Market Overview

The

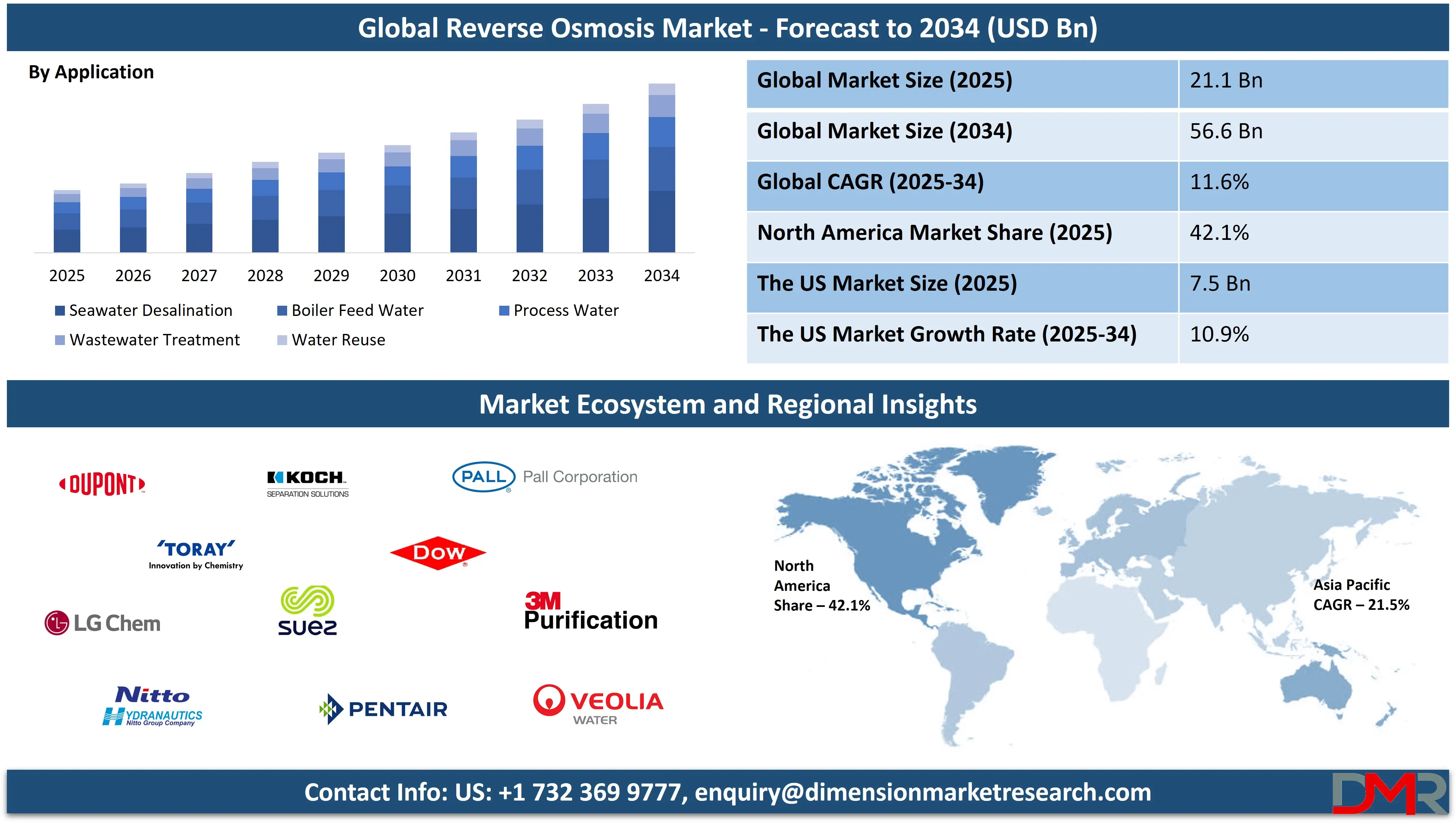

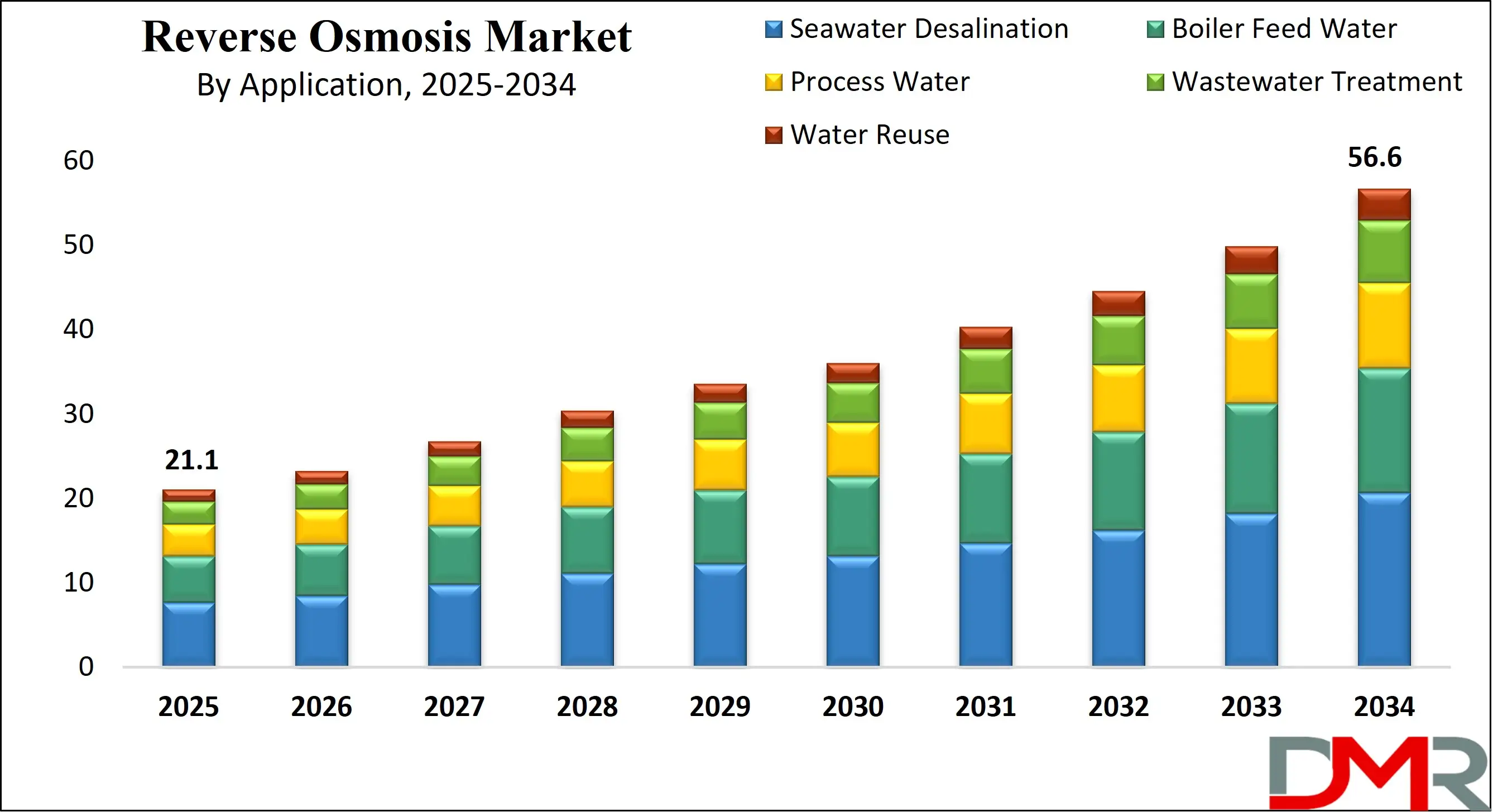

Global Reverse Osmosis Market size is expected to surge from

USD 21.1 billion in 2025 to

USD 56.6 billion by 2034, driven by a strong

11.6% CAGR amid rising demand for clean water solutions, desalination systems, and advanced membrane filtration technologies.

Reverse osmosis is a highly efficient water purification process that uses a semi-permeable membrane to remove impurities, contaminants, and dissolved salts from water by applying pressure to force water molecules through the membrane while leaving unwanted substances behind. It is widely used for producing clean drinking water, treating industrial process water, and facilitating seawater desalination.

The technology is especially valued for its ability to eliminate microscopic particles, heavy metals, bacteria, and dissolved solids. It is a preferred solution for various water treatment applications across residential, commercial, and industrial sectors. Reverse osmosis systems are often integrated with pre-treatment filters and post-treatment stages to enhance efficiency, prolong membrane life, and ensure high-quality output.

The global reverse osmosis market is experiencing steady expansion, driven by the growing need for sustainable water treatment solutions in response to escalating water scarcity, industrialization, and environmental regulations. With growing concerns over water contamination and declining freshwater resources, reverse osmosis has emerged as a crucial technology in municipal water treatment, wastewater recovery, and seawater desalination. The market is characterized by advancements in membrane materials, energy-efficient system designs, and the integration of smart monitoring technologies.

Rising demand from sectors such as pharmaceuticals, power generation, food and beverage processing, and microelectronics is further fueling adoption. Key trends include the shift toward modular RO systems, innovations in membrane durability, and the expansion of RO applications in both developed and emerging economies. As governments and industries prioritize water security and regulatory compliance, the reverse osmosis industry continues to evolve as a cornerstone of modern water filtration and purification strategies.

In addition to its widespread use in large-scale industrial and municipal projects, reverse osmosis is gaining traction in residential and commercial applications due to rising consumer awareness about water quality and health. Compact under-sink RO systems and portable water purifiers are becoming more common in households, offices, and small businesses, offering an accessible and reliable method for removing contaminants like fluoride, chlorine, lead, and nitrates.

As urban populations grow and infrastructure challenges persist, decentralized water treatment using reverse osmosis is becoming a practical solution for ensuring safe water access in remote and water-stressed regions. The market also reflects a rising emphasis on energy recovery systems and environmentally friendly designs, aiming to reduce operational costs and carbon footprint. This convergence of innovation, regulatory pressure, and consumer demand is positioning reverse osmosis as a key enabler of sustainable water management across a broad spectrum of end-use industries.

