve decision-making, and integrate advanced technologies such as artificial intelligence (AI), machine learning, and automation into their procurement processes.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Procurement as a Service Market: Competitive Landscape

The global competitive landscape of the Procurement as a Service (PaaS) market is characterized by a diverse mix of players, ranging from established procurement software providers to new-age startups offering specialized, niche services. As businesses globally prioritize efficiency, cost control, and strategic procurement, the competition among PaaS providers has become more intense, with each company striving to capture market share by offering innovative and scalable solutions. The key players in this market are leveraging a variety of strategies, such as partnerships, acquisitions, and product innovation, to enhance their service offerings and meet the growing demand for digital procurement solutions.

A significant aspect of the competitive landscape is the rise of technology-driven procurement platforms that integrate cutting-edge technologies like artificial intelligence (AI), machine learning, blockchain, and automation. These technologies enable PaaS providers to offer real-time analytics, predictive insights, and automated decision-making, which help businesses optimize supplier selection, enhance contract compliance, and improve spend visibility. The ability to offer end-to-end solutions that address every aspect of procurement, from sourcing and contract management to supplier performance tracking and spend analysis, has become a key differentiator in this competitive market. As businesses move toward more data-driven procurement strategies, providers that can offer deep data analytics capabilities are positioned to capture a larger share of the market.

Some of the prominent players in the Global Procurement as a Service are

- Accenture

- IBM

- GEP

- Capgemini

- WNS

- Genpact

- Infosys

- HCL Technologies

- TCS

- Xchanging

- Corbus

- Aquanima

- Proxima

- Denali

- Aegis Limited

- ChainIQ

- Source One

- Zycus

- Jaggaer

- LogicSource

- Other Key Players

Global Procurement as a Service Market: Recent Developments

- March 2025: Accenture acquired the procurement services provider Kearney, expanding its capabilities in digital procurement, artificial intelligence, and supply chain management solutions to better serve large enterprises across industries.

- December 2024: SAP announced the acquisition of Bertelsmann’s procurement platform, enhancing its cloud-based procurement services and extending its reach in the global market, particularly in the European region.

- July 2024: IBM acquired Turbonomic, a provider of cloud optimization and AI-driven supply chain solutions, bolstering its procurement-as-a-service platform to offer advanced analytics for smarter supplier management.

- May 2024: Oracle acquired Vertical Procurement, a digital procurement software company, to enhance its cloud-based enterprise resource planning (ERP) services with comprehensive procurement management tools.

- April 2024: Zycus, a leading procurement solutions provider, acquired Sourcing Allies, further enhancing its supplier management and sourcing capabilities with new tools for global supplier engagement.

- February 2024: GEP, a global leader in procurement and supply chain solutions, acquired Jaggaer, a procurement platform that provides solutions for spend management, sourcing, and supplier performance tracking.

- December 2023: Ivalua acquired Apex Sourcing, expanding its global footprint and strengthening its portfolio of cloud-based procurement services, including contract management and supplier performance solutions.

- October 2023: SynerTrade, a leading digital procurement solutions provider, acquired ProcureTech to enhance its portfolio with cutting-edge artificial intelligence and machine learning capabilities in procurement analytics.

- August 2023: Procurement software company Basware acquired Purchase-to-Pay Solutions, enabling Basware to broaden its suite of automated procurement tools and strengthen its competitive position in the European market.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 8.3 Bn |

| Forecast Value (2034) |

USD 20.0 Bn |

| CAGR (2025–2034) |

10.3% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Strategic Sourcing, Spend Management, Category Management, Process Management, Contract Management, and Transactions Management), By Organization Size (Large Enterprises and SMEs), and By Industry Vertical (Manufacturing, IT & Telecom, BFSI, Retail, Healthcare, and Others) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Accenture, IBM, GEP, Capgemini, WNS, Genpact, Infosys, HCL Technologies, TCS, Xchanging, Corbus, Aquanima, Proxima, Denali, Aegis Limited, ChainIQ, Source One, Zycus, Jaggaer, LogicSource.,and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Contents