Market Overview

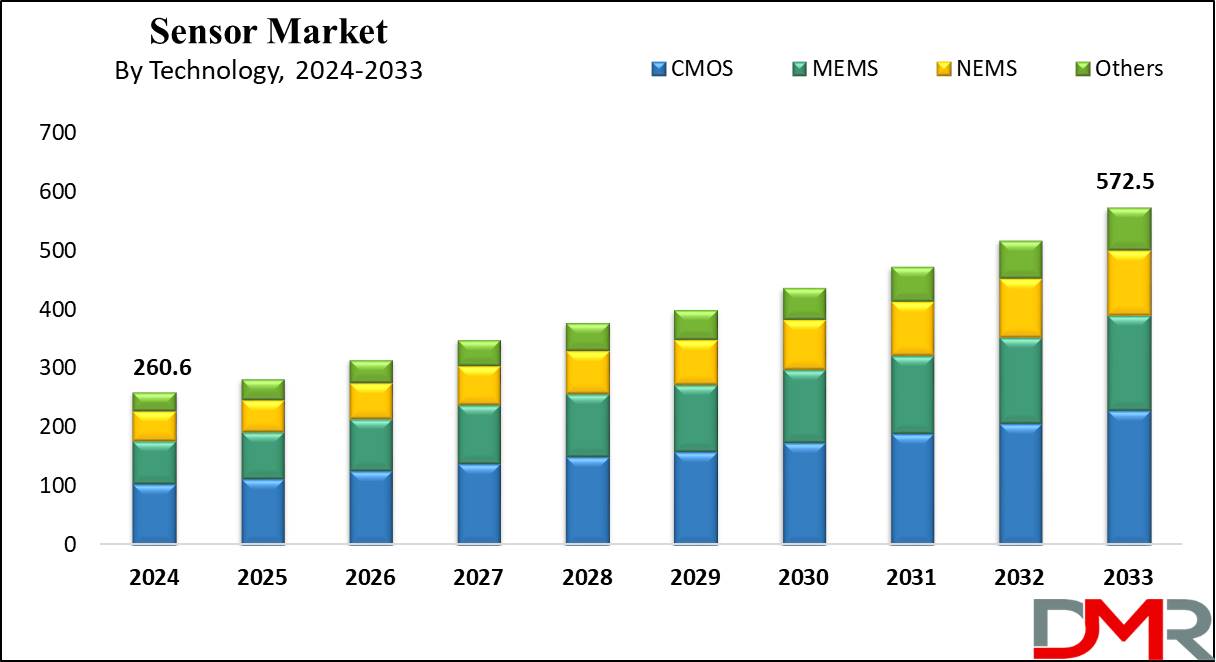

The Global Sensor Market is projected to reach USD 260.6 billion in 2024 and grow at a compound annual growth rate of 9.1% from there until 2033 to reach a value of USD 572.5 billion.

A sensor is a device or an electronic component that detects and responds to inputs from the physical environment. A typical input could be light, pressure, motion, heat, or moisture, among many others. There is a major growth in the trend toward automation. Sensors play a vital role in every aspect of automation, thus driving the growth of the market, especially with the rising adoption of smart sensing technologies.

The market is poised for significant growth, driven by the rising demand for wearable and electronic devices, alongside the rapid adoption of the

Internet of Things (IoT) and automation technologies. IoT-connected devices are creating vast opportunities for sensors across various sectors, including medicine, industrial applications, consumer electronics, and automotive industries.

According to Cisco's Annual Internet Report, the number of network-connected devices and connections reached approximately 30 billion by the end of 2023, a substantial increase from 18.4 billion in 2018. This surge in IoT adoption is anticipated to act as a primary driver for market expansion, as sensors are integral to IoT systems for data collection and real-time monitoring.

In addition to IoT advancements, the growing emphasis on energy efficiency and sustainability is further enhancing the potential for market growth. Smart sensors designed for energy optimization and minimal environmental impact are increasingly in demand, supporting sustainable practices across industries and boosting the usage of advanced industrial sensors.

