The Generative AI in Corporate Tax Management Market is transforming how companies manage their tax responsibilities. By leveraging sophisticated algorithms, Generative AI automates intricate tax computations, uncovers tax-saving strategies, and ensures adherence to constantly evolving regulations.

For businesses, this technology streamlines tax management, cutting down on time and resources while reducing the risk of mistakes. It also provides predictive insights that help organizations better prepare for future tax obligations.

As more companies realize the benefits of AI-powered tax solutions in enhancing accuracy and efficiency, the generative AI in corporate tax management market is growing. This is especially critical for large enterprises with complex tax structures that require advanced tools to handle their tax processes effectively.

The market for corporate tax management using

artificial intelligence (AI) is quickly expanding, as businesses seek to increase efficiency and accuracy when filing taxes. Businesses are using AI solutions such as data analysis, filing, reporting, and automation in data collection processes - ultimately decreasing human error while improving operational efficiency - leading to greater demand for AI-powered tax solutions across various industries.

Recent events demonstrate a rapid uptick in AI adoption for tax management, driven by global tax reforms and evolving tax laws. Companies under increasing pressure to meet compliance standards find AI solutions useful in streamlining their process while guaranteeing accuracy while mitigating risks; this shift can especially be observed among large corporations with complex tax needs.

AI-powered tax tools are becoming increasingly sought-after due to an ever-increasing need for real-time reporting and insights, corporate tax teams are turning towards AI to analyze vast amounts of financial data, optimize tax strategies and cut preparation costs associated with taxes. Furthermore, this transition has been spurred by an absence of skilled tax professionals - making AI an invaluable asset for efficient tax management.

Opportunities in this market are substantial, as generative AI can assist businesses in predicting potential tax liabilities and provide actionable insights. Furthermore, AI's use in improving tax audits and regulatory compliance has grown substantially, making it an indispensable asset in today's complex corporate tax environment.

As per salesforce Salesforce's State of IT report highlights that 86% of IT leaders expect generative AI to play an increasing role in their organizations in the coming months, yet only 67% have prioritized it for implementation within 18 months due to concerns around security, skillset and integration challenges.

Generative AI remains popular among marketers despite mixed feelings on its use. A Salesforce survey of over 1,000 marketers indicates 51% are already using it and 22% intending to do so soon; with 71% expecting it to eliminate busy work and save five hours weekly. As a result, this technology allows more time for strategic tasks than previously.

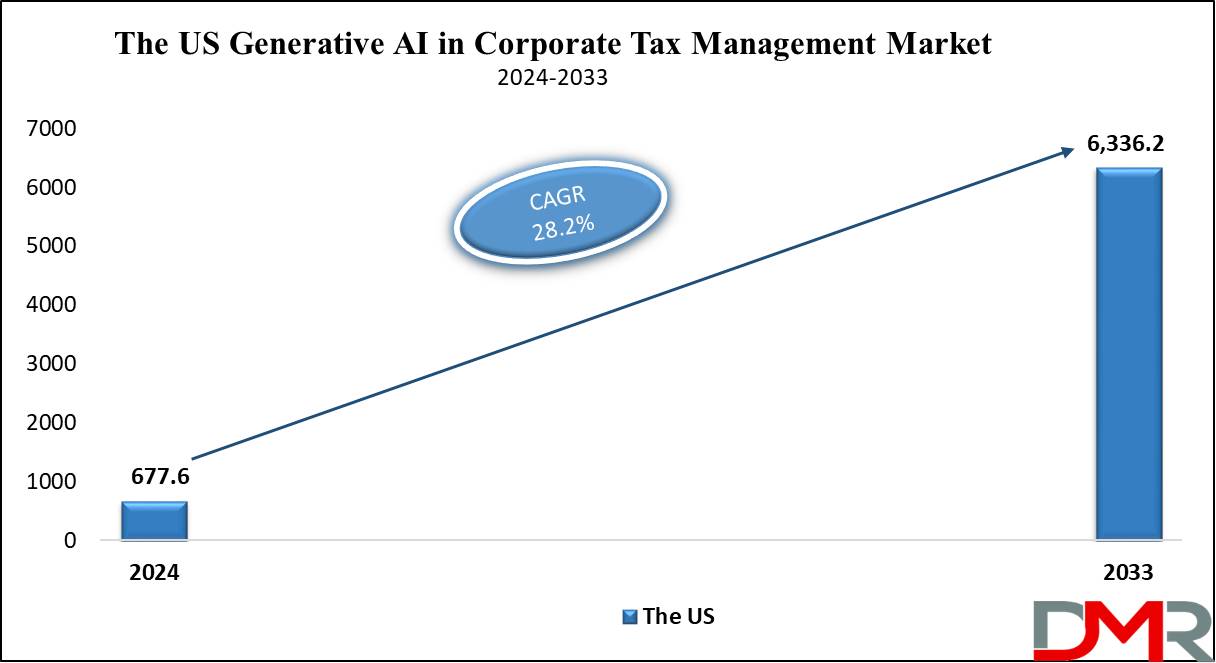

The US Generative AI in Corporate Tax Management Market

The

US Generative AI in Corporate Tax Management market is expected to

reach USD 677.6 million by the end of 2024 and is projected to grow significantly to an estimated

USD 6,336.2 million by 2033, with a

CAGR of 28.2%.

The increasing complexity of tax regulations and the need for real-time, accurate compliance in the U.S. have driven the growth of U.S. Generative AI in Corporate Tax Management market. Generative AI offers a solution by automating tax-related tasks, reducing human errors, and enhancing decision-making.

Integration of AI with existing enterprise resource planning (ERP) systems are key trend in the market as companies are increasingly adopting AI-driven tax management solutions that seamlessly connect with their ERP systems, enabling end-to-end automation of tax processes.

Key Takeaways

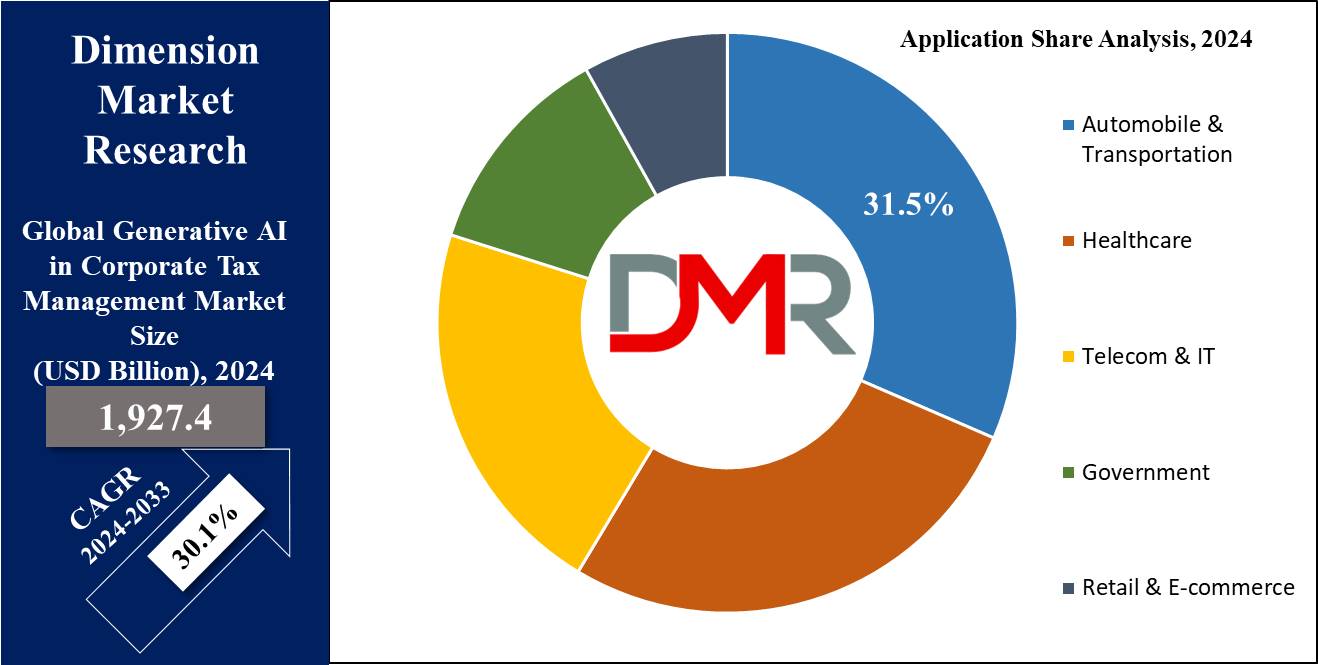

- Market Growth: It is projected that the global Generative AI in Corporate Tax Management market will experience growth of 18,182.5 million at a CAGR of 30.1 % from 2025-2033.

- Market Definition: Generative AI in Corporate Tax Management refers to the use of advanced AI algorithms to automate and optimize tax-related tasks.

- Component Analysis: Software will likely remain the leader in terms of revenue share in 2024 for Generative AI in Corporate Tax Management market with 69.1% share.

- Deployment Analysis: Cloud-based deployment is forecast to account for 68.6% of revenue share by 2024.

- Enterprises Analysis: Large enterprises are anticipated to hold the largest share of the market by the end of 2024.

- Application Analysis: Tax Compliance is anticipated to hold a significant 40.3% share of the market in terms of application by the end of 2024.

- Industry Vertical Analysis: BFSI is predicted to dominate the market with the largest based on industry vertical by 2024.

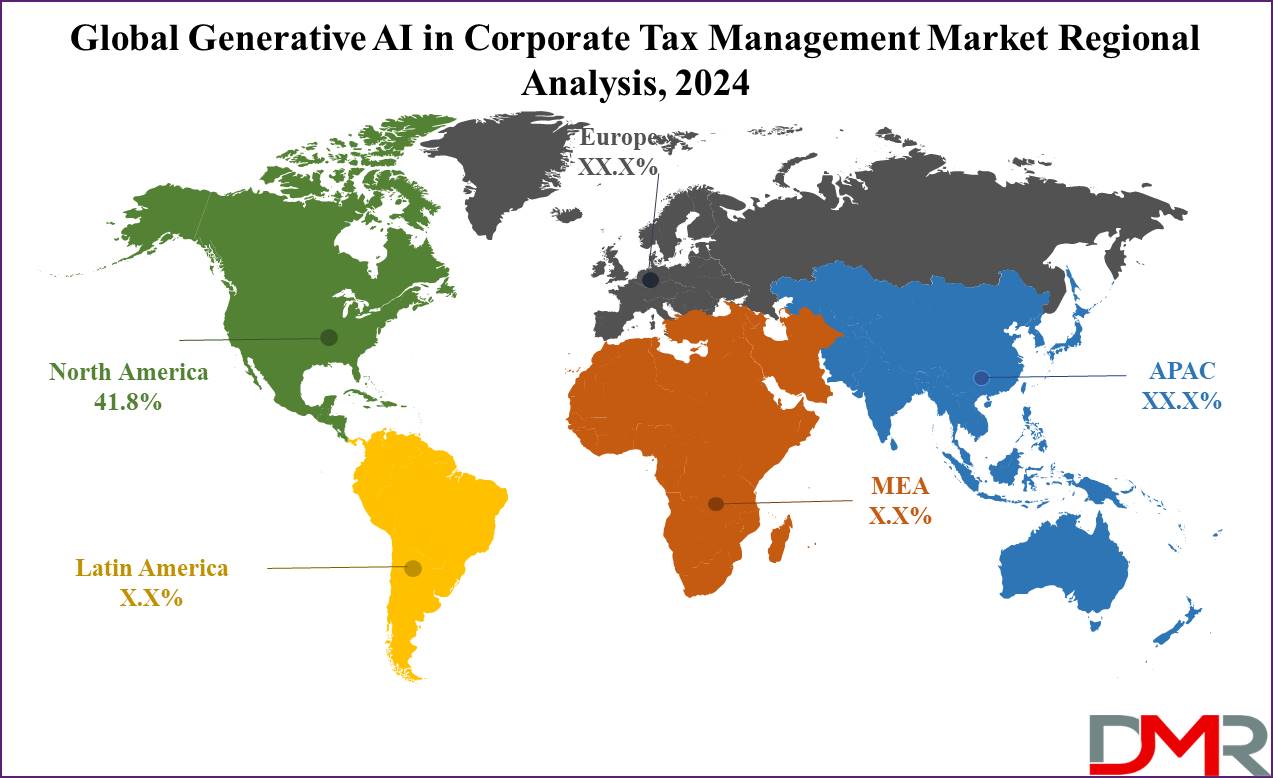

- Regional Analysis: North America is predicted to lead the generative AI in corporate tax management market globally with a 41.8 % market share by 2024.

Use Cases

- Automated Tax Document Generation: Generative AI can automatically generate tax documents, reports, and filings based on input data. By learning from historical tax forms and guidelines, it can create accurate and compliant documents, reducing manual errors and saving time.

- Tax Scenario Modeling and Prediction: Generative AI can simulate different tax scenarios based on current financial data and historical trends which allows companies to predict tax outcomes under many circumstances, helping in strategic decision-making and optimizing tax liabilities.

- Personalized Tax Advisory: Generative AI can provide personalized tax advice by analyzing a company’s financial data, historical tax filings, and current regulations. It helps in offering customized strategies for tax planning, ensuring compliance, and optimizing tax benefits.

- Anomaly Detection and Fraud Prevention: AI can analyze large datasets to detect unusual patterns or anomalies that may indicate errors or potential fraud. By continuously learning from new data, AI systems can enhance the accuracy of these detections over time.

Market Dynamic

Drivers

Technological Advancements and AutomationRapid advancements in technology, particularly in AI and

machine learning, are key drivers of the Generative AI in the Corporate Tax Management market. Generative AI automates various tax-related processes, such as monitoring regulatory changes, data entry, and document management. This automation improves efficiency and allows tax professionals to focus on more strategic tasks, optimizing resource allocation and reducing the likelihood of errors.

Growing Regulatory Compliance Demands

The increasing complexity of global tax regulations, with over 14,000 regulatory changes occurring monthly across approximately 19,000 tax jurisdictions, is driving the adoption of generative AI in corporate tax management. The need for real-time updates and accurate compliance tracking has become critical, and generative AI is crucial in automating these processes. By enabling companies to remain compliant more efficiently, AI helps mitigate risks associated with non-compliance, ensuring accuracy in tax reporting and adherence to regulatory requirements.

Restraints

High Implementation Costs and Data Security Concerns

The expansion of the generative AI market in corporate tax management is hindered by the significant costs associated with implementing AI-driven solutions and concerns over data security. Deploying these systems requires substantial investment in advanced technologies, infrastructure, and integration with existing systems.

Limited AI Expertise Among Tax Professionals

Limited expertise in AI among tax professionals is another significant challenge in the generative AI in the corporate tax management market. The effective integration of AI into corporate tax management requires a solid understanding of both tax regulations and AI technologies. However, many tax professionals may lack the necessary technical skills to implement and manage AI-driven solutions effectively.

Opportunities

AI-Driven Tax Management Tools for Multinational Corporations

One key opportunity in corporate tax management lies with AI's development of AI-driven tools tailored specifically for multinationals. Multinationals face the difficulty of complying with different jurisdictional tax regulations which makes compliance both complex and resource intensive; AI can manage this complexity, automate cross-border calculations, ensure compliance across various tax regimes, and streamline tax management processes by mitigating noncompliance risks while optimizing global tax strategies.

Predictive Analytics to Enhance Tax Strategy Decision-Making

Predictive analytics within generative AI tools has opened up greater potential in corporate tax management markets worldwide. Utilizing AI's predictive capabilities, predictive analytics has the power to analyze historical data, detect trends, and forecast future tax liabilities which enables companies to proactively manage tax obligations while optimizing tax positions and making more informed strategic decisions.

Trends

AI-Driven Automation Transforming Tax Management

Automating tax computations more swiftly and accurately has long been one of the main goals of corporate tax management, while at the same time decreasing manual intervention by companies. Automation of repetitive tasks, like data entry or compliance checks, frees tax professionals up to focus on more strategic aspects resulting in improved efficiencies and outcomes for business tax administration professionals.

Enhanced Data Analytics and Real-Time Insights

One trend seen increasingly across industries currently is AI-powered data analytics. Businesses utilize these sophisticated AI tools to understand tax information as it becomes ever more complex and vaster; using its rapid processing power for large datasets quickly while providing actionable insight to identify patterns, detect anomalies, and optimize tax strategies more effectively.

Research Scope and Analysis

By Component

Software as components is expected to dominate the Generative AI in Corporate Tax Management Market, commanding over 69.1 % in 2024, due to the growing complexity of tax regulations. Due to real-time processing and analysis requirements for tax regulation, corporations have increasingly turned to AI-powered software solutions in corporate tax administration for real-time processing and analysis.

Tax compliance software automates tax compliance processes, optimizes strategies, and ensures accurate reporting, providing businesses with a competitive advantage that contributes to market expansion. Scalability, flexibility, and integration capabilities make the software ideal for corporations seeking to streamline their tax management processes. Generative AI software offers advanced features like automated data analysis, real-time tax computation, and predictive analytics - essential features for corporate tax departments to effectively handle large volumes of data and complicated tax rules efficiently.

These software solutions reduce manual intervention, minimize mistakes, and provide invaluable insight, making them indispensable tools for corporate tax administration. The services segment is projected to experience rapid expansion as its focus on implementation, customization, and ongoing support of AI-powered tax software is anticipated. Services include consultation, training, and technical support which ensure effective usage and are customized specifically to individual business requirements.

By Deployment Mode

Cloud-based deployment is expected to dominate generative AI in the corporate tax management market with a revenue share of 68.6% in 2024, driven by its flexibility, scalability, and cost-effectiveness which makes it preferable for corporate tax operations. It allows companies to access powerful AI-driven tax management tools without the need for significant upfront investment in hardware or IT infrastructure.

Cloud-based deployment models are beneficial for large enterprises with complex tax requirements and smaller businesses that need advanced capabilities but lack the resources to maintain on-premises systems. It offers seamless updates, ensuring that organizations always have access to the latest features and regulatory compliance updates without disruption. Cloud-based deployment can scale resources on-demand allowing companies to handle peak tax seasons more efficiently, making it a more adaptable solution.

Meanwhile, the on-premises segment is less dominant because it requires substantial capital investment in infrastructure, ongoing maintenance, and dedicated IT staff. This type of deployment mode is preferred by organizations that have stringent data security requirements, as they allow for complete control over sensitive financial information.

By Enterprise Size

Large enterprises are expected to dominate the Generative AI for Corporate Tax Management Market due to their extensive and complex tax obligations that necessitate cutting-edge solutions for effective management. These businesses often operate across multiple jurisdictions and must adhere to many tax regulations that require tools for compliance, reporting, and strategic tax planning.

They usually possess the financial means necessary to invest in cutting-edge artificial intelligence technologies & ensure they can effectively implement and manage these systems. Generational AI software gives large companies an effective tool to automate repetitive tasks, analyze vast quantities of data, and uncover insights that significantly lower risks and penalties. AI solutions' scalability also enables large corporations to manage peak seasons more effectively like tax season without incurring substantial additional human resource requirements.

Small and Midsized Enterprises are increasingly understanding the advantages of Generative AI for tax management as more accessible Generative AI solutions become affordable & accessible. These tools help automate processes, increase accuracy, and ensure compliance.

By Application

Tax Compliance is predicted to dominate the generative AI in corporate tax management market with a revenue share of 40.3% in 2024, due to the rising complexity of tax regulations & increased scrutiny from tax authorities. Businesses of all sizes must adhere to many local, national, and international tax laws and regulations, and failure to comply can result in significant penalties, legal issues, & reputational damage.

Generative AI solutions are widely used to automate & streamline compliance processes, helping organizations accurately and timely meet their tax obligations. AI-driven compliance solutions also provide real-time monitoring and alert systems that help organizations identify & address potential compliance issues before they become problematic. Tax compliance is important to maintain the financial

health and legal standing of a business which drives its priority over other applications.

Meanwhile, tax planning and advisory uses AI to optimize tax strategies, reduce liabilities, and improve decision-making which involves preparing and filing accurate tax returns. Tax Reporting tools are essential for preparing precise and timely tax returns, while Tax Controversy Management focuses on resolving disputes with tax authorities.

By Industry Vertical

BFSI is expected to dominate the Generative AI in Corporate Tax Management Market with a revenue share in 2024. As this sector involves complex financial transactions with tight regulatory oversight, automated and optimization capabilities provided by generative AI can prove immensely helpful in terms of automation and efficiency.

These AI solutions automate tax compliance processes by collecting data automatically, adhering to constantly shifting tax regulations, and minimizing errors. Additionally, financial institutions benefit from these experts because they help manage large volumes of transactions and complex tax scenarios effectively, increase reporting accuracy, and offer actionable insights for improving tax strategies and compliance. BFSI firms' large operations and stringent regulatory demands necessitate adopting innovative AI technologies, solidifying their dominance within this market.

Following BFSI, healthcare, and

pharmaceutical industries are also turning more frequently to Generative AI as a corporate tax management tool due to the industry's complex regulatory environment and requirement for precise compliance. Generative AI provides healthcare and pharmaceutical companies with navigating complex tax laws with tools designed to optimize tax strategies and mitigate regulatory compliance risk with its software solutions.

The Global Generative AI in Corporate Tax Management Market Report is segmented based on the following

By Component

By Deployment Mode

By Enterprise Size

- Large Enterprises

- Small and Medium-sized Enterprises

By Application

- Tax Compliance

- Tax Controversy Management

- Tax Planning and Advisory

- Tax Reporting

- Others

By Industry Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Energy and Utilities

- Healthcare and Pharmaceuticals

- IT and Telecommunications

- Manufacturing

- Retail and eCommerce

- Others

Regional Analysis

North America is predicted to lead the generative AI in corporate tax management market with the largest market

share of 41.8% in 2024. This dominance is due to the region’s advanced technological infrastructure, a strong regulatory framework that demands sophisticated tax management solutions, and significant investments in AI and machine learning technologies.

The leadership of this region is also due to the presence of major technology and financial corporations that actively invest in AI to enhance tax processes. Additionally, the region’s emphasis on compliance and transparency in financial operations further boosts the adoption of advanced AI tools for corporate tax management.

The increasing demand for efficient and precise tax processing systems is expected to drive further investments and innovations in Generative AI, amplifying its influence in the market. Moreover, AI companies and startups in the U.S. and Canada have accelerated the development and adoption of AI tools in corporate tax management, reinforcing the region's leadership.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Generative AI in Corporate Tax Management market is characterized by intense competition, with numerous large and small players offering software and services to domestic and international markets. In 2024, the Generative AI in Corporate Tax Management Market is experiencing a transformative shift, fueled by leading companies that are incorporating advanced AI technologies into tax management solutions.

The market is currently moderately fragmented and is moving toward a more fragmented state. Some key players in this market are Thomson Reuters Corporation, Deloitte Touche Tohmatsu Limited, and KPMG International Limited. Major players operating in the market are adopting strategies such as innovating their products and services and engaging in mergers and acquisitions to expand the functionality of their product portfolios and maintain competitiveness.

CCH Tagetik (Wolters Kluwer) and Vertex, Inc. are leading the charge, providing AI-powered tax compliance and reporting solutions that simplify complex tax processes and enhance accuracy.

Some of the prominent players in the global generative AI corporate tax management market are

- Infosys

- PwC

- Deloitte

- Amazon Web Services (AWS)

- Capgemini

- Oracle

- KPMG

- Google Cloud

- Accenture

- Microsoft

- EY

- IBM

- Others

Recent Development

- In August 2024, Deloitte’s Omnia platform, with advanced generative AI capabilities, won the “AI Innovation Initiative of the Year” award for enhancing audit workflows and tax management.

- In June 2024, Vertex, Inc. acquired AI tax capabilities from Ryan, LLC to enhance global tax compliance with advanced AI-driven categorization.

- In May 2024, Wolters Kluwer launched new AI features in tax and accounting solutions and introduced an AI-powered virtual agent in June 2024 for improved customer support.

- In January 2024, Avalara, Inc. highlighted the growing role of AI in tax compliance, including AI assistants for data analysis and anomaly detection.

- In November 2023, Thomson Reuters integrated generative AI into their tax and accounting products and acquired Case Text for USD 650.0 million to boost AI-driven legal and tax research.

- In April 2023, PwC announced a USD 1.0 billion investment over three years to scale AI capabilities, aiming to automate complex tax processes and improve accuracy and efficiency.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 1,927.4 Mn |

| Forecast Value (2033) |

USD 20,632.1 Mn |

| CAGR (2024-2033) |

30.1% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 677.6 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Software, and Services), By Deployment Mode (Cloud, and On-premises), By Enterprise Size (Large Enterprises, and Small and Medium-sized Enterprises), By Application (Tax Compliance, Tax Controversy Management, Tax Planning and Advisory, Tax Reporting, Others), By Industry Vertical (Banking, Financial Services, and Insurance (BFSI), Energy and Utilities, Healthcare and Pharmaceuticals, IT and Telecommunications, Manufacturing, Retail and e-commerce, Others ) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Infosys, PwC, Deloitte, Amazon Web Services (AWS), Capgemini, Oracle, KPMG, Google Cloud, Accenture, Microsoft, EY, IBM, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |