Market Overview

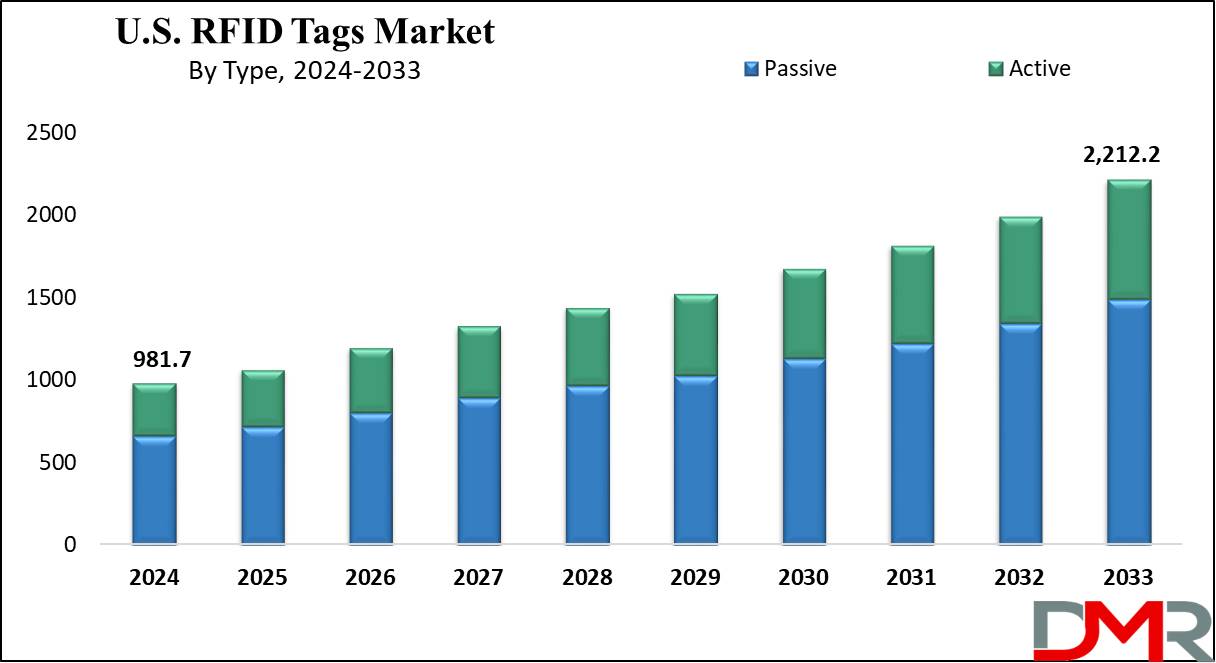

The U.S. RFID Tags Market is expected to reach a value of

USD 981.7 million by the end of 2024, and it is further anticipated to reach a market value of

USD 2,212.2 million by 2033 at a

CAGR of 9.4%.

RFID, or radio-frequency identification is a technology that is used for automated object identification. RFID tags are used for containing an integrated circuit with an antenna and memory, and store data like electronic product codes (EPCs) for tracking. They're categorized as active or passive, with active tags using battery power for signal transmission to readers.

Key Takeaways

- The U.S. RFID Tags Market is expected to grow by 1,230.5 million, at a CAGR of 9.4% during the forecasted period.

- By Type, passive RFID tags are expected to lead in 2024 & are anticipated to dominate throughout the forecasted period.

- By Product, Commercial RFID tags are anticipated to drive the growth of the U.S. RFID tags market.

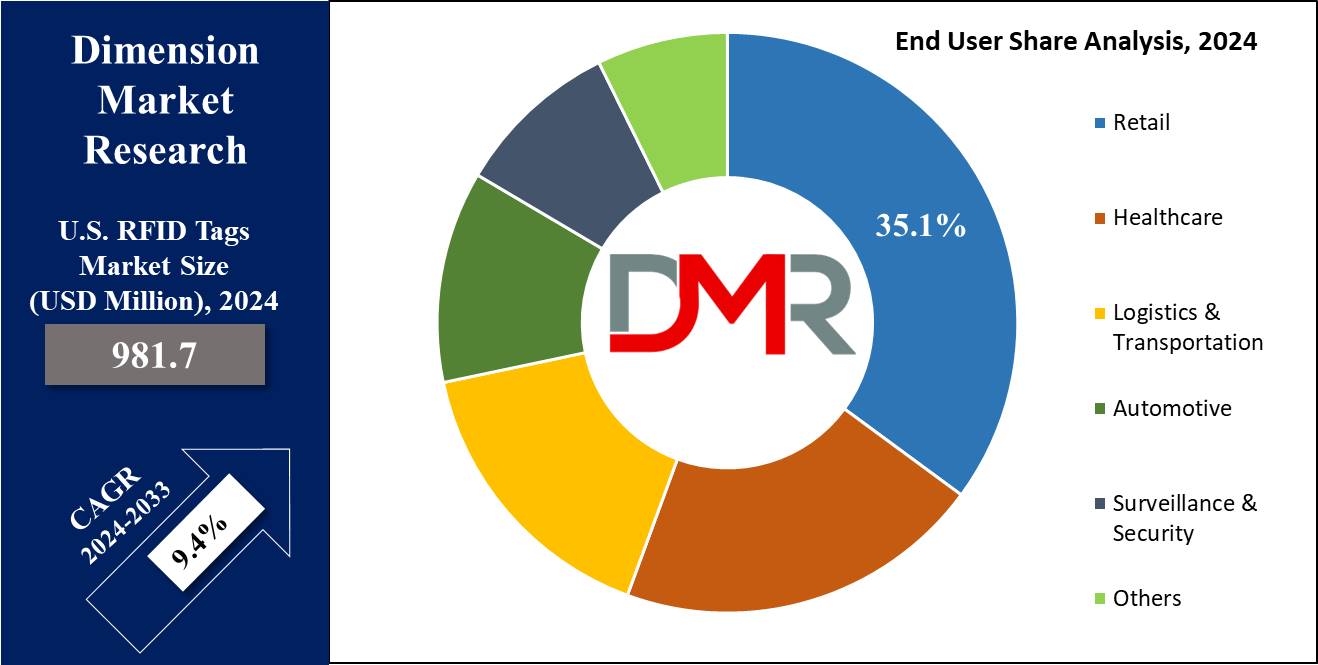

- By End User, the retail sector is expected to have a lead throughout the forecasted period.

- Some of the use cases of RFID tags include supply chain visibility, inventory management in retail, and more.

Use Cases:

- Inventory Management in Retail: RFID tags are largely used in retail stores across the US to improve inventory management processes. By tagging individual items with RFID chips, retailers can track the movement of products live, automate stock recovery, and avoid instances of stockouts or overstocking, which improves operational efficiency, decreases labor costs and improves the overall customer experience by ensuring products are always available when needed.

- Supply Chain Visibility: RFID technology is used throughout the supply chain in many industries, like manufacturing, logistics, & healthcare, among others. In the US, companies use RFID tags to track the movement of goods from production lines to distribution centers to retail stores, which provides members with live visibility into the location & status of shipments for better planning, forecasting, and decision-making.

- Asset Tracking and Management: Many organizations in the US use RFID tags for asset tracking & management purposes. From tracking high-value products like machinery & equipment to managing IT assets like laptops & servers, RFID technology allows companies to accurately locate & monitor their assets throughout their lifecycle, which lowers the risk of loss or theft, optimizes asset usage, and improves maintenance processes.

- Authentication and Anti-counterfeiting: RFID tags are being highly used across the US for product authentication & anti-counterfeiting measures. By placing these chips with unique identifiers into products or packaging, manufacturers can inspect genuine products & detect counterfeit items throughout the supply chain and at point-of-sale, which helps protect brands, ensures product quality & safety, and improves consumer trust and confidence in the authenticity of the goods they purchase.

Market Dynamic

The retail industry is majorly switching to RFID technology to improve supply chain visibility & operational efficiency. With a focus on timely delivery & store effectiveness, RFID provides benefits like low, streamlined inventory management, and increased sales, driving growth in the U.S. RFID tags market. In transportation, efficient systems are critical for economic development, providing social & economic advantages like job creation and better market access. RFID-enabled automatic toll collection improves productivity & customer convenience, making vehicles pass through toll booths smoothly, which is expected to further drive the market growth.

However, the large use of barcode systems creates a challenge to RFID adoption in the U.S., while concerns over privacy policies could also restrain market growth. Further, these obstacles and the benefits of RFID technology in the retail & transportation sectors are expected to drive its constant expansion during the forecast period.

Research Scope and Analysis

By Type

Passive RFID tags are expected to dominate the RFID tags market in 2024 as they are essential in driving the growth of the US RFID tag market due to their affordability and versatility across a variety of applications. These tags need no internal power source and are activated by radio frequency signals released by RFID readers, making them ideal for use in many industries like retail, logistics, and healthcare. Their low cost per unit creates mass installation, making businesses track & manage large volumes of assets, inventory, and shipments more efficiently.

Furthermore, developments in passive RFID technology, like better read ranges & data storage capacities, have expanded their capabilities and usability, driving further adoption. As businesses in the US constantly look for ways to improve operational efficiency and gain higher visibility into their supply chains, passive RFID tags play an important role in meeting these demands & driving market growth.

By Product

Commercial RFID tags are projected to be driving the growth of the US RFID tag market and are also anticipated to lead the market in 2024, due to their customized functionalities and higher applicability across many business sectors. These tags are mainly developed to meet the unique needs of commercial applications, ranging from inventory management & asset tracking to access control & authentication. With customizable features and strong performance capabilities, commercial RFID tags provide businesses in the US with better tools for enhancing operational efficiency, improving security, and optimizing resource usage.

Whether installed in retail stores to streamline inventory processes, in warehouses to track shipments, or in manufacturing facilities to look into production workflows, commercial RFID tags provide live visibility and actionable insights that drive better decision-making and business growth. As US enterprises largely recognize the value of RFID technology in driving competitive advantage, the need for commercial RFID tags constantly expands, fueling market expansion & innovation.

By End User

The retail sector is predicted to dominate the US RFID tag market in 2024, by using RFID technology retailers can have better inventory management & operational efficiency. Using these tags, retailers can track merchandise from the warehouse to the point of sale with greater accuracy & speed in comparison to traditional barcode systems, which allow real-time inventory tracking, reduce stockouts, minimize overstocking, and improve shelf recovery processes. In addition, RFID technology supports quick & efficient checkout experiences for customers, leading to higher satisfaction levels and better sales. As retailers continue to give preference to effective supply chain operations & improve the overall shopping experience, the need for RFID tags in the US retail sector is expected to grow and contribute largely to the expansion of the RFID tag market in the country.

The U.S. RFID Tags Market Report is segmented on the basis of the following:

By Type

By Product

- Commercial Tags

- Healthcare Tags

- Correction Tag

- Others

By End User

- Retail

- Healthcare

- Logistics & Transportation

- Automotive

- Surveillance & Security

- Others (Wildlife, Sports, Livestock, and IT)

Competitive Landscape

The US RFID tag market is characterized by a variety of players offering a range of RFID solutions customized to many industries & applications. Key factors influencing competition like product innovation, pricing strategies, distribution networks, and customer service offerings. Companies compete for market share by differentiating their offerings through technological developments, strategic partnerships, and effective marketing strategies to meet the changing needs of customers.

Some of the prominent players in the U.S. RFID Tags Market are:

- HID the US Corp

- RF Code Inc

- NXP Semiconductors

- Avery Dennison Corp

- Confidex Ltd

- AMS AG

- Atmel Corp

- Alien Technology

- Omni – ID Ltd

- Impinj Inc

- Other Key Players

Recent Developments

- In October 2023, PulpaTronics, launched paper-based RFID tags without metal or silicon components to reduce single-use electronics waste, as their chipless, paper-only tags replace traditional RFID tags, creating self-checkout and improving inventory management and theft prevention in retail stores.

- In October 2023, Fresenius Kabi launched +RFID smart labels for Diprivan®Injectable Emulsion, USP, 200 mg per 20 mL in single-dose vials, sold in the US, which is completely compatible with all major RFID kit & tray systems in the U.S. Further, the launch expands Fresenius Kabi’s industry-leading +RFID portfolio of fully interoperable labeled medications. The use of this technology removes the need to tag medicines manually which saves time and provides a safe, more efficient medication inventory process.

- In September 2023, Amazon launched a new offering that integrates the power of Just Walk Out technology & RFID, which is a first-of-its-kind for checkout-free tech, as it is an update to its computer vision-based offering and would allow retailers to provide an expanded selection of clothing, apparel, and other soft lines merchandise. RFID-enable stores are affordable and quick to install and deliver the same frictionless shopping experience customers.

- In July 2023, Beontag launched a line of tags consisting of RFID functionality, compatible with Impinj M800 series RAIN RFID tag chips. The Falcon M800, Pacer M800, Swift M800, and Setter M800 are developed with specialized antennas for retail & industrial use, using the latest IC technology, they prioritize readability, reliability, & worldwide supply chain compatibility.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 981.7 Mn |

| Forecast Value (2033) |

USD 2,212.2 Mn |

| CAGR (2023-2032) |

9.4% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Passive and Active), By Product (Commercial Tags, Healthcare Tags, Correction Tag, and Others), By End User (Retail, Healthcare, Logistics & Transportation, Automotive, Surveillance & Security, and Others (Wildlife, Sports, Livestock, and IT)) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

HID the US Corp, RF Code Inc, NXP Semiconductors, Avery Dennison Corp, Confidex Ltd, AMS AG, Atmel Corp, Alien Technology, Omni – ID Ltd, Impinj Inc, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The U.S. RFID Tags Market size is estimated to have a value of USD 981.7 million in 2024 and is expected to reach USD 2,212.2 million by the end of 2033.

Some of the major key players in the U.S. RFID Tags Market are HID the US Corp, RF Code Inc, NXP Semiconductors, and many others.

The market is growing at a CAGR of 9.4 percent over the forecasted period.

Contents

1.1.Objectives of the Study

1.3.Market Definition and Scope

2.U.S. RFID Tags Market Overview

2.1.Global U.S. RFID Tags Market Overview by Type

2.2.Global U.S. RFID Tags Market Overview by Application

3.U.S. RFID Tags Market Dynamics, Opportunity, Regulations, and Trends Analysis

3.1.1.U.S. RFID Tags Market Drivers

3.1.2.U.S. RFID Tags Market Opportunities

3.1.3.U.S. RFID Tags Market Restraints

3.1.4.U.S. RFID Tags Market Challenges

3.2.Emerging Trend/Technology

3.4.PORTER'S Five Forces Analysis

3.6.Opportunity Map Analysis

3.11.Supply/Value Chain Analysis

3.12.Covid-19 & Recession Impact Analysis

3.13.Product/Brand Comparison

4.Global U.S. RFID Tags Market Value ((US$ Mn)), Share (%), and Growth Rate (%) Comparison by By Type, 2017-2032

4.1.Global U.S. RFID Tags Market Analysis by By Type: Introduction

4.2.Market Size and Forecast by Region

5.Global U.S. RFID Tags Market Value ((US$ Mn)), Share (%), and Growth Rate (%) Comparison by By Product, 2017-2032

5.1.Global U.S. RFID Tags Market Analysis by By Product: Introduction

5.2.Market Size and Forecast by Region

6.Global U.S. RFID Tags Market Value ((US$ Mn)), Share (%), and Growth Rate (%) Comparison by By End User, 2017-2032

6.1.Global U.S. RFID Tags Market Analysis by By End User: Introduction

6.2.Market Size and Forecast by Region

6.5.Logistics & Transportation

6.7.Surveillance & Security

6.8.Others (Wildlife, Sports, Livestock, and IT)

10.Global U.S. RFID Tags Market Value ((US$ Mn)), Share (%), and Growth Rate (%) Comparison by Region, 2017-2032

10.1.1.North America U.S. RFID Tags Market: Regional Analysis, 2017-2032

10.2.1.Europe U.S. RFID Tags Market: Regional Trend Analysis

10.3.1.Asia-Pacific U.S. RFID Tags Market: Regional Analysis, 2017-2032

10.3.1.7.Rest of Asia-Pacifc

10.4.1.Latin America U.S. RFID Tags Market: Regional Analysis, 2017-2032

10.4.1.5.Rest of Latin America

10.5.Middle East and Africa

10.5.1.Middle East and Africa U.S. RFID Tags Market: Regional Analysis, 2017-2032

11.Global U.S. RFID Tags Market Company Evaluation Matrix, Competitive Landscape, Market Share Analysis, and Company Profiles

11.1.Market Share Analysis

11.3.2.Financial Highlights

11.3.5.Key Strategies and Developments

11.4.2.Financial Highlights

11.4.5.Key Strategies and Developments

11.5.2.Financial Highlights

11.5.5.Key Strategies and Developments

11.6.2.Financial Highlights

11.6.5.Key Strategies and Developments

11.7.2.Financial Highlights

11.7.5.Key Strategies and Developments

11.8.2.Financial Highlights

11.8.5.Key Strategies and Developments

11.9.2.Financial Highlights

11.9.5.Key Strategies and Developments

11.10.2.Financial Highlights

11.10.3.Product Portfolio

11.10.5.Key Strategies and Developments

11.11.2.Financial Highlights

11.11.3.Product Portfolio

11.11.5.Key Strategies and Developments

11.12.2.Financial Highlights

11.12.3.Product Portfolio

11.12.5.Key Strategies and Developments

11.13.2.Financial Highlights

11.13.3.Product Portfolio

11.13.5.Key Strategies and Developments

11.14.2.Financial Highlights

11.14.3.Product Portfolio

11.14.5.Key Strategies and Developments

12.Assumptions and Acronyms