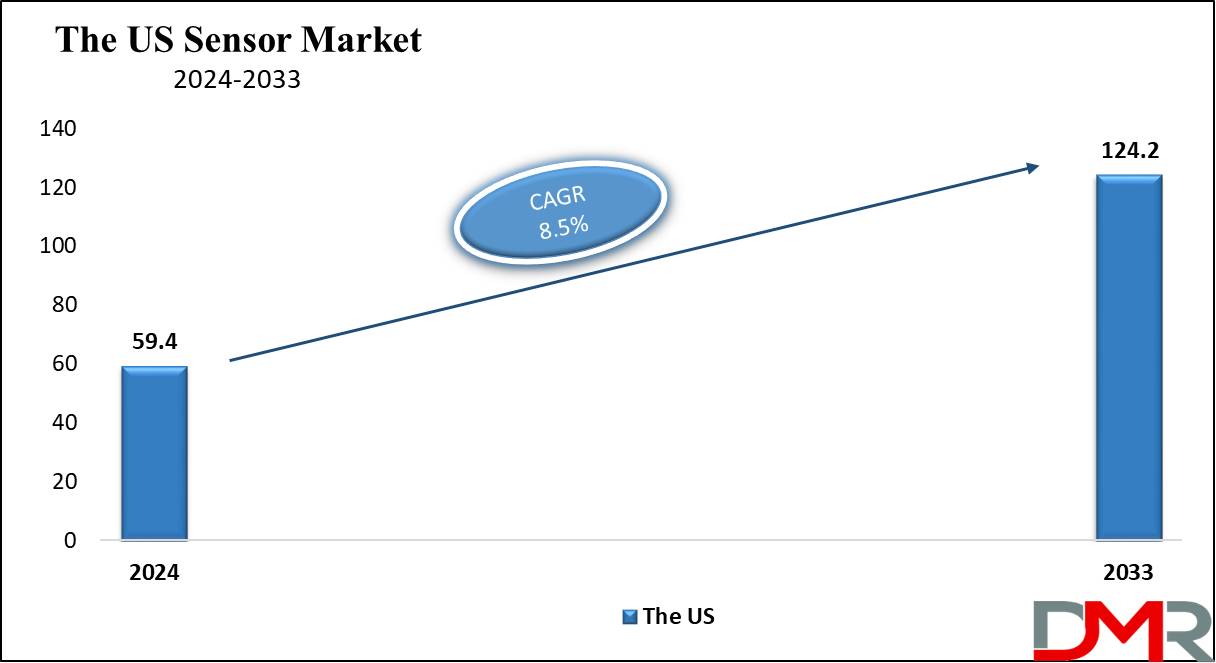

The US Sensor Market

The

US Sensor Market is projected to reach

USD 59.4 billion in 2024 at a compound annual

growth rate of 8.5% over its forecast period.

The sensors market in the US has promising growth opportunities driven by the growing demand for automation in industries and development in smart technology. The growth of smart homes,

smart home systems, IoT applications, and automotive innovations mainly in electric and autonomous vehicles are key growth areas. In addition, government initiatives promoting smart city projects and sustainability efforts further improve sensor adoption across various sectors.

Further, the growth in the market is driven by growing industrial automation and the rise of IoT applications, improving efficiency across many sectors. However, high production costs and concerns over data privacy and cybersecurity can impact market expansion. These factors create challenges for companies looking to innovate while making sure of compliance with regulations and maintaining consumer trust.

Key Takeaways

- Market Growth: The Sensor Market size is expected to grow by 290.5 billion, at a CAGR of 9.1% during the forecasted period of 2025 to 2033.