The US Reverse Osmosis Market

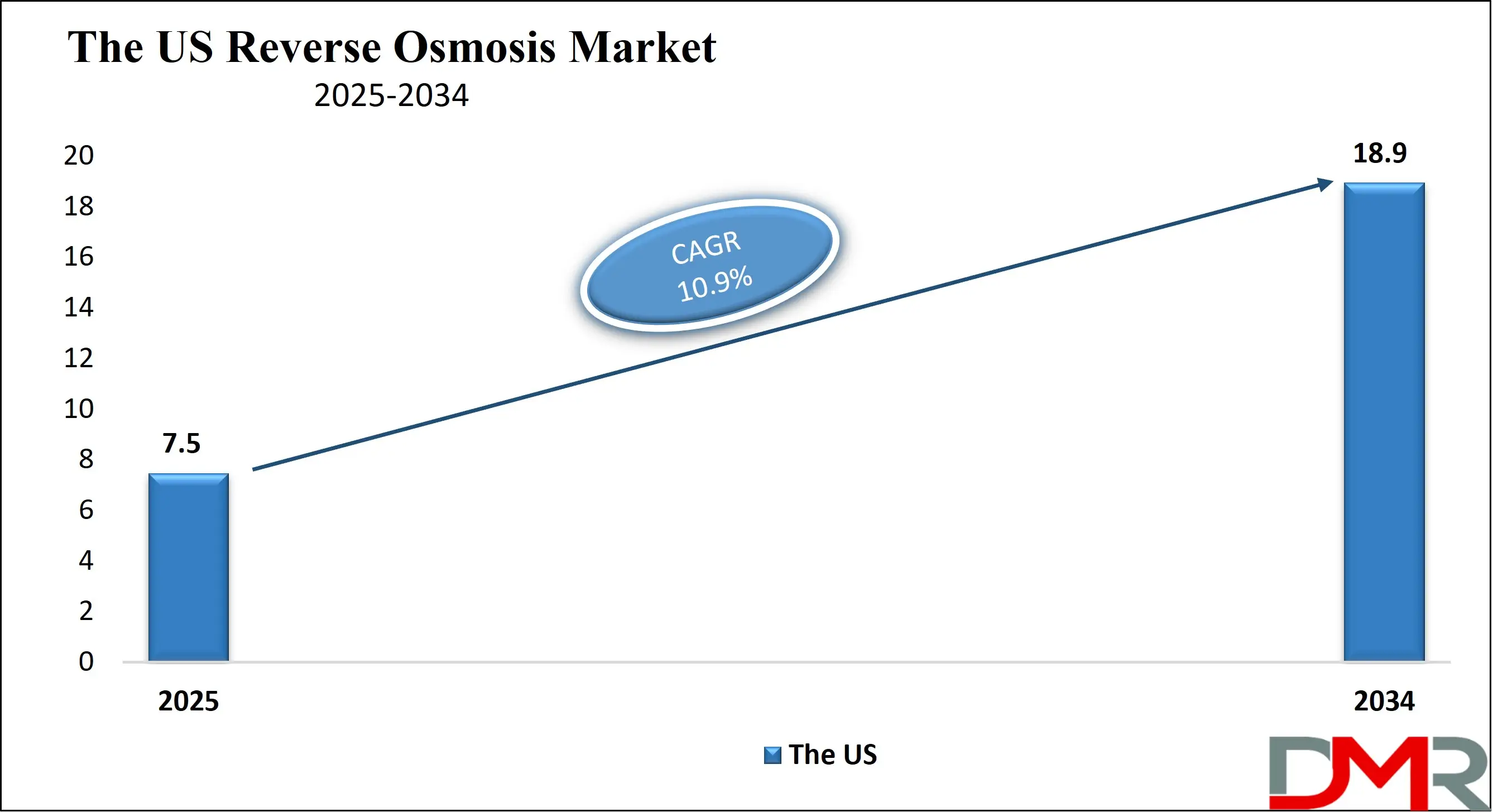

The U.S. Reverse Osmosis Market size is projected to be valued at USD 7.5 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 18.9 billion in 2034 at a CAGR of 10.9%.

The U.S. reverse osmosis market is experiencing significant growth, driven by growing concerns over water quality, scarcity, and the need for advanced purification technologies. The adoption of reverse osmosis systems spans across various sectors, including residential, commercial, and industrial applications. In residential settings, there's a growing demand for point-of-use systems that effectively remove contaminants such as lead, chlorine, and fluoride, ensuring safe drinking water for households.

Commercial establishments, particularly in the food and beverage industry, rely on reverse osmosis for consistent water quality essential to their operations. Industrially, sectors like pharmaceuticals, power generation, and chemical processing utilize reverse osmosis to meet stringent water purity standards, highlighting the technology's versatility and importance.

Technological advancements have further propelled the market, with innovations in membrane materials enhancing efficiency and durability. The integration of smart monitoring systems allows for real-time tracking and maintenance, optimizing performance and reducing downtime. Additionally, the U.S. government's emphasis on environmental regulations and sustainable practices has encouraged industries to adopt water treatment solutions like reverse osmosis, aligning with broader environmental goals. As urbanization continues and freshwater resources face growing pressure, the role of reverse osmosis in ensuring water security and quality becomes ever more critical, positioning it as a cornerstone in the nation's water treatment infrastructure.

The European Reverse Osmosis Market

The European reverse osmosis market is projected to reach a market value of USD 4.0 billion in 2025, with an estimated CAGR of 9.4% over the forecast period. This growth is driven by a combination of regulatory pressures, rising industrial demand, and growing awareness of sustainable water management practices.

One of the key factors contributing to this market growth is the European Union's commitment to environmental sustainability and strict water quality regulations. Policies and regulations aimed at improving water quality, reducing pollution, and ensuring water conservation have significantly increased the demand for advanced water treatment solutions, including reverse osmosis. Municipalities across Europe are investing heavily in modernizing water treatment infrastructure to comply with these regulations, and reverse osmosis technology plays a pivotal role in meeting these demands. This includes the treatment of wastewater, potable water, and seawater desalination in coastal regions.

Additionally, industries in Europe, including pharmaceuticals, food and beverage, power generation, and manufacturing, rely on high-quality purified water for their operations. The reverse osmosis systems are critical in these sectors, ensuring the production of ultra-pure water necessary for processes that require stringent water quality standards. As these industries continue to expand and modernize their production facilities, the demand for efficient and sustainable water treatment solutions like reverse osmosis is expected to grow steadily.

The Japanese Reverse Osmosis Market

The reverse osmosis market in Japan is projected to reach USD 1.3 billion in 2025, with a CAGR of 7.6% over the forecast period. This growth is driven by several factors, including Japan’s need for advanced water treatment technologies, its focus on industrial applications, and its ongoing commitment to sustainability and environmental protection.

One of the key factors contributing to this market growth is the strong demand for high-quality water in industrial sectors. Japan is a major industrial hub, with significant demand for ultra-pure water in sectors such as electronics manufacturing, power generation, pharmaceuticals, and food and beverage processing. In particular, industries like semiconductor manufacturing require extremely high-purity water to avoid contamination that could affect product quality. Reverse osmosis systems are vital in producing this ultra-pure water, which drives continued adoption across Japanese industries.

Additionally, Japan’s aging water infrastructure and water scarcity challenges are leading to an increased focus on improving water efficiency and sustainability. The country faces limited natural freshwater resources, which makes desalination and efficient water treatment systems more critical, especially in coastal areas. Reverse osmosis plays a pivotal role in seawater desalination, particularly in regions where traditional water sources are scarce. With Japan’s reliance on desalination plants for water supply, the demand for reverse osmosis technology is expected to continue rising, further contributing to market growth.

Global Reverse Osmosis Market: Key Takeaways

- Market Value: The global reverse osmosis size is expected to reach a value of USD 56.6 billion by 2034 from a base value of USD 21.1 billion in 2025 at a CAGR of 11.6%.

- By Membrane Type Segment Analysis: Thin-Film Composite (FTC) Membranes are expected to maintain their dominance in the membrane type segment, capturing 67.4% of the total market share in 2025.

- By System Type Segment Analysis: Single-Stage RO Systems are poised to consolidate their dominance in the system type segment, capturing 58.8% of the total market share in 2025.

- By Filter Module Type Segment Analysis: Spiral-Wound Membranes are expected to maintain their dominance in the filter module type segment, capturing 55.2% of the market share in 2025.

- By Flow Rate Type Segment Analysis: Up to 50 GPD flow rate is anticipated to retain its dominant position in the flow rate type segment, capturing 35.9% of the market share in 2025.

- By Distribution Channel Type Segment Analysis: Direct Sales are poised to consolidate their dominance in the distribution channel type segment, capturing 60.5% of the market share in 2025.

- By Application Segment Analysis: Seawater Desalination applications are anticipated to maintain their dominance in the application type segment, capturing 36.7% of the total market share in 2025.

- By End-User Segment Analysis: Municipal Water Treatment is expected to maintain its dominance in the end-user type segment, capturing 46.9% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global reverse osmosis market landscape with 42.1% of total global market revenue in 2025.

- Key Players: Some key players in the global reverse osmosis market are DuPont Water Solutions, Toray Industries Inc., LG Chem, Hydranautics (A Nitto Group Company), Koch Separation Solutions, SUEZ Water Technologies & Solutions, Pentair plc, Pall Corporation, Dow Water & Process Solutions, 3M Purification Inc., Veolia Water Technologies, Axeon Water Technologies, Watts Water Technologies, Pure Aqua Inc., Canature Environmental Products Co. Ltd., Genesis Water Technologies, AMPAC USA, Applied Membranes Inc., Bluewater Group, and Other Key Players.

Global Reverse Osmosis Market: Use Cases

Municipal Drinking Water Treatment

Municipalities across the globe are turning to reverse osmosis systems to ensure the delivery of clean, safe, and potable water to growing urban populations. Traditional filtration methods often fall short in removing dissolved solids, heavy metals, and microscopic pathogens. Reverse osmosis provides a reliable solution through high-pressure membrane filtration that eliminates up to 99% of contaminants, including nitrates, arsenic, and pharmaceutical residues. As cities face aging infrastructure and rising public health standards, RO technology plays a critical role in modernizing water treatment plants and meeting regulatory compliance. This use case is particularly prominent in regions facing groundwater contamination and limited freshwater availability.

Seawater Desalination for Freshwater Production

In coastal and arid regions with limited access to freshwater resources, reverse osmosis is the backbone of seawater desalination projects. Countries in the Middle East, North Africa, and parts of Asia Pacific rely heavily on large-scale RO desalination plants to convert seawater into potable water for both residential and industrial use. The RO process is favored for its energy efficiency compared to thermal desalination methods, and advancements in membrane durability and energy recovery systems have further improved operational viability. This application supports national water security strategies, reduces reliance on freshwater imports, and is vital for sustaining agriculture and urban development in water-stressed regions.

Industrial Wastewater Reuse and Recycling

Industries such as textiles, petrochemicals, pharmaceuticals, and food processing are adopting reverse osmosis to meet environmental standards and reduce water consumption through closed-loop systems. RO membranes are used to treat and reclaim industrial effluents by removing chemical pollutants, organic compounds, and suspended solids, allowing for safe reuse in production processes or compliant discharge into the environment. This form of industrial wastewater treatment helps companies achieve sustainability targets, lower operational costs, and avoid regulatory fines. Moreover, it minimizes the environmental impact of manufacturing operations by conserving freshwater and reducing the burden on public sewage systems.

High-Purity Water Generation for Healthcare and Electronics

Reverse osmosis is essential in sectors that demand ultra-pure water, such as semiconductor manufacturing, biotechnology, and hospital sterilization systems. In these environments, even trace impurities can compromise product quality or patient safety. RO systems are integrated into multi-stage purification setups alongside deionization and ultraviolet sterilization to achieve high levels of water purity. In pharmaceutical production, purified water is crucial for drug formulation, equipment cleaning, and laboratory use. In electronics, RO-treated water ensures the cleanliness and performance of silicon wafers and microchips. This use case reflects the critical role of precision water purification in high-tech and healthcare industries.

Global Reverse Osmosis Market: Stats & Facts

United Nations (UN) & World Health Organization (WHO)

- Global Water Access and Health Impacts:

- 785 million people lack basic drinking water services.

- Approximately 2 billion people consume water contaminated with feces.

- Contaminated drinking water leads to an estimated 485,000 diarrheal deaths annually.

Investment in Water Security:

- Global investment in water security is projected to range from USD 6.7 trillion by 2030 to USD 22.6 trillion by 2050.

Saudi Water Authority (SWA)

- Desalination Capacity:

- SWA operates 33 desalination plants and over 139 purification plants.

- It holds the Guinness World Record as the largest producer of desalinated water, accounting for 22% of global production.

- Current production capacity is 7.5 million cubic meters per day, with plans to increase to 11.5 million cubic meters per day.

- Environmental Initiatives:

- Aims to reduce carbon emissions from 60 million tonnes to 37 million tonnes by 2025.

- Plans to replace liquid fuel with low-emission energy sources, reducing emissions by 10.8 million tonnes by 2024.

- Committed to planting 5 million trees by 2030.

India

- Regulatory Measures:

- India has banned the use of RO water purifiers in areas where the Total Dissolved Solids (TDS) in drinking water exceed 500 mg/L.

- Infrastructure Development:

- The India Investment Grid lists approximately 500 opportunities worth USD 102.23 billion for developing and improving water treatment plants.

Senegal

- Mamelles Desalination Plant:

- Under construction with an expected output of 50,000 cubic meters of water daily, expandable to 100,000 cubic meters.

- Estimated to cost €200 million and provide up to 50% of Dakar's water supply upon completion in 2025.

Jordan

- Aqaba Desalination Plant:

- Planned to produce 250 million cubic meters of water annually.

- Estimated cost is USD 1 billion, aiming to supply 25% of Jordan's water needs.

- Expected to commence operations in 2026 or 2027.

Australia

- Adelaide Desalination Plant:

- Located in South Australia, it has a capacity of 100 gigaliters per annum (approximately 300 megaliters per day).

- Provides up to 50% of Adelaide's drinking water needs.

- Constructed for AUD 1.83 billion and completed in December 2012.

- Water Supply from RO (Perth):

- Approximately 17% of Perth's drinking water is sourced from a reverse osmosis plant that desalts seawater.

Global Desalination Overview

- Desalination Plants Worldwide:

- As of 2021, there were 22,000 desalination plants in operation globally.

- In 2018, 18,426 plants produced 87 million cubic meters of clean water daily, serving over 300 million people.

China

- Desalination Initiatives:

- A desalination plant planned for Tianjin in 2010 aimed to produce 100,000 cubic meters of seawater daily.

Spain

- RO Plant Development:

- In 2004, Spain planned to build 20 reverse osmosis plants along its coastlines to meet just over 1% of the nation's total water needs.

Global Reverse Osmosis Market: Market Dynamics

Global Reverse Osmosis Market: Driving Factors

Rising Demand for Advanced Water Purification in Industrial Processes

Industries such as power generation, oil & gas, and food processing are growing their reliance on reverse osmosis systems to meet strict water quality specifications for boilers, cooling towers, and production lines. The ability of RO systems to remove fine particulates and dissolved salts makes them ideal for achieving ultra-pure water standards essential for operational efficiency and equipment longevity.

Escalating Water Scarcity and Desalination Infrastructure Expansion

As freshwater sources become strained due to climate change and overexploitation, governments and private sectors are investing in large-scale desalination systems powered by reverse osmosis. These systems provide a viable and scalable solution to support urban water supply and agricultural irrigation in drought-prone regions, especially across the Middle East, Africa, and Asia-Pacific.

Global Reverse Osmosis Market: Restraints

High Energy Consumption and Operational Costs

Despite technological improvements, reverse osmosis systems still require significant energy input, especially in seawater desalination applications. This leads to elevated operating expenses and carbon emissions, making the process less economically feasible in regions with limited energy access or strict sustainability goals.

Membrane Fouling and Brine Disposal Challenges

Frequent membrane fouling caused by biofilms, scaling, or chemical imbalances leads to performance degradation and increased maintenance costs. Additionally, the disposal of concentrated brine waste remains a major environmental concern, particularly in coastal installations, where improper handling can affect marine ecosystems.

Global Reverse Osmosis Market: Opportunities

Integration of Smart Monitoring and AI-Driven System Optimization

The adoption of IoT-enabled sensors and artificial intelligence in RO systems is creating opportunities to enhance performance through predictive maintenance, real-time water quality analysis, and energy optimization. These smart water purification technologies reduce downtime, improve membrane lifespan, and support data-driven decision-making.

Expanding Access to Clean Water in Emerging Economies

Developing regions across Sub-Saharan Africa, South Asia, and Latin America present significant opportunities for deploying modular and decentralized reverse osmosis systems. These scalable and portable solutions address local water purification needs, supporting community-level access to safe drinking water and reducing dependency on centralized infrastructure.

Global Reverse Osmosis Market: Trends

Development of Next-Generation Membrane Technology

Researchers and manufacturers are focusing on innovative membrane materials such as graphene oxide, carbon nanotubes, and biomimetic designs to improve filtration efficiency, chemical resistance, and throughput. These advancements aim to reduce energy requirements while extending membrane durability under harsh operating conditions.

Shift toward Circular Water Management and Zero-Liquid Discharge (ZLD)

As sustainability becomes a priority, industries are adopting reverse osmosis as part of closed-loop water recycling and ZLD systems. This trend reflects a growing commitment to resource conservation, where wastewater is fully treated and reused, eliminating liquid discharge and minimizing environmental impact.

Global Reverse Osmosis Market: Research Scope and Analysis

By Membrane Type Analysis

Thin-film composite (TFC) membranes are poised to remain the dominant force in the reverse osmosis membrane type segment, commanding approximately 67.4% of the total market share in 2025. Their widespread adoption is driven by superior salt rejection capabilities, high permeability rates, and enhanced mechanical strength, making them the preferred choice across industrial, municipal, and commercial water purification systems.

Constructed using multiple layers, including a polyamide thin-film on a porous support base, these membranes offer excellent resistance to chemical degradation and high operational efficiency even under varying pressure conditions. Their compatibility with advanced desalination systems, wastewater reclamation units, and brackish water treatment applications has further reinforced their market leadership. Moreover, TFC membranes are continuously evolving through research focused on reducing fouling tendencies and improving energy efficiency, positioning them as a critical technology in modern sustainable water treatment frameworks.

In contrast, cellulose acetate membranes hold a smaller but still relevant portion of the market, primarily favored in specific water treatment environments where chlorine resistance and biodegradability are prioritized. These membranes, made from natural polymer sources, are especially suitable for low-pressure applications and systems where pre-treatment conditions are not ideal for thin-film membranes. Although they generally exhibit lower rejection rates compared to TFC membranes, cellulose acetate variants are known for their simplicity, cost-effectiveness, and ease of use, making them a practical choice in certain municipal and rural water filtration setups.

Additionally, their resistance to microbial degradation without requiring extensive chemical dosing appeals to operators seeking low-maintenance membrane filtration solutions. While their usage may be limited in high-performance industrial settings, cellulose acetate membranes continue to play a role in niche applications where environmental compatibility and basic water purification efficiency align with system requirements.

By System Type Analysis

Single-stage reverse osmosis (RO) systems are expected to maintain their lead in the system type segment, accounting for approximately 58.8% of the total market share in 2025. These systems are widely adopted across residential, commercial, and light industrial applications due to their cost-effectiveness, operational simplicity, and ability to efficiently remove a broad range of dissolved impurities from water. Designed with a single membrane module, they operate by applying pressure to drive water through a semi-permeable membrane, effectively filtering out salts, bacteria, and other contaminants.

Single-stage RO systems are particularly valued in settings where water quality requirements are moderate and space or infrastructure constraints exist. Their relatively low maintenance needs, energy efficiency, and ease of installation make them a preferred solution for decentralized water purification systems, including point-of-use and point-of-entry applications. Continued innovation in membrane technology and compact design further enhances their appeal in urban environments and developing regions.

Multi-stage reverse osmosis systems, while representing a smaller share of the market, serve a critical role in high-demand environments where advanced water treatment performance is essential. These systems incorporate two or more RO stages, allowing for higher recovery rates, reduced wastewater generation, and improved purification of feedwater with complex chemical or biological compositions. Multi-stage configurations are commonly used in industries such as pharmaceuticals, semiconductors, and power generation, where ultra-pure water is necessary for core operations.

The sequential filtration process enables better contaminant removal, making these systems ideal for seawater desalination, brine concentration, and zero-liquid discharge strategies. Although they typically require higher capital investment and more intricate operational oversight, multi-stage RO systems deliver long-term efficiency and compliance with stringent water quality standards. Their use is expanding as environmental regulations tighten and industries prioritize sustainability, making them a key component of integrated and high-performance water treatment infrastructures.

By Filter Module Type Analysis

Spiral-wound membranes are expected to retain their dominant position in the filter module type segment, accounting for around 55.2% of the market share in 2025. Their popularity stems from their high efficiency and compact design, which makes them ideal for a wide range of water purification applications, including seawater desalination, municipal water treatment, and industrial water filtration.

The spiral-wound configuration involves layers of membrane material wrapped around a central core, which maximizes the surface area for filtration while maintaining a relatively small footprint. This configuration enables spiral-wound membranes to handle high volumes of water with greater flux rates and lower operating costs compared to other filter types. Their versatility, scalability, and ability to withstand high pressures and varying feedwater qualities have cemented their status as the preferred choice for large-scale reverse osmosis systems, driving their dominance in both commercial and industrial sectors.

Plate & frame membranes, although less prevalent than spiral-wound configurations, offer a robust and reliable alternative in applications requiring high filtration performance and easy maintenance. These systems consist of flat, stacked membranes housed within a series of frames, allowing for increased flexibility in system design and easy access for cleaning and replacement. Plate & frame systems are particularly well-suited for industrial applications where feedwater characteristics may vary significantly, as the design allows for customization to handle a wide range of flow rates and pressures.

While typically less space-efficient than spiral-wound membranes, plate & frame modules excel in environments that require higher durability and resistance to fouling, making them ideal for treating challenging feedwaters such as those found in chemical processing, food and beverage industries, and certain wastewater treatment operations. Their ability to accommodate larger flow rates in a modular system makes them a key player in niche markets where performance and maintenance are critical considerations.

By Flow Rate Analysis

The "Up to 50 GPD" flow rate segment is expected to retain its dominant position in the flow rate type segment, accounting for 35.9% of the market share in 2025. This flow rate range is particularly popular in residential applications where moderate water demands are met, such as in under-sink water filtration systems or small-scale point-of-use purification units. These systems are compact, affordable, and highly efficient, making them ideal for households and small businesses looking to purify drinking water, remove contaminants, and improve taste.

The demand for systems within this flow rate is driven by the growing concerns over water quality, the availability of affordable technologies, and the growing trend toward personal water treatment solutions. Additionally, advancements in membrane technology have enhanced the performance of these systems, making them more energy-efficient and capable of removing a broader spectrum of contaminants, including chlorine, fluoride, and heavy metals.

The "50-500 GPD" flow rate segment serves a different set of needs, catering primarily to light commercial and industrial applications that require a higher volume of purified water. These systems are frequently used in businesses such as small restaurants, cafés, offices, and light manufacturing processes, where water usage exceeds typical household levels but does not require the extensive capacity of large-scale industrial systems. The increased flow rate allows for continuous operation without sacrificing water quality, providing a balance of performance and cost-effectiveness.

Systems in the 50-500 GPD range are designed to handle moderate to high contaminant levels in source water, such as in areas with more challenging water quality. As industries adopt more sustainable practices and regulatory pressure increases, these mid-range flow rate systems are becoming integral in sectors looking to meet water treatment standards while optimizing operational costs.

By Distribution Channel Analysis

Direct sales are expected to maintain their dominant position in the distribution channel type segment, capturing around 60.5% of the market share in 2025. This distribution model is particularly effective in the reverse osmosis market, as it allows manufacturers to establish a direct connection with end-users, providing more personalized customer service and better control over pricing, marketing, and product availability.

Direct sales are particularly beneficial for high-value or customized reverse osmosis systems, such as large-scale industrial and commercial water treatment solutions, where specific requirements must be addressed. The ability to offer tailored solutions, conduct site assessments, and provide after-sales support strengthens customer relationships and fosters long-term partnerships. Additionally, direct sales offer greater flexibility in terms of product configurations and upgrades, which is a key advantage for customers seeking highly specialized water filtration systems.

Distributors and system integrators play a critical role in expanding the reach of reverse osmosis systems, particularly in regions or markets where direct sales operations may be limited. These intermediaries bridge the gap between manufacturers and end-users, offering a wide array of products to meet various customer needs. Distributors often operate in smaller markets or regions with lower demand for large-scale systems, providing a cost-effective way for customers to access standard RO solutions.

System integrators, on the other hand, work closely with industries to design, install, and maintain complex water treatment systems, often integrating reverse osmosis with other purification technologies to meet specific regulatory or operational requirements. This distribution model is key for industries such as pharmaceuticals, food processing, and power generation, where customized and integrated solutions are essential for meeting stringent water quality standards. By leveraging their extensive network and technical expertise, distributors and system integrators enable manufacturers to reach broader markets and expand their customer base in both developing and mature markets.

By Application Analysis

Seawater desalination applications are expected to maintain their dominant position in the application type segment, capturing 36.7% of the total market share in 2025. This dominance is driven by the growing global demand for freshwater, especially in arid and water-scarce regions where conventional water sources are limited or unreliable. Reverse osmosis is widely regarded as the most efficient and cost-effective technology for converting seawater into potable water, making it a central part of large-scale desalination plants around the world.

The growing focus on sustainable water management and infrastructure development in coastal regions has led to a surge in investments in seawater desalination, further boosting the adoption of reverse osmosis systems. As urban populations expand and climate change exacerbates water stress, the importance of seawater desalination will continue to rise, solidifying its place as a key application for RO technology.

Boiler feed water treatment is another critical application in the reverse osmosis market, particularly in industries such as power generation, chemicals, and manufacturing. Boilers require highly purified water to prevent scaling, corrosion, and fouling of critical components like heat exchangers and pipes. Reverse osmosis is essential in producing high-quality boiler feed water by removing dissolved salts, suspended solids, and contaminants that could damage the boiler system.

In industries where downtime can be costly and maintenance is crucial, RO systems ensure that water quality meets the stringent standards necessary for efficient and safe boiler operation. The growing demand for energy-efficient power plants and industrial operations further propels the adoption of RO for boiler feed water treatment, as it enhances overall system performance and extends equipment lifespan. As industries push for greater sustainability and compliance with environmental regulations, the use of reverse osmosis for boiler feed water is becoming an integral part of modern water treatment practices.

By End-User Analysis

Municipal water treatment is expected to maintain its dominant position in the end-user segment, capturing 46.9% of the market share in 2025. This continued dominance is largely due to the growing urbanization and population growth globally, which puts significant pressure on municipal water systems to provide safe and clean drinking water. Reverse osmosis is a key technology in meeting this demand, as it offers highly effective removal of contaminants, including salts, chemicals, bacteria, and other pollutants, ensuring that treated water meets regulatory standards for consumption.

Municipalities are investing in advanced water purification solutions to address challenges such as aging infrastructure, water scarcity, and contamination of local water sources. As climate change and pollution continue to strain natural water resources, the role of reverse osmosis in municipal water treatment will only continue to grow, providing a sustainable and reliable solution to the global water crisis.

In the industrial segment, reverse osmosis systems play a critical role in providing high-quality water for a variety of applications. Industries such as pharmaceuticals, food and beverage processing, electronics manufacturing, and petrochemicals rely on RO technology to produce ultra-pure water that meets stringent quality requirements. The water used in these sectors must be free from impurities that could compromise product quality, equipment performance, or safety standards. In the pharmaceutical industry, for example, water used in the production of drugs must meet strict regulatory standards to ensure both safety and efficacy.

Similarly, the electronics industry depends on ultra-pure water for semiconductor manufacturing, where even the smallest amount of contamination can lead to defects in the final product. Reverse osmosis systems help industrial operators reduce production downtime, improve operational efficiency, and comply with strict environmental and regulatory standards. As industries globally focus on sustainability, water conservation, and cost reduction, the demand for reverse osmosis systems in industrial applications will continue to rise, making it an indispensable technology for many sectors.

The Reverse Osmosis Market Report is segmented based on the following:

By Membrane Type

- Thin-Film Composite (FTC) Membranes

- Cellulose Acetate Membranes

- Others

By System Type

- Single-Stage RO Systems

- Multi-Stage RO Systems

By Filter Module Type

- Spiral-Wound Membranes

- Plate & Frame

- Hollow Fiber

- Tubular

By Flow Rate

- Up to 50 GPD

- 50-500 GPD

- Above 500 GPD

By Distribution Channel

- Direct Sales

- OEMs

- Industrial Contracts

- Distributors/System Integrators

- E-Commerce & Retail

By Application

- Seawater Desalination

- Boiler Feed Water

- Process Water

- Wastewater Treatment

- Water Reuse

By End-User

- Municipal Water Treatment

- Industrial

- Chemicals

- Electronics

- Pharma

- Desalination Plants

- Residential & Commercial

Global Reverse Osmosis Market: Regional Analysis

Region with the Largest Revenue Share

North America is poised to lead the global reverse osmosis market, capturing an estimated 42.1% of total global market revenue in 2025. This dominance can be attributed to several factors, including advanced infrastructure, stringent water quality regulations, and a high demand for sustainable and efficient water treatment solutions across various sectors such as municipal water treatment, industrial processes, and residential applications.

The region's established focus on environmental conservation and water management, integrated with the growing pressure to address water scarcity issues, positions reverse osmosis systems as a critical technology for ensuring the availability of clean and potable water. In the U.S., for example, reverse osmosis is widely used across municipal water treatment plants, as well as in private and commercial settings, due to its effectiveness in removing contaminants and ensuring the safety of drinking water.

Region with significant growth

Asia-Pacific is expected to experience the highest compound annual growth rate (CAGR) in the global reverse osmosis market, driven by several factors that contribute to the growing demand for advanced water purification technologies. The region's rapid industrialization, urbanization, and rising population are putting significant pressure on water resources, particularly in countries like China, India, Japan, and Southeast Asian nations.

These dynamics are fueling the need for reliable and cost-effective water treatment solutions, including reverse osmosis systems, to meet both growing consumption and stringent water quality standards. The demand for reverse osmosis in the Asia-Pacific region is particularly notable in the context of addressing water scarcity and pollution. Many countries in this region are experiencing growing challenges related to water availability, quality, and pollution. Reverse osmosis offers an efficient solution for treating both freshwater and seawater, making it critical for regions that rely on desalination for drinking water, especially in coastal areas.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Reverse Osmosis Market: Competitive Landscape

The global competitive landscape of the reverse osmosis (RO) market is characterized by a dynamic mix of established multinational companies, regional players, and emerging innovators. The competition in this market is driven by several key factors, including technological advancements, product differentiation, cost efficiency, and geographic expansion. The leading players in the industry are actively vying for market share by focusing on improving the performance, durability, and energy efficiency of their RO systems, which are essential for driving customer adoption in both residential and industrial applications.

Key players such as DuPont Water Solutions, Toray Industries, LG Chem, SUEZ Water Technologies & Solutions, and Koch Separation Solutions dominate the market due to their significant R&D investments, expansive product portfolios, and established distribution channels. These companies are well-positioned to capitalize on the growing demand for reverse osmosis systems across various industries, including municipal water treatment, seawater desalination, industrial applications, and residential water purification. They leverage their expertise in membrane technology, filtration systems, and automation to offer high-quality solutions that meet the evolving needs of their customers.

Some of the prominent players in the Global Reverse Osmosis market are:

- DuPont Water Solutions

- Toray Industries, Inc.

- LG Chem

- Hydranautics (A Nitto Group Company)

- Koch Separation Solutions

- SUEZ Water Technologies & Solutions

- Pentair plc

- Pall Corporation

- Dow Water & Process Solutions

- 3M Purification Inc.

- Veolia Water Technologies

- Axeon Water Technologies

- Watts Water Technologies

- Pure Aqua, Inc.

- Canature Environmental Products Co., Ltd.

- Genesis Water Technologies

- AMPAC USA

- Applied Membranes, Inc.

- Bluewater Group

- Other Key Players

Global Reverse Osmosis Market: Recent Developments

- April 2025: SUEZ acquired Waterlink, a leading provider of water treatment solutions, to expand its portfolio in reverse osmosis and wastewater treatment technologies, enhancing its global presence.

- February 2025: Veolia North America merged with Ecosys to strengthen its capabilities in providing sustainable water purification systems, including reverse osmosis solutions, in North American markets.

- January 2024: Pentair plc acquired Aquionics, a provider of ultraviolet disinfection and advanced water filtration technologies, further complementing its reverse osmosis water treatment offerings for industrial applications.

- December 2023: Toray Industries announced the acquisition of Membrana, a manufacturer of filtration products, to bolster its reverse osmosis membrane production capacity and diversify its product range.

- November 2023: LG Chem completed its acquisition of a major stake in the membrane filtration company, Dow Water & Process Solutions, enabling it to expand its reverse osmosis membrane production and enhance its competitive positioning.

- September 2023: Koch Industries announced the acquisition of Water Technologies Inc., a leading supplier of reverse osmosis systems, to strengthen its position in the global water treatment market.

- June 2023: 3M Purification Inc. merged with Pall Corporation to create a more comprehensive portfolio for water filtration, including advanced reverse osmosis solutions for industrial and municipal applications.

- April 2023: AquaVenture Holdings acquired a controlling interest in Pure Aqua, Inc., expanding its water treatment capabilities and strengthening its presence in the reverse osmosis sector.

- March 2023: A. Schulman Inc., a leading polymer manufacturer, acquired the water treatment business of Asahi Kasei Corporation, enhancing its reverse osmosis and water purification solutions for various industrial applications.

- January 2023: SUEZ Water Technologies & Solutions merged with Aquatech International Corporation, forming a global powerhouse in water treatment technologies, including reverse osmosis solutions for municipal and industrial sectors.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 21.1 Bn |

| Forecast Value (2034) |

USD 56.6 Bn |

| CAGR (2025–2034) |

11.6% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 7.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Membrane Type (Thin-Film Composite (TFC) Membranes, Cellulose Acetate Membranes, and Others), By System Type (Single-Stage RO Systems and Multi-Stage RO Systems), By Filter Module Type (Spiral-Wound Membranes, Plate & Frame, Hollow Fiber, and Tubular), By Flow Rate (Up to 50 GPD, 50–500 GPD, and Above 500 GPD), By Distribution Channel (Direct Sales, Distributors/System Integrators, and E-Commerce & Retail), By Application (Seawater Desalination, Boiler Feed Water, Process Water, Wastewater Treatment, and Water Reuse), and By End-User (Municipal Water Treatment, Industrial, Desalination Plants, and Residential & Commercial). |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

DuPont Water Solutions, Toray Industries Inc., LG Chem, Hydranautics (A Nitto Group Company), Koch Separation Solutions, SUEZ Water Technologies & Solutions, Pentair plc, Pall Corporation, Dow Water & Process Solutions, 3M Purification Inc., Veolia Water Technologies, Axeon Water Technologies, Watts Water Technologies, Pure Aqua Inc., Canature Environmental Products Co. Ltd., Genesis Water Technologies, AMPAC USA, Applied Membranes Inc., Bluewater Group, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Contents