Market Overview

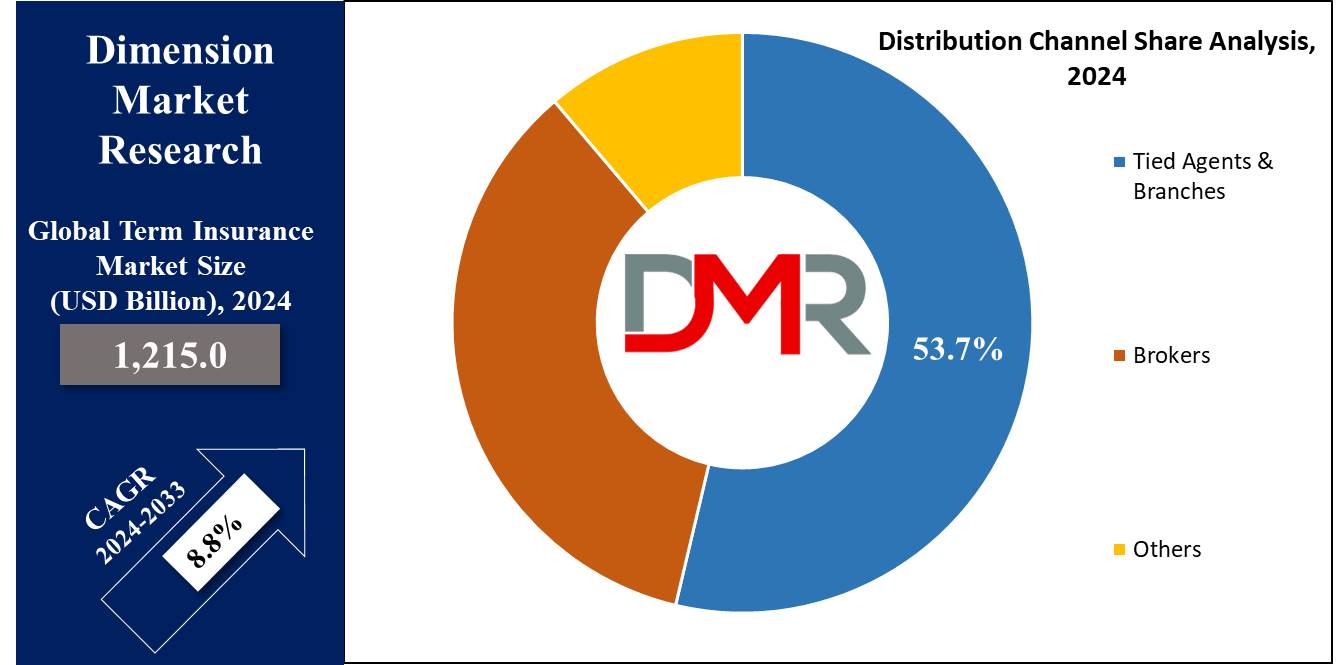

The Global Term Insurance Market is expected to reach a value of USD 1,215.0 billion by the end of 2024, and it is further anticipated to reach a market value of USD 2,601.2 billion by 2033 at a CAGR of 8.8%.

Term insurance is an authentic life insurance policy that provides coverage for a set period in exchange for a fixed premium, which offers complete protection at affordable rates, with the assurance that if the insured person passes away during the specified term, a pre-agreed sum is paid to the nominee. Unlike other insurance types, term insurance only focuses on providing guaranteed death benefits without any savings component.

Various types of term life insurance exist, like level term, decreasing term policies, and more. Premiums are determined by factors like age, health, and life expectancy, alongside the insurer's operational expenses & mortality rates for different age groups. Term durations typically range from 10 to 30 years, and in some cases, a medical examination may be needed, along with inquiries about the applicant's health, family history, & driving record.

The emergence of InsurTech is revolutionizing the term insurance industry by using advanced technologies like IoT, AI, and big data analytics. InsurTech improves its operational efficiency, cuts costs, and allows more competitive pricing for term insurance products. It’s also transforming areas such as

Cyber Insurance and the use of Insurance Chatbot technology to enhance customer interactions and deliver seamless digital services.

Its impact extends to many facets of insurance operations, like risk assessment, claims processing, contract drafting, and policy underwriting. As InsurTech constantly evolves, it is fundamentally reshaping how term insurers function and meet their customers, assisting in a new era of innovation and efficiency in the insurance landscape.

As per recent reports, the term insurance market has demonstrated steady growth, with significant implications for long-term care. In 2022, long-term care insurance claims were made by approximately 345,000 policyholders, reflecting a rising demand for such products.

Notably, 45% of assisted living facility residents rely on Medicaid to fund their care, highlighting the financial strain on individuals. Premiums for long-term care insurance stand at around $950 annually, with a 55-year-old male paying approximately $900 for $165,000 in immediate benefits. With 65-year-olds having a nearly 70% chance of needing long-term care, the market shows a clear trend toward increased demand for insurance coverage.

Among current 65-year-olds, 20% are expected to need long-term care for more than five years. Women are expected to need care longer, averaging 3.7 years compared to men’s 2.2 years. Over half of those over 65 will require significant long-term care, with 80.9% of residential care workers being women. The median age of assisted living residents stands at 84, and 56% of these residents are women. These figures indicate a robust and growing need for term insurance products addressing long-term care, as well as interest in complementary offerings through modern

Digital Insurance Platform solutions.

The term insurance industry is experiencing a surge in key events and opportunities in 2024. Notable conferences include the "Insurance Risk & Capital EMEA 2024" in London, focusing on risk management, AI in insurance, and interconnected risks, offering valuable networking and insights.

Additionally, Reuters Events' "Future of Insurance USA 2024" will delve into AI, customer-centricity, and profitability, while emphasizing innovations in underwriting and claims. The Insurance Asset Management Conference also highlights investment strategies in response to economic pressures and ESG trends. These gatherings provide platforms for industry leaders to explore transformative strategies and future trends in term insurance.

Key Takeaways

- Market Growth: The Term Insurance Market size is expected to grow by 1,290.0 billion, at a CAGR of 8.8% during the forecasted period of 2025 to 2033.

- By Type: Individual-level term life insurance segment is expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- By Distribution Channel: Tied agents & branches segment is expected to get the largest revenue share in 2024 in the Term Insurance market.

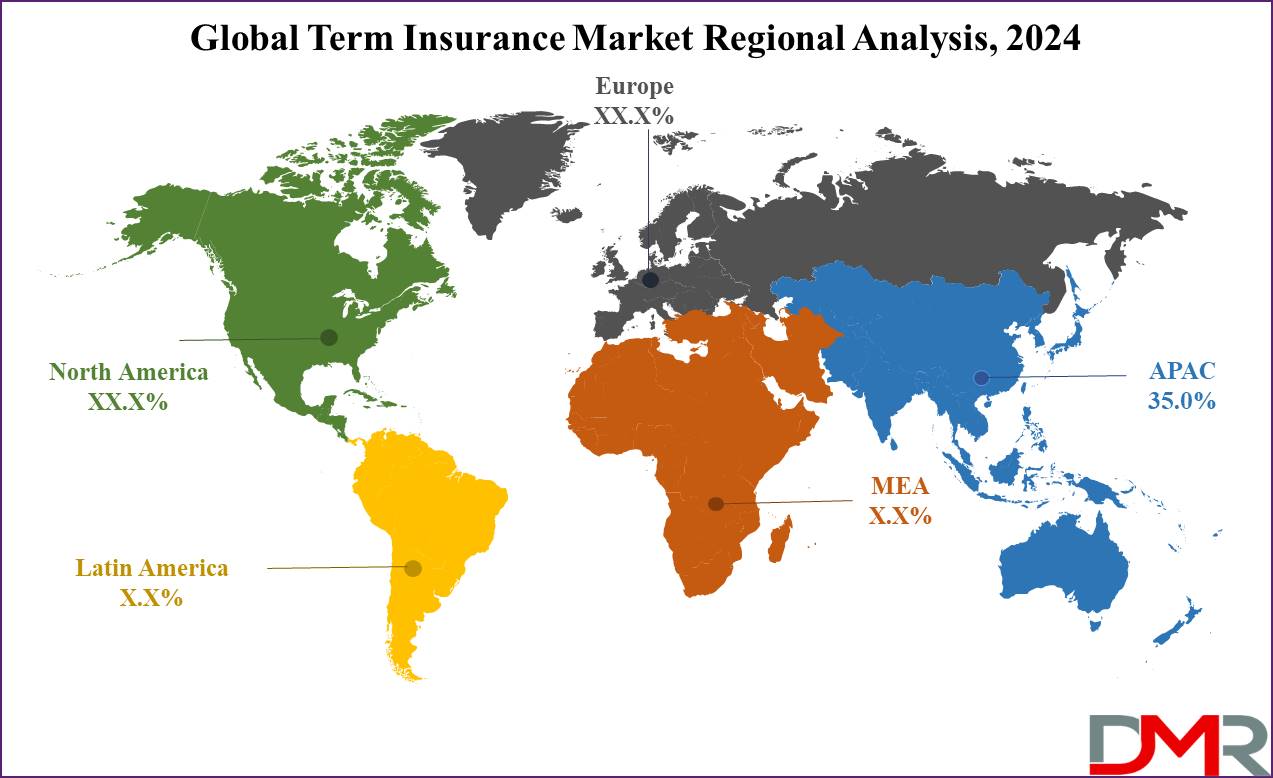

- Regional Insight: Asia Pacific is expected to hold over 35% share of revenue in the Global Term Insurance Market in 2024.

- Use Cases: Some of the use cases of Term Insurance include income replacement, business continuity, and more.

Use Cases

- Income Replacement: Term insurance is mostly used to replace lost income in the event of the policyholder's death, which is mainly important for breadwinners who have dependents relying on their income to meet everyday expenses, pay off debts, or fund future goals like education or retirement. Term insurance makes sure that if the insured person passes away during the term of the policy, their family will receive a lump sum amount to help cover ongoing expenses & maintain their standard of living.

- Mortgage Protection: Many homeowners use term insurance to protect their mortgage. In the event of the policyholder's death, the insurance proceeds can be utilized to pay off the remaining mortgage balance, making sure that the family can constantly live in the home without the burden of mortgage payments, which provides peace of mind and financial stability to the surviving family members during a difficult time.

- Business Continuity: Term insurance can be important for business owners to protect their companies from financial hardships in case of their untimely death. It can be utilized to fund buy-sell agreements, making sure that surviving business partners have the funds to buy out the deceased partner's share & maintain continuity of operations. In addition, term insurance can cover key employees whose loss would have a major impact on the company's profitability.

- Debt Repayment: Term insurance can be utilized to cover outstanding debts like credit card debt, personal loans, or student loans. If the insured person passes away, the insurance payout can be used by their beneficiaries to settle these debts, protecting them from becoming a financial burden on the family or estate, which makes sure that the family members are not left with the responsibility of paying off the deceased's debts out of their own pockets.

Market Dynamic

Government actions & reforms in the insurance sector have had a significant impact globally, majorly in nations like Australia, where the government introduced measures to improve private health insurance. These efforts focus on lowering costs, expanding access to mental health services, and incentivizing younger individuals to invest in insurance coverage. In developing countries like India & China, the growth in disposable income is expected to drive growth in the global term life insurance market.

Further, a study by the Swiss Re Institute highlighted that emerging markets, majorly China, are expected to contribute highly to this growth, with a growth in demand for term insurance policies due to better financial capabilities. Also, technological developments like robotic process automation &

Artificial Intelligence are transforming the insurance landscape by improving customer service, predicting outcomes more accurately, developing innovative products, identifying risks, & promoting cross-selling opportunities.

However, cybersecurity threats cause a significant risk to the term insurance market, mainly with the growing digitization of insurance processes & the proliferation of online platforms, which exposes insurers to potential data breaches, fraud, & financial losses, putting the risk to consumer trust and the integrity of the industry.

To address these challenges, term insurance companies must prioritize proactive cybersecurity measures, invest in advanced technologies, and promote a culture of cybersecurity awareness and compliance throughout the organization. By adopting a complete approach to cybersecurity risk management, insurers can reduce threats, protect sensitive data, and ensure long-term growth and sustainability in the ever-evolving insurance landscape.

Research Scope and Analysis

By Type

Individual-level term life insurance In the global term insurance market is expected to maintain its dominant position in 2024, by having a significant portion of revenue share, as it is personalized, providing coverage for a set period, mainly ranging between 10 to 30 years, as the thing distinguishes it is the way premiums are calculated, which takes into account factors like the individual's health, age, & lifestyle, which ensures that the insurance policy matches the specific circumstances of the insured person, providing them the most suitable and affordable coverage, as the growing demand for personalized financial protection, along with the flexibility of customization, has been driving the steady growth of this segment.

Further, the group-level term insurance segment is expected to experience significant growth in the coming future, which is customized for members of a particular group, like employees within a company. It operates on a collective coverage model, where premiums & benefits are determined based on the characteristics & requirements of the entire group, which mainly leads to more affordable rates for individual members due to the pooling of risk within the group. Group plans are also being extended to include benefits like Pet Insurance,

Travel Insurance, or even Cyber Insurance, creating attractive bundles for employers seeking comprehensive employee benefits.

The segment's expansion is mainly driven by its low cost, making it an attractive option for businesses & organizations looking to offer valuable employee benefits. In addition, the ease of enrollment further contributes to the growing adoption of group-level term insurance among various groups and organizations.

By Distribution Channel

In the term insurance market, the tied agents and branches segment as a distribution channel is expected to remain dominant in 2024, contributing significantly to overall revenue. Tied agents, who majorly represent a single insurance company, play a major role as distribution channels. Their rising prominence is due to their deep understanding of products, customized service, and strong brand affiliation.

By nurturing long-standing client relationships built on trust & loyalty, tied agents simplify complex insurance options, making term insurance more accessible &understandable, which in turn, drives the growth of this segment as they effectively connect with customers and cater to their needs.

Further, the broker's segment is expected to show a major expansion in the coming future.

Brokers are important distribution channels in the term insurance market, providing impartial advice and looking into a diverse range of insurance products from various providers. Their popularity comes from their ability to provide unbiased comparisons & customized coverage solutions according to individual preferences.

As consumers highly look for customization and competitive pricing, brokers fulfill this demand by providing transparency & choice. The brokers' role as trusted advisors, along with the growing consumer need for complete coverage, is expected to be driving their significant growth as a prominent distribution channel in the term insurance market.

The Term Insurance Market Report is segmented on the basis of the following

By Type

- Individual Level Term Life Insurance

- Group Level Term Life Insurance

- Decreasing Term Life Insurance

By Distribution Channel

- Tied Agents & Branches

- Brokers

- Others

Regional Analysis

In the

term insurance market, Asia Pacific is set to emerge as a major driver for the global market, while expecting to contribute over

35% of the market's revenue share by 2024. The region's strong growth is driven by several key factors. Firstly, Asia Pacific holds a vast & diverse population, mainly in countries like India & China, where awareness regarding the importance of life insurance is steadily rising.

Demographic shifts, like an aging population, further highlight the need for financial protection, driving the need for term insurance products. In addition, the presence of many life insurance companies in the region, along with supportive government policies & the rapid adoption of digital technologies, creates favorable conditions for new product development & industry advancement.

The usage of digital platforms makes insurance products more accessible, thereby improving market penetration and consumer outreach across the region. Moreover, Europe is also positioned to show significant growth in the term insurance market, as regulatory reforms, economic uncertainties, and a growing population have made individuals across Europe prioritize financial security, leading to a better demand for term insurance coverage.

Moreover, technological development and higher market competition have catalyzed the sector's expansion, providing consumers with a broader array of choices and streamlined processes. The growth experienced in both the Asia Pacific & European regions highlights the growing recognition of term insurance as a critical tool for financial planning and protection. As individuals become highly aware of the risks associated with unforeseen events, term insurance emerges as a preferred option to safeguard their financial well-being, driving sustained growth & innovation in the global term insurance market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

In the global term insurance market, players look to capture market share, by competing on various factors shaping the competitive landscape including product innovation, pricing strategies, distribution channels, & customer service. Companies are aiming to develop innovative term insurance products customized to diverse consumer needs while ensuring competitive pricing to attract & retain customers.

In addition, the effective usage of distribution channels like tied agents, brokers, & digital platforms plays a major role in market penetration. Providing superior customer service & building strong brand recognition are also important for having a competitive edge in this market environment, where consumer preferences and regulatory changes constantly influence industry dynamics.

Some of the prominent players in the global Term Insurance Market are

- Prudential Financial

- AIG

- Aegon Life Insurance Company Ltd

- Bajaj Allianz Life Insurance Co Ltd

- AIA Group

- United Health Group

- China Life Insurance

- AXA

- Zurich Insurance Group

- Allianz SE

- Other Key Players

Recent Developments

- In February 2024, The Nagaland government announced a fully-funded universal life insurance scheme to reduce financial hardship due to the untimely demise of a family's breadwinner, which is a testament to the state's constant commitment to ensuring the financial security &protection of its citizens, as it will provide life insurance coverage for the breadwinner of the family & accidental insurance coverage for three other members of every family in the state.

- In February 2024, Life Insurance Corporation of India launched its new unit-linked life insurance product, LIC Index Plus, which is a regular premium, individual life insurance plan that gives life insurance cover & savings throughout the term of the policy. Further, it claims additions as a percentage of Annualized Premium which are added to the unit fund on completion of a specific duration of policy years under an in-force policy & shall be used to purchase units.

- In January 2024, Kotak Mahindra Life Insurance launched a unit-linked term insurance plan that provides life coverage up to 100 times the annual premium. The 'T.U.L.I.P' Term with a Unit-Linked Insurance Plan also enables a customer to get returns like ULIP & additional protection against severe illnesses and accidental death. TULIP provides the customers with complete protection like a term plan and also the opportunity to grow their wealth like a ULIP launching with eight options taking care of customers' core financial needs.

- In December 2023, Aditya Birla Sun Life Insurance Company Limited (ABSLI) launched the “ABSLI Salaried Term Plan", which is a customized and affordable protection solution specifically developed for salaried professionals, categorized as non-linked, non-participating, pure-risk, life individual, & a premium plan, makes salaried individuals customize their protection plans based on their unique needs. The ABSLI Salaried Term Plan provides policyholders with many cover options customized to meet their diverse needs. In addition to the standard Life Cover option, policyholders have the flexibility to opt for a Life Cover with a Return of Premium (ROP) feature.

- In November 2023, Zurich Insurance Group announced a strategic partnership with Kotak Mahindra Bank Limited through the proposed acquisition of a 51% stake in Kotak Mahindra General Insurance Company Limited or Kotak General Insurance for USD 488 million, through a combination of fresh growth capital & share purchase. Further, Zurich will acquire an additional stake of about 19% over time, as it is expected that this transaction will provide the largest foreign insurer investment in the Indian insurance sector.

- In August 2023, Government of India introduced a new tax rule for life insurance policies which would have a significant impact on policyholders, mainly those who have high-premium policies. Under the new rule, any amount received from a life insurance policy with an annual premium of over INR 500,000 or USD 6, 000 will be taxable, which includes the sum assured, any bonuses, and other benefits. The new tax rule is likely to make traditional insurance plans less attractive to investors. These plans are mainly purchased by risk-averse investors who are looking for a guaranteed return on their investment.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 1,215.0 Bn |

| Forecast Value (2033) |

USD 2,601.2 Bn |

| CAGR (2023-2032) |

8.8% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Individual Level Term Life Insurance, Group Level Term Life Insurance, and Decreasing Term Life Insurance), By Distribution Channel (Tied Agents & Branches, Brokers, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Prudential Financial, AIG, Aegon Life Insurance Company Ltd, Bajaj Allianz Life Insurance Co Ltd, AIA Group, United Health Group, China Life Insurance, AXA, Zurich Insurance Group, Allianz SE, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Term Insurance Market size is estimated to have a value of USD 1,215.0 billion in 2024 and is expected to reach USD 2,601.2 billion by the end of 2033.

Asia Pacific is expected to have the largest market share in the Global Term Insurance Market with a share of about 35% in 2024.

Some of the major key players in the Global Term Insurance Market are Prudential Financial, AIG, Aegon Life Insurance Company Ltd, and many others.

The market is growing at a CAGR of 8.8 percent over the forecasted period.