The global RPA (Robotic Process Automation) and hyper-automation market is experiencing significant growth due to the growing demand for automation in numerous industries. Hyperautomation, which integrates advanced technology like AI, machine learning, and RPA, allows agencies to automate complicated business processes and show better performance. This marketplace is pushed with the need to decrease operational costs, improve productivity, and enhance consumer experience. Key sectors adopting RPA and hyper-automation include BFSI, healthcare, retail, and production. Additionally, the rise of digital transformation initiatives and the growing emphasis on regulatory compliance are similarly propelling market growth.

Large market players are channeling resources into the development of more progressive solutions to meet the many needs of various industries. It is also observed that more number of mergers and acquisitions, partnerships, and collaborations are taking place to expand the product offerings and strengthen market positions. However, key issues like high Implementation charges and Data security prompt the Global RPA And Hyper-automation market to grow during the forecast period with the help of technological advancements and the Increasing demand for automation solutions across sectors.

The US RPA and Hyperautomation Market

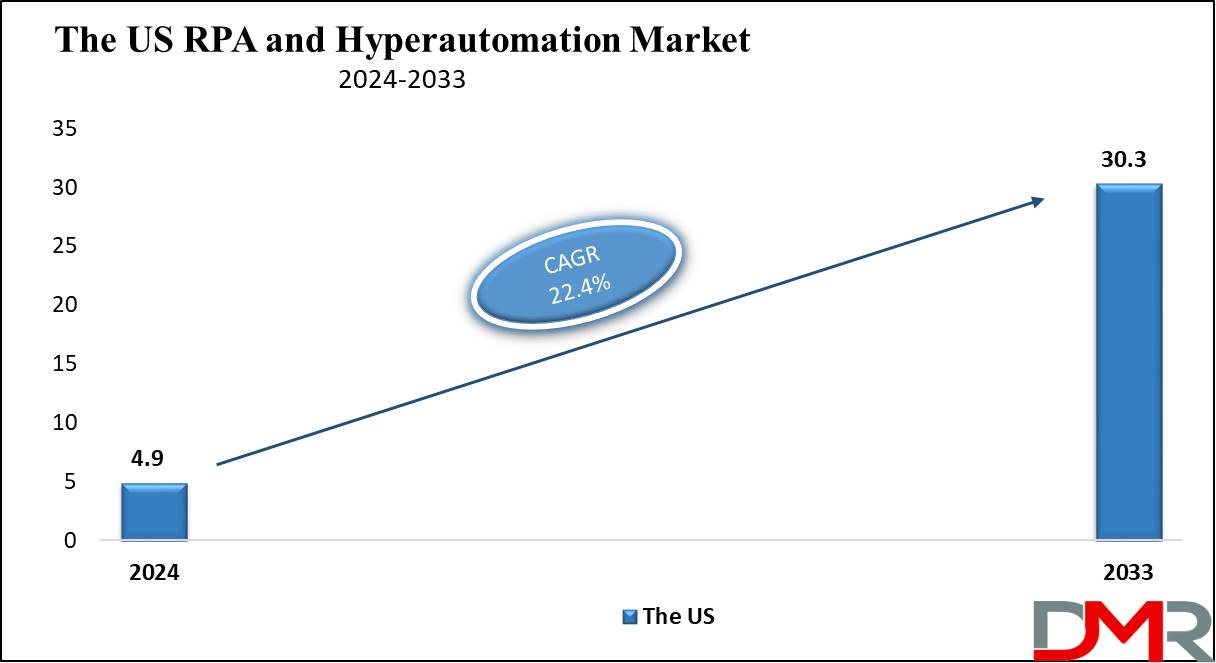

The US RPA and hyper-automation market is projected to hold a market value of USD 4.9 billion in 2024 which is further expected to grow up to USD 30.3 billion at a CAGR of 22.4%.

The US RPA and hyper-automation marketplace is at the forefront of technological innovation, pushed using the growing need for operational efficiency and price reduction throughout various industries. The marketplace is characterized by the rapid adoption of advanced automation technologies to streamline business processes and enhance productivity.

- Key sectors, such as BFSI, healthcare, and manufacturing, are leveraging RPA and hyper-automation to automate repetitive tasks, reduce mistakes, and improve customer service. The growing consciousness of digital transformation and regulatory compliance is further fueling market growth. In addition, the presence of principal technology organizations and an especially competitive enterprise environment are using the development of contemporary automation solutions.

- The US market, is also witnessing significant investments in research and development and strategic initiatives such as partnerships, mergers, and acquisitions to expand market share and enhance capabilities.

- Despite challenges like excessive implementation charges and cybersecurity issues, the US RPA and hyper-automation market is anticipated to hold its sturdy growth, supported by the aid of ongoing technological advancements and the rising demand for efficient automation solutions.

Key Takeaways

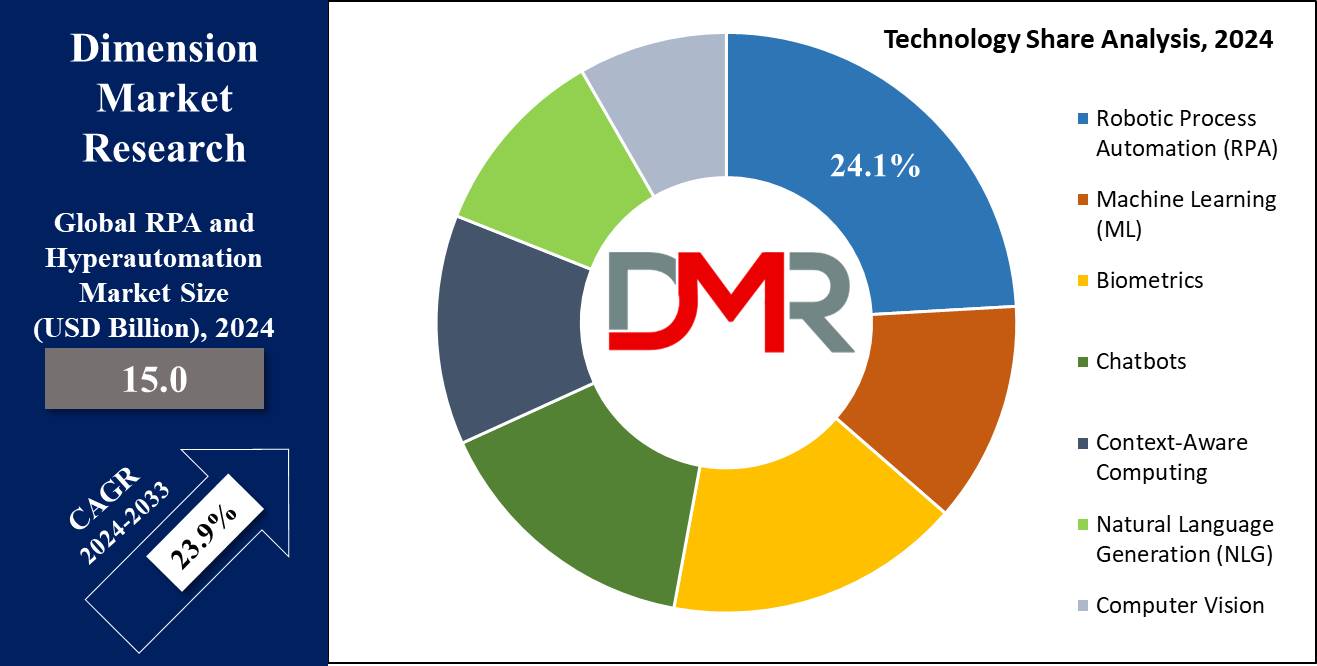

- Market Value: The Global RPA and Hyperautomation Market size is expected to hold a market value of USD 103.3 billion by the end of 2033 from a base value of USD 15.0 billion in at a CAGR of 23.9%.

- By Component Segment Analysis: Based on components, the solution is projected to dominate this segment as it holds the highest market share in 2024.

- By Deployment Mode Segment Analysis: Cloud deployment mode is anticipated to dominate the global RPA and hyper-automation market as it holds the highest market share in the context of deployment in 2024.

- By Technology Segment Analysis: Robotic Process Automation (RPA) is projected to dominate the technology segment as it holds 24.1% of the market share in 2024.

- By Business Function Segment Analysis: In terms of business function, sales, and marketing is projected to dominate this market dominate this segment with the highest market share in 2024.

- By Vertical Segment Analysis: The BFSI (Banking, Financial Services, and Insurance) sector is projected to dominate the global RPA and hyper-automation market as it holds 28.0% of the market share in 2024.

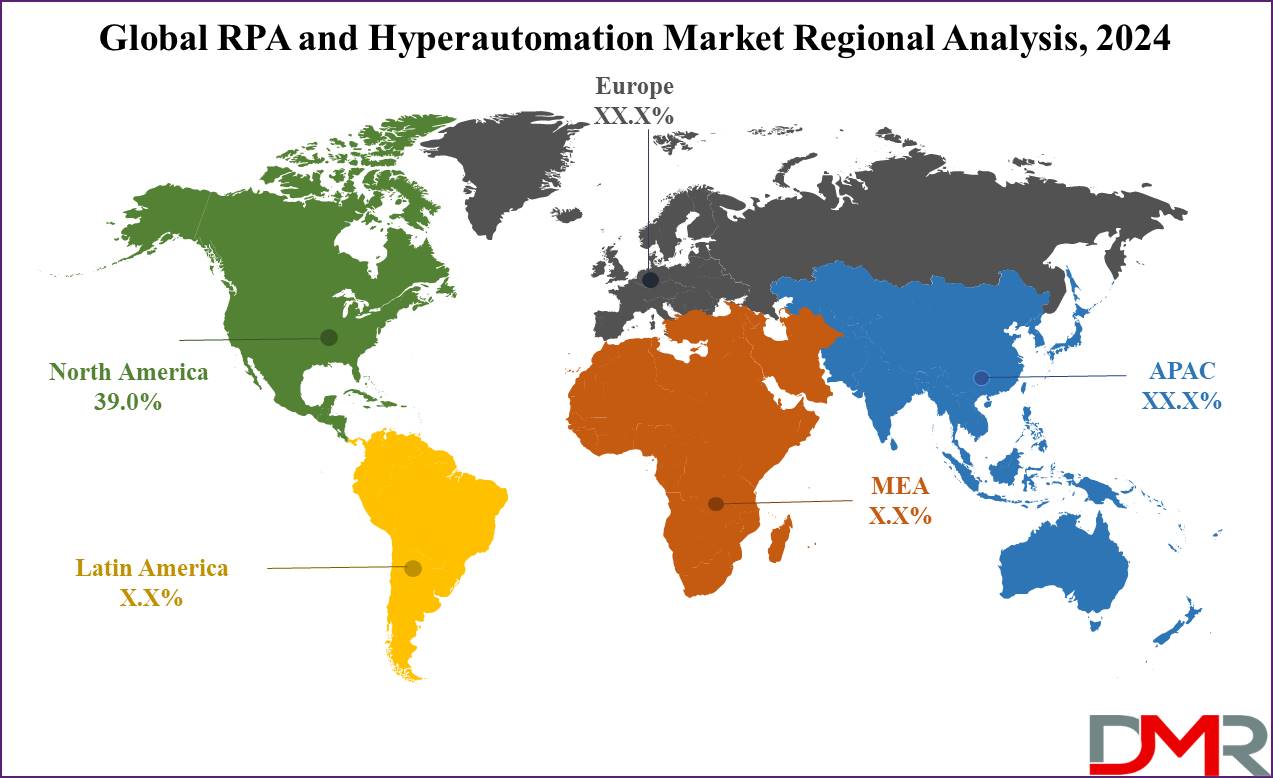

- Regional Analysis: North America is projected to dominate this market as it holds 39.0% of market share in 2024 which is further expected to show subsequent growth in the upcoming period of 2024 to 2033.

Use Cases

- Healthcare: Automating patient data management, billing processes, & appointment scheduling to improve operational efficiency and reduce administrative burdens on healthcare providers, resulting in affected patient care.

- Finance: Streamlining invoice processing, account reconciliation, and regulatory reporting to decrease errors, increase processing speed, and ensure compliance with financial policies, leading to better financial management.

- Retail: Enhancing inventory management, order processing, and customer support by automating repetitive responsibilities, permitting retailers to focus on strategic projects and enhance the usual overall customer experience.

- Manufacturing: Optimizing supply chain operations, quality control, and production monitoring through automation, leading to accelerated productiveness, decreased operational costs, and improved product quality.

Market Dynamic

Trends

Integration with AI and Machine LearningCombining AI/Machine learning with RPA is currently shaping up the new face of automation by enabling the RPA solutions to include cognitive aspects for the tasks to be automated. They enable the automation tools to reason with the data obtained, draw efficient conclusions, and enhance the decision-making system. The combination of RPA, AI, and machine learning makes up the new age of hyper-automation, in which the consumer can automate end-to-end business processes and optimize them in real time.

Increased Adoption of Cloud-Based Solutions

The use of cloud-based RPA and hyper-automation is observed as a trend in the market for robotic process automation. The fact is that cloud-based solutions have certain advantages that are related to scalability, flexibility, and, finally, lower costs connected with infrastructure. It is cost-effective for businesses as they can get automation solutions up and running and easily expanded in terms of capability without having to unnecessarily invest in the tools. Further, cloud-based solutions offer improved accessibility meaning organizations can modify and monitor their automation execution from any region, ideal in today’s context of remote work.

Growth Drivers

Rising Demand for Operational Efficiency

The main motivation behind the advanced adoption of RPA and hyper-automation solutions is increasing requirements for process optimization and cost-cutting across sectors. Several organizations have more and more started seeking possibilities of how to reduce the time and manpower spent on routine and tedious tasks. In applications like data and invoice entry, accounts receivables, general services, credit, and collections, a range of operational advantages can be obtained including; reductions in cost, cycle time, and inaccurate data.

Digital Transformation Initiatives

The pressure for businesses to adapt due to the developments in technology and to remain relevant are the factors that motivate organizations to use high levels of automation. Business digitalization requires new adaptation of appropriate business processes to effectively use digital solutions, and RPA and hyper-automation are vital parts of the change. The successful automation of repetitive processes and the linking of various systems enable organizations to create leaner, faster, and more customer-oriented processes, which are vital in today's competitive market.

Growth Opportunities

Expansion in Emerging Markets

Recent developments have shown that RPA and hyperautomation have vast opportunities for growth in emerging markets. As mentioned earlier, it is evident that the majority of the enterprises operating in these areas are seeking to improve efficiency and profitability through the use of automation systems. Such difficulties can be solved by using RPA and hyperautomation technologies since such solutions free up resources, cut costs, and help companies to grow. It is predicted that with growing knowledge of the functions of RPA as well as hyperautomation, emerging markets will demand automation solutions.

Development of Industry-Specific Solutions

Industry-specific automation solutions hold the possibility of considerable growth; these include healthcare, banking, financial services, and insurance and retail. Every industry may face different issues that could be solved by automating field-specific processes. For instance, in the healthcare industry, automation can revise the data of patients, charges, and appointments and in the BFSI industry, compliance filings, fraud checks, and services to customers can be improved using automation. This way, market players are capable of providing tailored solutions in various industries and stimulating a higher rate of RPA and hyperautomation implementation.

Restraints

High Implementation Costs

The high implementation cost acts as a major constraint, especially for medium and small-scale businesses that might not afford the costs of developing RPA and hyperautomation solutions. Automating involves such cost categories as licenses, hardware, training, and implementation of change. Furthermore, the implementation of RPA entails the assimilation of tools with the existing systems and procedures, and this may prove costly to organizations’ pockets, particularly those that are small and medium-sized.

Data Security and Privacy Concerns

Data security and privacy issues that come with the use of automation technologies are a challenge to market adoption in this case. With data being processed and managed within zones of RPA and clusters of hyperautomation, there are the risks posed to data which include vulnerability to hacking, and other associated risks such as non-relevant to data protection laws. To address such concerns measures like encryption, proper access control as well as constant audits are deemed necessary and which are likely to make it more complex and even very expensive to implement.

Research Scope and Analysis

By Component

Based on components, the solution is projected to dominate this segment as it holds the highest market share in 2024. In the global RPA and hyper-automation market, solutions dominate the component segment due to their comprehensive capabilities in addressing various business automation needs. Solutions are further categorized into standalone and integrated solutions. Standalone solutions provide specialized functionalities for specific tasks, while integrated solutions offer a cohesive platform that seamlessly combines multiple automation tools. This integration is crucial for organizations aiming to achieve end-to-end automation across different business processes.

The dominance of solutions is driven by the increasing demand for customized automation to enhance operational efficiency and reduce human intervention in repetitive tasks. Solutions enable businesses to streamline workflows, improve accuracy, and achieve faster processing times. Additionally, the scalability and flexibility of these solutions allow organizations to adapt to changing business requirements and scale their automation efforts as needed. The robust support and maintenance services associated with these solutions ensure continuous performance optimization and minimize downtime.

By Deployment Mode

Cloud deployment mode is anticipated to dominate the global RPA and hyper-automation market as it holds the highest market share in the context of deployment in 2024. The globalization of the RPA and hyper-automation is mainly attributed to the cloud deployment mode because of the various benefits over the on-premises implementations. This creates a need for cloud solutions as they are cheap, flexible, and scalable depending on the organization’s size and needs. One major advantage of cloud deployment is the decreased requirement for the company to make huge initial expenditures on capital in the procuring of hardware and structures, as the cloud service providers are responsible for these aspects. It means that by implementing this model businesses can only pay for several resources they are consuming and cannot go on a spending spree that is not economically viable.

Moreover, cloud services’ accessibility and remote access capabilities allow organizations to monitor automation from anywhere, which is valuable in the contemporary context of working and business globalization. Another factor that contributes to the popularity is also rapid integration and deployment possibilities of cloud solutions enable organizations they immediately begin and expand the automation procedures. Also, cloud providers have sound measures in security, data backup, and disaster recovery that eliminate some of the most common issues of data security and business disruption.

By Organization Size

Large enterprises dominate the global RPA and hyper-automation market due to their substantial resources and complex operational needs. Superior resources and a higher level of need for process automation make large businesses head the globalization RPA and hyper-automation market. Such organizations usually operate large and complex business processes, which makes them seek efficient and cost-effective automation systems. Due to the mentioned factors, RPA and hyper-automation solutions are especially relevant to large companies that need to centralize and optimize numerous processes, increase efficiency, and reduce the risk of errors in repetitive procedures.

IT monopolies are also more willing to incorporate such technologies and can fully allocate vast money resources to the implementation of RPA and hyper-automation solutions. Also, these institutions have both the skill and equipment to install, as well as manage intricate automatic systems. Another factor that pushes large enterprises toward adopting these solutions is the strict regulatory standard to be fulfilled and secondly, it makes the enterprises save face competitively in the market.

By Technology

Robotic Process Automation (RPA) is projected to dominate the technology segment as it hold 24.1% of the market share in 2024. The key strength of RPA that has been identified includes its flexibility especially when implemented in large businesses that do not require extensive overhaul of the IT systems. This makes it an ideal solution for organizations seeking to experience quick victories through automation procedures. RPA enables organizations to minimize the number of errors and save considerable amounts of money while increasing their efficiency because they can delegate repetitive and tedious tasks such as data input, checking invoices, and responding to customers’ inquiries.

This feature ensures that organizations begin automating a few processes so that they can expand the use of technology progressively across departments. Also, RPA can be integrated with other automatic technologies, including AI and machine learning to deal with more processes, making it a suitable solution to hyper-automation. For this reason, RPA is believed to remain the market leader in the hyper-automation technology segment as organizations strive to find more affordable and efficient automation solutions.

By Business Function

In terms of business function, sales, and marketing is projected to dominate this market dominate this segment with the highest market share in 2024. The business function segment, most relevant to the global RPA and hyper-automation market, is inhabited primarily by sales and marketing functions since these are the areas that offer the highest potential for process optimization and effective client interactions. Automated business solutions in sales and marketing particularly lead captures, customer classification, and other tailor-made communications make it easier for organizations to reach out to the right people. From entering data, sending emails, and posting on social media, among others, the S&M departments can instead concentrate on activities that lead to revenues.

This paper also reveals that RPA and hyper-automation improve customer relationship management (CRM) through follow-ups, interaction tracking, and customer behavior and preferences analysis. This in turn results in several benefits such as increased customer satisfaction thus, customer loyalty. In addition, when AI or machine learning is employed with automation tools, it is possible to do a deeper analysis of datasets along with the ability to create predictive models, which subsequently results in the enhancement of various automated campaigns.

By Verticals

The BFSI (Banking, Financial Services, and Insurance) sector is projected to dominate the global RPA and hyper-automation market as it holds 28.0% of the market share in 2024 due to its high potential for process automation and efficiency improvements. Financial institutions handle vast amounts of data and transactions daily, making them prime candidates for automation. RPA and hyper-automation solutions enable these organizations to streamline back-office operations, reduce processing times, and minimize errors in tasks such as data entry, loan processing, and compliance reporting. Additionally, the regulatory landscape in the BFSI sector is stringent, requiring accurate and timely reporting. Automation helps ensure compliance by maintaining consistency and accuracy in data handling and reporting. The cost-saving potential of automating routine tasks is significant, allowing financial institutions to allocate resources to more strategic functions.

Furthermore, the sector's need for enhanced customer service drives the adoption of automation to provide faster and more efficient customer interactions. The integration of advanced technologies like AI and machine learning with RPA further enhances the capabilities of financial institutions to predict market trends, assess risks, and personalize customer experiences. As the BFSI sector continues to prioritize digital transformation and operational efficiency, its dominance in the RPA and hyper-automation market is expected to persist.

The RPA and Hyperautomation Market Report is segmented on the basis of the following

By Component

- Solution

- Services

- Professional Services

- Training & Consulting

- System Integration & Implementations

- Support & Maintenance

- Managed Services

By Deployment Mode

By Organization Size

- Small & Medium Enterprises

- Large Enterprises

By Technology

- Robotic Process Automation (RPA)

- Machine Learning (ML)

- Biometrics

- Chatbots

- Context-Aware Computing

- Natural Language Generation (NLG)

- Computer Vision

By Business Function

- Sales & Marketing

- Finance & Accounting

- Human Resources (HR)

- Supply Chain & Operations

- Information Technology (IT)

By Verticals

- BFSI

- IT & Telecom

- Retail & Consumer Goods

- Healthcare & Life Sciences

- Manufacturing

- Transportation & Logistics

- Other Verticals

Regional Analysis

North America is projected to dominate the global RPA and hyper-automation market as it

holds 39.0% of the market share in 2024. North America continues to hold the largest share of the Global RPA & Hyper automation market mainly attributed to Technology, infrastructures, and competitive business environment. This area literally houses many large IT corporations as well as start-ups that advance and implement the most progressive forms of automation. Hence, there is a palpable need for RPA and hyper-automation that is catalyzed by an elevated implementation of digital transformation projects in different sectors such as BFSI, healthcare, and manufacturing industries.

Also, North Americans are more focused on minimizing operational costs and optimizing their performances, that’s why they are among the first to integrate automation solutions. Similarly, the availability of a strong IT platform and talented personnel enhances the chances of adopting and expanding automation techniques in the company. This has been made possible by some of the regulation policies that are in place; especially in the region to promote the use of automation in order to meet set standards and security of data. The pressure to develop new solutions with improved performance and the growing attention to customers’ needs as the market is constantly changing contribute to a steady interest in RPA and hyper-automation. Also, when there is a ready market and venture capital for funding and technology advancement, the pace of advances and market expansion increases.

Due to the intense focus of organizations across North America to search for means and ways to improve operational efficiency and gain competitive advantage, through the implementation of RP and hyper-automation, North America is anticipated to dominate the overall RPA and hyper-automation market in the global context in the course of the projection period.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the global RPA and hyper-automation market is characterized by the presence of numerous established players and innovative startups. Key market players such as UiPath, Automation Anywhere, Blue Prism, and Pegasystems dominate the market, offering comprehensive automation solutions that cater to various industry needs. These companies continuously invest in research and development to enhance their product offerings and maintain a competitive edge. Strategic initiatives such as partnerships, mergers, and acquisitions are common, allowing companies to expand their market share and capabilities. For instance, partnerships between automation providers and cloud service providers facilitate the integration of advanced technologies and cloud-based solutions.

Additionally, new entrants and startups bring innovative approaches and niche solutions, contributing to the market's dynamic nature. The competitive environment drives continuous advancements in automation technologies, ensuring that solutions are increasingly sophisticated and capable of handling complex business processes. As the demand for RPA and hyper-automation continues to grow, the market is expected to witness further consolidation and collaboration among key players, leading to the development of more integrated and scalable automation solutions.

Some of the prominent players in the Global RPA and Hyperautomation Market are:

- IBM

- Microsoft

- SAP

- Alteryx

- Appian

- Juniper Networks

- Zendesk

- Pegasystems

- Automation Anywhere

- UiPath

- ProcessMaker

- SolveXia

- Blue Prism

- Laserfiche

- Other Key Players

Recent Developments

2024

- June 2024 - UiPath: UiPath announced the launch of its new AI-powered platform that integrates advanced machine learning algorithms with RPA capabilities, enhancing the solution's ability to automate complex business processes. This development aims to provide businesses with more intelligent automation tools that can learn and adapt over time.

- May 2024 - Automation Anywhere: Automation Anywhere introduced a new cloud-native RPA solution designed to offer greater scalability and flexibility. This solution includes enhanced security features and improved integration capabilities with existing enterprise systems, making it easier for organizations to deploy and manage their automation initiatives.

- April 2024 - Blue Prism: Blue Prism announced a strategic partnership with Microsoft to integrate its RPA technology with Microsoft's Power Automate platform. This collaboration aims to provide customers with a more seamless and powerful automation experience, leveraging the strengths of both companies.

- March 2024 - Pegasystems: Pegasystems launched an upgraded version of its hyper-automation platform that includes advanced AI and natural language processing (NLP) capabilities. This enhancement allows for more sophisticated automation of customer interactions and back-office processes, improving overall efficiency and customer satisfaction.

- February 2024 - Kofax: Kofax unveiled a new suite of intelligent automation solutions that combine RPA, AI, and analytics. This suite is designed to help organizations automate end-to-end processes, from data capture to decision-making, providing a comprehensive solution for digital transformation.

- January 2024 - NICE: NICE announced the release of its new AI-driven automation platform that focuses on enhancing employee productivity and customer experience. The platform includes features such as advanced analytics, predictive modeling, and personalized automation workflows.

2023

- December 2023 - WorkFusion: WorkFusion launched its new AI-powered document processing solution, which automates the extraction and processing of information from complex documents. This solution aims to reduce manual effort and improve accuracy in document-intensive industries such as finance and insurance.

- November 2023 - AntWorks: AntWorks introduced its new fractal science-based automation platform that uses AI and machine learning to understand and automate complex processes. This platform is designed to provide more accurate and efficient automation solutions for various industries.

- October 2023 - Kryon Systems: Kryon Systems announced the launch of its new RPA-as-a-Service offering, providing businesses with a flexible and cost-effective way to implement and scale their automation efforts. This service includes comprehensive support and maintenance, allowing organizations to focus on their core business activities.

- September 2023 - EdgeVerve Systems: EdgeVerve Systems, a subsidiary of Infosys, released an updated version of its AssistEdge RPA platform, featuring enhanced AI capabilities and improved integration with enterprise systems. This update aims to provide businesses with more powerful and efficient automation tools.

- August 2023 - Pega: Pega announced the acquisition of Qurious.io, a leading provider of real-time speech analytics solutions. This acquisition aims to enhance Pega's customer service automation capabilities by integrating advanced speech recognition and analysis features into its platform.

- July 2023 - SAP: SAP introduced new RPA capabilities in its SAP Intelligent Robotic Process Automation suite, focusing on enhancing the automation of financial and procurement processes. This update aims to help organizations streamline their operations and improve financial performance.