Market Overview

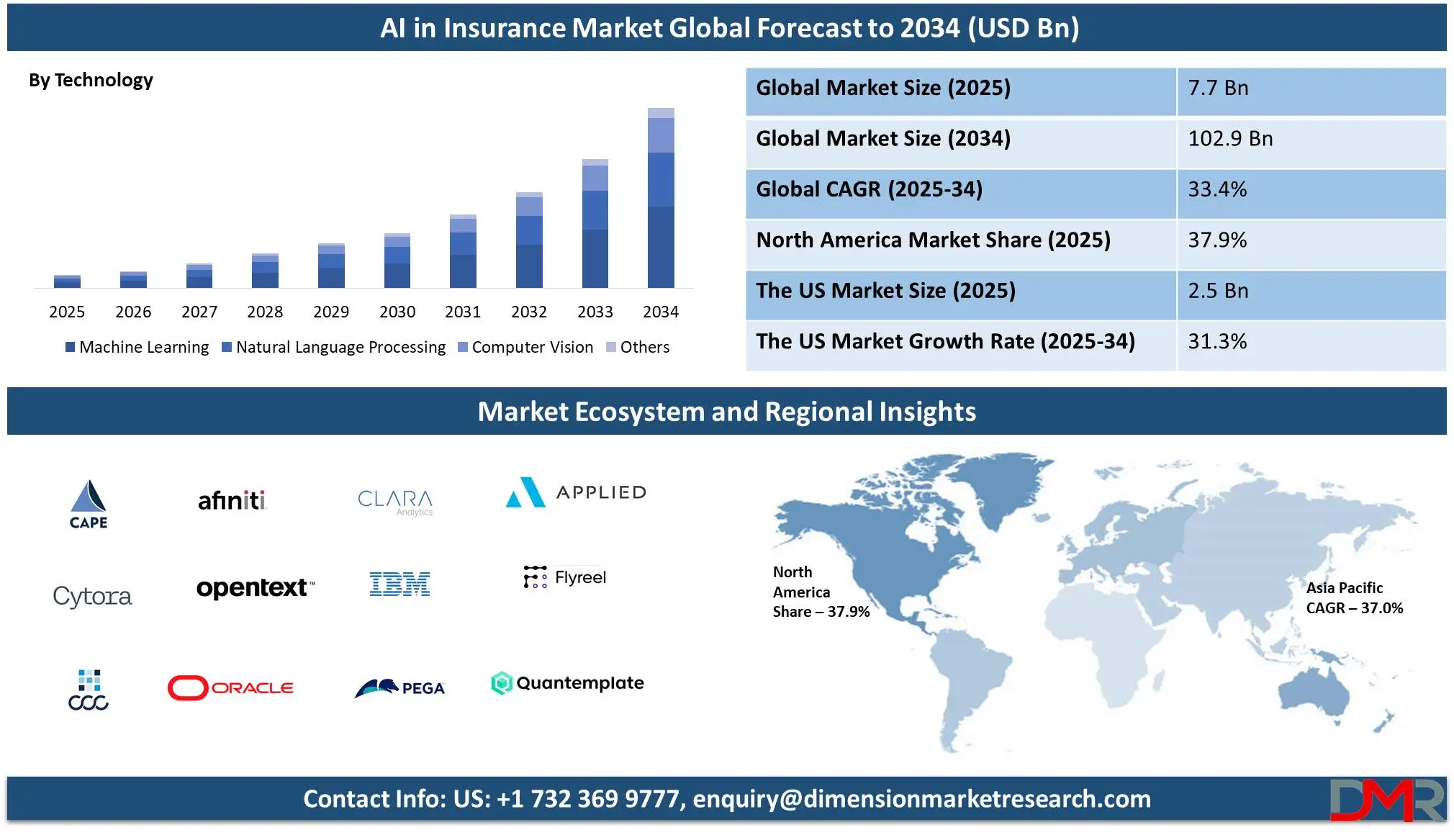

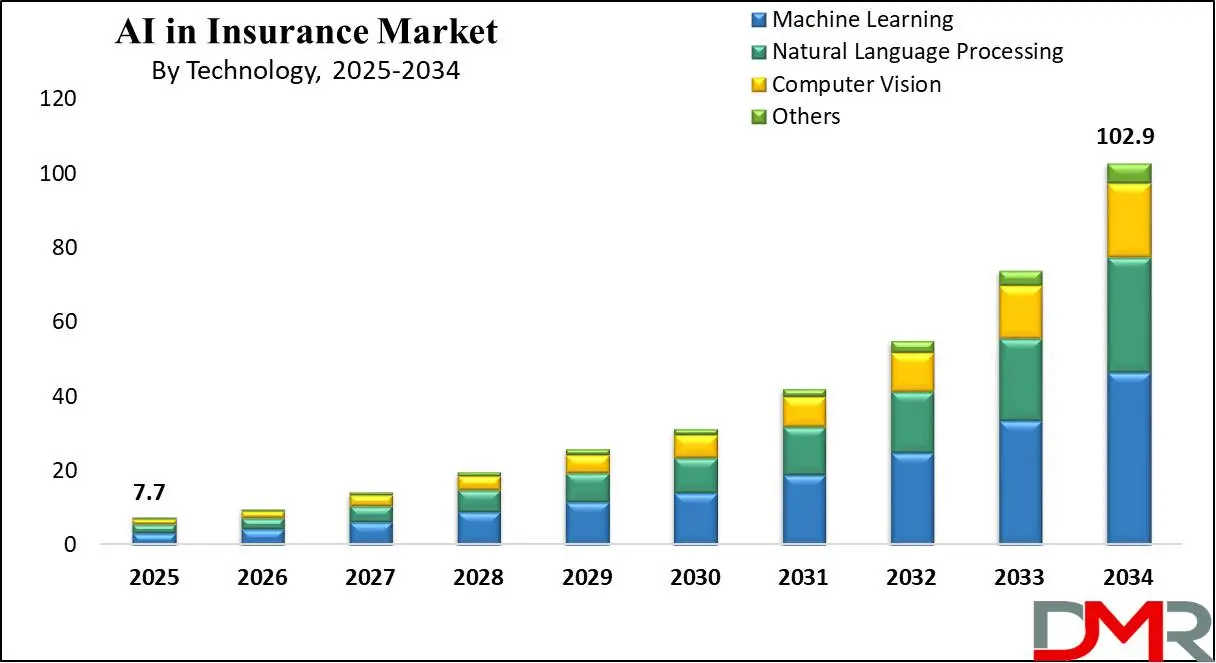

The Global Artificial Intelligence (AI) in Insurance Market is expected to be valued at

USD 7.7 billion in 2025 and is further anticipated to reach

USD 102.9 billion by 2034 at a

CAGR of 33.4%.

AI in Insurance refers to the integration of artificial intelligence technologies such as machine learning, natural language processing, computer vision, and robotic process automation into various functions within the insurance industry. AI is revolutionizing how insurers assess risk, underwrite policies, detect fraud, process claims, and engage with customers. By leveraging large datasets and advanced algorithms, AI enables insurers to make faster and more accurate decisions, automate repetitive tasks, and personalize customer interactions.

This leads to improved operational efficiency, reduced costs, and enhanced customer satisfaction. AI also empowers insurers to develop innovative products and services for evolving customer needs, making it a critical driver of digital transformation in the insurance sector. Similar AI applications are transforming other sectors, such as the

Artificial Intelligence in E-commerce Market, where AI enables personalized shopping experiences and smarter inventory management.

The Global Artificial Intelligence (AI) in Insurance Market refers to the growing application of Artificial Intelligence (AI) technologies across the insurance industry to automate processes, enhance decision-making, and improve customer experiences. AI in insurance encompasses a wide range of tools and technologies, including machine learning (ML), natural language processing (NLP), robotic process automation (RPA), computer vision, and predictive analytics.

These technologies are rapidly being used to streamline underwriting, claims processing, fraud detection, customer service, and risk assessment, leading to greater operational efficiency and reduced costs for insurers. As insurers seek to gain a competitive advantage, AI has emerged as a critical enabler of digital transformation in the sector—mirroring trends in sectors such as the

Artificial Intelligence in Transportation Market, where AI is enhancing logistics, safety, and autonomous vehicle development.

The market is characterized by rapid innovation and a shift towards data-driven insurance models. Insurers are now leveraging AI-powered platforms to analyze vast amounts of structured and unstructured data, including customer profiles, sensor data from IoT devices, satellite imagery, and social media feeds. By harnessing AI, insurers can offer personalized products, improve risk modeling, and make faster, more accurate claims decisions. This shift not only enhances customer satisfaction but also enables insurers to mitigate risks proactively.

The ability of AI to uncover hidden patterns in data and deliver real-time insights is transforming traditional insurance business models into agile and customer-centric ecosystems. AI adoption is also reshaping customer engagement across the insurance value chain. Insurtech firms and traditional insurers alike are deploying AI-powered chatbots, virtual assistants, and voice recognition systems to automate customer service and claims filing processes. These AI tools enable 24/7 customer interaction, reduce wait times, and resolve queries efficiently, thereby improving overall client satisfaction and loyalty.

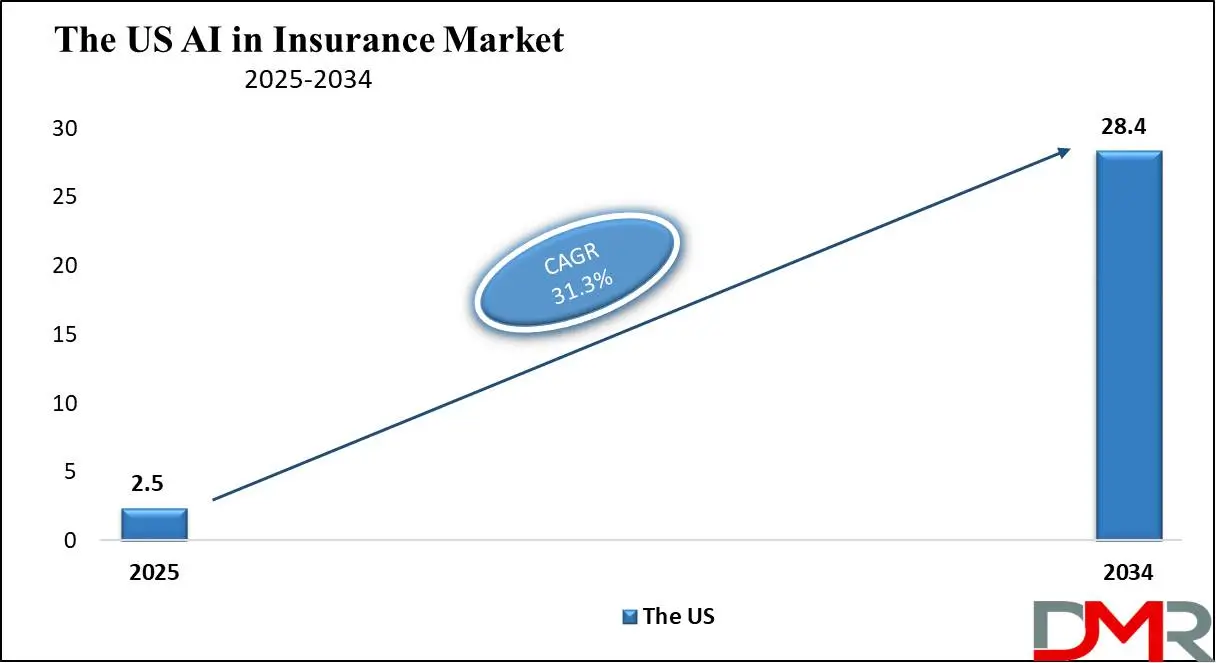

The US AI in Insurance Market

The US AI in Insurance Market is projected to be valued at USD 2.5 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 28.4 billion in 2034 at a CAGR of 31.3%.

The AI in Insurance market in the US is witnessing significant momentum as insurers across the country prioritize digital transformation to remain competitive and meet rising customer expectations. The U.S. insurance industry, being one of the largest and most mature globally, is leveraging AI to streamline complex processes such as claims management, underwriting, and customer service.

US insurers are deploying AI-powered tools, including predictive analytics and automation platforms, to improve speed and accuracy in decision-making. The adoption is further fueled by the growing availability of structured and unstructured data from sources like IoT devices, telematics, social media, and digital health records, enabling insurers to build more comprehensive risk profiles and enhance their product offerings.

In the US, AI is also playing a pivotal role in modernizing customer engagement strategies. This shift towards automated, AI-driven customer service models is helping US insurers reduce operational costs while enhancing customer satisfaction and loyalty. This transformation echoes across markets like the

Cyber Insurance Market, where AI is increasingly used to analyze cyber risk and support real-time policy adjustments.

Furthermore, the rising use of AI for hyper-personalized marketing campaigns and customized insurance products is allowing US insurers to tap into new customer segments and drive higher policyholder retention rates in a highly competitive market. The US market is also characterized by strong collaboration between traditional insurers and Insurtech startups.

The presence of a robust startup ecosystem in hubs like Silicon Valley, coupled with substantial venture capital investment, is driving AI innovation across the insurance value chain. Leading insurers are actively partnering with or acquiring AI-driven Insurtech firms to accelerate their digital initiatives and gain a competitive edge. This synergy between legacy players and technology innovators is shaping the future of the US insurance market by promoting agility and faster go-to-market strategies.

Global Artificial Intelligence (AI) in Insurance Market: Key Takeaways

- Market Value: The Global Artificial Intelligence (AI) in insurance market size is expected to reach a value of USD 102.9 billion by 2034 from a base value of USD 7.7 billion in 2025 at a CAGR of 33.4%.

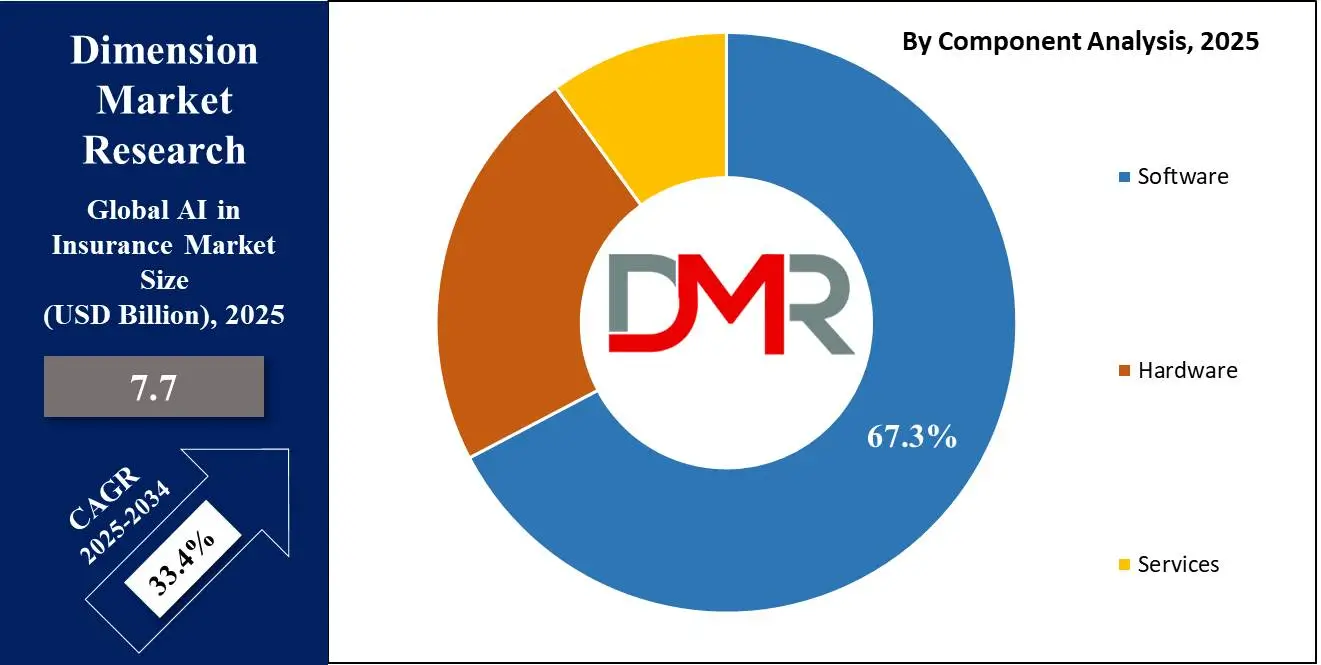

- By Component Type Segment Analysis: Software components are poised to consolidate their dominance in the component type segment capturing 67.3% of the total market share in 2025.

- By Technology Type Segment Analysis: Machine Learning technologies are anticipated to maintain their dominance in the technology type segment capturing 45.3% of the total market share in 2025.

- By Enterprise Size Type Segment Analysis: Large Enterprises are poised to consolidate their market position in the enterprise size type segment capturing 67.9% of the total market share in 2025.

- By Application Type Segment Analysis: Underwriting and Claims Assessment Management applications are expected to maintain their dominance in the application type segment capturing 31.3% of the total market share in 2025.

- Regional Analysis: North America is anticipated to lead the Global Artificial Intelligence (AI) in insurance market landscape with 37.9% of total global market revenue in 2025.

- Key Players: Some key players in the Global Artificial Intelligence (AI) in insurance market are Afiniti, Applied Systems, Bdeo, Cape Analytics, CCC Information Services, Clara Analytics, Cytora, Flyreel, FRISS, IBM Corporation, Kasko, Lemonade, Omnius, OpenText Corporation, Oracle Corporation, Pegasystems Inc, Planck, Quantemplate, Shift Technology, Snapsheet, Tractable, Zesty.ai, and Other Key Players.

Global Artificial Intelligence (AI) in Insurance Market: Use Cases

- AI-Driven Underwriting and Risk Assessment: Traditional underwriting often relies on manual data collection and historical risk models, which can be time-consuming and prone to human error. AI streamlines this process by automatically gathering and analyzing vast amounts of real-time data from diverse sources such as IoT devices, telematics, wearable health devices, and even satellite imagery. AI-powered algorithms assess customer risk profiles more accurately and in less time, enabling insurers to price policies more competitively and reduce exposure to high-risk clients.

- Automated and Accelerated Claims Processing: AI is revolutionizing the claims lifecycle by automating claim assessment, fraud detection, and settlement processes. Through the use of computer vision, insurers can process image and video evidence submitted by customers to automatically evaluate damage like in auto or property insurance. Machine learning models analyze historical claims data to predict the likelihood of claim approval and recommend the next steps to claims adjusters. This reduces human intervention, shortens settlement times, and improves customer experience.

- AI-Powered Fraud Detection and Prevention: AI enhances fraud prevention by using advanced pattern recognition and anomaly detection capabilities. AI systems are trained on large datasets of past claims and fraudulent cases, enabling them to flag unusual or suspicious patterns in real time. For instance, AI can detect inconsistencies in claim documentation, repetitive behavior by certain claimants, or irregularities in billing practices by healthcare providers. Natural Language Processing (NLP) is also used to analyze claim narratives and identify red flags.

- Personalized Customer Engagement and Product Recommendations: Insurers are deploying AI-driven recommendation engines to deliver insurance products based on individual customer preferences, risk profiles, and purchasing behavior. Using AI, insurers can segment customers more effectively and launch hyper-personalized marketing campaigns that resonate with specific demographics. Virtual agents and chatbots powered by NLP are also being used to provide instant customer support, answer queries, recommend policies, and even help customers adjust coverage in real time.

Global Artificial Intelligence (AI) in Insurance Market: Stats & Facts

- According to the National Association of Insurance Commissioners (NAIC), a recent survey revealed that 88.0% of auto insurers, 70% of home insurers, and 58% of life insurers are utilizing or exploring AI models in their operations.

- In December 2023, the National Association of Insurance Commissioners (NAIC) adopted the Model Bulletin on the Use of Artificial Intelligence Systems by Insurers. This bulletin provides a framework for insurers to ensure responsible AI deployment, emphasizing consumer protection and promoting fairness within the industry.

- The NAIC’s Third-Party Data and Models Task Force is addressing the growing use of AI systems and training data from third parties not regulated by state insurance departments, while also ensuring transparency and accuracy in AI-driven insurance decisions.

- The NAIC’s Big Data and Artificial Intelligence Working Group is actively conducting surveys across various insurance lines and releasing insights to inform AI-related regulatory approaches.

- Several states have adopted the NAIC Model Bulletin on the Use of Artificial Intelligence Systems by Insurers. For example, New Hampshire adopted Bulletin Docket #INS 24-011-AB on February 20, 2024, and New Jersey adopted Insurance Bulletin No. 25-03 on February 11, 2025. These adoptions reflect a growing trend among states to implement guidelines ensuring responsible AI use in the insurance industry.

- The National Conference of State Legislatures (NCSL) reports that the U.S. Office of Management and Budget (OMB) has issued guidance emphasizing ethical AI use, focusing on fairness, accountability, and transparency in federal agencies. Additionally, the AI Leadership to Enable Accountable Deployment Act proposes the creation of a Chief AI Officer Council to direct agencies' AI practices and ensure interagency coordination regarding AI.

- Furthermore, the OMB’s additional guidance in September 2024 outlines the role of Chief Artificial Intelligence Officers in managing AI risks, promoting innovation, and ensuring interagency collaboration for responsible AI technology deployment.

- The National Institute of Standards and Technology (NIST) released the “Artificial Intelligence Risk Management Framework: Generative Artificial Intelligence Profile” to promote safe AI technologies by addressing specific risks across AI platforms and prioritizing fairness, transparency, reliability, and accountability in AI systems.

Global Artificial Intelligence (AI) in Insurance Market: Market Dynamic

Global Artificial Intelligence (AI) in Insurance Market: Driving Factors

Surge in Data Generation and the Rise of Big Data Analytics

The widespread use of telematics, connected devices, smart homes, health wearables, and social media platforms has created a constant stream of structured and unstructured data that insurers can no longer ignore. This data-rich environment is pushing insurers to adopt AI-driven solutions to make sense of large, complex datasets.

AI technologies, particularly machine learning and predictive analytics, empower insurers to convert raw data into actionable insights. For example, real-time driving behavior data from telematics devices helps auto insurers build accurate risk models, while health insurers use biometric data to personalize wellness programs and premiums. This growing dependence on data-driven decision-making is accelerating AI adoption globally, as insurers recognize that traditional methods cannot match the speed and depth of insights AI provides.

Increasing Demand for Operational Efficiency and Cost Optimization

AI-powered automation tools, such as robotic process automation (RPA) and intelligent document processing, are being widely implemented to handle repetitive and time-intensive tasks like claims intake, policy issuance, and compliance checks. This shift enables insurers to reallocate human resources to more complex and value-adding activities, driving productivity and reducing turnaround times.

Moreover, AI-driven platforms help insurers minimize error rates and operational risks, further lowering administrative and claims processing costs. With global competition intensifying and customer expectations rising for faster, more seamless interactions, the drive for operational efficiency is a critical catalyst compelling insurers to integrate AI across various touchpoints of their businesses.

Global Artificial Intelligence (AI) in Insurance Market: Restraints

Data Privacy and Regulatory Challenges

Insurers heavily rely on AI to process sensitive customer information, including personal health data, financial records, and behavioral patterns. However, with growing scrutiny from regulatory bodies and the introduction of stringent data protection laws such as the General Data Protection Regulation (GDPR) in Europe and similar frameworks in other regions, insurers face significant legal and compliance risks. Mishandling or unauthorized use of customer data can result in hefty penalties, reputational damage, and erosion of customer trust. Furthermore, AI algorithms, particularly those that function as "black boxes," can lack transparency, making it difficult for insurers to explain AI-driven decisions to regulators or customers.

High Implementation Costs and Legacy System Integration

Many traditional insurers still rely on outdated IT infrastructure and siloed data systems that are not designed to support advanced AI applications. Upgrading or replacing these legacy systems to accommodate AI-powered solutions often requires substantial capital, time, and technical expertise.

Additionally, AI implementation involves costs related to data management, acquiring skilled AI talent, training models, and maintaining AI systems post-deployment. For small and mid-sized insurers, these financial and technical barriers can delay AI adoption or limit its scope to specific business functions. The challenge of aligning AI technologies with rigid legacy platforms further compounds the issue, slowing down the full realization of AI's benefits in streamlining workflows and improving customer engagement.

Global Artificial Intelligence (AI) in Insurance Market: Opportunities

Expansion of AI-Powered Insurance in Emerging Markets

Many countries in Asia Pacific, Latin America, and Africa are witnessing rapid digitalization and rising demand for affordable and accessible insurance solutions. AI can help insurers design microinsurance products and usage-based insurance models for populations traditionally excluded from mainstream insurance offerings.

Through AI-driven mobile platforms and automated customer onboarding processes, insurers can reach remote and low-income customers more efficiently. Additionally, AI can optimize risk assessment in regions where historical data may be scarce by utilizing alternative data sources such as mobile usage patterns, weather forecasts, and geospatial data. The growing smartphone penetration and improving digital infrastructure in these emerging markets create a fertile ground for insurers to leverage AI and expand their footprint while addressing the protection gap.

Growth of AI in Climate and Catastrophe Risk Modeling

The evolving risk landscape presents a significant opportunity for AI adoption in catastrophe risk modeling and climate analytics. AI algorithms can process massive amounts of climate data, satellite imagery, and environmental trends to predict the potential impact of extreme weather events such as hurricanes, floods, and wildfires. Insurers can use these insights to enhance property risk assessments, adjust underwriting guidelines, and price premiums more accurately.

Additionally, AI can help insurers design parametric insurance products, which offer faster payouts based on predefined triggers like weather thresholds. As insurers look to strengthen their resilience against climate risks and better serve policyholders affected by natural disasters, AI’s role in this domain is set to become critical.

Global Artificial Intelligence (AI) in Insurance Market: Trends

Rise of AI-Powered Hyperpersonalization in Insurance

AI plays a pivotal role in enabling this shift by analyzing large datasets, including customer preferences, purchasing behaviors, lifestyle choices, and real-time usage patterns. Advanced recommendation engines and AI-driven analytics tools help insurers craft highly customized policies and communication strategies. For example, in health insurance, AI can suggest wellness programs or coverage add-ons based on an individual's fitness data or medical history. This trend of hyperpersonalization is not only boosting customer satisfaction but also improving retention rates, as policyholders value the relevance and responsiveness of AI-enabled offerings.

Integration of AI with Blockchain for Enhanced Transparency

By combining AI’s decision-making capabilities with blockchain’s decentralized and immutable ledger, insurers are building systems that enhance security and automate contract execution through smart contracts. AI algorithms can process claims data, assess risks, and trigger automated payouts by blockchain-based smart contracts without the need for manual intervention.

This integration streamlines processes, reduces fraudulent claims, and ensures traceable audit trails. Furthermore, blockchain enhances customer trust by giving policyholders greater visibility into how their data is being used and how claims decisions are made. This AI-blockchain synergy is gaining momentum, especially in sectors like parametric insurance and reinsurance, where fast, verifiable transactions are critical.

Research Scope and Analysis

By Component Analysis

In the component type segment of the AI in insurance market, software solutions are expected to maintain a commanding position, accounting for approximately 67.3% of the total market share in 2025. This dominance is largely attributed to the rising adoption of AI-powered platforms and applications that support a variety of insurance processes such as underwriting, claims automation, fraud detection, customer engagement, and risk analytics. Insurers globally are investing heavily in AI-driven software tools such as predictive analytics engines, machine learning algorithms, natural language processing frameworks, and robotic process automation.

These software solutions enable insurers to streamline operations, reduce costs, and deliver highly personalized products to their clients. Furthermore, the growing integration of cloud-based AI solutions offers scalability and flexibility, allowing insurers to deploy advanced capabilities across multiple business functions without the need for heavy on-premises infrastructure.

The hardware segment also plays a crucial supporting role in the deployment of AI in insurance. This segment includes physical components such as high-performance servers, data storage systems, and networking equipment necessary to process and manage the large volumes of data that AI algorithms require. The hardware segment is experiencing steady growth as insurers and technology providers invest in robust IT infrastructure to support AI applications, especially for on-premises and hybrid cloud environments.

In addition, specialized hardware, including AI-optimized chips and GPUs, is becoming more important as insurers adopt advanced machine learning models and deep learning frameworks that demand significant computing power. While the hardware segment may not match the software segment in terms of market share, its relevance is growing, particularly as insurers require faster processing speeds and more secure environments to handle sensitive customer data and AI workloads efficiently.

By Technology Analysis

Within the technology-type segment of the AI in insurance market, machine learning is expected to retain its leading position, securing approximately 45.3% of the total market share in 2025. The continued dominance of machine learning stems from its ability to analyze vast amounts of structured and unstructured data, recognize patterns, and generate predictive insights that directly influence decision-making in the insurance sector.

Insurers are leveraging machine learning models for critical processes such as dynamic pricing, fraud detection, risk assessment, customer segmentation, and claims automation. These models enable insurers to make faster and more accurate predictions about customer behavior and potential risks, leading to improved underwriting precision and more efficient claims handling. Moreover, machine learning is pivotal in enabling usage-based insurance models, where premiums are adjusted in real time based on customer behavior, such as driving patterns or health metrics.

Alongside machine learning, natural language processing is emerging as a vital technology within this segment, playing an essential role in transforming how insurers interact with customers and process vast amounts of textual data. Natural language processing facilitates the automation of customer support through chatbots and virtual assistants, enabling insurers to provide 24/7 service, handle policy inquiries, and guide customers through the claims filing process without human intervention.

Additionally, NLP helps insurers process large volumes of unstructured data from claims documents, customer emails, and legal contracts, extracting key information to improve decision-making and streamline back-office operations. Insurers are also utilizing NLP to detect sentiment and intent within customer communications, helping to personalize interactions and improve customer satisfaction.

By Enterprise Size Analysis

In the enterprise size segment of the AI in insurance market, large enterprises are projected to dominate the landscape, securing approximately 67.9% of the total market share in 2025. This stronghold is largely due to the substantial financial and technological resources that large insurance corporations possess, enabling them to invest heavily in advanced AI-driven solutions. These enterprises are typically characterized by vast customer bases, complex business operations, and a wide range of product offerings, all of which necessitate sophisticated AI applications to optimize efficiency and maintain competitiveness.

Large insurers are deploying AI technologies across various functions such as claims automation, predictive analytics, fraud detection, and customer personalization. Furthermore, large enterprises often have legacy systems and vast datasets that require robust AI solutions to unlock actionable insights. The ability of these organizations to undertake large-scale digital transformation initiatives, integrate AI into core business processes, and partner with leading AI vendors ensures that they remain at the forefront of AI adoption in the insurance sector.

SMEs are also contributing to the global market, as their role is becoming more significant in cloud-based AI solutions and Software-as-a-Service (SaaS) models lowering the barriers to entry for advanced technology adoption.

Many SMEs are turning to AI to gain competitive advantages in niche insurance segments or regional markets where agility and customer-centricity are key differentiators. By leveraging AI-driven tools, such as chatbots, automated underwriting platforms, and basic fraud detection systems, SMEs can enhance operational efficiency, reduce overhead costs, and offer personalized products to their target customer base.

Additionally, as regulatory compliance becomes more complex and customer expectations shift towards faster and more transparent services, SMEs are using AI to modernize their workflows and improve client satisfaction. While constrained by limited budgets compared to larger players, SMEs are adopting flexible, scalable AI solutions to carve out space in a highly competitive insurance marketplace.

By Application Analysis

In the application segment of AI in the insurance market, underwriting and claims assessment management are expected to retain a dominant position, accounting for approximately 31.3% of the total market share in 2025. The prominence of this segment is driven by the pressing need for insurers to streamline core operational processes, improve decision accuracy, and reduce time-consuming manual tasks.

AI technologies are being extensively integrated into underwriting processes to evaluate risks more precisely by analyzing large datasets, including historical claims, customer behavior, and external market conditions. By automating much of the underwriting workflow, insurers can offer faster policy approvals and dynamic pricing models designed for individual risk profiles.

Similarly, in claims assessment, AI-powered tools are significantly enhancing efficiency by automating document verification, image recognition for damage estimation, and predictive analytics to forecast claim outcomes. These advancements not only shorten claim settlement cycles but also reduce operational costs while improving customer satisfaction by delivering quicker resolutions. Fraud detection and credit analysis also play critical roles in the AI-driven transformation of the global insurance market.

Fraud detection is majorly becoming a key focus area as insurers face rising incidents of fraudulent claims, which can severely impact profitability. AI-powered fraud detection systems use machine learning algorithms to identify unusual patterns and anomalies in claims data that might indicate potential fraud. These systems continuously learn from historical data and evolve to detect both traditional and emerging fraud schemes, improving the accuracy and speed of investigations. Additionally, AI enables real-time monitoring and risk scoring of claims, allowing insurers to flag suspicious activities early and reduce financial losses.

The AI in Insurance Market Report is segmented on the basis of the following:

By Component

- Software

- Hardware

- Service

By Technology

- Machine Learning

- Natural Language Processing

- Computer Vision

- Others

By Enterprise Size

By Application

- Underwriting and Claims Assessment

- Fraud Detection and Credit Analysis

- Customer Profiling and Segmentation

- Product and Policy Design

- Others

Global Artificial Intelligence (AI) in Insurance Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to maintain its leadership position in the Global Artificial Intelligence (AI) in insurance market, accounting for approximately

37.9% of the total market revenue in 2025. This dominance is largely attributed to the region's advanced digital infrastructure and the widespread adoption of cutting-edge technologies across the insurance industry. The United States, in particular, is home to a large number of prominent insurance companies and insurtech firms that are actively investing in AI-driven solutions to enhance operational efficiency, improve customer experience, and gain a competitive edge.

The region benefits from a well-established regulatory framework and a high level of consumer awareness regarding digital insurance offerings, which is fostering the rapid deployment of AI technologies in various business processes such as claims processing, underwriting, customer service, and fraud detection.

Additionally, North America is experiencing a surge in partnerships between traditional insurers and AI technology providers, aimed at accelerating innovation and addressing evolving customer expectations. The growing integration of AI-powered tools such as chatbots, machine learning platforms, predictive analytics, and natural language processing solutions is helping insurers in the region streamline workflows and reduce operational costs.

Region with the Highest CAGR

Asia Pacific is expected to register the highest compound annual growth rate (CAGR) in the Global Artificial Intelligence (AI) in insurance market in 2025. This accelerated growth is driven by the region’s rapid digital transformation, expanding middle-class population, and growing demand for more efficient and customer-centric insurance services.

Countries such as China, India, Japan, and South Korea are witnessing significant investments in insurtech and AI-enabled platforms, with insurers seeking to modernize their operations and meet the evolving needs of digitally savvy consumers. The widespread adoption of mobile technologies, coupled with high internet penetration across urban and rural areas, is creating an environment conducive to the expansion of AI-powered insurance solutions.

Additionally, the insurance industry in Asia Pacific is evolving quickly, spurred by favorable government initiatives and regulatory reforms aimed at encouraging digital innovation in the financial services sector. Insurers in the region are majorly turning to AI-driven tools to address critical business functions such as automated underwriting, fraud detection, claims processing, and customer engagement.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Artificial Intelligence (AI) in Insurance Market: Competitive Landscape

The global competitive landscape of the AI in insurance market is characterized by a dynamic mix of established multinational corporations, niche insurtech startups, and technology service providers. Traditional insurance giants are aggressively investing in AI technologies to modernize legacy systems, reduce operational costs, and stay ahead of evolving customer expectations.

These players are leveraging AI for critical functions such as automated underwriting, predictive analytics, virtual assistants, and fraud detection to enhance efficiency and improve customer retention. Major global insurers are also engaging in strategic partnerships and collaborations with AI vendors and fintech firms to co-develop advanced AI-driven solutions, further intensifying the competition within the market.

Alongside these established players, the market is witnessing the rapid rise of insurtech startups specializing in AI-powered platforms designed for specific insurance applications. These agile companies are introducing innovative products such as AI-based risk assessment models, digital claims processing platforms, and customer engagement solutions designed to disrupt traditional insurance workflows. Their ability to deliver flexible and customer-centric solutions at competitive costs is attracting attention from insurers seeking to accelerate their digital transformation efforts.

Some of the prominent players in the Global Artificial Intelligence (AI) in Insurance are:

- Afiniti

- Applied Systems

- Bdeo

- Cape Analytics

- CCC Information Services

- Clara Analytics

- Cytora

- Flyreel

- FRISS

- IBM Corporation

- Kasko

- Lemonade

- Omnius

- OpenText Corporation

- Oracle Corporation

- Pegasystems Inc

- Planck

- Quantemplate

- Shift Technology

- Snapsheet

- Tractable

- Zesty.ai

- Other Key Players

Global Artificial Intelligence (AI) in Insurance Market: Recent Developments

- February 2025: Verily, Alphabet's life sciences division, agreed to sell its insurance subsidiary, Granular, to Elevance Health. Granular specializes in stop-loss insurance, utilizing data science to assist self-funded employers in managing medical expenses.

- December 2024: Arthur J. Gallagher & Co. acquired AssuredPartners for USD 13.45 billion. AssuredPartners, an insurance broker, has integrated AI-driven solutions to enhance its service offerings.

- October 2024: Howden, a global insurance group, acquired Arctic Insurance AS, a rapidly growing insurance broker based in Oslo. This move is part of Howden's broader strategy to boost its influence in the Nordic region, focusing investment in local expertise and delivering global capabilities to clients within regional markets.

- October 2023: Applied Systems, a leading global provider of insurance software, acquired Planck, an AI company specializing in insurance solutions. This acquisition aims to enhance Applied's AI capabilities, accelerating their vision for the next generation of the digital insurance lifecycle and creating more value at each stage of the insurance process.

- August 2023: Eldridge Industries' subsidiary, Zinnia (formerly SE2), acquired Policygenius, an online insurance marketplace. This acquisition is part of Zinnia's strategy to bolster its end-to-end insurance software offerings and enhance its AI capabilities within the insurance industry.

- June 2023: Gradient AI, a Boston-based enterprise software provider specializing in artificial intelligence solutions for the insurance industry, secured USD 56.1 million in Series C funding led by Centana Growth Partners. This investment aims to enhance Gradient AI's capabilities in improving loss ratios and profitability for insurers by predicting underwriting and claims risks with greater accuracy.

- April 2023: Sapiens International Corporation, a global software solution provider, partnered with Microsoft to harness the power of generative artificial intelligence in the insurance industry. This collaboration aims to pioneer AI-driven solutions to enhance customer experience and productivity within the insurance sector.

- February 2023: AXA partnered with Microsoft to develop an internal generative AI solution, leading to the creation of AXA Secure GPT. This tool, based on ChatGPT and hosted internally on Microsoft's Azure Open AI technology, ensures data security while enhancing customer service and operational efficiency.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 7.7 Bn |

| Forecast Value (2034) |

USD 102.9 Bn |

| CAGR (2025-2034) |

33.4% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 2.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Software, Hardware, and Services), By Technology (Machine Learning, Natural Language Processing, Computer Vision, and Others), By Enterprise Size (Large Enterprises and SMEs), By Application ( Fraud Detection and Credit Analysis, Customer Profiling and Segmentation, Product and Policy Design, Underwriting and Claims Assessment, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Afiniti, Applied Systems, Bdeo, Cape Analytics, CCC Information Services, Clara Analytics, Cytora, Flyreel, FRISS, IBM Corporation, Kasko, Lemonade, Omnius, OpenText Corporation, Oracle Corporation, Pegasystems Inc, Planck, Quantemplate, Shift Technology, Snapsheet, Tractable, Zesty.ai, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Artificial Intelligence (AI) in insurance market size is estimated to have a value of USD 7.7 billion in 2025 and is expected to reach USD 102.9 billion by the end of 2034.

The US AI in insurance market is projected to be valued at USD 2.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 28.4 billion in 2034 at a CAGR of 31.3%.

North America is expected to have the largest market share in the Global Artificial Intelligence (AI) in insurance market with a share of about 37.9% in 2025.

Some of the major key players in the Global Artificial Intelligence (AI) in insurance market are Afiniti, Applied Systems, Bdeo, Cape Analytics, CCC Information Services, Clara Analytics, and many others.

The market is growing at a CAGR of 33.4 percent over the forecasted period.