Active Pharmaceuticals Ingredient Market Overview

The Global

Active Pharmaceuticals Ingredient Market is expected to hold a market value of

USD 249.0 billion in 2023 and is projected to show subsequent growth with a market value of

USD 446.6 billion by the end of 2032 at a CAGR of

6.4%.

An active pharmaceutical ingredient marketplace covers the part of a manufacturing sector that is actively involved in producing, developing, and distributing APIs globally. APIs are the active ingredients in pharmacological medication that have medical purpose and therapeutic effects. Components also go through different processes such as synthesis, extraction and purification that form the active pharmaceutical ingredient in a product.

Within the pharmaceutical sector, this market holds a large space since it is essential to manufacture and develop drugs. In the

pharmaceutical sector, innovators and generic drug makers advocate using APIs to develop a wide variety of medicines, including common over-the-counter drugs to complex biologics. The market for APIs comprises generic APIs (manufactured after the expiration of a patent) and innovative APIs associated with new drugs.

As chronic diseases, infectious conditions, and

genetic disorders become more prevalent worldwide, there is an increasing demand for safe yet effective medications that address their needs thus fuelling growth of the Active Pharmaceutical Ingredients (API) industry. According to a 2022 report by the International Diabetes Federation (IDF), global cases of diabetes are expected to reach 643 million by 2030 and 784 million by 2045.

Australian Bureau of Statistics reported in December 2023 that 1.3 million Australians, or 5.3% of the population, had diabetes as of 2022.

Diabetes-induced high blood sugar damages nerves controlling heart and blood vessels, leading to cardiovascular diseases such as coronary artery disease and stroke and increasing API demand in drug development efforts.

Biosimilar and biologic drugs developed for innovative therapeutic uses continue to boost API market growth, prompting companies to take strategic initiatives to expand API production capacity. CuraTeQ Biologics, a subsidiary of Aurobindo Pharma, invested INR 300 crore (USD 3.82 million) to expand biologics manufacturing facilities and received approval for contract manufacturing of biologicals in September 2022.

Novartis also recently made headlines when they announced a USD 300 million investment to enhance their biologic drug production and development capabilities. These investments, coupled with increasing approvals of biologic drugs, should encourage their adoption and lead to global demand for APIs used in drug production.

Active Pharmaceuticals Ingredient Market Key Takeaways

- In 2023, the North American region is projected to hold a revenue share of over 40.0%, while the Asia Pacific region is growing at the highest CAGR.

- Based on synthesis, Synthetic API dominates this segment by holding 72.6% of the market share.

- In 2023, by type, the innovative APIs segment accounted for 53.1% of revenue share.

- By manufacture type in 2023, Captive APIs dominate this market as they hold 52.5% of the market share and are projected to show subsequent growth in the upcoming year as well.

Active Pharmaceuticals Ingredient Market Use Cases

- Chronic Disease Treatment: APIs are essential in producing drugs for diabetes, hypertension, and cardiovascular diseases, meeting the growing demand for chronic disease management worldwide.

- Oncology Drugs Development: High-potency APIs (HPAPIs) are used in cancer treatments, especially in targeted therapies and chemotherapy drugs, addressing the rising global cancer burden.

- Antibiotics and Antivirals Production: APIs play a crucial role in manufacturing antibiotics and antiviral drugs, including those used in combating infectious diseases like COVID-19, influenza, and tuberculosis.

- Biopharmaceuticals and Biosimilars: APIs derived from biological sources support the growing field of biologics and biosimilars, offering advanced treatment options for autoimmune diseases, cancer, and more.

- Contract Manufacturing & Outsourcing (CDMO): Pharma companies outsource API production to CDMOs for cost efficiency, scalability, and regulatory compliance, especially for complex or niche molecules.

- Customized Medicine Formulation: APIs are used in personalized medicine, allowing custom drug formulations tailored to individual patient needs, especially in rare diseases or specific genetic conditions.

Active Pharmaceuticals Ingredient Market Dynamic

Several elements have an impact on the dynamics of the API market, consisting of improvements in production tactics, regulatory necessities, patent landscapes, and worldwide health traits. The growing demand for personalized medication is using a need for customized active pharmaceutical ingredients (APIs) that align with person-affected person necessities.

Personalized medication is predicated on genetic trying out and biomarkers to become aware of powerful treatment alternatives, leading to a rising call for APIs tailor-made specifically for patients with particular genetic profiles.

However, the complicated production tactics of many APIs, characterized by the aid of problematic molecular structures and multi-step synthesis routes, present a full-size venture to this market. A possibility arises from the growing demand for oncology treatments as

oncology remedies create opportunities for API manufacturers to collaborate on offering APIs for

clinical trials and time-honored versions of powerful drugs.

However, the intricacy of those treatment plans often leads pharmaceutical groups to outsource API manufacturing to contract manufacturing organizations (CMOs), driving expanded calls for APIs. The increase in the market is often propelled by the growing occurrence of chronic sicknesses, supportive government rules, and the persistent want for pharmaceutical solutions to address evolving healthcare challenges.

Driver

Generic drugs are an integral component of the Active Pharmaceutical Ingredient (API) market. Generics provide cost-effective alternatives to brand name medications and address healthcare needs of an increasing population worldwide, particularly in developing regions.

As patents expire for numerous blockbuster medications, production of generic APIs has accelerated quickly while governments and healthcare providers worldwide promote generics to lower medical expenses further increasing API demand. Meanwhile, manufacturing technologies advancements as well as outsourcing production hubs contribute to expanding availability and affordability and thus expanding global API demand further driving market expansion worldwide.

Trend

Biologics have become an integral component of the API market in recent years. Biologics including monoclonal antibodies, recombinant proteins, and vaccines - are in high demand due to their effectiveness at treating chronic and complex diseases like cancer, diabetes and autoimmune disorders.

Due to this rise in interest for biologics as treatment solutions for such conditions as cancer, diabetes and autoimmune disorders; production for them has taken hold through specialized manufacturing processes and facilities with companies investing heavily in R&D for biopharmaceutical API development while personalized medicine and biosimilars have also increased interest biopharmaceuticals thus becoming key growth segments within API market growth segments.

Restraint

Rigorous regulatory standards governing API manufacturing present a major impediment to market expansion. Adherence to Good Manufacturing Practices (GMPs) and strict quality control measures involves significant costs and complex processes for smaller manufacturers, particularly smaller and mid-sized producers.

Agencies like FDA and EMA enforce stringent guidelines to ensure safety, efficacy and consistency often delaying product approvals while increasing operational expenses significantly; any noncompliance risks involve heavy fines or production shutdowns which make competing with established producers difficult while inhibiting innovation while hindering expansion into emerging markets.

Opportunity

Contract manufacturing organizations (CMOs) represent an exciting prospect in the API market. Pharmaceutical companies are turning to contract manufacturing organizations (CMOs) for cost savings, improved efficiency, and to focus on core competencies like drug discovery and marketing. Outsourcing offers pharmaceutical companies access to specialized manufacturing expertise and regulatory-compliant facilities, particularly in regions like Asia-Pacific that provide cost advantages.

This trend has been further spurred by the rising complexity of biopharmaceutical APIs requiring advanced technologies. Pharmaceutical companies can partner with reliable CMOs to scale production quickly while meeting rising demand while still upholding quality standards.

Active Pharmaceuticals Ingredient Market Research Scope and Analysis

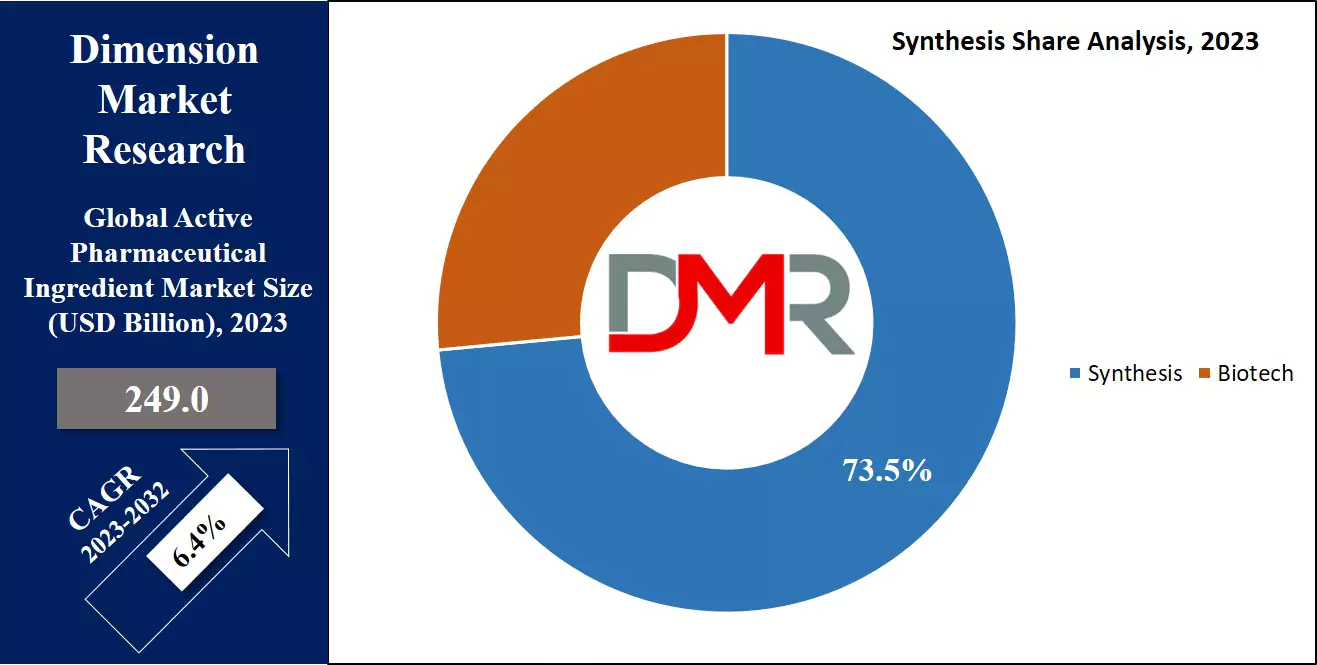

By Synthesis

Based on their synthesis, this segment is divided between synthetic APIs and biological APIs, where the synthetic APIs dominate this segment as they

hold 73.2% of the market share in 2023 and are projected to show subsequent growth in the forthcoming period of 2023 to 2032. Synthetic APIs dominate this segment due to their cost-effectiveness and streamlined manufacturing processes, which require less complex infrastructure compared to the production of biological APIs.

Synthetic APIs offer better scalability, as the chemical synthesis of these compounds can be easily and predictably scaled up, unlike the production of biological APIs, which may be constrained by the growth and behavior of living organisms. The synthetic process allows the manufacturers greater control over the composition and characteristics of the API, ensuring crucial consistency and predictability needed for pharmaceutical safety and efficacy.

Synthetic APIs often exhibit better stability than biological APIs as they have longer shelf life making them more suitable for pharmaceutical applications. While synthetic APIs have these advantages, the choice between synthetic and biological APIs depends on the specific requirements of the drug and its intended therapeutic effects. In certain cases, the unique properties of biological APIs, such as closely mimicking natural molecules, may make them more suitable for specific pharmaceutical applications.

By Manufacturers

Regarding manufacturers, Captive APIs dominate this segment as they hold the highest market share in 2023 and are expected to show subsequent growth in the upcoming 2023 to 2032. Captive APIs, dominate this segment as they give the manufacturer complete control over how their products integrate with other systems, ensuring a consistent and high-quality user experience.

This control over manufacturers' product quality also enhances security and compliance with industry regulations as it ensures a seamless user experience and compliance with industry standards. Monetization through controlled access can be a significant revenue stream, while quality assurance is maintained by limiting access to predefined features.

Captive APIs protect innovative technologies from exploitation by competitors, and their uniform use contributes to brand consistency across platforms. Moreover, manufacturers can efficiently focus on supporting a controlled set of integrations, reducing the resource-intensive nature of technical support and maintenance.

By Type

In the pharmaceutical industry, innovative APIs hold the dominant position compared to generic APIs, primarily due to several key factors patent protection grants exclusive rights to pharmaceutical companies for the production and sale of drugs associated with innovative APIs.

This exclusivity allows companies to recover research and development investments and fosters ongoing innovation. The higher profit margins associated with innovative APIs provide strong financial support to companies to invest in research and development, contributing to their market dominance.

The significant investment in research and development is a crucial driver for the prevalence of innovative APIs, involving substantial resources and efforts to discover novel compounds, conduct trials, and obtain regulatory approvals.

Innovative APIs are often linked to therapeutic advancements, offering improved efficacy, reduced side effects, or novel treatment approaches. The associated market exclusivity granted by regulatory agencies further solidifies the dominance of innovative APIs, restricting generic competitors from entering the market during specific periods.

Additionally, brand recognition plays a pivotal role, as innovative APIs are often marketed under recognizable brand names, establishing trust and preference among healthcare professionals and patients. While generic APIs become crucial after patent expirations for more affordable options, the dominance of innovative APIs is grounded in their association with cutting-edge research, therapeutic advancements, and the financial incentives provided by patent protection and higher profit margins.

By Application

The dominance of cardiovascular diseases inside the active pharmaceutical element (API) market is pushed with the aid of diverse significant factors inclusive of this sickness exhibits a high international incidence, encompassing situations like hypertension, coronary artery disease, and coronary heart failure, generating a consistent demand for prescription drugs, which includes APIs tailored for cardiovascular medications.

The chronic nature of cardiovascular illnesses, requiring long-term management, contributes to a sustained and enduring need for cardiovascular medicines, thereby fostering an ongoing call for APIs within this healing domain.

The diversity of medicines used in cardiovascular treatment, starting from anticoagulants to beta-blockers, creates a multifaceted and robust marketplace for APIs. Lifestyle factors which include negative living conditions, dietary conduct, and increasing strain levels contribute to the escalating prevalence of cardiovascular illnesses, sustaining the call for cardiovascular medicines and their related APIs.

Significant research and innovation inside the cardiovascular section caused the development of the latest and stepped-forward pills, encouraging pharmaceutical agencies to put money into novel compounds and formulations, consequently riding the demand for APIs.

The getting old worldwide population, with age, being a sizeable hazard factor for cardiovascular situations, similarly amplifies the superiority of those illnesses, contributing to a heightened demand for cardiovascular medications and APIs.

In other words, the cardiovascular phase remains a dominant and essential component of the API market, reflecting the persistent need for effective medicinal drugs to address the full-size and complicated challenges posed by cardiovascular sicknesses.

The Active Pharmaceutical Ingredient Market Report is segmented based on the following:

By Synthesis

- Synthetic APIs

- Biological APIs

- Monoclonal Antibodies

- Recombinant Proteins

- Vaccines

By Manufacturer

- Captive APIs

- Merchant APIs

- Generic APIs

- Innovative APIs

By Type

- Generic APIs

- Innovative APIs

By Application

- Cardiovascular Diseases

- Oncology

- Orthopedic

- Pulmonology

- Nephrology

- Ophthalmology

- Others

How Does Artificial Intelligence Contribute To Improve Active Pharmaceuticals Ingredient Market ?

- Accelerated Drug Discovery and API Design: AI algorithms analyze massive datasets to identify novel drug compounds and predict potential API candidates faster than traditional methods, reducing R&D time and cost.

- Predictive Modeling for Chemical Synthesis: AI can model and simulate complex chemical reactions, identifying optimal synthesis routes for APIs. This improves yield, efficiency, and cost-effectiveness of production.

- Quality Control and Assurance: AI-powered computer vision and machine learning systems help in real-time monitoring of API manufacturing processes, ensuring consistent quality and compliance with GMP (Good Manufacturing Practice) standards.

- Process Automation and Optimization: AI helps automate manufacturing workflows, from raw material management to final API production, improving scalability, reducing human error, and optimizing resource usage.

- Predictive Maintenance in Manufacturing Plants: AI enables predictive maintenance of API production equipment by analyzing operational data, reducing downtime, and extending equipment life.

- Regulatory Compliance Support: AI tools assist in regulatory document preparation, data integrity checks, and audit readiness, streamlining FDA/EMA approvals and reducing compliance risks.

- Market and Demand Forecasting: AI-driven analytics predict market trends, API demand, and pricing fluctuations, helping companies plan inventory and production schedules efficiently.

Active Pharmaceuticals Ingredient Market Regional Analysis

North America commands the world market for Active Pharmaceutical Ingredient (API), which

holds 40.0% of the global share in 2023 and is on course to continue this trend during future years. One of the most important things to note in this area is the high growth rate of chronic diseases like cardiovascular disease, diabetes cancer, and neurological disorders.

This health environment drives the demand for pharmaceuticals, notably, those APIs required in producing drugs used to treat chronic conditions. Government policies in North America strategically emphasize the use of generic drugs to minimize healthcare costs, thereby fostering the production and consumption of APIs, integral to generic medication formulations.

Furthermore, North America exhibits a robust demand for specialty drugs and biologics, intricate pharmaceuticals vital for treating chronic and rare diseases. Manufacturing procedures for these drugs utilize high-tech approaches to the production of API.

Further, significant advances in the technologies used for pharmaceutical manufacturing processes and huge investments put into researching and developing them lead to ensuring North America is at the pinnacle of producing APIs using innovative technology.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Active Pharmaceuticals Ingredient Market Competitive Landscape

The Active Pharmaceutical Ingredient (API) market is characterized by a dynamic and diverse competitive landscape, featuring industry leaders like AbbVie Inc., Teva Pharmaceutical Industries Ltd., and Mylan N.V. These companies, known for their advanced technology and extensive product range, strategically prioritize API production.

They form alliances with local partners to make certain a strong uncooked fabric supply, reinforcing their market dominance. Key players include Cipla Inc., Biocon, Amgen Inc., Dr. Reddy’s Laboratories Ltd, and Sun Pharmaceutical Industries Ltd .

API market works within a very complicated landscape where drug patents expire allowing increased outsourcing due to high production cost as well regulations are strict in nature. Major gamers in this marketplace prioritize launching new products for marketplace sustenance, exemplified by Teva Pharmaceutical and MEDinCell receiving FDA approval in August 2021 for a brand-new drug to treat schizophrenia.

Legal issues, as faced by Dr. Reddy's Laboratories and Eli Lilly and Company in 2020, have relatively slowed down the established order of new API centers. Established gamers, like Pfizer, maintain dominance via comprehensive product offerings and strategic strategies, which include partnerships and acquisitions.

Some of the prominent players in the Global Active Pharmaceuticals Ingredient Market are:

- Merck & Co. Inc.

- AbbVie Inc

- Bristol-Myers Squibb Company

- Boehringer Ingelheim International GmbH

- Cipla Inc.

- Teva Pharmaceutical Industries Ltd.

- Albemarle Corporation

- Viatris Inc.

- Aurobindo Pharma

- Sun Pharmaceutical Industries Ltd.

- Dr. Reddy’s Laboratories Ltd.

- Other Key Players

COVID-19 Pandemic & Recession: Impact on the Global Active Pharmaceuticals Ingredient Market

To a significant extent, the COVID-19 pandemic and related monetary recession have shaped the global API markets. Supply chain interruptions caused by the lockdowns and travel bans resulted in difficulties obtaining reliable delivery of APIs, especially at places outside their country, relying heavily on imports. The fast-paced need for niche pharmaceuticals, including the ones utilized in treating COVID-19 patients led to market growth. Moreover, regulatory methods were also affected probably slowing down manufacturing and approval of APIs.

The monetary recession delivered adjustments in call for, pricing pressures, and delays in planned expansions for API manufacturers. The pandemic elevated virtual transformation in the pharmaceutical area, emphasizing efficiency, high-quality control, and remote tracking. Global collaboration multiplied, fostering resilience and preparedness for future challenges.

Active Pharmaceuticals Ingredient Market Recent Developments

- In April 2023, Aurobindo Pharma approved the transfer of two API units (Unit V and XVII) to its wholly-owned subsidiary Apitoria Pharma Private Limited.

- In January 2023, Novartis divested its lively pharmaceutical component (API) manufacturing plant in Ringaskiddy, Ireland, to Sterling Pharma Solutions. Despite the sale, Novartis keeps the production of diverse APIs for cardiovascular, immunology, and oncology drugs on the Ringaskiddy facility.

- In 2023, 51 Indian pharmaceutical companies were approved for the Production Linked Incentive (PLI) Scheme which aims to reduce dependence on imported ingredients, particularly from China. PLI scheme extends incentives for 41 products over six years.

Active Pharmaceuticals Ingredient Market Report Details

| Report Characteristics |

| Market Size (2023) |

USD 249.0 Bn |

| Forecast Value (2032) |

USD 446.6 Bn |

| CAGR (2023-2032) |

6.4% |

| Historical Data |

2017 – 2022 |

| Forecast Data |

2023 – 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Synthesis (Synthetic APIs and Biological APIs), By

Manufacturer (Captive APIs and Merchant APIs), By

Type (Generic APIs and Innovative APIs), By

Application (Cardiovascular Diseases, Oncology,

Orthopedic, Pulmonology, Nephrology,

Ophthalmology and Others. |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Merck & Co. Inc., AbbVie Inc., Bristol-Myers Squibb

Company, Boehringer Ingelheim International GmbH,

Cipla Inc., Teva Pharmaceutical Industries Ltd.,

Albemarle Corporation, Viatris Inc., Aurobindo

Pharma, Sun Pharmaceutical Industries Ltd., Dr.

Reddy’s Laboratories Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Active Pharmaceuticals Ingredient Systems Market size is estimated to have a value of USD

249.0 billion in 2023 and is expected to reach USD 436.6 billion by the end of 2032.

North America has the largest market share for the Global Active Pharmaceuticals Ingredient Market

with a share of about 40.0% in 2023.

Some of the major key players in the Global Active Pharmaceuticals Ingredient Market are Merck & Co.

Inc., AbbVie Inc., Bristol-Myers Squibb Company, Boehringer Ingelheim International GmbH, Cipla Inc.,

Teva Pharmaceutical Industries Ltd., Albemarle Corporation, Viatris Inc., Aurobindo Pharma, Sun

Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories Ltd., and many others.

The market is growing at a CAGR of 6.4 percent over the forecasted period.