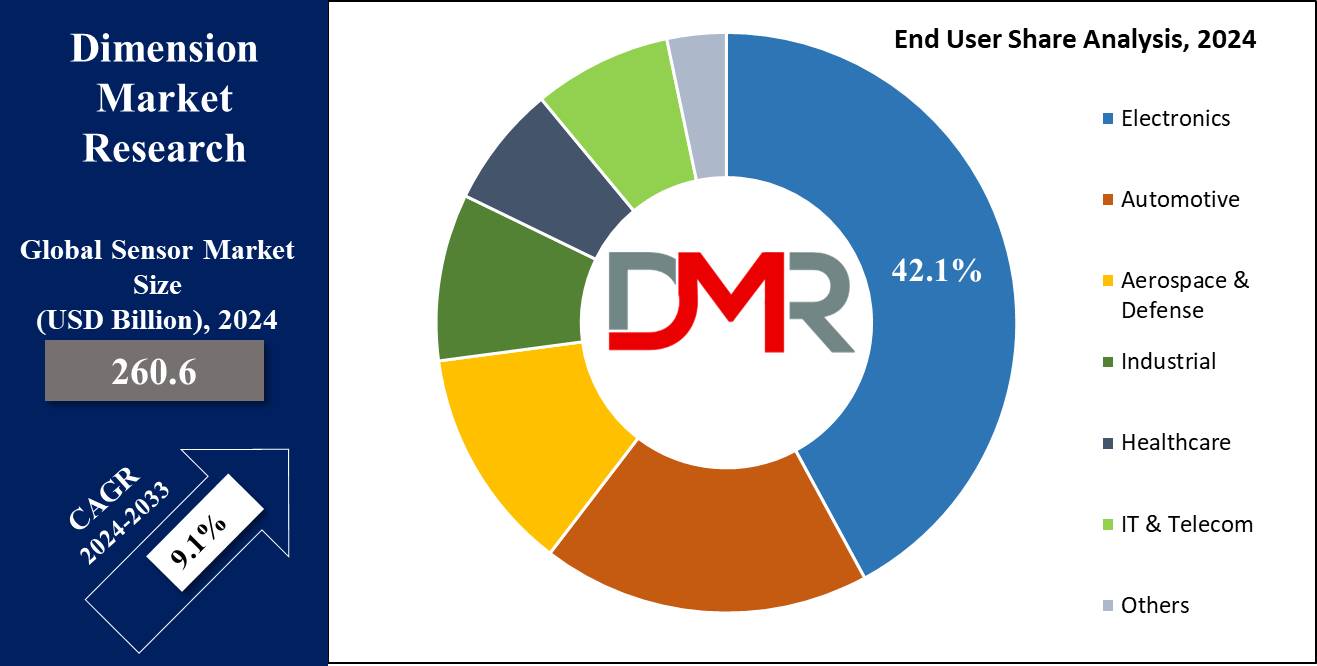

- By Type: The biosensors segment is anticipated to get the majority share of the Sensor Market in 2024.

- By Technology: The CMOS segment is expected to be leading the market in 2024

- By End User: The electronic segment is expected to get the largest revenue share in 2024 in the Sensor Market.

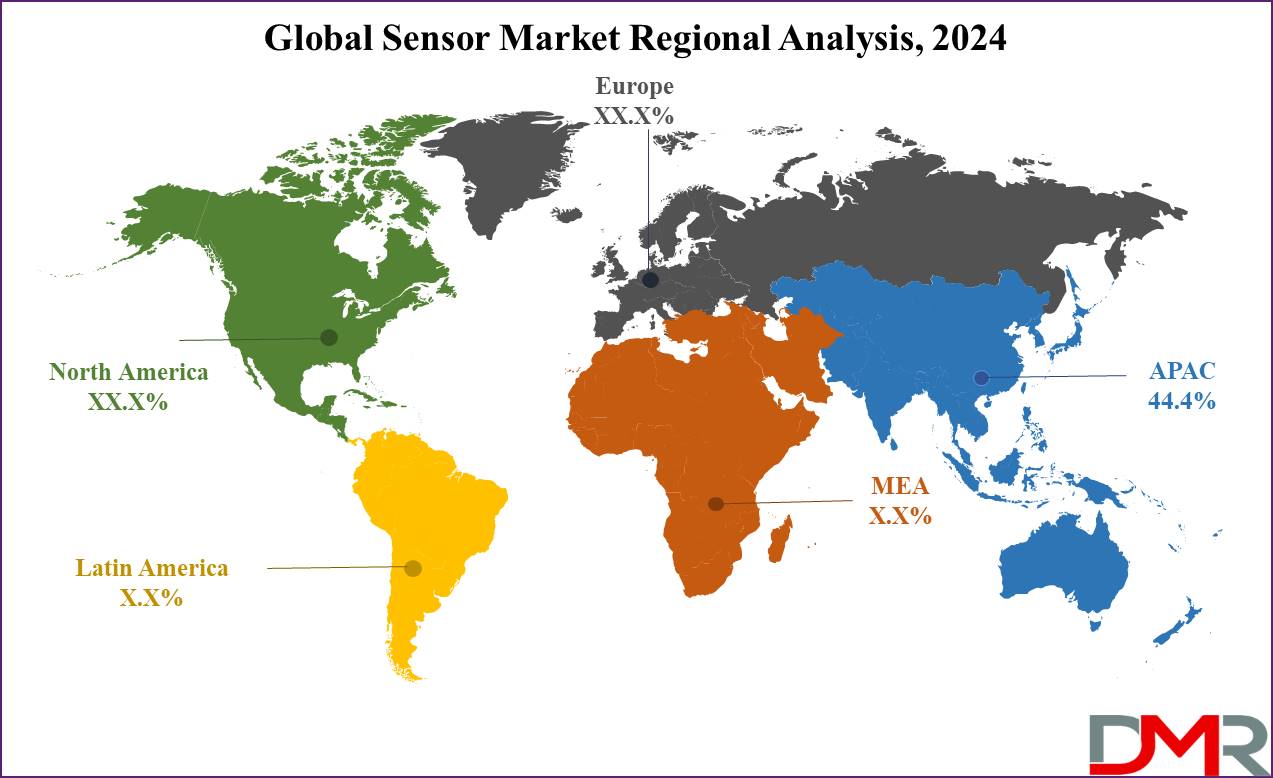

- Regional Insight: Asia Pacific is expected to bof revenue in the Global Sensor Market in 2024.

- Use Cases: Some of the use cases of Sensor include healthcare applications, industrial automation, and more.

Use Cases:

- Environmental Monitoring: Sensors like temperature, humidity, and air quality detectors track ecological changes to protect against hazards or maintain optimal conditions in industries, agriculture, & smart homes.

- Healthcare Applications: Wearable sensors monitor heart rate, oxygen levels, and glucose, allowing remote health tracking and advanced diagnosis of medical conditions.

- Automotive Systems: Sensors like proximity, lane detection, and tire pressure sensors improve vehicle safety, help in navigation, and enhance fuel efficiency in modern automobiles.

- Industrial Automation: Pressure, motion, and vibration sensors support predictive maintenance, optimize production processes, and minimize downtime in factories and supply chains.

Market Dynamic

Driving Factors

Rising Adoption of IoT and Smart Devices

With the growth of Internet of Things (IoT) applications, sensors are vital for connecting devices in smart homes, cities, and industries. The rising demand for automation, along with wearable tech and connected appliances, is driving the market growth. The need for simple data collection, real-time monitoring, and predictive analytics also adds momentum to sensor demand.

Advancements in AI and Edge Computing

Integrating AI and edge computing allows sensors to process data locally, minimizing latency and enhancing efficiency, which has driven growth across sectors like healthcare, automotive, and industrial automation, where fast data processing is vital. Moreover, innovations in MEMS (Micro-Electro-Mechanical Systems) and wireless sensors continue to expand sensor capabilities and applications.

Restraints

High Costs and Complex Integration

Advanced sensors, mainly those used in IoT, automotive, and healthcare, can be expensive to develop and integrate. The need for specialized hardware and software infrastructure adds complexity, making adoption challenging for smaller businesses. In addition, interoperability issues between different sensor platforms can slow deployment across industries.

Data Security and Privacy Concerns

As sensors collect large volumes of sensitive data in real time, concerns around cybersecurity and privacy grow. Industries like healthcare and smart cities need strong & advanced security frameworks, which can be costly to implement. Further, fears of data breaches and regulatory compliance issues can deter organizations from fully adopting sensor technologies.

Opportunities

Expansion in Wearables and Healthcare Solutions

The increasing popularity of wearable devices and remote healthcare monitoring provides a significant opportunity for sensor manufacturers. Sensors tracking crucial signs like heart rate, glucose levels, and blood oxygen are vital for customized healthcare and chronic disease management. With aging populations and telemedicine growth, the need for these sensors will continue to rise.

Development of Smart Infrastructure and 5G Networks

As smart cities and infrastructure projects gain traction, sensors play a major role in monitoring utilities, traffic, and environmental conditions. The rollout of 5G networks &

5G services will further improve sensor connectivity and data transmission speeds, allowing more efficient IoT ecosystems, which provides opportunities for manufacturers to develop advanced sensors for real-time, large-scale applications.

Trends

Integration with IoT and Industry 4.0

The major adoption of smart devices & industrial automation is driving the need for advanced sensors. These sensors are vital in supporting real-time data collection, predictive maintenance, and operational efficiency across industries like manufacturing, energy, and healthcare. Moreover, their integration into Industry 4.0 ecosystems allows smooth data exchange and automation, which helps optimize workflows and minimize downtime.

Miniaturization and Wireless Advancements

A transformation towards compact, energy-efficient sensor solutions is gaining momentum. Developments in microcontrollers and transceivers, along with technologies like Bluetooth Low Energy (BLE) and LoRa, are allowing the advancement of smaller, more versatile sensors. These advancements enable sensors to be embedded in consumer electronics, wearables, and automotive applications, improving both device functionality and energy management.

Research Scope and Analysis

By Type

Biosensors are majorly drive the growth in the sensor market and are expected to take the dominant share of the market in 2024 by providing advanced healthcare applications and personalized medicine. These devices can detect particular biological substances, enabling real-time monitoring of vital health parameters, like glucose levels or pathogens, which is essential for managing chronic diseases. The growth in wearable technology and home health monitoring systems is a decrease in the requirement for biosensors.

Furthermore, their application the food safety and environmental monitoring is expanding their market reach, contributing to complete sensor market expansion. Further, the image sensor segment is anticipated to grow at a significant rate during the forecast period, which is driven mainly by the growth in demand for smartphones and portable devices equipped with cameras.

The digital camera industry is transforming with constant innovations, aiming for enhancements like higher resolution, better performance in low light, and faster-focusing capabilities. Image sensor technology plays a major role in meeting these demands by capturing and processing high-quality images

By Technology

The sensors market is divided into several segments based on technology, like CMOS, MEMS, NEMS, and others. Among these, CMOS technology is expected to dominate in 2024. CMOS sensors are mostly found in digital cameras, CCTV cameras, and video cameras, where they are vital for image production. These low-cost electronic chips are also utilized in astronomical telescopes, barcode readers, and scanners.

Their affordability makes them a prominent choice for consumer electronics. In addition, CMOS sensors are integral to applications in robotics and machine vision. Like the 2D barcode scanners use CMOS sensors to help robotic devices identify and manage items, allowing the efficient movement and organization within factory environments

By End User

The electronics segment is a major driver of growth in the sensor market and is projected to lead the market in 2024, driven by the growing demand for smart devices and advanced technologies. Sensors are major to consumer electronics, like

smartphones, tablets, and wearables, improving functionalities like photography, health monitoring, and user interaction. As manufacturers constantly innovate to enhance the user experience, the demand for high-quality sensors rises.

Further, the trend toward smart homes and Internet of Things (IoT) applications is enhancing the sensor integration in many electronic products, supporting the overall expansion of the sensor market

The application of sensors in the automotive industry is astronomically rising. Further, the automotive industry as an end user is predicted to grow at a steady rate during the forecast period.

Sensors play a highly important role in data collection among connected services like smart automobiles, and the Internet of Things (IoT) is gaining popularity, in services like remote monitoring, integrated entertainment systems, predictive maintenance, and car diagnostics. To provide drivers and car owners with valuable insights and specialized services, sensors collect data on vehicle health, usage trends, and driving behavior.

The Sensor Market Report is segmented on the basis of the following

By Type

- Image Sensor

- Biosensors

- Accelerometer & Speed Sensor

- Optical Sensor

- Touch Sensor

- Temperature Sensor

- Pressure Sensor

- Others

By Technology

By End User

- Electronics

- Automotive

- Aerospace & Defense

- Industrial

- Healthcare

- IT & Telecom

- Others

Regional Analysis

The Asia Pacific region is set to play a vital role in the growth of the sensor market by having

44.4% of the total market share in 2024, mainly due to its strong electronics manufacturing base and growing demand for smart technologies. In addition, countries like China, Japan, and South Korea are leading the charge, producing a variety of consumer electronics that depend heavily on sensors.

In addition, the rapid expansion of the automotive sector, mainly with electric vehicles, is further driving sensor adoption. Also, government initiatives promoting smart city developments and environmental monitoring contribute to the region's growth in the sensor market. Further, the North American sensors market is expected to grow at a significant rate during the forecast period.

This growth, which is largely driven by the ongoing adoption of industrial automation, boosts demand for various sensors. In addition, the growing sales of smartphones and wearable devices, like smartwatches & fitness trackers, are expected to expand the need for proximity sensors in the region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the sensor market is dynamic and characterized by quick innovation and collaboration among leading players. Companies are investing heavily in research & development to develop advanced sensor technologies, like smart sensors and IoT integration. Strategic partnerships, mergers, and acquisitions are common as businesses focus on expanding their market reach and enhancing product offerings.

Additionally, the focus on sustainability and regulatory compliance is driving companies to develop sensors that monitor environmental parameters, making sure of compliance with stringent regulations, which fosters continuous enhancement and adaptation to evolving industry demands.

Some of the prominent players in the Global Sensor are

- ABB

- Texas Instruments Inc.

- OMRON Corp

- Siemens

- Samsung Electronic

- STMicroelectronics

- Honeywell

- NXP Semiconductor

- TE Connectivity

- Rockwell Automation

- Other Key Players

Recent Developments

- In September 2024, TriEye released the TES200 1.3MP SWIR image sensor based on the innovative TriEye CMOS image sensor technology that allows SWIR capabilities utilizing a CMOS manufacturing process, making it the first commercially available product released in the Raven product family. Further, TES200 operates in the 700nm to 1650nm wavelength range, providing high sensitivity and 1.3MP resolution. With its large format, high frame rate, and low power consumption, the TES200 provides better sensitivity and dynamic range, which makes the latest image sensor ideal for imaging and sensing applications across many industries, like automotive, industrial, robotics, and biometrics.

- In August 2024, Renesas Electronics Corporation launched an advanced all-in-one sensor module engineered for indoor air quality monitoring. The RRH62000, the first multi-sensor air quality module from Renesas, incorporates multiple sensor parameters in a compact design and accurately detects distinctive particle sizes, volatile organic compounds, and gasses harmful to human health.

- In August 2024, Nvidia has plans to launch Omniverse Cloud Sensor RTX a microservice, which would be able to provide physically accurate sensor simulation to accelerate the development of completely autonomous machines of any kind. Further, through this developers can test sensor perception and associated artificial intelligence (AI) software at scale in physically accurate, realistic virtual environments before real-world implementation.

- In June 2024, OmniVision launched the new OV01D1R intelligent CMOS image sensor for the computing industry to address infrared (IR) facial authentication, human presence detection (HPD), and always-on (AON) technology with a single sensing camera while retaining low power consumption and operating independently from the laptop’s RGB camera.

- In May 2024, Lumotive and Hokuyo Automatic Co., Ltd introduced the commercial release of the YLM-10LX 3D lidar sensor, which is powered by Lumotive's Light Control Metasurface optical beamforming technology, providing a major step forward in applying solid-state, programmable optics to transform 3D sensing across industrial automation and service robotics applications.

- In May 2024, Luminar Technologies introduced Luminar’s next-generation lidar sensor, Luminar Halo, as the new sensor was designed for mass adoption by mainstream consumer vehicles. The new sensor is expected to provide a 4x better performance, a 3x reduction in size, a 2x improvement in thermal efficiency, and more than a 2x improvement in cost. Further, it is anticipated to be under 1 inch in height, under 1 kilogram in weight, and use approximately 10 watts of power consumption, which will seamlessly blend into the roofline of a car or behind the windshield.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 260.6 Bn |

| Forecast Value (2033) |

USD 572.5 Bn |

| CAGR (2024-2033) |

9.1% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 59.4 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Image Sensor, Biosensors, Accelerometer & Speed Sensor, Optical Sensor, Touch Sensor, Temperature Sensor, Pressure Sensor, and Others), By Technology (CMOS, MEMS, NEMS, and Others), By End User (Electronics, Automotive, Aerospace & Defense, Industrial, Healthcare, IT & Telecom, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

ABB, Texas Instruments Inc, OMRON Corp, Siemens, Samsung Electronics, STMicroelectronics, Honeywell, NXP Semiconductor, TE Connectivity, Rockwell Automation, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Sensor Market size is expected to reach a value of USD 260.6 billion in 2024 and is expected to reach USD 572.5 billion by the end of 2033.

Asia Pacific is expected to have the largest market share in the Global Sensor Market with a share of about 44.4% in 2024.

The Sensor Market in the US is expected to reach USD 59.4 billion in 2024.

Some of the major key players in the Global Sensor Market are Amgen, Novartis, Pfizer, and others.

The market is growing at a CAGR of 9.1 percent over the forecasted period.