A distribution transformer is an essential component in the power delivery chain. It is used to reduce the high voltage of electricity received from transmission lines to a lower voltage suitable for residential and commercial use. Positioned near end-users, these transformers ensure the safe and efficient supply of electricity to homes, offices, and industries.

The distribution transformer market includes all activities related to the production, sale, and deployment of these units, involving manufacturers, energy providers, and government bodies working together to enhance power infrastructure. The market also aligns with connected systems such as power transformers, uninterruptible power supply (UPS), and energy storage technologies, which help improve electricity reliability.

The global demand for distribution transformers continues to rise as countries invest in strengthening their electricity networks. This market is especially crucial in the context of energy reliability, electrification in rural areas, and the growing emphasis on renewable energy sources.

By modernizing distribution systems, utilities can reduce power losses and improve overall efficiency. The integration of smart grid analytics, smart demand response, and virtual power plant solutions highlights the need for robust and adaptable power infrastructure, making distribution transformers a priority for both developed and developing economies.

In 2025, growth opportunities in the distribution transformer market will be driven by the replacement of aging equipment and the need for smart energy systems. Big players like ABB, Siemens, and Schneider Electric are pushing technological boundaries by launching energy-efficient and digitally enabled transformers.

These companies are also offering advanced monitoring and diagnostics services that appeal to utilities aiming to reduce operational costs, while related infrastructure, such as generators, diesel generators, and portable generators, continues to support backup requirements.

At the same time, new and small-scale businesses can tap into regional opportunities by offering localized, cost-effective solutions. Many governments are supporting grid modernization projects, which create entry points for startups and local suppliers.

Companies that can provide innovative materials, flexible production, or after-sales services like transformer maintenance and performance analytics will be well-positioned to grow. The market also benefits from parallel investments in manufacturing automation, heavy construction equipment, and industrial distribution projects, particularly in the Kingdom of Saudi Arabia (KSA) Energy sector and Asia-Pacific economies.

Several key trends are reshaping the distribution transformer market. One of the most notable is the shift toward smart transformers equipped with IoT-based sensors for real-time monitoring, integrating with smart lighting and smart home systems.

These smart systems can help identify potential faults before they lead to failures, saving both time and money for utility providers. Another trend is the focus on energy efficiency, with new units delivering lower power losses compared to older models.

To highlight this, the U.S. electric utility sector consumed around 1.3 million distribution transformers in 2022, according to the EIA. Additionally, the Canadian Electricity Association reported that older systems lost 5%–7% of electricity, while new transformer models reduced that figure to under 2.5%.

These improvements not only lower energy bills but also support environmental goals through green technology & sustainability initiatives and solar panel recycling projects. The growing adoption of photovoltaic and building-integrated photovoltaic (BIPV) systems further drives the need for advanced transformers, while future applications in electrified roads and 5G fixed wireless access networks emphasize their role in modern power grids.

Key Takeaways

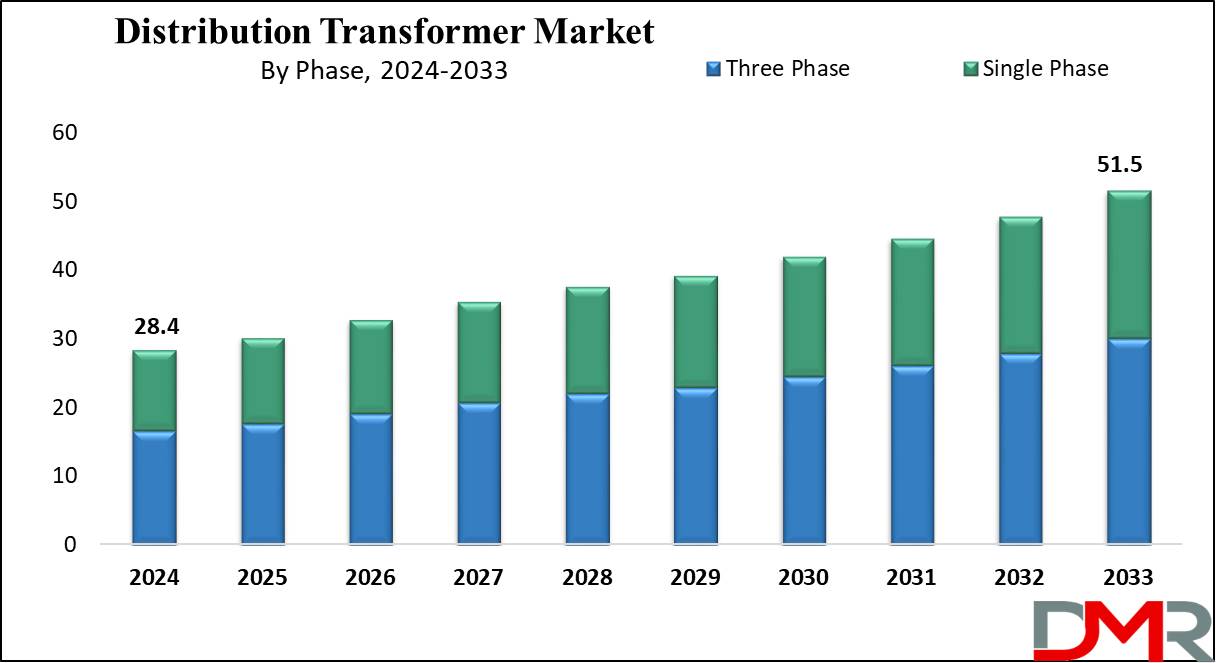

- Market Growth: The Distribution Transformer Market size is expected to grow by 21.4 billion, at a CAGR of 6.9% during the forecasted period of 2025 to 2033.

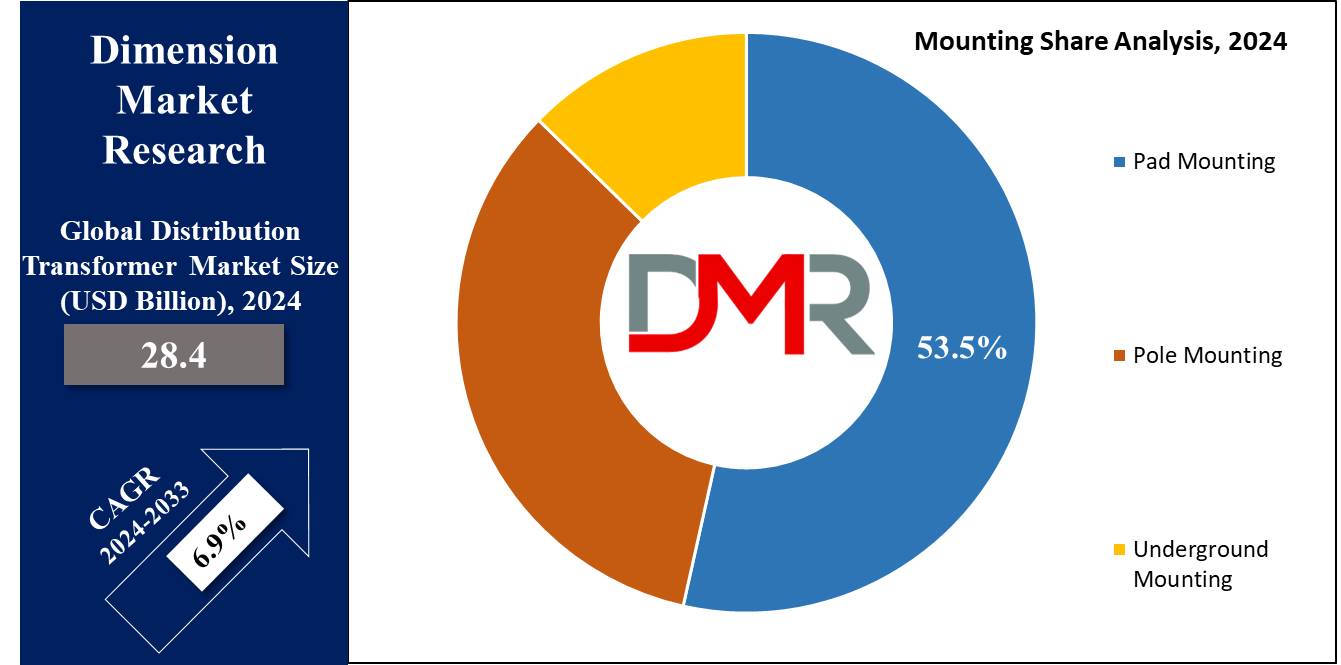

- By Mounting: The pad-mounted segment is expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- By Phase: Three-phase segment is expected to lead the Distribution Transformer market in 2024.

- By End User: The industrial sector is expected to get the largest revenue share in 2024 in the Distribution Transformer market.

- Regional Insight: Asia Pacific is expected to hold a 37.0% share of revenue in the Global Distribution Transformer Market in 2024.

- Use Cases: Some of the use cases of the Distribution Transformer include load balancing, energy efficiency, and more.

Use Cases

- Voltage Step-Down: Distribution transformers minimize the high-voltage electricity from power plants to lower voltages suitable for residential & commercial use, ensuring safe and effective power delivery.

- Load Balancing: They assist in balancing the electrical load across the distribution network, preventing overloads, and maintaining system stability and efficiency.

- Energy Efficiency: Distribution transformers improve energy efficiency by reducing energy losses during transmission, minimizing wastage, and reducing operational costs.

- Power Quality Improvement: These transformers enhance power quality by providing consistent voltage levels, which protect electrical equipment, HVAC systems, and chillers from voltage spikes and fluctuations.

- Transformer Oil Usage: Many distribution transformers utilize transformer oil to cool and insulate internal components, enhancing operational reliability and safety.

Market Dynamic

Driving Factors

Urbanization and Infrastructure Development

Fast urbanization and infrastructure projects in developing economies drive the need for reliable electricity distribution and support the need for distribution transformers to assist the expanding residential, commercial, and industrial sectors. The demand is further reinforced by the growth of construction equipment, heavy construction equipment, and advanced manufacturing systems.

Renewable Energy Integration

The higher adoption of renewable energy sources, like solar and wind, requires efficient distribution transformers to integrate these variable power sources into the grid. Deployment of wind power generators, micro combined heat and power, micro turbines, and gasification systems highlights their role in ensuring a stable and reliable energy supply.

Restraints

High Initial Costs

The significant capital investment needed for purchasing and installing distribution transformers can be a major barrier for utilities & industries, mainly in developing regions with limited financial resources.

Regulatory and Environmental Concerns

Strict regulations & environmental concerns regarding the use of certain materials and the disposal of old transformers can complicate compliance & increase operational costs for manufacturers and users.

Opportunities

Smart Grid Technology Adoption

The high installation of smart grid technologies provides significant opportunities for advanced distribution transformers with integrated monitoring and communication capabilities, improving grid reliability, efficiency, and real-time management through smart grid analytics and smart demand response.

Emerging Markets Expansion

The higher demand for electrification in emerging markets provides a major growth opportunity for distribution transformer manufacturers, driven by investments in new infrastructure projects & rural electrification programs. Expansions in regions like APAC, supported by France's hydropower initiatives and KSA Energy projects, further support growth.

Trends

Eco-Friendly Transformers

There is a growing trend towards the development and deployment of eco-friendly distribution transformers, like those using biodegradable ester fluids instead of traditional mineral oil, to address environmental concerns & regulatory requirements.

Digitalization and Smart Transformers

The market is highly moving towards digitalization with the adoption of smart transformers integrated with advanced sensors and IoT capabilities, allowing real-time monitoring, predictive maintenance, and better grid management.

Research Scope and Analysis

By Mounting

The distribution transformer market is expected to be dominated by the pad-mounted segment, which is set to hold more than half of the market share. Pad-mounted transformers are mainly designed for outdoor installation, usually on a concrete pad, which removes the need for a separate building and thus saves space & construction costs. These transformers are common in urban and suburban areas where space constraints and visual appeal are primary considerations.

By being placed underground, pad-mounted transformers support maintaining the aesthetic quality of their surroundings, making them an ideal choice for locations where maintaining a clean &uncluttered appearance is important. Their outdoor placement also delivers practical benefits, like easier access to maintenance and repairs, contributing to their broad adoption and dominance in the market.

By Phase

The distribution transformer market is projected to be led by the three-phase segment, which is set to command over majority market share and is also expected to grow significantly during the forecast period. In a three-phase system, optimal load distribution across all three phases is important for balanced operation.

Distribution transformers play a major role in achieving this balance by ensuring uniform voltage output across each phase, which highlights the vitality of efficient power distribution in many industrial and commercial applications.

With the growing demand for reliable electricity supply and the growing focus on energy efficiency, the three-phase distribution transformers are anticipated to continue their strong growth trajectory, and support of balanced power transmission makes them essential components in modern electrical networks, driving their sustained market dominance and projected expansion in the coming future.

By Power Range

In the distribution transformer market, the segment spanning from 2.5 MVA to 10 MVA is predicted to have a significant share, exceeding one-third of the total market in 2024. Transformers within this power rating range are key components in supporting the electricity grid's functionality.

They are strategically placed across the distribution network to meet the higher power demands of residential complexes, commercial entities, and infrastructure facilities. These transformers serve important functions in voltage regulation and load management, improving the efficiency & reliability of the distribution system as a whole.

By effectively distributing electricity & managing fluctuations in demand, transformers in this range contribute to maintaining a stable power supply to end-users, thereby playing a vital role in sustaining modern living & business operations.

Their major deployment highlights their importance in ensuring uninterrupted electricity supply across different sectors, cementing their dominance in the distribution transformer market. The need for reliable power constantly grows and is expected to maintain its significant market share and potentially expand further in the coming years.

By Insulation

The oil-immersed insulation type segment is anticipated to have the largest market share in 2024 in the distribution transformer market, exceeding half of the market. Immersed transformers are favored across various applications for their reliability, efficiency, & lower maintenance needs. Their design supports effective heat dissipation, allowing uninterrupted operation even under fluctuating loads. Moreover, the usage of insulating oil safeguards transformer components against moisture & contaminants, supporting their durability and lifespan.

These features make immersed transformers a preferred choice for various industries and settings where dependable power distribution is crucial. Their broad adoption highlights their importance in ensuring a stable and effective electricity supply, driving their dominance in the market. As industries constantly prioritize reliability and longevity in their electrical infrastructure, the immersed insulation type is expected to maintain its major market share and potentially expand further in the coming years.

By End User

Within the distribution transformer market, the industrial sector is anticipated to be a dominant force in 2024 and also drive the market throughout the forecast period. These transformers find multiple uses in industrial settings, mainly in powering motor-driven machinery.

Electric motors act as integral components in industrial processes, driving a range of equipment like pumps, conveyor belts, compressors, fans, and numerous machinery types. Distribution transformers play a major role in supporting the efficient operation of these motors by providing the requisite voltage levels, which ensures smooth & reliable functioning of industrial processes, thereby enhancing productivity & operational efficiency.

As a result, distribution transformers are indispensable assets in industrial environments, assisting the smooth functioning of important machinery & processes. Further, the broad adoption highlights their significance in powering industrial operations, contributing highly to the overall growth and stability of the distribution transformer market. With a constant focus on industrial automation & efficiency. Moreover, the industrial segment is anticipated to maintain its stronghold and potentially expand further in the coming future.

The Distribution Transformer Market Report is segmented based on the following

By Mounting

- Pad Mounting

- Pole Mounting

- Underground Mounting

By Phase

By Power Range

- Up to 0.5 MVA

- 0.5 MVA to 2.5 MVA

- 2.5 MVA to 10 MVA

- More than 10 MVA

By Insulation

- Oil Immersed Insulation

- Dry Insulation

By End User

- Residential

- Industrial

- Commercial

- Power Utility

Regional Analysis

The Asia-Pacific region is expected to lead the distribution transformer market, capturing a

substantial share of 37.0% in 2024, and is expected to experience significant growth throughout the forecast period, as countries like China and India, characterized by rapid growth populations & expanding industrial sectors, exhibit constant growth in electricity demand., which highlights the necessity for a strong distribution transformer network to ensure constant power supply to urban areas, industrial complexes, & rural communities.

Further, in India, government initiatives like the Saubhagya scheme have been highly promoted by the distribution transformer market by spearheading ambitious electrification efforts. These initiatives focus on extending electricity access to remote villages, further driving the need for distribution transformers and contributing to the region's dominance in the market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The distribution transformer market is highly competitive, having a mix of established players & emerging manufacturers competing for market share. Companies compete on various factors, like technological innovation, product quality, & cost efficiency. The push for smart grid solutions & eco-friendly products intensifies the competition, prompting constant developments & strategic partnerships.

In addition, regional market dynamics & regulatory landscapes influence competitive strategies, with firms customizing their offerings to meet the demands of the locals and maintaining compliance standards. The market also experiences frequent mergers & acquisitions as players aim to enhance their capabilities and expand their global presence.

Some of the prominent players in the Global Distribution Transformer Market are

- Siemens AG

- Eaton Corporation

- Hitachi Energy Ltd

- Wilson Transformer VC

- SPX Transformer Company

- Bharat Heavy Electricals Ltd

- Schneider Electric SE

- Hitachi Energy Ltd

- General Electric Company

- CG Power and Industrial Solutions Limited

- Other Key Players

Recent Developments

- In April 2024, The U.S. Department of Energy (DOE) finalized congressionally mandated energy efficiency standards for distribution transformers to enhance the resiliency &efficiency of America’s power grid, helping good-paying, high-quality manufacturing jobs, and enhancing the deployment of affordable, reliable, &clean electricity around the nation, which include a longer compliance timeline of five years saving American utilities and commercial and industrial entities USD 824 million per year in electricity costs, and result in more demand for core materials like grain-oriented electrical steel (GOES).

- In April 2024, Hitachi Energy introduced an ambitious upgrade and modernization of its power transformer factory in Varennes, and other supports in Montreal, to address the fast-growing customer in need of sustainable energy in North America, with over USD 100 million in projects around Montreal including funding from the Government of Quebec through Investissement Quebec.

- In April 2024, Hitachi Industrial Equipment Systems Co., Ltd. and Mitsubishi Electric Corporation announced that they have agreed to transfer the distribution transformer business of Mitsubishi Electric's Nagoya Works, which creates & manufactures factory automation (FA) equipment, to Hitachi Industrial Equipment Systems and combine their businesses.

- In March 2024, Siemens Energy announced to fund USD 149.8 million to build a large power transformer factory in Charlotte, North Carolina, Gov. Roy Cooper as the site will be the company’s first power transformer manufacturing facility in the U.S. and will improve its Charlotte operations, and also create around 600 jobs in logistics, mechanics, assembly & other roles.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 28.4 Bn |

| Forecast Value (2033) |

USD 51.5 Bn |

| CAGR (2024-2033) |

6.9% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Mounting (Pad Mounting, Pole Mounting, and Underground Mounting), By Phase (Single Phase and Three Phase), By Power Range (Up to 0.5 MVA, 0.5 MVA to 2.5 MVA, 2.5 MVA to 10 MVA, and More than 10 MVA), By Insulation (Oil Immersed Insulation and Dry Insulation), By End User (Residential, Industrial, Commercial, and Power Utility) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Siemens AG, Eaton Corporation, Hitachi Energy Ltd, Wilson Transformer VC, SPX Transformer Company, Bharat Heavy Electricals Ltd, Schneider Electric SE, Hitachi Energy Ltd, General Electric Company, CG Power and Industrial Solutions Limited, and Other Key Players |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |