The vibration control system or VCS is an important part across many sectors like mining, aviation, and healthcare, and functions by constantly reducing incoming vibrations through feedback & feed-forward mechanisms. Feedback control constantly monitors & adjusts based on vibration data, while feed-forward control anticipates & counteracts vibrations beforehand. These systems, once mainly used in automotive & electrical equipment, have expanded into aerospace, defense, and healthcare, driven by the need for enhanced reliability and efficiency.

Market growth for vibration control systems is driven by the expansion of the automotive & aviation industries, with a focus on creating next-generation systems to reduce vibrations in aircraft. Further, anti-vibration solutions in automotive applications, like mounting & bushing systems, contribute to better vehicle efficiency & component longevity. However, challenges like strict regulations, high costs, & reliability issues create a few obstacles to market expansion.

In response to regulatory pressures, manufacturers are pushed to upgrade VCS designs, mainly in sectors like defense & aviation. Despite hindrances, growth opportunities exist, driven by the need for smart, adaptive systems and developments in technologies like Active Noise & Vibration Control (ANVC). In addition, innovations like web-based continuous machine condition monitoring provide opportunities for improving aircraft performance and reliability, providing a bright outlook for the market in the coming future.

Key Takeaways

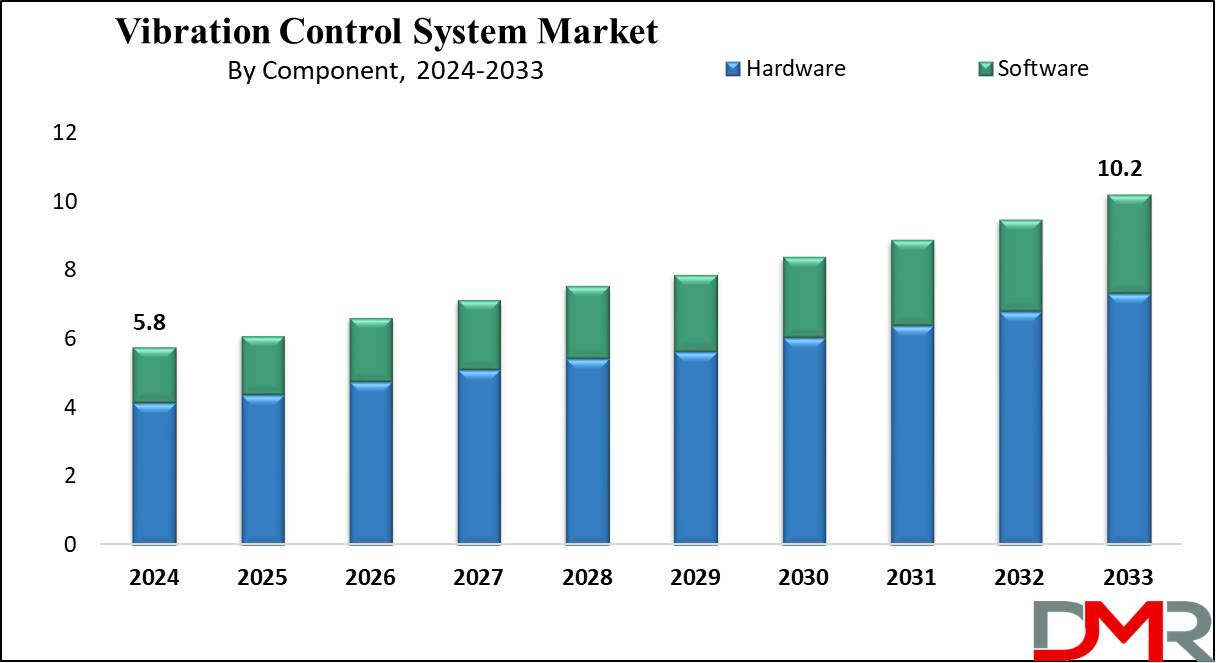

- Market Growth: The Vibration Control System Market is expected to grow by 4.1 billion, at a CAGR of 6.5% during the forecasted period of 2025 to 2033.

- By Component: The hardware segment is expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- By Category: The active segment is expected to get the largest revenue share in 2024 in the Vibration Control System market.

- By System Type: The vibration control segment is expected to lead the market in 2024

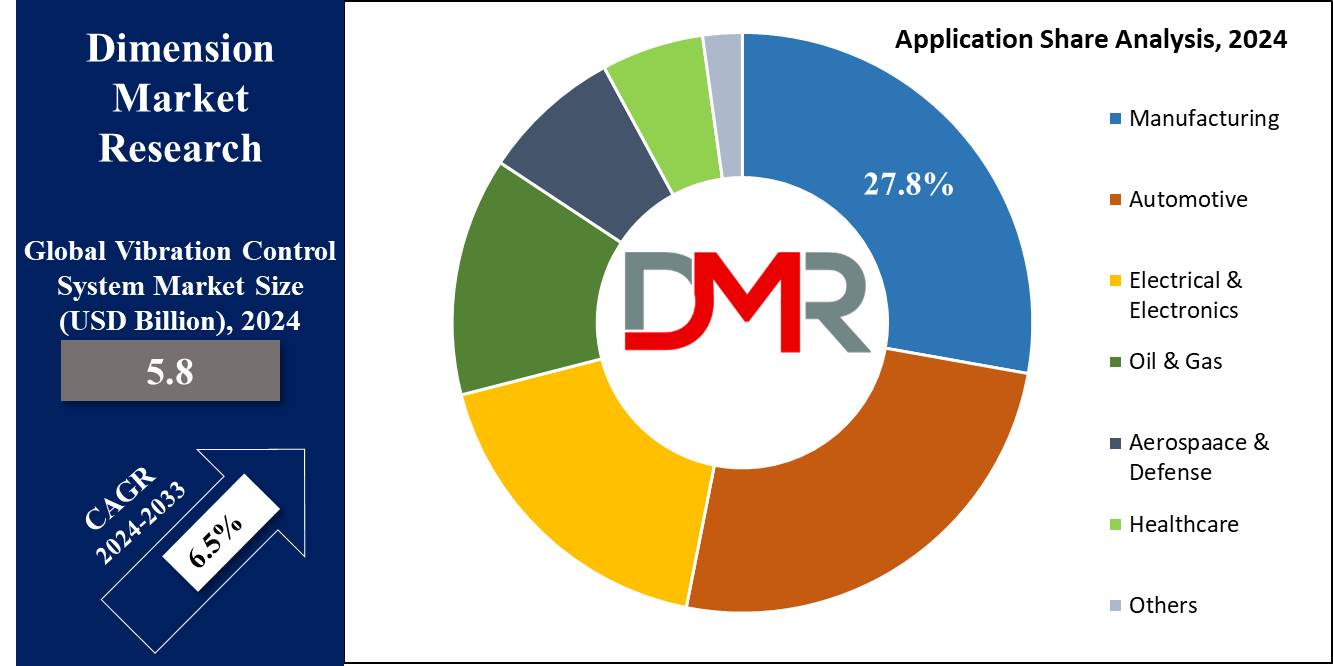

- By Application: The manufacturing segment is expected to get the largest revenue share in 2024 in the vibration control system market.

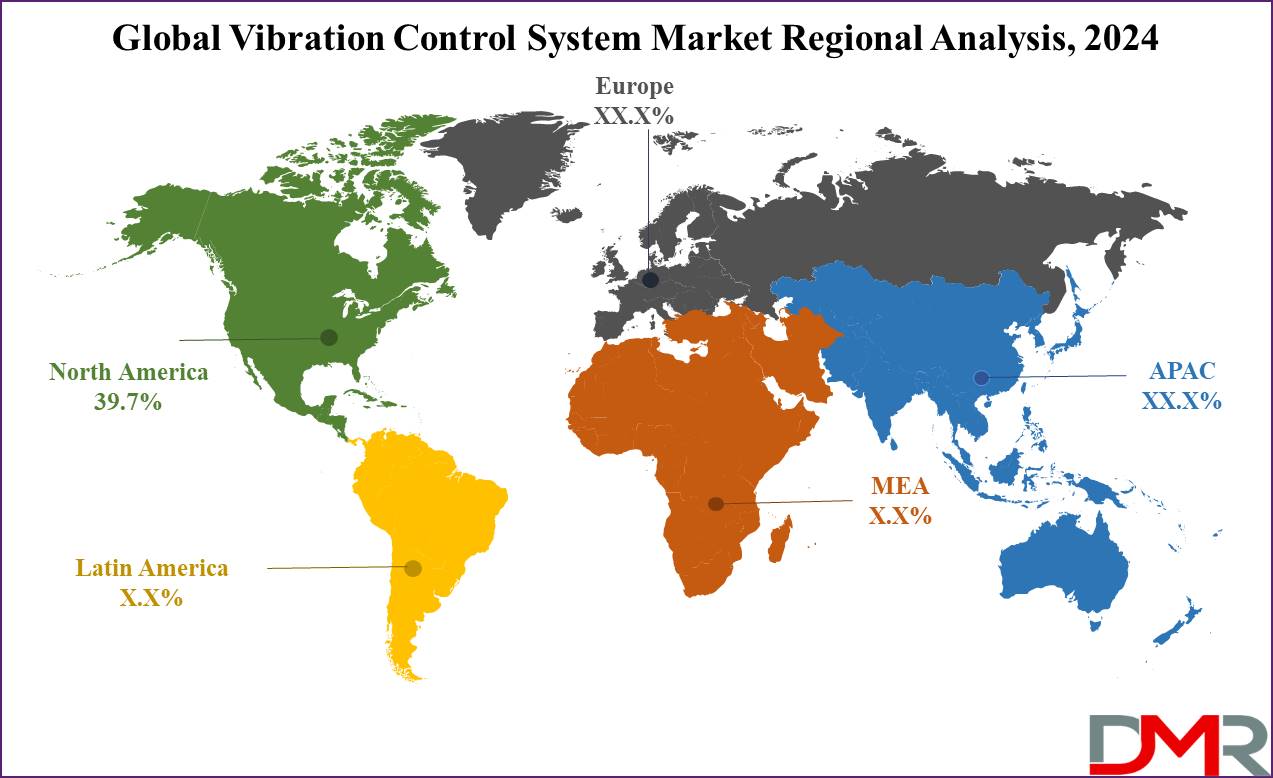

- Regional Insight: North America is expected to hold a 39.7% share of revenue in the Global Vibration Control System Market in 2024.

- Use Cases: Some of the use cases of the vibration control system include the automotive industry, aerospace & defense, and more.

Use Cases

- Aerospace & Defense: Vibration control systems are important in aerospace & defense applications to ensure the structural integrity of aircraft and other aerospace vehicles. These systems help in reducing vibrations caused by engine operation, turbulence, & other factors, thereby improving the safety & performance of aircraft components. Like, active vibration control systems are used to reduce vibrations in helicopter fuselages, enhancing passenger comfort & operational efficiency.

- Automotive Industry: In the automotive sector, VCS plays an important role in improving vehicle performance, comfort, & safety. These systems are used to reduce vibrations generated by engine operation, road irregularities, &other sources, thereby improving ride quality & minimizing driver fatigue. Anti-vibration components like mounts, bushings, and dampers are mainly used to isolate vibrations and noise, ensuring smoother operation & extended lifespan of vehicle parts.

- Industrial Machinery: Vibration control systems find large use in industrial machinery applications to reduce the adverse effects of vibrations on equipment performance & longevity. By employing active or passive vibration control mechanisms, manufacturers can reduce vibrations generated during operation, minimizing wear & tear on machinery components and improving overall efficiency. These systems are mainly important in precision manufacturing processes where even minor vibrations can impact product quality.

- Healthcare Equipment: Vibration control systems are important in healthcare equipment like MRI machines, CT scanners, & laboratory instruments to maintain precision & accuracy during operation. These systems help reduce vibrations that can deform imaging results or affect sensitive medical procedures. By using vibration isolation techniques, healthcare facilities can ensure optimal performance & reliability of diagnostic & therapeutic equipment, eventually improving patient outcomes and safety.

Market Dynamic

Growth in the vibration control systems market demand is driven by a growing focus on mechanical balance & stability in both automotive &industrial machinery. Vibration Control Systems or VCS play an important role in efficiently managing incoming vibrations, providing isolation & control for machines, whether stationary or in motion. These systems are precisely developed to reduce vibrations, thereby minimizing friction & other disruptive factors.

Providers of Vibration Control Systems give importance to innovation through the launch of new products & significant investments in R&D initiatives, strengthening their market presence & stimulating growth. Providing significant advantages in safeguarding machine operations, VCS helps prevent heat generation, wear &tear, and energy loss, along with cracks & breakage. Further, their applications span diverse industries like automotive, aerospace, defense, electronics, oil and gas, and healthcare. The growing adoption of VCS across many sectors drives market growth, as businesses prioritize the growth of mechanical performance and operational efficiency.

However, the global vibration control system market experiencing many constraints hindering its growth of the market. Strict industry regulations, along with high system costs, create higher challenges for manufacturers. In addition, concerns surrounding component reliability & maintenance issues further restrain market expansion. In sectors like aerospace & defense, where reliability is the main, the need for constant upgrades to meet regulatory standards provides ongoing hurdles.

Moreover, the complexity of integrating vibration control systems into existing infrastructure adds to deployment difficulties. Despite these restraints, opportunities depend on the development of smarter, adaptive systems and innovative technologies, showcasing potential opportunities for future market growth.

Research Scope and Analysis

By Component

The global vibration control systems market by component is segmented into hardware and software components, where the hardware sector is expected to dominate revenue share in 2024, including various sensors, controllers, and actuators important for vibration control across industries like automotive, aerospace, building, and healthcare. With the growing demand to lower noise & vibration levels, the hardware segment is expected to maintain its dominance, further propelled by the adoption of more sophisticated sensors and control systems.

Conversely, the software segment, which includes vibration data monitoring and analysis tools, is expected to grow steadily, which is driven by the rising adoption of software tools in the automotive, aerospace, and healthcare industries, providing live data monitoring & analysis to improve operational efficiency. In addition, the market is expected to expand due to the growing demand for vibration control systems in many sectors to enhance comfort & safety standards, mainly in automotive & aerospace applications.

Moreover, the integration of Industry 4.0 technologies like the Internet of Things (IoT) &

Artificial Intelligence (AI) is expected to further drive market growth. These technologies offer real-time monitoring & analysis of vibration data, improving performance and operational effectiveness across many industries.

By Category

The global market for vibration control systems is categorized into active, passive, and hybrid segments. Among these, the active segment is expected to dominate revenue share in 2024 due to growing demand across industries like aerospace, defense, automotive, and healthcare. Active systems provide live monitoring & modification capabilities to minimize vibrations & noise, thereby improving operational efficiency. Moreover, development in sensor &control system technologies is expected to further drive growth in this segment.

Further, the passive segment is expected to show steady growth, providing practical solutions to reducing vibrations and noise, mainly in the industrial, construction, and maritime sectors. Market growth in this segment is likely to be driven by increased deployment in emerging economies. In addition, the hybrid segment, combining both active & passive elements, is forecasted to experience significant growth, providing effective & affordable solutions in sectors like healthcare, aerospace, and automotive, especially in developing nations.

Further, the market is expected to expand driven by the growth demand across various industries, like automotive and aerospace, where the need to lower noise & vibration levels to enhance comfort and safety remains paramount.

By Systems Type

The vibration control segment within the vibration control systems market is expected to show rapid growth throughout the forecast period, mainly driven by growing demand for tremor & vibration sustaining solutions in the oil & gas and power plant industries. These sectors use various anti-vibration devices like washers, absorbers, bushes, mounts, springs, hangers, and dampers to smoothly isolate tremors and shocks in power plant operations. Within the vibration control segment, there are many sub-segments, like isolating pads and isolators, meeting specific industry needs.

Furthermore, VCS with motion control capabilities is anticipated to have a significant industry share by 2033, due to the expansion of the automotive & aerospace sectors. Motion control systems play an important role in fixed-wing aircraft by reducing quivers & tremors in helicopter fuselages created by main rotor movements.

In addition, the growing focus on improving passenger comfort & convenience in aircraft is expected to drive further growth in this segment over the coming years. As industries constantly prioritize operational stability & safety, along with the need for better comfort standards in transportation, the vibration control segment is positioned for major expansion, catering to many industry requirements with advanced motion control technologies.

By Application

The manufacturing segment is set to dominate the global vibration control system revenue share in 2024, with significant growth opportunities also expected in the electrical & electronics vertical, which is driven by the growing industrial machinery manufacturing across the globe. Further, vibration control mechanisms in the electronics industry, including control electronics, sensors, and actuators, form a feedback loop to safeguard structures & equipment from impact forces.

In addition, anti-vibration components like bushes, cylindrical buffers, mounts, & sandwich mounts find high usage in industrial applications, providing passive vibration isolation for measuring equipment & electronic instruments. These mechanisms extend beyond the electrical & electronics sector, finding application in industries like mining & quarrying and food manufacturing.

Further, high growth is expected in vibration control systems within the automotive industry over the forecast period. These systems play a vital role in improving vehicle efficiency by reducing vibrations & friction, thereby optimizing the performance of vehicle components & enhancing fuel efficiency while reducing wear & tear. The automotive sector's adoption of vibration control systems constantly grows as manufacturers enhance vehicle performance, comfort, and regulatory compliance.

These systems are essential for lowering vibrations, improving efficiency, expanding component lifespan, reducing noise levels, and driving technological development in the automotive industry. Also, the integration of vibration control systems across many industries is growing, which highlights their vital role in improving operational efficiency, reducing maintenance costs, and enhancing overall performance.

The Vibration Control System Market Report is segmented on the basis of the following

By Component

By Category

By System Type

- Motion Control

- Springs

- Hangers

- Washers & Bushes

- Mounts

- Vibration Control

- Isolating Pads

- Isolators

- Others

By Application

- Automotive

- Aerospace & Defense

- Manufacturing

- Electrical & Electronics

- Healthcare

- Oil & Gas

- Others

Regional Analysis

North America is expected to lead the vibration control systems market, by having the

largest share at 39.7% in 2024, driven by high demand for anti-vibration solutions across major sectors like healthcare, aviation, and defense. The United States, in major, stands out within the region, showcasing growth in the adoption of anti-vibration mechanisms across diverse industries like electronics & electrical, automotive, & food manufacturing. Its early use of vibration control technology has supported the establishment of many regional manufacturers & solution providers, contributing to the region's market growth and consolidating its position as a leading player across the world.

Further, the Asia Pacific is expected to emerge as the fastest-growing region during the forecast period, driven by fast industrialization in countries like Japan, China, & India. Further, China comes out as a main manufacturing hub due to its low capital costs & development in technology. Furthermore, Latin America is expected to experience considerable growth, driven by constant technological upgrades in vibration control systems. Further, Brazil, in particular, plays a major role in market expansion, experiencing fast development across sectors like textile, oil & gas, automotive, and machinery & equipment.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global vibration control system market features a competitive landscape characterized by a variety of players looking to meet the increasing demand across various industries. Key factors influencing competition like product innovation, technological developments, and strategic partnerships. Companies within the market focus on developing advanced vibration control solutions to look into specific industry requirements, like aerospace, automotive, & healthcare.

Moreover, partnerships with industry stakeholders &research institutions play a major role in driving innovation & market penetration. In addition, competitive pricing strategies & effective marketing initiatives are being used to maintain market share & expand the customer base. Moreover, the competitive landscape of the global vibration control system market highlights the importance of constant innovation & collaboration to meet changing industry demands & stay ahead in the market.

Some of the prominent players in the global Vibration Control System Market are:

- Fabreeka

- Cooper Standard

- GERB

- VICODA GmbH

- VSL International Ltd

- Farat

- DynaTronic Corporation

- NSV

- Resistoflex

- VibraSystems Inc

- Other Key Players

Recent Developments

- In January 2024, RuggON announced that the company plans to launch its new Ground Control System (GCS) for controlling UAVs at CES 2024. The system is built around the company's popular LUNA 3 8-inch rugged tablet, which allows users to control virtually any UAV, while the tablet's big & bright screen provides excellent video feedback. The UAV-controlling system is also certified to provide Global Navigation Satellite System (GNSS) positioning and tracking services.

- In September 2023, Kinetics Noise Control Inc. launched the new and enhanced KSR 3.0 Vibration Isolation Rail, which comes in two options: fully or partially assembled & is recommended for isolation of small-to-medium-sized pieces of rooftop equipment. It will also provide wind or seismic restraint. Further, with its universal fit, the KSR 3.0 is compatible with most factory-provided roof curbs & pre-installed restrained spring isolators are effective in avoiding equipment vibration while restraining against wind/seismic forces.

- In August 2023, Fluke Reliability acquired Azima DLI, a market leader in subscription-based remote condition monitoring & AI-powered vibration analytics software, which allows industrial businesses to grow asset uptime, minimize reactive, and unnecessary preventive maintenance, optimize manufacturing operations & asset health while maximizing revenue through accurate, predictive insights. Their Watchman 360 vibration analytics platform inspects specific faults, predicts time-to-failure and recommends corrective action.

- In March 2023, SGS Hong Kong launched its latest service on Vibration Monitoring, based on ISO 10816-3, which offers criteria for evaluating the vibration of machinery having power above 15 kW & operating speeds between 120 r/min & 15 000 r/min according to measurements taken on non-rotating parts and a general guideline for determining complete machine condition based on the magnitude of vibration & changes in vibration levels over time & serves as a general guideline for assessing, Severity of vibration measured on bearing, bearing pedestals or housing of industrial machines, and radial shaft vibration on coupled industrial machines.

- In November 2022, SICK launched its MPB10 Multi-Physics Box condition monitoring sensor, a leading and rugged bolt-on device developed to deliver real-time, continuous service data from industrial machines, like electric motors, pumps, fans, and conveyor systems, even in the harshest industry environments. Further, it is an all-in-one device developed to make it easy to monitor & interpret vibration, shock, and temperature measurement data delivered right from the heart of machines, and provides service data to show more affordable predictive maintenance practices that can improve plant availability, maximize operating life, and protect product & process quality.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 5.8 Bn |

| Forecast Value (2033) |

USD 10.2 Bn |

| CAGR (2023-2032) |

6.5% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Hardware and Software), By Category (Active, Passive, and Hybrid), By System Type (Motion Control and Vibration Control), By Application (Automotive, Aerospace & Defense, Manufacturing, Electrical & Electronics, Healthcare, Oil & Gas, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Fabreeka, Cooper Standard, GERB, VICODA GmbH, VSL International Ltd, Farat, DynaTronic Corporation, NSV, Resistoflex, VibraSystems Inc, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |