The sponge counting system is a

medical tool designed to prevent retained surgical sponges inside patients after surgery. They involve manually counting sponges at multiple stages of surgery to ensure accuracy. Modern advancements include integrating

RFID tags or barcode technology, automating the tracking process, and minimizing human error.

Healthcare professionals can verify sponge counts quickly and efficiently by scanning each sponge. It improves patient safety and reducing complications associated with retained surgical items.

Sponge Counting System Market is enjoying significant expansion as food processing, pharmaceuticals and manufacturing industries increasingly adopt automated counting solutions to enhance productivity by reducing labor costs, minimizing errors and improving inventory accuracy - essential elements for businesses looking to streamline operations.

Recent technological innovations in artificial intelligence and machine learning are driving innovations in sponge counting systems, increasing precision and efficiency of counting for better integration into different industries. Automation and smart technologies continue to offer new opportunities for growth in the market.

Pharmaceutical industries require precise counting and packaging of tablets and capsules; similarly, food manufacturers utilizing sponge counting systems for food processing such as sponges or baked goods require quality control, inventory management and faster production lines to increase efficiency and reduce costs. Therefore, sponge counting systems have become incredibly popular.

Opportunities in the market are being driven by an increased emphasis on sustainability and waste reduction, with companies exploring creative methods of minimizing product wastage during counting and packaging processes. Industries continue adopting green practices and automation; sponge counting systems have become indispensable tools in meeting environmental goals while meeting operational sustainability benchmarks.

The US Sponge Counting System Market

The US Sponge Counting System market is expected to reach USD 59.4 million by the end of 2024 and is projected to grow significantly to an estimated USD 103.7 million by 2033, with a CAGR of 6.4%.

The United States, in particular, plays a pivotal role in this market due to the high volume of surgeries performed annually, alongside increasing efforts to prevent retained surgical sponges (RSS), a significant postoperative complication.

Automation and digital solutions are increasingly being integrated with hospital information systems to streamline processes and improve accuracy. Additionally, rising healthcare spending, coupled with heightened awareness of medical malpractice costs, is fueling demand for these systems, particularly in large hospitals and surgical centers.

Key Takeaways

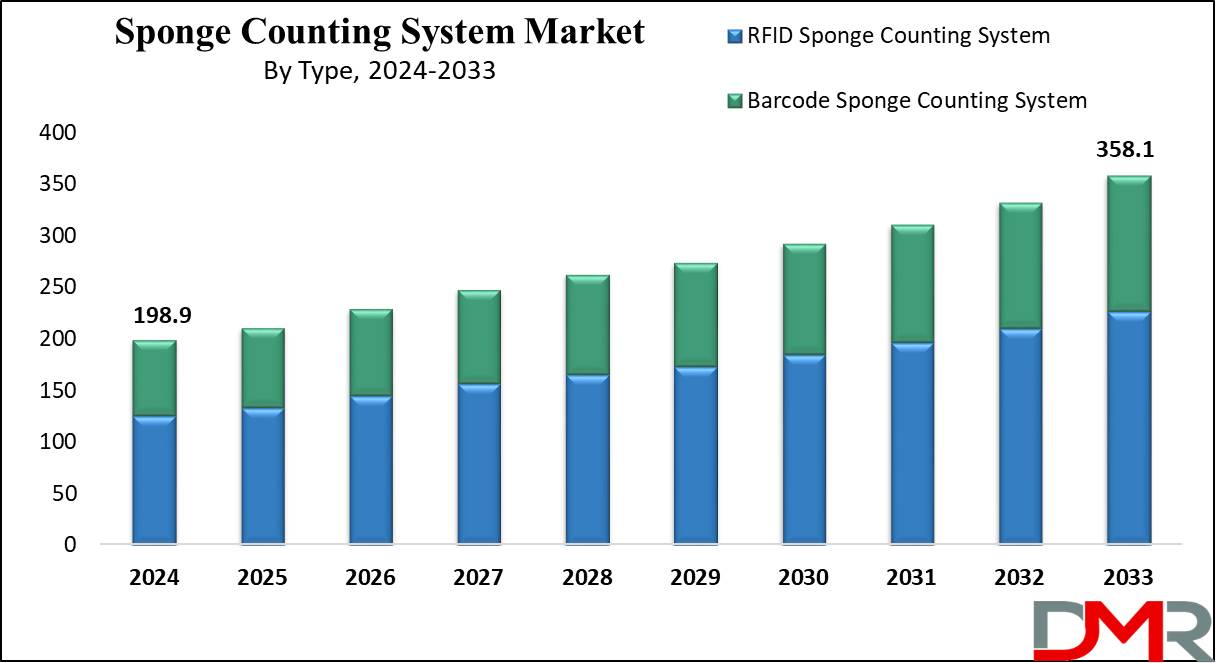

- Market Growth: It is projected that the global sponge counting system market will experience growth of 147.1 million at a CAGR of 6.8 % from 2025 to 2033.

- Market Definition: Sponge counting system is a safety protocol used in surgical settings to prevent retained surgical sponges inside a patient's body after surgery.

- Type Analysis: RFID Sponge Counting Systems are expected to lead the market based on type with the highest revenue share in 2024.

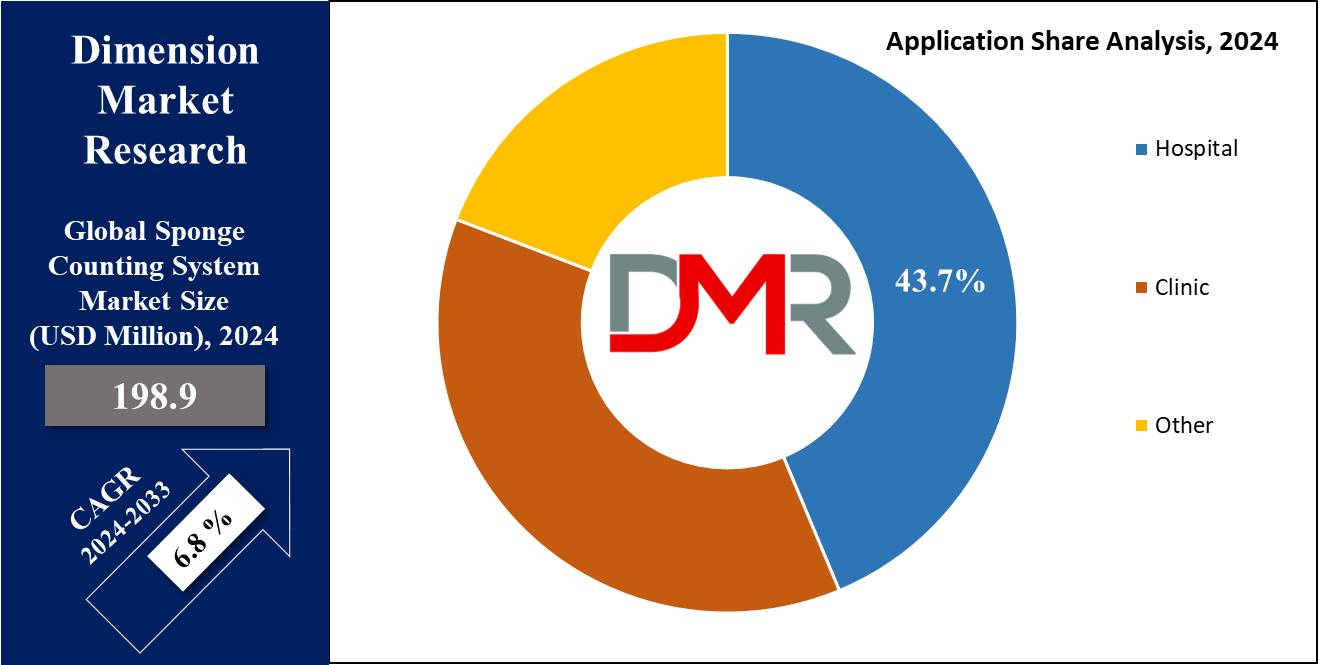

- Application Analysis: Hospitals as applications are expected to dominate the market with a largest market share in 2024.

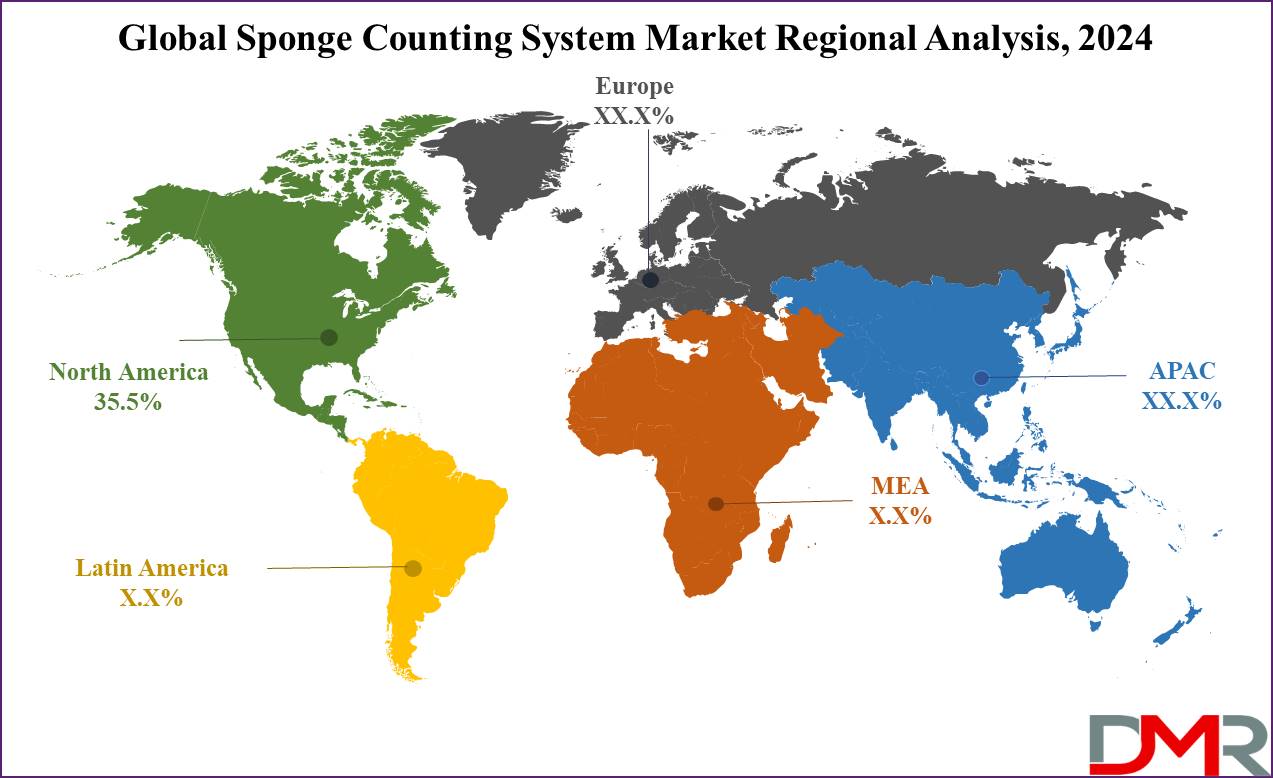

- Regional Analysis: North America is expected to lead the sponge counting system market globally with a 35.5% market share by 2024.

Use Cases

- Surgical Sponge Counting and Tracking: In surgeries, it’s critical to ensure that no sponges or tools are left inside the patient. Sponge counting systems automate and enhance accuracy in counting sponges before and after surgery, reducing the risk of retained surgical items.

- Real-Time Monitoring During Surgery: These systems can provide real-time monitoring and feedback during surgeries, allowing surgical teams to be alerted immediately if a sponge is unaccounted for, helping to minimize delays and prevent complications due to retained sponges.

- Patient Safety Improvement: By using sponge counting systems, hospitals, and surgical centers can improve patient safety, reduce the chances of postoperative complications, and minimize legal liabilities related to surgical errors involving retained items.

- Data Analytics for Operational Efficiency: Sponge counting systems often integrate with hospital management systems to provide valuable data insights, such as surgery duration, resource use, and compliance rates. This data can be used to improve operational efficiency, streamline workflow, and reduce costs associated with additional surgeries or treatments caused by RSIs.

Market Dynamic

Drivers

Increasing Number of Surgical ProceduresThe demand for sponge counting systems is increasing with the rising number of surgeries globally due to an aging population and advancements in medical treatments. The prevalence of diseases such as diabetes, obesity, and cardiovascular issues become more prevalent, and the number of surgical interventions is on the rise. The rise in healthcare services, especially in emerging economies, directly fuels the demand for sponge counting systems, which are critical to patient safety.

Focus on Patient Safety and Regulatory Compliance

Stringent regulatory guidelines and increasing awareness of patient safety drive healthcare facilities to adopt sponge counting systems, as surgical errors such as RSIs can lead to severe legal and financial consequences. With growing patient safety initiatives by healthcare organizations like the Joint Commission, which mandates sponge counting, hospitals are adopting advanced counting technologies to ensure compliance.

Restraints

High Costs of Advanced Sponge Counting Systems

Advanced sponge counting systems, especially those that incorporate technologies such as radiofrequency identification (RFID) or machine learning, can be expensive. The high initial investment, maintenance costs, and the need for ongoing training present a significant challenge for smaller hospitals, especially in developing countries where budget constraints may limit technology adoption.

Resistance to Technological Change and DisruptionsSome healthcare institutions, particularly in regions with less stringent regulatory oversight, still rely on manual counting methods. Staff may be resistant to adopting new technologies due to the learning curve and the time it takes to adapt. The reliance on traditional practices, coupled with the perception that manual counting is sufficient, may reduce the adoption rate of automated sponge counting systems.

Opportunities

Technological InnovationsThe integration of

artificial intelligence (AI) and

machine learning (ML) into sponge counting systems presents opportunities for enhancing accuracy. AI can assist in predictive analytics to foresee potential errors, while ML algorithms can continuously learn from past surgeries to improve counting accuracy. Companies that leverage these technologies to enhance product offerings stand to gain a significant competitive advantage.

Trends

Integration with Broader Surgical Safety and Workflow Management SystemsHospitals are moving toward more holistic operating room (OR) management systems that not only track sponges but also manage all surgical instruments, tissues, and even consumables used during a procedure. These integrated solutions allow for real-time data tracking, alerting surgical staff of discrepancies immediately and providing a full audit trail post-surgery. This trend reflects a shift toward complete automation and digitalization of OR procedures.

Increased Adoption of RFID and Barcode-Based Systems

The adoption of RFID (Radio Frequency Identification) and barcode technology is rapidly increasing. RFID-enabled sponges and instruments can be tracked in real-time, ensuring that none are left inside a patient post-operation. The growing affordability of RFID technology is making it a viable option for more healthcare facilities, not just large hospitals with significant budgets.

Research Scope and Analysis

By Type

RFID (Radio Frequency Identification) sponge-counting systems are expected to take the lead as the global sponge-counting systems based on type with the highest revenue share by 2024. This technology enables real-time tracking and automatic counting of surgical sponges in real-time, significantly decreasing human error in operating rooms.

RFID systems use embedded tags in sponges which communicate with scanning devices to quickly identify any missing or retained sponges during or post-surgery. Automating counting offers greater safety and convenience compared to manual counting methods or barcode-based systems that rely on line-of-sight scanning systems.

As healthcare facilities prioritize patient safety and regulatory compliance, demand for RFID sponge counting systems has skyrocketed in healthcare facilities worldwide. Furthermore, their decreasing costs as well as advances in system integration is driving widespread acceptance. Barcode sponge counting systems comprise another major part of this market.

While barcode systems offer more economical alternatives, such as manually scanning each sponge individually for counting purposes increases risk due to human error and should therefore only be considered an affordable substitute.

Barcode systems rely on visible codes that require direct interaction to operate, making time-consuming surgical procedures timelier than expected. Yet barcode systems remain relevant solutions in healthcare facilities where costs are an issue or advanced RFID systems have yet to be deployed.

By Application

Hospital is expected to lead the global sponge counting system market with the largest revenue share due to the high volume and complexity of surgical procedures performed in these settings. Hospitals handle a wide range of surgeries, from routine to complex operations, which increases the risk of retained surgical sponges (RSS).

To mitigate this risk, hospitals are increasingly adopting advanced sponge counting systems, such as RFID and barcode systems, to enhance patient safety, comply with stringent regulatory standards, and avoid costly litigation. The Joint Commission, FDA, and other regulatory bodies mandate strict protocols for surgical safety in hospitals, pushing them to invest in cutting-edge technology like RFID-based sponge counting systems to minimize errors and improve operational efficiency.

Additionally, hospitals often have larger budgets and more resources compared to smaller clinics, enabling them to implement and integrate advanced technologies seamlessly. Meanwhile, clinics typically handle less complex surgical procedures and have lower patient volumes. While they still face the risk of retained surgical sponges, the scale and intensity of these risks are lower compared to hospitals. As a result, clinics tend to rely more on traditional sponge counting methods or less expensive technologies like barcode-based systems.

The global sponge counting system market report is segmented based on the following

By Type

- RFID Sponge Counting System

- Barcode Sponge Counting System

By Application

Regional Analysis

North America is predicted to dominate the sponge counting system market with a

revenue share of 35.5% in 2024, due to advanced healthcare infrastructure, high awareness regarding surgical safety, and strict regulations surrounding surgical procedures. The dominance of this region is due to stringent safety standards enforced by key regulatory bodies like the U.S. Food and Drug Administration (FDA) and the Joint Commission.

These organizations require healthcare facilities to adopt technologies that minimize surgical errors, such as retained surgical sponges (RSS), making sponge counting systems a standard practice in hospitals. These regulations ensure that hospitals implement reliable methods to improve patient safety and prevent complications caused by RSS, which can lead to severe legal and health consequences. Moreover, North America's strong investment in healthcare technology and innovation further strengthens its position in the market.

Hospitals and healthcare institutions in the region are quick to adopt automated systems and advanced RFID-based sponge-tracking technologies. These innovations allow for precise and real-time tracking of surgical sponges, significantly reducing human error. As these systems improve accuracy and efficiency in operating rooms, they are becoming the go-to solution for reducing the risk of RSS.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The sponge counting system market is characterized by intense competition, with numerous large and small players offering products and solutions to domestic and international healthcare markets. The market is currently moderately fragmented but gradually moves toward a more fragmented state as new players enter and innovation accelerates. Some key players in this market include Stryker Corporation, Medtronic PLC, Haldor Advanced Technologies, and Surgicount Medical.

Major companies in the sponge counting system market are employing various strategies to maintain competitiveness and expand their market share. These strategies include product innovation, focusing on developing more efficient, automated, and RFID-based systems to enhance accuracy and reduce surgical errors.

Leading players are also engaging in mergers and acquisitions to broaden their product portfolios and integrate advanced technologies, improving the overall functionality of their offerings.

Some of the prominent players in the global sponge counting system market are

- Cardinal Health

- STERIS Healthcare

- Owens & Minor

- Stryker

- Tally Surgical

- Advanced Medical Innovations (AMI)

- Medtronic

- Xodus Medical

- RAM Surgical

- Medline

- DeRoyal

- Others

Recent Development

- In August 2024, A major player in the medical device industry, Medcount Technologies, launched an advanced sponge counting system that integrates AI for real-time tracking and error reduction. This system aims to enhance surgical safety by providing more accurate and reliable counting methods.

- In June 2023, Cardinal Health unveiled a new software update for their sponge counting systems that enhances data analytics capabilities, allowing for better compliance tracking and performance metrics.

- In April 2023, The Kerala Institute of Medical Sciences (KIMS) implemented the first digitized and automated system for identifying and tracking surgical sponges. This innovative solution uses barcodes to uniquely identify sponges before sterilization, scanning them in and out during surgery. It enhances patient safety by eliminating human counting errors, speeding up surgeries, and reducing costs to about ₹35,000 per operating theater.

- In October 2022, Stryker Corporation introduced an enhanced version of their sponge counting system with improved sensor technology, allowing for more accurate detection and tracking of sponges during surgical procedures.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 198.9 Mn |

| Forecast Value (2033) |

USD 358.1 Mn |

| CAGR (2024-2033) |

6.8% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 59.4 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (RFID Sponge Counting System, and Barcode Sponge Counting System), By Application (Hospital, Clinic, and Other) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Cardinal Health, STERIS Healthcare, Owens & Minor, Stryker, Tally Surgical, Advanced Medical Innovations (AMI), Medtronic, Xodus Medical, RAM Surgical, Medline, DeRoyal, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |