.

Refractory materials are advanced ceramic substances designed to withstand intense chemical corrosion, high temperatures, & mechanical stress. By providing mechanical durability, resistance to corrosion, & thermal insulation, they play a vital yet often underestimated role in the daily operations of nearly every industry. These materials have proven indispensable for numerous sectors in establishing crucial manufacturing processes, including iron and steel, cement, various metals, glass, paper & pulp, and petrochemicals.

In certain sectors such as steel and other metals, these items are treated as consumables & need periodic replacement to function properly. Conversely, sectors like glass & cement consider their long-term investment as they can serve their purpose for up to a decade. Refractory materials are pivotal for the advancement of diverse end-use sectors due to their non-toxic production methods, with over 90% of them being recycled or reused. However, the market for these materials faced challenges due to the impact of the COVID-19 pandemic, given its reliance on cement, glass, steel, & metal manufacturing, as well as mining, heavy industry, & oil and gas sectors.

Market Dynamic

The Global Refractory Materials Market is experiencing growth due to rising investments in the iron and steel sectors. This growth is evident in developed and emerging nations such as the United States, China, & India, where refractory materials are widely employed for thermal insulation purposes. The surge in iron and steel production is attributed to rapid infrastructure development and increased demand from the automotive industry.

A major driving force in the refractory materials market is the consistent growth in steel industries. Despite refractory materials costing slightly higher, approximately two to three percent more than steel, the expanding infrastructure, along with thriving oil and gas and automobile sectors, is fueling the development of the steel industry. While opportunities persist in cement, glass, & non-ferrous sectors for refractory businesses, the steel industry significantly influences their success. Currently, three-fourths of the global demand for refractories stems from the steel industry, a dominance expected to persist throughout the entire projection period.

The ecological impact of raw materials used in refractories like carbon, carbides, silica, ceramic fibers, and similar substances is substantial. Prolonged contact with ceramic fibers can lead to adverse health effects such as respiratory issues, skin irritation, &, in extreme cases, fatalities. Furthermore, the manufacturing process of refractories emits hazardous pollutants, like nitrogen oxides & carbon monoxide, which adversely affect the environment. Another challenge that persists is overproduction affecting steel sectors. Despite challenges, there has been a gradual recovery over the past year. Moreover, due to the focus on self-reliance and reducing imports, investments in the steel industry are anticipated to rise in emerging & underdeveloped nations, further driving the demand for refractory materials.

Research Scope and Analysis

By Form

Under the form segment, the shaped segment emerges as the primary revenue contributor and is expected to dominate throughout the projected period. Shaped refractory materials offer platforms with intricate designs & larger surface areas or honeycomb patterns. These structures help in the exposure of metal catalysts to reactive gases or reactants. Industries requiring highly effective thermal insulation solutions, in conjunction with these unique designs, opt for shaped refractory materials. For example, sectors like iron and steel manufacturing, cement production, and glass manufacturing favor shaped refractory materials for superior thermal insulation in kilns, incinerators, furnaces, and reactors. This trend is propelling the growth of this segment in the global market.

By Product

In terms of products, the market is categorized into clay and non-clay segments. The clay segment holds a larger market share due to its lower cost compared to the non-clay segment. Products such as fireclay bricks & insulation materials are typically crafted from clay materials and are extensively used by producers in the iron & steel industry. Additionally, raw materials for producing refractory clay items are more easily accessible, further contributing to its dominance in the market. Specific manufacturing methods involve strong acids & bases, making non-clay refractory products highly resistant to corrosion. They offer superior corrosion resistance compared to their standard clay counterparts.

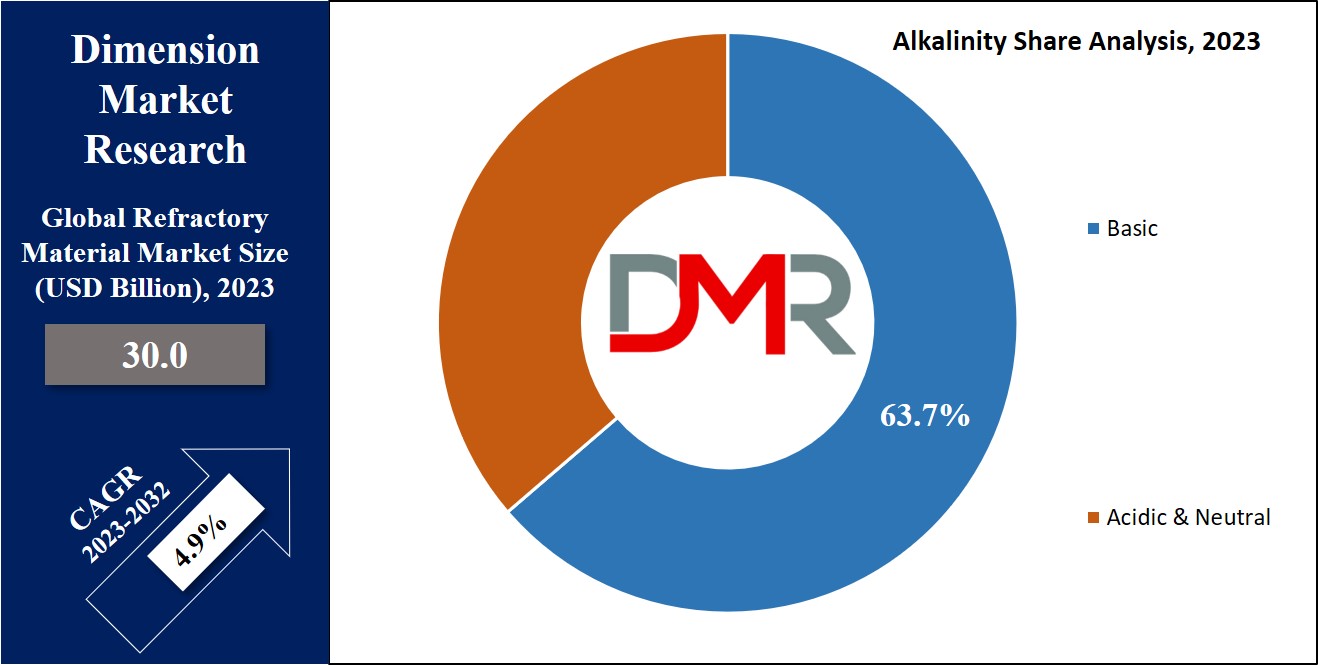

By Alkalinity

Under the alkalinity segment, the basic category dominates the market share in 2023. Basic refractory materials are utilized in areas where the surroundings & slags have alkaline conditions. They find application in both offshore and onshore structures, such as incinerators, kilns, chemical manufacturing facilities, & the metal fabrication sector, due to their stability in alkaline environments, making them valuable for thermal insulation purposes. This factor propels the global market for basic refractory materials.

By End-User

Under the end-user segment, the market is segmented into the following sectors, Iron & Steel, Non-Ferrous Metals, Glass, Cement, and Others. The iron and steel sector commands the most significant portion of this market due to its extensive usage in virtually all furnaces, reactors, and vessels employed in steel production. Additionally, the refractory lining is regularly replaced, occurring every half hour - 2 days, at different stages of the steel manufacturing process. This leads to substantial consumption by the iron and steel industry.

The advancement of glass melting technology hinges primarily on the progress & caliber of refractory goods. Selecting the right refractory material is paramount when constructing a glass furnace, given that the furnace's longevity is directly contingent on the quality of the refractory material. AZS (Alumina Zirconia Silica) serves as the fundamental structural refractory material for glass furnaces, mainly because molten glass does not readily adhere to it and does not react with it. The growing glass industry, driven by a shift towards eco-friendly alternatives over plastics, is boosting the need for refractory materials.

The Refractory Material Market Report is segmented on the basis of the following

By Form

By Product

By Alkalinity

By End-User

- Iron & Steel

- Non-Ferrous Metals

- Glass

- Cement

- Others

Regional Analysis

During the forecast period (2023-2032), the refractory material market in the Asia-Pacific region is expected to experience significant growth. However, in 2023, the Asia-Pacific region accounts for 82.3% of the market share, majorly because of the rising demand for iron & steel across various sectors like

construction, industry, automotive, & more.

This rise in demand has pushed iron and steel manufacturers to expand their production capacities, where refractory materials are important for maintaining stable temperatures. Especially, in China, the cement manufacturing sector is rapidly expanding, compelling refractory material producers to develop high-quality products tailored for high-temperature applications in furnaces, kilns, incinerators, & similar settings.

Moreover, in North America, market expansion is anticipated due to rising requirements from several sectors within the region, notably the iron & steel as well as glass industries. Europe's market, on the other hand, is poised for sustained growth, driven by the increasing steel and glass demands from the automotive manufacturers operating within the region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Global Market for Refractory Materials is competitive, with many companies trying to be the best. They use different strategies like working together or creating new products to stay ahead. These companies also focus on making their products eco-friendly to meet the demand for environmentally friendly items. Changes in technology, rules, and what people like affect this market. The companies that can adapt to these changes and offer good quality materials do well. Industries like steel, cement, glass, and automotive need these materials, so companies work hard to meet their needs and stay competitive in the market.

Some of the prominent players in the Global Refractory Material Market are:

- Imerys

- Saint-Gobain

- RHI Magnestia

- KAEFER SE & Co. KG

- Alsey Refractories Co.

- Magnezit Group

- Harbison Walker International

- Dalmia Bharat Refractory

- Morgan Advanced Materials

- Lanexis

- Vitcas

- Other Key Players

COVID-19 Pandemic & Recession: Impact on the Global Refractory Material Market

The COVID-19 pandemic and the subsequent economic recession have significantly impacted the global refractory material market. The widespread lockdowns & disruptions in manufacturing & construction activities led to a decrease in demand for refractory materials, especially in sectors such as cement, steel, & glass production, which are major consumers of these materials.

Supply chain interruptions, labor shortages, & reduced investments further hampered the growth of the industry. However, the market showed resilience as countries gradually reopened their economies, stimulating demand for refractory materials in construction projects and industrial activities. Additionally, the pandemic accelerated digital transformation in the industry, with a focus on remote monitoring and automation. As the world continues to recover, the refractory material market is adapting to new norms, emphasizing sustainable practices and technological advancements to meet evolving market demands.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 30 Bn |

| Forecast Value (2032) |

USD 46.1 Bn |

| CAGR (2023-2032) |

4.9% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Form (Shaped and Unshaped), By Product (Clay

and Non-Clay), By Alkalinity (Basic and Acidic &

Neutral), and By End-User (Iron & Steel, Non-Ferrous

Metals, Glass, Cement, and Others). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Imerys, Saint-Gobain, RHI Magnestia, KAEFER SE &

Co. KG, Alsey Refractories Co., Magnezit Group,

Harbison Walker International, Dalmia Bharat

Refractory, Morgan Advanced Materials, Lanexis,

Vitcas, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |